美国通胀高企,华尔街为何不焦虑?

该谈谈通货膨胀了,但或许现在还不是时候。

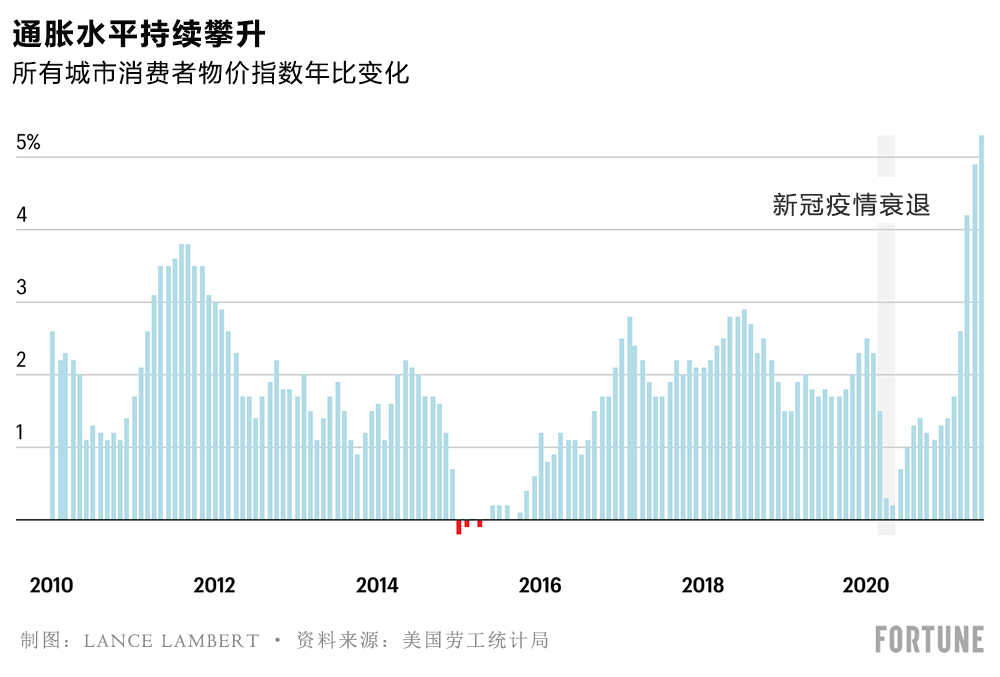

有87%的美国人依旧对商品和服务价格持续上涨感到不安,但金融公司的高管们并没有感到紧张。或许他们只是厌倦了谈论这个话题,这从他们在本季度营收电话会议的发言中可见一斑。

自2011年以来,今年第一季度企业高管谈论通胀问题的次数,达到了自2011年以来的最高水平,但最近几周,金融机构的高管并没有在这场讨论中发表太多意见。虽然有些银行和经纪商尚未公布营收数据,但部分华尔街最大的银行和经纪商提前公布的财务报表显示,金融机构的高管并没有对物价上涨和供应链拥堵等问题感到焦虑。

通胀率持续上升引发了许多公司的担忧,例如Ben & Jerry’s的母公司联合利华(Unilever)下调了其之前设定的年度利润目标。供应链问题恶化、被抑制的需求和大宗商品价格的持续飙升,迫使消费品公司必须决定是将增加的成本转嫁给消费者,还是自行吸纳这些成本。

瑞银集团(UBS Group)的首席执行官拉尔夫•哈默斯7月20日在这家瑞士银行的营收电话会议上说:“投资者所面临的是美国30年来最严重的通货膨化。”(他曾经两次提及通货膨胀这个问题。)

虽然通货膨胀是消费者和二手车公司主要担心的问题,但通胀对金融行业也产生了影响。高通胀会影响股市回报率,导致抵押利率上升,该行业一些创纪录的交易也出现了变数。虽然这些都很有可能发生,但美联储(Federal Reserve)却一直强调,预计通胀的影响是临时性的。我们很难知道金融机构的高管到底如何看待通胀的影响,因为他们并没有发表太多意见。

过去两周,美国银行(Bank of America)、摩根士丹利(Morgan Stanley)、富国银行(Wells Fargo)和花旗集团(Citigroup)的营收电话会议上鲜有提及通货膨胀,甚至根本没有讨论这个话题。其他金融机构也没有表现出太多危机意识。金融机构高管曾经在极少场合下这样谈论通胀问题:

高盛集团(Goldman Sachs)的首席执行官苏德巍(David Solomon)在7月13日表示,美联储的讲话表明“它很关注通胀风险。”这符合投行经济学家们自己的观点,即通胀压力是临时的,任何由此导致的风险“都能得到充分管控”。

摩根大通(JPMorgan Chase)的营收电话会议上曾经短暂提及通胀问题。摩根大通正在大量囤积现金,以防物价上涨的影响持续太长时间。虽然其首席执行官杰米•戴蒙表示,他预计通胀问题“会比美联储的预测稍微严重一些”,但它并没有对摩根大通的支出产生重要影响。

摩根大通的首席财务官杰里米•巴纳姆在上周召开的营收电话会议上称:“我想说在我们的业绩报告中,我并没有看到通胀的影响。但显然,我们都无法预测未来。”他指出:“可以合理假设我们会遇到一些挑战”,但我们无法确定挑战的严重程度。

花旗集团的首席财务官马克•曼森认为,通胀可能会影响劳动力成本和人才竞争。但他在7月14日说:“我们会用往常的做法来应对这些问题,而且我们会继续尝试提高效率,这基本上能够抵消通胀的影响。”

无论大银行如何看待通胀问题,它都会对消费者产生严重影响。《财富》杂志在7月初的一项调查显示,最近几个月,人们对通货膨胀的担忧情绪持续加剧,有超过一半美国人表示他们“非常担心”通胀问题。(有评论员指出,通货膨胀会使数以百万计的美国人受益,尤其是背负债务的美国人。)

贝莱德(BlackRock)的首席执行官拉里•芬克在7月14日的营收电话会议上称:“通货膨胀是投资者最担心的问题。”他表示,该公司发现有大量资金流入与通胀率挂钩的交易所交易基金,因此需要“评估其投资组合受到的潜在影响”。

目前,美国人可以做的只有端着Ben & Jerry’s的冰淇淋(或许很快会涨价),思考美联储是否会采取行动,并坐看这些行动的结果。(财富中文网)

翻译:刘进龙

审校:汪皓

该谈谈通货膨胀了,但或许现在还不是时候。

有87%的美国人依旧对商品和服务价格持续上涨感到不安,但金融公司的高管们并没有感到紧张。或许他们只是厌倦了谈论这个话题,这从他们在本季度营收电话会议的发言中可见一斑。

自2011年以来,今年第一季度企业高管谈论通胀问题的次数,达到了自2011年以来的最高水平,但最近几周,金融机构的高管并没有在这场讨论中发表太多意见。虽然有些银行和经纪商尚未公布营收数据,但部分华尔街最大的银行和经纪商提前公布的财务报表显示,金融机构的高管并没有对物价上涨和供应链拥堵等问题感到焦虑。

通胀率持续上升引发了许多公司的担忧,例如Ben & Jerry’s的母公司联合利华(Unilever)下调了其之前设定的年度利润目标。供应链问题恶化、被抑制的需求和大宗商品价格的持续飙升,迫使消费品公司必须决定是将增加的成本转嫁给消费者,还是自行吸纳这些成本。

瑞银集团(UBS Group)的首席执行官拉尔夫•哈默斯7月20日在这家瑞士银行的营收电话会议上说:“投资者所面临的是美国30年来最严重的通货膨化。”(他曾经两次提及通货膨胀这个问题。)

虽然通货膨胀是消费者和二手车公司主要担心的问题,但通胀对金融行业也产生了影响。高通胀会影响股市回报率,导致抵押利率上升,该行业一些创纪录的交易也出现了变数。虽然这些都很有可能发生,但美联储(Federal Reserve)却一直强调,预计通胀的影响是临时性的。我们很难知道金融机构的高管到底如何看待通胀的影响,因为他们并没有发表太多意见。

过去两周,美国银行(Bank of America)、摩根士丹利(Morgan Stanley)、富国银行(Wells Fargo)和花旗集团(Citigroup)的营收电话会议上鲜有提及通货膨胀,甚至根本没有讨论这个话题。其他金融机构也没有表现出太多危机意识。金融机构高管曾经在极少场合下这样谈论通胀问题:

高盛集团(Goldman Sachs)的首席执行官苏德巍(David Solomon)在7月13日表示,美联储的讲话表明“它很关注通胀风险。”这符合投行经济学家们自己的观点,即通胀压力是临时的,任何由此导致的风险“都能得到充分管控”。

摩根大通(JPMorgan Chase)的营收电话会议上曾经短暂提及通胀问题。摩根大通正在大量囤积现金,以防物价上涨的影响持续太长时间。虽然其首席执行官杰米•戴蒙表示,他预计通胀问题“会比美联储的预测稍微严重一些”,但它并没有对摩根大通的支出产生重要影响。

摩根大通的首席财务官杰里米•巴纳姆在上周召开的营收电话会议上称:“我想说在我们的业绩报告中,我并没有看到通胀的影响。但显然,我们都无法预测未来。”他指出:“可以合理假设我们会遇到一些挑战”,但我们无法确定挑战的严重程度。

花旗集团的首席财务官马克•曼森认为,通胀可能会影响劳动力成本和人才竞争。但他在7月14日说:“我们会用往常的做法来应对这些问题,而且我们会继续尝试提高效率,这基本上能够抵消通胀的影响。”

无论大银行如何看待通胀问题,它都会对消费者产生严重影响。《财富》杂志在7月初的一项调查显示,最近几个月,人们对通货膨胀的担忧情绪持续加剧,有超过一半美国人表示他们“非常担心”通胀问题。(有评论员指出,通货膨胀会使数以百万计的美国人受益,尤其是背负债务的美国人。)

贝莱德(BlackRock)的首席执行官拉里•芬克在7月14日的营收电话会议上称:“通货膨胀是投资者最担心的问题。”他表示,该公司发现有大量资金流入与通胀率挂钩的交易所交易基金,因此需要“评估其投资组合受到的潜在影响”。

目前,美国人可以做的只有端着Ben & Jerry’s的冰淇淋(或许很快会涨价),思考美联储是否会采取行动,并坐看这些行动的结果。(财富中文网)

翻译:刘进龙

审校:汪皓

Time to talk about inflation—or not.

With 87% of Americans still roiling about rising prices for goods and services, finance company executives aren’t biting their nails. Or maybe they are just tired of talking about it—that is, if their commentary on this quarter’s earnings calls is any indication.

On the heels of the first three months of this year, where more corporate executives were discussing inflation than they have since 2011, finance executives haven’t had a whole lot to add to the conversation in recent weeks. While some banks and brokerages still have yet to report their earnings figures, early statements from some of Wall Street’s largest banks and brokerages indicate that financial executives aren’t anxious about the rising prices and supply chain congestion.

Inflation rates have been on the rise—harboring concerns for companies like Ben & Jerry’s owner Unilever, which is pulling back on profitability goals it had set for the year. Companies that sell consumer goods are having to decide whether to pass cost increases down to the consumer or absorb them as supply chain issues, pent-up demand and commodity prices skyrocket.

“Investors are wrestling with the conundrum of the highest U.S. inflation in 30 years,” Ralph Hamers, CEO of UBS Group said on the Swiss Bank’s earnings call July 20. (It was one of only two times he mentioned inflation).

While inflationary fears are a key concern for consumers and certainly for used car companies, there are potential ramifications on the financial sector, too. Higher inflation could put a damper on record stock market returns, trigger higher mortgage rates, and even knock some of the record dealmaking the industry has experienced. These are all within the realm of possibility, though the Fed has been saying it expects the impact of inflation to be temporary. As for what financial executives think about all of it, it’s hard to know: They haven’t been saying a whole lot.

In the last two weeks, inflation was hardly mentioned—or not discussed at all—on earnings calls for Bank of America, Morgan Stanley, Wells Fargo, and Citigroup. There was little sense of alarm at other financial institutions either. Here's what they had to say on the rare times it was mentioned:

Commentary from the Federal Reserve shows that “the central bank is focused on this risk,” Goldman Sachs CEO David Solomon said on July 13. That supports the investment bank economists’ own views inflation pressures will be temporary and any resulting risks “could be adequately managed.”

Inflation came up briefly during the earnings call for JPMorgan Chase, which has been hoarding cash in case the effects of price spikes are longer-lasting. But while the bank’s CEO, Jamie Dimon, said he expects inflation to be “a little bit worse than what the Fed thinks,” it hasn’t played any kind of significant role in the bank’s expenses.

“In terms of inflation, I would say that we're not seeing inflation in our actuals,” Jeremy Barnum, CFO of JPMorgan Chase said on the company’s earnings call last week. “But obviously, your guess is as good as mine in terms of the future,” he said, noting that “it would be reasonable to assume that's going to be a little bit of a challenge,” although it wasn’t clear to what degree.

It’s possible inflation could have an impact on labor costs and the competition for talent at Citigroup, according to the company’s CFO, Mark Mason, although “we deal with that on a regular basis,” he said July 14, “and we continue to look for productivity and efficiency savings that largely tend to offset that.”

However the big banks are looking at it, inflation matters quite a lot to consumers. A recent Fortune survey from earlier July shows that fear has continued to rise in recent months, with more than half of Americans saying they are “very concerned” about it. (Some commentators argue inflation will actually benefit millions of Americans, particularly those in debt).

“Inflation concerns [are] top of mind for investors,” BlackRock CEO Larry Fink acknowledged on the asset manager’s call July 14, mentioning it had seen inflows into exchange-traded funds linked to inflation rates and that the company needed to “assess the potential impact on their portfolios.”

As for now, all Americans can do is sit back with pints of Ben & Jerry’s (that may soon go up in price), ponder whether the Fed will take action and see how all of it plays out.