尽管通胀高企,利率攀升,华尔街普遍预测经济衰退的走向,但美国人在过去一年的支出仍接近创纪录的水平,他们选择把钱花在迪士尼度假和DoorDash送货服务上。

在线银行SoFi的投资策略主管利兹•杨表示,不断上涨的工资和新冠疫情期间积累的“现金缓冲”储蓄使消费者具有“前所未有的消费能力“。在疫情期间,消费放缓,与此同时,纾困支票和增强失业保险等福利使居民收入增加。但数据显示,随着生活成本急剧攀升,近几个月许多美国人已经开始使用信用卡为他们的新消费习惯买单,并开始消耗之前的存款。一些专家担心,这意味着可能会出现消费放缓,甚至发生经济衰退。

杨在周四的一篇文章中写道:“基于我的直觉和常识,没有取之不尽的储蓄支持这种水平的支出,也没有无限的工资上涨维持足够高的支出水平来一直推动GDP的增长。时间会证明一切,但我仍然相信有些事情需要妥协。“

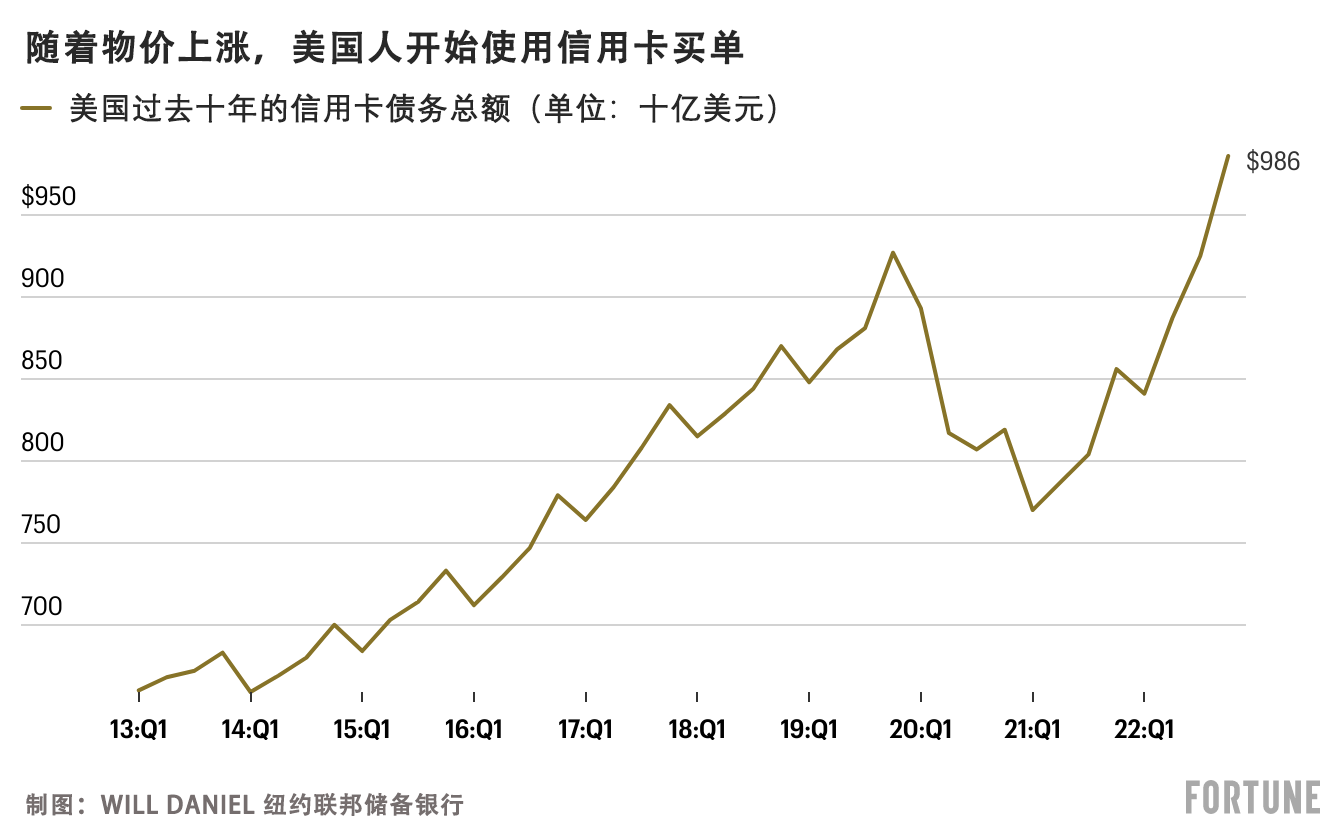

纽约联邦储备银行(New York Federal Reserve)本周发布的一份报告显示,美国消费者的信用卡余额在2022年第四季度跃升7%,达到9,860亿美元,创历史新高。摩根士丹利(Morgan Stanley)估计,仅去年一年,消费者就花掉了在疫情期间积累的2.7万亿美元超额储蓄的约30%,低收入消费者花费的储蓄甚至接近50%。

摩根士丹利的经济学家在1月24日的报告中写道:“按照我们预期的支出速度,储蓄将快速减少。“他们认为,2023年,消费者将从疫情期间积累的储蓄中再花掉5,000亿美元。

美国人储蓄账户存款不断减少和对信用卡的日益依赖可能会导致今年消费支出(占美国GDP的 70%)放缓。再加上制造业订单和信贷状况等主要经济指标的不断恶化,一些经济学家,如非营利研究机构美国经济评议会(The Conference Board)的经济研究高级主任阿塔曼•奥齐尔德勒姆,认为经济衰退不可避免。

阿塔曼周五写道,“到目前为止,包括就业和个人收入在内的劳动力市场相关指标依然强劲。但美国经济评议会仍预计,通胀高企、利率攀升和消费支出萎缩将使美国经济在2023年陷入衰退。”

相互矛盾的数据和对经济衰退的担忧

今年,美国消费者的经济健康状况数据相互矛盾,即使最有经验的经济学家对此也感到困惑。

在连跌两个月后,零售销售额1月份迎来大幅反弹。美国银行研究所(Bank of America Institute)的研究人员表示,他们在一份新报告中发现了“今年年初消费支出增加的迹象”,并指出,1月份每个家庭的信用卡和借记卡支出同比增长5.1%。

美国上个月还新增51.7万个就业岗位,失业率降至3.4%,为53年来的最低水平。自去年以来,社会保障金大幅增加,全国各地的最低工资标准也大幅提高。

经济学人集团(Economist Group)研究与分析部门经济学人智库(Economist Intelligence Unit)的全球经济学家凯琳•伯奇对《财富》杂志表示:“1月份劳动力市场依然强劲的表现证实,美国家庭和整体经济仍处于相对稳定的状态。”

美国劳工统计局(Bureau of Labor Statistics)周二公布,以消费者价格指数衡量的同比通胀率也从6月份达到的9.1%峰值降至1月份的6.4%。鉴于就业岗位充足,通胀逐渐消退,高盛(Goldman Sachs)上周将美国经济预期衰退概率从35%下调至25%。

然而,一些其他数据表明,消费者保持较高水平支出的能力正在减弱,这与近期乐观的经济数据相矛盾。

虽然通胀正在下降,但高物价仍然影响着各个收入水平的美国人。金融服务公司普美利加(Primerica)在一项新研究中发现,在2022年的最后三个月,80%以上的中等收入家庭减少了存款金额或从现有储蓄中提取资金以维持生计。安永-博智隆(EY-Parthenon)首席经济学家格雷戈里•达科本周对《金融时报》表示,低收入家庭已经花光了所有疫情期间积累的存款,开始“动用”定期储蓄。

PYMNTS和借贷俱乐部(LendingClub)的一份新报告显示,总体而言,到2022年底,近65%的美国人都是“月光族”,比2021年多出930万人。衡量美国人储蓄存款占可支配收入比例的指标“个人储蓄率”,已经从疫情前2020年2月的9.3%下降到12月的3.4%。

除此之外,Bankrate的高级行业分析师泰德•罗斯曼警告称,美国人正在用信用卡债务为其大部分消费买单。纽约联邦储备银行的数据显示,由于信用卡债务同比增长15%,去年第四季度美国家庭债务总额攀升至创纪录的16.9万亿美元,较上一季度增长2.4%。

他周四对《财富》杂志表示:“强劲的消费支出、40年来最高水平的通胀以及急剧上升的信用卡利率,这些因素共同推动信用卡余额创下新高。“他指出,目前46%的信用卡持卡人背负信用卡债务,而这一数字一年前为39%。

经济学人智库的伯奇警告称,利率不断攀升和通胀高企也正在给“美国家庭造成越来越大的财务压力”,她认为这种趋势不会很快结束。

她表示:“随着未来几个月利率进一步上升……2023年消费支出将大幅放缓。”

这并不是什么好消息,因为消费支出占美国GDP的70%,对经济增长来说至关重要。

富国银行投资研究所(Wells Fargo Investment Institute)投资策略分析师詹妮弗•蒂默曼甚至在本周撰写了一份题为《消费支出疲弱可能预示着什么》(What weakening consumer spending may be foreshadowing)的报告。她在报告中警告称,她已经看到了消费支出减少以及家庭面临“财务压力”的迹象,这些情况在历史上都预示着经济下行。

她在周二的一份报告中写道:“我们认为,经通胀调整后的工资压力以及美联储加息的影响,将在未来几个月引发经济衰退。典型的衰退标志已经在释放同样的信号。”(财富中文网)

译者:郝秀

审校:汪皓

尽管通胀高企,利率攀升,华尔街普遍预测经济衰退的走向,但美国人在过去一年的支出仍接近创纪录的水平,他们选择把钱花在迪士尼度假和DoorDash送货服务上。

在线银行SoFi的投资策略主管利兹•杨表示,不断上涨的工资和新冠疫情期间积累的“现金缓冲”储蓄使消费者具有“前所未有的消费能力“。在疫情期间,消费放缓,与此同时,纾困支票和增强失业保险等福利使居民收入增加。但数据显示,随着生活成本急剧攀升,近几个月许多美国人已经开始使用信用卡为他们的新消费习惯买单,并开始消耗之前的存款。一些专家担心,这意味着可能会出现消费放缓,甚至发生经济衰退。

杨在周四的一篇文章中写道:“基于我的直觉和常识,没有取之不尽的储蓄支持这种水平的支出,也没有无限的工资上涨维持足够高的支出水平来一直推动GDP的增长。时间会证明一切,但我仍然相信有些事情需要妥协。“

纽约联邦储备银行(New York Federal Reserve)本周发布的一份报告显示,美国消费者的信用卡余额在2022年第四季度跃升7%,达到9,860亿美元,创历史新高。摩根士丹利(Morgan Stanley)估计,仅去年一年,消费者就花掉了在疫情期间积累的2.7万亿美元超额储蓄的约30%,低收入消费者花费的储蓄甚至接近50%。

摩根士丹利的经济学家在1月24日的报告中写道:“按照我们预期的支出速度,储蓄将快速减少。“他们认为,2023年,消费者将从疫情期间积累的储蓄中再花掉5,000亿美元。

美国人储蓄账户存款不断减少和对信用卡的日益依赖可能会导致今年消费支出(占美国GDP的 70%)放缓。再加上制造业订单和信贷状况等主要经济指标的不断恶化,一些经济学家,如非营利研究机构美国经济评议会(The Conference Board)的经济研究高级主任阿塔曼•奥齐尔德勒姆,认为经济衰退不可避免。

阿塔曼周五写道,“到目前为止,包括就业和个人收入在内的劳动力市场相关指标依然强劲。但美国经济评议会仍预计,通胀高企、利率攀升和消费支出萎缩将使美国经济在2023年陷入衰退。”

相互矛盾的数据和对经济衰退的担忧

今年,美国消费者的经济健康状况数据相互矛盾,即使最有经验的经济学家对此也感到困惑。

在连跌两个月后,零售销售额1月份迎来大幅反弹。美国银行研究所(Bank of America Institute)的研究人员表示,他们在一份新报告中发现了“今年年初消费支出增加的迹象”,并指出,1月份每个家庭的信用卡和借记卡支出同比增长5.1%。

美国上个月还新增51.7万个就业岗位,失业率降至3.4%,为53年来的最低水平。自去年以来,社会保障金大幅增加,全国各地的最低工资标准也大幅提高。

经济学人集团(Economist Group)研究与分析部门经济学人智库(Economist Intelligence Unit)的全球经济学家凯琳•伯奇对《财富》杂志表示:“1月份劳动力市场依然强劲的表现证实,美国家庭和整体经济仍处于相对稳定的状态。”

美国劳工统计局(Bureau of Labor Statistics)周二公布,以消费者价格指数衡量的同比通胀率也从6月份达到的9.1%峰值降至1月份的6.4%。鉴于就业岗位充足,通胀逐渐消退,高盛(Goldman Sachs)上周将美国经济预期衰退概率从35%下调至25%。

然而,一些其他数据表明,消费者保持较高水平支出的能力正在减弱,这与近期乐观的经济数据相矛盾。

虽然通胀正在下降,但高物价仍然影响着各个收入水平的美国人。金融服务公司普美利加(Primerica)在一项新研究中发现,在2022年的最后三个月,80%以上的中等收入家庭减少了存款金额或从现有储蓄中提取资金以维持生计。安永-博智隆(EY-Parthenon)首席经济学家格雷戈里•达科本周对《金融时报》表示,低收入家庭已经花光了所有疫情期间积累的存款,开始“动用”定期储蓄。

PYMNTS和借贷俱乐部(LendingClub)的一份新报告显示,总体而言,到2022年底,近65%的美国人都是“月光族”,比2021年多出930万人。衡量美国人储蓄存款占可支配收入比例的指标“个人储蓄率”,已经从疫情前2020年2月的9.3%下降到12月的3.4%。

除此之外,Bankrate的高级行业分析师泰德•罗斯曼警告称,美国人正在用信用卡债务为其大部分消费买单。纽约联邦储备银行的数据显示,由于信用卡债务同比增长15%,去年第四季度美国家庭债务总额攀升至创纪录的16.9万亿美元,较上一季度增长2.4%。

他周四对《财富》杂志表示:“强劲的消费支出、40年来最高水平的通胀以及急剧上升的信用卡利率,这些因素共同推动信用卡余额创下新高。“他指出,目前46%的信用卡持卡人背负信用卡债务,而这一数字一年前为39%。

经济学人智库的伯奇警告称,利率不断攀升和通胀高企也正在给“美国家庭造成越来越大的财务压力”,她认为这种趋势不会很快结束。

她表示:“随着未来几个月利率进一步上升……2023年消费支出将大幅放缓。”

这并不是什么好消息,因为消费支出占美国GDP的70%,对经济增长来说至关重要。

富国银行投资研究所(Wells Fargo Investment Institute)投资策略分析师詹妮弗•蒂默曼甚至在本周撰写了一份题为《消费支出疲弱可能预示着什么》(What weakening consumer spending may be foreshadowing)的报告。她在报告中警告称,她已经看到了消费支出减少以及家庭面临“财务压力”的迹象,这些情况在历史上都预示着经济下行。

她在周二的一份报告中写道:“我们认为,经通胀调整后的工资压力以及美联储加息的影响,将在未来几个月引发经济衰退。典型的衰退标志已经在释放同样的信号。”(财富中文网)

译者:郝秀

审校:汪皓

Despite high inflation, rising interest rates, and consistent recession predictions from Wall Street, Americans have continued spending at near a record pace over the past year, opting to splurge on Disney vacations and DoorDash deliveries.

Rising wages and a “cash buffer” of savings that was built up during the pandemic—when spending slowed and benefits like stimulus checks and enhanced unemployment boosted incomes—have provided consumers with “unprecedented spending power,” according to Liz Young, head of investment strategy at SoFi, an online bank. But data shows many Americans have begun financing their new spending habits with credit cards and draining their savings in recent months, as the cost of living soars. Some experts fear that means a spending slowdown—or even a recession—could be on the horizon.

“My intuition and common sense says there’s not a bottomless pit of savings to support this level of spending, and there’s not a bottomless pit of wage growth to keep it elevated enough to drive GDP indefinitely,” Young wrote in a Thursday article. “Time will tell, but I still believe something’s gotta give.”

U.S. consumers’ credit card balances jumped 7% in the fourth quarter of 2022 to a new record high of $986 billion, a New York Federal Reserve report showed this week. And Morgan Stanley estimates that last year alone consumers spent roughly 30% of the $2.7 trillion in excess savings they built up during the pandemic, with lower-income consumers tapping closer to 50%.

“At the pace of spending we anticipate, savings are on track to dwindle rapidly,” the investment bank’s economists wrote in a Jan. 24 note, arguing consumers will spend another $500 billion of their pandemic savings in 2023.

Americans’ ailing savings accounts and increasing reliance on credit cards is likely to cause consumer spending—which represents 70% of U.S. GDP—to slow this year. And with leading economic indicators like manufacturing orders and credit conditions deteriorating as well, some economists like Ataman Ozyildirim, senior director of economics at The Conference Board, a non-profit research organization, believe a recession is inevitable.

“Indicators related to the labor market—including employment and personal income—remain robust so far. Nonetheless, The Conference Board still expects high inflation, rising interest rates, and contracting consumer spending to tip the U.S. economy into recession in 2023,” he wrote Friday.

Conflicting data and recession fears

Conflicting data about the health of the U.S. consumer has created confusion among even the most experienced economists this year.

After falling for two consecutive months, retail sales rebounded sharply in January. And Bank of America Institute researchers said they found “signs of a strengthening in consumer spending at the start of this year” in a new report, noting that credit and debit card spending per household rose 5.1% year-over-year in January.

The U.S. economy also added 517,000 jobs last month, pushing the unemployment rate to a 53-year low of 3.4%; social security payments have risen dramatically since last year; and the minimum wage has jumped in various parts of the country.

“The still-strong position of the labor market in January confirms that households and the broader economy are still in relatively firm standing,” Cailin Birch, global economist at the Economist Intelligence Unit (EIC), the research and analysis division of the Economist Group, told Fortune.

Year-over-year inflation, as measured by the consumer price index, fell from its June high of 9.1% to just 6.4% in January as well, the Bureau of Labor Statistics reported Tuesday. With ample available jobs and fading inflation, Goldman Sachs cut its forecast for the odds of a U.S. recession from 35% to 25% last week.

But recent positive economic data clashes with a number of other statistics that indicate consumers’ ability to keep spending at elevated levels is waning.

Although inflation is coming down, high prices are still impacting Americans at every income level. Over 80% of middle-income households cut down on their savings or pulled money from existing savings to make ends meet in the last three months of 2022, the financial services company Primerica found in a new study. And Gregory Daco, chief economist at EY-Parthenon, told the Financial Times this week that lower-income families have spent all their pandemic savings and begun “dipping into” regular savings.

Overall, nearly 65% of Americans were living paycheck to paycheck at the end of 2022, 9.3 million more than the year before, according to a new report from PYMNTS and LendingClub. And the personal savings rate—which measures Americans savings as a percentage of disposable income—has fallen from 9.3% in February 2020 before the pandemic, to just 3.4% in December.

On top of that, Ted Rossman, senior industry analyst at Bankrate, warned that Americans are financing much of their spending with credit card debt. Total household debt increased 2.4% in the fourth quarter to a record $16.9 trillion, driven by rising a 15% year-over-year jump in credit card debt, according to the New York Federal Reserve.

“Robust consumer spending, the hottest inflation readings in 40 years and sharply higher credit card rates have combined to push credit card balances to a new record high,” he told Fortune Thursday, noting that 46% of credit cardholders now carry credit card debt compared to 39% a year ago.

The ECI’s Birch warned that rising interest rates and high inflation are causing “increasing financial strain on households” as well, and she argues the trend won’t end anytime soon.

“As interest rates rise further in the coming months…this will cause consumer spending to slow considerably over the course of 2023,” she said.

That’s not great news, because consumer spending represents 70% of U.S. GDP, which makes it critical to economic growth.

Jennifer Timmerman, investment strategy analyst at Wells Fargo Investment Institute, even wrote a note this week titled “What weakening consumer spending may be foreshadowing,” warning that she is already seeing fading spending and signs of “financial stress” in households that have historically pointed towards a downturn.

“We believe that pressure on inflation-adjusted wages, along with the impact of Federal Reserve rate increases, will trigger an economic slowdown in coming months. Traditional recession signposts already are signaling as much,” she wrote in a Tuesday note.