就在波音让其飞机再次升空之际,这家公司所面临的挑战却越发严峻。美国联邦航空管理局(FAA)上周曾发表声明,尽管波音被限飞的737 MAX机型最终回归天空,但整个737 MAX系列的任何增产计划以及其他MAX机型的监管批准都将被叫停,最主要的就是MAX 7和10机型,而这两个机型据称在本月早些时候发生的阿拉斯加空难之前即将获得FAA的批准。这一声明意味着,监管方已无法容忍波音顽固的质量控制问题,而且这一次其态度异常坚决,并要求波音拿出系统性的解决方案。与此同时,波音的航空公司客户开始公然叛逃,美联航(United)首席执行官斯科特·科比已经开始与空客会谈,通过购买A321来替代此前计划新购的277架波音 737 MAX 10飞机。

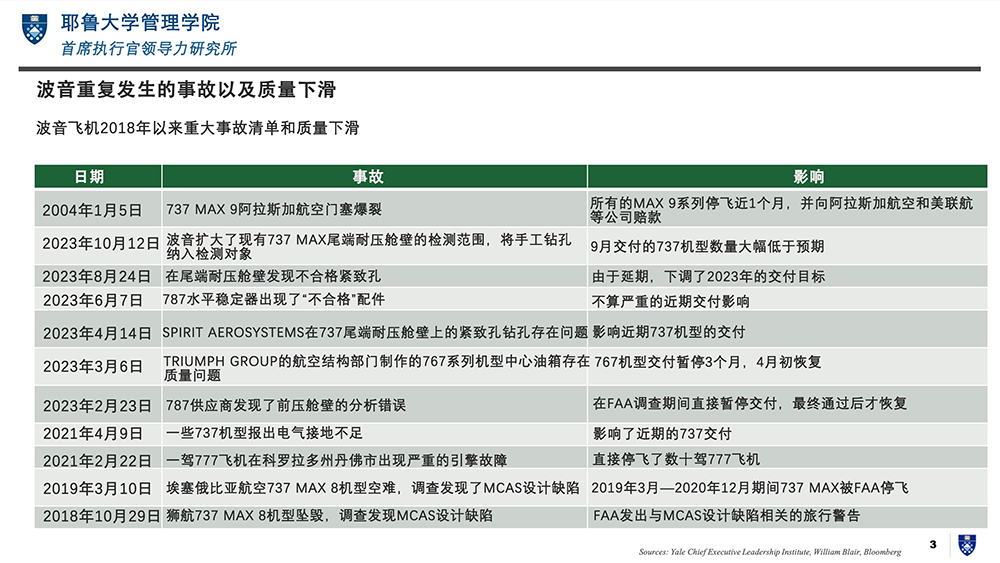

此前,我们经常表扬波音首席执行官大卫·卡尔霍恩,理由是他迅速地解决了诸多前任留下来的问题,包括引导波音在经历了疫情和航空产业下行周期后重获现金流盈利能力,修复与监管方之间受损的关系,重启对中国的交货,以及减少高负债,但我们在去年还前瞻性地预测过,公司依然无法摆脱质量控制突发事件。

1. 改变治理和内部质量控制流程,以便在整个机构为安全赋能的同时让安全理念更加深入人心

自2019年导致376人死亡的灾难性MAX机型空难之后,波音董事会创建了更加严苛的安全流程,包括一个特殊的由五人构成的董事会航空安全小组委员会,并在公司设置了首席航空安全官职位。尽管安全小组委员会当中的4人都是新董事,也就是加入董事会的时间还不到两年(这一点倒不是很惊讶,考虑到80%的波音董事自2019年以来都已全部更换),但其资历却是异常耀眼,拥有广泛的航空领域经验。这其中包括小组委员会主席、通用电气航空(GE Aviation)前首席执行官大卫·乔伊斯,美国海军前负责人约翰·理查德森上将,前大陆航空(Continental Airlines)首席执行官劳伦斯·凯尔纳,前空军督察长史戴斯·哈里斯将军,以及Carrier Global首席执行官大卫·吉特林。

卡尔霍恩任命外部安全专家来审查波音的安全流程在方向上是正确的,但FAA并不满足于审计这一种手段,而且似乎正在推动更加彻底的永久性改革,包括直接在波音的供应链中安插FAA或第三方监控方。

2. 理顺波音支离破碎的供应链

各种迹象表明,波音已经失去了对其供应商的功能监管和控制,而供应链多元化的不到位以及责任制的缺失更是加剧了这个问题。波音与Spirit AeroSystems之间失衡的关系便是例证,而后者几乎包揽了波音各种机型机身的生产工作。

多年来,我们曾前瞻性地多次警告,Spirit会给波音业务带来潜在风险,例如供应链的“软肋”,而且也曾警告,前首席执行官哈里·斯通塞弗因在2005年出售Spirit而犯错,但新的检举者报告称,这种失调婚姻的糟糕程度甚至超出了我们的理解范畴。

《西雅图时报》(Seattle Times)本周的最新报道援引了一位十分可信的匿名检举者提供的信息,波音工程师在过去一年中发现了不少于392例Spirit公司质量控制问题。在其中一个案例中,Spirit公司的工程师理应修复了这些问题,但波音检察人员却发现Spirit公司仅仅是“掩盖”了有问题的部分,迫使波音不得不在公司内部进行进一步的修理。还有报告讲述了Spirit公司奉行的是恐惧、威吓和成本削减文化,并不提倡雇员汇报问题,同时用大批低薪、缺乏培训的替代者替换了专家及资深工程师。波音以调查仍在进行为由,拒绝回复媒体的置评请求。与此同时,Spirit公司发布了一份声明,称其首要关注点在于其提供的“飞机结构的质量和产品完整性”,同时还表示,公司正在与波音合作解决此事,并将遵守后续的监管方规定。

迫于压力,Spirit领导层在过去4个月中几乎换了个遍,即便功勋卓著的新首席执行官帕特·夏纳罕正在全身心地应对Spirit的流程挑战,但从过去20年来看,Spirit就不应该独立运营,仅此而已。Spirit公司的低利润资本密集型业务以及岌岌可危的资产负债表,或许会稀释波音宝贵的自由现金流,但波音财务掌门人对此避而不谈。尽管如此,人们不得不问,这个加起来相当于波音市值3%的公司是否真的值得在经营方面如此大费周章。值得一提的是,为了给Spirit续命,波音又向Spirit注资了数亿美元。

3. 巩固公众信任,而不是将公众沟通交给监管方

到目前为止,卡尔霍恩在接受媒体采访和召开全员会议时均以父亲和祖父的个人口吻来强调安全性,同时,他也在阿拉斯加空难之后紧急与国会进行了多次会面,并因此而受到称赞。此外,卡尔霍恩令外界称赞的举措还包括,作为对首要客户公开责难的回应,例如夏威夷航空(Hawaiian Airlines)、美联航和瑞安航空(Ryanair)的各位首席执行官,卡尔霍恩允许其航空公司客户向任意波音或Spirit生产厂派遣检查员。

然而,让MAX 9系列机型回归天空可能并不算什么难事。未来数个月,FAA将对波音内部流程挑战开展长期深入的监管,受此影响,卡尔霍恩掌控舆论并继续巩固公众信任的难度就会越来越大。

当波音在此前面临类似的长期监管审查时,卡尔霍恩的一些前任曾获得过一些不明智的建议:用极为模糊、冷淡的法律术语来搪塞监管方和调查员,均以失败告终。这一次,波音的挑战更为严峻,因为未来几个月波音将不得不做出一些困难却十分必要的取舍。例如,即便波音一再声称生产和交付更多的MAX机型是其首要任务,但很多分析师认为波音可能需要调低其在数个月之前刚发布的靓丽生产和财务目标,而且有可能有必要在万众期待的周三电话会议上对业绩指引三缄其口。一些人还提到,出于责任制的考虑,应对公司内部进行重组。

法官路易斯·布兰代斯的名言“阳光是最好的消毒剂”用在这里是再合适不过了。无论投资者或律师如何分说,公共安全和巩固公众信任的优先级必须高于一切短期商业影响。如果波音能够采取强硬的必要举措,并让外界认为这一举措并非意气用事或内斗,而是为了重塑自身信誉所采取的广泛战略计划的一部分,那么就可以避免出现一些不必要的市场恐慌、员工疑惑以及情绪性投机行为。

此外,展现有责任心的人性化领导力,而不是拿官僚流程或让下属来背锅来搪塞,将大大有助于减少负面新闻的影响。

很多航空公司高管如今都在开玩笑说,那句老话“要不是有波音的话,我是不会去的”,说不定会变成“要是有波音的话,我是不会去的”,除非波音能够尽快重振其安全文化。波音今后将何去何从?这基本上取决于人们如何看待波音——是一家能够让飞机安全飞行的公司,还是一家眼高手低的公司。(财富中文网)

杰弗瑞·索能菲尔德(Jeffrey Sonnenfeld )是耶鲁大学管理学院莱斯特·克朗管理实践教授兼高级副院长。他被《Poets & Quants》杂志评选为“年度管理学教授”。

史蒂文·田(Steven Tian)是耶鲁大学首席首席执行官领导力研究所的研究主任,亦是洛克菲勒家族理财室前量化投资分析师。

译者:冯丰

审校:夏林

就在波音让其飞机再次升空之际,这家公司所面临的挑战却越发严峻。美国联邦航空管理局(FAA)上周曾发表声明,尽管波音被限飞的737 MAX机型最终回归天空,但整个737 MAX系列的任何增产计划以及其他MAX机型的监管批准都将被叫停,最主要的就是MAX 7和10机型,而这两个机型据称在本月早些时候发生的阿拉斯加空难之前即将获得FAA的批准。这一声明意味着,监管方已无法容忍波音顽固的质量控制问题,而且这一次其态度异常坚决,并要求波音拿出系统性的解决方案。与此同时,波音的航空公司客户开始公然叛逃,美联航(United)首席执行官斯科特·科比已经开始与空客会谈,通过购买A321来替代此前计划新购的277架波音 737 MAX 10飞机。

此前,我们经常表扬波音首席执行官大卫·卡尔霍恩,理由是他迅速地解决了诸多前任留下来的问题,包括引导波音在经历了疫情和航空产业下行周期后重获现金流盈利能力,修复与监管方之间受损的关系,重启对中国的交货,以及减少高负债,但我们在去年还前瞻性地预测过,公司依然无法摆脱质量控制突发事件。

FAA已将波音列入了观察名单,而且也顺带着让卡尔霍恩成为了热锅上的蚂蚁。对于这位心烦意乱的首席执行官来说,重塑波音的信誉成为了最为重要和紧迫的事项。卡尔霍恩与过去30年中的六位波音首席执行官都相熟,曾亲眼目睹了波音的多个发展阶段,甚至包括波音收购麦克唐纳-道格拉斯公司(McDonnell-Douglas)之前的历史。我们建议卡尔霍恩应采取以下三个具体举措,来重振波音的安全文化,同时,我们还给出了用于支撑我们建议的一些原始数据。

1. 改变治理和内部质量控制流程,以便在整个机构为安全赋能的同时让安全理念更加深入人心

自2019年导致376人死亡的灾难性MAX机型空难之后,波音董事会创建了更加严苛的安全流程,包括一个特殊的由五人构成的董事会航空安全小组委员会,并在公司设置了首席航空安全官职位。尽管安全小组委员会当中的4人都是新董事,也就是加入董事会的时间还不到两年(这一点倒不是很惊讶,考虑到80%的波音董事自2019年以来都已全部更换),但其资历却是异常耀眼,拥有广泛的航空领域经验。这其中包括小组委员会主席、通用电气航空(GE Aviation)前首席执行官大卫·乔伊斯,美国海军前负责人约翰·理查德森上将,前大陆航空(Continental Airlines)首席执行官劳伦斯·凯尔纳,前空军督察长史戴斯·哈里斯将军,以及Carrier Global首席执行官大卫·吉特林。

然而,持续不断的突发安全问题意味着董事会的决议明显没有完全落实到生产和装配线,而且这个挑战并非只是出现某起事故那么简单。新的质量控制流程在波音生产厂的落实到位程度依然是个未知的问题。有人怀疑,专注于安全的声音是否在内部得到了充分重视。一份检举报告称,波音自有的质量控制体系经常会遭到忽视,因为重压之下的生产线检查员有时候会提供伪造或错误的信息,与之相印证的是,公司长期存在的投资不足和自我监控不足的投诉。

卡尔霍恩任命外部安全专家来审查波音的安全流程在方向上是正确的,但FAA并不满足于审计这一种手段,而且似乎正在推动更加彻底的永久性改革,包括直接在波音的供应链中安插FAA或第三方监控方。

2. 理顺波音支离破碎的供应链

各种迹象表明,波音已经失去了对其供应商的功能监管和控制,而供应链多元化的不到位以及责任制的缺失更是加剧了这个问题。波音与Spirit AeroSystems之间失衡的关系便是例证,而后者几乎包揽了波音各种机型机身的生产工作。

多年来,我们曾前瞻性地多次警告,Spirit会给波音业务带来潜在风险,例如供应链的“软肋”,而且也曾警告,前首席执行官哈里·斯通塞弗因在2005年出售Spirit而犯错,但新的检举者报告称,这种失调婚姻的糟糕程度甚至超出了我们的理解范畴。

《西雅图时报》(Seattle Times)本周的最新报道援引了一位十分可信的匿名检举者提供的信息,波音工程师在过去一年中发现了不少于392例Spirit公司质量控制问题。在其中一个案例中,Spirit公司的工程师理应修复了这些问题,但波音检察人员却发现Spirit公司仅仅是“掩盖”了有问题的部分,迫使波音不得不在公司内部进行进一步的修理。还有报告讲述了Spirit公司奉行的是恐惧、威吓和成本削减文化,并不提倡雇员汇报问题,同时用大批低薪、缺乏培训的替代者替换了专家及资深工程师。波音以调查仍在进行为由,拒绝回复媒体的置评请求。与此同时,Spirit公司发布了一份声明,称其首要关注点在于其提供的“飞机结构的质量和产品完整性”,同时还表示,公司正在与波音合作解决此事,并将遵守后续的监管方规定。

迫于压力,Spirit领导层在过去4个月中几乎换了个遍,即便功勋卓著的新首席执行官帕特·夏纳罕正在全身心地应对Spirit的流程挑战,但从过去20年来看,Spirit就不应该独立运营,仅此而已。Spirit公司的低利润资本密集型业务以及岌岌可危的资产负债表,或许会稀释波音宝贵的自由现金流,但波音财务掌门人对此避而不谈。尽管如此,人们不得不问,这个加起来相当于波音市值3%的公司是否真的值得在经营方面如此大费周章。值得一提的是,为了给Spirit续命,波音又向Spirit注资了数亿美元。

波音也不是没有希望,几乎所有的供应商都严重依赖波音,因此他们都在齐心协力、斗志昂扬地以最快的方式来解决这些久拖未决的底层结构性挑战。就像丘吉尔说过的那句老话一样,“绝不要浪费一次好的危机。”

3. 巩固公众信任,而不是将公众沟通交给监管方

到目前为止,卡尔霍恩在接受媒体采访和召开全员会议时均以父亲和祖父的个人口吻来强调安全性,同时,他也在阿拉斯加空难之后紧急与国会进行了多次会面,并因此而受到称赞。此外,卡尔霍恩令外界称赞的举措还包括,作为对首要客户公开责难的回应,例如夏威夷航空(Hawaiian Airlines)、美联航和瑞安航空(Ryanair)的各位首席执行官,卡尔霍恩允许其航空公司客户向任意波音或Spirit生产厂派遣检查员。

然而,让MAX 9系列机型回归天空可能并不算什么难事。未来数个月,FAA将对波音内部流程挑战开展长期深入的监管,受此影响,卡尔霍恩掌控舆论并继续巩固公众信任的难度就会越来越大。

当波音在此前面临类似的长期监管审查时,卡尔霍恩的一些前任曾获得过一些不明智的建议:用极为模糊、冷淡的法律术语来搪塞监管方和调查员,均以失败告终。这一次,波音的挑战更为严峻,因为未来几个月波音将不得不做出一些困难却十分必要的取舍。例如,即便波音一再声称生产和交付更多的MAX机型是其首要任务,但很多分析师认为波音可能需要调低其在数个月之前刚发布的靓丽生产和财务目标,而且有可能有必要在万众期待的周三电话会议上对业绩指引三缄其口。一些人还提到,出于责任制的考虑,应对公司内部进行重组。

法官路易斯·布兰代斯的名言“阳光是最好的消毒剂”用在这里是再合适不过了。无论投资者或律师如何分说,公共安全和巩固公众信任的优先级必须高于一切短期商业影响。如果波音能够采取强硬的必要举措,并让外界认为这一举措并非意气用事或内斗,而是为了重塑自身信誉所采取的广泛战略计划的一部分,那么就可以避免出现一些不必要的市场恐慌、员工疑惑以及情绪性投机行为。

此外,展现有责任心的人性化领导力,而不是拿官僚流程或让下属来背锅来搪塞,将大大有助于减少负面新闻的影响。

很多航空公司高管如今都在开玩笑说,那句老话“要不是有波音的话,我是不会去的”,说不定会变成“要是有波音的话,我是不会去的”,除非波音能够尽快重振其安全文化。波音今后将何去何从?这基本上取决于人们如何看待波音——是一家能够让飞机安全飞行的公司,还是一家眼高手低的公司。(财富中文网)

杰弗瑞·索能菲尔德(Jeffrey Sonnenfeld )是耶鲁大学管理学院莱斯特·克朗管理实践教授兼高级副院长。他被《Poets & Quants》杂志评选为“年度管理学教授”。

史蒂文·田(Steven Tian)是耶鲁大学首席首席执行官领导力研究所的研究主任,亦是洛克菲勒家族理财室前量化投资分析师。

译者:冯丰

审校:夏林

Paradoxically, just as Boeing is getting its planes back in the air, its challenges are only getting more serious. The FAA’s announcement last week–that while Boeing’s grounded 737 MAX 9 jets are finally returning to the skies, there will be a complete halt on any production increases for the entire 737 MAX program and any new regulatory approvals for additional MAX lines, most notably the MAX 7 and 10, which were reportedly nearing FAA approval right before the Alaska Air accident earlier this month–suggests that regulators are running out of patience for Boeing’s persistent quality control woes and are putting the foot down this time, demanding systemic fixes. Meanwhile, Boeing’s airline customers are in open revolt: United’s CEO Scott Kirby has already begun talks with Airbus about substituting A321 purchases for their formerly planned new 277 Boeing 737 Max 10 purchases.

We’ve often praised Boeing CEO Dave Calhoun for navigating deftly through a slew of inherited challenges, including guiding Boeing back to cash flow profitability out of COVID and the aerospace cyclical downturn, repairing damaged relations with regulators, restarting deliveries to China, and reducing high indebtedness–but we also presciently predicted last year that quality control flare-ups would prove persistent.

With the FAA putting Boeing on probation, and by extension, Calhoun on the hot seat, restoring Boeing’s credibility has become the embattled CEO’s single most important and urgent mandate. Having known the last six CEOs of Boeing personally going back three decades, and having closely observed Boeing through many life stages even before the McDonnell Douglas merger, here are three concrete steps Calhoun should take to revive Boeing’s safety culture, along with an accompanying slide deck of original data supporting our recommendations.

1. Change governance and internal quality control processes to empower and embed safety more deeply across the organization

After the devastating 2019 MAX crashes that resulted in 376 deaths, the Boeing board established heightened safety processes, including a special five-person Aerospace Safety Subcommittee of the Board, as well as a Chief Aerospace Safety Officer within the company. Although four of the five members of the Safety Subcommittee are new board members with less than two years of experience (which is hardly surprising considering that 80% of Boeing’s board has turned over since 2019), their credentials are undoubtedly sterling, drawing across extensive aerospace sector experience. These include Subcommittee Chair and former CEO of GE Aviation David Joyce, former head of the U.S. Navy Adm. John Richardson, former CEO of Continental Airlines Lawrence Kellner, former Inspector General of the Air Force Gen. Stayce Harris, and Carrier Global CEO David Gitlin.

Yet the continued flare-up of safety issues means that something is evidently getting lost in translation between the board and the manufacturing and assembly lines–and the challenge runs much deeper than any single incident. How deeply the new quality control processes have permeated into Boeing’s production plants is an open question. One wonders whether safety-focused voices are sufficiently empowered internally, as one whistleblower report claimed that Boeing’s own quality control systems were routinely ignored with under-pressure line inspectors sometimes providing false or erroneous information, which would be consistent with long-running complaints of underinvestment and inadequate self-policing.

Calhoun’s appointment of an external safety expert to review Boeing’s safety processes is a step in the right direction–but the FAA appears to be pushing for more wholesale and permanent changes, including embedding FAA or third-party monitors directly across Boeing’s supply chain, unsatisfied with mere auditing.

2. Clean up Boeing’s broken supply chain

By all appearances, Boeing has lost functional oversight and control over its suppliers, an issue that has been exacerbated by a lack of supply chain diversification and accountability. This is embodied by Boeing’s dysfunctional relationship with Spirit AeroSystems, which manufactures virtually all of Boeing’s fuselages.

For years, we have presciently and repeatedly warned about the latent risk posed by Spirit to Boeing’s operations, as the “soft underbelly” in the supply chain, and how former CEO Harry Stonecipher made a mistake by selling Spirit in 2005–but new whistleblower reports suggest that this dysfunctional marriage may be even worse than we appreciated.

According to a fresh report in the Seattle Times this week, citing an anonymous but credible whistleblower, Boeing engineers found no less than 392 instances of Spirit quality control failures over the last year. In one instance, Spirit’s engineers supposedly repaired the issues, only for the Boeing inspector to discover that Spirit merely “painted over” the problematic parts, forcing Boeing to do any further repairs in-house. Additional reports document how Spirit employees were encouraged not to report problems amidst a culture of fear, intimidation, and cost-cutting, with expert veteran engineers replaced by legions of cheaper and undertrained replacements. Boeing has refused to respond to media requests for comment, citing ongoing investigations. Meanwhile, Spirit has issued a statement saying that their primary focus is “the quality and product integrity of the aircraft structures” they deliver, adding that the company was working with Boeing on the matter and following regulators’ protocols.

Although the Spirit leadership ranks have almost completely turned over in the last four months amidst apparent pressure, and even if accomplished new CEO Pat Shanahan is committed to fixing Spirit’s process challenges, the last 20 years have shown that Spirit should not be a standalone company, period. No matter how much Boeing’s financial whiz kids resist the prospect of diluting Boeing’s prized free cash flow with Spirit’s low-margin, capital-intensive business, and wobbly balance sheet, one has to wonder whether a sum equivalent to 3% of Boeing’s market capitalization is worth all the operational headaches, especially as Boeing continues to inject hundreds of millions into Spirit to keep it afloat.

The silver lining here for Boeing is that almost all of its suppliers are heavily dependent on Boeing and thus, all are aligned and motivated to urgently fix these underlying, long-deferred structural challenges together. As the old Churchill saying goes, “Never let a good crisis go to waste.”

3. Fortify public trust instead of deferring to regulators in communicating with the public

So far, Calhoun has won plaudits for his reassuring media interviews, all-staff meetings where he spoke about safety in personal terms as a father and grandfather, and desperately needed meetings with Congress in the days after the Alaska Air incident. Similarly, Calhoun was praised for letting his airline customers send inspectors to any Boeing or Spirit manufacturing plant in response to the public condemnations of major customers such as the CEOs of Hawaiian, United, and Ryanair.

But getting the MAX 9s back into the sky may have been the easy part. As the FAA digs in for protracted, intrusive oversight into Boeing’s internal process challenges in the months ahead, it will become progressively harder for Calhoun to control the narrative and continue fortifying public trust.

When Boeing faced similarly protracted regulatory reviews before, some of Calhoun’s predecessors of were ill-advised to hide behind exceedingly vague, impersonal legalese in deference to regulators and investigators–which did not end well. This time around, Boeing’s challenge is even more acute since there will almost certainly need to be difficult but necessary tradeoffs in the months ahead. For example, even though Boeing has said repeatedly that building and delivering more MAXs is their top priority this year, many analysts consider it likely that Boeing will need to lower the lofty production and financial targets laid out merely months ago, and will likely need to withhold guidance during its highly anticipated earnings call on Wednesday. Some have also floated the prospect of internal reorganizations as accountability beckons.

Now more than ever, Justice Louis Brandeis’ quip that “sunlight is the best disinfectant” rings true. Public safety and fortifying public trust must outweigh all short-term commercial impacts, no matter what investors or lawyers say. Needless market panic, employee confusion, and sensationalized speculation can be avoided if tough but necessary moves are packaged and perceived as a part of a broader strategic plan to restore Boeing’s credibility, rather than being seen as reactionary impulsiveness or palace intrigue.

Furthermore, showing an accountable human face of leadership–rather than hiding behind bureaucratic processes or delegating bad news to subordinates–can go a long way in making bad news more palatable.

Many airline executives are now joking that the old mantra, “if it’s not Boeing, I’m not going” will be at risk of turning into “if it’s Boeing, it’s not going” unless Boeing can revive its safety culture soon. Where Boeing goes from here will largely depend on whether they are seen as having safe planes in the clouds–or whether they are seen as having their own heads in the clouds.

Jeffrey Sonnenfeld is the Lester Crown Professor in Management Practice and Senior Associate Dean at Yale School of Management. He was named “Management Professor of the Year” by Poets & Quants magazine.

Steven Tian is the director of research at the Yale Chief Executive Leadership Institute and a former quantitative investment analyst with the Rockefeller Family Office.