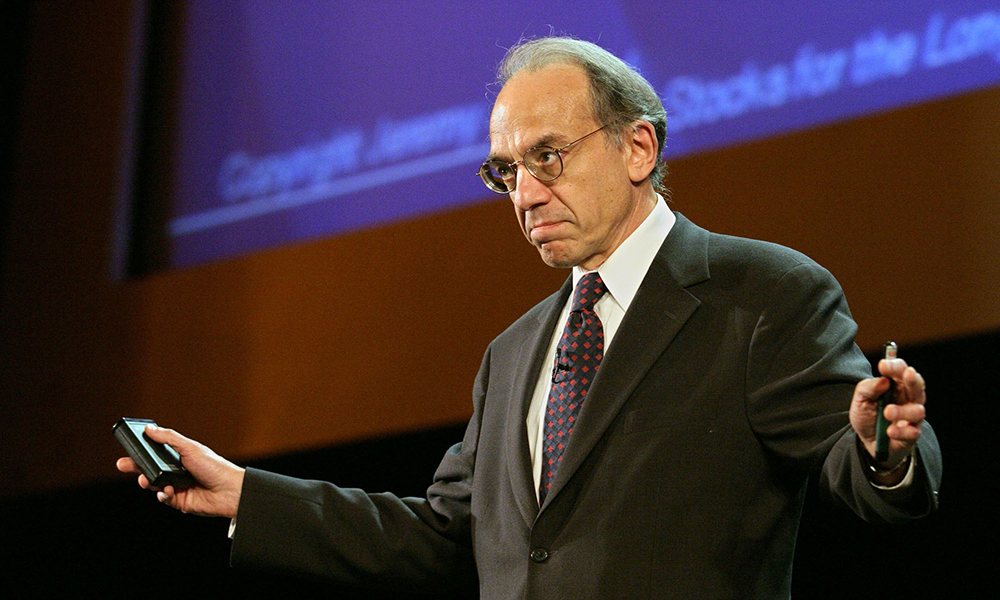

2023年年初,华尔街的多头并不多。在经历了残酷的一年之后,分析师和首席执行官们正在恢复元气。去年,标准普尔500指数(S&P 500)下挫近20%,专注科技股的纳斯达克综合指数(Nasdaq Composite)暴跌33%。对于大多数人来说,士气低落,但沃顿商学院(Wharton School)的教授杰里米·西格尔却感到乐观。

据Insider网站报道,他在WisdomTree的每周评论中写道:“我认为今年股市将表现非常好,美国股市将上涨15%至20%。大多数人认为,必须等到今年下半年才会出现反弹,但我认为这将在上半年出现。”

事实证明,西格尔的看法是正确的。今年迄今为止,标准普尔500指数的涨幅刚超过13%,与此同时,华尔街的许多看跌者也变得不那么看空了。但西格尔却反其道而行之,再次从人群中脱颖而出。

“今年下半年很难看到很多推动市场上行的动能出现。”他在6月26日告诉美国消费者新闻与商业频道(CNBC),并指出许多周期性股票已经“为温和衰退定价”,而且“如果发生这种情况,他也不会感到惊讶”。

尽管今年5月的失业率仍然接近新冠疫情前低点,但西格尔指出,申请失业救济人数上升,尤其是过去几周,这证明在美联储(Federal Reserve)加息的重压下,经济正在放缓。他说:“申请失业救济的情况并不乐观。”美国劳工统计局(Bureau of Labor Statistics)的数据显示,今年6月早些时候,每周初请失业金人数达到了自2021年10月以来的最高水平,为26.4万人。

西格尔还指出,“盈利疲软”以及重新开始学生贷款还款对消费者支出的影响,都是股市的潜在阻力。据投资银行Jefferies估计,9月1日恢复助学贷款支付后,美国人每月将面临约180亿美元的债务。经济学家一再警告说,这一费用将减缓消费者支出,而在高通胀和利率上升的情况下,消费者支出一直表现出惊人的弹性。

在6月16日至19日期间,摩根士丹利(Morgan Stanley)对约2,000名学生贷款借款人进行了调查,其中37%的人表示,他们需要削减其他方面的支出,以便在恢复学生贷款支付后每月偿还贷款,而34%的人称,他们根本无法偿还贷款。

西格尔说:“看到重新开始学生贷款还款,申请失业救济人数上升,我并未谈及灾难,而是当人们问:‘好吧,积极的一面是什么?’我的回答是:我只是没有看到那么多推动市场上行的动能出现。”

这位沃顿商学院的教授指出,不断上涨的房价和抵押贷款利率也在减缓消费支出(消费支出约占GDP增长的70%),这加大了经济衰退的可能性。

“在过去三年里,拥有住房的成本增加了两倍。实际收入发生了什么变化呢?停滞不前。”他说。他认为,许多购房者不会有资金用于“旅行、购车和其他一切维持经济发展的事物”。

西格尔一直在批评美联储在过去一年中对抗通胀的措施,认为美联储加息过快、过高,加大了经济衰退的可能性。对他而言,至少有一种积极的方式来看待即将到来的温和衰退。

西格尔说:“温和衰退积极的一面是,美联储不仅不会加息,而且我认为在今年年底之前,美联储可能降息。尽管所有人都认为这不可能,但我一直在谈论这一情况。”(财富中文网)

译者:中慧言-王芳

2023年年初,华尔街的多头并不多。在经历了残酷的一年之后,分析师和首席执行官们正在恢复元气。去年,标准普尔500指数(S&P 500)下挫近20%,专注科技股的纳斯达克综合指数(Nasdaq Composite)暴跌33%。对于大多数人来说,士气低落,但沃顿商学院(Wharton School)的教授杰里米·西格尔却感到乐观。

据Insider网站报道,他在WisdomTree的每周评论中写道:“我认为今年股市将表现非常好,美国股市将上涨15%至20%。大多数人认为,必须等到今年下半年才会出现反弹,但我认为这将在上半年出现。”

事实证明,西格尔的看法是正确的。今年迄今为止,标准普尔500指数的涨幅刚超过13%,与此同时,华尔街的许多看跌者也变得不那么看空了。但西格尔却反其道而行之,再次从人群中脱颖而出。

“今年下半年很难看到很多推动市场上行的动能出现。”他在6月26日告诉美国消费者新闻与商业频道(CNBC),并指出许多周期性股票已经“为温和衰退定价”,而且“如果发生这种情况,他也不会感到惊讶”。

尽管今年5月的失业率仍然接近新冠疫情前低点,但西格尔指出,申请失业救济人数上升,尤其是过去几周,这证明在美联储(Federal Reserve)加息的重压下,经济正在放缓。他说:“申请失业救济的情况并不乐观。”美国劳工统计局(Bureau of Labor Statistics)的数据显示,今年6月早些时候,每周初请失业金人数达到了自2021年10月以来的最高水平,为26.4万人。

西格尔还指出,“盈利疲软”以及重新开始学生贷款还款对消费者支出的影响,都是股市的潜在阻力。据投资银行Jefferies估计,9月1日恢复助学贷款支付后,美国人每月将面临约180亿美元的债务。经济学家一再警告说,这一费用将减缓消费者支出,而在高通胀和利率上升的情况下,消费者支出一直表现出惊人的弹性。

在6月16日至19日期间,摩根士丹利(Morgan Stanley)对约2,000名学生贷款借款人进行了调查,其中37%的人表示,他们需要削减其他方面的支出,以便在恢复学生贷款支付后每月偿还贷款,而34%的人称,他们根本无法偿还贷款。

西格尔说:“看到重新开始学生贷款还款,申请失业救济人数上升,我并未谈及灾难,而是当人们问:‘好吧,积极的一面是什么?’我的回答是:我只是没有看到那么多推动市场上行的动能出现。”

这位沃顿商学院的教授指出,不断上涨的房价和抵押贷款利率也在减缓消费支出(消费支出约占GDP增长的70%),这加大了经济衰退的可能性。

“在过去三年里,拥有住房的成本增加了两倍。实际收入发生了什么变化呢?停滞不前。”他说。他认为,许多购房者不会有资金用于“旅行、购车和其他一切维持经济发展的事物”。

西格尔一直在批评美联储在过去一年中对抗通胀的措施,认为美联储加息过快、过高,加大了经济衰退的可能性。对他而言,至少有一种积极的方式来看待即将到来的温和衰退。

西格尔说:“温和衰退积极的一面是,美联储不仅不会加息,而且我认为在今年年底之前,美联储可能降息。尽管所有人都认为这不可能,但我一直在谈论这一情况。”(财富中文网)

译者:中慧言-王芳

At the beginning of 2023, there weren’t many bulls on Wall Street. Analysts and CEOs were recovering after a brutal year in which the S&P 500 sank nearly 20% and the tech-heavy Nasdaq Composite cratered 33%. For most, morale was low, but Wharton professor Jeremy Siegel was feeling optimistic.

“I think we should have a very good year for equities, with U.S. markets up 15% to 20%,” he wrote in his weekly WisdomTree commentary, per Insider. “Most think these gains have to wait for the second half of the year, but I can see this happening in the first half.”

Siegel turned out to be right. The S&P 500 is up just over 13% year to date, and many of Wall Street’s bears have become, well, less bearish in the meantime. But Siegel has done quite the opposite, once again standing apart from the crowd.

“It’s hard to see a lot of upside catalysts for the market in the second half of this year,” he told CNBC on June 26, noting that many cyclical stocks are already “priced for a mild recession” and he “wouldn’t be surprised if that happened.”

Although the unemployment rate remained near pre-pandemic lows last month, Siegel pointed to rising jobless claims, especially over the past few weeks, as evidence that the economy is slowing under the weight of the Fed’s interest rate hikes. “Jobless claims have not been looking good,” he said. Weekly initial jobless claims hit their highest level since October 2021 earlier this month at 264,000, data from the Bureau of Labor Statistics shows.

Siegel also pointed to “softness in earnings” and the impact of the restart of student loan payments on consumer spending as potential headwinds for stocks. Americans will be on the hook for some $18 billion a month when student loan payments resume on Sept. 1, according to an estimate from investment bank Jefferies. Economists have repeatedly warned that this cost will slow consumer spending, which has been surprisingly resilient in the face of high inflation and rising interest rates.

Between June 16 and 19, Morgan Stanley surveyed roughly 2,000 student loan borrowers, and 37% said they’ll need to cut their spending in other areas to make their monthly loan payments when they resume, while 34% said they won’t be able to make their payments at all.

“Looking at student loan payments restarting, elevated jobless claims, I’m not talking about disaster, but when people are saying: ‘Well, what is on the upside?’ I just don’t see as many factors,” Siegel said.

Rising home prices and mortgage rates are also slowing consumer spending, which makes up roughly 70% of GDP growth, making a recession more likely, according to the Wharton professor.

“The cost of homeownership has tripled over the past three years. And what’s happened to real incomes? Stagnant,” he said, arguing that many homebuyers are not going to have the money for “trips, cars, and everything else which is keeping the economy going.”

For Siegel, who has been a consistent critic of the Fed’s fight against inflation over the past year, arguing they’ve lifted interest rates too fast and too high, increasing the odds of recession, there is at least one positive way to look at the coming mild recession.

“The bright side of a mild recession is that not only will we not get rate increases, but I think there is still—and I’ve been saying this even though everyone thinks there’s no possibility—[a chance] that we will get rate decreases by the end of the year,” he said.