健身方式已经发生剧变,健身房会消失吗?

全美壶铃的短缺以及社交媒体对压平疫情曲线的呼吁,可能凸显了新冠疫情社交隔离期间居家健身的重要性。然而,随着健身房的重新开业,人们依然蜂拥而至,与同伴们一道挥汗如雨。

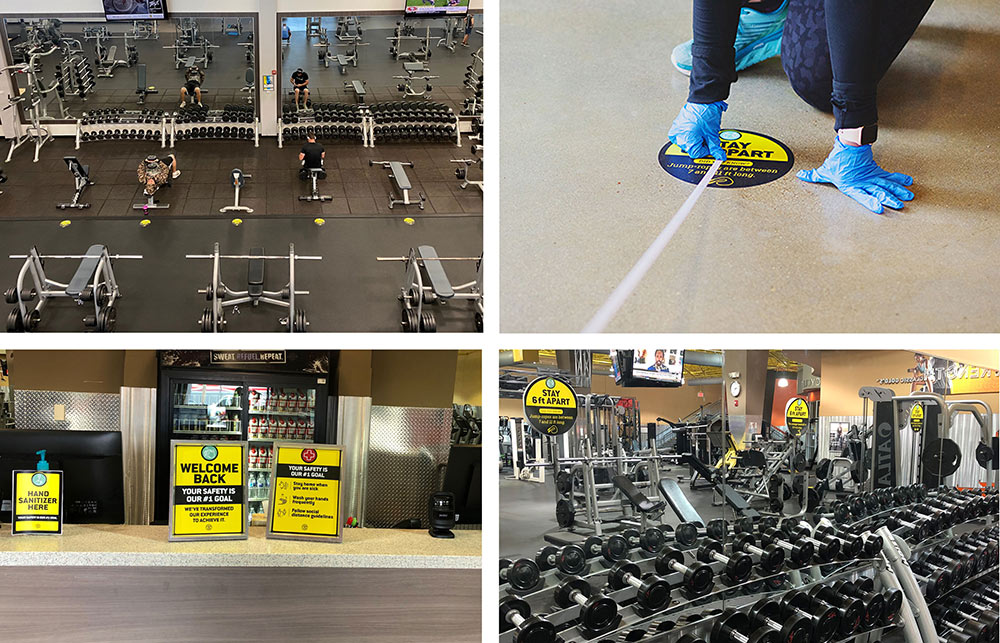

随着居家隔离令开始解除,全美超过半数州的健身房都已经重新开业,其中大多数健身房都在一定程度上减少了接待人数或其他社交隔离限制。作为第一阶段的一部分,特朗普总统联邦重启计划允许健身房重新开业。公共卫生专家称,回归健身房为时尚早,但很多美国人都迫不及待地去健身房练上几个回合,即便健身房的面目因为实施社交隔离而发生了改变。

国际健康、球类和体育俱乐部协会(IHRSA)称,健身是一个价值340亿美元的行业,约20%的美国人都是某家健身俱乐部的会员。当其健身场所停业之后,很多人都转向了手机或笔记本。独角兽公司Classpass的首席商务官扎克•阿普特说,疫情提升了虚拟健身产品的可访问市场规模,并迫使传统健身房提供更多的居家健身虚拟产品。Classpass于今年1月宣布其估值达到了10亿美元。疫情还提升了人们对健身益处的认识:心血管健康问题是导致新冠肺炎重症或死亡的重要风险因素之一。

阿普特说:“我们经历了在线或虚拟健身需求的暴涨,要不是新冠疫情,这一现象可能不会发生。”国际健康、球类和体育俱乐部协会已经在其2019年报告中将虚拟健身这类技术加强型产品列为一种重要的行业趋势,而且很多健身房,尤其是大型连锁店,正在通过各种途径进一步抢占虚拟市场。然而,要不是新冠疫情爆发,线上业务可能永远也无法成为如此重要的关注点。

健身行业早在这一切发生之前便已进入了转变期。Piper Sandler的分析师皮特•凯斯说:“健身行业在过去几年发生了很大的变化。”市场规模最大的莫过于高端精品健身工作室,它们提供的是某一种服务,例如普拉提或芭蕾,还有像Planet Fitness这类走量的高性价比健身房。中端市场则是像Gold Gym这类品牌的天下,但这类品牌在疫情爆发后难以维持其竞争力,因此在顶端和低端市场健身产品的夹击下逐渐失去了其传统客户群。

Planet Fitness是该领域少数上市公司之一。凯斯称,该公司目前的状况便是疫情对健身行业估值影响的缩影。他说:“我们看到,公司的股价从约70美元下跌至最低点的约30美元。”

但公司的股票在6月初出现了反弹,当时公司向美国证券交易委员会(SEC)报备的文件称,得益于新入会人数的增加抵消了客户的流失,这家有着800处店面的公司的会员数量依然十分稳定。凯斯称,这一点与其公司在4月和5月开展的两项调查一致,该调查显示,约80%的受调对象有可能保留其健身房会员。

为了打消信心不足会员的顾虑并确保其继续保留会员,市场中的各大健身俱乐部都需要拿出强有力的方案,展示重新开业后的健身房会在社交隔离以及继续巩固这些措施方面都做了哪些工作,这意味着它们将会降低会员接待数量和加强消毒举措等。

阿巴拉契亚州立大学研究健身动机的运动科学教授本杰明•斯布里称,很多美国人都有可能返回健身房。他说:“健身房依然能够提供很多人们在家中无法实现的健身项目。”

健身房颇具吸引力一点在于,除了能够便捷地使用设备和健身空间外,有两件价格不菲的事物可能在家中无法实现。一是健身教练和课程导师的专业知识,以及健身圈文化和其他健身人士的支持。斯布里说:“人们去健身房的部分原因在于与其他人一道健身,并分担健身的苦楚。我觉得很多人对此非常渴望。”

那些成功完成转型、在家健身的人士也有可能继续在家健身,至少会持续一段时间。第一,家里很方便;第二,他们如今也购买了健身设备。家用健身器材的购买在过去一个季度出现了上涨,从昂贵的跑步机到哑铃这类更加基础的设施均是如此。为了确保跟上健身计划,人们的购买热情还让这些设备出现了短缺状况。斯布里说,认真的周末健身达人可能已经解决了在家健身的问题。

即便那些有能力自己制定训练计划的人士也都依赖于多种多样的在线课程。拥有很多群体健身课程的健身房,例如CrossFit健身房和瑜伽工作室,已经在尝试让其客户通过健身直播这种方式,在家接触一部分专业知识和健身群体,发布付费点播视频,提供激励型在线辅导,甚至在某些情况下出租设备。

麦克马斯特大学研究锻炼和大脑的人体运动学家詹妮弗•海茨称,运动如今比以往任何时候都更重要。她表示,对于那些定期锻炼的人来说,即便是停止运动两周,“也足以造成情绪的不佳。”锻炼是减压的一个重要方式,对于受疫情影响的数千万人来说至关重要。她说,最后,锻炼还有助于人们保持清醒和专注度,这样,长时间的Zoom电话会议也可能不再那么难熬。

事情无法在短时间内回归正常。斯布里说,哪怕顾客在数个月或一年之内都不会回归健身房,虚拟服务也能够帮助健身房留住顾客,并与其保持互动。这些服务通常比健身房会费便宜,而且采用点播形式。

当健身房因为疫情而闭店时,Gold’s Gym便已经推出了一个应用程序。Gold’s Gym的总裁兼首席执行官亚当•泽茨夫说,我们免费提供应用程序的下载和使用,而且该应用程序自1月以来的下载量已经达到了数十万次。公司加速了对应用程序中已有内容的改善工作,并添加了新功能。公司的泽茨夫还表示,“公司今后将在这一领域投入重金。”

与虚拟健身公司打交道的客户在最近几个月中也出现了增长。例如,Peloton的独立数字会员月费为12.99美元,使用健身车或跑步机的月注册费用为39美元,这两款设备的一次性投入成本均达到了上千美元。公司的注册人数自疫情开始之后出现了大幅增加,也让公司的会员数突破了100万大关。

JMP Securities的Peloton分析师隆•乔西称,实现这个数字是一场“艰苦卓绝的斗争”,而且会对市场渗透带来长期的影响。到目前为止,很多新注册用户依然在处于这个独立应用程序的免费试用期,公司在疫情开始时便将试用期从1个月延至3个月。他说,所有这些额外注册用户受到的短期财务冲击不一定会对本季度的营收造成影响,但下个季度我们就会看到,到底有多少人转化为付费用户。

彭博行业研究(Bloomberg Intelligence)的数据认为,从历史上来看,约10%的Peloton的独立应用程序用户会转化为健身车或跑步机的完整权限会员。最近的经济下滑可能会改变这个转化率,因为很多人的可支配收入有所下降。然而从某种意义上来说,这种精品健身服务也可以成为一种经济实惠的选择:Macquarie公司的分析师保罗•戈尔丁表示,Peloton最大的销售收入来自于收入低于7.5万美元的家庭。

此前,健身车令人望而却步的价签及其昂贵的月租费曾经让消费者失去了兴趣,但Peloton的理念在于,对于有两个用户的家庭来说,注册和设备租赁的月费如果分期付的话为97美元,远低于两人的精品健身房会费。戈尔丁说:“它还说明了一个事实,无论设备看起来有多贵,健身行业都已经找到了合适的方式来传递价值及其具有的灵活性。”

乔西说:“这些趋势有可能会继续延续下去,家用设备、居家锻炼只是其中的一种。”他预计这一领域将会进一步多元化,但Peloton有明显的优势,而且走在了其专业虚拟健身竞争对手的前面,例如Echelon、Myx Fitness和Mirror。

总之,像其他事物一样,健身行业因为疫情而发生了改变。但这并不意味着人们就会放弃集体健身的方式。肯尼索州立大学的体育管理教授那拉尼•巴特勒称:“我觉得人们并不愿意一直待在家中。如今,所有人都在渴望得到社群感,而且体育的确能够满足这一需求。”

巴特勒称,随着迪士尼游乐设施的重新开业,健身与体育场所正在密切关注接下来可能会发生的事情。她说:“在我看来,迪士尼确实正在塑造我们今后开展体育赛事的标准做法,从口罩到无现金支付,再到进园时的体温测量。”

市场各个层面重新开启的健身中心已经实施了其中的某些举措。然而大多数业内人士预计,行业的稳定可能还需要数月乃至数年的时间,因为针对新冠病毒的疫苗至少还需要一年的时间才能上市。但疫情引发的快速变化向我们展现了两件重要的事情:虚拟健身产品复制健身社群影响的相似度越高,这类产品的成功性也就越大;而且如果条件允许,很多人都渴望再次与其朋友一道挥汗如雨。(财富中文网)

译者:Feb

全美壶铃的短缺以及社交媒体对压平疫情曲线的呼吁,可能凸显了新冠疫情社交隔离期间居家健身的重要性。然而,随着健身房的重新开业,人们依然蜂拥而至,与同伴们一道挥汗如雨。

随着居家隔离令开始解除,全美超过半数州的健身房都已经重新开业,其中大多数健身房都在一定程度上减少了接待人数或其他社交隔离限制。作为第一阶段的一部分,特朗普总统联邦重启计划允许健身房重新开业。公共卫生专家称,回归健身房为时尚早,但很多美国人都迫不及待地去健身房练上几个回合,即便健身房的面目因为实施社交隔离而发生了改变。

国际健康、球类和体育俱乐部协会(IHRSA)称,健身是一个价值340亿美元的行业,约20%的美国人都是某家健身俱乐部的会员。当其健身场所停业之后,很多人都转向了手机或笔记本。独角兽公司Classpass的首席商务官扎克•阿普特说,疫情提升了虚拟健身产品的可访问市场规模,并迫使传统健身房提供更多的居家健身虚拟产品。Classpass于今年1月宣布其估值达到了10亿美元。疫情还提升了人们对健身益处的认识:心血管健康问题是导致新冠肺炎重症或死亡的重要风险因素之一。

阿普特说:“我们经历了在线或虚拟健身需求的暴涨,要不是新冠疫情,这一现象可能不会发生。”国际健康、球类和体育俱乐部协会已经在其2019年报告中将虚拟健身这类技术加强型产品列为一种重要的行业趋势,而且很多健身房,尤其是大型连锁店,正在通过各种途径进一步抢占虚拟市场。然而,要不是新冠疫情爆发,线上业务可能永远也无法成为如此重要的关注点。

健身行业早在这一切发生之前便已进入了转变期。Piper Sandler的分析师皮特•凯斯说:“健身行业在过去几年发生了很大的变化。”市场规模最大的莫过于高端精品健身工作室,它们提供的是某一种服务,例如普拉提或芭蕾,还有像Planet Fitness这类走量的高性价比健身房。中端市场则是像Gold Gym这类品牌的天下,但这类品牌在疫情爆发后难以维持其竞争力,因此在顶端和低端市场健身产品的夹击下逐渐失去了其传统客户群。

Planet Fitness是该领域少数上市公司之一。凯斯称,该公司目前的状况便是疫情对健身行业估值影响的缩影。他说:“我们看到,公司的股价从约70美元下跌至最低点的约30美元。”

但公司的股票在6月初出现了反弹,当时公司向美国证券交易委员会(SEC)报备的文件称,得益于新入会人数的增加抵消了客户的流失,这家有着800处店面的公司的会员数量依然十分稳定。凯斯称,这一点与其公司在4月和5月开展的两项调查一致,该调查显示,约80%的受调对象有可能保留其健身房会员。

为了打消信心不足会员的顾虑并确保其继续保留会员,市场中的各大健身俱乐部都需要拿出强有力的方案,展示重新开业后的健身房会在社交隔离以及继续巩固这些措施方面都做了哪些工作,这意味着它们将会降低会员接待数量和加强消毒举措等。

阿巴拉契亚州立大学研究健身动机的运动科学教授本杰明•斯布里称,很多美国人都有可能返回健身房。他说:“健身房依然能够提供很多人们在家中无法实现的健身项目。”

健身房颇具吸引力一点在于,除了能够便捷地使用设备和健身空间外,有两件价格不菲的事物可能在家中无法实现。一是健身教练和课程导师的专业知识,以及健身圈文化和其他健身人士的支持。斯布里说:“人们去健身房的部分原因在于与其他人一道健身,并分担健身的苦楚。我觉得很多人对此非常渴望。”

那些成功完成转型、在家健身的人士也有可能继续在家健身,至少会持续一段时间。第一,家里很方便;第二,他们如今也购买了健身设备。家用健身器材的购买在过去一个季度出现了上涨,从昂贵的跑步机到哑铃这类更加基础的设施均是如此。为了确保跟上健身计划,人们的购买热情还让这些设备出现了短缺状况。斯布里说,认真的周末健身达人可能已经解决了在家健身的问题。

即便那些有能力自己制定训练计划的人士也都依赖于多种多样的在线课程。拥有很多群体健身课程的健身房,例如CrossFit健身房和瑜伽工作室,已经在尝试让其客户通过健身直播这种方式,在家接触一部分专业知识和健身群体,发布付费点播视频,提供激励型在线辅导,甚至在某些情况下出租设备。

麦克马斯特大学研究锻炼和大脑的人体运动学家詹妮弗•海茨称,运动如今比以往任何时候都更重要。她表示,对于那些定期锻炼的人来说,即便是停止运动两周,“也足以造成情绪的不佳。”锻炼是减压的一个重要方式,对于受疫情影响的数千万人来说至关重要。她说,最后,锻炼还有助于人们保持清醒和专注度,这样,长时间的Zoom电话会议也可能不再那么难熬。

事情无法在短时间内回归正常。斯布里说,哪怕顾客在数个月或一年之内都不会回归健身房,虚拟服务也能够帮助健身房留住顾客,并与其保持互动。这些服务通常比健身房会费便宜,而且采用点播形式。

当健身房因为疫情而闭店时,Gold’s Gym便已经推出了一个应用程序。Gold’s Gym的总裁兼首席执行官亚当•泽茨夫说,我们免费提供应用程序的下载和使用,而且该应用程序自1月以来的下载量已经达到了数十万次。公司加速了对应用程序中已有内容的改善工作,并添加了新功能。公司的泽茨夫还表示,“公司今后将在这一领域投入重金。”

与虚拟健身公司打交道的客户在最近几个月中也出现了增长。例如,Peloton的独立数字会员月费为12.99美元,使用健身车或跑步机的月注册费用为39美元,这两款设备的一次性投入成本均达到了上千美元。公司的注册人数自疫情开始之后出现了大幅增加,也让公司的会员数突破了100万大关。

JMP Securities的Peloton分析师隆•乔西称,实现这个数字是一场“艰苦卓绝的斗争”,而且会对市场渗透带来长期的影响。到目前为止,很多新注册用户依然在处于这个独立应用程序的免费试用期,公司在疫情开始时便将试用期从1个月延至3个月。他说,所有这些额外注册用户受到的短期财务冲击不一定会对本季度的营收造成影响,但下个季度我们就会看到,到底有多少人转化为付费用户。

彭博行业研究(Bloomberg Intelligence)的数据认为,从历史上来看,约10%的Peloton的独立应用程序用户会转化为健身车或跑步机的完整权限会员。最近的经济下滑可能会改变这个转化率,因为很多人的可支配收入有所下降。然而从某种意义上来说,这种精品健身服务也可以成为一种经济实惠的选择:Macquarie公司的分析师保罗•戈尔丁表示,Peloton最大的销售收入来自于收入低于7.5万美元的家庭。

此前,健身车令人望而却步的价签及其昂贵的月租费曾经让消费者失去了兴趣,但Peloton的理念在于,对于有两个用户的家庭来说,注册和设备租赁的月费如果分期付的话为97美元,远低于两人的精品健身房会费。戈尔丁说:“它还说明了一个事实,无论设备看起来有多贵,健身行业都已经找到了合适的方式来传递价值及其具有的灵活性。”

乔西说:“这些趋势有可能会继续延续下去,家用设备、居家锻炼只是其中的一种。”他预计这一领域将会进一步多元化,但Peloton有明显的优势,而且走在了其专业虚拟健身竞争对手的前面,例如Echelon、Myx Fitness和Mirror。

总之,像其他事物一样,健身行业因为疫情而发生了改变。但这并不意味着人们就会放弃集体健身的方式。肯尼索州立大学的体育管理教授那拉尼•巴特勒称:“我觉得人们并不愿意一直待在家中。如今,所有人都在渴望得到社群感,而且体育的确能够满足这一需求。”

巴特勒称,随着迪士尼游乐设施的重新开业,健身与体育场所正在密切关注接下来可能会发生的事情。她说:“在我看来,迪士尼确实正在塑造我们今后开展体育赛事的标准做法,从口罩到无现金支付,再到进园时的体温测量。”

市场各个层面重新开启的健身中心已经实施了其中的某些举措。然而大多数业内人士预计,行业的稳定可能还需要数月乃至数年的时间,因为针对新冠病毒的疫苗至少还需要一年的时间才能上市。但疫情引发的快速变化向我们展现了两件重要的事情:虚拟健身产品复制健身社群影响的相似度越高,这类产品的成功性也就越大;而且如果条件允许,很多人都渴望再次与其朋友一道挥汗如雨。(财富中文网)

译者:Feb

A national kettlebell shortage and social media calls to #plankthecurve may have highlighted the importance of at-home fitness during COVID-19 social distancing, but as gyms open up, people are returning in droves to sweat with their peers.

Gyms have reopened in more than half of states across the country as stay-at-home orders begin to lift, most under some form of reduced occupancy or other social distancing restrictions. President Trump’s federal reopening plan allows gyms to reopen as part of phase 1. Public health experts say it’s too soon for a return to the weightlifting bench, but many Americans can’t wait to get back to working out—even if the gym has been modified to allow for social distancing.

Fitness is a $34 billion industry, and an estimated 20% of Americans have a membership to some kind of fitness club, according to the International Health, Racquet & Sportsclub Association (IHRSA). When their workout spaces shut their doors, a number of them turned to their phones or laptops. The pandemic has increased the addressable market for virtual fitness offerings and also forced traditional gyms to move into offering more virtual products for at-home workouts, says Zach Apter, chief commercial officer of Classpass, which announced a $1 billion unicorn valuation in January. The pandemic has also raised awareness of the health benefits of working out: Poor cardiovascular health is one of the major risk factors for severe illness or death as a result of COVID-19.

“We have experienced a demand shock for online or virtual fitness that might not have happened in a non-COVID world,” Apter says. The IHRSA had already identified technology-enhanced offerings like virtual fitness as an important industry trend in its 2019 report, and many gyms, especially large chains, were looking at moving further into the virtual space. But it might never have become such a priority without COVID-19.

All this unfolded in an industry that was already in a state of change. “The fitness industry has evolved a lot in the last couple of years,” says analyst Peter Keith of Piper Sandler. The largest market segments are at the high-end boutique fitness studios, which tend to cater to one specific kind of exercise like Pilates or barre, and high-value, low-price (HVLP) gyms like Planet Fitness that rely on volume. In the middle market are properties like Gold’s Gym, which were already struggling to maintain relevance when the pandemic began, their traditional customer base hollowed out by offerings at the top and bottom of the market, Keith says.

Planet Fitness is one of the few publicly traded stocks in this space, and Keith says that what happened there is a good example of how the pandemic impacted valuation in the fitness space. “You’re looking at a stock that went from about $70 to kind of bottoming out around $30,” he says.

But the stock saw a jump at the beginning of June, when an SEC filing stated that membership numbers at the 800 company-owned locations were remaining steady, thanks to a spike in new sign-ups offset by churn. Keith says that’s consistent with the results of two surveys his firm conducted in April and May that showed about 80% of respondents are likely to retain their gym membership.

To reassure uncertain people and ensure continued membership, fitness clubs at all points in the market need to have firm plans for what a reopened gym will look like in terms of social distancing and continue to reinforce those measures as they reopen, which will mean decreased capacity and increased sanitation measures, among other things.

Benjamin Sibley, an Appalachian State University professor of exercise science who studies workout motivation, says many Americans are likely to return to their gym. “Gyms still offer a lot of things that people are struggling to achieve at home,” says Sibley.

One of the gym’s big appeals—besides easy access to equipment and workout space, two things that are expensive and may not be available at home—is access to both the expert knowledge of trainers and class instructors and the community knowledge and support of other people working out. “Part of it is actively working out with other people at the same time and that shared suffering. I think a lot of people are going to be hungry for that,” says Sibley.

Those who managed to make the transition to at-home workouts successfully are likely to continue working out at home, at least some of the time. For one thing, it’s convenient. For another, they have the equipment now. Purchases of home fitness equipment from big-ticket items like treadmills to more basic equipment like dumbbells spiked in the last quarter, causing supply shortages as people tried to ensure they can keep up with their fitness routines. Serious weekend warriors have likely figured it out, says Sibley.

Even many who don’t have the knowledge to design a routine themselves have relied on a wide selection of online classes. Gyms that have a lot of group fitness offerings, like CrossFit gyms and yoga studios, have tried to give their clients access to some of that knowledge and community at home by doing things like live-streaming workouts, posting videos for on-demand consumption, providing motivational coaching online, and even in some cases renting out equipment.

Exercise is more important now than ever, says Jennifer Heisz, a McMaster University kinesiologist who studies exercise and the brain. For people who regularly exercise, even two weeks of sedentary time “is enough to cause a dip in mood,” she says. And exercise is a key component of stress relief, crucial to the millions of people who had their lives upended by the pandemic. Finally, she says, exercise helps people stay alert and focused, which might make those long Zoom meetings a little easier to handle.

Things won’t go back to normal anytime soon. Virtual offerings help gyms hold on to clients and keep them engaged, even if they won’t be returning to the gym for months or a year, Sibley says. These offerings are often less expensive than gym memberships or offered on an à la carte basis.

When its gyms shut their doors because of the pandemic, Gold’s Gym already had an app. The company made that app free to download and use and saw hundreds of thousands of downloads since January, says Gold’s Gym president and CEO Adam Zeitsiff. The company accelerated improvements that had already been in the works and added new features. In the future, “we’re going to be investing heavily,” Zeitsiff adds.

Consumer engagement with virtual fitness companies has also grown in recent months. For example, Peloton—which sells both a $12.99 per month independent digital membership and a $39 per month subscription for use with its stationary bike or treadmill, which both have one-time costs of thousands of dollars for the equipment—has seen a significant bump since the pandemic began, pushing the company over the 1 million subscriber mark.

Hitting that mark is an “uphill battle,” says Peloton analyst Ron Josey of JMP Securities, and may have longer-term effects on market penetration. For now, many of those new subscribers are still on free trial of the stand-alone app, which the company extended from one to three months at the start of the pandemic. The short-term financial impact of all those extra subscribers won’t necessarily show up in this quarter’s earnings, he says—but the next quarter will show how many were converted to paying subscribers.

Bloomberg Intelligence data suggests that, historically, about 10% of Peloton’s stand-alone app users are converted to an All-Access membership with a bike or treadmill. It’s possible that the recent economic downturn could change that conversion figure since many may have less disposable income. But in a certain light, this boutique fitness offering could be a budget choice: Analyst Paul Golding of Macquarie notes that Peloton is making the largest sales gains in households with income under $75,000.

The sticker shock of the bike and the expensive monthly subscription it needs has turned off consumers before, but Peloton’s argument is that for a household with two users, the monthly payment for both the subscription and equipment, if paid in installments, is significantly less at $97 than two boutique gym memberships. “It also goes to show that however expensive a piece of equipment might seem, the industry has found ways of conveying the value as well as the flexibility that that brings,” Golding says.

“Home equipment, home exercise, is one of these trends that is likely to continue,” Josey says. He expects further diversification into this space but says Peloton is well positioned and ahead of its boutique virtual fitness competitors like Echelon, Myx Fitness, and Mirror.

The bottom line is that, like everything else, the fitness industry has been changed by the pandemic. But that doesn’t mean people are going to stop working out together. “I don’t think people are going to want to stay at home forever,” says B. Nalani Butler, a professor of sport management at Kennesaw State University. “Everybody, right now, is just craving that sense of community, and sports really does bring that.”

Butler says fitness and sports venues are closely watching what happens as Disney properties reopen. “From what I understand, they’re really setting the standards for how we’re going to be doing everything in sports,” she says, “from face masks to cashless payments to temperature checks when you go in.”

Reopened fitness centers at all segments of the market have implemented some of those measures already. But it’s likely to be months or years before the industry stabilizes, because a vaccine for SARS-CoV-2, the virus that causes COVID-19, is at least a year away, according to most estimates. But the rapid shift occasioned by the pandemic has shown two important things: The closer virtual fitness products can get to replicating the community impact of fitness, the more likely they are to succeed; and when it’s possible, many are eager to sweat among their friends once again.