疫情时期的房地产热潮引发了“投资者狂热”,这是自房地产泡沫以来美国房地产市场从未见过的。普通人纷纷涌入市场,希望建立爱彼迎(Airbnb)帝国。机构投资者,比如黑石集团旗下的Home Partners of America,迅速扩大了他们的单户住宅投资组合。房屋建筑商急于趁热打铁,破土动工建造创纪录的“投机性”房屋。而像Opendoor和Zillow这样的iBuyers(iBuyer模式的最大优势是简化了房屋买卖的流程,即房地产投资人直接从卖家手中买房,买家再向公司购房,iBuyer公司承担了其中的交易环节)则优化了购房算法。

快进到10月份,投资者狂热已经被投资者恐慌所取代。美国正在进行住房修正——房价在6月至8月间下降了1.6%,这让许多投资者望而却步。这标志着自2012年以来美国全国房价首次出现下跌。

投资者的回撤是有道理的。虽然大多数住房经济学家并不认为会出现像金融危机那样规模的房价修正——在金融危机期间,美国房价在2006年至2012年期间下跌了27%——但他们承认,这次房价修正比2006年时更为剧烈。滞后的凯斯-席勒指数(Case-Shiller Index)已经显示,旧金山的房价下降了8.2%。

在Redfin首席执行官格伦·凯尔曼看来,疫情期间的房地产热潮带来的投资者狂热可以用来解释为什么这次房价回落速度更快。从历史上看,房价具有粘性。卖家根本不想在价格上让步,除非经济因素,如供应过剩,迫使他们转手。但对于机构投资者和建筑商来说,情况就不同了。如果他们认为价格即将下跌,他们就会想先退出。凯尔曼说,在疫情时期的房地产热潮中,投资者在购房者中所占比例上升,这最终使美国房地产市场更容易受到房价下滑的冲击。

“当如雨后春笋般林立的摩天大楼出现问题时,你们(投资者)第一个想退出。要做到这一点就要找到最低销售价格,然后再降2%。如果在第一个周末还没有卖出去,就[继续]降低销售价格。”凯尔曼说。

换句话说,凯尔曼暗示,房地产投资者,包括Redfin的iBuyer业务,在经济繁荣时期推动房价更快上涨,并将在修正期间推动房价更快回落。

“我的看法是,由于建筑商和iBuyers占了更多库存,这导致了房价更快回落。我们就是其中之一,我们也是iBuyer。” 凯尔曼说。“我们立即注意到,访问我们网站的人越来越少,报名参观房屋的人越来越少……我们坐拥价值3.5亿美元的待售房屋,这些房屋是我们用自己的钱买的,或者更糟的是用贷款买的。”我们一直告诉投资者,我们将通过迅速行动来保护我们的资产负债表。我们没有把希望作为一种策略。我们立即开始降价。”

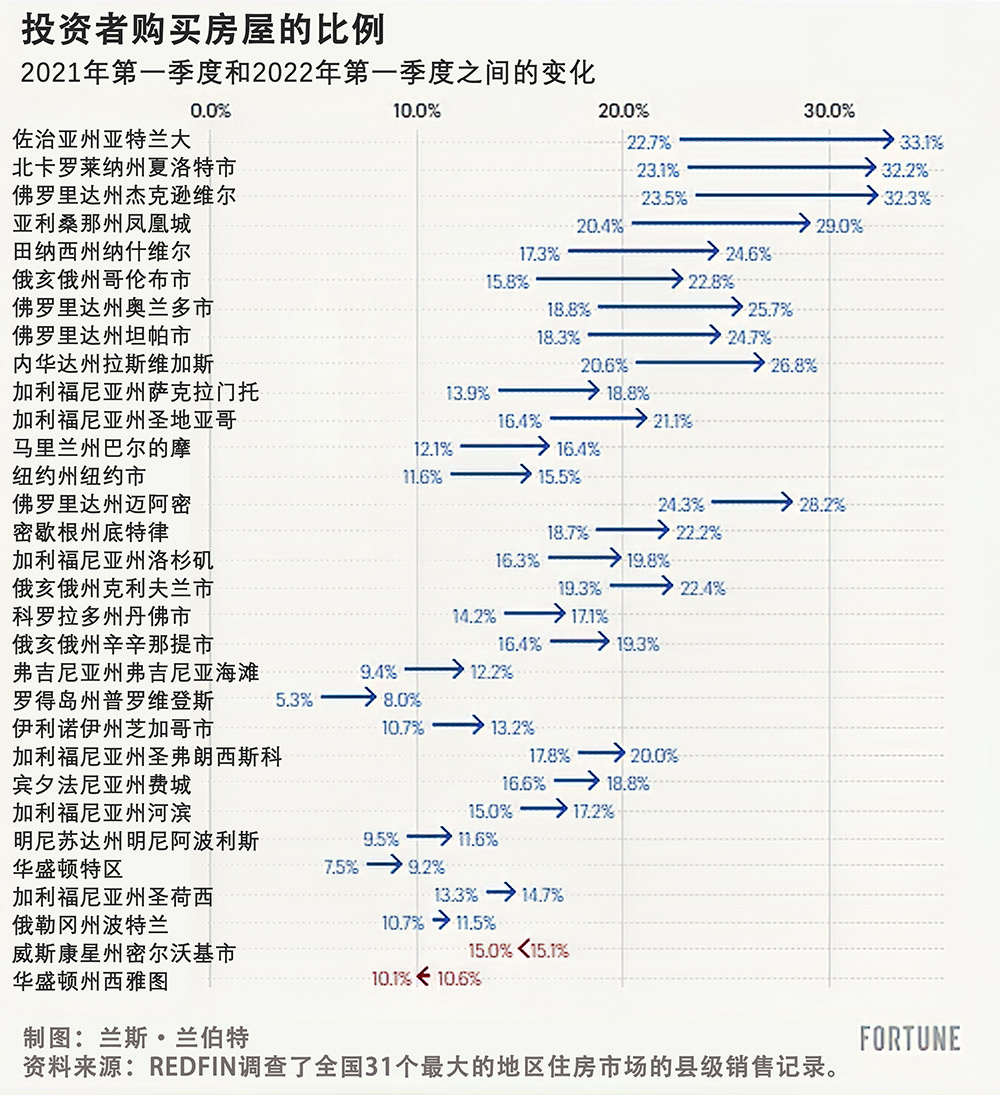

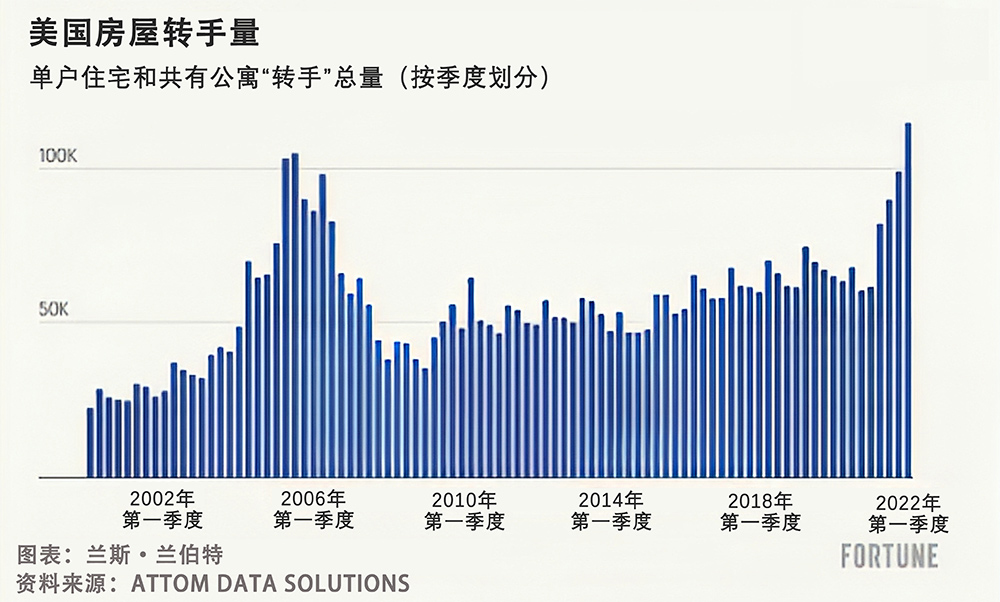

为什么疫情期间,投资者纷纷涌入房地产市场(见上图和下图)?低抵押贷款利率、创纪录的升值和飙升的租金结合起来,让投资者无法抗拒。这吸引了从炒房者到房东夫妻,再到华尔街巨头的所有人。

但我们要清楚的是,在疫情期间的房地产热潮中,投资者狂热并不足以让美国房价上涨43%。相反,创纪录的房价上涨是由一场完美风暴引发的。白领专业人士可以在任何地方办公,他们既能购买更大的房产,也能前往博伊西这样的遥远市场。抵押贷款利率在2021年1月跌至2.65%的历史低点,即使在房价上涨的情况下,也使得抵押贷款更容易负担。更不用说,这一切都发生在低库存和有利的千禧一代首次购房者人口结构时期。

虽然抵押贷款利率的飙升导致了买方需求的历史性回落,但这并没有转化为库存的大幅飙升。大多数房主并不害怕。那么,在库存水平紧张的情况下,房价怎么会下跌呢?这是因为杠杆投资者不想玩“观望”的游戏。而只要有一栋房子跌破其可比销售价格,就可以导致整个地区的可比销售价格下降。

“一旦需求减弱,我们就开始降低房价,这就推低了房价。在我们标价降低的社区里,如今,每一套待售房屋都会有可比销售价格,每个买家都会知道并谈论这一情况。”凯尔曼说。

当然,在疫情期间的房地产热潮中,所谓的投资者狂热并不是一成不变的。投资者狂热在凤凰城、奥斯汀和拉斯维加斯等西部新兴城市尤为疯狂。这可以用来解释为什么那些充满泡沫的房地产市场正在急剧修正。

看看拉斯维加斯北部的这处房产就知道了。今年5月,Opendoor以54.08万美元的价格买下了这栋房子。仅仅几周后,Opendoor就在7月以58.1万美元的价格将其挂牌出售。但Opendoor为时已晚:拉斯维加斯的房地产市场已经翻盘了。时间快进到10月,这套房源刚刚下架,此前经过一系列降价,其挂牌价已降至47.2万美元。

乍一看,人们可能会认为Opendoor很快就会在这处房产上损失约13%。并不完全是。当Redfin和Opendoor等iBuyers购买房屋时,他们向卖家收取“服务费”,以换取快速交易。一方面,这缓冲了iBuyer的潜在损失。另一方面,这种缓冲意味着iBuyer不太害怕降价。

并不是所有人都同意凯尔曼的观点。早在今年5月,Zillow的高管就曾对《财富》杂志表示,该公司失败的iBuyer项目并没有在疫情期间的房地产热潮中推高美国房价。直到11月,Zillow宣布将退出该项目,该项目以过高的价格购买房屋,臭名昭著。在Zillow看来,购买计划规模太小,根本无法推高美国房价。

虽然凯尔曼将抵押贷款利率上升带来的房价迅速回落归因于投资者和建筑商,但他表示,还有其他因素在起作用。他说,首先,在2008年住房市场崩溃后的几年里,美国住房市场对抵押贷款利率变得更加敏感。其次,他说,房地产崩盘让卖家和买家都知道,房价确实会下跌。

“我认为人们从1946年到2008年一直信奉的房价总会上涨的信仰已经不复存在了。我的父母认为(房价)下跌简直是不可思议。”凯尔曼说。但他表示,2008年的房市崩盘打破了这种“信仰”。“因此,人们(现在)对这种(修正)的反应几乎是创伤后应激障碍(PTSD),他们回撤得更快。”

房价下一步将走向何方?

房地美(Freddie Mac)和美国抵押贷款银行家协会(Mortgage Bankers Association)等组织预计,未来几年房价将出现横盘走势。穆迪分析公司和高盛等公司预测,全国房价从峰值到低谷下跌了10%左右。穆迪分析公司预测,如果经济衰退来袭,全国房价的跌幅将在15%至20%之间。简而言之:出现了各种房价前景预测。(财富中文网)

译者:中慧言-王芳

疫情时期的房地产热潮引发了“投资者狂热”,这是自房地产泡沫以来美国房地产市场从未见过的。普通人纷纷涌入市场,希望建立爱彼迎(Airbnb)帝国。机构投资者,比如黑石集团旗下的Home Partners of America,迅速扩大了他们的单户住宅投资组合。房屋建筑商急于趁热打铁,破土动工建造创纪录的“投机性”房屋。而像Opendoor和Zillow这样的iBuyers(iBuyer模式的最大优势是简化了房屋买卖的流程,即房地产投资人直接从卖家手中买房,买家再向公司购房,iBuyer公司承担了其中的交易环节)则优化了购房算法。

快进到10月份,投资者狂热已经被投资者恐慌所取代。美国正在进行住房修正——房价在6月至8月间下降了1.6%,这让许多投资者望而却步。这标志着自2012年以来美国全国房价首次出现下跌。

投资者的回撤是有道理的。虽然大多数住房经济学家并不认为会出现像金融危机那样规模的房价修正——在金融危机期间,美国房价在2006年至2012年期间下跌了27%——但他们承认,这次房价修正比2006年时更为剧烈。滞后的凯斯-席勒指数(Case-Shiller Index)已经显示,旧金山的房价下降了8.2%。

在Redfin首席执行官格伦·凯尔曼看来,疫情期间的房地产热潮带来的投资者狂热可以用来解释为什么这次房价回落速度更快。从历史上看,房价具有粘性。卖家根本不想在价格上让步,除非经济因素,如供应过剩,迫使他们转手。但对于机构投资者和建筑商来说,情况就不同了。如果他们认为价格即将下跌,他们就会想先退出。凯尔曼说,在疫情时期的房地产热潮中,投资者在购房者中所占比例上升,这最终使美国房地产市场更容易受到房价下滑的冲击。

“当如雨后春笋般林立的摩天大楼出现问题时,你们(投资者)第一个想退出。要做到这一点就要找到最低销售价格,然后再降2%。如果在第一个周末还没有卖出去,就[继续]降低销售价格。”凯尔曼说。

换句话说,凯尔曼暗示,房地产投资者,包括Redfin的iBuyer业务,在经济繁荣时期推动房价更快上涨,并将在修正期间推动房价更快回落。

“我的看法是,由于建筑商和iBuyers占了更多库存,这导致了房价更快回落。我们就是其中之一,我们也是iBuyer。” 凯尔曼说。“我们立即注意到,访问我们网站的人越来越少,报名参观房屋的人越来越少……我们坐拥价值3.5亿美元的待售房屋,这些房屋是我们用自己的钱买的,或者更糟的是用贷款买的。”我们一直告诉投资者,我们将通过迅速行动来保护我们的资产负债表。我们没有把希望作为一种策略。我们立即开始降价。”

为什么疫情期间,投资者纷纷涌入房地产市场(见上图和下图)?低抵押贷款利率、创纪录的升值和飙升的租金结合起来,让投资者无法抗拒。这吸引了从炒房者到房东夫妻,再到华尔街巨头的所有人。

但我们要清楚的是,在疫情期间的房地产热潮中,投资者狂热并不足以让美国房价上涨43%。相反,创纪录的房价上涨是由一场完美风暴引发的。白领专业人士可以在任何地方办公,他们既能购买更大的房产,也能前往博伊西这样的遥远市场。抵押贷款利率在2021年1月跌至2.65%的历史低点,即使在房价上涨的情况下,也使得抵押贷款更容易负担。更不用说,这一切都发生在低库存和有利的千禧一代首次购房者人口结构时期。

虽然抵押贷款利率的飙升导致了买方需求的历史性回落,但这并没有转化为库存的大幅飙升。大多数房主并不害怕。那么,在库存水平紧张的情况下,房价怎么会下跌呢?这是因为杠杆投资者不想玩“观望”的游戏。而只要有一栋房子跌破其可比销售价格,就可以导致整个地区的可比销售价格下降。

“一旦需求减弱,我们就开始降低房价,这就推低了房价。在我们标价降低的社区里,如今,每一套待售房屋都会有可比销售价格,每个买家都会知道并谈论这一情况。”凯尔曼说。

当然,在疫情期间的房地产热潮中,所谓的投资者狂热并不是一成不变的。投资者狂热在凤凰城、奥斯汀和拉斯维加斯等西部新兴城市尤为疯狂。这可以用来解释为什么那些充满泡沫的房地产市场正在急剧修正。

看看拉斯维加斯北部的这处房产就知道了。今年5月,Opendoor以54.08万美元的价格买下了这栋房子。仅仅几周后,Opendoor就在7月以58.1万美元的价格将其挂牌出售。但Opendoor为时已晚:拉斯维加斯的房地产市场已经翻盘了。时间快进到10月,这套房源刚刚下架,此前经过一系列降价,其挂牌价已降至47.2万美元。

乍一看,人们可能会认为Opendoor很快就会在这处房产上损失约13%。并不完全是。当Redfin和Opendoor等iBuyers购买房屋时,他们向卖家收取“服务费”,以换取快速交易。一方面,这缓冲了iBuyer的潜在损失。另一方面,这种缓冲意味着iBuyer不太害怕降价。

并不是所有人都同意凯尔曼的观点。早在今年5月,Zillow的高管就曾对《财富》杂志表示,该公司失败的iBuyer项目并没有在疫情期间的房地产热潮中推高美国房价。直到11月,Zillow宣布将退出该项目,该项目以过高的价格购买房屋,臭名昭著。在Zillow看来,购买计划规模太小,根本无法推高美国房价。

虽然凯尔曼将抵押贷款利率上升带来的房价迅速回落归因于投资者和建筑商,但他表示,还有其他因素在起作用。他说,首先,在2008年住房市场崩溃后的几年里,美国住房市场对抵押贷款利率变得更加敏感。其次,他说,房地产崩盘让卖家和买家都知道,房价确实会下跌。

“我认为人们从1946年到2008年一直信奉的房价总会上涨的信仰已经不复存在了。我的父母认为(房价)下跌简直是不可思议。”凯尔曼说。但他表示,2008年的房市崩盘打破了这种“信仰”。“因此,人们(现在)对这种(修正)的反应几乎是创伤后应激障碍(PTSD),他们回撤得更快。”

房价下一步将走向何方?

房地美(Freddie Mac)和美国抵押贷款银行家协会(Mortgage Bankers Association)等组织预计,未来几年房价将出现横盘走势。穆迪分析公司和高盛等公司预测,全国房价从峰值到低谷下跌了10%左右。穆迪分析公司预测,如果经济衰退来袭,全国房价的跌幅将在15%至20%之间。简而言之:出现了各种房价前景预测。(财富中文网)

译者:中慧言-王芳

The Pandemic Housing Boom unleashed an “investor mania” unlike anything seen in the U.S. housing market since the aughts housing bubble. Average Joes poured into the market in hopes of building Airbnb empires. Institutional investors, like Blackstone-owned Home Partners of America, quickly expanded their single-family home portfolios. Homebuilders, eager to strike while the irons were hot, broke ground on a record number of “spec” homes. While iBuyers, like Opendoor and Zillow, ramped up their algorithmic homebuying programs.

Fast-forward to October, and that investor mania has been replaced by investor panic. The ongoing housing correction—U.S. home prices have fallen 1.6% between June and August—has scared many investors to the sidelines. That marks the first national home price decline since 2012.

The investor pullback makes sense. While most housing economists don’t foresee a correction on scale with the Great Financial Crisis bust—during which U.S. home prices fell 27% between 2006 and 2012—they do acknowledge that this home price correction is sharper than it was in 2006. The lagged Case-Shiller Index already shows that home prices are down 8.2% in San Francisco.

To Redfin CEO Glenn Kelman, the Pandemic Housing Boom’s investor frenzy helps explain why home prices are correcting faster this time around. Historically speaking, home prices are sticky. Sellers simply don’t want to relent on price unless economics, like a supply glut, force their hand. That’s not as much the case for institutional investors and builders. If they think prices are about to drop, they want to get out first. The fact that the Pandemic Housing Boom saw investors become a higher share of buyers, Kelman says, ultimately makes the U.S. housing market more vulnerable to a faster swing down.

“When the shiitake mushrooms hit the fan, you [investors] want to get out first. The way to do that is to figure out where the lowest sale is, and be 2% below that. And if it doesn’t sell in the first weekend, move it down [again],” Kelman says.

In other words, Kelman is suggesting that real estate investors, including Redfin’s iBuyer business, helped drive home prices up faster during the boom and will push prices down faster during the correction.

“My take is that because builders and iBuyers account for more inventory, that leads to a faster correction. We’re one of them, we’re an iBuyer,” Kelman says. “We notice immediately when fewer people are on our website and fewer are signing up for tours…We’re sitting on $350 million worth of homes for sale that we bought with our own money, or worse bought with borrowed money. And what we always told investors is that we would protect our balance sheet by acting quickly. We don’t have hope as a strategy. We immediately started marking down things.”

Why was there an investor bull rush (see charts above and below) into the housing market during the pandemic? A combination of low mortgage rates, record appreciation, and soaring rents simply made it irresistible for investors. It brought out everyone from home flippers, to mom-and-pop landlords, to Wall Street juggernauts.

But let’s be clear: Investor mania alone didn’t send U.S. home prices up 43% during the Pandemic Housing Boom. Instead, record home price appreciation was spurred by a perfect storm. The ability to work from anywhere saw white-collar professionals both pony up for larger properties and take off for far-flung markets like Boise. And historically low mortgage rates, which bottomed out at 2.65% in January 2021, made mortgage payments more affordable even as prices rose. Not to mention this all occurred amid a period of low inventory and favorable first-time millennial homebuyer demographics.

While spiked mortgage rates have caused a historic pullback in buyer demand, it hasn’t translated into a massive inventory spike. Most homeowners aren’t scared. So how can home prices fall even if inventory levels are tight? It’s because leveraged investors don’t want to play the “wait and see” game. And all it takes is one home to fall below its comp price to reduce comps for an entire area.

“As soon as demand weakened, we were marking properties down, and that drives prices down. Every other home for sale in a neighborhood where we marked the listing down now has a comparable sale that every buyer is going to know about and talk about,” Kelman says.

Of course, so-called investor mania during the Pandemic Housing Boom wasn’t one-size-fits-all. The investor frenzy was particularly fierce in Western boomtowns like Phoenix, Austin, and Las Vegas. That helps explain why those frothy housing markets are correcting so dramatically right now.

Look no further than this property in North Las Vegas. In May, Opendoor bought the home for $540,800. Just weeks later, Opendoor listed it for sale in July at $581,000. But Opendoor was too late: The Las Vegas housing market had already rolled over. Fast-forward to October, and the listing just got taken off the market after a series of price cuts brought its list price to $472,000.

At first glance, one might assume Opendoor could soon take a loss of around 13% on the property. Not exactly. See, when iBuyers like Redfin and Opendoor buy a home, they charge sellers a “service fee” in exchange for the speedy transaction. On one hand, that buffers the potential loss for the iBuyer. On the other hand, that buffer means the iBuyer is less afraid to mark down the price.

Not everyone agrees with Kelman. Back in May, Zillow officials told Fortune that the company’s failed iBuyer program—which notoriously overpaid for homes until Zillow announced in November it would exit the program—didn’t drive up U.S. home prices during the Pandemic Housing Boom. In Zillow’s eyes, the buying program was simply too small to do so.

While Kelman attributes the swiftness of the home price correction that was brought on by rising mortgage rates to investors and builders, he says there were also other factors at play. For starters, he says the U.S. housing market has become more mortgage rate sensitive in the years following the 2008 housing crash. Second, he says the housing crash taught sellers and buyers alike that home prices can indeed fall.

“I think that the religion people had from 1946 to 2008, that housing prices always go up, is dead. My parents believed that it was literally inconceivable for [home] prices to go down,” Kelman says. But that housing “religion” got broken, he says, by the 2008 crash. “So folks respond [now] to that [correction] with almost PTSD, and they pull back much more quickly.”

Where will home prices head next?

Groups like Freddie Mac and the Mortgage Bankers Association foresee home prices going sideways in the coming years. And firms like Moody’s Analytics and Goldman Sachs predict a peak-to-trough national decline of around 10%. If a recession hits, Moody’s predicts that national decline would come in between 15% to 20%. Simply put: Home price outlooks are all over the place.