与美国住房市场已经触底的最新观点不同,经济研究咨询公司Pantheon Macroeconomics不久前发布的一份报告称,美国住房市场还远未迎来真正的反弹。

在他们看来,今年春季美国住房市场的回暖只是一个假象。

的资深美国经济学家基兰•克兰西(Kieran Clancy)写道:“越来越多的评论员称住房市场正在复苏,但这并不属实,为此我们感到很困惑。在2022年底房贷利率下降后,今年年初房地产销售量飙升,但近期因房贷利率回升该数值已经有所下跌。而房贷申请数量也表明,房地产销售量很快就会跌至周期内新低。”

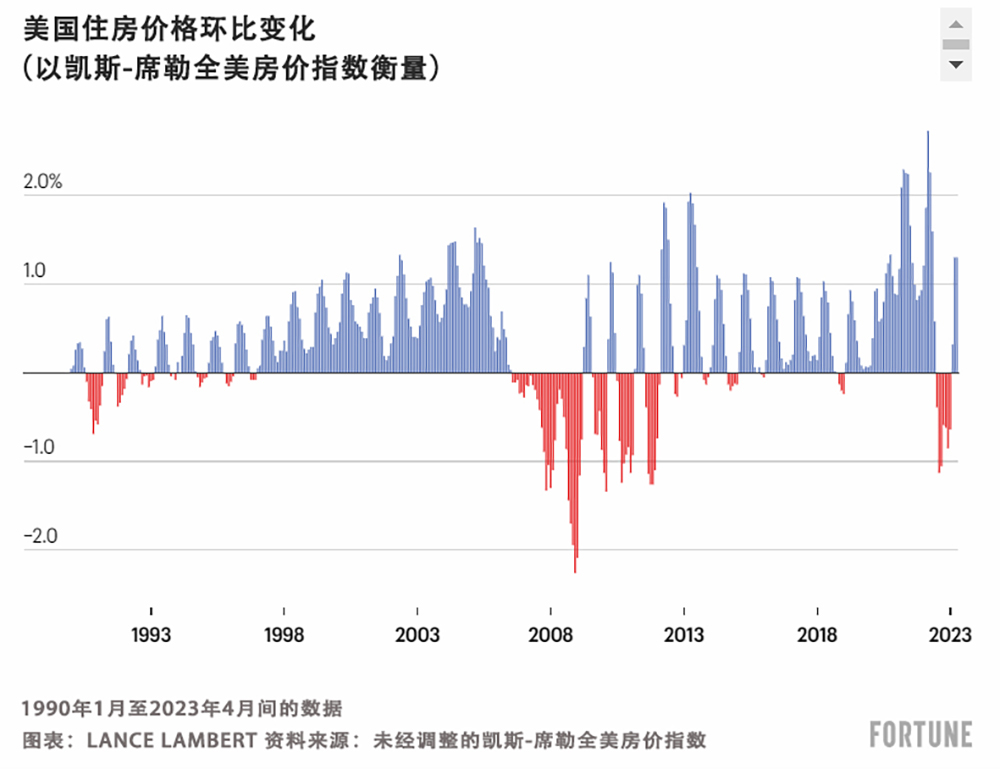

克兰西写道,阻碍住房市场真正复苏的关键因素在于负担能力。去年房贷利率的暴涨给市场带来冲击,加上疫情房产热(Pandemic Housing Boom)期间全美房价飙升超过40%,住房市场的负担能力受到了严重削弱,这是2006年房地产泡沫鼎盛时期以来从未见过的。

克兰西表示:“不过,从长远来看,房价尚有很大的下降空间;销售量骤减的滞后效应将导致房价持续大幅下跌。虽然价格变动的速度和幅度尚不确定,但其走向是显而易见的。”

不同于克兰西对美国房价会进一步下跌的预测,CoreLogic和Zillow等公司的经济学家认为,美国房价早在今年年初就已经触底。为了证明这一点,这些公司指出,现在房价与新房销售量又开始上涨了。

然而,住房市场春季优于预期的表现并不足以说服Pantheon Macroeconomics。该咨询公司的克兰西特别指出,住房建筑商状况的好转是由“他们大力度的折扣和转售房屋库存量紧张推动的,而非因为住房市场已经真正开始复苏。”

克兰西写道:“然而,新房变得更加热销并不会改变整体情况。换句话说,在市场负担能力改善之前,整体市场活动是不可能持久复苏的。当前,中等价位现有单户住宅的购置者每月偿还的房贷相当于劳动者平均税后月收入的一半左右,而新冠疫情前这一比例为30%至35%。除非市场负担能力改善(这需要房贷利率下调,房价降低,或两者并驾齐驱),否则住房销售将难以复苏。简言之,住房市场并未进入复苏的早期阶段;只不过房地产业的低迷开始从需求、销售量和建筑项目的锐减向价格和住房相关消费支出的下降演变。”

记住,当像Pantheon Macroeconomics这样的公司说到“美国房价”时,他们指的是全美整体的房价水平。(财富中文网)

译者:中慧言-刘嘉欢

与美国住房市场已经触底的最新观点不同,经济研究咨询公司Pantheon Macroeconomics不久前发布的一份报告称,美国住房市场还远未迎来真正的反弹。

在他们看来,今年春季美国住房市场的回暖只是一个假象。

的资深美国经济学家基兰•克兰西(Kieran Clancy)写道:“越来越多的评论员称住房市场正在复苏,但这并不属实,为此我们感到很困惑。在2022年底房贷利率下降后,今年年初房地产销售量飙升,但近期因房贷利率回升该数值已经有所下跌。而房贷申请数量也表明,房地产销售量很快就会跌至周期内新低。”

克兰西写道,阻碍住房市场真正复苏的关键因素在于负担能力。去年房贷利率的暴涨给市场带来冲击,加上疫情房产热(Pandemic Housing Boom)期间全美房价飙升超过40%,住房市场的负担能力受到了严重削弱,这是2006年房地产泡沫鼎盛时期以来从未见过的。

克兰西表示:“不过,从长远来看,房价尚有很大的下降空间;销售量骤减的滞后效应将导致房价持续大幅下跌。虽然价格变动的速度和幅度尚不确定,但其走向是显而易见的。”

不同于克兰西对美国房价会进一步下跌的预测,CoreLogic和Zillow等公司的经济学家认为,美国房价早在今年年初就已经触底。为了证明这一点,这些公司指出,现在房价与新房销售量又开始上涨了。

然而,住房市场春季优于预期的表现并不足以说服Pantheon Macroeconomics。该咨询公司的克兰西特别指出,住房建筑商状况的好转是由“他们大力度的折扣和转售房屋库存量紧张推动的,而非因为住房市场已经真正开始复苏。”

克兰西写道:“然而,新房变得更加热销并不会改变整体情况。换句话说,在市场负担能力改善之前,整体市场活动是不可能持久复苏的。当前,中等价位现有单户住宅的购置者每月偿还的房贷相当于劳动者平均税后月收入的一半左右,而新冠疫情前这一比例为30%至35%。除非市场负担能力改善(这需要房贷利率下调,房价降低,或两者并驾齐驱),否则住房销售将难以复苏。简言之,住房市场并未进入复苏的早期阶段;只不过房地产业的低迷开始从需求、销售量和建筑项目的锐减向价格和住房相关消费支出的下降演变。”

记住,当像Pantheon Macroeconomics这样的公司说到“美国房价”时,他们指的是全美整体的房价水平。(财富中文网)

译者:中慧言-刘嘉欢

In contrast to the emerging narrative that the U.S. housing market has bottomed, a recent report from economic research consultancy firm Pantheon Macroeconomics argues that the housing market is far from experiencing a true rebound.

In their eyes, the U.S. housing market’s bounce this spring was simply a head fake.

“We are baffled by the emerging narrative in the commentariat that housing is now recovering, because it isn’t. Home sales jumped at the start of the year, lagging the late-2022 dip in mortgage rates, but they have fallen more recently thanks to the latest back-up in rates, and mortgage applications signal that they will soon dip to a new cycle low,” wrote Kieran Clancy, the senior U.S. economist at Pantheon Macroeconomics.

Pantheon Macroeconomics

The key hurdle to a true recovery in the housing market, Clancy writes, is affordability. Last year’s mortgage rate shock, combined with national home prices spiking over 40% during the Pandemic Housing Boom, has deteriorated housing affordability in a way unseen since the housing bubble peak in 2006.

“The broader point here, though, is that the bulk of the drop in home prices is yet to come; the lagged effect of the plunge in sales points to a steep and sustained drop. The speed and scale of the adjustment in prices is uncertain, but the direction of travel is clear,” wrote Clancy.

While Clancy thinks national house prices have further to fall, economists at firms like CoreLogic and Zillow think national home prices bottomed earlier this year. For evidence, those firms have pointed to the fact that national house prices, along with new home sales, are rising again.

However, the housing market's stronger-than-expected spring performance isn't enough to convince Pantheon Macroeconomics. In particular, Pantheon's Clancy points to the homebuilder rebound as driven by "aggressive [builder] discounts and a lack of resale inventory—not an actual housing market recovery.

"The shift in sales towards new homes does not change the bigger picture, however, which is that a durable recovery in overall market activity is out of the question until affordability improves. Mortgage payments for a buyer of a median-priced existing single-family home are now about half of average after-tax incomes, up from 30-to-35% pre-Covid. Home sales can’t recover until affordability improves, which requires lower mortgage rates, or falling home prices, or both," wrote Clancy. "In short, the housing market is not in the early stages of recovery; the downturn merely is morphing from a collapse in demand, sales, and construction, to falling prices and housing-related consumption spending."

Keep in mind, when a firm like Pantheon Macroeconomics says "U.S. home prices" they're talking about a national aggregate.