希音寻求与更多品牌合作,该快时尚巨头正在“亚马逊化”

电商巨头希音(Shein)将走出其赖以成名的时尚和服装领域,开拓其他领域的市场。在这一过程中,它与另外一个家喻户晓的在线市场平台变得越来越像。

据路透社(Reuters)于4月30日报道称,希音正在寻求与更多品牌合作,包括日用品巨头高露洁-棕榄(Colgate-Palmolive)、玩具厂商孩之宝(Hasbro)和化妆品牌等,希望它们通过希音平台出售商品。希音平台以经济实惠的时尚服装而成名,但也引起了外界对其用工和环境影响方面的担忧。它正在采取措施打造一个包罗万象的平台。

据路透社报道,在4月17日于法国巴黎举办的一个会议上,希音的欧洲、中东与非洲品牌运营高级总监克里斯蒂娜·芳塔娜表示:“所有人都会将希音与时尚相关联,但我们正在开拓所有垂直领域。”

她补充道:“我们的消费者希望看到所有品牌,[因此]消费者想要什么,我们就要满足他们的需求。”

美国加州大学伯克利分校(University of California at Berkeley)的经济分析与政策教授史蒂夫·塔德雷斯对《财富》杂志表示,希音的扩张显然是抢占电商领域更多市场份额的一种策略。

希音在美国快时尚市场占据最大市场份额,2023年的年利润较前一年翻了一番,达到20亿美元。希音计划进行首次公开募股,估值高达900亿美元。虽然与亚马逊(Amazon)在美国电商领域38%的市场份额相比,希音零售帝国的规模仍然逊色不少,但塔德雷斯称,希音将以行业领先者为目标奋起直追。

他说:“面对世界各地对亚马逊的监管,以及认为需要对亚马逊的垄断加以控制的讨论,希音现在开始抢占亚马逊的份额,甚至未来可能抢占更多份额,这并不意外。”

大获成功的希音

来自中国的快时尚平台希音,由亿万富翁许仰天创立于2008年。该平台大获成功,通过其大规模高效生产和经销策略,月用户数量高达4,500万。

希音利用人工智能和电子监控,能够识别网络趋势,并反馈给供应商进行小批量生产,然后根据初步销售数据决定是否大规模生产一款产品。该系统几乎保证了该公司可以准确把握市场趋势,并快速推出商品,但它也因为侵犯版权、数据爬取以及假冒商品泛滥等指控而陷入困境。

尽管欧盟委员会(European Commission)等监管机构试图制衡该公司,以阻止其可疑的商业行为,但希音可能已经找到了规避监管的方法。

哈佛商学院(Harvard Business School)的名誉教授约翰·戴顿告诉《财富》杂志,希音吸引更多品牌加入其平台的策略,只会帮助该公司躲过外界的更多关注:该平台上很快就会有成千上万种消费者熟悉和信赖的商品,例如高露洁牙膏和培乐多(Play-Doh)彩泥等,这从本质上是在告诉监管机构这里没有值得关注的问题。

戴顿表示:“它们不会受到监管机构的审查。”

与亚马逊竞争

塔德雷斯指出,希音这种隐居幕后的方法,使其向时尚之外的领域扩张,变成了合理的下一步措施。凭借高效的基础设施,希音能够更加灵活地向服装以外的领域扩张。

他补充道:“我真的认为这是一种明智的商业决策,即‘我们有出色的物流网络,首先让我们将其向可以采购到廉价商品的其他领域扩张。’”

市场调研平台AlphaWatch.AI的科技分析师兼首席运营官马睿对《财富》杂志表示,希音在服装领域的稳固地位,让它在与亚马逊的竞争中获得了另一个优势。马睿指出,众所周知,时尚是一个“挑剔”的行业,而且尽管亚马逊同样涉足了服装领域,它却未能像希音一样成功。

她说:“历史上,供需匹配的难度极大。这并不是一个特别容易成功的品类。”

但在希音抢占亚马逊的市场份额的同时,亚马逊也在对希音做同样的事情。2023年12月,亚马逊宣布,从今年1月起,对15美元以下的服装,将卖家费用从17%降至5%,对15美元至20美元的服装按10%收取费用。亚马逊在4月29日称,其订单送达速度将比以往任何时候更快:美国60个大城市下的订单,60%可以当日或次日送达。亚马逊指出,这是公司维持电商市场领先地位和满足客户需求的长期策略的一部分。而希音的客户可能要等待14天才能收到订购的商品。

塔德雷斯认为这是一种正常现象。与大多数市场一样,当一家公司找到一种有效的策略时,公司的理念就会开始趋于一致。

他说:“这些公司变得越来越像,这不足为奇。因为只要有一种行之有效的成功策略……就会出现模仿者。”

对消费者而言,各电商平台的促销和优惠活动,肯定会出现抄袭和雷同现象。但马睿称,不要被希音模仿竞争对手的做法所迷惑。该公司提供的商品,可能开始非常类似于亚马逊,但在幕后,它仍然在坚持使用其独特的物流网络。

她告诉《财富》杂志:“消费者可能感觉没有区别。它将变成一家无所不包的商店。但我认为希音打造购物体验的逻辑,与亚马逊截然不同。”(财富中文网)

译者:刘进龙

审校:汪皓

电商巨头希音(Shein)将走出其赖以成名的时尚和服装领域,开拓其他领域的市场。在这一过程中,它与另外一个家喻户晓的在线市场平台变得越来越像。

据路透社(Reuters)于4月30日报道称,希音正在寻求与更多品牌合作,包括日用品巨头高露洁-棕榄(Colgate-Palmolive)、玩具厂商孩之宝(Hasbro)和化妆品牌等,希望它们通过希音平台出售商品。希音平台以经济实惠的时尚服装而成名,但也引起了外界对其用工和环境影响方面的担忧。它正在采取措施打造一个包罗万象的平台。

据路透社报道,在4月17日于法国巴黎举办的一个会议上,希音的欧洲、中东与非洲品牌运营高级总监克里斯蒂娜·芳塔娜表示:“所有人都会将希音与时尚相关联,但我们正在开拓所有垂直领域。”

她补充道:“我们的消费者希望看到所有品牌,[因此]消费者想要什么,我们就要满足他们的需求。”

美国加州大学伯克利分校(University of California at Berkeley)的经济分析与政策教授史蒂夫·塔德雷斯对《财富》杂志表示,希音的扩张显然是抢占电商领域更多市场份额的一种策略。

希音在美国快时尚市场占据最大市场份额,2023年的年利润较前一年翻了一番,达到20亿美元。希音计划进行首次公开募股,估值高达900亿美元。虽然与亚马逊(Amazon)在美国电商领域38%的市场份额相比,希音零售帝国的规模仍然逊色不少,但塔德雷斯称,希音将以行业领先者为目标奋起直追。

他说:“面对世界各地对亚马逊的监管,以及认为需要对亚马逊的垄断加以控制的讨论,希音现在开始抢占亚马逊的份额,甚至未来可能抢占更多份额,这并不意外。”

大获成功的希音

来自中国的快时尚平台希音,由亿万富翁许仰天创立于2008年。该平台大获成功,通过其大规模高效生产和经销策略,月用户数量高达4,500万。

希音利用人工智能和电子监控,能够识别网络趋势,并反馈给供应商进行小批量生产,然后根据初步销售数据决定是否大规模生产一款产品。该系统几乎保证了该公司可以准确把握市场趋势,并快速推出商品,但它也因为侵犯版权、数据爬取以及假冒商品泛滥等指控而陷入困境。

尽管欧盟委员会(European Commission)等监管机构试图制衡该公司,以阻止其可疑的商业行为,但希音可能已经找到了规避监管的方法。

哈佛商学院(Harvard Business School)的名誉教授约翰·戴顿告诉《财富》杂志,希音吸引更多品牌加入其平台的策略,只会帮助该公司躲过外界的更多关注:该平台上很快就会有成千上万种消费者熟悉和信赖的商品,例如高露洁牙膏和培乐多(Play-Doh)彩泥等,这从本质上是在告诉监管机构这里没有值得关注的问题。

戴顿表示:“它们不会受到监管机构的审查。”

与亚马逊竞争

塔德雷斯指出,希音这种隐居幕后的方法,使其向时尚之外的领域扩张,变成了合理的下一步措施。凭借高效的基础设施,希音能够更加灵活地向服装以外的领域扩张。

他补充道:“我真的认为这是一种明智的商业决策,即‘我们有出色的物流网络,首先让我们将其向可以采购到廉价商品的其他领域扩张。’”

市场调研平台AlphaWatch.AI的科技分析师兼首席运营官马睿对《财富》杂志表示,希音在服装领域的稳固地位,让它在与亚马逊的竞争中获得了另一个优势。马睿指出,众所周知,时尚是一个“挑剔”的行业,而且尽管亚马逊同样涉足了服装领域,它却未能像希音一样成功。

她说:“历史上,供需匹配的难度极大。这并不是一个特别容易成功的品类。”

但在希音抢占亚马逊的市场份额的同时,亚马逊也在对希音做同样的事情。2023年12月,亚马逊宣布,从今年1月起,对15美元以下的服装,将卖家费用从17%降至5%,对15美元至20美元的服装按10%收取费用。亚马逊在4月29日称,其订单送达速度将比以往任何时候更快:美国60个大城市下的订单,60%可以当日或次日送达。亚马逊指出,这是公司维持电商市场领先地位和满足客户需求的长期策略的一部分。而希音的客户可能要等待14天才能收到订购的商品。

塔德雷斯认为这是一种正常现象。与大多数市场一样,当一家公司找到一种有效的策略时,公司的理念就会开始趋于一致。

他说:“这些公司变得越来越像,这不足为奇。因为只要有一种行之有效的成功策略……就会出现模仿者。”

对消费者而言,各电商平台的促销和优惠活动,肯定会出现抄袭和雷同现象。但马睿称,不要被希音模仿竞争对手的做法所迷惑。该公司提供的商品,可能开始非常类似于亚马逊,但在幕后,它仍然在坚持使用其独特的物流网络。

她告诉《财富》杂志:“消费者可能感觉没有区别。它将变成一家无所不包的商店。但我认为希音打造购物体验的逻辑,与亚马逊截然不同。”(财富中文网)

译者:刘进龙

审校:汪皓

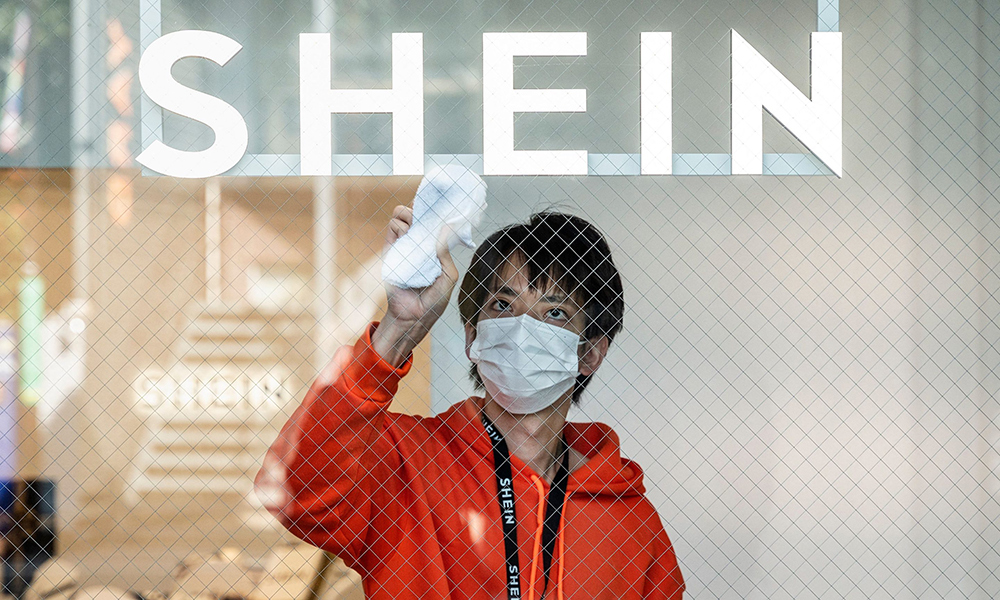

E-commerce giant Shein is spreading its arms to envelope more than just the fashion and apparel for which it’s known—and it’s starting to look like another familiar online market platform in the process.

Shein is wooing brands such as household goods conglomerate Colgate-Palmolive, toy maker Hasbro, and skincare brands to sell their products in its marketplace, Reuters reported on April 30. The company, known for affordable and stylish clothes—albeit made with concerns about labor practices and its environmental impact—is taking steps to create a platform that is everything to everyone.

“Everybody associates Shein with fashion, but we are doing all verticals,” Christina Fontana, Shein’s senior director of brand operations for Europe, Middle East and Africa, said at a Paris conference on April 17, according to Reuters.

“Our consumers want brands, [so] if that’s what they’re looking for, that’s what we’re going to give them,” she added.

Shein’s outward expansion is a clear tactic to take a bigger piece of the e-commerce pie, Steve Tadelis, economic analysis and policy professor at the University of California at Berkeley, told Fortune.

Shein has the largest fast-fashion market share in the U.S, and its annual profit doubled to $2 billion in 2023 from the year before. It’s eyeing an IPO and a whopping $90 billion valuation. While the size of its retail empire still pales in comparison to Amazon’s stranglehold on 38% of the U.S. e-commerce market, Tadelis said Shein will want to go after the industry leader.

“It shouldn’t be surprising that with all of the regulators around the world and talking about the Amazon monopoly that needs to be reined in, well, Shein is now taking a bite out of their apple and will probably take more of those bites,” he said.

Shein’s big wins

Shein, a China-based fast-fashion platform founded by billionaire Sky Xu in 2008, has skyrocketed to success and 45 million monthly users through its massive and efficient production and distribution strategies.

Using AI and electronic monitoring, Shein is able to identify online trends, turn to its suppliers to manufacture small batches of products, then take initial sales data to decide to mass produce a product. The system nearly guarantees the company has its finger on the pulse of trends and can deliver goods fast, though it’s gotten into hot water over allegations of copyright infringement and data scraping, as well as the proliferation of counterfeit product listings.

Even as regulatory bodies, like the European Union’s European Commission, have tried to put checks and balances on the company to stymie its questionable business practices, Shein may have found a way around that.

John Deighton, professor emeritus at the Harvard Business School, told Fortune that Shein’s strategy of incorporating more brand names onto its platform will only help the company dodge increased attention: The site could soon be flooded with thousands of listings from familiar and trusted products, such as Colgate toothpaste and Play-Doh, essentially telling regulatory bodies there’s nothing to see here.

“They won’t get caught up by the scrutiny,” Deighton said.

Butting heads with Amazon

Shein’s behind-the-scenes methodology makes expanding beyond fashion a natural next step, Tadelis argued. With an efficient infrastructure in place, Shein is able to be more nimble in expanding outward from apparel.

“I really think this is a smart business decision of saying, ‘We have an amazing logistics network, let’s start expanding it into other areas where we could procure cheap products,’” he added.

Rui Ma, tech analyst and COO of market research platform AlphaWatch.AI, told Fortune that Shein’s secure spot in apparel offers another advantage in its race to beat Amazon. Fashion is a notoriously finicky sector, and Amazon, despite dipping its toe into the world of apparel, hasn’t been able to see the same success as Shein, Ma said.

“It’s been very—historically—very difficult to match up demand supply,” she said. “It’s not been a particularly easy category.”

But as Shein takes pages out of Amazon’s playbook, Amazon is simultaneously doing the same to Shein. Amazon announced last December it would slash seller fees from 17% to 5% for apparel under $15, with apparel between $15 to $20 triggering a 10% fee, starting in January. The company said on April 29 its packages are getting delivered faster than ever: 60% of orders placed in 60 major U.S. cities arrived the same day or day after the order was placed. According to the company, that’s part of its longstanding efforts to stay on top of the e-commerce market and tend to customer needs. Shein customers may have to wait 14 days for their orders to arrive.

Tadelis believes this is par for the course. Just as in most markets, company philosophies start to converge on each other when one finds an effective formula.

“There’s no surprise that these things are looking more alike,” he said. “Because once there’s a good, winning strategy … then you’re going to see imitators.”

For the consumer, there will certainly appear to be copycatting and similarities in promotions and perks across e-commerce platforms. But Ma said, don’t be fooled by Shein’s bid to mime its competitors. The site might start to look a lot like Amazon in its offerings, but behind the scenes, it’s very much sticking with its unique logistics network.

“It might feel the same to us as consumers. It’s going to become more of an everything store,” she told Fortune. “But how it builds that experience, I think the logic is very different from Amazon.”