利润下滑,现金减少,通用电气走上不归路?

|

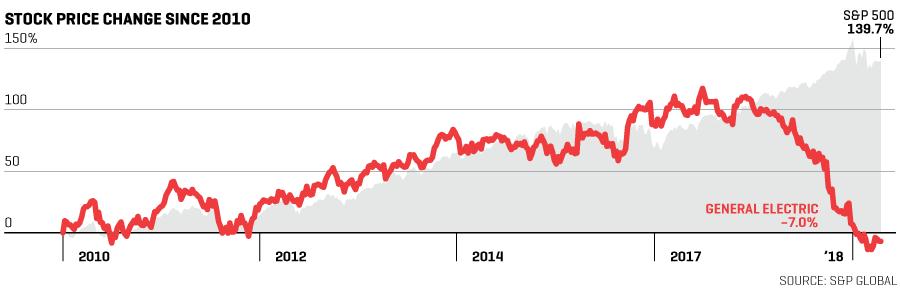

如果首席执行官在宣布辞职之后公司的股票却应声上涨,遇到这种情况任谁都不会好受,但这便是杰夫·伊梅尔特在2017年6月12日的遭遇。他卸任的消息在某种程度上并不让人感到吃惊,因为一些投资者和分析师多年来一直都在敦促其下台,但此消息一出,业界依然一片哗然。 伊梅尔特已担任通用电气(以下简称“GE”)首席执行官长达16年之久,而在外界看来,公司没有制定任何具体的继任计划,而且61岁的伊梅尔特也没有任何让位的打算。然而突然间,外界被告知伊梅尔特在仅仅7周之后就要离职(其非执行董事长一职还将延长两个月),其继任为约翰·弗兰纳里,后者是GE医疗业务负责人,业已在GE供职30年。没过多久,投资者便意识到这是一条利好消息。虽然当天大盘业绩平平,但GE的股价在投资者的推动下上涨了4%。 这一乐观情绪来得似乎有点太早了。6月12日,GE的股价以每股28.94美元收盘,但自此之后再也没有触及这一价位。随着全球经济的复苏和美国股票指数的飙升,GE却轰然倒塌,让股东1000亿美元的财富化成了泡影。在受到接二连三不利消息的打击之后,投资者可谓是心力交瘁,不知所措。William Blair & Co.的分析师尼古拉斯·黑曼说:“投资者对此感到困惑不已,而且失去了投资意愿。目前的情况并不是地形勘察那么简单,而是在没有灯光和地图的情况下探索山洞。”Melius Research的分析师斯考特·戴维斯称,一些投资者已经对GE不再抱有任何幻想:“很多投资者告诉我们,他们不会再买GE的股票。” |

It’s a bad day for a CEO when he announces he’s retiring and the stock goes up. That was Jeff Immelt’s day on June 12, 2017. The news of his departure was in one sense no surprise—some investors and analysts had been urging his ouster for years—but it was also a shock. He’d been General Electric’s CEO for almost 16 years, and outsiders were unaware of any specific succession plans or that ¬Immelt, at age 61, had any intention of stepping down. Suddenly they were told that in just seven weeks he’d be gone as CEO (he remained nonexecutive board chairman an additional two months), to be succeeded by John Flannery, head of GE’s health care business and a 30-year employee. Investors didn’t need long to decide this was good news. The market was flat that day, but they bid GE stock up 4%. Their optimism was at best premature. The stock closed at $28.94 on June 12 and has not reached that price since. As economies boomed worldwide and U.S. stock indexes soared, GE has collapsed in a meltdown that has destroyed well over $100 billion of shareholder wealth. Pounded by a nonstop barrage of bad news, investors are traumatized and disoriented. “They just can’t figure it out and don’t want to invest,” says analyst Nicholas Heymann of William Blair & Co. “This isn’t like surveying the landscape. It’s spelunking with no lights and no manual.” Analyst Scott Davis of Melius Research says some investors have become permanently disillusioned: “Many have told us they will never own GE again.” |

|

那些大量购买GE股票的退休人员和雇员对此感到愤怒不已;一些人还包围了GE在4月举行的年度股东大会。一些前任高管对GE当前的处境也是感到震惊不已。其中一名前任高管说:“这简直是匪夷所思。我做梦都没有想到会出现这一天。太疯狂了。”毕竟,这可是GE啊,这位企业贵族是道琼斯指数最初的成员企业之一,而且也拥有全球最知名的管理学府。如今,它却深陷财务泥沼,未来不甚明朗。其债券在伊梅尔特就任首席执行官时拥有3A评级,如今的级别却比A2级还要低5档,其交易价格与Baa评级的债券相当,仅比垃圾债券高出一线而已。 为应对这一窘境,GE对上届领导层进行了大换血,这种魄力在同等规模和地位的公司当中可谓是前无古人。在过去10个月中,相继离开的高管包括首席执行官、首席财务官(还兼任副董事长)、另外两名副董事长(共4位副董事长)、最大业务部门的负责人以及多名其他高管和半数的董事。董事会的剧烈震荡“可能是美国企业治理史上最为重大的事件之一”,一位GE的长期供应商说道。作为GE的学生,他一直密切关注着GE。 |

Retirees and employees who bought heavily into the stock are furious; some picketed GE’s annual meeting in April. Former executives are dumbfounded. “It’s unfathomable,” says one. “You couldn’t possibly dream this up. It’s crazy.” After all, this is GE, a corporate aristocrat, an original Dow component, the world’s most celebrated management academy, now revealed as a financial quagmire with a deeply uncertain future. Its bonds, rated triple-A when Immelt became chief, are now rated five tiers lower at A2 and trade at prices more consistent with a Baa rating, one notch above junk. In response to this debacle, GE has repudiated its previous leadership with a zeal unprecedented in a company of its size and stature. Gone in the past 10 months are the CEO, the CFO (who was also a vice chair), two of the three other vice chairs, the head of the largest business, various other executives—and half the board of directors. The radical board shake-up “could be one of the most seminal events in the history of U.S. corporate governance,” says a longtime vendor and close student of GE. |

|

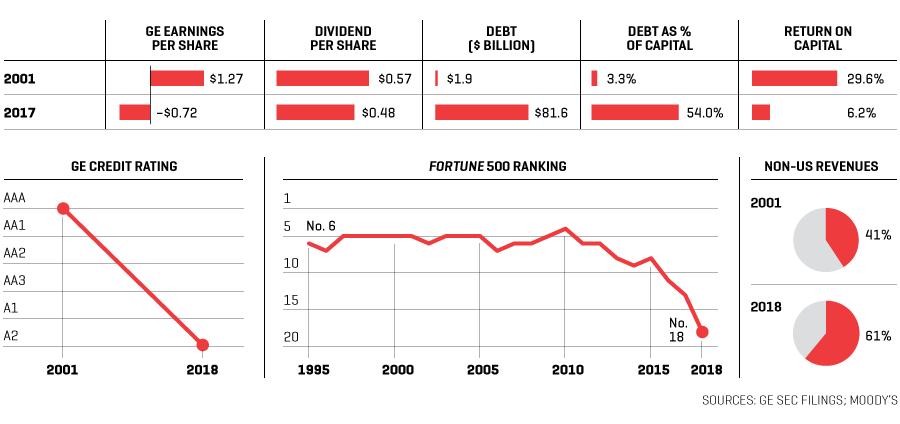

伊梅尔特拒绝就此文接受采访,但是向《财富》提供了一份声明。在声明中,他介绍了自己获得的成就,并说道:“没有人希望看到股价会跌至当前的水平。在我任期的最后一年,我购买了公司800万美元的股票,因为我对GE团队充满信心。我热爱这家公司,而且我也敦促投资者开始向前看,并在市场中大获全胜。” 弗兰纳里释放的最劲爆的信息是,他将彻底与GE近期历史诀别。他在去年10月对投资者说:“我们一直在,而且将继续对公司进行彻底的评估。”具体说来:“我们正在评估公司的业务、流程、企业[功能]、公司文化、决策流程、对于目标和问责制的看法、员工激励措施、不同领域投资的优先顺序……全球研发、数字和添加剂[制造]。我们还评估了公司的操作流程、团队、资本配置以及与投资者的沟通方式。所有的一切都成为了评估对象……GE将发生翻天覆地的变化。” 由此得出的结论:公司目前一团糟。 弗兰纳里甚至还提出了一个不可思议的看法:GE在拆分之后可能会更有价值。Melius Research的戴维斯说:“GE所面临的压力非常大,可能会迫使公司采取某些分拆举措。”不管最终结局如何,弗兰纳里都有可能因此而出名,要么成为GE的救命恩人,要么成为导致其分崩离析的罪人。 所有这一切为各地投资者带来了两个疑问:GE怎么了?今后会怎么样?公司必须先回答第一个问题。这个故事必然和杰夫·伊梅尔特有关,而且远在最近的股票内爆之前便已经开始了。用前GE高管的话来说,“车轮从2017年开始脱离,但车轮上的轮爪螺母很久之前便已经松动了。” 伊梅尔特经常提到,自己在首席执行官任期伊始并不怎么顺利:他在上任4天后发生了911事件。多架飞机(其中的一架用的是GE的引擎)撞入了世贸中心大厦,由GE Capital承保。航空旅行需求大幅缩减,让GE这家全球最大飞机租赁商的业务步履维艰。在45岁的伊梅尔特担任首席执行官的第一周,他便遇到了一生中最大的危机。 他成功地度过了这一难关,被迫做出了诸多常人始料未及的决定。如果当时不是他支持并为GE的客户美国西部航空公司的政府贷款担保提供部分资金保障,事情会怎么样?如果他没有点头,如今这家航空公司将不复存在。他在职业生涯中从未碰过航空业务,但他依然提供了支持。美国西部航空公司时任和当前(通过一系列并购)的首席执行官道格·帕克说:“我对伊梅尔特感激不尽。这是一个巨大的风险。他本来可以以不懂行为由拒绝此事。” 在接下来的几个月中,随着各国和各大公司开始痴迷于证券,伊梅尔特看到了一个机会。GE以不为人知的价格收购了Ion Track,后者拥有高级爆炸物检测技术。18个月后,他以9亿美元的价格购买了另一家爆炸物检测公司InVision。然而在2009年,他将两家公司包装成为GE Homeland Security,并在一次交易中出售了其大部分控股权益,但售价仅有7.6亿美元。他的证券豪赌以血亏告终。 这一败举拉开了一个模式的帷幕,众多分析师和观察家认为这一模式是导致GE陷入当前困境的一个重要因素。他们称,伊梅尔特喜欢跟随大流,以高价收购当前最火的业务。 例如,2010年到2014年期间,油价位于100美元/桶附近,GE购买了油气行业9家公司。然后,在2016年,油价出现了腰斩,GE同意将其油气业务与上市油田服务提供商贝克休斯合并,创建了一家由GE持有绝大部分股权的公司。监管方于去年7月批准了这一交易,贝克休斯的股价迅速下探,即使油价有所回升,但公司的股价到目前为止仍未能达到去年夏季的高点位置。在伊梅尔特离开GE仅仅数天之后,公司通过口头通知成立了一个名为金融和资本配置委员会的专门小组,专注于审查管理层资金控制松散问题。弗兰纳里对这个委员会提出的第一项任务便是“评估公司退出贝克休斯的方式。” 另一个案例:2004年,随着美国房价的飙升,GE向一家名为WMC的次贷抵押公司注资5亿美元。2007年,房价下跌,GE解雇了WMC大部分员工,并出售了公司,当年损失了10亿美元。今年2月份,GE宣称,美国司法部有可能会认定WMC在被GE收购后存在违法行为,为此,GE拨备了15亿美元,用于应对可能的处罚。 并非伊梅尔特经手的所有交易都会赔钱。就其收购和处置而言,最令人吃惊的莫过于其惊人的数量。他开展了数百个交易,并趾高气扬地宣称自己是唯一一个曾经购买并出售了超过1000亿美元业务的首席执行官。GE在破产拍卖中以3.58亿美元收购了安然的风力涡轮机制造资产,并以此为基础(随后通过多项收购进一步扩张)打造的一项业务在去年斩获了103亿美元的营收。在金融危机爆发前夕,伊梅尔特以116亿美元的价格将GE的塑料业务出售给沙特基础工业公司,成为了他主导的业界交易额最高的业务剥离案例。该价格超过了分析师的预期,被广泛誉为GE的杰作。 然而,从整体来看,伊梅尔特的收购技巧算不上出众,而且也引发了一个更大的问题。如果让华尔街的分析师、客户、经销商、竞争对手、前任高管和前任董事来回答“GE为何会走到今天这个地步”这个问题时,他们首先都会提到同一个内容:“资本配置”。这一点对于任何首席执行官来说都至关重要,对于GE来说尤为如此,因为其业务组合一直在不断地变化当中。外界几乎一致认为,伊梅尔特并不擅长此道。 尽管伊梅尔特最大的业务剥离项目——公司的塑料业务——可能是他最辉煌的交易战绩,但他所主导的最大的收购交易似乎却成为了他最大的败笔,而且仍在拖累公司。这次交易就是2015年对阿尔斯通的收购,这家法国公司是GE最大的业务GE Power的有力竞争对手。GE Power致力于生产发电厂发电用的大型涡轮,并为其提供服务。收购价格达到了106亿美元,是GE历史上最昂贵的业内收购。伊梅尔特的发言人指出,董事会曾先后八次对这一交易进行评估,然后批准了该交易。 该交易存在不少问题。阿尔斯通的利润率较低,但GE认为自己可以帮助其扭转这一局面。GE的策略很大一部分依赖于销售服务,然而监管方迫使GE剥离了阿尔斯通的服务业务。此次收购带来了3万多名高成本雇员,其中很多都位于欧洲,但是GE认为这些员工贡献的价值将超过其成本。最糟糕的是,收购的时机差到了极点。GE花重金押注使用化石燃料的涡轮机,而可再生能源的成本竞争力却在不断提升。结果:全球市场对GE Power产品的需求大幅下滑,但GE大量资金的走向却是背道而驰。GE Power的利润暴跌了45%。 |

Immelt declined to be interviewed for this article but sent Fortune a statement in which he cited accomplishments and said, “None of us like where the stock is today. I purchased $8 million of stock in my last year as CEO because I believe in the GE team. I love the company, and I urge them to start looking forward and win in the markets.” Flannery’s strongest message is how completely he’s breaking with GE’s recent past. “The review of the company has been, and continues to be, exhaustive,” he told investors last October. Specifically: “We are evaluating our businesses, processes, [the] corporate [function], our culture, how decisions are made, how we think about goals and accountability, how we incentivize people, how we prioritize investments in the segments … global research, digital, and additive [manufacturing]. We have also reviewed our operating processes, our team, capital allocation, and how we communicate to investors. Everything is on the table … Things will not stay the same at GE.” Inescapable conclusion: This place is an unholy mess. Flannery has even voiced the unthinkable, that GE might be more valuable in pieces. “The pressure on GE to announce some sort of breakup is very high,” says Davis of Melius Research. Whatever happens, Flannery has a good shot at becoming famous—as the guy who saved GE or the guy who broke it up. All of which leaves the world asking two questions: What happened? And what’s next? The first question must be answered first. It is inevitably a story about Jeff Immelt, and it starts well before the stock’s recent implosion. As a former GE executive puts it, “The wheels came off in 2017, but the lug nuts had been loosening for a long time.” Immelt often notes that his CEO tenure got off to a rough start; it began just four days before 9/11. Airplanes, one of them powered by GE engines, crashed into the World Trade Center towers, insured by GE Capital. Air travel demand contracted violently, hobbling GE’s business as the world’s largest lessor of planes. In his first week as chief, at age 45, he faced a once-in-a-lifetime crisis. He came through it well, forced to make decisions for which no one could be prepared. Should he support and partially backstop a government loan guarantee for America West Airlines, a GE customer? If he didn’t say yes—now—the airline would fail. Never in his career had he touched the airline business. He said yes. “I’m eternally grateful to him,” says Doug Parker, America West’s CEO at the time, and now, through a series of mergers, CEO of American Airlines. “It was a huge risk. He could have said he didn’t understand this and wouldn’t do it.” In the following months, as countries and companies obsessed over security, Immelt saw an opportunity. GE bought Ion Track, a company with advanced explosive-detection technology, for an undisclosed price. Some 18 months later he bought another explosive-detection company, ¬InVision, for $900 million. But in 2009 he sold a large majority interest in the two firms, packaged as GE Homeland Security, in a deal that valued the unit at just $760 million. His security bet was a bust. It was the beginning of a pattern, which many analysts and observers say is an important element in GE’s current misery. Immelt followed fads, they say, paying top dollar to acquire the hot businesses of the moment. For example, from 2010 through 2014, when oil prices hovered around $100 a barrel, GE bought at least nine businesses in the oil and gas industry. Then, in 2016, with prices down by half, it agreed to combine its oil and gas unit with Baker Hughes, a publicly traded oilfield services provider, creating a company owned mostly by GE. Regulators approved the deal last July; Baker Hughes stock quickly fell and has yet to reach the price it hit that summer, even as oil prices have risen. Just days after Immelt left GE’s board, in a telling move, it formed a panel called the Finance and Capital Allocation Committee, whose express purpose is to scrutinize management’s loose control of its wallet. The first thing Flannery tasked them to work on was “evaluating our exit options on Baker Hughes.” Another example: In 2004, with U.S. home prices rocketing, GE paid $500 million for a subprime mortgage company called WMC. In 2007, with home prices falling, GE laid off most WMC employees and sold the company, which lost $1 billion that year. This past February, GE announced that the Justice Department “is likely to assert” violations of law at WMC when GE owned it, and GE reserved $1.5 billion against a possible penalty. By no means were all of Immelt’s deals losers. What’s most striking about his acquisitions and divestitures is their staggering quantity. He did hundreds of deals and claims with apparent pride to be the only CEO who has ever bought and sold over $100 billion of businesses. Among those deals were some big winners. GE bought Enron’s wind turbine manufacturing assets for $358 million in a bankruptcy auction, creating the foundation of a business (augmented with several later acquisitions) that brought in $10.3 billion of revenue last year. In his largest industrial divestiture, Immelt sold GE’s plastics business to Saudi Basic Industries for $11.6 billion just before the financial crisis; the price was more than analysts expected, and the deal was widely regarded as excellent for GE. On the whole, though, Immelt’s shopping skills were not stellar, and it was part of a larger problem. Ask Wall Street analysts, customers, vendors, competitors, former executives, and former directors to explain how GE ended up where it is, and their first words are the same: “capital allocation.” That’s a crucial job for any CEO, nowhere more so than at GE, with its ever-shifting portfolio of businesses. The near-universal consensus outside the company is that Immelt was bad at it. While Immelt’s biggest industrial divestiture, plastics, may have been his best deal, his biggest acquisition looks like his worst—and it’s still dragging the company down. That was his 2015 acquisition of Alstom, a big French competitor of GE’s largest business, GE Power, which makes and services the huge turbines that utilities use to generate electricity. At a price of $10.6 billion, this was GE’s most expensive industrial acquisition ever. An Immelt spokesman notes that the board reviewed the deal eight times and approved it. The problems were many. Alstom’s profit margins were low, but GE figured it could raise them. GE’s strategy relied heavily on selling services, but regulators made the company divest Alstom’s service business. The acquisition added more than 30,000 high-cost employees, many in Europe, but GE figured they’d more than pay for themselves. Worst of all, the purchase was spectacularly mistimed. GE doubled down on fossil-fuel-fired turbines just as renewables were becoming cost competitive. Result: Global demand for GE Power’s products collapsed, while GE had bet heavily the other way. GE Power’s profit plunged 45%. |

|

该交易成为了一场灾难,也让GE成为了业界的笑柄。在GE Power一落千丈之际,一位前任高管回忆道:“人们看着我们说:‘你们干这行都有上百年的历史了吧,不是吗?’”在伊梅尔特任职期间,GE都会理直气壮地为这一交易辩护。然而,就在伊梅尔特辞去董事长一职数周之后,弗兰纳里承认了所有人心知肚明的事情,他对投资者说:“很明显,阿尔斯通长期以来的表现明显低于我们的预期。我想这一点大家有目共睹。” 然而,阿尔斯通并非是伊梅尔特在资本配置方面所犯的最大的错误,而且阿尔斯通与之相比还远远不及。这一事件发生在数年前,而且逐渐升级,当时,他在金融危机之前大幅提升了GE Capital的负债规模。一个广为流行的说法是,他的前任杰克·韦尔奇将GE Capital扩大到了一个不可持续的水平,迫使伊梅尔特将其缩减至合理的规模,但数字却指向了相反的方向。GE Capital在韦尔奇最后10年的任期中所贡献的利润从未超过GE总利润的41%,而伊梅尔特则通过让GE Capital背负2500亿美元的额外债务,扩张了其业务规模,直到2007年,GE Capital 2007年在GE利润中的占比达到了55%。他还允许GE Capital承担更多的风险,最明显的举措就是让该公司直接在商业地产市场进行权益投资。此举一开始倒是赚了不少钱,但是在金融危机爆发之后,GE Capital的利润蒸发殆尽。伊梅尔特自大萧条以来首次削减了GE的派息,而且被迫立即向沃伦·巴菲特求援30亿美元。GE Capital自此之后便一蹶不振。当伊梅尔特2015年宣布计划解散GE Capital时,投资者无不为之欢呼雀跃。 |

The transaction has been a debacle and an embarrassment. A former senior leader recalls that as GE Power cratered, “people looked at us and said, ‘You’ve been in this business a hundred years, right?’ ” GE nonetheless defended the deal stoutly as long as Immelt was around. Then, a few weeks after he stepped down as board chairman, Flannery acknowledged what everyone already knew, telling investors, “Alstom has clearly performed below our expectations, clearly. I don’t need to tell you that.” Yet Alstom was not Immelt’s worst capital-allocation blunder, nor even close. That occurred years earlier, in increments, as he bulked up GE Capital before the financial crisis. A popular story line holds that his predecessor, Jack Welch, enlarged GE Capital unsustainably, forcing Immelt to deflate it back to sane dimensions. But the numbers show the opposite. GE Capital never accounted for more than 41% of GE profits during Welch’s last decade, while Immelt expanded the business by adding over $250 billion of debt to it, until it accounted for 55% of GE’s profit in 2007. He also allowed it to take greater risks, notably by making direct equity investments in commercial real estate. That worked great until the crisis, when most of GE Capital’s profit evaporated. Immelt cut GE’s dividend for the first time since the Great Depression and had to ask Warren Buffett for $3 billion right away. GE Capital never recovered, and when Immelt announced plans to dismantle it in 2015, investors cheered. |

|

伊梅尔特在其他方面的资本配置也存在问题。他曾花费930亿美元回购股票,此举倒不一定就是坏主意,但不幸的是,他似乎十分擅长以高价回购。2008年-2011年期间,GE仅花费了70亿美元(包含在上述930亿美元中)用于回购股票,当时股价基本上还只有十几美元。随后,公司花费了近800亿美元回购股票,价格超过了30美元/股。 即便在GE业务现金创造能力不足时,伊梅尔特依然维持了派息额度,此举迫使他不得不通过借钱来直接向股东付钱。伊梅尔特的一位发言人说:“杰夫有一次曾削减过派息额度,但他不希望第二次削减。”弗兰纳里也承认:“多年来,我们所支付的股息超过了我们的自由现金流。”在伊梅尔特离任数天之后,弗兰纳里和董事会将股息降低了一半。 不当的资本配置能够通过数据资料体现出来,但人力资源和文化管理的量化则要难得多,然而,这两个因素的重要性至少不亚于资本配置,而这一点也是GE陷入困境的又一个因素。 GE知名的人才培养机制的硬件依然存在,包括纽约州克劳顿管理学院、Session C管理评估等,然而,多名曾与伊梅尔特共事的前任高管认为,人才系统的软件出现了倒退。一位前任高管说:“毫无疑问的是,领导力培养流程的严谨性出现了一些问题。”他的看法也反映了多年前存在的一个普遍观点。然而,这些仅仅是一些看法罢了,而且伊梅尔特的一位发言人指出,GE飞机引擎和医疗业务强劲的业绩反驳了有关GE存在广泛文化问题的看法。一些高管认为,绩效文化依然十分强大。约翰·莱斯说:“我有很多机会离开公司,并拿到更高的薪水。我之所以留在GE是因为公司的文化。它会敦促你发挥自身最大的能力,如果你未能做到这一点,那么你就得对此进行解释并承担相应的责任。” 弗兰纳里的行动和声明异常有力地证明,GE的人力资本和文化也需要得到高度的重视,这一点也证实了批评者一直在强调的问题。显然,他对于所接手的高管团队并不满意,并指出,“40%的团队都是新人。”他一直都在提醒投资者,“公司的领导层发生了重大变化。” |

He mishandled capital in other ways too. He spent $93 billion buying back stock, which isn’t necessarily a bad idea, but he had an unfortunate knack for buying at high prices. GE spent only $7 billion of that $93 billion from 2008 through 2011, when the stock price was mostly in the teens; the company spent almost $80 billion buying back shares at prices over $30. Immelt also maintained the dividend even when GE’s operations weren’t furnishing enough cash, forcing him to borrow money and send it directly to shareholders. An Immelt spokesman says, “Jeff cut the dividend once. He did not want to do it twice.” Flannery admits, “We’ve been paying a dividend in excess of our free cash flow for a number of years now.” Days after Immelt left, Flannery and the board cut the dividend by half. Inept capital allocation can be documented with hard data. Management of human capital and culture is much squishier but at least as important. It too was a contributor to GE’s collapse. The hardware of GE’s famous talent development apparatus remains in place—the famous Crotonville, N.Y., campus, the Session C management appraisals—but several former executives who worked with Immelt believe the system’s software deteriorated. “There’s no question that the leadership development process lost some of its rigor,” says one, echoing a common view that goes back years. Still, those are only opinions, and an Immelt spokesman notes that the strong performance of GE’s jet engine and health care businesses rebuts the notion of a broad cultural problem. Some executives felt the culture of performance remained powerful. “I had many opportunities to leave and be paid more,” says John Rice, who retired as a vice chairman in March. “I stayed because of the culture. It pushed you to do all you could do, and if you didn’t, you had to explain it and be accountable for it.” The strongest evidence that human capital and culture need serious attention at GE comes from Flannery’s actions and statements, which reinforce what the critics have been saying. He clearly wasn’t happy with the top team he inherited and has noted that “40% of the team is new.” He constantly reminds investors that “there have been significant changes in the leadership of the company.” |

|

弗兰纳里最喜欢的话题可能莫过于完善GE公司文化的必要性。他对投资者说:“文化一词,我曾经强调了数百遍。”在企业内部,这个词语时常会出现在他们耳畔。他明确表示,GE需要加强其严谨性和责任感。努力是件好事,结果最重要。 弗兰纳里(拒绝了采访请求)指的是缺乏执行的公司。他说:“GE Power非常糟糕的执行使其市场状况进一步恶化。”与伊梅尔特共事的高管称,他意识到了执行的重要性,但感觉公司的执行成为了一种自我维持的核心竞争力。一名高管说:“杰夫在一开始认为这家公司有着超凡的运营执行力,而且无论如何都要将其保持下去。这是个致命的错误。” 在对自己所继承的文化进行批判时,弗兰纳里提出的最令人吃惊的一个观点是:公司需要“更多的坦诚、更多的辩论和更多的对抗。”什么,更多的坦诚?在GE?长期以来,这家公司一直将坦诚视为粗鲁,并因此而闻名。伊梅尔特的一名发言人称,与伊梅尔特的会面“充斥着对抗”。然而,弗兰纳里总是会提到这一点,而且与伊梅尔特共事的高管也表达了同样的顾虑。一位前任高管说:“杰夫基本上不会听从下属的意见。”一位前工作人员提到:“在杰夫任职期间,对抗是不存在的。当最大的老板自认为是全世界最聪明的人时,问题就会变得很严重。” 杰夫·伊梅尔特是一位大块头、和蔼可亲、充满魅力的人。他有一种自然的亲和力。他在辛辛那提长大,他的父亲是GE飞机引擎业务的一名经理,然而杰夫称,他父亲并非是他为GE效力的原因。达特茅斯学院以橄榄球运动员的身份将其录入学校,并让他负责进攻截锋这一并不怎么显耀的位置,而且他认为自己今后可能会成为职业选手。校友将他视为领导者,他是兄弟会的会长,而且他的一位兄弟会成员、前Vanguard首席执行官比尔·麦克纳布称,大家对伊梅尔特成为GE首席执行官并不感到吃惊。 在毕业之后,他回到了辛辛那提,在宝洁知名的品牌管理项目中找了一份工作。坐在他旁边的就是微软未来的首席执行官史蒂夫·鲍尔默;他们曾一块研究过邓肯·海茵的蛋糕配方,而且伊梅尔特在回忆时经常会大笑不已,并称他们当时都是“非常糟糕的员工”。当然,他们也不至于那么糟糕。多年之后,伊梅尔特来到了哈佛商学院,然后进入了GE,最初在公司总部担任内部营销顾问。 当他成为首席执行官时,他遇到了每一位新首席执行官都必须面对的任务:重新改造公司。根据传统,前任首席执行官会离开董事会,并离开总部大楼,从而让新任长官能够放开手脚,重新确立GE的发展方向。伊梅尔特所推行的变革有两项需要立即执行。他立即着手提升了GE的国际化水平。令人吃惊的是,像GE这样一家大型的知名公司,其60%的业务来源于美国国内。在伊梅尔特离开时,GE的业务遍布180个国家,其61%的收入来源于美国之外的地区。新兴市场贡献的营收从100亿美元提升至450亿美元。一些分析师认为,在某些市场,尤其是中国,大部分新业务的收购价格过高。然而,全球经济增长的轨迹已经在移动,而且GE应紧随其后。 《财富》美国500强:第18位 2017公司情况:通用电气 营收:1223亿美元 利润:亏损580亿美元 雇员数量:31.3万名 股东总回报:-3.8%* *股东总回报假定使用2007-2017年年利率。 面对大趋势,伊梅尔特的另一个主要应对举措就是提升GE的数字化水平。此举在现在看来是显而易见的事情,然而在7年前,大型工业公司所面临的数字化机遇并不十分明显。分析师对伊梅尔特的先见之明大家赞赏,然而公司再次在执行上面犯了错误。分析师黑曼说:“他们很早便发现了数据对工业的价值,但公司付出的代价要比预想的高昂得多。”2015年,伊梅尔特甚至称,GE到2020年将成为排名前十的软件公司。如今,没有人会抱有这样的想法,而且公司位于加州圣雷蒙的软件业务将裁掉100多名员工。然而,这一理念显然是正确的,而且GE的行动方向也是正确的。弗兰纳里说:“我们仍一心致力于公司的[数字化]业务,但是我们需要一个更加专注的策略。” 上述很多变化都发生在金融危机之后,而且投资者对于所看到的变化大多持赞成态度。GE股价跟随标普500指数稳步上升的步伐。当GE在2015年落后标普500之后,伊梅尔特信心满满地预测公司的股价将在2018年上涨2美元,可谓是大幅增长。激进投资者尼尔森·佩尔茨的Trian Fund购买了公司25亿美元的股份。佩尔茨因追究资产组合领导者的责任而闻名,因此伊梅尔特不得不兑现其2018年股价上涨2美元的承诺。股价恢复上涨,但是车轮螺母越来越松。2016年末,全世界都开始意识到这一问题。 人们首先发现的问题是现金。GE处于严重的入不敷出状态。公司有能力支付其账单,但是其银行储蓄却越来越少,大量资金需求日渐显现,例如补足缺口达数十亿美元的养老金。2015-2017年期间,GE创造了300亿美元的自由现金流和资产销售额,但是公司在股票回购、派息和收购方面耗费了750亿美元。经济学家赫伯·斯腾曾说过一条至理名言:如果一件事无法永远持续下去,它总有停止的那一天。GE走上了一条不归路。 引发世界关注的第二件事情在于GE Power问题的严重程度。近期,也就是在2017年5月末,伊梅尔特向华尔街透露,GE Power的运营利润展望为“++”,意味着非常积极。仅仅在两个月之后,GE报告称GE Power的季度利润出现了下滑,订单也有所下降,而且公司的展望也不是很好。随着今年时光的流逝,公司的情况不断恶化。 然而,不利消息接踵而至。在GE于11月停止派息之后,公司在12月宣布GE Power裁员1.2万名。1月,GE减记62亿美元,涉及GE Captial长期照护保险业务,并表示该业务在未来7年中需另行计提150亿美元。这笔始料未及的费用异常巨大,结果招来了美国证券交易委员会的调查,该事件依然未得到解决。随后在2月,GE公布了美国司法部对WMC Mortgage的调查,并于4月宣布拨备15亿美元。5月,GE表示可能会让WMC进入破产程序。 |

Perhaps his favorite theme is the need to fix the GE culture. “Culture—you’ve heard me say it a hundred times,” he told investors. “Inside the business they’ve heard it a lot. “He’s explicit that GE needs more “rigor” and “accountability—outcomes matter. Effort’s good, outcomes matter.” Flannery (who declined an interview request) is describing a company that doesn’t execute. In GE Power, he says, “we have exacerbated the market situation with some really poor execution.” Executives who worked with Immelt say he appreciated the importance of execution but felt it was a self-sustaining core competency. “Jeff assumed early on that this company is phenomenal at operational execution and will continue no matter what,” says one. “That was a fatal mistake.” The most surprising element in Flannery’s critique of the culture he inherited is that it needs “more candor, more debate, more pushback.” Really—more candor? At GE? The place has long been famous as a company where frankness borders on rudeness. An Immelt spokesman says “there was a lot of pushback” in meetings with Immelt. Yet Flannery harps on the point, and executives who worked with Immelt voice the same concern. “Jeff just didn’t listen to his subordinates,” says a former finance executive. “Pushback went away under Jeff,” says a former staff member. “When the top guy is the smartest guy in the world, you’ve got a real problem.” Jeff Immelt is a big, affable, charming man. People tend to like him. He grew up in Cincinnati, where his father was a manager in GE’s aircraft engine business, though Jeff says that fact didn’t influence his decision to work at GE. Dartmouth recruited him as a football player in the nonglamorous position of offensive tackle, and he thought he might one day play professionally. Schoolmates saw him as a leader; he was president of his fraternity, and one of his fraternity brothers, former Vanguard CEO Bill McNabb, says no one was surprised when Immelt became GE’s chief. After college he returned to Cincinnati for a job in Procter & Gamble’s famous brand management program. Seated next to him was future Microsoft CEO Steve Ballmer; they worked on Duncan Hines cake mix, and Immelt often recalls with a laugh that they were “horrible employees.” They must not have been too bad. A couple of years later, Immelt went to Harvard Business School and then to GE, where he started as an internal marketing consultant at headquarters. When he became CEO, he faced the task that confronts every new GE boss: remaking the company. By tradition, the former chief executive leaves the board and leaves the building, giving the new captain free rein to set GE’s direction. Immelt’s changes included two that urgently needed doing. He immediately started making GE more global. Surprisingly for such a big, famous company, it was still doing 60% of its business in the U.S. By the time Immelt left, GE was operating in 180 countries and getting 61% of its revenue from outside the U.S.; annual revenue from emerging markets expanded from $10 billion to $45 billion. Some analysts complain that in certain markets, especially China, much of that new business was bought at too high a price. But the locus of global economic growth was moving, and GE needed to follow it. Rank 18 2017 Company Profile: General Electric. Revenues:$122.3 Billion Profits:-$5.8 Billion Employees:313,000 Total return to shareholders :-3.8%* *Total Return to Shareholders assumes the 2007–2017 Annual Rate. Immelt’s other major response to a mega¬trend was making GE more digital. It’s obvious in retrospect, but seven years ago the digital opportunities for a big industrial company weren’t so clear. Analysts praise Immelt for prescience, though again they fault the execution. “They were early in figuring out the value of data to indus¬trial businesses,” says analyst Heymann, “but it was dramatically more expensive than envisioned.” In 2015 Immelt even said that GE would be a top 10 software company by 2020. No one expects that anymore, and the company is laying off more than 100 employees at its San Ramon, Calif., software operation. The concept, however, was clearly correct, and GE moved in the right direction. Flannery says, “We’re still deeply committed to [digital], but we want a much more focused strategy.” Many of these changes happened in the aftermath of the financial crisis, and investors mostly liked what they saw. GE stock tracked the S&P 500’s steady march upward. When GE fell behind in 2015, Immelt confidently predicted the company would earn $2 a share in 2018, a big increase. Activist investor Nelson Peltz’s Trian Fund bought a $2.5 billion stake. Peltz is well known for holding leaders of his portfolio companies accountable, and Immelt was on the hook to deliver $2 a share in 2018. The stock resumed its rise. But the lug nuts were loosening. Late in 2016, the world began to notice. What it noticed first was cash. GE was spending far more than it was generating. The company could pay its bills, but its cushion was getting thin, and heavy cash requirements loomed, such as restocking a pension fund that was underfunded by billions. From 2015 through 2017, GE generated about $30 billion from free cash flow and asset sales, but it spent about $75 billion on stock buybacks, dividends, and acquisitions. As economist Herb Stein famously observed, if something can’t go on forever, it will stop. GE was headed for a brick wall. The next thing the world noticed was the magnitude of the trouble unfolding at GE Power. As recently as late May of 2017, Immelt was telling Wall Street the operating profit outlook for GE Power was “++,” meaning very positive. Just two months later, GE reported that Power’s quarterly profit was down, orders were down, and the outlook wasn’t good. As the year progressed, it got worse. The cascade of grim news accelerated. After GE halved the dividend in November, it announced in December that 12,000 GE Power employees would be axed. In January it wrote off $6.2 billion in connection with a long-term-care insurance business in GE Capital and said that business would require another $15 billion of write-offs over the next seven years. The charge was so big and unexpected that the SEC opened an investigation, still unresolved. Then, in February, GE revealed the Justice Department investigation into WMC Mortgage and in April announced its $1.5 billion reserve. In May it said it might put WMC into bankruptcy. |

|

这些负面惊喜终于结束了吗?没人知道。伊梅尔特2018年股价增长2美元的目标已经早就被人忘却(华尔街一致预测将上涨0.94美元)。取而代之的是弗兰纳里所提出的目标,而这一目标几乎是低调到了极点:“让公司恢复现金和盈利创造能力。” 这个答案回答了我们提出的第一个问题“GE怎么了?”。第二个问题“未来会怎么样?”则取决于GE将以何种形式来拆分。其照明和火车相关的业务以及一些小型业务部门已公开对外出售。如果拆分到此为止,那么这个GE也还是我们所熟知的GE,涵盖电力、航空和医疗业务。尽管医疗和航空部门的业务依然顺风顺水,但考虑到GE Power业绩的下滑,要想修复这三驾马车,并使之成为一家充满活力的公司,GE需要花费数年的功夫。 然而,一些投资者,尤其是Trian,可能没有耐心等待那么长的时间。Trian的爱德华·盖登于去年10月加入GE董事会,而Trian公司因其推动其资产组合公司的分拆而闻名。1月,弗兰纳里明确提到了拆分这一做法,而且对于外界的各种揣测也是听之任之。如果三架马车中的一架遭到拆分,那么我们所熟知的GE将不复存在。这家公司的名称肯定不会有变化,但其内涵将消亡。美国国际电话电报公司便是这一方面的前车之鉴,该公司曾是一家庞大的国际化企业巨头,如今却被拆分成了众多零散部门,各自等待着被吞并和进一步拆分。 说到消亡,当前面临最大危险的是“GE管理有方”的口碑。与公司的大多数特色不一样的是,这一口碑有其起始日期:1900年4月24日,当时《华尔街日报》称,“GE如今成为了投资者心目中管理最完善的工业公司之一”。这一美誉经历了无数的经济跌宕,然而却在过去10年的某一个时段出现了问题。如今已是行将就木。 这一饱经风霜的企业品牌是否能够东山再起已经成为了GE所面临的最大问题。公司并不存在生存危机,而是存在更高层面的顾虑,那就是为公司确立正确的发展方向。其结果关乎这家超凡的公司是否能够重拾昔日风采,还是最终沦为平庸。(财富中文网) 本文最初发表于《财富》2018年6月1日刊。 译者:冯丰 审校:夏林 |

Are the bad surprises finally over? No one has the faintest idea. Immelt’s goal of $2 EPS in 2018 is long forgotten (Wall Street’s consensus forecast is $0.94). In its place is Flannery’s stated goal, which is almost pathetically modest: “restoring the oxygen of cash and earnings to the company.” That answers our first question, What happened? The answer to the second—What’s next?—depends on the various pieces into which GE is disassembled. Its lighting and train-related businesses plus some smaller units are publicly for sale. If that’s as far as it goes, a still recognizable GE would remain, comprising the power, aviation, and health care businesses. Rehabbing that troika into a thriving company would be a multiyear effort because of GE Power’s decline; the health care and aviation units are doing well. But some investors, especially Trian, might not want to wait so long. Trian’s Ed Garden joined the GE board in October, and Trian is well known for often urging the breakup of its portfolio companies. In January Flannery explicitly raised the option of a breakup and has said nothing to dampen speculation. If even one of the three main businesses were to be separated from the others, GE as we know it would end. An entity by that name would surely persist, but its meaning would be lost. The analog would be ITT, once an imposing global conglomerate, now an assortment of diminished pieces on their own journeys of merging and subdividing. Most in danger of extinction is GE’s reputation as a superbly managed company. Unlike most marks of character, this one has a start date: April 24, 1900, when the Wall Street Journal declared, “General Electric is entitled now to take rank as one of the … best managed industrial companies known to investors.” That reputation survived economic ups and downs until sometime in the past decade. It’s now on life support. Whether its storied corporate brand can be revived has become the largest question about GE. The company faces no crisis of survival. Its main businesses will likely carry on in some form. The tension surrounding the company is of a higher nature, befitting GE. It’s whether this extraordinary company will regain its lost luster or descend, at last, to mediocrity. This article originally appeared in the June 1, 2018 issue of Fortune. |