一位对大规模股灾有深入了解的传奇投资者表示,美国股市即将泡沫破灭,其惨重程度将不亚于1929年和2000年的股灾。

英国亿万富翁杰里米·格兰瑟姆是投资管理公司GMO的联合创始人,据报道,该公司管理的资产接近650亿美元。

格兰瑟姆的个人资产预计为10亿美元。他之前估计,美国股市崩盘的概率为85%,之后他将这个概率下调至70%。

尽管他认为美国股市崩盘的概率下降,但他相信美国股市创造了一场泡沫破灭的完美风暴,例如资产价格,不过他表示,人工智能的出现推迟了泡沫破灭的时间。

在上周末发布的《WealthTrack》对他的采访中,擅长制定长期投资策略的格兰瑟姆称,近十年来,美国股市从“近乎完美”的环境中受益。

他说:“我只对大规模股市泡沫感兴趣,比如1929年、2000年和2021年,这是美国股市最严重的三次泡沫。我们已经符合了所有条件。”

格兰瑟姆目前经营以其自己的名字命名的家族基金会,该基金会专门从事绿色投资。他表示,这些“条件”是指长期经济上行周期、强劲的牛市和收益等。

在这些情景下,格兰瑟姆指出,之后市场都经历了“急速下跌”。

1929年的黑色星期四(Black Thursday),单日有140亿美元资金从股市蒸发;2000年,纳斯达克(Nasdaq)在不到两年内下跌76.81%;2021年,纳斯达克下跌10%。

格兰瑟姆提到今年6月的标准普尔500指数(S&P 500)较去年10月的低位上涨20%。他表示,在他预测的股市崩盘之前的股市反弹是“必然的和恰当的”。

格兰瑟姆的悲观预测经常被证明是正确的。

两年前,格兰瑟姆也曾经告诉《WealthTrack》,他预测股市会出现“史诗级”的泡沫,因为多个不同市场出现了极端交易,例如房地产市场、“网红股”市场和价格极低的债券市场等。

一年后,许多资产都经历了大规模回调,比如影业公司AMC等网红股在夏天大幅下跌。

考虑到这种内爆的影响严重程度不一,既有可能与1929年的股灾相当,也有可能与2000年“不太严重的”经济衰退类似,因此格兰瑟姆质疑:美国经济将以多快的速度陷入衰退,经济衰退将持续多长时间?利润率会下降到什么程度?

“利润率已经大幅下降,但情况可能更加严重。其他经济变量会有哪些变化,例如全球贸易问题、与中国的摩擦、战争危机等。这些因素会产生哪些影响?现在很难预测。”

人工智能“迷你泡沫”

格兰瑟姆称,科技行业的颠覆性技术引发的所谓迷你泡沫,“扰乱了”他的预测。

微软(Microsoft)等公司的股价暴涨。微软在今年4月召开的营收电话会议上提及了50次“人工智能”。

Meta自从宣布将业务重心从元宇宙转移到人工智能产品和服务之后,也得到了类似回报,其首席执行官马克·扎克伯格凭借在Meta持有的股份,个人财富暴涨约400亿美元。

格兰瑟姆说,他目前并不确定人工智能是否“发展速度足够快和足够强劲”,能够避免股市泡沫破灭。

这位投资专家表示,他之所以将股市崩盘的概率从“可怕的”85%下调到70%,是因为ChatGPT等技术的出现。

然而,他认为人工智能引起的股市反弹只涉及一个小众市场。他解释道:“谁都知道,在人工智能出现之前,情况已经非常复杂。我们要面对通货膨胀,还有美联储(Federal Reserve),我们要考虑利率会以多快的速度上涨以及会有多大上涨幅度,还要考虑战争的后续影响等。”

“自从ChatGPT发布以及去年10月和11月以来,迅速引起了人们的兴趣,而且人们关注的领域非常集中。”

格兰瑟姆指出,关于人工智能技术将对市场行情产生多大影响,不同的人会有不同看法。他表示,关于人工智能技术对社会的影响,存在着各种不同的意见。

格兰瑟姆说:“一些地球上最聪明的人认为人工智能没有意义,它只是通过试错学习的鹦鹉而已。还有人认为人工智能会改变一切,它将提高生产率,并在诸多方面带来改善。”

格兰瑟姆认为,人工智能的发展过程,与他预测的近期泡沫的演变过程并不一致:“距离传统泡沫破灭、传统的经济衰退、传统的利润率下降以及股市暴跌,还有一两年时间。这些情况可能发生在人工智能真正产生影响之前。”(财富中文网)

译者:刘进龙

审校:汪皓

一位对大规模股灾有深入了解的传奇投资者表示,美国股市即将泡沫破灭,其惨重程度将不亚于1929年和2000年的股灾。

英国亿万富翁杰里米·格兰瑟姆是投资管理公司GMO的联合创始人,据报道,该公司管理的资产接近650亿美元。

格兰瑟姆的个人资产预计为10亿美元。他之前估计,美国股市崩盘的概率为85%,之后他将这个概率下调至70%。

尽管他认为美国股市崩盘的概率下降,但他相信美国股市创造了一场泡沫破灭的完美风暴,例如资产价格,不过他表示,人工智能的出现推迟了泡沫破灭的时间。

在上周末发布的《WealthTrack》对他的采访中,擅长制定长期投资策略的格兰瑟姆称,近十年来,美国股市从“近乎完美”的环境中受益。

他说:“我只对大规模股市泡沫感兴趣,比如1929年、2000年和2021年,这是美国股市最严重的三次泡沫。我们已经符合了所有条件。”

格兰瑟姆目前经营以其自己的名字命名的家族基金会,该基金会专门从事绿色投资。他表示,这些“条件”是指长期经济上行周期、强劲的牛市和收益等。

在这些情景下,格兰瑟姆指出,之后市场都经历了“急速下跌”。

1929年的黑色星期四(Black Thursday),单日有140亿美元资金从股市蒸发;2000年,纳斯达克(Nasdaq)在不到两年内下跌76.81%;2021年,纳斯达克下跌10%。

格兰瑟姆提到今年6月的标准普尔500指数(S&P 500)较去年10月的低位上涨20%。他表示,在他预测的股市崩盘之前的股市反弹是“必然的和恰当的”。

格兰瑟姆的悲观预测经常被证明是正确的。

两年前,格兰瑟姆也曾经告诉《WealthTrack》,他预测股市会出现“史诗级”的泡沫,因为多个不同市场出现了极端交易,例如房地产市场、“网红股”市场和价格极低的债券市场等。

一年后,许多资产都经历了大规模回调,比如影业公司AMC等网红股在夏天大幅下跌。

考虑到这种内爆的影响严重程度不一,既有可能与1929年的股灾相当,也有可能与2000年“不太严重的”经济衰退类似,因此格兰瑟姆质疑:美国经济将以多快的速度陷入衰退,经济衰退将持续多长时间?利润率会下降到什么程度?

“利润率已经大幅下降,但情况可能更加严重。其他经济变量会有哪些变化,例如全球贸易问题、与中国的摩擦、战争危机等。这些因素会产生哪些影响?现在很难预测。”

人工智能“迷你泡沫”

格兰瑟姆称,科技行业的颠覆性技术引发的所谓迷你泡沫,“扰乱了”他的预测。

微软(Microsoft)等公司的股价暴涨。微软在今年4月召开的营收电话会议上提及了50次“人工智能”。

Meta自从宣布将业务重心从元宇宙转移到人工智能产品和服务之后,也得到了类似回报,其首席执行官马克·扎克伯格凭借在Meta持有的股份,个人财富暴涨约400亿美元。

格兰瑟姆说,他目前并不确定人工智能是否“发展速度足够快和足够强劲”,能够避免股市泡沫破灭。

这位投资专家表示,他之所以将股市崩盘的概率从“可怕的”85%下调到70%,是因为ChatGPT等技术的出现。

然而,他认为人工智能引起的股市反弹只涉及一个小众市场。他解释道:“谁都知道,在人工智能出现之前,情况已经非常复杂。我们要面对通货膨胀,还有美联储(Federal Reserve),我们要考虑利率会以多快的速度上涨以及会有多大上涨幅度,还要考虑战争的后续影响等。”

“自从ChatGPT发布以及去年10月和11月以来,迅速引起了人们的兴趣,而且人们关注的领域非常集中。”

格兰瑟姆指出,关于人工智能技术将对市场行情产生多大影响,不同的人会有不同看法。他表示,关于人工智能技术对社会的影响,存在着各种不同的意见。

格兰瑟姆说:“一些地球上最聪明的人认为人工智能没有意义,它只是通过试错学习的鹦鹉而已。还有人认为人工智能会改变一切,它将提高生产率,并在诸多方面带来改善。”

格兰瑟姆认为,人工智能的发展过程,与他预测的近期泡沫的演变过程并不一致:“距离传统泡沫破灭、传统的经济衰退、传统的利润率下降以及股市暴跌,还有一两年时间。这些情况可能发生在人工智能真正产生影响之前。”(财富中文网)

译者:刘进龙

审校:汪皓

A legendary investor whose expertise lies in major stock crashes says the market is heading toward a burst bubble, akin to the crises seen in 1929 and 2000.

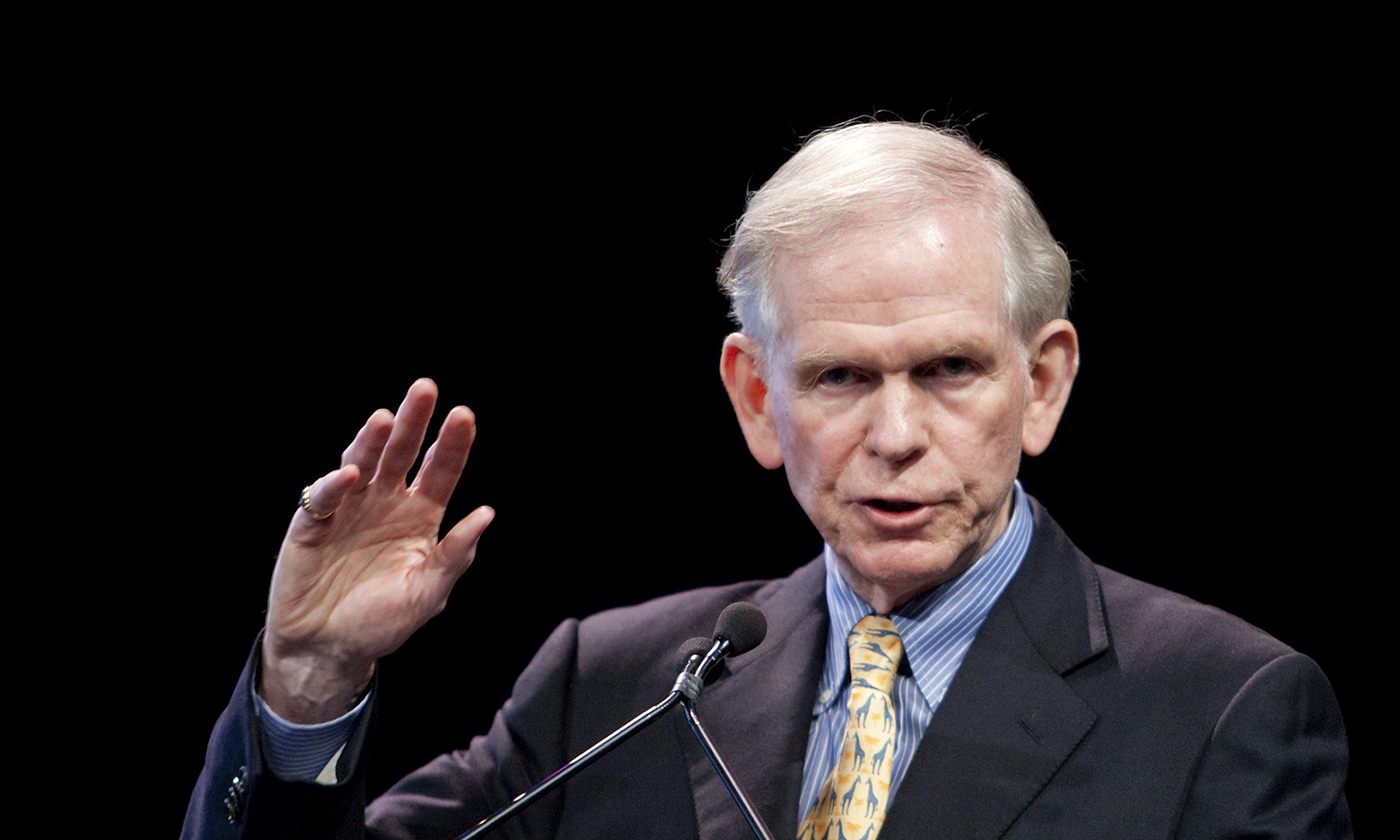

British billionaire Jeremy Grantham is cofounder of investment management company GMO, which reportedly handles a near $65 billion in assets.

Grantham, estimated to be worth $1 billion himself, previously estimated an 85% likelihood that the stock market would crash but has since downgraded that to 70%.

Despite the figure dropping, Grantham is convinced the market has created a perfect storm for bubbles—such as asset prices—to burst, but said the emergence of artificial intelligence has delayed the pop.

Speaking to WealthTrack in an interview published over last weekend, Grantham, who specializes in long-term investment strategy, said stocks had benefited from an “almost perfect” environment for nearly a decade.

“I’m only interested in the really great bubbles like 1929, 2000, and 2021, [which] are the three senior bubbles in [the] U.S stock market. We have checked off pretty well every one of the boxes,” he said.

Grantham, who now heads up a family foundation in his own name which specializes in green investments, said these “boxes” are periods of long economic upswings, a strong bull market, and strong earnings.

In each of these scenarios Grantham points out that the markets were then followed by a “sharp leg down.”

In 1929 it was Black Thursday when $14 billion was wiped off the market in a single day; in 2000 the Nasdaq lost 76.81% of its value in less than two years; and in 2021 it similarly took a 10% hit.

Grantham said that a rally before his predicted crash was “all present and correct,” pointing out that the S&P 500 had a 20% rise in June compared with its October low.

Grantham’s gloomy predictions have a track record of being right.

Two years ago Grantham similarly told WealthTrack he expected to see a bubble of “epic” proportions because a number of different markets were trading at extremes: variously the housing market, the “meme” stock market, and the bond market operating at extreme lows.

A year later many of these assets saw major corrections, with meme-motivated shares like movie-theater company AMC seeing a massive drop-off by the summer.

Given that the impact of such an implosion could range from the desolation of the 1929 crash to the “respectable” recession of 2000, Grantham questioned: How quickly and for how long will the economy go down? How low will profit margins fall?

“They have fallen a decent bit already, but they could do a lot worse. And how badly other economic variables will be—the trouble within global trade, the trouble with China, the trouble with the war. And how will that play out? It’s very difficult to tell.”

A.I. “mini-bubble”

Grantham said he was “disturbed” by the emergence of a so-called mini-bubble which has ballooned as a result of disrupters in the tech industry.

Businesses like Microsoft—which mentioned the phrase “artificial intelligence” 50 times on an earnings call in April—have seen massive growth to their share price.

Meta is enjoying similar returns, with CEO Mark Zuckerberg’s wealth spiking by around $40 billion—courtesy of the shares he owns in the platform—since making announcements about pivoting from the metaverse to focus on A.I. products and services.

Grantham said he is currently unsure as to whether A.I. will be “quick enough and strong enough” to keep the market bubble from bursting.

The investment expert said the emergence of technologies like ChatGPT was the reason he had scaled back his prediction of a “ridiculously high” 85% chance that the market would burst—to 70%.

However he countered that the A.I. rally was a niche market, explaining: “Lord knows this was complicated before A.I. raised its ugly head. We had inflation, the Fed, how quickly would rates go up, how far would they go up, how would the war play out—it goes on and on.

“Now we have, since ChatGPT and October and November last year, we have a new little flurry of interest that is very concentrated.”

How far the technology will go to change the course of the market depends on whom you ask, Grantham pointed out, saying there is a “scramble” of opinions on how the technology will impact society.

“Some of the brightest people on the planet say it’s all nonsense, it’s just a parrot learning by trial and error. Other people say it will change everything, it will double productivity and everything in between,” Grantham noted.

Grantham’s guess is that A.I. is not operating on the same timescale as the bubble in the near future he is predicting: “We have a year or two here to have a fairly traditional bubble losing air, a fairly traditional recession, and fairly traditional decline in profit margins and some grief in the stock markets. We can do that before the real effects of A.I. kick in.”