虽然过去一年多以来,不断有人预测美国将陷入经济衰退,美国持续加息还面临恶性通胀,但美国的劳动力市场却继续证明着它的弹性。7月7日,美国政府数据向对一天前出炉的惊人数据感到担忧的华尔街投资者,发布了一份“恰到好处的”就业报告。美国劳工统计局(Bureau of Labor Statistics)7月7日的报告显示,6月美国雇主新增209,000个就业岗位。经济学家们普遍预测美国将新增230,000个就业岗位。这个数据未能达到经济学家们的预期,是自2021年1月以来幅度最小的月度涨幅,但对交易商而言却是好消息。7月6日ADP的私人工资报告称,6月私营行业新增497,000个就业岗位,这令交易商感到震惊。ADP的数据让人们担心,美联储(Federal Reserve)可能需要继续加息,才能放慢经济增长速度,真正控制通货膨胀。但7月7日美国劳工统计局的报告是15个月来美国就业增长速度首次低于经济学家们的预期,而且专家们认为,这实际上是好消息。

工资处理机构UKG的劳动力经济学家戴夫·吉尔伯森表示,尽管就业增长“或许表现并不出色”,但他依旧没有发现劳动力市场存在任何“裂痕”,而且最近就业增长放缓让美联储可以实现软着陆,即在不发生引发失业潮的经济衰退的情况下降低通胀。他说:“6月,美国劳动力市场有所降温,新增就业增速放缓,这有助于实现备受期待的经济软着陆。7月7日的报告进一步证实了UKG的评估,即劳动力市场状态良好,但并未出现过热。”

最新就业数据显然并不火爆,但6月新增就业足以将失业率从5月的3.7%下降到3.6%。美联储的数据显示,相比之下,过去十年的平均失业率为5.1%。

贝莱德(BlackRock)的全球固定收益首席投资官和贝莱德全球配置投资团队主管里克·里德对《财富》杂志表示:“新增209,000个就业岗位虽然低于我们和华尔街经济学家们的一致预估,但劳动力市场数据并不妨碍我们认为美国的就业环境依旧是稳健的。劳动力市场整体上显然依旧运转良好,并且尽管利率持续升高,但劳动力市场并没有出现太多的动荡迹象。”

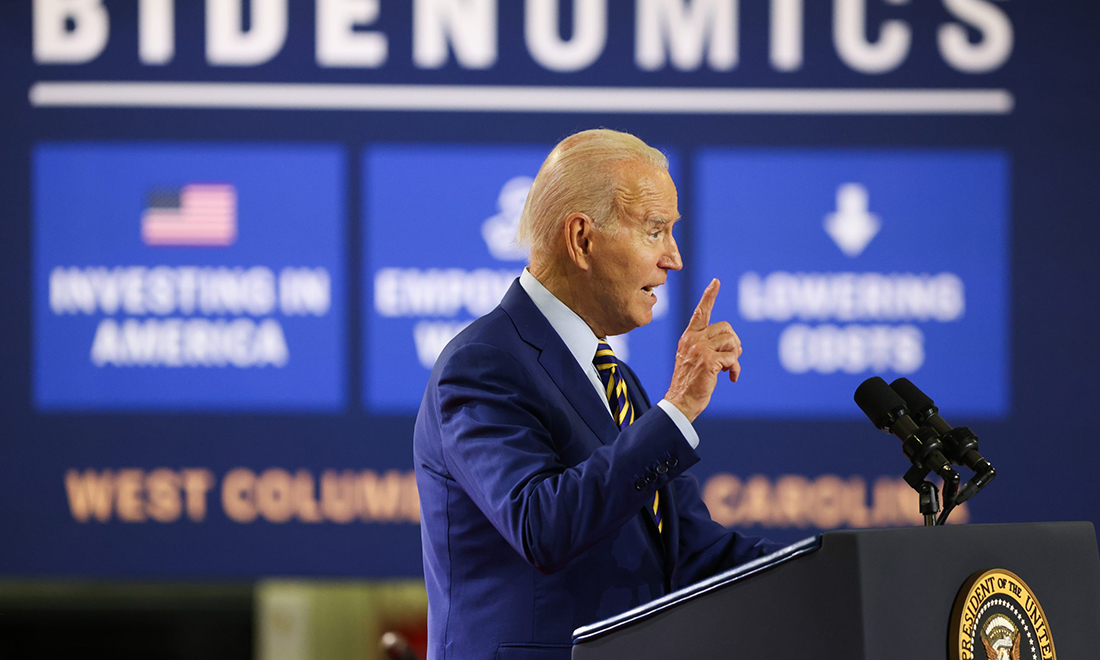

美国总统乔·拜登的政府很快对7月7日稳健的就业报告欢呼雀跃,称这证明“拜登经济学正在发挥作用”,并表示目前连续数月的低失业率,是自20世纪60年代以来任何十年间前所未见的。

白宫在一份声明中指出:“通胀率下降了超过一半。我们看到经济增长速度稳定。这就是拜登经济学,即通过创造就业、降低努力工作的家庭的生活成本和在美国进行明智的投资等措施发展经济。”

招聘平台Indeed Hiring Lab的经济研究负责人尼克·邦克告诉《财富》杂志,经济学家或投资者不应该因为209,000个新增就业岗位而退缩不前。由于美国人口增长大幅放缓,邦克认为,美国经济只需要每个月增加60,000至80,000个就业岗位,就能够维持当前的失业率。他解释道:“因此超过200,000个新增就业岗位,比维持劳动力市场紧张所需要的新增就业岗位数量多了一倍以上。”

美联储的数据显示,6月核心劳动力就业与人口比率,即25岁至54岁的上班族在劳动力队伍中的占比,也上涨至22年来的新高80.9%。女性的这个比例达到75.3%,达到史上最高水平。

邦克表示,核心劳动力就业数据证明,金融界和实体经济对经济状况的悲观情绪,并没有“影响”劳动力市场。

他说:“工资上涨幅度不温不火,但按照任何客观标准来看,人才招聘依旧强劲。去年,我们担心人们可能不会重新就业,但现在处于最佳工作年龄的人群正在重新进入劳动力队伍。2023年上半年,美国劳动力市场表现强劲。除非发生任何戏剧性的变化,才会影响就业市场的发展轨迹。”

美国经济的另外一个积极信号是,6月末制造业令人失望的数据发布之后,7月7日的数据显示服务业表现依旧强劲。6月,ISM Services的采购经理人指数(PMI)从5月的50.3反弹到53.9,达到自今年2月以来的最高水平。PMI指数通过库存、新订单和产量等数据来衡量服务业的健康状况。PMI指数高于50意味着服务业正在扩张。

PMI指数还表明服务业的成本性通胀正在下降。联信银行(Comerica Bank)的首席经济学家比尔·亚当斯在提到该数据时称:“6月ISM Services的PMI指数带来了好消息,经济活动大幅增长,原材料成本压力显著下降。”他将此称为一个“恰到好处的”惊喜。

未来经济、劳动力市场和美联储将会如何变化?

虽然最近美国经济有一连串好消息,但一些专家依旧认为,经济衰退不可避免。例如,富国银行投资研究所(Wells Fargo Investment Institute)的总裁达雷尔·科朗克在今年6月的年中前景展望报告中指出,依旧有充分的证据证明“经济衰退近在眼前”,他提到了世界大型企业联合会(Conference Board)持续下降的先行经济指数(Leading Economic Index)。该指数以建筑许可证、平均每周工作时间和制造商新订单等数据,分析经济健康状况。

Indeed Hiring Lab的邦克承认,劳动力市场也表现出“增长放缓”的迹象,但他认为在此之前,劳动力市场一直表现强劲。他说:“虽然万事无保证,但美国劳动力市场依旧强劲意味着美国经济将以更缓慢但更可持续的速度增长。经济衰退会发生。但目前,对新招聘岗位的需求持续高涨,而且雇主依旧在努力留住现有员工。”

并非只有邦克从最新就业报告里看到了好的一面。

ZipRecruiter的首席经济学家茱莉娅·波拉克对《财富》杂志表示,尽管有迹象表明美联储“终于开始产生不利影响”,但她仍然对劳动力市场的未来感到乐观。这位经济学家称,就业水平依旧远低于没有新冠疫情的情况下应该达到的水平,这意味着在许多行业将迎来持续的“追赶性招聘”。

她说:“最近去过餐厅或机场的人都知道美国仍然存在人手不足的问题。”她还表示,6月的每周平均收益增长率为3.7%,这也符合“通胀持续放缓”的趋势,将为美联储提供帮助。

高盛资产管理(Goldman Sachs Asset Management)的全球战略咨询解决方案主管康迪斯·谢指出,最近的就业数据证明,劳动力市场依旧“紧张”,这会让美联储官员持续加息,但这不会持续太久。

她告诉《财富》杂志:“数据再次证明,劳动力再平衡问题仍然存在。美联储本月准备继续加息……然而,我们依旧预计,美联储将很快达到其终点利率,使其数十年来最激进的紧缩行动接近尾声。”(财富中文网)

译者:刘进龙

审校:汪皓

虽然过去一年多以来,不断有人预测美国将陷入经济衰退,美国持续加息还面临恶性通胀,但美国的劳动力市场却继续证明着它的弹性。7月7日,美国政府数据向对一天前出炉的惊人数据感到担忧的华尔街投资者,发布了一份“恰到好处的”就业报告。美国劳工统计局(Bureau of Labor Statistics)7月7日的报告显示,6月美国雇主新增209,000个就业岗位。经济学家们普遍预测美国将新增230,000个就业岗位。这个数据未能达到经济学家们的预期,是自2021年1月以来幅度最小的月度涨幅,但对交易商而言却是好消息。7月6日ADP的私人工资报告称,6月私营行业新增497,000个就业岗位,这令交易商感到震惊。ADP的数据让人们担心,美联储(Federal Reserve)可能需要继续加息,才能放慢经济增长速度,真正控制通货膨胀。但7月7日美国劳工统计局的报告是15个月来美国就业增长速度首次低于经济学家们的预期,而且专家们认为,这实际上是好消息。

工资处理机构UKG的劳动力经济学家戴夫·吉尔伯森表示,尽管就业增长“或许表现并不出色”,但他依旧没有发现劳动力市场存在任何“裂痕”,而且最近就业增长放缓让美联储可以实现软着陆,即在不发生引发失业潮的经济衰退的情况下降低通胀。他说:“6月,美国劳动力市场有所降温,新增就业增速放缓,这有助于实现备受期待的经济软着陆。7月7日的报告进一步证实了UKG的评估,即劳动力市场状态良好,但并未出现过热。”

最新就业数据显然并不火爆,但6月新增就业足以将失业率从5月的3.7%下降到3.6%。美联储的数据显示,相比之下,过去十年的平均失业率为5.1%。

贝莱德(BlackRock)的全球固定收益首席投资官和贝莱德全球配置投资团队主管里克·里德对《财富》杂志表示:“新增209,000个就业岗位虽然低于我们和华尔街经济学家们的一致预估,但劳动力市场数据并不妨碍我们认为美国的就业环境依旧是稳健的。劳动力市场整体上显然依旧运转良好,并且尽管利率持续升高,但劳动力市场并没有出现太多的动荡迹象。”

美国总统乔·拜登的政府很快对7月7日稳健的就业报告欢呼雀跃,称这证明“拜登经济学正在发挥作用”,并表示目前连续数月的低失业率,是自20世纪60年代以来任何十年间前所未见的。

白宫在一份声明中指出:“通胀率下降了超过一半。我们看到经济增长速度稳定。这就是拜登经济学,即通过创造就业、降低努力工作的家庭的生活成本和在美国进行明智的投资等措施发展经济。”

招聘平台Indeed Hiring Lab的经济研究负责人尼克·邦克告诉《财富》杂志,经济学家或投资者不应该因为209,000个新增就业岗位而退缩不前。由于美国人口增长大幅放缓,邦克认为,美国经济只需要每个月增加60,000至80,000个就业岗位,就能够维持当前的失业率。他解释道:“因此超过200,000个新增就业岗位,比维持劳动力市场紧张所需要的新增就业岗位数量多了一倍以上。”

美联储的数据显示,6月核心劳动力就业与人口比率,即25岁至54岁的上班族在劳动力队伍中的占比,也上涨至22年来的新高80.9%。女性的这个比例达到75.3%,达到史上最高水平。

邦克表示,核心劳动力就业数据证明,金融界和实体经济对经济状况的悲观情绪,并没有“影响”劳动力市场。

他说:“工资上涨幅度不温不火,但按照任何客观标准来看,人才招聘依旧强劲。去年,我们担心人们可能不会重新就业,但现在处于最佳工作年龄的人群正在重新进入劳动力队伍。2023年上半年,美国劳动力市场表现强劲。除非发生任何戏剧性的变化,才会影响就业市场的发展轨迹。”

美国经济的另外一个积极信号是,6月末制造业令人失望的数据发布之后,7月7日的数据显示服务业表现依旧强劲。6月,ISM Services的采购经理人指数(PMI)从5月的50.3反弹到53.9,达到自今年2月以来的最高水平。PMI指数通过库存、新订单和产量等数据来衡量服务业的健康状况。PMI指数高于50意味着服务业正在扩张。

PMI指数还表明服务业的成本性通胀正在下降。联信银行(Comerica Bank)的首席经济学家比尔·亚当斯在提到该数据时称:“6月ISM Services的PMI指数带来了好消息,经济活动大幅增长,原材料成本压力显著下降。”他将此称为一个“恰到好处的”惊喜。

未来经济、劳动力市场和美联储将会如何变化?

虽然最近美国经济有一连串好消息,但一些专家依旧认为,经济衰退不可避免。例如,富国银行投资研究所(Wells Fargo Investment Institute)的总裁达雷尔·科朗克在今年6月的年中前景展望报告中指出,依旧有充分的证据证明“经济衰退近在眼前”,他提到了世界大型企业联合会(Conference Board)持续下降的先行经济指数(Leading Economic Index)。该指数以建筑许可证、平均每周工作时间和制造商新订单等数据,分析经济健康状况。

Indeed Hiring Lab的邦克承认,劳动力市场也表现出“增长放缓”的迹象,但他认为在此之前,劳动力市场一直表现强劲。他说:“虽然万事无保证,但美国劳动力市场依旧强劲意味着美国经济将以更缓慢但更可持续的速度增长。经济衰退会发生。但目前,对新招聘岗位的需求持续高涨,而且雇主依旧在努力留住现有员工。”

并非只有邦克从最新就业报告里看到了好的一面。

ZipRecruiter的首席经济学家茱莉娅·波拉克对《财富》杂志表示,尽管有迹象表明美联储“终于开始产生不利影响”,但她仍然对劳动力市场的未来感到乐观。这位经济学家称,就业水平依旧远低于没有新冠疫情的情况下应该达到的水平,这意味着在许多行业将迎来持续的“追赶性招聘”。

她说:“最近去过餐厅或机场的人都知道美国仍然存在人手不足的问题。”她还表示,6月的每周平均收益增长率为3.7%,这也符合“通胀持续放缓”的趋势,将为美联储提供帮助。

高盛资产管理(Goldman Sachs Asset Management)的全球战略咨询解决方案主管康迪斯·谢指出,最近的就业数据证明,劳动力市场依旧“紧张”,这会让美联储官员持续加息,但这不会持续太久。

她告诉《财富》杂志:“数据再次证明,劳动力再平衡问题仍然存在。美联储本月准备继续加息……然而,我们依旧预计,美联储将很快达到其终点利率,使其数十年来最激进的紧缩行动接近尾声。”(财富中文网)

译者:刘进龙

审校:汪皓

Despite more than a year of consistent recession predictions, rising interest rates, and stubborn inflation, the labor market continues to prove its resilience. On July 7, government data revealed something like a Goldilocks jobs report to Wall Street investors who had been worried by a shocking data drop the day before. U.S. employers added 209,000 jobs in June, the Bureau of Labor Statistics (BLS) reported on July 7. The figure missed economists’ consensus forecast for 230,000 new jobs and amounted to the smallest monthly gain since January 2021—but that was good news for traders who were jarred by July 6’s ADP private payrolls report, claiming that 497,000 jobs were added to the private sector in June. The ADP data had sparked concerns that the Federal Reserve may need to keep raising interest rates in order to slow the economy and truly tame inflation. But July 7’s BLS report was the first time in 15 months that job growth has come in below economists’ expectations, and the experts argue that actually, that’s good news.

Dave Gilbertson, a labor economist at payroll processor UKG, said that although job growth “might not blow the doors off,” he still doesn’t see any “cracks” in the labor market, and the recent slowdown could enable the Fed to achieve a soft landing after all—where inflation fades without a job-killing recession. “The U.S. labor market moderated in June, as new job creation edged down—a step towards the much sought-after soft landing in the economy. July 7’s report reinforced UKG’s assessment that the labor market is holding up very well, but it’s not on fire,” he said.

The latest jobs data clearly weren’t red-hot, but June’s job gains were enough to push the unemployment rate down to 3.7%, from 3.6% the month before. That compares with an average unemployment rate of 5.1% over the past decade, according to Federal Reserve data.

“Despite coming in a bit below our and Street economists’ consensus estimates today, at 209,000 jobs gained, the labor market data did little to dissuade us from the view that the employment dynamic in the U.S. is still solid,” Rick Rieder, BlackRock’s chief investment officer of global fixed income and head of the BlackRock global allocation investment team, told Fortune. “The full labor market picture is clearly still running at a decent level and shows little sign of rolling over, even as interest rates move higher and higher.”

The Biden administration was quick to celebrate the solid jobs report on July 7, calling it evidence of “Bidenomics in action” and noting that the current streak of consecutive months of low unemployment is unmatched in any decade going all the way back to the 1960s.

“Inflation has come down by more than half. We are seeing stable and steady growth. That’s Bidenomics—growing the economy by creating jobs, lowering costs for hardworking families, and making smart investments in America,” the White House said in a statement.

Nick Bunker, head of economic research at the Indeed Hiring Lab, told Fortune that 209,000 new jobs shouldn’t be balked at by economists or investors, either. Owing to a major slowdown in U.S. population growth, Bunker argued the economy only needs to add between 60,000 and 80,000 jobs per month to maintain current unemployment levels. “So gains in excess of 200,000 are more than double the pace needed to keep the labor market tight,” he explained.

The prime-age employment-to-population ratio, which measures the share of workers ages 25 to 54 in the labor force, also rose to a 22-year high of 80.9% in June, according to Federal Reserve data. And among women, it reached 75.3%, the highest level on record.

Bunker said the prime-age employment data is evidence that persistent pessimism about the state of the economy from both Wall Street and Main Street hasn’t yet “weighed down” the labor market.

“Payroll gains have moderated, but hiring continues to be strong by any objective standard. People in their prime working years are rejoining the labor force after concerns last year that workers would never return,” he said. “The U.S. labor market wrapped up the first half of 2023 in a position of strength. It’ll take something dramatic happening to derail it anytime soon.”

In another positive sign for the U.S. economy, after disappointing data from the manufacturing sector came in late June, the services sector showed continued strength on July 7. The ISM Services Purchasing Managers’ Index (PMI), which measures the health of the services sector by looking at data like inventories, new orders, and production, rebounded from 50.3 in May to 53.9 last month, its highest level since February. A reading above 50 indicates expansion in the sector.

The index also revealed fading cost inflation in the services sector. “The ISM Services PMI delivered excellent news in June, with a solid increase in activity and input cost pressures cooling notably,” Bill Adams, Comerica Bank’s chief economist, said of the data, calling it a “Goldilocks” surprise.

What’s next for the economy, the labor market, and the Fed?

Despite the recent string of good news for the economy, some experts remain convinced that a recession is inevitable. Wells Fargo Investment Institute president Darrell Cronk, for example, said the evidence remains overwhelming that a “recession is at our doorstep” at a midyear outlook presentation in June, pointing to the consistent drop in the Conference Board’s Leading Economic Index, which looks at data like building permits, average weekly hours worked, and manufacturers’ new orders to get a sense of the health of the economy.

Indeed’s Bunker admitted that the labor market is also showing signs of “slowing,” but he noted that it’s doing so from a position of strength. “Nothing is guaranteed, but the U.S. labor market continues to point toward a slower, but more sustainable pace of economic growth,” he said. “Recessions happen. But for now, demand for new hires remains elevated and employers are still holding on to the workers they have.”

Bunker is not the only one seeing the bright side of the latest jobs report, either.

ZipRecruiter’s chief economist Julia Pollak told Fortune that even though there were signs that the Fed’s rate hikes are “finally biting,” she remains optimistic about the future of the labor market. The economist noted that employment levels are still well below what they would have been without the pandemic, which means there’s ongoing “catch-up hiring” in many industries.

“Anyone who has been to a restaurant or airport lately knows America is still understaffed,” she said, adding that average weekly earnings growth of 3.7% in June was also “consistent with a continued slowdown in inflation” that will help the Fed.

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, said that the latest jobs data shows the labor market remains “tight,” which will lead Fed officials to continue raising interest rates—but not for much longer.

“The print reinforces the fact that labor rebalancing issues persist,” she told Fortune. “The Fed is poised to continue its hiking cycle this month…However, we continue to expect that the Fed will soon reach its terminal rate, bringing it closer toward the end of its most aggressive tightening campaign in generations.”