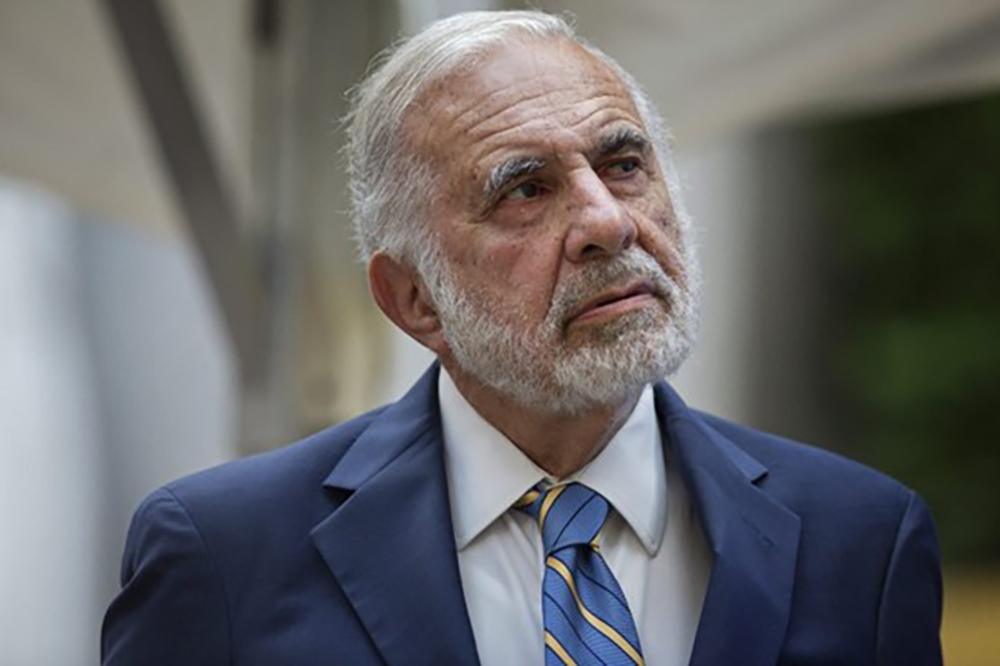

2015年5月19日,亿万富翁激进投资者卡尔·伊坎(Carl Icahn)出席在纽约举行的杠杆融资对抗黑色素瘤慈善活动。图片来源:VICTOR J. BLUE—BLOOMBERG/GETTY IMAGES

2015年5月19日,亿万富翁激进投资者卡尔·伊坎(Carl Icahn)出席在纽约举行的杠杆融资对抗黑色素瘤慈善活动。图片来源:VICTOR J. BLUE—BLOOMBERG/GETTY IMAGES你知道男性有多执迷于古罗马的故事吗?在TikTok新的热门话题里,女性询问她们生活中的男性多久会琢磨罗马帝国一次。答案令人瞠目结舌,一些男性承认,他们每周甚至每天都会反复琢磨古罗马的辽阔疆域和影响力。

这一热门话题现在非常受欢迎,TikTok上的#罗马帝国标签浏览量已超过12亿次。无独有偶,亿万富翁们也难逃追忆角斗和战车竞赛时代的魅力。看看Meta的马克·扎克伯格(Mark Zuckerberg)就知道了,他多次表达了对奥古斯都(Augustus)的钦佩之情,奥古斯都是古代世界上最伟大的独裁者之一,也是凯撒遇刺后罗马的第一位皇帝。

“我不确定自己是否过多琢磨罗马帝国了。我想知道我的女儿马克西玛(Maxima)、奥古斯特(August)和奥蕾莉亚(Aurelia)会怎么想。” 这位亿万富翁周二在Threads上发布了这样一条帖子,呼应了罗马帝国这一近期的TikTok热门话题。

但其他亿万富翁似乎琢磨更多的是罗马帝国的灭亡,而不是罗马帝国本身。伊坎企业(Icahn Enterprises)创始人、亿万富翁卡尔·伊坎在上世纪80年代以“企业掠夺者”的典型形象一举成名。他甚至在去年警告称,疫情期间美国通胀水平上升与罗马帝国衰落时期的情况很像。伊坎在去年9月的“货币节最佳新创意”上对市场观察网(MarketWatch)说:“最糟糕的情况尚未出现。通货膨胀会带来严重后果。你无法治愈它带来的损伤。”

全球最大对冲基金桥水基金(Bridgewater Associates)的创始人瑞·达利欧(Ray Dalio)是另一位有着惊人相似观点的亿万富翁。达利欧在2021年出版了一本关于罗马帝国兴衰的书,名为《原则:应对变化中的世界秩序》(Principles for Dealing with The Changing World Order: Why Nations Succeed and Fail)。他在2022年6月的《金融时报》播客节目《拉赫曼说事》中解释说,美联储在疫情期间大幅增加货币供应量的做法与罗马帝国衰落时期的情况如出一辙。

“从历史上看,当国家没有足够的资金时,就会印钞,这可以追溯到罗马帝国时期。”他说。

众所周知,罗马帝国经历了恶性通货膨胀,此前几位皇帝降低了货币“第纳尔”银币(denarius)的含银量,以增加国家资本。公元64年,一场所谓的大火烧毁了半个罗马城,导致尼禄皇帝(emperor Nero)寻求一种快速获得重建城市所需资金的方法。据一些历史学家估计,罗马皇帝的货币贬值政策最终导致公元200年至300年间通货膨胀率达到15,000%。

达利欧于2022年放弃了对桥水基金的控制权,但据报道,他已开始努力恢复自己在该公司的地位。他曾暗示,联邦政府在疫情期间通过债务为支出项目提供资金的决定,可能是重演这段痛苦历史的开始。

他向英国《金融时报》表示:“在我的一生中,这是我们经常看到的经典动态,但它也是货币涨跌背后的底层原因。”

风险投资公司安德森·霍洛维茨(Andreessen Horowitz)的联合创始人、亿万富翁企业家兼程序员马克·安德森(Marc Andreessen)最近也提到了罗马帝国的衰落,他在去年10月的一篇社交媒体帖子中,将自己在加州的经历比作生活在“曾经辉煌一时的社会的废墟中”。他写道:“就像公元250年的罗马一样,我们生活在文化和创造力蓬勃发展的时代,但发展道路却变得越来越危险,而且没有人知道确切原因。”

虽然很难概括亿万富翁阶层的历史阅读趋势,更不用说整个男性群体了,但超级富豪对罗马帝国兴衰的痴迷是有先例的——几百年来都是如此。最终当选为英国议会议员的爱德华·吉本(Edward Gibbon)出身于英国富裕家庭(该家族在18世纪20年代的南海泡沫(South Sea Bubble)中失去了大部分财富,但后来又重新获得了财富)。他被认为是启蒙运动的关键人物,这主要归功于他宏大的多卷本历史著作——《罗马帝国衰亡史》(The History of the Decline and Fall of the Roman Empire)(书名恰如其分)。从那以后,这本书就一直被个人收藏,甚至可能在伊坎、达利欧等人手中。他的书籍并未涉及恶性通货膨胀,而且如今,人们普遍认为该书有问题(这是因为他认为,罗马帝国接受基督教最终削弱了公民美德,造成了严重后果,他对宗教的批评在后来引发了反犹太主义的指控)。(值得注意的是,总体而言,吉本的反天主教倾向是启蒙思想的标志。)

超级富豪对罗马帝国衰落的执着可能也与二战后美国经济竞争对手的崛起有关。二战结束后,美国经济约占全球GDP的50%。但到2022年,经过新兴市场多年的发展和其他发达经济体的复苏,这一数字已降至13.5%。这暗示着叙事转向美国经济衰落。

1992年,《哈佛商业评论》(Harvard Business Review)首次讨论了触及这一点的新趋势,并称之为美国的“衰落主义”,指出预言者、精英,甚至许多普通公众都开始担心,在经济竞争日益激烈的情况下,美国出现了“根本性的问题”。这些担忧可能是合乎情理的,但也可能只是反映了美国在世界舞台上地位的变化,而不是一个经济“帝国”的坍塌。但有趣的是,纵观历史,所有事件往往都能追溯到罗马帝国时期。罗马帝国令世界各地的男性群体“魂牵梦绕”(无论亿万富翁与否)。(财富中文网)

译者:中慧言-王芳

你知道男性有多执迷于古罗马的故事吗?在TikTok新的热门话题里,女性询问她们生活中的男性多久会琢磨罗马帝国一次。答案令人瞠目结舌,一些男性承认,他们每周甚至每天都会反复琢磨古罗马的辽阔疆域和影响力。

这一热门话题现在非常受欢迎,TikTok上的#罗马帝国标签浏览量已超过12亿次。无独有偶,亿万富翁们也难逃追忆角斗和战车竞赛时代的魅力。看看Meta的马克·扎克伯格(Mark Zuckerberg)就知道了,他多次表达了对奥古斯都(Augustus)的钦佩之情,奥古斯都是古代世界上最伟大的独裁者之一,也是凯撒遇刺后罗马的第一位皇帝。

“我不确定自己是否过多琢磨罗马帝国了。我想知道我的女儿马克西玛(Maxima)、奥古斯特(August)和奥蕾莉亚(Aurelia)会怎么想。” 这位亿万富翁周二在Threads上发布了这样一条帖子,呼应了罗马帝国这一近期的TikTok热门话题。

但其他亿万富翁似乎琢磨更多的是罗马帝国的灭亡,而不是罗马帝国本身。伊坎企业(Icahn Enterprises)创始人、亿万富翁卡尔·伊坎在上世纪80年代以“企业掠夺者”的典型形象一举成名。他甚至在去年警告称,疫情期间美国通胀水平上升与罗马帝国衰落时期的情况很像。伊坎在去年9月的“货币节最佳新创意”上对市场观察网(MarketWatch)说:“最糟糕的情况尚未出现。通货膨胀会带来严重后果。你无法治愈它带来的损伤。”

全球最大对冲基金桥水基金(Bridgewater Associates)的创始人瑞·达利欧(Ray Dalio)是另一位有着惊人相似观点的亿万富翁。达利欧在2021年出版了一本关于罗马帝国兴衰的书,名为《原则:应对变化中的世界秩序》(Principles for Dealing with The Changing World Order: Why Nations Succeed and Fail)。他在2022年6月的《金融时报》播客节目《拉赫曼说事》中解释说,美联储在疫情期间大幅增加货币供应量的做法与罗马帝国衰落时期的情况如出一辙。

“从历史上看,当国家没有足够的资金时,就会印钞,这可以追溯到罗马帝国时期。”他说。

众所周知,罗马帝国经历了恶性通货膨胀,此前几位皇帝降低了货币“第纳尔”银币(denarius)的含银量,以增加国家资本。公元64年,一场所谓的大火烧毁了半个罗马城,导致尼禄皇帝(emperor Nero)寻求一种快速获得重建城市所需资金的方法。据一些历史学家估计,罗马皇帝的货币贬值政策最终导致公元200年至300年间通货膨胀率达到15,000%。

达利欧于2022年放弃了对桥水基金的控制权,但据报道,他已开始努力恢复自己在该公司的地位。他曾暗示,联邦政府在疫情期间通过债务为支出项目提供资金的决定,可能是重演这段痛苦历史的开始。

他向英国《金融时报》表示:“在我的一生中,这是我们经常看到的经典动态,但它也是货币涨跌背后的底层原因。”

风险投资公司安德森·霍洛维茨(Andreessen Horowitz)的联合创始人、亿万富翁企业家兼程序员马克·安德森(Marc Andreessen)最近也提到了罗马帝国的衰落,他在去年10月的一篇社交媒体帖子中,将自己在加州的经历比作生活在“曾经辉煌一时的社会的废墟中”。他写道:“就像公元250年的罗马一样,我们生活在文化和创造力蓬勃发展的时代,但发展道路却变得越来越危险,而且没有人知道确切原因。”

虽然很难概括亿万富翁阶层的历史阅读趋势,更不用说整个男性群体了,但超级富豪对罗马帝国兴衰的痴迷是有先例的——几百年来都是如此。最终当选为英国议会议员的爱德华·吉本(Edward Gibbon)出身于英国富裕家庭(该家族在18世纪20年代的南海泡沫(South Sea Bubble)中失去了大部分财富,但后来又重新获得了财富)。他被认为是启蒙运动的关键人物,这主要归功于他宏大的多卷本历史著作——《罗马帝国衰亡史》(The History of the Decline and Fall of the Roman Empire)(书名恰如其分)。从那以后,这本书就一直被个人收藏,甚至可能在伊坎、达利欧等人手中。他的书籍并未涉及恶性通货膨胀,而且如今,人们普遍认为该书有问题(这是因为他认为,罗马帝国接受基督教最终削弱了公民美德,造成了严重后果,他对宗教的批评在后来引发了反犹太主义的指控)。(值得注意的是,总体而言,吉本的反天主教倾向是启蒙思想的标志。)

超级富豪对罗马帝国衰落的执着可能也与二战后美国经济竞争对手的崛起有关。二战结束后,美国经济约占全球GDP的50%。但到2022年,经过新兴市场多年的发展和其他发达经济体的复苏,这一数字已降至13.5%。这暗示着叙事转向美国经济衰落。

1992年,《哈佛商业评论》(Harvard Business Review)首次讨论了触及这一点的新趋势,并称之为美国的“衰落主义”,指出预言者、精英,甚至许多普通公众都开始担心,在经济竞争日益激烈的情况下,美国出现了“根本性的问题”。这些担忧可能是合乎情理的,但也可能只是反映了美国在世界舞台上地位的变化,而不是一个经济“帝国”的坍塌。但有趣的是,纵观历史,所有事件往往都能追溯到罗马帝国时期。罗马帝国令世界各地的男性群体“魂牵梦绕”(无论亿万富翁与否)。(财富中文网)

译者:中慧言-王芳

Have you heard that men think about ancient Rome a lot? There’s a new viral Tik Tok trend where women ask the men in their lives how often they think about the Roman Empire. The answers are pretty surprising, with some men admitting that they think about the influence and breadth of the ancient state multiple times per week, or even multiple times per day.

The trend is now so popular that the #RomanEmpire hashtag on TikTok has surpassed 1.2 billion views. And as it happens, billionaires aren’t immune from the charm of reminiscing about the days of gladiatorial combat and chariot races, either. Just take a look at Meta’s Mark Zuckerberg, who has repeatedly expressed his admiration for Augustus, one of the ancient world’s greatest dictators, and also the first emperor of Rome after Julius Caesar’s assassination.

“Not sure if I think about the Roman Empire too much. I wonder what my daughters Maxima, August and Aurelia think,” the billionaire posted on Threads Tuesday, leaning into the recent Roman empire TikTok trend.

But other billionaires seem to be thinking more about the downfall of the Roman Empire than the empire itself. Carl Icahn, the billionaire founder of Icahn Enterprises who rose to fame as the archetypal “corporate raider” in the 1980s, even warned last year that the rise of U.S. inflation during the pandemic looked a lot like what was seen during the fall of the Roman Empire. “The worst is yet to come,” Icahn told MarketWatch at the Best New Ideas in Money Festival last September. “Inflation is a terrible thing. You can’t cure it.”

Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, is another billionaire with an uncannily similar diagnosis. Dalio, who published a book about the rise and fall of empires in 2021 called Principles for Dealing with The Changing World Order: Why Nations Succeed and Fail, explained in a June 2022 episode of the Financial Times’ Rachman Review podcast that the Federal Reserve’s expansion of the U.S. money supply during the pandemic mirrored what was seen during the fall of the Roman empire.

“When countries don’t have enough money historically, then they print money, and that goes back to the Roman Empire,” he said.

The Roman Empire famously experienced hyperinflation after a series of emperors lowered the silver content in their currency, the denarius, in an attempt to bolster state funds. It began after the so-called Great Fire destroyed half of Rome in 64 AD, leading emperor Nero to search for a quick fix method of gaining the money required to rebuild the city. Roman emperors’ currency debasement eventually led to an inflation rate of 15,000% between A.D. 200 and 300, according to estimates by some historians.

Dalio, who gave up control of Bridgewater in 2022 but has reportedly begun a struggle to regain his status at the firm, has alluded to the idea that the federal government’s decision to finance spending programs via debt throughout the pandemic could be the beginning of a repeat of this torrid history.

“For my whole life, it’s a classic dynamic that we see all the time, but it is also the basis behind the rises and declines of currencies,” he told the Financial Times.

Marc Andreessen, the billionaire entrepreneur and programmer who co-founded the venture capital firm Andreessen Horowitz, has also recently referenced the fall of the Roman Empire, comparing his experience in California to living in the “ruins of a once great society” in a social media post last October. “Like Rome in maybe 250 A.D., we live amidst an enormous flowering of culture and creativity, but the roads are becoming unsafe and nobody is quite sure why,” he wrote.

While it’s difficult to generalize about the history-reading trends of a class of billionaires, let alone the entire male gender, there is precedent for a fixation on the decline and fall of the Roman Empire among the ultrawealthy—hundreds of years of it. Edward Gibbon, who was ultimately elected to the UK Parliament, was born into a propertied English family that had lost most of its fortune in the South Sea Bubble of the 1720s but later regained it. He’s known to history as a key figure from the Enlightenment, largely thanks to his epic multi-volume work of history, the aptly named “The History of the Decline and Fall of the Roman Empire.” The book has been in personal libraries ever since, and may even be in the possession of Icahn, Dalio, et al. His thesis did not touch on hyperinflation and is widely considered problematic today, however, as he argued that the Empire’s embrace of Christianity ultimately fatally weakened its civic virtue, and his criticisms of religion have brought latter-day accusations of antisemitism. (Gibbon’s anti-Catholic leanings were a hallmark of Enlightenment thought in general, it’s worth noting.)

The fixation of the fall of the Roman Empire among the ultrawealthy may also be tied to the rise of economic competitors to the U.S. after World War II. After that war ended, the U.S. economy represented roughly 50% of global GDP. But in 2022, after years of development in emerging markets and recoveries in other advanced economies, that number has fallen to just 13.5%. Cue the decline and fall narrative.

In 1992, the Harvard Business Review first discussed a new trend that touched on this point, which it called American “declinism,” noting that prognosticators, elites, and even many members of the general public had begun to fear that something was “fundamentally wrong” with the U.S. amid rising economic competition. Those fears may be warranted, but they could also simply be a reflection of the changing position of the U.S. on the world stage, rather than the collapse of an economic “empire.” But it is funny how, throughout history, things often come back to the Romans, on the minds of men everywhere, be they billionaire or not.