房地产市场未来会发生三件事情

早在今年6月,美联储的主席杰罗姆·鲍威尔就明确表示:房地产市场将经历“重启”。

“我想说的是,如果你是购房者,或者想要买房的年轻人,你就需要等待房地产市场重回稳定状态。我们需要重新回到供需平衡、通货膨胀再次走低、抵押贷款利率再次走低的状态。”

每当央行从货币宽松政策转向货币紧缩政策,就会对房地产等对利率敏感行业产生影响。当然,如果在住宅类房地产在短短两年多的时间里飙升43%之后收紧货币政策,带来的影响就会更大。鲍威尔在6月承认了这一点。然而,他没有明确表示利率冲击是否会推动房价下跌。

时间快进到9月,我们无需质疑住房“重启”是否会影响房价。早在今年6月,美国房地产市场仍然处于房地产活动大幅下滑的初期阶段。从那以后,我们看到房地产活动,包括房屋销售和房屋建设水平大幅下降。但随着8月的数据陆续出炉,我们现在有明确的证据表明,房地产市场的低迷已经超越了第一阶段(即房地产活动大幅下滑),进入了第二阶段(即房价下跌)。

“我们的观点是,(抵押贷款)利率在高位停留的时间越长,房地产市场就越会继续受到冲击,并进入重启模式。现在必须要进行的负担能力重启机制是针对房价的。因此,我们预测全国很多市场将面临两位数的房价下跌。”约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)的研究主管小里克·帕拉西奥斯告诉《财富》杂志。

让我们更深入地了解一下,当我们进入房地产市场低迷的第二阶段时,这三个要素将发生什么变化。

1. 房价回调正在蔓延。

今年,随着抵押贷款利率从3.2%飙升至6.3%,业内人士知道这将导致房地产活动的急剧收缩。然而,许多看好房地产的人认为,这不会拉低房价。今年3月,Zillow甚至预测未来一年房价还将上涨17.8%。

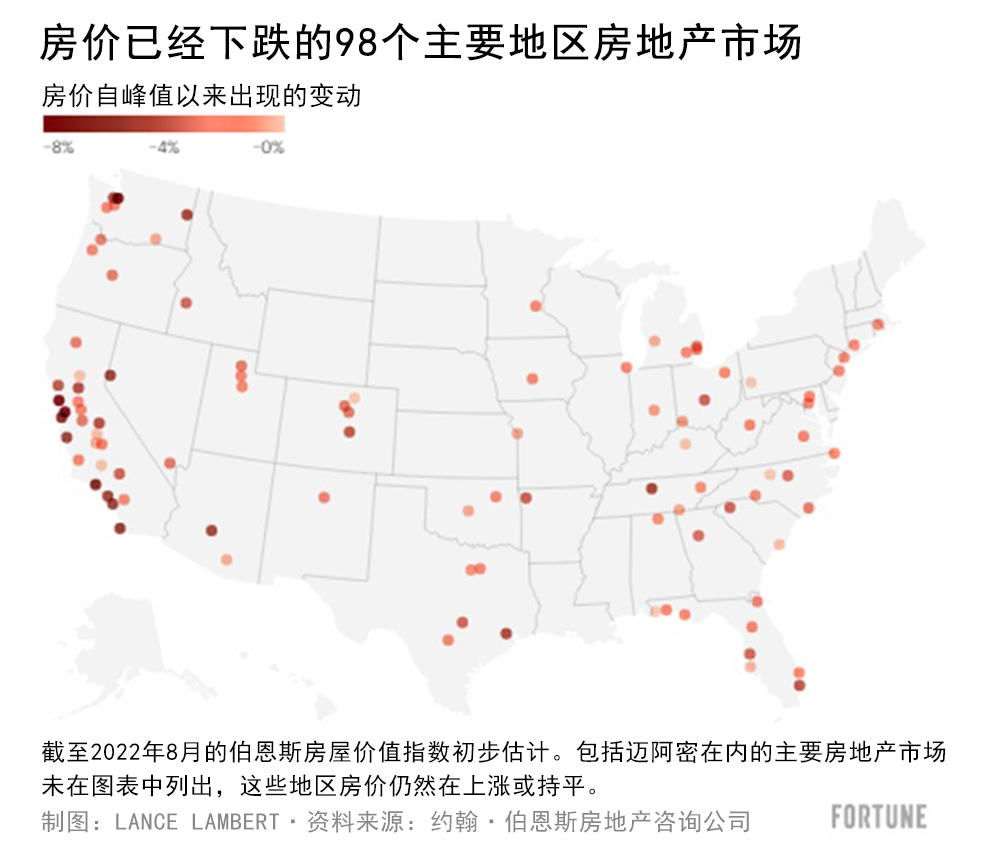

很明显,看好房地产的人错了。在约翰·伯恩斯房地产咨询公司追踪的148个地区房地产市场中,98个房地产市场的房价已经从2022年的峰值下跌。只有50个房地产市场仍然处于峰值期。

在11个房地产市场中,伯恩斯房屋价值指数(Burns Home Value Index)已经下跌了5%以上。其中旧金山房价下跌了8.2%。虽然在每年的这个时候,房价中值下降是很常见的,但由于季节性,房屋价值或“房屋买卖历史对比”下降并不常见。简而言之:房价回调比之前想象的更剧烈,影响范围也更广。

包括穆迪分析公司(Moody's Analytics)、约翰·伯恩斯房地产咨询公司、Zonda和Zelman & Associates在内的越来越多的研究公司预计,房价回调将持续到2023年。穆迪分析公司认为,美国房价从高点以来的跌幅将很快达到5%。该公司指出,在严重“高估”的房地产市场,房价下跌幅度可能在5%到10%之间。穆迪分析公司预测,如果经济陷入衰退,房价跌幅将会翻倍。但即便是这样的情况,美国房价跌幅也仍然低于2006年至2012年间从高点以来27%的跌幅。

目前,仍然有包括Zillow在内的一些公司认为,房价回调——由抵押贷款利率飙升造成的负担能力紧缩所驱动——不会延续到2023年。Zillow总部位于西雅图。Zillow房地产网站承认,62%的房地产市场将在2022年第三季度出现房价下跌。然而,Zillow的经济学家预测,在2022年8月至2023年8月期间,只有28.5%的房地产市场将出现同比下跌。

2. 房地产市场的低迷将很快蔓延到房地产以外的领域。

与去年同期相比,持续的楼市低迷已经导致新屋销售和成屋销售分别下降了29.6%和20.2%。Redfin、Realtor.com和Compass等房地产公司已经宣布裁员。房屋建筑商正在取消项目,而一些抵押贷款机构正濒临破产。

即使如此,房地产市场低迷带来的大部分金融痛苦都被遏制在房地产行业内。这种情况即将改变。

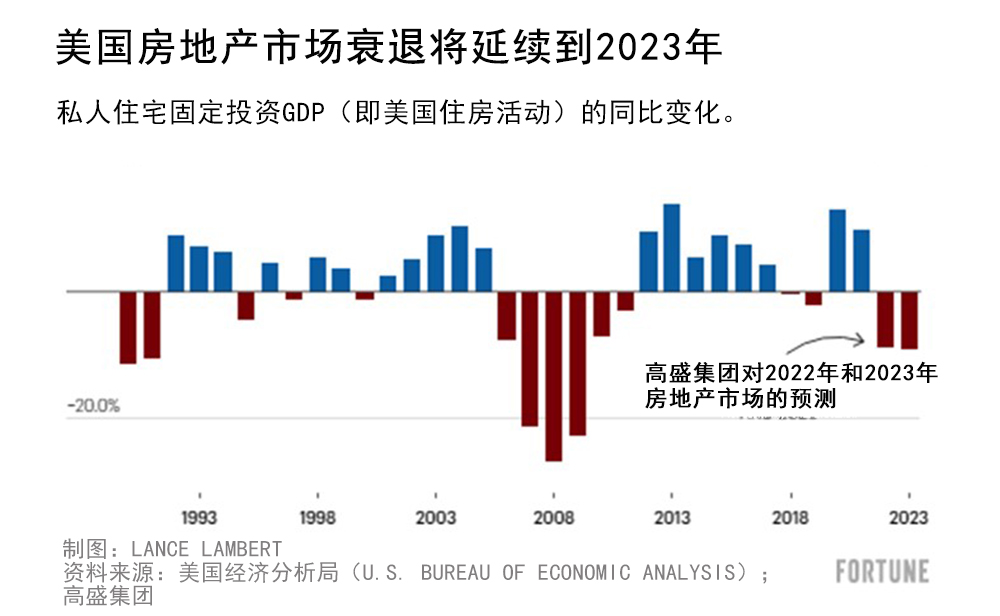

高盛集团(Goldman Sachs)的研究人员最近发表了一篇题为《房地产市场低迷:房价将进一步下跌》(The Housing Downturn: Further to Fall)的论文。该投资银行预测,美国住房GDP将在2022年下降8.9%,在2023年再下降9.2%。在2007年12月正式开始的经济大衰退(Great Recession)之前,2006年住房GDP下降了7.4%,2007年下降了21.4%。

如果高盛集团的预测是正确的,这将意味着美国房地产市场的收缩将很快蔓延到更广泛的经济领域。这并没有令人感到意外。毕竟,美联储已经提高了联邦基金利率,试图减缓经济增长。

由于全国各地的购房者暂停了房屋搜索,这导致房屋建筑商终止活动。这导致对冰箱、木材、窗户和油漆等物品的需求下降。从理论上讲,这些经济收缩应该有助于控制失控的通货膨胀。

经济学博客《计算风险》(Calculated Risk)的作者比尔·麦克布莱德在今年夏天早些时候对《财富》杂志表示:“(房地产市场)不是目标,但它(房地产市场)本质上是目标。”

3. 卖家要求暂停。

随着新冠疫情导致的房地产热潮在今年夏天逐渐消退,我们看到全国各地的库存激增。在像奥斯汀和博伊西这样的泡沫市场中,3月至8月间的库存增幅超过300%。

但这种库存激增的势头已经开始消退。

Realtor.com网站5月的活跃房源增加了10.69万套。6月和7月活跃房源分别增加了10.29万套和12.82万套。然而,8月库存增幅放缓至3.19万套。Altos Research预测,在今年余下的时间里,库存实际上会下降。

发生了什么事情呢?首先,卖家开始意识到买家受够了高价买房了。一些卖家只是在等待房地产市场走出低迷,而不是以低价卖房。

还有利率锁定效应。绝大多数未偿还抵押贷款的利率低于5%,其中很大一部分甚至低于3%。如果他们现在出售,他们就将放弃历史上最低的抵押贷款利率。这样的付款增幅对买一套比他们已经拥有的房子更大更贵的房子的买家来说几乎没有吸引力。

帕拉西奥斯告诉《财富》杂志:“要说服人们放弃低得离谱的利率将非常困难。”尽管许多业内人士认为,库存紧张将有助于防止房地产市场崩盘,但帕拉西奥斯表示,这不足以阻止房价回调。(财富中文网)

译者:中慧言-王芳

早在今年6月,美联储的主席杰罗姆·鲍威尔就明确表示:房地产市场将经历“重启”。

“我想说的是,如果你是购房者,或者想要买房的年轻人,你就需要等待房地产市场重回稳定状态。我们需要重新回到供需平衡、通货膨胀再次走低、抵押贷款利率再次走低的状态。”

每当央行从货币宽松政策转向货币紧缩政策,就会对房地产等对利率敏感行业产生影响。当然,如果在住宅类房地产在短短两年多的时间里飙升43%之后收紧货币政策,带来的影响就会更大。鲍威尔在6月承认了这一点。然而,他没有明确表示利率冲击是否会推动房价下跌。

时间快进到9月,我们无需质疑住房“重启”是否会影响房价。早在今年6月,美国房地产市场仍然处于房地产活动大幅下滑的初期阶段。从那以后,我们看到房地产活动,包括房屋销售和房屋建设水平大幅下降。但随着8月的数据陆续出炉,我们现在有明确的证据表明,房地产市场的低迷已经超越了第一阶段(即房地产活动大幅下滑),进入了第二阶段(即房价下跌)。

“我们的观点是,(抵押贷款)利率在高位停留的时间越长,房地产市场就越会继续受到冲击,并进入重启模式。现在必须要进行的负担能力重启机制是针对房价的。因此,我们预测全国很多市场将面临两位数的房价下跌。”约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)的研究主管小里克·帕拉西奥斯告诉《财富》杂志。

让我们更深入地了解一下,当我们进入房地产市场低迷的第二阶段时,这三个要素将发生什么变化。

1. 房价回调正在蔓延。

今年,随着抵押贷款利率从3.2%飙升至6.3%,业内人士知道这将导致房地产活动的急剧收缩。然而,许多看好房地产的人认为,这不会拉低房价。今年3月,Zillow甚至预测未来一年房价还将上涨17.8%。

很明显,看好房地产的人错了。在约翰·伯恩斯房地产咨询公司追踪的148个地区房地产市场中,98个房地产市场的房价已经从2022年的峰值下跌。只有50个房地产市场仍然处于峰值期。

在11个房地产市场中,伯恩斯房屋价值指数(Burns Home Value Index)已经下跌了5%以上。其中旧金山房价下跌了8.2%。虽然在每年的这个时候,房价中值下降是很常见的,但由于季节性,房屋价值或“房屋买卖历史对比”下降并不常见。简而言之:房价回调比之前想象的更剧烈,影响范围也更广。

包括穆迪分析公司(Moody's Analytics)、约翰·伯恩斯房地产咨询公司、Zonda和Zelman & Associates在内的越来越多的研究公司预计,房价回调将持续到2023年。穆迪分析公司认为,美国房价从高点以来的跌幅将很快达到5%。该公司指出,在严重“高估”的房地产市场,房价下跌幅度可能在5%到10%之间。穆迪分析公司预测,如果经济陷入衰退,房价跌幅将会翻倍。但即便是这样的情况,美国房价跌幅也仍然低于2006年至2012年间从高点以来27%的跌幅。

目前,仍然有包括Zillow在内的一些公司认为,房价回调——由抵押贷款利率飙升造成的负担能力紧缩所驱动——不会延续到2023年。Zillow总部位于西雅图。Zillow房地产网站承认,62%的房地产市场将在2022年第三季度出现房价下跌。然而,Zillow的经济学家预测,在2022年8月至2023年8月期间,只有28.5%的房地产市场将出现同比下跌。

2. 房地产市场的低迷将很快蔓延到房地产以外的领域。

与去年同期相比,持续的楼市低迷已经导致新屋销售和成屋销售分别下降了29.6%和20.2%。Redfin、Realtor.com和Compass等房地产公司已经宣布裁员。房屋建筑商正在取消项目,而一些抵押贷款机构正濒临破产。

即使如此,房地产市场低迷带来的大部分金融痛苦都被遏制在房地产行业内。这种情况即将改变。

高盛集团(Goldman Sachs)的研究人员最近发表了一篇题为《房地产市场低迷:房价将进一步下跌》(The Housing Downturn: Further to Fall)的论文。该投资银行预测,美国住房GDP将在2022年下降8.9%,在2023年再下降9.2%。在2007年12月正式开始的经济大衰退(Great Recession)之前,2006年住房GDP下降了7.4%,2007年下降了21.4%。

如果高盛集团的预测是正确的,这将意味着美国房地产市场的收缩将很快蔓延到更广泛的经济领域。这并没有令人感到意外。毕竟,美联储已经提高了联邦基金利率,试图减缓经济增长。

由于全国各地的购房者暂停了房屋搜索,这导致房屋建筑商终止活动。这导致对冰箱、木材、窗户和油漆等物品的需求下降。从理论上讲,这些经济收缩应该有助于控制失控的通货膨胀。

经济学博客《计算风险》(Calculated Risk)的作者比尔·麦克布莱德在今年夏天早些时候对《财富》杂志表示:“(房地产市场)不是目标,但它(房地产市场)本质上是目标。”

3. 卖家要求暂停。

随着新冠疫情导致的房地产热潮在今年夏天逐渐消退,我们看到全国各地的库存激增。在像奥斯汀和博伊西这样的泡沫市场中,3月至8月间的库存增幅超过300%。

但这种库存激增的势头已经开始消退。

Realtor.com网站5月的活跃房源增加了10.69万套。6月和7月活跃房源分别增加了10.29万套和12.82万套。然而,8月库存增幅放缓至3.19万套。Altos Research预测,在今年余下的时间里,库存实际上会下降。

发生了什么事情呢?首先,卖家开始意识到买家受够了高价买房了。一些卖家只是在等待房地产市场走出低迷,而不是以低价卖房。

还有利率锁定效应。绝大多数未偿还抵押贷款的利率低于5%,其中很大一部分甚至低于3%。如果他们现在出售,他们就将放弃历史上最低的抵押贷款利率。这样的付款增幅对买一套比他们已经拥有的房子更大更贵的房子的买家来说几乎没有吸引力。

帕拉西奥斯告诉《财富》杂志:“要说服人们放弃低得离谱的利率将非常困难。”尽管许多业内人士认为,库存紧张将有助于防止房地产市场崩盘,但帕拉西奥斯表示,这不足以阻止房价回调。(财富中文网)

译者:中慧言-王芳

Back in June, Fed Chair Jerome Powell made it clear: The housing market would go through a “reset.”

“I’d say if you are a homebuyer, somebody or a young person looking to buy a home, you need a bit of a reset. We need to get back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again,” Powell told reporters.

Whenever a central bank moves from monetary easing to monetary tightening, there’s going to be an impact on a rate-sensitive sector like real estate. That impact, of course, is going to be even greater when monetary tightening comes after the asset class—residential real estate—spiked 43% in just over two years. Powell admitted that much in June. However, Powell was noncommittal as to whether the rate shock would push home prices lower.

Fast forward to September, and we no longer need to question if the housing “reset” will affect home prices. Back in June, the U.S. housing market was still just in the early innings of a sharp drop in housing activity. Since, we’ve seen housing activity, including home sales and home construction levels, go much lower. But as data rolls in for August, we now have clear evidence that the housing market downturn has moved beyond that first stage (i.e. a sharp drop in housing activity) and into the second stage (i.e. falling home prices).

“The longer that [mortgage] rates stay elevated, our view is that housing is going to continue to feel it and have this reset mode. And the affordability resetting mechanism right now that has to happen is on [home] prices. And so there are a lot of markets across the country where we’re forecasting that home prices are going to fall double-digits,” Rick Palacios Jr., head of research at John Burns Real Estate Consulting, tells Fortune.

Let’s take a deeper look at the three elements that’ll shift as we move into the second stage of the housing market downturn.

1. The home price correction is spreading.

As mortgage rates spiked—going from 3.2% to 6.3% this year—industry insiders knew it'd cause a sharp contraction in housing activity. However, many housing bulls thought it wouldn't pull prices down. In March, Zillow went as far as to predict another 17.8% jump in home prices over the coming year.

It's clear that housing bulls got it wrong. Among the 148 regional housing markets tracked by John Burns Real Estate Consulting, 98 housing markets have seen home values fall from their 2022 peaks. Just 50 markets remains at their peak.

In 11 markets, the Burns Home Value Index* has already dropped by more than 5%. That includes a 8.2% drop in San Francisco home values. While it's common for median list prices to drop around this time of year, it's not common for home values or "comps" to fall because of seasonality. Simply put: The home price correction is sharper—and more widespread—than previously thought.

A growing chorus of research firms—including Moody's Analytics, John Burns Real Estate Consulting, Zonda, and Zelman & Associates—expect this home price correction to continue into 2023. Peak-to-trough, Moody's Analytics thinks U.S. home prices could soon fall 5%. In significantly "overvalued" housing markets, Moody's Analytics thinks that price drop could range from 5% to 10%. If a recession manifests, Moody's Analytics predicts those price drops would double. But even that scenario would still be below the peak-to-trough U.S. home price decline of 27% we saw between 2006 and 2012.

There are still some firms that don't think the home price correction—which is driven by an affordability squeeze created by spiked mortgage rates—will carry over into 2023. That includes Zillow. The Seattle-based home listing site acknowledges that 62% of housing markets should see falling home values in the third quarter of 2022. However, Zillow economists predict that only 28.5% of markets are headed for year-over-year declines between August 2022 and August 2023.

2. The housing downturn will soon spread beyond housing.

On a year-over-year basis, the ongoing housing downturn has seen new home sales and existing home sales fall by 29.6% and 20.2%. Real estate firms like Redfin, Realtor.com, and Compass have already issued layoffs. Homebuilders are calling off projects, while some mortgage lenders are teetering on bankruptcy.

That said, most of the financial pain of the housing downturn has been contained within the real estate industry. That's about to change.

Researchers at Goldman Sachs recently released a paper titled “The Housing Downturn: Further to Fall.” The investment bank forecasts that U.S. housing GDP will drop by 8.9% in 2022 and another 9.2% in 2023. In the lead-up to the Great Recession—which officially started in December 2007—housing GDP fell by 7.4% in 2006 and 21.4% in 2007.

If Goldman Sachs is right, it'll mean the contractions in the U.S. housing market will soon sprawl out into the broader economy. That's not surprising. After all, the Federal Reserve has upped the Federal Funds rate in an attempt to slow the economy.

As home shoppers across the country put their home search on pause it causes homebuilders to pull back. That sees decreased demand for things like refrigerators, lumber, windows, and paint. Those economic contractions should, in theory, help to rein in runaway inflation.

"It [housing] is not the target, but it [housing] is essentially the target," Bill McBride, author of the economics blog Calculated Risk, told Fortune earlier this summer.

3. Sellers are calling timeout.

As the Pandemic Housing Boom fizzled out this summer, we saw inventory jump across the country. In bubbly markets, like Austin and Boise, that inventory jump was greater than 300% between March and August.

But that inventory spike is already fizzling out.

Active listings on Realtor.com jumped by 106,900 homes in May. That was followed by 102,900 and 128,200 jumps in June and July. However, that slowed in August to just a 31,900 inventory jump. And through the rest of the year, Altos Research predicts inventory will actually fall.

What's going on? For starters, sellers are realizing that buyers are done paying top dollar. Rather than take less, some sellers are simply waiting out the housing downturn.

There's also the rate lock-in effect. The vast majority of outstanding mortgages have rates below 5%—with a big chunk even below 3%. If they sell now, they'd be giving up their historically low mortgage rate. That payment jump is hardly appealing for move-up buyers.

"It's going to be very very hard to persuade people to let go of those insanely low rates," Palacios tells Fortune. While many industry insiders believe tight inventory will help to prevent a housing crash, Palacios says it won't be enough to prevent the home price correction.