每当比尔·格利进入房间的时候,总能吸引人们的目光。你很难不注意到他,因为他身高6英尺8英寸(约2.03米)。对于熟悉科技界的人来说,格利是过去十年知名度最高的风险投资者之一,甚至在2022年Showtime频道拍摄的有关Uber的电视剧《恣意橫行》(Super Pumped)中扮演了一个主要角色。剧中强调了格利作为特拉维斯·卡兰尼克的早期投资者之一所发挥的作用,以及他在后来赶走卡兰尼克的过程中扮演的关键角色。

但格利和妻子艾米后来悄悄卖掉了位于旧金山的房子,搬进了德克萨斯州奥斯汀市区的一栋摩天大楼,从此他过上了更低调的生活。他和妻子搬回故乡德克萨斯,并没有引起太多人的关注,直到上周我前往奥斯汀期间有几次听到有人提及他的名字,并且有一些媒体调查发现他买下了一套房子。他表示,这种巧妙的处理方式是有意为之。

我与格利见面的地点是在咖啡厅,我们面对面坐在一个红色卡座里,旁边的墙上有一幅画,上面写着“我们都是罢工的流浪汉”。他表示:“我和妻子从25年前就开始讨论这个计划。这不是一份声明。我不想把从加州搬到德州变成大新闻。有人热衷于这样做,但我不想卷入其中。我并不想成为那种叙事的一部分,因为它并不是我搬家的原因。”

目前,格利很少接受采访,但我们坐在一起畅谈了一个多小时,讨论了他一年半前离开旧金山的决定,以及他从硅谷最有影响力的风险投资基金之一Benchmark离职的原因。他在Benchmark任职二十多年,投资了Uber、Grubhub、Zillow、Stitch Fix、Vudu以及其他多家公司。(Gurley在2020年没有参与Benchmark的第10只基金,但依旧在之前设立的基金担任合伙人,依旧会出席Benchmark的会议,还占据10个董事会席位。)

格利表示,在目前的市场环境下,他投资的公司,包括HackerOne、Nextdoor、GoodEggs和Solv等,都需要他投入更多精力,而且开会要占用很多时间。但他在闲暇时涉猎广泛,比如投资上市公司股票。他以2019年发表的演讲为基础出版了一本书,讲述了如何找到梦想的职业。他还开始学吉他,这是他“在新冠期间的爱好”。他表示,自己还与德州大学奥斯汀分校(University of Texas at Austin)有一些合作,帮助该校通过创业者将其成果商业化。他曾就读于该校的商学院。你或许还在ACL Live、Continental Club或者C-Boys Heart & Soul上见过他,因为他经常在这些平台进行直播。

德克萨斯州吸引格利的并非奥斯汀生机勃勃的科技氛围。事实上,他说他很怀念旧金山的知识分子精神,以及在午餐或晚宴上与偶遇的人们进行的交谈。他说道:“人人都说奥斯汀是一个适合创业的地方,但我认为它并没有真正释放这方面的潜力。”格利表示,重回德克萨斯一直是他和妻子之间“非正式的协议”,而且他喜欢奥斯汀的餐厅、现场音乐和适宜步行的交通环境。他说他现在会拿出时间接触形形色色的人,如音乐家、烈酒品牌的老板、酒店经营者或房地产商等。 “我发现这很有趣,与以往的经历截然不同。”

空出的前排座椅

对于像格利这样的杰出人物而言,他比曾与我一起喝过咖啡的数十名知名度较低的投资者更加低调。他会淡化自己曾取得的成功,而且他用现金支付。他对我很好奇,询问了我住在哪里和我写过哪些文章。他从不回避我提出的问题,但他也不会主动谈论自己。谈话结束后我才意识到,当天是他的生日。但他并没有主动提到这一点。

三年前,关于格利不再参与Benchmark第10只基金的消息传出后,引起了人们的关注,尽管马特·科勒尔或米奇·拉斯基等Benchmark的其他合伙人近几年也纷纷离开该基金。57岁的格利有许多成功退出的机会,他的工作经历本可以让他继续在风投领域再经营20年,并通过参与新基金获得收入。但格利对我说他不感兴趣。

他说道:“虽然我不想公开指名道姓,但我认为有些风险投资者从业的时间太长。我不想这样做。你能理解吗?”

而且,Benchmark的结构与其他基金不同,它采用平等合伙制,所有合伙人按同样的比例分摊各基金的管理费和参与利润分成。格利认为,如果他不再履行自己的责任,还继续参与利润分成,这种行为是不恰当的。

他说道:“在风险投资行业,要想站在巅峰,你必须要疯狂,要非常努力,你只能活在担心你的基金错过下一个谷歌(Google)的恐惧当中。在一只基金里,你要么竭尽全力努力拼搏,因为我们是一支团队,要么就从那里离开。”

尽管如此,他对科技行业的未来依旧有强烈的直觉判断。 “如果我依旧是一名风险投资者,我会关注人工智能的许多垂直应用。我看过人工智能的编程能力,简直太疯狂了……不使用人工智能的程序员将被淘汰,因为人工智能将大幅提高人们的效率。问题是还有哪些应用能够提高效率,我认为人们正在持续探索。”

史蒂夫·马丁的书《天生喜剧狂》(Born Standing Up),让格利最终下定决心离开风投行业。 “有一天,【马丁】在拉斯维加斯演出,他上场后发现第一排座位竟然是空的,这是他第一次看到这种情况。他取消了之后几天的演出,并且再也没有进行单口喜剧表演。后来他开始转型,演奏斑卓琴,经营剧院和参加表演……就像我所说的那样,就好像我不曾走上过舞台,所以我不想说我要留在舞台上。这种观念影响了我。”(财富中文网)

翻译:刘进龙

审校:汪皓

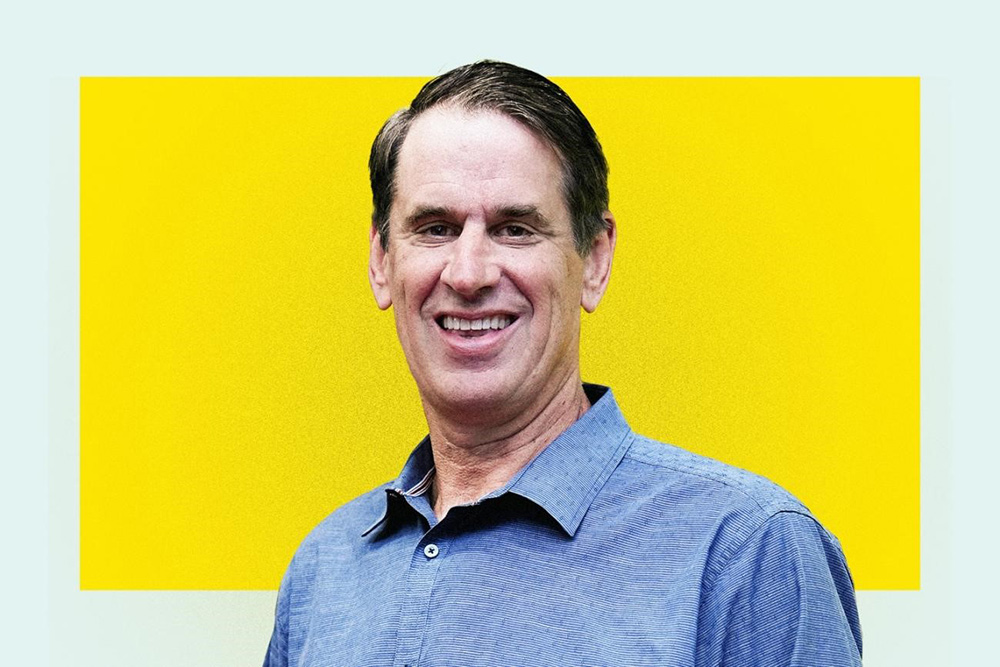

比尔·格利解释了自己为什么离开Benchmark和旧金山。

摄影:STEPHEN OLKER —— 盖蒂图片社为SXSW提供

每当比尔·格利进入房间的时候,总能吸引人们的目光。你很难不注意到他,因为他身高6英尺8英寸(约2.03米)。对于熟悉科技界的人来说,格利是过去十年知名度最高的风险投资者之一,甚至在2022年Showtime频道拍摄的有关Uber的电视剧《恣意橫行》(Super Pumped)中扮演了一个主要角色。剧中强调了格利作为特拉维斯·卡兰尼克的早期投资者之一所发挥的作用,以及他在后来赶走卡兰尼克的过程中扮演的关键角色。

但格利和妻子艾米后来悄悄卖掉了位于旧金山的房子,搬进了德克萨斯州奥斯汀市区的一栋摩天大楼,从此他过上了更低调的生活。他和妻子搬回故乡德克萨斯,并没有引起太多人的关注,直到上周我前往奥斯汀期间有几次听到有人提及他的名字,并且有一些媒体调查发现他买下了一套房子。他表示,这种巧妙的处理方式是有意为之。

我与格利见面的地点是在咖啡厅,我们面对面坐在一个红色卡座里,旁边的墙上有一幅画,上面写着“我们都是罢工的流浪汉”。他表示:“我和妻子从25年前就开始讨论这个计划。这不是一份声明。我不想把从加州搬到德州变成大新闻。有人热衷于这样做,但我不想卷入其中。我并不想成为那种叙事的一部分,因为它并不是我搬家的原因。”

目前,格利很少接受采访,但我们坐在一起畅谈了一个多小时,讨论了他一年半前离开旧金山的决定,以及他从硅谷最有影响力的风险投资基金之一Benchmark离职的原因。他在Benchmark任职二十多年,投资了Uber、Grubhub、Zillow、Stitch Fix、Vudu以及其他多家公司。(Gurley在2020年没有参与Benchmark的第10只基金,但依旧在之前设立的基金担任合伙人,依旧会出席Benchmark的会议,还占据10个董事会席位。)

格利表示,在目前的市场环境下,他投资的公司,包括HackerOne、Nextdoor、GoodEggs和Solv等,都需要他投入更多精力,而且开会要占用很多时间。但他在闲暇时涉猎广泛,比如投资上市公司股票。他以2019年发表的演讲为基础出版了一本书,讲述了如何找到梦想的职业。他还开始学吉他,这是他“在新冠期间的爱好”。他表示,自己还与德州大学奥斯汀分校(University of Texas at Austin)有一些合作,帮助该校通过创业者将其成果商业化。他曾就读于该校的商学院。你或许还在ACL Live、Continental Club或者C-Boys Heart & Soul上见过他,因为他经常在这些平台进行直播。

德克萨斯州吸引格利的并非奥斯汀生机勃勃的科技氛围。事实上,他说他很怀念旧金山的知识分子精神,以及在午餐或晚宴上与偶遇的人们进行的交谈。他说道:“人人都说奥斯汀是一个适合创业的地方,但我认为它并没有真正释放这方面的潜力。”格利表示,重回德克萨斯一直是他和妻子之间“非正式的协议”,而且他喜欢奥斯汀的餐厅、现场音乐和适宜步行的交通环境。他说他现在会拿出时间接触形形色色的人,如音乐家、烈酒品牌的老板、酒店经营者或房地产商等。 “我发现这很有趣,与以往的经历截然不同。”

空出的前排座椅

对于像格利这样的杰出人物而言,他比曾与我一起喝过咖啡的数十名知名度较低的投资者更加低调。他会淡化自己曾取得的成功,而且他用现金支付。他对我很好奇,询问了我住在哪里和我写过哪些文章。他从不回避我提出的问题,但他也不会主动谈论自己。谈话结束后我才意识到,当天是他的生日。但他并没有主动提到这一点。

三年前,关于格利不再参与Benchmark第10只基金的消息传出后,引起了人们的关注,尽管马特·科勒尔或米奇·拉斯基等Benchmark的其他合伙人近几年也纷纷离开该基金。57岁的格利有许多成功退出的机会,他的工作经历本可以让他继续在风投领域再经营20年,并通过参与新基金获得收入。但格利对我说他不感兴趣。

他说道:“虽然我不想公开指名道姓,但我认为有些风险投资者从业的时间太长。我不想这样做。你能理解吗?”

而且,Benchmark的结构与其他基金不同,它采用平等合伙制,所有合伙人按同样的比例分摊各基金的管理费和参与利润分成。格利认为,如果他不再履行自己的责任,还继续参与利润分成,这种行为是不恰当的。

他说道:“在风险投资行业,要想站在巅峰,你必须要疯狂,要非常努力,你只能活在担心你的基金错过下一个谷歌(Google)的恐惧当中。在一只基金里,你要么竭尽全力努力拼搏,因为我们是一支团队,要么就从那里离开。”

尽管如此,他对科技行业的未来依旧有强烈的直觉判断。 “如果我依旧是一名风险投资者,我会关注人工智能的许多垂直应用。我看过人工智能的编程能力,简直太疯狂了……不使用人工智能的程序员将被淘汰,因为人工智能将大幅提高人们的效率。问题是还有哪些应用能够提高效率,我认为人们正在持续探索。”

史蒂夫·马丁的书《天生喜剧狂》(Born Standing Up),让格利最终下定决心离开风投行业。 “有一天,【马丁】在拉斯维加斯演出,他上场后发现第一排座位竟然是空的,这是他第一次看到这种情况。他取消了之后几天的演出,并且再也没有进行单口喜剧表演。后来他开始转型,演奏斑卓琴,经营剧院和参加表演……就像我所说的那样,就好像我不曾走上过舞台,所以我不想说我要留在舞台上。这种观念影响了我。”(财富中文网)

翻译:刘进龙

审校:汪皓

Bill Gurley opens up about stepping back at Benchmark and leaving San Francisco.

STEPHEN OLKER—GETTY IMAGES FOR SXSW

When Bill Gurley enters a room, people notice. It’s hard not to: He is a towering 6’8”. And for those well-versed in tech, Gurley is one of the most famous venture capitalists of the last decade—even becoming a main character in the 2022 Showtime television series on Uber, Super Pumped, which highlighted Gurley’s role as one of the first investors to back Travis Kalanick, then later a key player in pushing him out of the company.

But ever since Gurley and his wife, Amy, quietly sold their home in San Francisco and moved into a skyscraper in downtown Austin, Tex., he’s enjoyed more anonymity than usual. And his move back to Texas, where he and his wife are originally from, has largely gone unnoticed until I heard his name thrown around a couple times last week during a trip to Austin and some journalistic sleuthing revealed he had purchased a place. That subtlety, he says, was by design.

“My wife and I have been talking about this for 25 years. It wasn’t a statement. I wasn’t making a huge California-Texas thing. Others were, and I didn’t want to get caught up in that. I literally did not want to be a part of that narrative, because it wasn’t the reason why,” Gurley told me as we met for coffee, sitting across from one another in a red booth next to a picture on the wall with the words “we are all bums on strike.”

Gurley rarely gives interviews these days, but he sat with me for over an hour and opened up about both leaving San Francisco a year and a half ago and stepping back at Benchmark, one of Silicon Valley’s most prominent venture capital firms, where he spent more than two decades backing the likes of Uber, Grubhub, Zillow, Stitch Fix, Vudu, and a host of other companies. (Gurley excluded himself from Benchmark’s tenth fund in 2020 though he still serves as a partner of previous funds, attends Benchmark meetings, and holds 10 board seats)

Gurley says his portfolio companies, which include HackerOne, Nextdoor, GoodEggs, and Solv, require a lot more of his attention these days in the current environment, and meetings are taking up a lot of his time. But he’s dabbling in a few things in the background: Public stock investing. A book based on a speech he gave in 2019 about pursuing your dream job. He started learning guitar—his “COVID hobby.” And he’s doing some work with the University of Texas at Austin, where he went to business school, helping them with commercializing their efforts with entrepreneurs, he says. You might also see him at ACL Live, the Continental Club, or C-Boys Heart & Soul—where he frequents live shows.

It wasn’t Austin’s burgeoning tech scene that drew Gurley to Texas. In fact, he says he misses the intellectual spirit of San Francisco—and the conversations that emerged when he ran into people at lunch or at dinner parties. “Everyone talks about Austin like an entrepreneurial place, but it hasn’t really delivered, I think, relative to the potential,” he says. Rather, Gurley says that returning to Texas had always been an “unofficial agreement” between he and his wife, and he likes Austin for its restaurants, live music, and walkability. He says he now spends time with a much more diverse group of people—musicians, people that own spirit brands, run hotels, or sell real estate. “I find it interesting: It’s just different, you know?”

An empty top row

For someone as prominent as Gurley, he carries himself in a more understated manner than dozens of lesser-known investors I’ve grabbed a cup of coffee with. He downplays his own success, and he pays in good, old-fashioned cash. He’s curious about me, asking his own questions about where I live and about something I’ve written. He never shied away from any question I asked, but he didn’t volunteer anything about himself, either. I realized after our conversation that I had reached out to him on his birthday. He didn’t mention it.

When word got out that Gurley wouldn’t be part of Benchmark’s tenth fund three years ago, it was notable, even though other Benchmark partners like Matt Cohler or Mitch Lasky have also stepped back in recent years. At 57 years old, with a slew of successful exits behind him, Gurley had the kind of track record that would have welcomed him riding out the next 20 years and taking a paycheck from new funds. But Gurley tells me he wasn’t interested.

“Without naming names, I think there are VCs that have hung around too long, you know? I didn’t want to be that person. Does that make sense?” he says.

And particularly because of Benchmark’s unusual structure relative to other firms—an equal partnership where all partners have an identical cut of each fund’s management fees and profits—it didn’t feel right for Gurley to keep earning his share if he wasn’t going to be doing his share.

“The venture business, if you want to be at the top, requires insane, remarkable hustle… You have to live in fear that the next Google is going to get funded by a firm that’s not yours,” he says. “Either you’re in there rowing as hard as you can, because we’re all a team, or you’re not.”

That said, he still has strong instincts about the future of tech. “If I were still active as a venture capitalist, I’d be looking at a lot of the vertical applications of A.I. I look at the coding stuff, and it’s insane… If you’re not using it, I think you’re probably writing your own death certificate as a programmer, because people are going to be so much more efficient. And the question is: What are other applications that have that kind of productivity boost or lift, and I think people are trying to figure that out.”

But in the end, it was a book by Steve Martin, Born Standing Up, that helped convince Gurley it was time to step back. “One day, [Martin] is in Vegas and he comes out, and the top row is empty, the first time he’s ever seen the top row empty. He quits the next day—never does standup again. And then he goes off and he does his banjo and his theater and his acting.… Like I said, I don’t think I ever played the stage, so I’d rather not say I’m the same. It influenced me. That notion influenced me.”