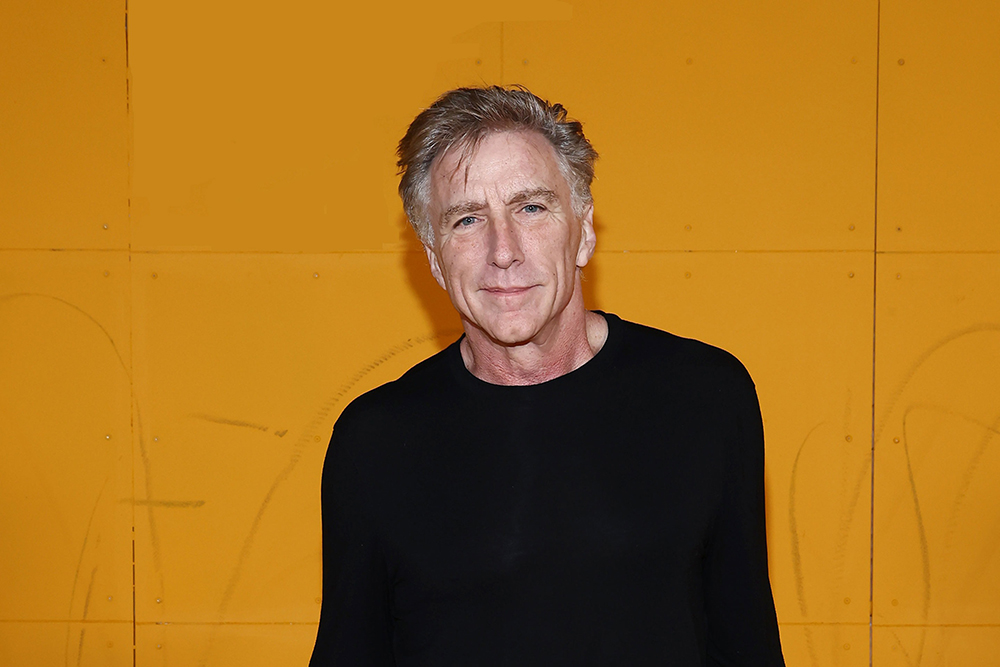

在整顿大企业方面,VF公司(VF Corp)的新任首席执行官布拉肯·达雷尔可以说是轻车熟路。在2023年夏天执掌陷入困境的鞋类和服装制造商VF之前,达雷尔曾经在罗技公司(Logitech)工作十多年,随着平板电脑普及,罗技公司的键盘、耳机和麦克风等配件不再流行。在他职业生涯早期,曾经通过吸引年轻男性帮助宝洁(Procter & Gamble)的“老香料”(Old Spice)品牌起死回生。

如今,VF旗下的范斯(Vans)、北面(The North Face)、Timberland、Dickies等品牌都在走下坡路,达雷尔再次忙得不可开交。以滑板鞋品牌范斯为例,该品牌曾经炙手可热,如今却相当冷清。不少人认为范斯品牌已经不再“酷炫”,上季度的销售额下降了29%。与此同时,北面不敌Cotopaxi、始祖鸟(Arcteryx)等品牌,也比不上长期竞争对手巴塔哥尼亚(Patagonia)。还有,2023年5月VF第二次大额减记,按照2021年收购Supreme花费的20亿美元来算减记总额已经达到三分之一,原本公司打算靠街头服饰品牌Supreme重燃活力,然而落空。

就在几年前,VF还被当作投资组合公司经营的典范,如今的业绩数字却令人唏嘘。2000年至2016年间,公司的收入翻了一番,利润翻了两番。然而过去两年,股价却下跌了75%。

在一位激进股东的压力下,达雷尔承认各项改变措施可能需要一段时间才能够收效。不过他表示,当前仍然处于紧急状态,所以会亲自出手帮助范斯调整,毕竟多年来该品牌一直是推动VF增长的动力。他打算等范斯重回正轨就大幅恢复各品牌的自主权,因为近年来VF的丹佛总部决策逐渐集中,品牌自主方面受到了影响。

达雷尔打算避免重蹈覆辙的一点是,业务上升期却忽略业务增长。他指出,多年来范斯只推出了五款差不多的鞋,结果被竞争对手超越。

他对《财富》杂志表示:“我们没有利用快速增长,也没有投资创新。”

为使文章表述更为清晰,以下内容已经过编辑和整理。

《财富》:当你接手VF时,旗下的主要品牌都在苦苦挣扎。你怎么选择先去哪里灭火?

布拉肯·达雷尔:我先是发现VF最大的品牌范斯衰退之势非常明显。然后我问:“总体来说,哪里的业务最差?”回答是美洲。第三步又问:“我们的品牌在市场上有何不同之处?”我深知拿不出好产品业务就不可能优秀,所以不得不质疑公司的产品能不能比得上竞争对手。由此我确定工作重点。

VF是投资组合公司,会不会改变你推进转型的方式?你想让各品牌像以前一样独立经营吗?

有一种方法可以让多家品牌一直保持强大和真实,就是假装品牌并不属于投资组合。路威酩轩集团(LVMH)就是这套模式,各品牌完全独立。但身处投资组合能够利用供应链等优势,或者携各品牌通过某家零售商打入市场时,就可以提供很多东西,还能够说:“我们非常了解你的业务。”

多年来,业内一直认为VF是服装和鞋类的模范制造商。在过去几年里,这家一流公司发生了什么?

美洲市场中,我们在权责划分上架构不合理,北美表现平平。第二件事情是,我们没有推动最佳实践,导致VF学习经验方面非常有限。我们也没有利用之前的快速增长投资创新、新产品和开发新特许经营权。

当我看到范斯衰落和Supreme减记时,很想知道酷品牌在VF之类的大企业中是不是很难顺利发展。

15年里,范斯从4亿美元增长到40亿美元,所以在VF发展很不错。滑板文化是蓬勃发展的领域。但我们刚开始在Supreme犯了一些错误。品牌独立经营时做得非常棒。

范斯呢?这种品牌可以重新变得“酷炫”吗?

有可能。我在宝洁负责的“老香料”就是品牌转型的好例子。很久以前,对我们的父辈甚至祖父辈而言,“老香料”是一个酷炫品牌,尽管以今天的标准来看,广告有性别歧视问题。产品要为新一代更新,最后我们把“老香料”改造成价值数十亿美元的品牌。另一个例子是新百伦(New Balance,不属于VF),之前也没有了酷炫的感觉。现在看发展也不错。

VF经营当中很重要的一部分是并购,主要是因为曾经将收购品牌成功地改造成为市场领先者。你在并购方面有何理念?

并购的关键是扭转业务局面,实现长期可持续增长,而不是并购交易本身。我不指望现阶段达成转型协议,主要是实现自然增长,把品牌变成强大可持续的增长引擎。我不想当投资组合投资者;更希望推动业务发展。

在上次的季度电话会议上,你提到北美大部分地区的暖冬影响了北面的业绩。你担心气候变化对品牌的影响吗?

总体来说,我确实担心气候变化,但品牌也要想办法不断扩张。对北面而言,我们有团队正在制定大约五种不同的策略,确保一年365天都有适合的产品,至少要满足户外场景,而不只是冬天不登山的时候。我们有很多成长机会。之前的产品主要倾向男性多于女性,所以在女性领域还有很多增长的空间。

你什么时候才能够确认品牌恢复活力,之后你会减少干涉吗?

我就像热导导弹,哪里可以帮上忙我就去哪里。如果我无能为力,就确保有最优秀的人才负责。如果我是手下的部门领导,就不会希望首席执行官像我在范斯一样。所以,是的,之后我会放手。(财富中文网)

译者:梁宇

审校:夏林

在整顿大企业方面,VF公司(VF Corp)的新任首席执行官布拉肯·达雷尔可以说是轻车熟路。在2023年夏天执掌陷入困境的鞋类和服装制造商VF之前,达雷尔曾经在罗技公司(Logitech)工作十多年,随着平板电脑普及,罗技公司的键盘、耳机和麦克风等配件不再流行。在他职业生涯早期,曾经通过吸引年轻男性帮助宝洁(Procter & Gamble)的“老香料”(Old Spice)品牌起死回生。

如今,VF旗下的范斯(Vans)、北面(The North Face)、Timberland、Dickies等品牌都在走下坡路,达雷尔再次忙得不可开交。以滑板鞋品牌范斯为例,该品牌曾经炙手可热,如今却相当冷清。不少人认为范斯品牌已经不再“酷炫”,上季度的销售额下降了29%。与此同时,北面不敌Cotopaxi、始祖鸟(Arcteryx)等品牌,也比不上长期竞争对手巴塔哥尼亚(Patagonia)。还有,2023年5月VF第二次大额减记,按照2021年收购Supreme花费的20亿美元来算减记总额已经达到三分之一,原本公司打算靠街头服饰品牌Supreme重燃活力,然而落空。

就在几年前,VF还被当作投资组合公司经营的典范,如今的业绩数字却令人唏嘘。2000年至2016年间,公司的收入翻了一番,利润翻了两番。然而过去两年,股价却下跌了75%。

在一位激进股东的压力下,达雷尔承认各项改变措施可能需要一段时间才能够收效。不过他表示,当前仍然处于紧急状态,所以会亲自出手帮助范斯调整,毕竟多年来该品牌一直是推动VF增长的动力。他打算等范斯重回正轨就大幅恢复各品牌的自主权,因为近年来VF的丹佛总部决策逐渐集中,品牌自主方面受到了影响。

达雷尔打算避免重蹈覆辙的一点是,业务上升期却忽略业务增长。他指出,多年来范斯只推出了五款差不多的鞋,结果被竞争对手超越。

他对《财富》杂志表示:“我们没有利用快速增长,也没有投资创新。”

为使文章表述更为清晰,以下内容已经过编辑和整理。

《财富》:当你接手VF时,旗下的主要品牌都在苦苦挣扎。你怎么选择先去哪里灭火?

布拉肯·达雷尔:我先是发现VF最大的品牌范斯衰退之势非常明显。然后我问:“总体来说,哪里的业务最差?”回答是美洲。第三步又问:“我们的品牌在市场上有何不同之处?”我深知拿不出好产品业务就不可能优秀,所以不得不质疑公司的产品能不能比得上竞争对手。由此我确定工作重点。

VF是投资组合公司,会不会改变你推进转型的方式?你想让各品牌像以前一样独立经营吗?

有一种方法可以让多家品牌一直保持强大和真实,就是假装品牌并不属于投资组合。路威酩轩集团(LVMH)就是这套模式,各品牌完全独立。但身处投资组合能够利用供应链等优势,或者携各品牌通过某家零售商打入市场时,就可以提供很多东西,还能够说:“我们非常了解你的业务。”

多年来,业内一直认为VF是服装和鞋类的模范制造商。在过去几年里,这家一流公司发生了什么?

美洲市场中,我们在权责划分上架构不合理,北美表现平平。第二件事情是,我们没有推动最佳实践,导致VF学习经验方面非常有限。我们也没有利用之前的快速增长投资创新、新产品和开发新特许经营权。

当我看到范斯衰落和Supreme减记时,很想知道酷品牌在VF之类的大企业中是不是很难顺利发展。

15年里,范斯从4亿美元增长到40亿美元,所以在VF发展很不错。滑板文化是蓬勃发展的领域。但我们刚开始在Supreme犯了一些错误。品牌独立经营时做得非常棒。

范斯呢?这种品牌可以重新变得“酷炫”吗?

有可能。我在宝洁负责的“老香料”就是品牌转型的好例子。很久以前,对我们的父辈甚至祖父辈而言,“老香料”是一个酷炫品牌,尽管以今天的标准来看,广告有性别歧视问题。产品要为新一代更新,最后我们把“老香料”改造成价值数十亿美元的品牌。另一个例子是新百伦(New Balance,不属于VF),之前也没有了酷炫的感觉。现在看发展也不错。

VF经营当中很重要的一部分是并购,主要是因为曾经将收购品牌成功地改造成为市场领先者。你在并购方面有何理念?

并购的关键是扭转业务局面,实现长期可持续增长,而不是并购交易本身。我不指望现阶段达成转型协议,主要是实现自然增长,把品牌变成强大可持续的增长引擎。我不想当投资组合投资者;更希望推动业务发展。

在上次的季度电话会议上,你提到北美大部分地区的暖冬影响了北面的业绩。你担心气候变化对品牌的影响吗?

总体来说,我确实担心气候变化,但品牌也要想办法不断扩张。对北面而言,我们有团队正在制定大约五种不同的策略,确保一年365天都有适合的产品,至少要满足户外场景,而不只是冬天不登山的时候。我们有很多成长机会。之前的产品主要倾向男性多于女性,所以在女性领域还有很多增长的空间。

你什么时候才能够确认品牌恢复活力,之后你会减少干涉吗?

我就像热导导弹,哪里可以帮上忙我就去哪里。如果我无能为力,就确保有最优秀的人才负责。如果我是手下的部门领导,就不会希望首席执行官像我在范斯一样。所以,是的,之后我会放手。(财富中文网)

译者:梁宇

审校:夏林

VF Corp’s new CEO, Bracken Darrell, knows his way around a big corporate fix-up job. Before taking the helm at the troubled footwear and apparel maker last summer, Darrell spent more than a decade atop Logitech, whose tech accessory products like keyboards, headphones, and microphones were no longer needed as tablets became popularized. Earlier in his career, he brought Procter & Gamble’s Old Spice brand back to life by appealing to younger men.

Now, at VF, with a stable of brands like Vans, The North Face, Timberland, and Dickies that are all in decline, Darrell again has his hands full. Take Vans, the once-hot, now cold skateboarder shoe brand. Sales fell 29% last quarter, and some argue it has lost its “cool” factor. The North Face, meanwhile, has lost ground to brands like Cotopaxi, Arcteryx, and, of course, long-time archrival Patagonia. And let’s not forget that in May, VF took the second of two big write-downs, totaling one-third of the $2 billion it spent in 2021 on Supreme, the hip streetwear brand that was supposed to re-energize the whole company.

These numbers are sobering, considering just a few years ago, VF was heralded as a model for running a portfolio company. Revenue doubled, and profits quadrupled between 2000 and 2016. In the last two years, however, shares have fallen 75%.

Under pressure from an activist shareholder who is mollified for now, Darell admits he is making changes that will likely take some time to pay off. But still in emergency mode, he says he’s very hands-on in fixing Vans, for years VF’s engine of growth. Once the skateboarding retailer is back on track, he plans to restore all of the brands’ considerable autonomy that has been eroded in recent years by the gradual centralization of decision-making at VF’s Denver headquarters.

One mistake Darell doesn’t plan to repeat is failing to infuse business when it’s on the upswing, he says, pointing to Vans, which has, more or less, trotted out the same five shoe models for years and gotten lapped by competitors.

“We didn’t take advantage of our rapid growth and invest in innovation,” he tells Fortune.

This article has been edited and condensed for clarity.

Fortune: You get to VF, and all of its major brands are struggling. How do you choose which fire to put out first?

Bracken Darrell: I saw that Vans, VF’s biggest brand, was in a strong secular decline. Then I asked, ‘Where is the business generally the least healthy?’ That was the Americas. Third, I asked, ‘What is different about our brands in the market?’ I’ve never seen a place where you had a great business without having great products, so I had to question whether we have better products than our competition. I set my priorities from there.

Does the fact that VF is a portfolio company change how you are carrying out the turnaround? Do you want to have the brands run independently from one another as they traditionally have?

One way to make sure brands continue to be strong and authentic is to pretend they’re not in a portfolio. That’s the LVMH model, where they function entirely independently of each other. But there are some things you can leverage in a portfolio, such as supply chain, or when you go to market with a retailer with all your brands and can offer a lot and say, ‘We really understand your business.’

For years, VF was held up as a model apparel and footwear maker. What happened in the last few years to a best-in-class company?

In the Americas, we had the wrong structure in terms of who was in charge of what, and North America performed at a mediocre level. A second thing is we just didn’t drive best practices, and that led to limited learning across VF. We also didn’t take advantage of our formerly fast growth to invest back in innovation, new products, and new franchises.

When I see the Vans meltdown and the Supreme write-downs, I wonder whether cool brands can thrive within a large corporation like VF.

Vans went from $400 million to $4 billion over 15 years, so it certainly thrives at VF. And skateboard culture is a segment that is thriving right now. But we made some missteps in the beginning with Supreme. When they run it independently, they’re fantastic.

What about Vans? Can a brand like that get its ‘cool’ back?

It is possible. My best example of a brand turnaround was Old Spice when I was at P&G. A long time ago, it was cool for our fathers, maybe our grandfathers, though the advertising was sexist by today’s standards. It had to be renewed for the next generation, and we ultimately turned it into a multi-billion dollar brand. Another example is New Balance (not part of VF), which has lost its cool. Look at it now.

A big part of VF’s modus operandi was M&A, thanks to its track record of turning brands it bought into market-leading names. What is your M&A philosophy?

It’s about turning the business around for long-term sustainable growth, not deals. I don’t expect us to make any transformational deals now. I want to put pressure on getting organic growth and turning these brands into strong, sustainable growth engines. I don’t want to be a portfolio investor; I want to be a business grower.

On your last quarterly call, you mentioned the warm winter in much of North America is hurting The North Face. Do you worry about climate change’s impact on the brand?

I do worry about climate change overall, but brands also need to figure out how to expand constantly. For The North Face, we have a team working on about five different strategies so we can make sure they are relevant 365 days a year, at least outdoors, not just when you’re not on the mountain in winter. We have so many opportunities to grow. We tend to skew more males than females, so we have ample opportunities with women.

When will you know your brands have their mojo back, and will you be less hands-on after the point?

I’m a heat-seeking missile, and I go wherever I can help. Where I can’t help, I want to make sure we have the best people. If I were a division leader working for me, I wouldn’t want the CEO to be doing what I am doing with Vans. So yes, later on, I’ll be hands-off.