加密货币崩盘,专家预测未来还会有更大跌幅

对加密货币的持有者来说,其忍耐力在过去几个月经历了一场严峻的考验。

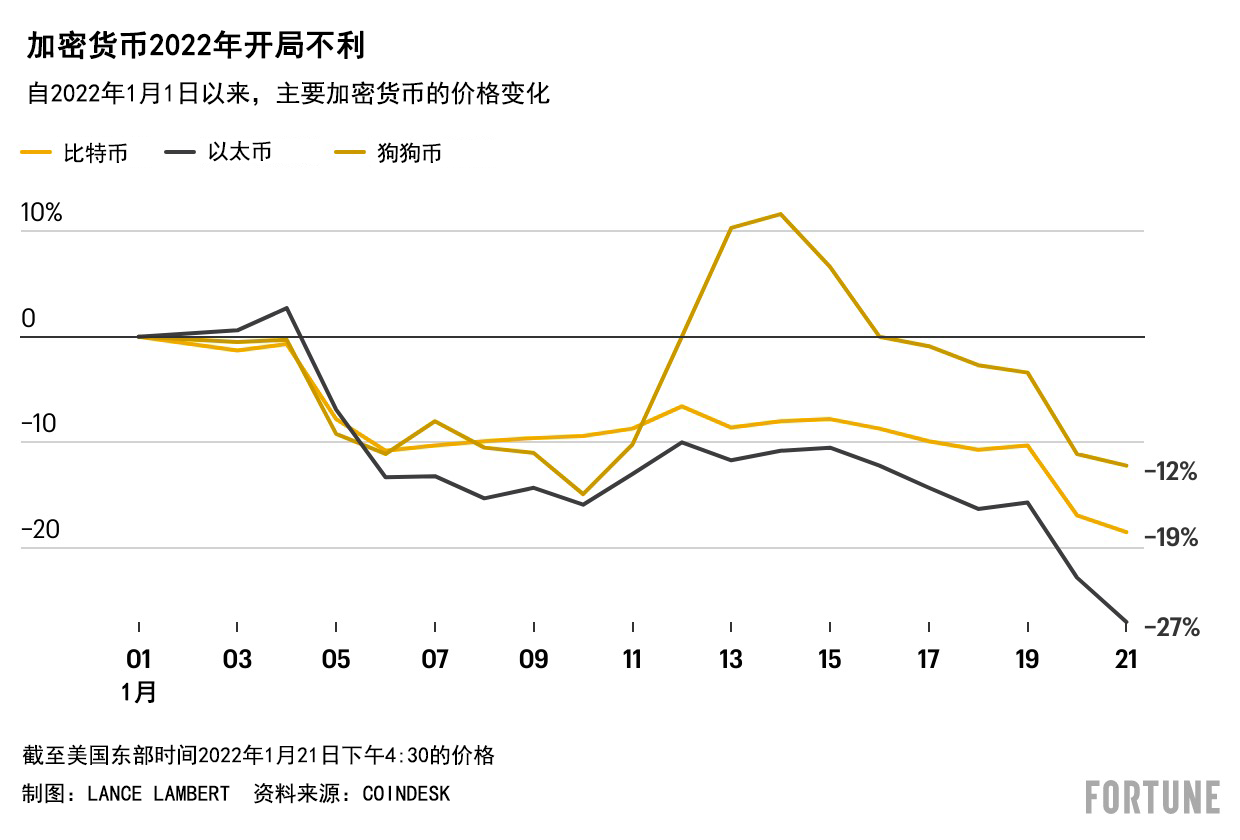

加密货币数据网站CoinMarketCap称,比特币(Bitcoin)和以太币(Ethereum)这两大顶级数字资产的市值自2021年11月中旬以来双双下滑了40%以上(比特币的价格在2021年11月升至约6.9万美元的历史新高,然后于今年1月21日下午交易期间暴跌至3.69万美元)。最近几天,比特币的价格一直在4万美元大关附近波动,但在1月21日大跌至3.7万美元以下,一旦跌破这个水平,“比特币在下探至3万美元之前不会获得多少支撑”,数据分析公司Oanda的高级市场分析师爱德华·莫亚在1月21日下午早些时候发布的纪要中写道。

尽管比特币这类加密货币的价格大跌对加密货币的长期投资者来说已经是司空见惯的事情,然而,加密货币投资公司Arca的首席投资官杰夫·多曼认为,人们对这种坚挺的数字资产的信心正在逐渐衰退。多曼说:“一直有投资者在撤离,尤其是人们对比特币的兴趣自然而然也略有降温。”

自2021年11月创历史新高以来,比特币携手大盘持续走低,尤其是成长型和科技股这类高风险资产(科技股占比较大的纳斯达克最近进入了纠正期,下滑了10%,而且1月21日仍然在下探)。比特币与科技股这类资产的关联并非什么新趋势,不过,这种关联在最近几周有所加强:彭博(Bloomberg)数据显示,纳斯达克综合指数(Nasdaq Composite)与比特币之间100天的关联度为0.47,而2021年11月底约为0.30。

专家称,正如很多人在最近几周提到的那样,比特币这类加密货币与科技股同时下跌的主要原因在于美联储(Federal Reserve)在2021年11月例会上的强势变脸,也就是加速紧缩和加息的步伐——这一点偏离了2020年以来支撑加密货币的各项政策。莫亚对《财富》杂志说:“美联储误判了[通胀]局势,他们如今不得不采取激进的紧缩政策,而此举让债券收益率一路狂飙。(10年收益率本周升至1.9%的高位,不过随后失守1.8%大关。)这对高风险资产来说并不是好事,而比特币在很大程度上是当中风险最高的资产。”

Arca的多曼指出,从凯西·伍德的方舟创新ETF基金(ARK Innovation ETF)到特殊目的收购公司(SPAC),最近的IPO活动以及比特币,一切“都随着这些美联储利率预期而受到了冲击,而且基本上一路下探。”受近期崩盘影响,比特币充当通胀对冲工具的观点亦出现了动摇。

多曼称:“不管比特币理应承担什么样的角色,一些宏观基金和政府以及传统金融机构如今都将其作为一项宏观风险指标来交易。这种现象在短期内将成为主流。”不过,多曼并不认为这一现象会一直存在。

与此同时,资产多元化可能也是比特币价格骤降的一个推手。莫亚指出,交易员“正在将目光投向其他人押注的……一些替代货币,而且这些货币有望成为以太币的主要竞争对手,成为下一个规模最大的区块链。”同时,莫亚还提到了Solana、Polkadot、Cardano和Avalanche等加密货币(这些货币最近也受到了冲击)。他说:“这种交易的多元化真的让比特币很受伤。”

莫亚还认为,全球能源危机以及俄罗斯于1月20日禁止使用以及开采比特币的威胁,可能会“让比特币企稳的尝试复杂化。”

加密货币将何去何从?

至于加密货币今后将何去何从,这在很大程度上取决于你说的是哪种货币。

Oanda的莫亚表示,比特币可能在未来几个月中继续保持波动,这意味着从技术角度来讲,比特币今年第一季度的交易价格区间可能为3.5万美元至5万美元。在此之后,他预计比特币价格在美联储今年第二次加息之后会处于一个更加稳定的状态,然后在2022年年末有所改善(他预计可能在6万美元左右)。与此同时,莫亚认为以太币的价格在今年会反弹,并突破4000美元(目前交易价为2600美元左右),但他还指出,以太币正在失去其在非同质化代币(NFT)的市场份额,而且他并不确定其能够“轻松升至”5000美元。

对日本加密货币交易所Bitbank的加密货币市场分析师长谷川裕也来说,比特币近期的走势“完全取决于下周的[美国联邦公开市场委员会(Federal Open Market Committee)]会议”,他对《财富》杂志说道。根据长谷川裕也以及加密货币研究和数据公司Messari的分析,比特币今年可能的最低价位在2.8万美元左右,与2021年的最低价相当(不过他认为比特币可能在年末会反弹至6万美元至8万美元的区间)。

加密货币研究公司Delphi Digital的市场与宏观经济负责人凯文·凯利也认为,比特币的前路将更加崎岖:他通过电子邮件对《财富》杂志说,自己预计“加密货币市场在短期到中期内并不会一帆风顺。”他还表示:“过去24小时内新出现的抛售现象来的比我们预想的早一些,但过去几周这一情绪在不断恶化。”他指出,他们重点关注的价位为3.56万美元至3.72万美元,“这个价位的突破或将导致流动性的聚集。”之后,“我们有望看到比特币在3.4万美元附近获得支撑。”凯利称,如果“情绪持续恶化”,他们“也不排除”价格下探至3万美元低位区间的可能性。

与此同时,Arca的多曼并不认为比特币在今后会出现更大的跌幅:“要说有什么不同的话”,他说,有鉴于风险资产在加息周期早期阶段良好的表现,“这一点被人们过分夸大了”。他预测,今年大多数数字资产普遍都会上涨。

然而很明显,并非所有的加密货币都将拥有同样的表现,而且多曼、长谷川裕也和凯利这类人认为,今年,表现良好和表现不佳的加密货币阵营将变得更加泾渭分明。正如多曼在最近的博客中写道,2022年将呈现出这样一种光景:“一些领域会出现熊市,一些领域则是牛市。市场恐慌所导致的持续数周的高关联度并不会消除领域的离散现象,也不会削弱长期关联度。”

确实,加密货币的某些领域发生了很多事情,例如非同质化代币以及游戏和元宇宙、去中心化金融(DeFi)和Web3,然而说到比特币,长谷川裕也认为:“短期内,今年没有什么盼头。我觉得,Solana、Avalanche这类加密货币的表现会优于比特币。”

然而,尽管加密货币投资者在眼下感到肉疼不已,但看看推特(Twitter)就知道,一些比特币拥趸已经做好血战到底的准备。(财富中文网)

译者:冯丰

审校:夏林

对加密货币的持有者来说,其忍耐力在过去几个月经历了一场严峻的考验。

加密货币数据网站CoinMarketCap称,比特币(Bitcoin)和以太币(Ethereum)这两大顶级数字资产的市值自2021年11月中旬以来双双下滑了40%以上(比特币的价格在2021年11月升至约6.9万美元的历史新高,然后于今年1月21日下午交易期间暴跌至3.69万美元)。最近几天,比特币的价格一直在4万美元大关附近波动,但在1月21日大跌至3.7万美元以下,一旦跌破这个水平,“比特币在下探至3万美元之前不会获得多少支撑”,数据分析公司Oanda的高级市场分析师爱德华·莫亚在1月21日下午早些时候发布的纪要中写道。

尽管比特币这类加密货币的价格大跌对加密货币的长期投资者来说已经是司空见惯的事情,然而,加密货币投资公司Arca的首席投资官杰夫·多曼认为,人们对这种坚挺的数字资产的信心正在逐渐衰退。多曼说:“一直有投资者在撤离,尤其是人们对比特币的兴趣自然而然也略有降温。”

自2021年11月创历史新高以来,比特币携手大盘持续走低,尤其是成长型和科技股这类高风险资产(科技股占比较大的纳斯达克最近进入了纠正期,下滑了10%,而且1月21日仍然在下探)。比特币与科技股这类资产的关联并非什么新趋势,不过,这种关联在最近几周有所加强:彭博(Bloomberg)数据显示,纳斯达克综合指数(Nasdaq Composite)与比特币之间100天的关联度为0.47,而2021年11月底约为0.30。

专家称,正如很多人在最近几周提到的那样,比特币这类加密货币与科技股同时下跌的主要原因在于美联储(Federal Reserve)在2021年11月例会上的强势变脸,也就是加速紧缩和加息的步伐——这一点偏离了2020年以来支撑加密货币的各项政策。莫亚对《财富》杂志说:“美联储误判了[通胀]局势,他们如今不得不采取激进的紧缩政策,而此举让债券收益率一路狂飙。(10年收益率本周升至1.9%的高位,不过随后失守1.8%大关。)这对高风险资产来说并不是好事,而比特币在很大程度上是当中风险最高的资产。”

Arca的多曼指出,从凯西·伍德的方舟创新ETF基金(ARK Innovation ETF)到特殊目的收购公司(SPAC),最近的IPO活动以及比特币,一切“都随着这些美联储利率预期而受到了冲击,而且基本上一路下探。”受近期崩盘影响,比特币充当通胀对冲工具的观点亦出现了动摇。

多曼称:“不管比特币理应承担什么样的角色,一些宏观基金和政府以及传统金融机构如今都将其作为一项宏观风险指标来交易。这种现象在短期内将成为主流。”不过,多曼并不认为这一现象会一直存在。

与此同时,资产多元化可能也是比特币价格骤降的一个推手。莫亚指出,交易员“正在将目光投向其他人押注的……一些替代货币,而且这些货币有望成为以太币的主要竞争对手,成为下一个规模最大的区块链。”同时,莫亚还提到了Solana、Polkadot、Cardano和Avalanche等加密货币(这些货币最近也受到了冲击)。他说:“这种交易的多元化真的让比特币很受伤。”

莫亚还认为,全球能源危机以及俄罗斯于1月20日禁止使用以及开采比特币的威胁,可能会“让比特币企稳的尝试复杂化。”

加密货币将何去何从?

至于加密货币今后将何去何从,这在很大程度上取决于你说的是哪种货币。

Oanda的莫亚表示,比特币可能在未来几个月中继续保持波动,这意味着从技术角度来讲,比特币今年第一季度的交易价格区间可能为3.5万美元至5万美元。在此之后,他预计比特币价格在美联储今年第二次加息之后会处于一个更加稳定的状态,然后在2022年年末有所改善(他预计可能在6万美元左右)。与此同时,莫亚认为以太币的价格在今年会反弹,并突破4000美元(目前交易价为2600美元左右),但他还指出,以太币正在失去其在非同质化代币(NFT)的市场份额,而且他并不确定其能够“轻松升至”5000美元。

对日本加密货币交易所Bitbank的加密货币市场分析师长谷川裕也来说,比特币近期的走势“完全取决于下周的[美国联邦公开市场委员会(Federal Open Market Committee)]会议”,他对《财富》杂志说道。根据长谷川裕也以及加密货币研究和数据公司Messari的分析,比特币今年可能的最低价位在2.8万美元左右,与2021年的最低价相当(不过他认为比特币可能在年末会反弹至6万美元至8万美元的区间)。

加密货币研究公司Delphi Digital的市场与宏观经济负责人凯文·凯利也认为,比特币的前路将更加崎岖:他通过电子邮件对《财富》杂志说,自己预计“加密货币市场在短期到中期内并不会一帆风顺。”他还表示:“过去24小时内新出现的抛售现象来的比我们预想的早一些,但过去几周这一情绪在不断恶化。”他指出,他们重点关注的价位为3.56万美元至3.72万美元,“这个价位的突破或将导致流动性的聚集。”之后,“我们有望看到比特币在3.4万美元附近获得支撑。”凯利称,如果“情绪持续恶化”,他们“也不排除”价格下探至3万美元低位区间的可能性。

与此同时,Arca的多曼并不认为比特币在今后会出现更大的跌幅:“要说有什么不同的话”,他说,有鉴于风险资产在加息周期早期阶段良好的表现,“这一点被人们过分夸大了”。他预测,今年大多数数字资产普遍都会上涨。

然而很明显,并非所有的加密货币都将拥有同样的表现,而且多曼、长谷川裕也和凯利这类人认为,今年,表现良好和表现不佳的加密货币阵营将变得更加泾渭分明。正如多曼在最近的博客中写道,2022年将呈现出这样一种光景:“一些领域会出现熊市,一些领域则是牛市。市场恐慌所导致的持续数周的高关联度并不会消除领域的离散现象,也不会削弱长期关联度。”

确实,加密货币的某些领域发生了很多事情,例如非同质化代币以及游戏和元宇宙、去中心化金融(DeFi)和Web3,然而说到比特币,长谷川裕也认为:“短期内,今年没有什么盼头。我觉得,Solana、Avalanche这类加密货币的表现会优于比特币。”

然而,尽管加密货币投资者在眼下感到肉疼不已,但看看推特(Twitter)就知道,一些比特币拥趸已经做好血战到底的准备。(财富中文网)

译者:冯丰

审校:夏林

For HODLers of crypto, the last couple months have been quite the test of endurance.

The price of Bitcoin and Ethereum, the two top digital assets by market cap, dropped over 40% each since mid-November, according to CoinMarketCap (Bitcoin hit an all-time high of roughly $69,000 in November before sinking to around $36,900 as of January 21 afternoon trading). In recent days, the price of Bitcoin has fluctuated around the $40,000 mark, but on January 21 crashed to under $37,000—a level below which "there is not much support until the $30,000 level," Edward Moya, senior market analyst at Oanda, argued in an early January 21 afternoon note.

Big drops in the price of coins like Bitcoin are certainly nothing surprising for longer-term crypto investors, but Jeff Dorman, the chief investment officer at crypto investment firm Arca, suggests there are signs of waning confidence in the stalwart digital asset. "There's been outflows," Dorman notes. "There's certainly been a little bit of a cool down in terms of interest in Bitcoin specifically."

Since hitting its all-time high in November, Bitcoin has plunged alongside the broader market, in particular riskier assets like growth and tech stocks (the tech-heavy Nasdaq recently fell into correction territory, defined as a 10% drop, and continued to sink on January 21). The correlation between Bitcoin and assets like tech stocks is not a new trend, though it has grown stronger in recent weeks: According to Bloomberg data, the 100-day correlation between the Nasdaq Composite and Bitcoin is at 0.47, up from around 0.30 in late November.

As many have pointed out over recent weeks, the big reason why cryptos like Bitcoin are falling alongside tech stocks, experts argue, is the Federal Reserve's more hawkish turn in its November meeting, indicating an accelerated pace of tapering and rate hikes—a shift away from policies that buoyed crypto since 2020. "The Fed clearly misread the [inflation] situation and they're now having to go aggressive with Fed tightening, and this has sent Treasury yields skyrocketing," Moya told Fortune (the 10-year yield hit as high as 1.9% this week, though it has since retreated to under 1.8%). "That's not good for risky assets; Bitcoin, for the most part, is the riskiest asset of them all."

Arca's Dorman notes that everything from Cathie Wood's ARK Innovation ETF to SPACs, recent IPOs, and Bitcoin are "all getting hammered and they've gone pretty much straight down in line with those Fed rate expectations." The recent crash also put cracks into the argument that Bitcoin serves as a hedge against inflation.

"Regardless of what Bitcoin is supposed to be, it is being traded right now as a macro risk indicator by a bunch of macro funds and governments and traditional financial institutions," Dorman suggests. "That's going to dominate the short term narrative," though he doesn't believe that will always be the case.

Meanwhile diversification may also be a factor in Bitcoin's slump. Traders are "going to other alt coins that people are betting ... are going to be the key rivals that take on Ethereum as far as becoming the next big blockchain," notes Moya, pointing to Solana, Polkadot, Cardano, and Avalanche, to name a few (those coins have also taken a hit lately). "The diversification trade has really hurt Bitcoin," he argues.

Moya also suggests the global energy crisis and Russia's threat to ban the use and mining of Bitcoin on January 20 may be "complicating Bitcoin's attempt to stabilize."

Where is crypto headed?

As to where crypto is headed from here, a lot depends on which coin you're talking about.

Oanda's Moya believes Bitcoin is likely to remain volatile in the next couple of months, suggesting that from a technical standpoint, it might trade in the $35,000 to $50,000 range during the first quarter of this year. After that, he expects the crypto to find more stable ground after the Fed's second rate hike this year, and end 2022 in a better spot (he estimates possibly around $60,000). Moya believes Ethereum, meanwhile, should rebound and trade above $4,000 this year (it's currently trading around $2,600), but points out Ethereum is losing marketshare in NFTs, and he's unsure it will "have an easy run" to $5,000.

For Yuya Hasegawa, a crypto market analyst at Japanese crypto exchange Bitbank, Bitcoin's near-term path "really depends on next week's [Federal Open Market Committee] meeting," he told Fortune. He sees the coin's potential bottom this year to be somewhere around $28,000, which was roughly its bottom price in 2021, according to Hasegawa and crypto research and data firm Messari (though he believes Bitcoin can rebound to trade between $60,000 and $80,000 by year's end).

Kevin Kelly, the head of markets and macro at crypto research firm Delphi Digital, also expects Bitcoin to be on a bumpier path: he told Fortune via email that he expects "the crypto market to struggle in the short to medium-term," adding that "the latest sell off the last 24 [hours] was a bit quicker than we initially anticipated but sentiment has continued to deteriorate the last few weeks." He said the key levels they are watching are $35,600 to $37,200, "which represents a potential cluster of liquidations if we breach these levels," after which "we'd be looking at support" near $34,000. Kelly said they "can't rule out" a drop to the low $30,000 range, however, "if sentiment continues to deteriorate."

Arca's Dorman, meanwhile, doesn't see a bigger plunge in the cards for Bitcoin: "If anything," he argues, "this has been incredibly overblown" given that risk assets tend to perform well during the early stages of rate hiking cycles. He predicts that broadly, most digital assets will rise this year.

But clearly not all cryptos are the same, and those like Dorman, Hasegawa, and Kelly suggest this year will bring greater dispersion between which coins perform well and which don't. As Dorman wrote in a recent blogpost, 2022 will be an environment "where we have a bear market in some sectors and a bull market in others. A few weeks of high correlation due to market panic does not invalidate sector dispersion and lower longer-term correlations."

Indeed, a lot is happening in certain areas in crypto, like NFTs and gaming and the metaverse, DeFi, and Web3—whereas for Bitcoin, "in the shorter term, there's not much to expect this year," Hasegawa argues. "Solana, Avalanche, those coins will perform well compared to Bitcoin, I think."

But however much pain crypto investors are feeling at the moment, take one look at Twitter and you’ll find a Bitcoin believer or two ready to stick it out.