每当华尔街嗅到一丝新的创新可能助推营收增长的气味时,它便会变得有点兴奋过头。投行的卖方分析师会争相发布相关公司的看涨研究报告;经济师和策略师会开始讨论增长、通胀和生产力新技术的潜在影响力;而资金经理则开始思考这一切对其资产组合的影响。这一连串活动和关注可能会迅速转变为自我强化的炒作循环,而且主打颇为乐观的预测。

人工智能的崛起便印证了华尔街对新技术进步的这种狂热。OpenAI聊天机器人在2022年11月的成功发布便引发了一波对生成式人工智能潜力的热捧。追随者们认为该技术能够重塑世界,带来物质的极大丰富,甚至治愈绝症,同时还可以提升工人生产力,降低企业成本。自那之后,分析师一直在关注人工智能或将对企业营收带来的影响,尤其是对大型科技公司的影响,而那些有望因为新人工智能技术而获得相关营收的公司[例如微软(Microsoft)或英伟达(Nvidia)]则见证了自家股价的飙升。与此同时,华尔街一直在源源不断地输出研究报告和调查,进一步推高(只会偶尔地贬低)人工智能热。

《财富》杂志分析了来自于投行、对冲基金和投资研究公司的数百页人工智能报告,并发现了一些惊人的相似之处。总的来说,华尔街异常看好人工智能的长期前景,分析师们认为它将提升员工的生产力和GDP,而且其终极影响力能够与互联网的诞生相媲美。然而,这里的关键词是——终极。华尔街的研究报告和调查展现了专家们的分歧:一些认为近期的人工智能热过于夸张,另一些专家认为则是合理的,因为该技术得到了迅速采用,而且具有长期成功的潜力。

华尔街报告的标题通常十分直白。私募股权巨头凯雷(Carlyle)将其10月的报告命名为《勇敢的新世界:人工智能及其下游产业的影响力》(Brave New World: AI and Its Downstream Implications),它把生成式人工智能的诞生称之为“人类历史的”转折点,并将其比作与电气化。花旗(Citi)则把其9月57页的报告取名为《人工智能爆发:人工智能军备竞赛》(Unleashing AI: The AI Arms Race),该报告重点介绍了生成式人工智能在实现技术创新民主化以及提升员工生产力方面的潜力。报告的作者直截了当地写道:“我们认为人工智能是游戏规则的改变者。”

大多数的投行和华尔街研究公司在今年发布了多篇有关人工智能的详尽报告,以及简单的人工智能相关个股纪要。然而,介绍这一趋势的大量笔墨都被用于反驳一种顾虑:最近的人工智能热被过分渲染或还不成熟。在今年7月名为《生成式人工智能:炒作还是真具有颠覆性》(Generative AI: Hype, or Truly Transformative)的报告中,高盛集团(Goldman Sachs)采访了这场辩论的反方人工智能专家。在这篇报告里,纽约大学(New York University)的心理学与神经科学荣誉教授加里·马库斯认为,生成式人工智能遭到了“过度炒作”,而且真正的人工通用智能距离现实生活还有很长的路要走。然而,风投公司Conviction的创始人萨拉·郭表示,生成式人工智能将推动新时代的到来,在这个时代中,科技将变得“更有用,更可及而且更平价。”

继7月报告之后,高盛集团在9月发布了一篇偏解释性的文章,名为《为什么人工智能不是泡沫》(Why AI is not a bubble)。该文重点介绍了人工智能的潜力,并认为人工智能相关股票的价格并没有达到典型的泡沫交易价。高盛集团的团队在描述人工智能相关股票的潜力时写道:“我们认为,这个有望带来更突出业绩的新技术周期依然处于相对早期的阶段。”

一些资深华尔街分析师甚至十分推崇人工智能泡沫说,认为泡沫是必要的,不可避免的,甚至可能大有裨益,有助于那些真正具有颠覆性的技术获得更快的发展。

投资公司DeepWater Asset Management的执行合伙人吉恩·芒斯特在10月17日名为《人工智能泡沫守则》(The AI Bubble Playbook)的报告里解释道:“泡沫可以确保新兴技术获得远超所需的资本,并让其脱颖而出的概率最大化。如果没有‘过量’的资本去追逐每一个糟糕的理念,尤其是这个糟糕的理念实际上颇为不俗时,我们可能就永远无法完全享受铁路、汽车或互联网带来的各种益处。”

在告诉投资者该如何应对人工智能炒作周期的震荡之前,芒斯特在报告中称,不公平的是,炒作吹出来的“泡沫会让人产生负面联想”。这位资深科技分析师建议投资者了解一下那些为人工智能技术提供运行载体的硬件公司,比如半导体巨头英伟达,这家公司自年初至今的股价上涨了180%。不过,芒斯特主要还是强调了那些将使用人工智能来提升数据可及性和可用性的云储存和软件公司,例如微软、MongoDB和Databricks,以及人工智能应用软件公司,比如专注于游戏的软件开发商Unity Software或数据科学和分析公司Alteryx。

他总结说:“人工智能可能存在泡沫,但通过与真实的泡沫进行客观对比后我们发现,这一行业离疯狂还远着呢。”

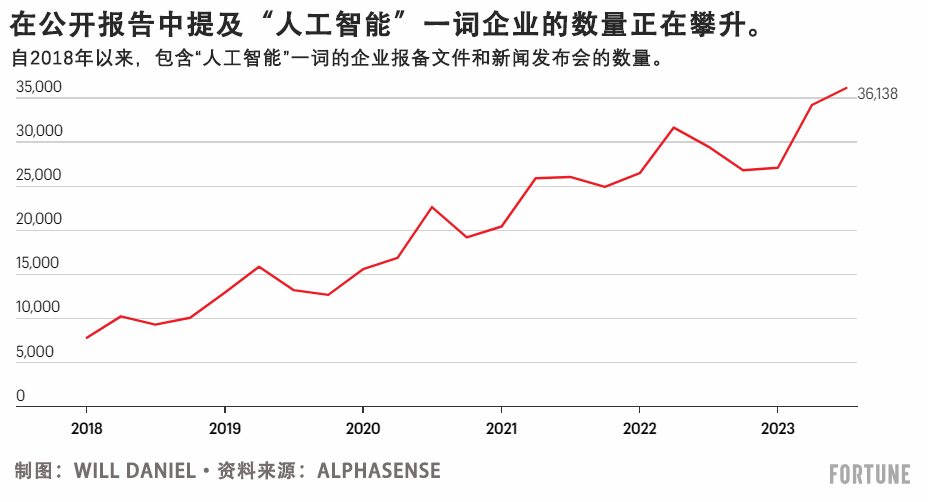

韦德布什(Wedbush)的科技分析师丹·艾夫斯也在6月详细介绍“人工智能淘金热”(AI gold rush)的报告中玩起了泡沫说。艾夫斯是首批将人工智能崛起与互联网泡沫初期进行对比的分析师。在人工智能时间线上,艾夫斯认为是1995年而不是1999年,这意味着这个泡沫在破灭之前还有很大的膨胀空间,而且投资者应该利用这一趋势。他认为,人们能够在企业营收电话会议和讲演里感受到了人工智能热。市场情报公司AlphaSense称,企业营收电话会议、新闻发布会和其他公开文件中提及“人工智能”一词的数量自2018年以来飙升了363%。具有讽刺意味的是,这家公司也在使用人工智能来挖掘财务数据里的信息。

然而,正如《财富》杂志此前报道的那样,一些专家担心华尔街的投资者和散户们对人工智能的潜力有点过于乐观。贝勒大学(Baylor University)的电气与计算机工程教授罗伯特·马克思在7月的采访里说:“我们正处于炒作期——泡沫期。我觉得人们必须放缓脚步,并更加清醒地去思考。”

投资研究公司New Constructs的创始人大卫·特雷纳称,他认为投资者的这种害怕错过机会的心理,正在将一些股票的价格推至不可持续的水平。他说:“投资者真的得小心行事了。”

尽管专家们提出了上述警告,但不怎么看好(至少长期内)人工智能的主流投行或对冲基金几乎是凤毛麟角的存在。在华尔街看来,人工智能不亚于“电的面世”,而且有一天可能成为类似于“数字上帝”的事物。以下是华尔街最新研究报告中有关其人工智能狂热症的一些集锦。

美国银行:“现实证明炒作的合理性”

主要观点:“在最新的人工智能浪潮中,受益的不只是科技公司。我们认为,生成式人工智能的转型潜力可能接近电话、汽车、个人电脑和互联网等颠覆性技术,相关技术通常在15年至30年后成为主流。”

关键数据:据美国银行(Bank of America)估计,未来五年,企业人工智能应用有望帮标准普尔500指数(S&P 500)中的成份股公司减少约650亿美元成本,到2030年,人工智能的经济影响可能达到15.7万亿美元。

引述和统计数据摘自今年10月美国银行研究所(Bank of America Research)的人工智能报告《人工智能进化:现实证明炒作的合理性》(AI Evolution: Reality Justifies the Hype)和《人工智能进化:股票与ETF受益人》(AI Evolution: Stock & ETF Beneficiaries),作者为分析师阿尔克什·沙阿和安德鲁·莫斯。

凯雷:人工智能的革命性堪比电力

主要观点:“生成式人工智能就好比电力出现,该比较可能还算恰当……必须注意LLM(大型语言模型)的‘幻觉问题’……很多情况下模型的输出需要人工验证,航空或国防等关键领域应用可能还要等很长一段时间。”

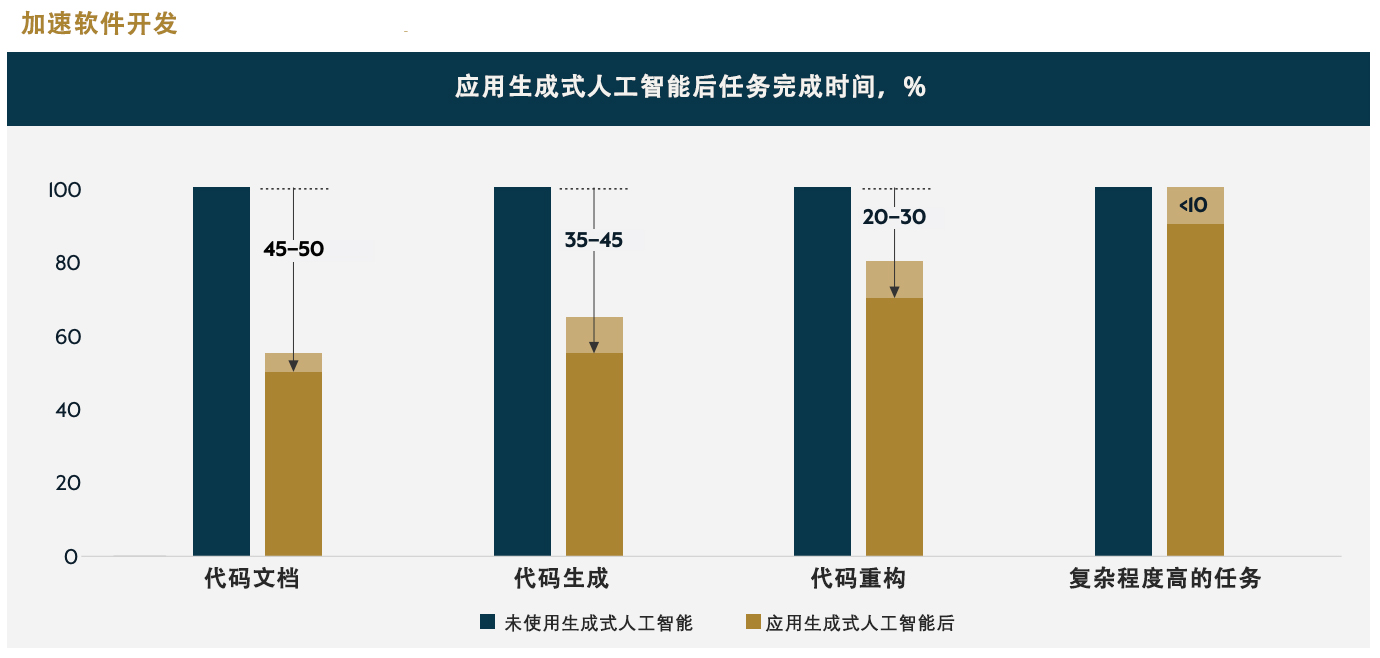

关键数据:麦肯锡(McKinsey)的一项研究显示,最终60%至70%的工作量可以通过生成式人工智能应用实现自动化。

引述和统计数据来自今年10月凯雷发布的题为《勇敢的新世界:人工智能及其下游产业的影响力》的报告,报告作者为全球研究和投资战略主管贾森·托马斯和凯雷欧洲技术合作伙伴投资咨询团队董事总经理兼联席主管迈克尔·万德。

瑞银:“代际转型”

主要观点:“虽然称不上‘数字时代的神’,不过生成式人工智能的进步速度相当惊人。如今,开发和训练模型的成本通常高达数百万美元,不过开源模型进展稳定,技术采用看起来很快。”

关键数据:埃森哲(Accenture)的数据显示,约40%的工作时间可能受到生成式人工智能兴起的影响。

引述和统计数据来自瑞银集团(UBS)131页的报告,题为“生成式人工智能会引发代际转型吗?”(Will Generative AI deliver a generational transformation?)报告作者为瑞银的迈克尔·布里斯特和十几位分析师,发表于今年5月。

花旗:人工智能将接手营销工作——以及更多

主要观点:“单就概念而言,人工智能并不是新鲜事,生成式人工智能代表着人工智能进化最新的转折点。不过,生成式人工智能有其独特之处,该技术在改变各行业工作和整体提高生产力方面潜力巨大。”

关键数据:根据行业研究公司Gartner估计,到2025年,大型机构对外的营销信息将有30%为人工生成,去年这一数字约为2%。

引述和统计数据来自今年9月花旗发布的57页报告《人工智能爆发:人工智能军备竞赛》,报告由数十名分析师和行业专家撰写。

高盛集团:人工智能将推动全球GDP增长7%

主要观点:“目前科技行业估值还比不上之前的泡沫时期,回报率最高的‘早期赢家’往往资产负债表非常强劲,投资回报也很理想。”

关键数据:根据高盛集团的一项研究,如果人工智能广泛采用,未来十年生产率的年增长率可能略低于1.5%,从而推动全球GDP增长7%。

引述和统计数据来自今年9月5日题为《为什么人工智能不是泡沫》的报告,报告作者为高盛集团的全球股票首席策略师彼得·奥本海默领导的一群专家和分析师。

摩根士丹利:失业炒作不足为信

主要观点:“以就业来说,我不认为会有大量工人因为新技术的出现而失去岗位,这种悲观论调不足微信。经济一直在不断发展,当年灯泡的出现也没有让大批蜡烛工人失业。”

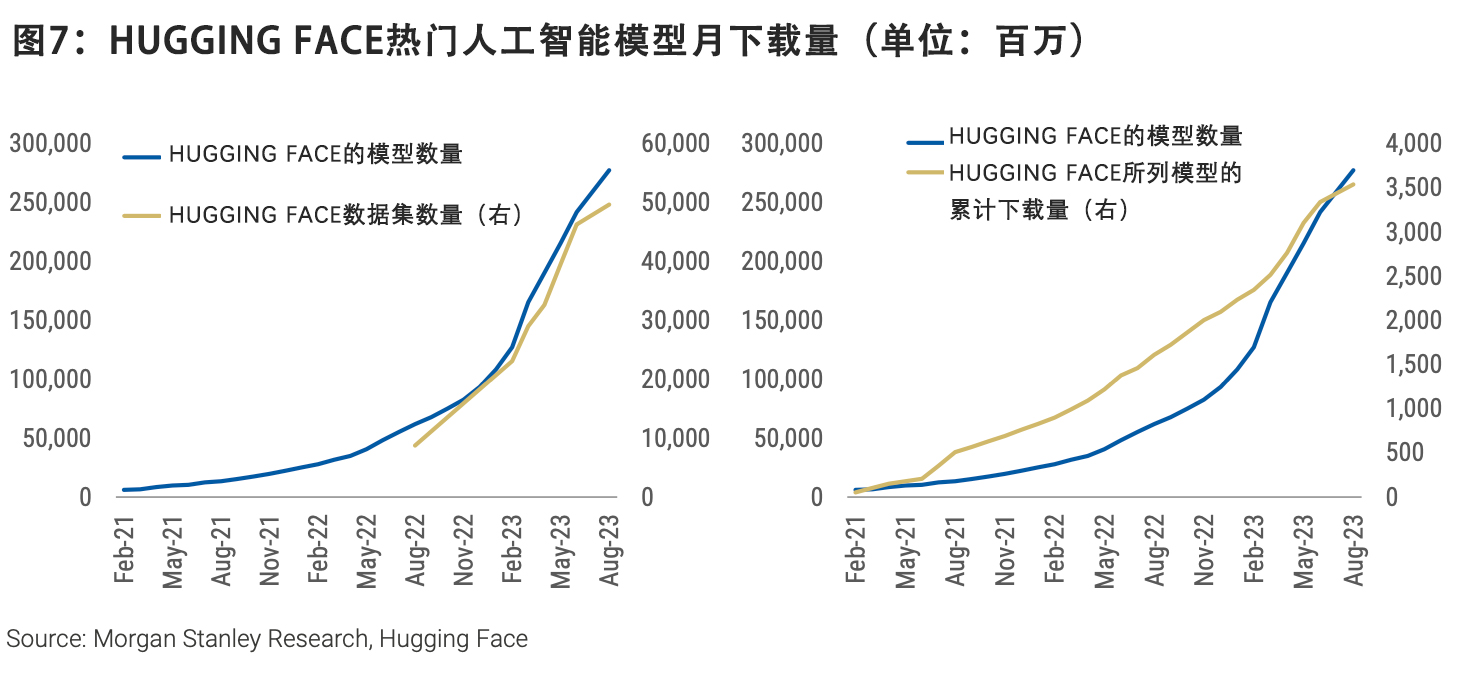

关键数据:作为最受欢迎的开源人工智能模型库,Hugging Face上人工智能模型的月下载量今年大幅飙升。从2021年1月到2023年8月,Hugging Face上排名前10的模型的下载量已达35亿。

针对人工智能这一话题,摩根士丹利(Morgan Stanley)已经撰写多篇报告,包括《人工智能指南》(AI Guidebook),但前文引用的内容和统计数据出自今年8月发布的两篇报告,分别为该机构全球首席经济学家塞思·卡彭特撰写的《人工智能利弊分析》(AI: The Long and Short of It)和股票策略师爱德华·斯坦利撰写的《人工智能与“年度选美大赛”》(AI & The Annual Beauty Contest)。

德意志银行:人工智能将赋能而非取代人类员工

主要观点:“尽管历史证据表明,从长远来看,技术革命通常会带来更优质的新岗位、更高的生产效率和更强劲的经济增长,但仍然有很多人担心人工智能会引发失业潮……不过今年夏天出现的一系列新证据表明,部分担忧可能没有根据,人工智能很可能会赋能而不是取代白领工作”。

关键数据:人工智能推动的自动化转型对高收入国家就业情况的潜在影响要大得多。国际劳工组织(International Labour Organization)在今年8月发布的一项研究显示,高收入国家约5.5%的就业岗位会受到自动化的影响,而在低收入国家,这一比例仅为0.4%。

上述观点和统计数据来自德意志银行(Deutsche Bank)的全球经济和主题研究主管吉姆·里德以及两位研究分析师阿德里安·考克斯和加林娜·波兹尼亚科娃在今年9月撰写的研究报告《人工智能最新进展:不应错过的六大主题》(AI Update: Six Key themes you missed while you were at the beach)。

凯投宏观:这轮人工智能浪潮对股市的影响将与上升阶段的互联网泡沫类似

主要观点:“这轮人工智能浪潮对股市的影响将与20世纪90年代处于膨胀阶段的互联网热潮类似……当然,泡沫都终将破灭。但就人工智能而言,这一天可能还要数年时间才会到来。不过无论如何,我们都不认为这会‘敲响人工智能技术的丧钟’,就像当年持续至少五年时间才破灭的互联网泡沫也没有让互联网技术走向终结一样。”

关键数据:凯投宏观(Capital Economics)称,在互联网革命期间,美国的生产力年增长率达到1.5%,在判断本轮人工智能革命的影响时,这一数字也有参考价值。

上述观点和统计数据出自今年9月发布的两份研究报告,分别题为《人工智能、经济和市场——人工智能将如何改变全球经济》(AI, Economies and Markets – How artificial intelligence will transform the global economy)和《如何看待人工智能在股市中的作用》(How we see AI playing out in stock markets)。(财富中文网)

译者:冯丰

审校:夏林

每当华尔街嗅到一丝新的创新可能助推营收增长的气味时,它便会变得有点兴奋过头。投行的卖方分析师会争相发布相关公司的看涨研究报告;经济师和策略师会开始讨论增长、通胀和生产力新技术的潜在影响力;而资金经理则开始思考这一切对其资产组合的影响。这一连串活动和关注可能会迅速转变为自我强化的炒作循环,而且主打颇为乐观的预测。

人工智能的崛起便印证了华尔街对新技术进步的这种狂热。OpenAI聊天机器人在2022年11月的成功发布便引发了一波对生成式人工智能潜力的热捧。追随者们认为该技术能够重塑世界,带来物质的极大丰富,甚至治愈绝症,同时还可以提升工人生产力,降低企业成本。自那之后,分析师一直在关注人工智能或将对企业营收带来的影响,尤其是对大型科技公司的影响,而那些有望因为新人工智能技术而获得相关营收的公司[例如微软(Microsoft)或英伟达(Nvidia)]则见证了自家股价的飙升。与此同时,华尔街一直在源源不断地输出研究报告和调查,进一步推高(只会偶尔地贬低)人工智能热。

《财富》杂志分析了来自于投行、对冲基金和投资研究公司的数百页人工智能报告,并发现了一些惊人的相似之处。总的来说,华尔街异常看好人工智能的长期前景,分析师们认为它将提升员工的生产力和GDP,而且其终极影响力能够与互联网的诞生相媲美。然而,这里的关键词是——终极。华尔街的研究报告和调查展现了专家们的分歧:一些认为近期的人工智能热过于夸张,另一些专家认为则是合理的,因为该技术得到了迅速采用,而且具有长期成功的潜力。

华尔街报告的标题通常十分直白。私募股权巨头凯雷(Carlyle)将其10月的报告命名为《勇敢的新世界:人工智能及其下游产业的影响力》(Brave New World: AI and Its Downstream Implications),它把生成式人工智能的诞生称之为“人类历史的”转折点,并将其比作与电气化。花旗(Citi)则把其9月57页的报告取名为《人工智能爆发:人工智能军备竞赛》(Unleashing AI: The AI Arms Race),该报告重点介绍了生成式人工智能在实现技术创新民主化以及提升员工生产力方面的潜力。报告的作者直截了当地写道:“我们认为人工智能是游戏规则的改变者。”

大多数的投行和华尔街研究公司在今年发布了多篇有关人工智能的详尽报告,以及简单的人工智能相关个股纪要。然而,介绍这一趋势的大量笔墨都被用于反驳一种顾虑:最近的人工智能热被过分渲染或还不成熟。在今年7月名为《生成式人工智能:炒作还是真具有颠覆性》(Generative AI: Hype, or Truly Transformative)的报告中,高盛集团(Goldman Sachs)采访了这场辩论的反方人工智能专家。在这篇报告里,纽约大学(New York University)的心理学与神经科学荣誉教授加里·马库斯认为,生成式人工智能遭到了“过度炒作”,而且真正的人工通用智能距离现实生活还有很长的路要走。然而,风投公司Conviction的创始人萨拉·郭表示,生成式人工智能将推动新时代的到来,在这个时代中,科技将变得“更有用,更可及而且更平价。”

继7月报告之后,高盛集团在9月发布了一篇偏解释性的文章,名为《为什么人工智能不是泡沫》(Why AI is not a bubble)。该文重点介绍了人工智能的潜力,并认为人工智能相关股票的价格并没有达到典型的泡沫交易价。高盛集团的团队在描述人工智能相关股票的潜力时写道:“我们认为,这个有望带来更突出业绩的新技术周期依然处于相对早期的阶段。”

一些资深华尔街分析师甚至十分推崇人工智能泡沫说,认为泡沫是必要的,不可避免的,甚至可能大有裨益,有助于那些真正具有颠覆性的技术获得更快的发展。

投资公司DeepWater Asset Management的执行合伙人吉恩·芒斯特在10月17日名为《人工智能泡沫守则》(The AI Bubble Playbook)的报告里解释道:“泡沫可以确保新兴技术获得远超所需的资本,并让其脱颖而出的概率最大化。如果没有‘过量’的资本去追逐每一个糟糕的理念,尤其是这个糟糕的理念实际上颇为不俗时,我们可能就永远无法完全享受铁路、汽车或互联网带来的各种益处。”

在告诉投资者该如何应对人工智能炒作周期的震荡之前,芒斯特在报告中称,不公平的是,炒作吹出来的“泡沫会让人产生负面联想”。这位资深科技分析师建议投资者了解一下那些为人工智能技术提供运行载体的硬件公司,比如半导体巨头英伟达,这家公司自年初至今的股价上涨了180%。不过,芒斯特主要还是强调了那些将使用人工智能来提升数据可及性和可用性的云储存和软件公司,例如微软、MongoDB和Databricks,以及人工智能应用软件公司,比如专注于游戏的软件开发商Unity Software或数据科学和分析公司Alteryx。

他总结说:“人工智能可能存在泡沫,但通过与真实的泡沫进行客观对比后我们发现,这一行业离疯狂还远着呢。”

韦德布什(Wedbush)的科技分析师丹·艾夫斯也在6月详细介绍“人工智能淘金热”(AI gold rush)的报告中玩起了泡沫说。艾夫斯是首批将人工智能崛起与互联网泡沫初期进行对比的分析师。在人工智能时间线上,艾夫斯认为是1995年而不是1999年,这意味着这个泡沫在破灭之前还有很大的膨胀空间,而且投资者应该利用这一趋势。他认为,人们能够在企业营收电话会议和讲演里感受到了人工智能热。市场情报公司AlphaSense称,企业营收电话会议、新闻发布会和其他公开文件中提及“人工智能”一词的数量自2018年以来飙升了363%。具有讽刺意味的是,这家公司也在使用人工智能来挖掘财务数据里的信息。

然而,正如《财富》杂志此前报道的那样,一些专家担心华尔街的投资者和散户们对人工智能的潜力有点过于乐观。贝勒大学(Baylor University)的电气与计算机工程教授罗伯特·马克思在7月的采访里说:“我们正处于炒作期——泡沫期。我觉得人们必须放缓脚步,并更加清醒地去思考。”

投资研究公司New Constructs的创始人大卫·特雷纳称,他认为投资者的这种害怕错过机会的心理,正在将一些股票的价格推至不可持续的水平。他说:“投资者真的得小心行事了。”

尽管专家们提出了上述警告,但不怎么看好(至少长期内)人工智能的主流投行或对冲基金几乎是凤毛麟角的存在。在华尔街看来,人工智能不亚于“电的面世”,而且有一天可能成为类似于“数字上帝”的事物。以下是华尔街最新研究报告中有关其人工智能狂热症的一些集锦。

美国银行:“现实证明炒作的合理性”

主要观点:“在最新的人工智能浪潮中,受益的不只是科技公司。我们认为,生成式人工智能的转型潜力可能接近电话、汽车、个人电脑和互联网等颠覆性技术,相关技术通常在15年至30年后成为主流。”

关键数据:据美国银行(Bank of America)估计,未来五年,企业人工智能应用有望帮标准普尔500指数(S&P 500)中的成份股公司减少约650亿美元成本,到2030年,人工智能的经济影响可能达到15.7万亿美元。

引述和统计数据摘自今年10月美国银行研究所(Bank of America Research)的人工智能报告《人工智能进化:现实证明炒作的合理性》(AI Evolution: Reality Justifies the Hype)和《人工智能进化:股票与ETF受益人》(AI Evolution: Stock & ETF Beneficiaries),作者为分析师阿尔克什·沙阿和安德鲁·莫斯。

凯雷:人工智能的革命性堪比电力

主要观点:“生成式人工智能就好比电力出现,该比较可能还算恰当……必须注意LLM(大型语言模型)的‘幻觉问题’……很多情况下模型的输出需要人工验证,航空或国防等关键领域应用可能还要等很长一段时间。”

关键数据:麦肯锡(McKinsey)的一项研究显示,最终60%至70%的工作量可以通过生成式人工智能应用实现自动化。

引述和统计数据来自今年10月凯雷发布的题为《勇敢的新世界:人工智能及其下游产业的影响力》的报告,报告作者为全球研究和投资战略主管贾森·托马斯和凯雷欧洲技术合作伙伴投资咨询团队董事总经理兼联席主管迈克尔·万德。

瑞银:“代际转型”

主要观点:“虽然称不上‘数字时代的神’,不过生成式人工智能的进步速度相当惊人。如今,开发和训练模型的成本通常高达数百万美元,不过开源模型进展稳定,技术采用看起来很快。”

关键数据:埃森哲(Accenture)的数据显示,约40%的工作时间可能受到生成式人工智能兴起的影响。

引述和统计数据来自瑞银集团(UBS)131页的报告,题为“生成式人工智能会引发代际转型吗?”(Will Generative AI deliver a generational transformation?)报告作者为瑞银的迈克尔·布里斯特和十几位分析师,发表于今年5月。

花旗:人工智能将接手营销工作——以及更多

主要观点:“单就概念而言,人工智能并不是新鲜事,生成式人工智能代表着人工智能进化最新的转折点。不过,生成式人工智能有其独特之处,该技术在改变各行业工作和整体提高生产力方面潜力巨大。”

关键数据:根据行业研究公司Gartner估计,到2025年,大型机构对外的营销信息将有30%为人工生成,去年这一数字约为2%。

引述和统计数据来自今年9月花旗发布的57页报告《人工智能爆发:人工智能军备竞赛》,报告由数十名分析师和行业专家撰写。

高盛集团:人工智能将推动全球GDP增长7%

主要观点:“目前科技行业估值还比不上之前的泡沫时期,回报率最高的‘早期赢家’往往资产负债表非常强劲,投资回报也很理想。”

关键数据:根据高盛集团的一项研究,如果人工智能广泛采用,未来十年生产率的年增长率可能略低于1.5%,从而推动全球GDP增长7%。

引述和统计数据来自今年9月5日题为《为什么人工智能不是泡沫》的报告,报告作者为高盛集团的全球股票首席策略师彼得·奥本海默领导的一群专家和分析师。

摩根士丹利:失业炒作不足为信

主要观点:“以就业来说,我不认为会有大量工人因为新技术的出现而失去岗位,这种悲观论调不足微信。经济一直在不断发展,当年灯泡的出现也没有让大批蜡烛工人失业。”

关键数据:作为最受欢迎的开源人工智能模型库,Hugging Face上人工智能模型的月下载量今年大幅飙升。从2021年1月到2023年8月,Hugging Face上排名前10的模型的下载量已达35亿。

针对人工智能这一话题,摩根士丹利(Morgan Stanley)已经撰写多篇报告,包括《人工智能指南》(AI Guidebook),但前文引用的内容和统计数据出自今年8月发布的两篇报告,分别为该机构全球首席经济学家塞思·卡彭特撰写的《人工智能利弊分析》(AI: The Long and Short of It)和股票策略师爱德华·斯坦利撰写的《人工智能与“年度选美大赛”》(AI & The Annual Beauty Contest)。

德意志银行:人工智能将赋能而非取代人类员工

主要观点:“尽管历史证据表明,从长远来看,技术革命通常会带来更优质的新岗位、更高的生产效率和更强劲的经济增长,但仍然有很多人担心人工智能会引发失业潮……不过今年夏天出现的一系列新证据表明,部分担忧可能没有根据,人工智能很可能会赋能而不是取代白领工作”。

关键数据:人工智能推动的自动化转型对高收入国家就业情况的潜在影响要大得多。国际劳工组织(International Labour Organization)在今年8月发布的一项研究显示,高收入国家约5.5%的就业岗位会受到自动化的影响,而在低收入国家,这一比例仅为0.4%。

上述观点和统计数据来自德意志银行(Deutsche Bank)的全球经济和主题研究主管吉姆·里德以及两位研究分析师阿德里安·考克斯和加林娜·波兹尼亚科娃在今年9月撰写的研究报告《人工智能最新进展:不应错过的六大主题》(AI Update: Six Key themes you missed while you were at the beach)。

凯投宏观:这轮人工智能浪潮对股市的影响将与上升阶段的互联网泡沫类似

主要观点:“这轮人工智能浪潮对股市的影响将与20世纪90年代处于膨胀阶段的互联网热潮类似……当然,泡沫都终将破灭。但就人工智能而言,这一天可能还要数年时间才会到来。不过无论如何,我们都不认为这会‘敲响人工智能技术的丧钟’,就像当年持续至少五年时间才破灭的互联网泡沫也没有让互联网技术走向终结一样。”

关键数据:凯投宏观(Capital Economics)称,在互联网革命期间,美国的生产力年增长率达到1.5%,在判断本轮人工智能革命的影响时,这一数字也有参考价值。

上述观点和统计数据出自今年9月发布的两份研究报告,分别题为《人工智能、经济和市场——人工智能将如何改变全球经济》(AI, Economies and Markets – How artificial intelligence will transform the global economy)和《如何看待人工智能在股市中的作用》(How we see AI playing out in stock markets)。(财富中文网)

译者:冯丰

审校:夏林

When Wall Street catches a whiff of a new innovation that could drive earnings growth, it tends to get a little overexcited. Sell-side analysts at investment banks rush to put out bullish research reports on related companies; economists and strategists start discussing the potential impacts of the new tech for growth, inflation, and productivity; and money managers begin to ponder the implications of it all for their portfolios. It’s a flurry of activity and interest that can quickly turn into a self-reinforcing hype cycle featuring highly optimistic forecasts.

The rise of artificial intelligence is the latest example of how the Street can become attached to a new technological advancement. The widely successful release of OpenAI’s chatbot ChatGPT in November sparked a wave of enthusiasm about generative AI’s potential to reshape the world, usher in an age of abundance, or even cure the incurable—all while boosting worker productivity and reducing corporate costs. Ever since, analysts have been watching for signs of AI’s impact on corporate earnings, particularly when it comes to big tech, and firms that show promise in drawing in new AI-related revenues (like Microsoft or Nvidia) have seen their stocks soar. Meanwhile, there’s been a steady stream of research reports and studies pouring out of Wall Street that push (and only occasionally downplay) the AI hype.

Fortune analyzed hundreds of pages of AI reports from investment banks, hedge funds, and investment research firms and found some striking similarities. In short, the Street is incredibly bullish on the long-term prospects of AI, with analysts arguing it will boost worker productivity and GDP on a scale similar to the birth of the internet — eventually. But that’s the key word: eventually. Wall Street’s research reports and studies reveal a split between experts who believe that the near-term AI hype is overdone, and those who argue it’s justified given the rapid adoption of the technology and potential for long-term succes.

The titles of the Street’s reports are typically quite revealing. The private equity giant Carlyle went with “Brave New World: AI and Its Downstream Implications” for its October report that called the birth of generative AI a “watershed in human history,” comparing it to electrification. Citi decided on “Unleashing AI: The AI Arms Race” for its 57-page September opus that emphasizes the potential for generative AI to democratize tech innovation and increase worker productivity. “We believe it is a game changer,” the report’s authors put it plainly.

Most investment banks and Wall Street research firms issued several major AI reports this year, as well as a smattering of AI-focused single stock notes. But a large portion of the ink spilled on this trend has been devoted to rebutting concerns that the recent AI enthusiasm is overblown or premature. In a July report titled “Generative AI: Hype, or Truly Transformative,” Goldman Sachs spoke with AI experts on opposite sides of the debate. In the piece, Gary Marcus, professor emeritus of psychology and neural science at New York University, argued generative AI is being “overhyped” and true artificial general intelligence is a long way from reality. But Sarah Guo, founder of the venture capital firm Conviction, made the case that it will usher in an era where technology becomes “more useful, accessible, and less expensive.”

Goldman followed up its July report with another, slightly more defensive, offering in September called “Why AI is Not a Bubble” that emphasized the potential of the technology and argued that AI-related stocks were not trading at the typical bubble prices. “We believe we are still in the relatively early stages of a new technology cycle that is likely to lead to further outperformance,” the Goldman team wrote of the potential for AI-linked stocks.

Some veteran Wall Street analysts even leaned into the AI bubble talk, arguing that bubbles are necessary, unavoidable, and even maybe a net positive that can help a truly revolutionary technology develop more rapidly.

“Bubbles ensure that more than sufficient amounts of capital are invested into the emerging technology to give it the greatest chance of breaking out. Without ‘excess’ capital chasing every bad idea, especially bad ideas that were actually great, we may have never enjoyed the full benefits of railroads, the automobile, or the Internet,” Gene Munster, managing partner at the investment firm DeepWater Asset Management, explained in an Oct. 17 report titled “The AI Bubble Playbook.”

Hype-fed “bubbles get an unfairly negative connotation,” Munster argued in the report, before detailing how investors can play the ups and downs of the AI hype cycle. The veteran tech analyst recommended investors look to hardware companies that create the technologies that allow AI to operate, like the semiconductor giant Nvidia — even after its over 180% year-to-date rise. But mainly, Munster highlighted cloud storage and software firms that will use AI to make data more accessible and usable, like Microsoft, MongoDB, and Databricks, as well as AI application software firms, like the gaming focused developer Unity Software or the data science and analytics firm Alteryx.

“AI might be frothing, but objective comparison to a bonafide bubble says we’re nowhere near roaring insanity,” he concluded.

Wedbush tech analyst Dan Ives also played on the bubble talk in a June report that detailed the “AI gold rush.” Ives was one of the first to compare the rise of AI to that of the internet during the early days of the dotcom bubble. On the AI timeline, Ives believes it’s 1995, not 1999 — meaning this bubble has a lot of room to inflate before it bursts, and investors should go along for the ride. To his point, the enthusiasm over AI can be seen in corporate earnings calls and presentations. Mentions of the term “AI” in corporate earnings reports, press releases, and other public filings have soared 363% since 2018, according to the market intelligence firm AlphaSense, which ironically uses AI to delve through financial data.

Still, as Fortune previously reported, some experts fear that investors on both Wall Street and Main Street are getting a bit too excited over AI’s potential. “We’re in a hype curve—a bubble,” Robert Marks, an electrical and computer engineering professor at Baylor University, said in a July interview. “And I think that people have to slow down and be a bit more sober in terms of their thinking.”

David Trainer, founder of investment research firm New Constructs, added that he believes investors’ fear of missing out is driving some stocks to unsustainable levels. “Investors just have to be really careful,” he said.

Despite all the warnings from experts, you’d be hard pressed to find a major investment bank or hedge fund that isn’t an AI believer — at least over the long term. If you ask the Street, AI is akin to the “advent of electricity” and one day may be something like a “digital god.” Here’s a look at some of the highlights from Wall Street’s latest research reports on its AI obsession.

Bank of America: “Reality justifies the hype”

Key quote: “It’s not just tech companies that will benefit from AI’s newest wave. Our view is that GenAI’s transformation potential will likely be similar to the transformation driven by past disruptive technologies like the telephone, automobile, personal computer and internet, which have historically reached mainstream adoption after 15-30 years.”

Key statistic: Corporate AI implementation could cut S&P 500 companies’ costs by ~$65 billion over the next 5 years and AI’s economic impact could reach $15.7 trillion by 2030, according to BofA’s estimates.

This quote and statistic were pulled from Bank of America Research’s October AI reports, “AI Evolution: Reality Justifies the Hype” and “AI Evolution: Stock & ETF Beneficiaries,” written by analysts Alkesh Shah and Andrew Moss.

Carlyle: AI is as revolutionary as electricity

Key Quote: “Generative AI has been analogized to the advent of electricity, and this comparison may be apt…We must also be mindful of the ‘hallucination problem’ with LLMs [Large Language Models]…human verification of their outputs will still be required in many cases, and their use in mission critical applications like aeronautics or defense could lay very far in the future.”

Key statistic: Between 60% and 70% of employee workloads could eventually be automated by generative AI applications, according to a McKinsey study.

This quote and statistic came from an October Carlyle report titled “Brave New World: AI and its Downstream Implications” by Jason Thomas, head of global research and investment strategy, and Michael Wand, managing director and co-head of the Carlyle Europe Technology Partners investment advisory team.

UBS: “A generational transformation”

Key quote: “While not a ‘digital god’, Generative AI's capabilities have advanced at a remarkable pace. The costs of developing and training models today typically run to many millions of dollars, but open-source models are gaining ground and adoption of the technology appears set to be swift.”

Key statistic: Some 40% of all working hours could be impacted by the rise of generative AI, according to data from Accenture.

This quote and stat came from a 131-page UBS report titled “Will Generative AI deliver a generational transformation?” that was written by a dozen UBS analysts led by Michael Briest and published in May.

Citi: AI will handle your marketing—and much more

Key quote: “As a concept, artificial intelligence (AI) is not new, and Generative AI represents the latest inflection point in the evolution of AI. However, what is distinctive about Generative AI is the tremendous potential it holds to transform work across industries and boost overall productivity.”

Key statistic: By 2025, 30% of outbound marketing messages from large organizations will be synthetically generated, up from roughly 2% last year, according to estimates from the industry research firm Gartner.

This quote and statistic is from a September 57-page Citi report, “Unleashing AI: The AI Arms Race”, which was written by a group of dozens analysts and industry experts.

Goldman Sachs: AI could boost global GDP 7%

Key quote: “Current valuations in the technology sector are not as stretched as in previous bubble periods and the 'early winners' that have enjoyed the strongest returns have unusually strong balance sheets and returns on investment.”

Key statistic: Productivity growth could rise by just under 1.5% annually over the next decade if AI undergoes widespread adoption, boosting global GDP by 7%, according to a Goldman Sachs study.

This quote and statistic comes from a September 5 report titled “Why AI is not a bubble” which was written by a group of experts and analysts, led by chief global equity strategist Peter Oppenheimer.

Morgan Stanley: Don’t believe the unemployment hype

Key quote: “For employment, I continue to be skeptical of the gloomy prognostications that a myriad of workers will lose their jobs to new technology. Economies evolve, and the advent of the lightbulb has not left a lingering horde of unemployed candlemakers.”

Key statistic: Monthly downloads of AI models on Hugging Face, the most popular repository for open-source AI models, have soared this year. Between January 2021 and August 2023, the top 10 models on Hugging Face have been downloaded 3.5 billion times.

Morgan Stanley has written various major AI reports including its “AI Guidebook,” but this quote and statistic are from the August reports “AI: The Long and Short of It” by chief global economist Seth Carpenter and the “AI & The Annual Beauty Contest” by equity strategist Edward Stanley.

Deutsche Bank: AI will “augment rather than replace” workers

Key quote: “Job losses have been one of the most immediate concerns about generative AI, despite historical evidence showing that over the long term technological revolutions have typically led to new, higher quality jobs, greater productivity and economic growth...However, emerging evidence over the summer suggested some fears may be unfounded, with AI likely to augment rather than replace white-collar jobs.”

Key statistic: The potential effects of AI-based automation on employment are much more drastic in high-income countries. Some 5.5% of total employment in high-income countries is exposed to automation effects, compared to just 0.4% in low-income countries, an August International Labour Organization (ILO) study shows.

This quote and statistic are from a September research note titled “AI Update: Six key themes you missed while you were at the beach” written by Deutsche Bank’s head of global economics and thematics research, Jim Reid, and two of research analysts, Adrian Cox and Galina Pozdnyakova.

Capital Economics: Like the dotcom bubble on the way up

Key quote: “AI will have a similar impact on equities to the one that the Internet had during the second half of the 1990s, when the “dotcom bubble” was inflating…Of course, bubbles eventually burst. But it could be years before that occurred in this case. Regardless, we don’t think that would sound the death knell for AI – any more than the bursting of the dotcom bubble, which was at least five years in the making, sounded one for the Internet.”

Key statistic: Productivity gains during the internet revolution hit 1.5% per year in the U.S., and that could be a “reasonable guide to what is achievable” during the AI revolution as well, according to Capital Economics.

This quote and statistic are from two September research reports titled “AI, Economies and Markets – How artificial intelligence will transform the global economy” and “How we see AI playing out in stock markets.”