耶鲁大学经济学家罗伯特·席勒在2000年3月出版了一本名为《非理性繁荣》(Irrational Exuberance)的书,宣称股市是泡沫。不久之后,科技股泡沫破裂。2004年,这位耶鲁大学经济学教授发表了一篇名为《房地产市场是否存在泡沫》(“Is There a Bubble in the Housing Market?”)的论文,呼吁人们关注不断飙升的房价。最后,在2007年——就在美国房价崩盘之前——席勒成功预测了房价很快就会崩盘。

时间快进到2023年,在经历了疫情期间的繁荣时期后,席勒再次密切关注美国房地产市场。根据凯斯-席勒全国房价指数(Case-Shiller National Home Price Index),美国房价飙升了43%。该指数是席勒几十年前帮助编制的独户住宅指数。

只是这一次,席勒并没有预测全美房价会崩盘,也没有预测房价会持续上涨。相反,席勒上周接受美国全国广播公司财经频道(CNBC)采访时似乎暗示,全美房价将出现一段时间的横盘走势。

席勒说:“房地产市场不同于股市,它通常是可以预测的。自2012年以来,房价一直在上涨,已经有大约 10 年的时间保持稳定增长。但随着这轮利率上升周期的结束,房产牛市可能即将结束。”

席勒认为,在房地产热潮期间,由于购房者急于锁定 2% 和 3% 的抵押贷款利率(他们知道这种情况不会持续太久),房地产市场出现了一些繁荣现象。

席勒说:“我认为对加息的恐惧影响了人们的想法。不只是房主,新购房者也想在利率进一步上升之前进场。他们想要锁定较低利率,所以这对房市产生了积极影响,但这种影响即将结束。”

去年夏天,席勒在接受美国全国广播公司财经频道采访时表示,疫情期间的房地产市场热潮(Pandemic Housing Boom)可能会被“房价下跌期”所取代。2022年8月,他表示:“芝加哥商品交易所(Chicago Mercantile Exchange)有一个房价期货市场……现在处于现货溢价状态:预计到2024年或2025年,房价将下跌逾10%。”

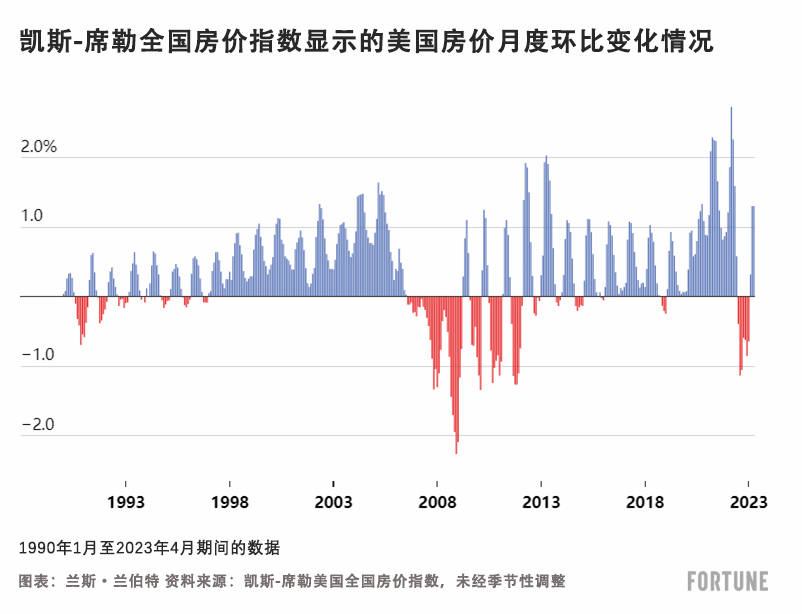

根据凯斯-席勒全国房价指数,全美房价在2022年6月至2023年1月期间确实下跌了5.1%,但到今年4月为止已经反弹了2.8%。

然而,上周席勒暗示,近期全国房价上涨可能只是季节性的。

席勒说:“房价上涨的部分原因只是季节性的。如今是夏季,房价通常会在夏季出现上涨。”

如果席勒的观点是正确的,今年春夏的全美房价上涨只是“季节性的”,这可能意味着随着房地产市场进入季节性放缓的秋冬季节,今年晚些时候房价将再次出现环比下跌。

席勒说:“我们将拭目以待:美国经济能否能实现软着陆。但这是一种可能性。不管怎样,我不会因此而感到恐慌。”(财富中文网)

译者:中慧言-王芳

耶鲁大学经济学家罗伯特·席勒在2000年3月出版了一本名为《非理性繁荣》(Irrational Exuberance)的书,宣称股市是泡沫。不久之后,科技股泡沫破裂。2004年,这位耶鲁大学经济学教授发表了一篇名为《房地产市场是否存在泡沫》(“Is There a Bubble in the Housing Market?”)的论文,呼吁人们关注不断飙升的房价。最后,在2007年——就在美国房价崩盘之前——席勒成功预测了房价很快就会崩盘。

时间快进到2023年,在经历了疫情期间的繁荣时期后,席勒再次密切关注美国房地产市场。根据凯斯-席勒全国房价指数(Case-Shiller National Home Price Index),美国房价飙升了43%。该指数是席勒几十年前帮助编制的独户住宅指数。

只是这一次,席勒并没有预测全美房价会崩盘,也没有预测房价会持续上涨。相反,席勒上周接受美国全国广播公司财经频道(CNBC)采访时似乎暗示,全美房价将出现一段时间的横盘走势。

席勒说:“房地产市场不同于股市,它通常是可以预测的。自2012年以来,房价一直在上涨,已经有大约 10 年的时间保持稳定增长。但随着这轮利率上升周期的结束,房产牛市可能即将结束。”

席勒认为,在房地产热潮期间,由于购房者急于锁定 2% 和 3% 的抵押贷款利率(他们知道这种情况不会持续太久),房地产市场出现了一些繁荣现象。

席勒说:“我认为对加息的恐惧影响了人们的想法。不只是房主,新购房者也想在利率进一步上升之前进场。他们想要锁定较低利率,所以这对房市产生了积极影响,但这种影响即将结束。”

去年夏天,席勒在接受美国全国广播公司财经频道采访时表示,疫情期间的房地产市场热潮(Pandemic Housing Boom)可能会被“房价下跌期”所取代。2022年8月,他表示:“芝加哥商品交易所(Chicago Mercantile Exchange)有一个房价期货市场……现在处于现货溢价状态:预计到2024年或2025年,房价将下跌逾10%。”

根据凯斯-席勒全国房价指数,全美房价在2022年6月至2023年1月期间确实下跌了5.1%,但到今年4月为止已经反弹了2.8%。

然而,上周席勒暗示,近期全国房价上涨可能只是季节性的。

席勒说:“房价上涨的部分原因只是季节性的。如今是夏季,房价通常会在夏季出现上涨。”

如果席勒的观点是正确的,今年春夏的全美房价上涨只是“季节性的”,这可能意味着随着房地产市场进入季节性放缓的秋冬季节,今年晚些时候房价将再次出现环比下跌。

席勒说:“我们将拭目以待:美国经济能否能实现软着陆。但这是一种可能性。不管怎样,我不会因此而感到恐慌。”(财富中文网)

译者:中慧言-王芳

Yale University economist Robert Shiller released a book back in March 2000 titled Irrational Exuberance, which proclaimed that the stock market was a bubble. Soon afterward, the tech bubble burst. Then, in 2004, the Yale economics professor called attention to spiking house prices with a paper titled “Is There a Bubble in the Housing Market?” Finally, in 2007—just before U.S. home prices crashed—Shiller correctly predicted that house prices would soon crash.

Fast-forward to 2023, and Shiller is once again closely watching the U.S. housing market after its period of exuberance during the pandemic, which included a 43% jump in U.S. home prices measured by the Case-Shiller National Home Price Index—a single-family index that Shiller helped to build many decades ago.

Only this time around Shiller isn’t predicting a national home price crash—or a sustained boom. Instead, Shiller went on CNBC last week and seemed to suggest that national house prices would go sideways for a bit.

“The housing market is different than the stock market, it’s normally forecastable. It has been growing since 2012, it has been about 10 years of steady growth in home prices. But it may be coming to an end with this interest rate rising cycle,” Shiller said.

Throughout the course of the boom, Shiller thinks some exuberance entered into the housing market as homebuyers rushed to lock in 2% and 3% mortgage rates, which they knew wouldn’t last long.

“I think the fear of interest rate increases has influenced people’s thinking. It is not just the homeowners, it’s new buyers who wanted to get in before the interest rates went up even more. They wanted to lock in, so that’s been a positive influence on the market, but it’s coming to an end,” Shiller said.

Last summer, Shiller suggested to CNBC that the Pandemic Housing Boom could be replaced by a period of declining house prices. In August 2022, he said: "The Chicago Mercantile Exchange has a futures market for home prices… That's in backwardation now; [home] prices are expected to fall by something a little over 10% by 2024 or 2025."

While national house prices as measured by Case-Shiller did fall 5.1% between June 2022 and January 2023, they've since rebounded 2.8% through April.

However, last week Shiller hinted that recent national house price gains might just be a seasonal blimp.

"Part of what's happening in the increase in home prices is just seasonal, it's the summer and it's typically going up in the summer," Shiller said.

If Shiller is right and national house price gains this spring and summer are just "seasonal," it could mean month-over-month price declines return later this year as the housing market enters into the seasonally slower fall and winter months.

"We'll see, whether we get a soft landing [of the U.S. economy]. But it's a possibility. I'm not panicking one way or another," Shiller said.