2022年6月,美联储(Federal Reserve)的主席杰罗姆·鲍威尔对记者表示,飙升的抵押贷款利率将有助于“重置”新冠疫情期间“过热的”房地产市场。

他在去年夏天告诉记者:“我想说,如果你计划买房,无论你是否是年轻人,都需要房地产市场进行重置。我们需要恢复到供需平衡的状态,并且通货膨胀下降,抵押贷款利率降低。”

鲍威尔后来在2022年9月承认“我在说到重置的时候,并没有查看特定的数据”,但他又称“美国的房地产市场可能必须经历一轮回调”,才能恢复平衡市场,而且“艰难的[房地产]市场回调”已经在进行当中。11月,他又进一步指出在新冠疫情期间形成了“房地产市场泡沫”,而且“房地产市场将迎来泡沫的另一个阶段”。

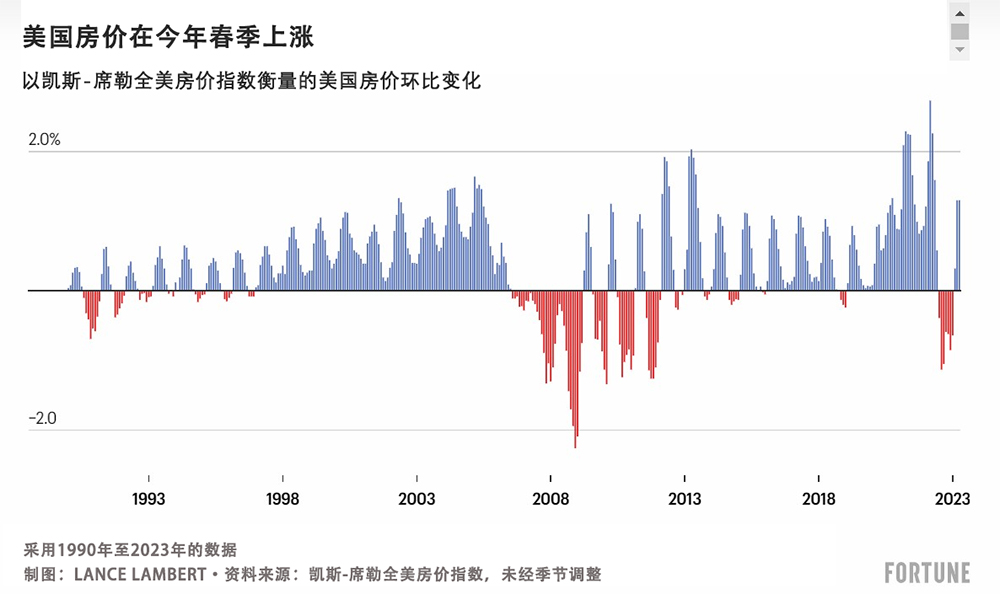

一些经济观察家认为,鲍威尔似乎在暗示房价可能大幅下跌。一段时间以来,美国的房价确实在下跌。从2022年6月至2023年1月,凯斯-席勒全美房价指数(Case-Shiller National Home Price Index)跟踪的美国房价下跌5.2%(季节调整后跌幅为3%)。

但这种趋势未能持续。今年春季,在美国西部和得克萨斯州最明显的“艰难的[房地产]市场回调”,失去了动力。房价并未趋于平稳,而是再次上涨。

6月27日,我们了解到凯斯-席勒跟踪的全美房价自2012年以来,首次出现同比负增长(-0.2%)。然而,与此同时,美国房价却经历了远高于预期的春季上涨。我们在6月27日了解到,3月至4月,美国房价上涨1.3%(季节调整后涨幅为0.5%)。这代表连续三个月环比上涨,使年初至今的房价上涨了2.3%。

鲍威尔在上周表示,他正密切关注房价再次上涨的情况。

鲍威尔说道:“房地产市场确实对利率非常敏感。房地产市场是最先感受到低利率或高利率影响的领域,我们在过去一年确实看到了这种现象。目前,我们看到房地产市场正在接近低谷,或许会有小幅上涨。我们正在密切关注市场形势。我确实认为,房租和房价会推高住房服务通胀[CPI跟踪的整体住房成本],但我认为它们不会快速上涨,而是会在低位徘徊。”

今年春季的房价反弹提出了一个问题:鲍威尔是否实现了他的目标?目前房地产市场是否变得更加“平衡”?

假设鲍威尔的目标并非是让房价下跌,而是希望通过增加库存水平来实现房地产市场“平衡”。毕竟如果房屋库存增长到足够高的水平,就能够减少竞价战的数量。

在去年抵押贷款利率飙升后不久,美国大部分地区的房屋库存水平确实开始上涨。然而,今年春季的需求反弹消化了增长的库存,截至今年5月,Realtor.com上挂牌出售的有效房源只有582,032套。虽然这比2022年5月增长了22%,但与2019年5月接近120万套的有效待售房源相比,今年5月的挂牌房源减少了50.5%。

尽管全美房价同比为负增长,但全国房价依旧再次上涨,而且转售库存量依旧非常紧张。对购房人而言,这听起来不像是“平衡”的市场状态。

为什么房地产市场依旧竞争激烈?

德意志银行(Deutsche Bank)认为,今年春季美国房地产市场反弹,进一步证明存在房屋缺口。新冠疫情期间的远程办公繁荣加快了美国各地对房地产的需求,加剧了房屋供应短缺。

德意志银行的分析师在今年5月发表的一篇文章里表示:“由于更高的利率和房价的抑制作用,美国房地产市场[去年秋天]度过了周期中段危机,但十年前在全球金融危机之后开始的周期并没有结束。至少房屋供应短缺的说法在方向上可能是正确的。”

美联储的一线希望是:虽然房地产市场依旧竞争激烈,但至少目前房租增长速度放缓。与房价不同,房租会被直接计入消费物价指数的通货膨胀计算。

另外一个好消息是,飙升的抵押贷款利率并没有冲击房屋建筑业。鲍威尔表示,最好的结果是在控制通胀的同时,不会导致房屋供应短缺进一步恶化。去年11月,鲍威尔对记者称“房地产市场存在长期供应短缺”,他表示“很难进行区域划分,很难建设足够多的住宅以满足公众的需求”。

因此,鲍威尔可能很高兴看到新建房屋销量和房屋开工量恢复增长。但如果住宅建设过热,可能刺激火爆的就业市场,这并非美联储目前期待看到的现象。(财富中文网)

译者:刘进龙

审校:汪皓

2022年6月,美联储(Federal Reserve)的主席杰罗姆·鲍威尔对记者表示,飙升的抵押贷款利率将有助于“重置”新冠疫情期间“过热的”房地产市场。

他在去年夏天告诉记者:“我想说,如果你计划买房,无论你是否是年轻人,都需要房地产市场进行重置。我们需要恢复到供需平衡的状态,并且通货膨胀下降,抵押贷款利率降低。”

鲍威尔后来在2022年9月承认“我在说到重置的时候,并没有查看特定的数据”,但他又称“美国的房地产市场可能必须经历一轮回调”,才能恢复平衡市场,而且“艰难的[房地产]市场回调”已经在进行当中。11月,他又进一步指出在新冠疫情期间形成了“房地产市场泡沫”,而且“房地产市场将迎来泡沫的另一个阶段”。

一些经济观察家认为,鲍威尔似乎在暗示房价可能大幅下跌。一段时间以来,美国的房价确实在下跌。从2022年6月至2023年1月,凯斯-席勒全美房价指数(Case-Shiller National Home Price Index)跟踪的美国房价下跌5.2%(季节调整后跌幅为3%)。

但这种趋势未能持续。今年春季,在美国西部和得克萨斯州最明显的“艰难的[房地产]市场回调”,失去了动力。房价并未趋于平稳,而是再次上涨。

6月27日,我们了解到凯斯-席勒跟踪的全美房价自2012年以来,首次出现同比负增长(-0.2%)。然而,与此同时,美国房价却经历了远高于预期的春季上涨。我们在6月27日了解到,3月至4月,美国房价上涨1.3%(季节调整后涨幅为0.5%)。这代表连续三个月环比上涨,使年初至今的房价上涨了2.3%。

鲍威尔在上周表示,他正密切关注房价再次上涨的情况。

鲍威尔说道:“房地产市场确实对利率非常敏感。房地产市场是最先感受到低利率或高利率影响的领域,我们在过去一年确实看到了这种现象。目前,我们看到房地产市场正在接近低谷,或许会有小幅上涨。我们正在密切关注市场形势。我确实认为,房租和房价会推高住房服务通胀[CPI跟踪的整体住房成本],但我认为它们不会快速上涨,而是会在低位徘徊。”

今年春季的房价反弹提出了一个问题:鲍威尔是否实现了他的目标?目前房地产市场是否变得更加“平衡”?

假设鲍威尔的目标并非是让房价下跌,而是希望通过增加库存水平来实现房地产市场“平衡”。毕竟如果房屋库存增长到足够高的水平,就能够减少竞价战的数量。

在去年抵押贷款利率飙升后不久,美国大部分地区的房屋库存水平确实开始上涨。然而,今年春季的需求反弹消化了增长的库存,截至今年5月,Realtor.com上挂牌出售的有效房源只有582,032套。虽然这比2022年5月增长了22%,但与2019年5月接近120万套的有效待售房源相比,今年5月的挂牌房源减少了50.5%。

尽管全美房价同比为负增长,但全国房价依旧再次上涨,而且转售库存量依旧非常紧张。对购房人而言,这听起来不像是“平衡”的市场状态。

为什么房地产市场依旧竞争激烈?

德意志银行(Deutsche Bank)认为,今年春季美国房地产市场反弹,进一步证明存在房屋缺口。新冠疫情期间的远程办公繁荣加快了美国各地对房地产的需求,加剧了房屋供应短缺。

德意志银行的分析师在今年5月发表的一篇文章里表示:“由于更高的利率和房价的抑制作用,美国房地产市场[去年秋天]度过了周期中段危机,但十年前在全球金融危机之后开始的周期并没有结束。至少房屋供应短缺的说法在方向上可能是正确的。”

美联储的一线希望是:虽然房地产市场依旧竞争激烈,但至少目前房租增长速度放缓。与房价不同,房租会被直接计入消费物价指数的通货膨胀计算。

另外一个好消息是,飙升的抵押贷款利率并没有冲击房屋建筑业。鲍威尔表示,最好的结果是在控制通胀的同时,不会导致房屋供应短缺进一步恶化。去年11月,鲍威尔对记者称“房地产市场存在长期供应短缺”,他表示“很难进行区域划分,很难建设足够多的住宅以满足公众的需求”。

因此,鲍威尔可能很高兴看到新建房屋销量和房屋开工量恢复增长。但如果住宅建设过热,可能刺激火爆的就业市场,这并非美联储目前期待看到的现象。(财富中文网)

译者:刘进龙

审校:汪皓

Back in June 2022, Fed Chair Jerome Powell told reporters that spiked mortgage rates would “reset” the “overheated” pandemic housing market.

“I’d say if you are a homebuyer, somebody or a young person looking to buy a home, you need a bit of a reset,” Powell told reporters last summer. “We need to get back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again.”

Powell later acknowledged in September that “when I say reset, I’m not looking at a particular specific set of data,” while adding, “We probably in the housing market have to go through a correction to get back” to a balanced market, and a “difficult [housing] correction” was already ongoing. In November, he went a step further and said a “housing bubble” had formed during the pandemic and “the housing market will go through the other side of that.”

To some economic onlookers, it sounded like Powell was insinuating that home prices might take a leg down. And for a while, national home prices were on the way down. Between June 2022 and January 2023, U.S. home prices as tracked by the Case-Shiller National Home Price Index fell 5.2% (or down 3% with seasonal adjustment).

That didn’t last long. This spring, that “difficult [housing] correction”—which was sharpest out West and in Texas—lost momentum. And instead of taking a breather, home prices took another jump up.

On June 27, we learned that national house prices as tracked by Case-Shiller went negative on a year-over-year basis (-0.2%) for the first time since 2012. However, it comes as prices are posting a stronger than expected spring run. Indeed, we also learned on June 27 that prices rose 1.3% between March and April (or 0.5% with seasonal adjustment). That marks three straight month-over-month gains and puts the year-to-date home price gains at 2.3%.

That fact that home prices are rising again is something that Powell said last week he's closely watching.

"Housing is certainly very interest [rate] sensitive. It's one of the first places that is either helped by low rates or held back by higher rates, and we certainly saw that over the course of the last year. We now see housing putting in a bottom, and maybe moving up a bit. We're watching that situation carefully. I do think we'll see rents and house prices filtering into housing services inflation [overall housing costs as tracked by CPI], and I don't see them coming up quickly. I see them wandering around at a low level," Powell said.

This spring's house price rebound raises the question: Did Powell accomplish his goal? Is this really a more "balanced" housing market?

Let's say, hypothetically, Powell's goal wasn't to bring down house prices, and instead he wanted to "balance" the housing market by pushing inventory levels back up. After all, if inventory rose enough, it could reduce the number of bidding wars.

Not long after mortgage rates spiked last year, inventory levels did begin to rise across much of the country. However, this spring's demand rebound soaked up those inventory gains, and by May there were only 582,032 active listings for sale on Realtor.com. While that's up 22% from May 2022, it's still down 50.5% from May 2019 when active listings totaled nearly 1.2 million.

Not only are national house prices rising again even as the year-over-year calculation goes negative, but resale inventory is also still very tight. That doesn't sound like much "balance" for buyers.

Why does the housing market remain so stubbornly competitive?

According to Deutsche Bank, the housing market's bounce back this spring is further proof that the housing market is under-built. That shortage was only intensified by the pandemic's remote work boom, which accelerated demand for housing across much of the country.

"The U.S. housing market was simply navigating a mid-cycle crisis [last fall] with higher rates and home prices acting to govern, but not derail a cycle that had started over a decade ago in the wake of the Great Financial Crisis," wrote Deutsche Bank analysts in a paper published last month. "If nothing else, the under-built narrative is likely directionally correct."

The silver lining for the Fed: While the housing market remains competitive, rent growth has slowed down, at least for now. And unlike house prices, rents are directly factored into the consumer price index's inflation calculation.

The other silver lining might be that spiked mortgage rates aren't translating into a homebuilding bust. Powell has suggested it would be best to tame inflation without making the housing shortage worse. Back in November, Powell told reporters that "there's a longer run housing shortage," adding that "it's hard to get zoning and hard to get housing built in sufficient quantities to meet the public's demand."

So Powell might be happy to see that new-home sales and housing starts are rising again. Then again, if residential construction heats up too much, it could add fuel to the strong labor market—which isn't exactly something the Federal Reserve wants right now.