“美国版贝壳”疯狂炒房,助长房价虚高

没有什么比Zillow更能够代表美国对房地产的痴迷。随着新冠疫情蔓延,美国房市一飞冲天,买家、卖家和大批看热闹的人蜂拥到Zillow的网站和应用程序。现在,Zillow的月均用户数超过2亿,约两倍于在娱乐与体育节目电视网(ESPN.com)上看最新比赛的人数。最近,Zillow狂热现象甚至登上了《周六夜现场》(Saturday Night Live),演员们对着并不打算买的房子垂涎三尺,发出诱惑的声音:“需要新梦想吗?那你应该去Zillow看看。”

尽管备受关注,但让Zillow业务真正得以持续的动力并非来自只看不买的人,甚至不是真正想购买房产的人,而是莱斯莉·特纳之类的中介。

特纳是Zillow的金牌中介,她向Zillow购买潜在购房者在网站上提交的联系信息。2018年,通过Zillow的搭线,她联系上一对正在美国南卡罗来纳州查尔斯顿寻找第二套房子的夫妇,特纳是当地的Maison Real Estate的经纪人。在她的帮助下,买家买下了一栋符合所有要求、价值33.5万美元的房屋。两年后,那对夫妇找特纳签协议出售房屋(37.3万美元),随后在附近买了一处投资性房产(45万美元),并在市中心买下一套永久住宅(84.5万美元)。四笔都是大金额销售,全都来自当初Zillow搭的线。

对特纳之类的中介来说,从Zillow寻找潜在买家并不是完美解决方案。特纳说,每年向Zillow支付约25万美元的信息费,仅可以给她创造12%的销售额。但Zillow用户众多且规模巨大,为她的小中介机构提供了难得的附加价值。“主要是打品牌和推广知名度。”她说。“如果你在Zillow寻找查尔斯顿市市中心的房子,就会看到我们。”

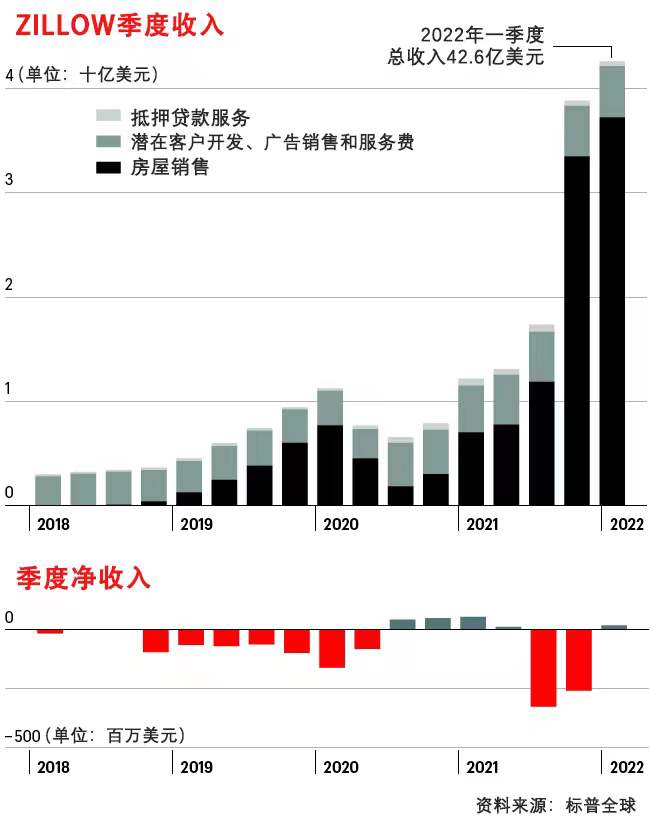

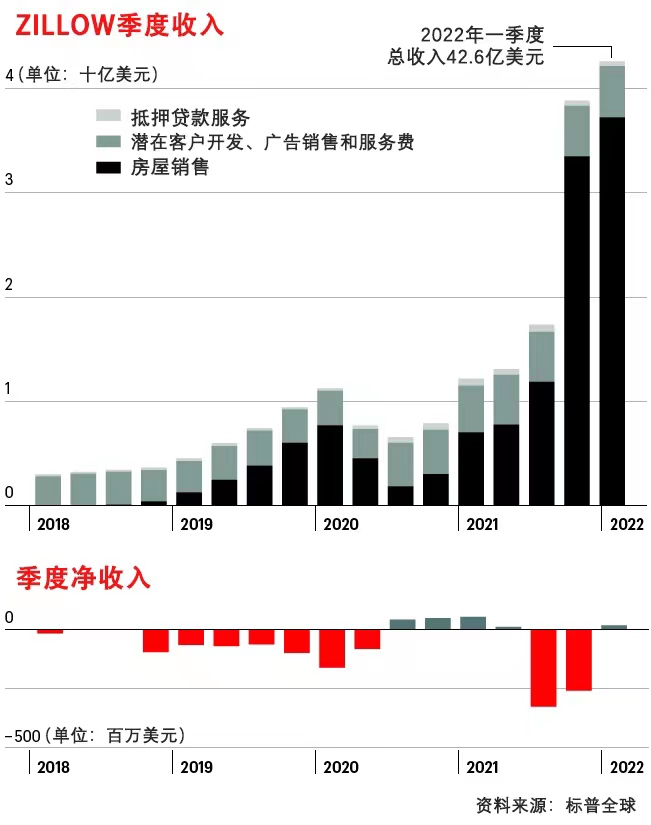

然而,这部分业务从来不是Zillow最诱人的部分。毕竟,潜在客户开发(lead generation)的做法已经持续了几十年,电话销售乃至上门销售时代就已经开始。但该业务带来的盈利可能推动公司发展:2021年,涉及潜在客户开发的部门是Zillow的第二大部门,也是资产负债表中唯一盈利的部门。

收入最大一块来自哪里?是2021年惊人爆发的炒房业务,与潜在客户开发业务完全不同。2021年11月,Zillow宣布关闭名为Zillow Offers的炒房业务,解雇2000名员工,还要尽快处理剩下的房源。不过在2021年,该业务卖出了大量房屋,推动公司的收入从之前一年的33亿美元增至81亿美元,也帮助Zillow首次跻身《财富》美国500强,但如果着眼未来,这绝对不是好消息。即便收入大规模增加,美国房地产市场也史无前例火爆,公司还是亏损了5.28亿美元。

回顾Zillow陷入炒房困局之路,其实起初只是2018年在菲尼克斯和拉斯维加斯的小规模试点项目。Zillow成立于2006年,当时推出了房价估算工具Zestimate,认为算法能够估算房屋的当前价值并预测未来变化。公司希望找出可以快速升值的房产,催促卖家支付公司5%至9%的服务费,之后买下房子,再转手获利。

Zillow并未透露在菲尼克斯和维加斯的具体情况,但结果显然激发了创始人及首席执行官理查德·巴顿的热情。他宣布扩张计划并告诉投资者,预计未来三到五年内Zillow Offers能够带来最多200亿美元的年收入。现在,Zillow的首席运营官杰里米·瓦克斯曼回顾业务时坚称,公司别无选择,只能做大做强才有可能推动Zillow Offers成功。买卖房屋是昂贵、复杂、低利润的业务,只有形成规模才可以盈利。瓦克斯曼说,公司需要“高效的自动化交易,才能够覆盖业务所需的固定成本,需要大量技术、大量数据、高度自动化,以及大量资本”。

理论是不错,但注定要面临两大问题,其中之一Zillow无法控制,另一个则是自身导致的问题。首先是新冠疫情,导致Zillow等很多公司预期要承担最糟糕的后果。为了应对可能的市场停滞,公司向中介收取的销售线索费用减半。不过市场并未放缓。事实上,2020年夏季迎来了历史性的繁荣。火热的市场提升了Zillow的信心,2021年一季度,Zillow Offers推动赚取了创纪录的5200万美元利润,公司也开始加快速度买入房屋。

这正是车轮开始脱轨之处。到2021年春季,市场已经过热,Zillow广受称赞的算法也是房屋倒手策略的基础,再想准确估价预测越发困难。分析师表示,该公司相信算法夸大后的数字,在全美以过高的价格买入房屋。

购买辛辛那提郊外联合镇的一幢中西风格的两层楼房屋就是一个例子。根据公开记录和房地产数据库就能够一窥究竟,2021年夏季,业主以33.85万美元价格挂牌。Zillow以35万美元买下,几乎立刻以36.6万美元挂牌。即使在蓬勃发展的市场中,这个价格也不会有人买。三个月后,Zillow以32.9万美元出售了该房产,损失还不包括交易或持有成本。

Zillow激进的算法伤害的不仅是公司自身。由于Zillow在全美高价购买房屋,很可能在美国房地产史上最火热的时期协助推高了房价。该公司跟真正需要房子的刚需竞争,还经常战胜刚需。Zillow表示,目标房价在20万美元至40万美元之间,往往是首次购房者最关注的价格区间。(Zillow否认自己与买家存在竞争,称其会快速转售房屋,而且购买的大部分房屋尚未挂牌出售。)当然,Zillow一家公司不太可能改变宏观房地产环境,但加入了更大一波私人投资者,在新冠疫情期间,这群人的疯狂购买无疑影响了房价。1月,投资者购房占美国房屋销售的33%,是2012年约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)开始跟踪数据以来最高比例。

Zillow的高管对算法失败、亏损数百万美元以及Zillow Offers崩盘并不太关心。“这是业务的一部分。总会有大波动。有的成功,有的失败。”Zillow的总裁苏珊·戴姆勒表示。

该公司非但没有自我反省,反而开始着手下一个大项目,即所谓的“房屋超级应用程序”。尽管名称夸张,但这款应用程序实际上看起来很像回归其核心业务,主要满足中介和房主的需求。

尽管Zillow专注各处抢房,但从2013年StreeteEasy(5000万美元)和2015年Trulia(25亿美元)的大笔收购开始,该公司一直在稳步推进。2018年,Zillow以6500万美元收购了抵押贷款公司Mortgage Lenders of America,开始涉足抵押贷款业务。2021年,Zillow又斥资5亿美元收购可以帮助房地产中介安排看房的网站ShowingTime。一笔笔收购,再加上Zillow开始为购房者提供产权、交割和托管服务等选项,公司终于能够开始整合房地产业务“马赛克”,这一概念由Stephens公司的分析师约翰·坎贝尔提出,其中多项业务可能会出现在超级应用程序中。“从卖掉A房屋,到买入B房屋,所有事都属于(Zillow)的业务。”坎贝尔说。他希望该公司更加激进,将业务拓展到像搬家服务这样的领域。

Zillow认为,尽管已经提供各种服务并建立了品牌知名度,但尚未发挥出潜力,可能确实如此。去年美国约有600万人购买房屋,公司声称买房过程中约400万人访问过Zillow。其中约150万人请Zillow帮忙联系中介。然而,2021年只有3%的美国房产交易中,买家曾经通过Zillow联系中介。该公司认为,到2025年这一比例将翻一番,年收入将超过50亿美元。瓦克斯曼问道,为什么要打住?“即使占到交易6%,前路仍然漫长,还有94%的交易我们没有参与。”

行业观察人士的态度谨慎乐观。Evercore ISI的高级董事总经理马克·马哈尼称,要实现目标,Zillow应将业务范围进一步扩大到房地产各领域,并保持收购。“乐观的前景是,最后变成(房地产)平台公司。”

如果房地产市场发展顺利,应该有机会。然而Zillow算法崩溃显示,预测美国房地产未来趋势几乎不可能。随着经济降温和抵押贷款利率上升,就算不是预言家也能够看到市场最终回归现实。

事实上,看起来情况已经非常严重。今年春天,穆迪分析(Moody’s Analytics)发现,96%的美国房地产市场被“高估”。对Zillow来说,要想在房地产市场调整时期实现突破将尤为艰难。买家和卖家的减少意味着服务需求的降低。关键是,这也意味着出售给中介的优质潜在买家线索更少,而且市场低迷期间房地产中介往往选择退出行业,购买它们服务的中介也更少。

2010年,史蒂夫·乔布斯穿着标志性的黑色高领毛衣,走上苹果公司(Apple)位于库比蒂诺的总部的舞台,台下掌声雷动。当时这位传奇掌门人介绍了最近发布的iPad。他演示的应用程序是哪个?正是Zillow。

当年,乔布斯正在做他最擅长的事情:抓住人们的想象力。Zillow也一样。2006年成立以来,Zillow一直身处行业最前沿,将房地产市场呈现在人们面前的屏幕上。后来的炒房业务背离了根本使命。也许如今公司新方向将推动回归本源:给购房者更多的权利,而不是跟刚需竞争。(财富中文网)

本文另一版本登载于《财富》杂志2022年6/7月刊,标题为《Zillow还能回归本业吗?》(Can Zillow go home again?)。

译者:梁宇

审校:夏林

没有什么比Zillow更能够代表美国对房地产的痴迷。随着新冠疫情蔓延,美国房市一飞冲天,买家、卖家和大批看热闹的人蜂拥到Zillow的网站和应用程序。现在,Zillow的月均用户数超过2亿,约两倍于在娱乐与体育节目电视网(ESPN.com)上看最新比赛的人数。最近,Zillow狂热现象甚至登上了《周六夜现场》(Saturday Night Live),演员们对着并不打算买的房子垂涎三尺,发出诱惑的声音:“需要新梦想吗?那你应该去Zillow看看。”

尽管备受关注,但让Zillow业务真正得以持续的动力并非来自只看不买的人,甚至不是真正想购买房产的人,而是莱斯莉·特纳之类的中介。

特纳是Zillow的金牌中介,她向Zillow购买潜在购房者在网站上提交的联系信息。2018年,通过Zillow的搭线,她联系上一对正在美国南卡罗来纳州查尔斯顿寻找第二套房子的夫妇,特纳是当地的Maison Real Estate的经纪人。在她的帮助下,买家买下了一栋符合所有要求、价值33.5万美元的房屋。两年后,那对夫妇找特纳签协议出售房屋(37.3万美元),随后在附近买了一处投资性房产(45万美元),并在市中心买下一套永久住宅(84.5万美元)。四笔都是大金额销售,全都来自当初Zillow搭的线。

对特纳之类的中介来说,从Zillow寻找潜在买家并不是完美解决方案。特纳说,每年向Zillow支付约25万美元的信息费,仅可以给她创造12%的销售额。但Zillow用户众多且规模巨大,为她的小中介机构提供了难得的附加价值。“主要是打品牌和推广知名度。”她说。“如果你在Zillow寻找查尔斯顿市市中心的房子,就会看到我们。”

然而,这部分业务从来不是Zillow最诱人的部分。毕竟,潜在客户开发(lead generation)的做法已经持续了几十年,电话销售乃至上门销售时代就已经开始。但该业务带来的盈利可能推动公司发展:2021年,涉及潜在客户开发的部门是Zillow的第二大部门,也是资产负债表中唯一盈利的部门。

收入最大一块来自哪里?是2021年惊人爆发的炒房业务,与潜在客户开发业务完全不同。2021年11月,Zillow宣布关闭名为Zillow Offers的炒房业务,解雇2000名员工,还要尽快处理剩下的房源。不过在2021年,该业务卖出了大量房屋,推动公司的收入从之前一年的33亿美元增至81亿美元,也帮助Zillow首次跻身《财富》美国500强,但如果着眼未来,这绝对不是好消息。即便收入大规模增加,美国房地产市场也史无前例火爆,公司还是亏损了5.28亿美元。

回顾Zillow陷入炒房困局之路,其实起初只是2018年在菲尼克斯和拉斯维加斯的小规模试点项目。Zillow成立于2006年,当时推出了房价估算工具Zestimate,认为算法能够估算房屋的当前价值并预测未来变化。公司希望找出可以快速升值的房产,催促卖家支付公司5%至9%的服务费,之后买下房子,再转手获利。

Zillow并未透露在菲尼克斯和维加斯的具体情况,但结果显然激发了创始人及首席执行官理查德·巴顿的热情。他宣布扩张计划并告诉投资者,预计未来三到五年内Zillow Offers能够带来最多200亿美元的年收入。现在,Zillow的首席运营官杰里米·瓦克斯曼回顾业务时坚称,公司别无选择,只能做大做强才有可能推动Zillow Offers成功。买卖房屋是昂贵、复杂、低利润的业务,只有形成规模才可以盈利。瓦克斯曼说,公司需要“高效的自动化交易,才能够覆盖业务所需的固定成本,需要大量技术、大量数据、高度自动化,以及大量资本”。

理论是不错,但注定要面临两大问题,其中之一Zillow无法控制,另一个则是自身导致的问题。首先是新冠疫情,导致Zillow等很多公司预期要承担最糟糕的后果。为了应对可能的市场停滞,公司向中介收取的销售线索费用减半。不过市场并未放缓。事实上,2020年夏季迎来了历史性的繁荣。火热的市场提升了Zillow的信心,2021年一季度,Zillow Offers推动赚取了创纪录的5200万美元利润,公司也开始加快速度买入房屋。

这正是车轮开始脱轨之处。到2021年春季,市场已经过热,Zillow广受称赞的算法也是房屋倒手策略的基础,再想准确估价预测越发困难。分析师表示,该公司相信算法夸大后的数字,在全美以过高的价格买入房屋。

购买辛辛那提郊外联合镇的一幢中西风格的两层楼房屋就是一个例子。根据公开记录和房地产数据库就能够一窥究竟,2021年夏季,业主以33.85万美元价格挂牌。Zillow以35万美元买下,几乎立刻以36.6万美元挂牌。即使在蓬勃发展的市场中,这个价格也不会有人买。三个月后,Zillow以32.9万美元出售了该房产,损失还不包括交易或持有成本。

Zillow激进的算法伤害的不仅是公司自身。由于Zillow在全美高价购买房屋,很可能在美国房地产史上最火热的时期协助推高了房价。该公司跟真正需要房子的刚需竞争,还经常战胜刚需。Zillow表示,目标房价在20万美元至40万美元之间,往往是首次购房者最关注的价格区间。(Zillow否认自己与买家存在竞争,称其会快速转售房屋,而且购买的大部分房屋尚未挂牌出售。)当然,Zillow一家公司不太可能改变宏观房地产环境,但加入了更大一波私人投资者,在新冠疫情期间,这群人的疯狂购买无疑影响了房价。1月,投资者购房占美国房屋销售的33%,是2012年约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)开始跟踪数据以来最高比例。

Zillow的高管对算法失败、亏损数百万美元以及Zillow Offers崩盘并不太关心。“这是业务的一部分。总会有大波动。有的成功,有的失败。”Zillow的总裁苏珊·戴姆勒表示。

该公司非但没有自我反省,反而开始着手下一个大项目,即所谓的“房屋超级应用程序”。尽管名称夸张,但这款应用程序实际上看起来很像回归其核心业务,主要满足中介和房主的需求。

尽管Zillow专注各处抢房,但从2013年StreeteEasy(5000万美元)和2015年Trulia(25亿美元)的大笔收购开始,该公司一直在稳步推进。2018年,Zillow以6500万美元收购了抵押贷款公司Mortgage Lenders of America,开始涉足抵押贷款业务。2021年,Zillow又斥资5亿美元收购可以帮助房地产中介安排看房的网站ShowingTime。一笔笔收购,再加上Zillow开始为购房者提供产权、交割和托管服务等选项,公司终于能够开始整合房地产业务“马赛克”,这一概念由Stephens公司的分析师约翰·坎贝尔提出,其中多项业务可能会出现在超级应用程序中。“从卖掉A房屋,到买入B房屋,所有事都属于(Zillow)的业务。”坎贝尔说。他希望该公司更加激进,将业务拓展到像搬家服务这样的领域。

Zillow认为,尽管已经提供各种服务并建立了品牌知名度,但尚未发挥出潜力,可能确实如此。去年美国约有600万人购买房屋,公司声称买房过程中约400万人访问过Zillow。其中约150万人请Zillow帮忙联系中介。然而,2021年只有3%的美国房产交易中,买家曾经通过Zillow联系中介。该公司认为,到2025年这一比例将翻一番,年收入将超过50亿美元。瓦克斯曼问道,为什么要打住?“即使占到交易6%,前路仍然漫长,还有94%的交易我们没有参与。”

行业观察人士的态度谨慎乐观。Evercore ISI的高级董事总经理马克·马哈尼称,要实现目标,Zillow应将业务范围进一步扩大到房地产各领域,并保持收购。“乐观的前景是,最后变成(房地产)平台公司。”

如果房地产市场发展顺利,应该有机会。然而Zillow算法崩溃显示,预测美国房地产未来趋势几乎不可能。随着经济降温和抵押贷款利率上升,就算不是预言家也能够看到市场最终回归现实。

事实上,看起来情况已经非常严重。今年春天,穆迪分析(Moody’s Analytics)发现,96%的美国房地产市场被“高估”。对Zillow来说,要想在房地产市场调整时期实现突破将尤为艰难。买家和卖家的减少意味着服务需求的降低。关键是,这也意味着出售给中介的优质潜在买家线索更少,而且市场低迷期间房地产中介往往选择退出行业,购买它们服务的中介也更少。

2010年,史蒂夫·乔布斯穿着标志性的黑色高领毛衣,走上苹果公司(Apple)位于库比蒂诺的总部的舞台,台下掌声雷动。当时这位传奇掌门人介绍了最近发布的iPad。他演示的应用程序是哪个?正是Zillow。

当年,乔布斯正在做他最擅长的事情:抓住人们的想象力。Zillow也一样。2006年成立以来,Zillow一直身处行业最前沿,将房地产市场呈现在人们面前的屏幕上。后来的炒房业务背离了根本使命。也许如今公司新方向将推动回归本源:给购房者更多的权利,而不是跟刚需竞争。(财富中文网)

本文另一版本登载于《财富》杂志2022年6/7月刊,标题为《Zillow还能回归本业吗?》(Can Zillow go home again?)。

译者:梁宇

审校:夏林

IS THERE a better symbol of America’s real estate obsession than Zillow? As the U.S. home market rocketed into the stratosphere in the wake of the pandemic, buyers, sellers—and plenty of lookie-loos— have flocked to its site and app; Zillow is now averaging more than 200 million users a month, roughly double the number of people checking the latest scores on ESPN.com. The Zillow phenomenon even made a recent appearance on Saturday Night Live, where cast members drooled over listings they had no intention of buying and a sultry voice cooed, “Need a new fantasy? Then you need Zillow.”

But for all the attention, the real force keeping Zillow’s business going isn’t those window-shoppers, or even the ones actually looking to buy—it’s the Leslie Turners.

Turner is a Zillow Premier Agent, meaning she pays the company for the contact information interested buyers submit through the site. In 2018, one of those Zillow leads connected her with a couple looking for a second home in Charleston, S.C., where Turner is a broker at Maison Real Estate. With her help, the buyers landed a $335,000 cottage that ticked all their boxes. Two years later they reached out to Turner to help sell the cottage ($373,000), buy an investment property nearby ($450,000), and splurge on a permanent residence in the heart of downtown ($845,000). That’s four major sales—all from that one little lead.

Zillow leads aren’t a perfect solution for agents like Turner. She say she pays Zillow about $250,000 per year for the information, and credits it for just 12% of her sales. But Zillow’s ubiquity and scale provide her local boutique agency with something otherwise out of its reach. “It’s branding and marketing awareness,” she says. “When you’re looking for a home on Zillow in downtown Charleston, you’re seeing us.”

This aspect of Zillow’s business has never been the sexiest part of what it does. After all, lead generation has been around for decades, going back to telemarketers and even door-to-door salesmen. But its financials might get you going: In 2021, the division that includes lead gen was the company’s second largest—and the only profitable portion of its balance sheet.

What was the biggest piece of the revenue pie? Well, that’s something quite different: the company’s home-flipping business, which blew up in spectacular fashion last year. In November, Zillow announced it was shutting down the effort—known as Zillow Offers—laying off 2,000 workers and scrambling to off-load its remaining homes. But a year of selling vast numbers of houses had already juiced the company’s revenue to $8.1 billion in 2021, up from $3.3 billion the previous year. That was enough to boost Zillow onto the Fortune 500 for the first time in its history, but far from good news for its future: Even on that massive influx, the company lost $528 million in the midst of one of the hottest real estate markets the country has ever seen.

*****

THE PATH TO ZILLOW’S homeflipping debacle began innocently enough, with small-scale pilot programs in Phoenix and Las Vegas in 2018. The company, which got its start in 2006 when it launched its home price estimator tool, Zestimate, thought its algorithm could suss out a home’s current worth and predict how it would change in the future. The plan was to identify properties that are quickly appreciating and have motivated sellers willing to pay Zillow’s 5% to 9% service fee; buy the homes; and flip them at a profit.

While Zillow hasn’t shared details of how it fared in Phoenix and Vegas, the results clearly fired up founder and CEO Rich Barton. He announced plans to expand and told investors he expected Zillow Offers to bring in up to $20 billion in annual revenue within three to five years. Reflecting on the business now, Jeremy Wacksman, Zillow’s COO, insists the company had no choice but to go big to give Zillow Offers a shot at success: Buying and selling homes is an expensive, complicated, low-margin business that can be profitable only on a massive scale. The company needed to “automate transactions so efficiently that you can cover the fixed cost required to run that operation, which requires a lot of technology, a lot of data, a lot of automation, and, again, a lot of capital,” says Wacksman.

Not a bad theory, but doomed by a pair of issues—one beyond Zillow’s control, and the other explicitly of its own making. First came the pandemic, which led many, including Zillow, to assume the worst; the company halved what it charged agents for leads as it hunkered down for a stagnant market. But that slowdown never came. In fact, the summer of 2020 ushered in what would become a historic boom. The red-hot market fed Zillow’s confidence, and with Zillow Offers helping drive a record $52 million profit in the first quarter of 2021, the company threw its house buying into overdrive.

That’s where the wheels started to come off. By spring of 2021, the market had overheated to a point where Zillow’s much-lauded algorithm, the backbone of its home-flipping strategy, was struggling to make accurate pricing predictions. Believing its own inflated numbers, say analysts, the company began overpaying for homes all across the country.

One such home was a Midwestern two-story house located in Union Township, outside Cincinnati. Public records and real estate databases tell the story in miniature: The owners listed it for $338,500 in the summer of 2021. Zillow bought it for $350,000 and almost immediately relisted it for $366,000. Even in a booming market, no one bit. After three months, Zillow sold the property for $329,000—a loss that doesn’t include closing or carrying costs.

Zillow’s trigger-happy algorithm didn’t hurt just the company: As Zillow paid top dollar for homes across the country, it likely helped to bid up prices amid a stretch that we now know to be the hottest in the U.S. housing market’s tabulated history. It was also competing against—and often beating out—people looking for a place to live; the company has said it targeted homes priced between $200,000 and $400,000, a range often favored by first-time buyers. (Zillow disputes that it was in competition with buyers, saying it resold homes quickly and that the majority of houses it purchased were not yet listed for sale.) It’s unlikely that Zillow alone moved the macro housing environment, but it was part of a larger wave of private investors whose turbocharged buying undoubtedly impacted home values during the pandemic. In January, investors made up 33% of U.S. home sales, the largest share since John Burns Real Estate Consulting started tracking the data in 2012.

*****

ZILLOW EXECUTIVES are blasé about the failures of its algorithm, the loss of millions of dollars, and the implosion of Zillow Offers. “It’s a part of business. You’re going to take some big swings. Some work out, some don’t,” says Zillow president Susan Daimler.

Far from soul searching, the company is already on to what it sees as the next big thing—something it calls “a housing super app.” Despite the hyperbolic name, this app actually seems very much like a return to Zillow’s core business, serving the needs of agents and homeowners.

Even while it focused on scooping up homes, Zillow continued the track record of major acquisitions it started with StreetEasy in 2013 ($50 million) and Trulia in 2015 ($2.5 billion). In 2018, it bought Mortgage Lenders of America for $65 million and began to dip its toe into lending. In 2021, Zillow completed a $500 million purchase of ShowingTime, a site real estate agents use to schedule home viewings. These purchases, as well as the fact that Zillow also started offering options like title, closing, and escrow services for homebuyers, position the company to begin putting together what John Campbell, an analyst with Stephens, calls a “mosaic” of all things real estate, many of which will likely end up on its super app. “Anything that you have to do to get out of home A and into home B is in [Zillow’s] purview,” says Campbell. He’d like to see the company get even more aggressive and branch into things like moving help.

For all the services it offers and brand awareness it’s built, Zillow believes it has yet to live up to its potential—and it may have a point. Of the 6 million or so people who bought a home in the U.S. last year, about 4 million visited zillow.com at some point in the process, according to the company. Roughly 1.5 million of them asked Zillow to put them in touch with a real estate agent. Yet only 3% of all U.S. home transactions in 2021 involved a buyer who was connected to an agent through Zillow. The company thinks it can double that share by 2025, taking it above $5 billion in annual revenue. And why stop there, asks Wacksman. “Even at 6% [of transactions], there is a long way to go; there would still be 94% that we are not participating in.”

Industry watchers are cautiously optimistic. Hitting these goals would require Zillow to expand its purview even further into real estate’s nooks and crannies, and to keep up its pace of acquisitions, says Mark Mahaney, senior managing director at Evercore ISI: “The bullish outlook would be that they can become a [real estate] platform company.”

It would help if the housing market cooperated. As Zillow’s algorithmic meltdown illustrated, predicting the future of U.S. real estate is a virtually impossible task. But with the economy cooling and mortgage rates on the rise, you don’t have to be Nostradamus to see the market eventually coming back down to earth.

In fact, things are already looking pretty maxed out: An analysis conducted this spring by Moody’s Analytics found that 96% of U.S. housing markets are “overvalued.” A housing correction would be a tough break for Zillow. Fewer buyers and sellers mean less demand for its services. Critically, that also means fewer good leads to sell to agents, and because realtors often drop out of the industry during down markets, fewer agents to buy them.

*****

IN 2010, Steve Jobs, dressed in his iconic black turtleneck, walked onstage at Apple’s Cupertino headquarters to rapturous applause. The legendary CEO was demoing the recently released iPad. The app he used for the presentation? Zillow.

At that moment, Jobs was doing what he did best: capturing our imaginations. So was Zillow. Since its founding in 2006, Zillow has been at the forefront of bringing the real estate market alive on our screens. The company’s home-flipping experiment was a step away from that mission. Perhaps its new direction will bring it back to its roots: empowering homebuyers—not competing against them.

This article appears in the June/July 2022 issue of Fortune with the headline, “Can Zillow go home again?”