在积累财富方面,每一代人的轨迹都略有不同,这受到经济变化、数字进步和文化规范变化的影响。美国最年轻和最新的工薪阶层——Z世代刚刚开始崭露头角,并开始增加自己的净资产。

Z世代的平均净资产

Z世代(简称Gen Z)是指出生于1997年至2012年之间的人。这一代人中年龄最大的成员即将年满25岁,他们正积极参加工作,成为房主,组建家庭,并创办自己的企业。这一代人中最年轻的只有10岁。

大多数Z世代的财富积累之旅才刚刚开始,部分原因是许多人还没有参加工作,而那些参加工作的人还没有进入黄金收入期。

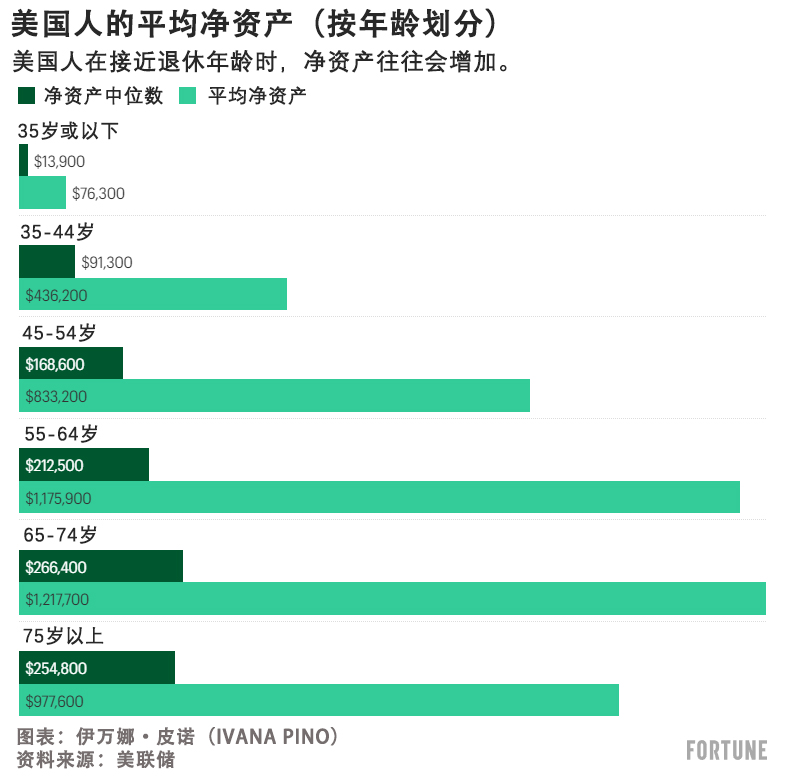

根据美联储2019年消费者财务调查,35岁以下的美国人(包括千禧一代和Z世代)的平均净资产为7.6万美元。

Z世代的净资产与其他世代相比如何?

与老一辈人相比,Z世代的平均净资产并不高。35岁以上的千禧一代平均资产超过40万美元。X世代的平均净资产在40万到83.3万美元之间,而包括婴儿潮一代和沉默一代在内的老一辈人的平均净资产则达到了数百万美元。

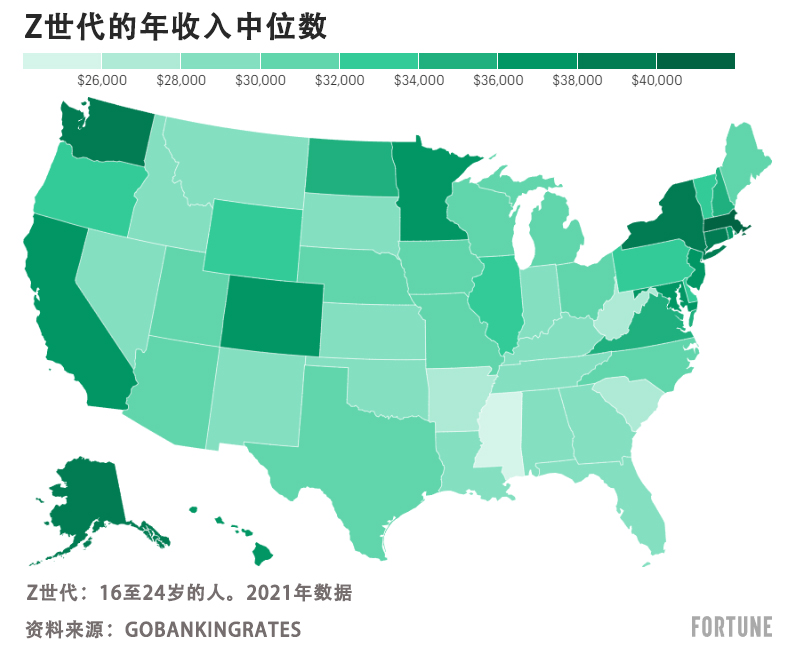

Z世代的平均净资产是所有世代中最低的,这不足为奇,因为他们中只有少数人参加工作,而且入门级工作的工资通常较低。收入较低导致储蓄和投资较少。德勤公司(Deloitte)最近发布的一份报告发现,46%的Z世代过着月光族的生活,超过四分之一的Z世代对自己能否舒适地退休没有信心。根据GoBankingRates最近的研究,Z世代员工的典型年薪因州而异,但2021年所有州的平均水平为3.25万美元。

“对于许多人来说,二十多岁是他们开始职业生涯和可能开始新职业生涯的时期。他们的收入潜力可能有限,这可能会让他们很难在这十年里建立净资产。”Personal Capital公司的注册理财规划师保罗•迪尔(Paul Deer)说。

这一代人中的许多人也把投资放在了次要位置。美国银行(Bank of America)的一项调查显示,近40%的人没有进行投资,主要原因包括没有多余的资金(44%)、不知道从哪里开始(31%)和感觉投资风险太大(23%)。同一项调查还发现,虽然一些Z世代优先考虑拥有住房,这通常被吹捧为建立净资产的关键方式,但大多数人由于房价飙升和日常成本上升而推迟成为房主。

是什么塑造了Z世代的净资产和财务前景?

有几大因素影响了这一代人建立和增加净资产的能力。经济低迷、创纪录的通货膨胀率、不断上升的教育成本和工资停滞,这些因素都给积累财富造成了重大障碍。

Z世代仍是职场新人

许多Z世代的人年龄较小:这一代人中有一半未满18岁,三分之二仍在上学或上大学,只有四分之一的Z世代人达到了工作年龄。即使对于那些参加工作的人来说,他们在职业生涯和赚取入门级薪水方面可能仍在努力站稳脚跟。

瑞银集团(UBS)驻帕萨迪纳的财务顾问理查德•伯坦(Richard Bertain)表示:“千禧一代和Z世代处于赚钱、储蓄和积累的早期阶段。储蓄情况似乎参差不齐,在许多情况下,他们还没养成储蓄的习惯。”

大萧条为Z世代的理财定下了基调

虽然最年长的Z世代在2007-2009年经济衰退期间只有十几岁,但许多人仍记得看着他们的哥哥姐姐们一边努力找工作,一边还着巨额学生贷款。因此,研究表明,尽管与老一辈人相比, Z世代人为退休储蓄较少,但他们的储蓄占其收入的比重较大。Z世代为退休储蓄的中位数是收入的20%,而千禧一代为收入的15%。

不过,在设定财务目标时,尚未结婚和尚未成家的Z世代工作人士倾向于优先考虑更直接的目标,如偿还信用卡、学生贷款和建立应急基金,而不是为退休储蓄。

Z世代的学生贷款债务比前几代人更多

根据美国教育部的一项分析,联邦学生贷款债务累计达到1.6万亿美元,超过4500万贷款人的债务还在增加。美联储的数据显示,Z世代的学生债务平均为20,900美元,比千禧一代高出13%。7.7%的Z世代学生债务余额超过5万美元。

因此,一些Z世代人已经推迟了重大里程碑,如买房、组建家庭,或为退休投资。某些措施,如一次性学生贷款豁免计划,给Z世代带来了希望,他们将有更多的可支配收入来实现未来的财务里程碑,但并不是所有的学生贷款借款人都能从这个计划中受益,一些Z世代的余额远远超过最高豁免额。

新冠肺炎疫情预计将对这一代人产生长期影响

对于许多Z世代人来说,疫情带来了他们一生中第二次重大经济危机,这场危机仍在对他们的个人财务状况造成严重破坏,其全面影响还有待观察。乔治敦大学的一份报告发现,25%的Z世代成年人(18-23岁)在疫情前就没有储蓄,据报告,自从疫情爆发以来,他们要么花光了储蓄,要么推迟储蓄或偿还债务。

Z世代人可以通过3种方式建立净资产

好消息是:Z世代有充裕的时间来建立净资产。而建立并维持庞大的净资产,就需要在现在做出积极的财务选择,这些选择将在未来带来回报。以下是步入正轨的几种方法:

1. 优先考虑偿还债务和储蓄。高债务余额,尤其是高息债务,会妨碍实现其他财务目标。专家表示,要尽早养成良好的储蓄习惯,并随着年龄的增长和收入的增加继续保持这些习惯,这会让你终身受益。

“较高的收入很容易被抵押贷款、汽车贷款、育儿费用和奢侈消费吞噬,比如愉快的度假体验和豪华晚餐。相反,重要的是保持前十年建立的储蓄和投资原则,如果可能的话,甚至提升收入的储蓄比例。”迪尔说。

2. 创业精神。创业可能是关键的财富驱动力,一些Z世代已经注意到了这一点。朝九晚五的疲劳、无与伦比的社交媒体技能以及日益增强的社会意识结合起来,正促使Z世代抛弃传统的企业工作环境,转而自己创业。微软公司(Microsoft)2022年的一项调查发现,超过60%的Z世代已经开始或打算开始创业。

3. 早点开始投资。一些专家建议留出税后收入的15%-25%用于投资,尽管这对每个人来说可能有点不同。然而,你越早开始投资,即使只有几美元,由于复利,你的资金就有更多的时间增长,从而使你受益。

迪尔说:“关键是养成良好的财务习惯,并坚持原则,这将有助于你在余生建立更多净资产。”(财富中文网)

编者注:本文中包含的建议、意见或排名出自Fortune Recommends™编辑团队。本内容未经任何合作伙伴或其他第三方审查,也未得到任何合作伙伴或其他第三方认可。

译者:中慧言-王芳

在积累财富方面,每一代人的轨迹都略有不同,这受到经济变化、数字进步和文化规范变化的影响。美国最年轻和最新的工薪阶层——Z世代刚刚开始崭露头角,并开始增加自己的净资产。

Z世代的平均净资产

Z世代(简称Gen Z)是指出生于1997年至2012年之间的人。这一代人中年龄最大的成员即将年满25岁,他们正积极参加工作,成为房主,组建家庭,并创办自己的企业。这一代人中最年轻的只有10岁。

大多数Z世代的财富积累之旅才刚刚开始,部分原因是许多人还没有参加工作,而那些参加工作的人还没有进入黄金收入期。

根据美联储2019年消费者财务调查,35岁以下的美国人(包括千禧一代和Z世代)的平均净资产为7.6万美元。

Z世代的净资产与其他世代相比如何?

与老一辈人相比,Z世代的平均净资产并不高。35岁以上的千禧一代平均资产超过40万美元。X世代的平均净资产在40万到83.3万美元之间,而包括婴儿潮一代和沉默一代在内的老一辈人的平均净资产则达到了数百万美元。

Z世代的平均净资产是所有世代中最低的,这不足为奇,因为他们中只有少数人参加工作,而且入门级工作的工资通常较低。收入较低导致储蓄和投资较少。德勤公司(Deloitte)最近发布的一份报告发现,46%的Z世代过着月光族的生活,超过四分之一的Z世代对自己能否舒适地退休没有信心。根据GoBankingRates最近的研究,Z世代员工的典型年薪因州而异,但2021年所有州的平均水平为3.25万美元。

“对于许多人来说,二十多岁是他们开始职业生涯和可能开始新职业生涯的时期。他们的收入潜力可能有限,这可能会让他们很难在这十年里建立净资产。”Personal Capital公司的注册理财规划师保罗•迪尔(Paul Deer)说。

这一代人中的许多人也把投资放在了次要位置。美国银行(Bank of America)的一项调查显示,近40%的人没有进行投资,主要原因包括没有多余的资金(44%)、不知道从哪里开始(31%)和感觉投资风险太大(23%)。同一项调查还发现,虽然一些Z世代优先考虑拥有住房,这通常被吹捧为建立净资产的关键方式,但大多数人由于房价飙升和日常成本上升而推迟成为房主。

是什么塑造了Z世代的净资产和财务前景?

有几大因素影响了这一代人建立和增加净资产的能力。经济低迷、创纪录的通货膨胀率、不断上升的教育成本和工资停滞,这些因素都给积累财富造成了重大障碍。

Z世代仍是职场新人

许多Z世代的人年龄较小:这一代人中有一半未满18岁,三分之二仍在上学或上大学,只有四分之一的Z世代人达到了工作年龄。即使对于那些参加工作的人来说,他们在职业生涯和赚取入门级薪水方面可能仍在努力站稳脚跟。

瑞银集团(UBS)驻帕萨迪纳的财务顾问理查德•伯坦(Richard Bertain)表示:“千禧一代和Z世代处于赚钱、储蓄和积累的早期阶段。储蓄情况似乎参差不齐,在许多情况下,他们还没养成储蓄的习惯。”

大萧条为Z世代的理财定下了基调

虽然最年长的Z世代在2007-2009年经济衰退期间只有十几岁,但许多人仍记得看着他们的哥哥姐姐们一边努力找工作,一边还着巨额学生贷款。因此,研究表明,尽管与老一辈人相比, Z世代人为退休储蓄较少,但他们的储蓄占其收入的比重较大。Z世代为退休储蓄的中位数是收入的20%,而千禧一代为收入的15%。

不过,在设定财务目标时,尚未结婚和尚未成家的Z世代工作人士倾向于优先考虑更直接的目标,如偿还信用卡、学生贷款和建立应急基金,而不是为退休储蓄。

Z世代的学生贷款债务比前几代人更多

根据美国教育部的一项分析,联邦学生贷款债务累计达到1.6万亿美元,超过4500万贷款人的债务还在增加。美联储的数据显示,Z世代的学生债务平均为20,900美元,比千禧一代高出13%。7.7%的Z世代学生债务余额超过5万美元。

因此,一些Z世代人已经推迟了重大里程碑,如买房、组建家庭,或为退休投资。某些措施,如一次性学生贷款豁免计划,给Z世代带来了希望,他们将有更多的可支配收入来实现未来的财务里程碑,但并不是所有的学生贷款借款人都能从这个计划中受益,一些Z世代的余额远远超过最高豁免额。

新冠肺炎疫情预计将对这一代人产生长期影响

对于许多Z世代人来说,疫情带来了他们一生中第二次重大经济危机,这场危机仍在对他们的个人财务状况造成严重破坏,其全面影响还有待观察。乔治敦大学的一份报告发现,25%的Z世代成年人(18-23岁)在疫情前就没有储蓄,据报告,自从疫情爆发以来,他们要么花光了储蓄,要么推迟储蓄或偿还债务。

Z世代人可以通过3种方式建立净资产

好消息是:Z世代有充裕的时间来建立净资产。而建立并维持庞大的净资产,就需要在现在做出积极的财务选择,这些选择将在未来带来回报。以下是步入正轨的几种方法:

1. 优先考虑偿还债务和储蓄。高债务余额,尤其是高息债务,会妨碍实现其他财务目标。专家表示,要尽早养成良好的储蓄习惯,并随着年龄的增长和收入的增加继续保持这些习惯,这会让你终身受益。

“较高的收入很容易被抵押贷款、汽车贷款、育儿费用和奢侈消费吞噬,比如愉快的度假体验和豪华晚餐。相反,重要的是保持前十年建立的储蓄和投资原则,如果可能的话,甚至提升收入的储蓄比例。”迪尔说。

2. 创业精神。创业可能是关键的财富驱动力,一些Z世代已经注意到了这一点。朝九晚五的疲劳、无与伦比的社交媒体技能以及日益增强的社会意识结合起来,正促使Z世代抛弃传统的企业工作环境,转而自己创业。微软公司(Microsoft)2022年的一项调查发现,超过60%的Z世代已经开始或打算开始创业。

3. 早点开始投资。一些专家建议留出税后收入的15%-25%用于投资,尽管这对每个人来说可能有点不同。然而,你越早开始投资,即使只有几美元,由于复利,你的资金就有更多的时间增长,从而使你受益。

迪尔说:“关键是养成良好的财务习惯,并坚持原则,这将有助于你在余生建立更多净资产。”(财富中文网)

编者注:本文中包含的建议、意见或排名出自Fortune Recommends™编辑团队。本内容未经任何合作伙伴或其他第三方审查,也未得到任何合作伙伴或其他第三方认可。

译者:中慧言-王芳

When it comes to building wealth, each generation is on a slightly different trajectory, shaped by a changing economy, digital advances, and shifting cultural norms. The youngest and newest working Americans—Generation Z—are just beginning to make their mark and grow their own net worths.

Average net worth of Generation Z

Generation Z, or Gen Z, is made up of individuals born between 1997 and 2012. The oldest members of this generation are turning 25, and are actively participating in the workforce, becoming homeowners, starting families, and launching their own businesses. The youngest members of this generation are just 10 years old.

Most Gen Zers are still at the very start of their wealth-building journey, due in part to the fact that many have still not joined the workforce, and those who are working have not yet entered their prime earning years.

According to the Federal Reserve’s 2019 Survey of Consumer Finances, Americans under age 35 (a mix of millennials and Gen Zers) have an average net worth of $76,000.

How does Gen Z’s net worth compare to other generations?

Compared to older generations, the average Gen Zer’s net worth falls short. The average millennial over age 35 stands at over $400,000. Those in Generation X have average net worths between $400,000 and $833,000, and older generations including Baby Boomers and the Silent Generation have average net worths that creep into the millions.

It’s not a surprise that Gen Z has the lowest average net worth of all the generations since there’s only a small number of them in the workforce, and entry-level jobs usually have lower salaries. Lower earnings have translated to lower savings and investment contributions. A recent report released by Deloitte found that 46% of Gen Zers are living paycheck-to-paycheck and over a quarter of Gen Zers are not confident that they will be able to retire comfortably. The typical annual salary for Generation Z workers varies from state to state, but the average across all states was $32,500 in 2021, according to recent research by GoBankingRates.

“For many people, the twenties are the time in their life when they are starting their professional lives and possibly a new career. Their earning potential may be somewhat limited, which might make it seem difficult to build net worth during this decade,” says Paul Deer, a certified financial planner at Personal Capital.

Investing has also been put on the backburner by many in this generation. Nearly 40% have no investments, and the top reasons for not investing include having no additional funds to spare (44%), not knowing where to start (31%) and feeling investing is too risky (23%), according to a Bank of America Survey. The same survey found that while some Gen Zers are prioritizing homeownership, which is often touted as a key way to build net worth, the majority are holding off on becoming homeowners due to surging home prices and rising everyday costs.

What has shaped Gen Z’s net worth and financial future?

Several factors have played a role in this generation’s ability to build and grow their net worths. A combination of economic downturns, record-breaking inflation, rising educational costs, and stagnant wages have all created significant barriers to building wealth.

Gen Z is still new to the workforce

Many Gen Zers are younger: half of this generation are still under the age of 18, two-thirds are still of school or college-age, and just a quarter of Gen Zers are of working age. Even for those participating in the workforce, they’re likely still gaining their footing when it comes to their professional careers and earning entry-level salaries.

“Millennial and Gen Z are earlier in the earning, saving, and accumulating phase,” says Richard Bertain, a Pasadena-based financial advisor for UBS. “Savings seems to be spotty and the habit of saving, in many instances, hasn’t become a habit yet.”

The Great Recession set the tone for Gen Z’s money management

While the oldest Gen Zers were just pre-teens during the 2007-2009 recession, many still remember watching older siblings struggle to find jobs while paying off big student loans. As a result, studies show that even though Gen Zers are saving less for retirement compared to older generations, they are saving a larger portion of their income. Gen Z sets aside a median 20% of their income for retirement, compared to a median 15% contribution from millennials.

Still, when it comes to setting financial goals, working Gen Zers who are not yet married and haven’t started families tend to prioritize more immediate goals like paying down credit cards, student loans, and building their emergency funds over saving for retirement.

Gen Z has more student loan debt than previous generations

According to a Department of Education analysis, the cumulative federal student loan debt stands at $1.6 trillion and rising for more than 45 million borrowers. Gen Zers have, on average, $20,900 in student debt—that’s 13% more than millennials, according to the Fed. And 7.7% of Gen Zers have balances over $50,000.

As a result, some Gen Zers have put off major milestones like purchasing a home, starting a family, or investing for retirement. Certain measures like the one-time student loan forgiveness program have given Gen Zers hope that they’ll have more available income to fund future financial milestones, but not all student loan borrowers will benefit from this program and some Gen Zers have balances that far exceed the maximum forgiveness amount.

The COVID-19 pandemic is expected to have long-term effects on this generation

For many Gen Zers, the pandemic ushered in the second major economic crisis in their lifetimes, one that is still wreaking havoc on their personal finances and the full effects of which are yet to be seen. One report by Georgetown University found that 25% of Gen Z adults (ages 18-23), who were already lacking in savings pre-pandemic, reported having either spent their savings or delayed saving or paying off debt since the pandemic hit.

3 ways Gen Zers can build their net worth

The good news: Gen Zers have time on their side. And building and maintaining a strong net worth is all about making positive financial choices now that will pay off later on. A few ways to get on track:

1. Prioritize paying down debt and saving: High debt balances, and especially high-interest debt, can get in the way of achieving other financial goals. Experts say building good savings habits early and continuing to implement those as you age and earn more money can make all the difference.

“It can be easy for higher earnings to get swallowed up in mortgage and car payments, child-rearing expenses, and splurging on a few luxuries like nice vacations and fancy dinners. Instead, it’s important to maintain the saving and investing disciplines that were established in the previous decade and even increase the percentage of income saved, if possible,” says Deer.

2. Entrepreneurship: Starting your own business can be a key wealth-driver, and some Gen Zers have already taken note. A combination of 9-to-5 fatigue, unparalleled social media skills, and an increased sense of social awareness are driving Gen Zers to ditch traditional corporate work environments for their own start-ups. A 2022 survey by Microsoft found that more than 60% of Gen Zers have started—or intend to start—their own business.

3. Investing early: Some experts recommend setting aside anywhere from 15%-25% of your after-tax income for investing, although this could look a little different for everyone. However, the earlier you start investing, even if it’s only a few dollars, the more time your money has to grow and work for you thanks to compound interest.

“The key is establishing good financial habits and disciplines that will help you build net worth over the rest of your life,” says Deer.

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends™editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.