8月22日,道琼斯工业平均指数(Dow Jones Industrial Average)下跌超过600点,原因是投资者再次对美联储(Federal Reserve)的激进加息感到担忧,结束了今年夏季的股市反弹。

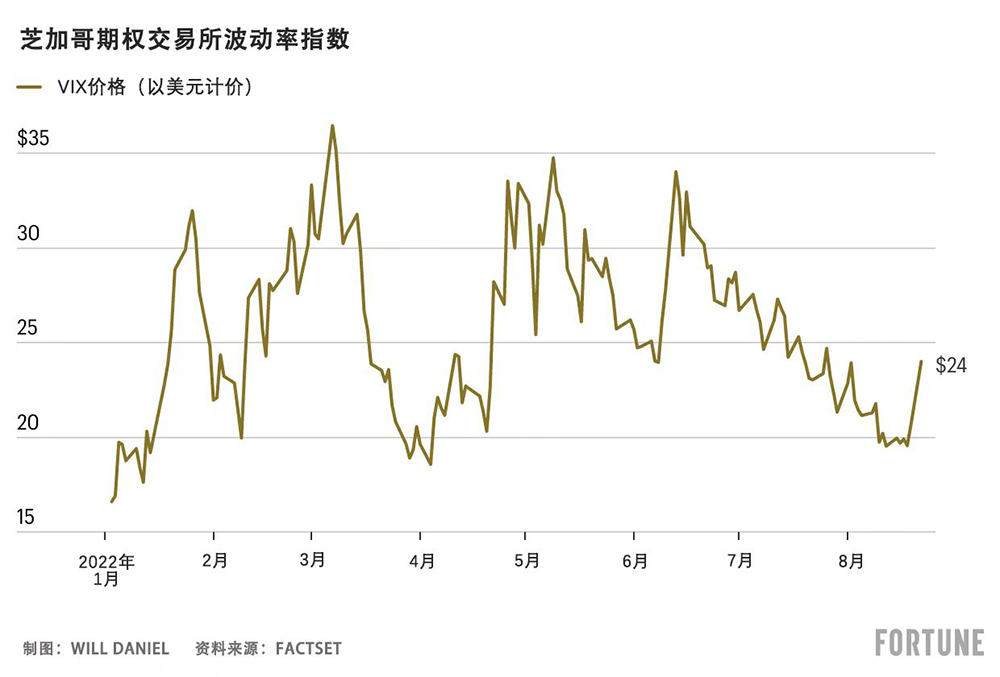

与此同时,芝加哥期权交易所(Chicago Board Options Exchange)的波动率指数(Volatility Index)在8月22日上升了近17%。波动率指数又被称为华尔街的“恐慌指数”。

1987年黑色星期一股市崩盘之后诞生的波动率指数,用于衡量美国股市的预期波动率。该指数基于标准普尔500指数(S&P 500)看涨和看跌期权的实时价格,自2008年金融危机以来在华尔街被广泛应用。

期权是一种衍生品,使投资者有权利(但没有义务)在指定日期或指定日期之前按照特定价格买入或卖出一种标的资产。

波动率指数之所以又被称为“恐慌指数”,是因为它用于衡量市场波动率或者价格变化速度,可以用来评估投资者和交易商的情绪。

它的工作原理是:当投资者和交易商担心股市的未来时,他们更可利用期权帮助保护其投资组合。这反过来会推高波动率指数,让其他投资者意识到他们的同行感觉到了危险。

专家们对《财富》杂志表示,8月22日,有多个关键因素帮助推高了波动率指数。

首先,8月22日是俄罗斯民族主义哲学家、弗拉基米尔·普京总统的“精神导师”亚历山大·杜金的女儿达里娅·杜金娜被刺杀之后的第一个交易日。交易商预计,普京可能针对此次刺杀采取反击,进一步减少对欧洲的天然气供应,并认为此次刺杀事件只会延长俄乌冲突的时间。

联信银行(Comerica Bank)的首席经济学家比尔·亚当斯告诉《财富》杂志:“在欧洲迎来冬季能源短缺和经济严重下滑之前,俄乌冲突平息的可能性越来越低。”

除此之外,8月22日也是俄罗斯国有能源巨头俄罗斯天然气工业股份公司(Gazprom)宣布北溪1号(Nord Stream 1)管道再次进行计划外维护之后的第一个交易日。北溪1号将俄罗斯的天然气通过波罗的海输送到德国。

随着天然气价格创历史新高,批评者认为俄罗斯利用这条管道惩罚对其实施制裁的欧洲国家,并“胁迫”各国使用俄罗斯卢布购买天然气。

由于北溪1号管道维护和杜金娜遇刺身亡,8月22日,美国和欧洲的天然气价格暴涨,作为欧洲天然气基准的荷兰TTF天然气期货价格上涨19%,达到每兆瓦时291.90美元。

但波动率指数的大幅上升,不只是因为欧洲出现能源短缺的可能性增加。投资者担心,尽管持续通胀导致经济增长停滞,欧美各国央行将不得不继续加息,进而增加了西方爆发更严重经济衰退的可能性。

安永-博智隆(EY-Parthenon)的首席经济学家格雷格·达科说:“对欧洲通胀持续上升的预期以及对各国央行采取激进紧缩政策的担忧,让投资者变得高度紧张。”他还表示,“在可预测的未来,市场将依旧处于一个高度动荡的环境。”

除了对经济衰退的担忧和欧洲的能源危机以外,波动率指数上升的另外一个潜在原因是,交易商试图在最近喜忧参半的经济新闻的冲击下,从市场波动中获利。

近几年,随着与指数挂钩的交易所交易基金(ETF)和衍生品的兴起,波动率指数交易变成了一个小型产业。位于休斯顿的投资公司Sanders Morris Harris的董事长乔治·保尔指出,波动率指数“对投资者而言是从市场波动中获利的一种高效的、低成本、流动性的方式,前提是投资者对市场涨跌的判断准确。”

保尔表示,随着波动率指数交易的增长,该指数将不再像以前一样,充分代表市场的“恐慌”或“贪婪”。但他认为,该指数依旧是“个人和机构管理投资组合风险的一个主要工具”,其作为衡量投资者情绪的指标,重要性不容忽视。

他说:“波动率指数已经变成了抵消波动性的黄金标准。因此,它是一种非常高效的机制,尽管它所采用的看跌/看涨比率与市场上涨或下跌的关联度较为宽松。”(财富中文网)

译者:刘进龙

审校:汪皓

8月22日,道琼斯工业平均指数(Dow Jones Industrial Average)下跌超过600点,原因是投资者再次对美联储(Federal Reserve)的激进加息感到担忧,结束了今年夏季的股市反弹。

与此同时,芝加哥期权交易所(Chicago Board Options Exchange)的波动率指数(Volatility Index)在8月22日上升了近17%。波动率指数又被称为华尔街的“恐慌指数”。

1987年黑色星期一股市崩盘之后诞生的波动率指数,用于衡量美国股市的预期波动率。该指数基于标准普尔500指数(S&P 500)看涨和看跌期权的实时价格,自2008年金融危机以来在华尔街被广泛应用。

期权是一种衍生品,使投资者有权利(但没有义务)在指定日期或指定日期之前按照特定价格买入或卖出一种标的资产。

波动率指数之所以又被称为“恐慌指数”,是因为它用于衡量市场波动率或者价格变化速度,可以用来评估投资者和交易商的情绪。

它的工作原理是:当投资者和交易商担心股市的未来时,他们更可利用期权帮助保护其投资组合。这反过来会推高波动率指数,让其他投资者意识到他们的同行感觉到了危险。

专家们对《财富》杂志表示,8月22日,有多个关键因素帮助推高了波动率指数。

首先,8月22日是俄罗斯民族主义哲学家、弗拉基米尔·普京总统的“精神导师”亚历山大·杜金的女儿达里娅·杜金娜被刺杀之后的第一个交易日。交易商预计,普京可能针对此次刺杀采取反击,进一步减少对欧洲的天然气供应,并认为此次刺杀事件只会延长俄乌冲突的时间。

联信银行(Comerica Bank)的首席经济学家比尔·亚当斯告诉《财富》杂志:“在欧洲迎来冬季能源短缺和经济严重下滑之前,俄乌冲突平息的可能性越来越低。”

除此之外,8月22日也是俄罗斯国有能源巨头俄罗斯天然气工业股份公司(Gazprom)宣布北溪1号(Nord Stream 1)管道再次进行计划外维护之后的第一个交易日。北溪1号将俄罗斯的天然气通过波罗的海输送到德国。

随着天然气价格创历史新高,批评者认为俄罗斯利用这条管道惩罚对其实施制裁的欧洲国家,并“胁迫”各国使用俄罗斯卢布购买天然气。

由于北溪1号管道维护和杜金娜遇刺身亡,8月22日,美国和欧洲的天然气价格暴涨,作为欧洲天然气基准的荷兰TTF天然气期货价格上涨19%,达到每兆瓦时291.90美元。

但波动率指数的大幅上升,不只是因为欧洲出现能源短缺的可能性增加。投资者担心,尽管持续通胀导致经济增长停滞,欧美各国央行将不得不继续加息,进而增加了西方爆发更严重经济衰退的可能性。

安永-博智隆(EY-Parthenon)的首席经济学家格雷格·达科说:“对欧洲通胀持续上升的预期以及对各国央行采取激进紧缩政策的担忧,让投资者变得高度紧张。”他还表示,“在可预测的未来,市场将依旧处于一个高度动荡的环境。”

除了对经济衰退的担忧和欧洲的能源危机以外,波动率指数上升的另外一个潜在原因是,交易商试图在最近喜忧参半的经济新闻的冲击下,从市场波动中获利。

近几年,随着与指数挂钩的交易所交易基金(ETF)和衍生品的兴起,波动率指数交易变成了一个小型产业。位于休斯顿的投资公司Sanders Morris Harris的董事长乔治·保尔指出,波动率指数“对投资者而言是从市场波动中获利的一种高效的、低成本、流动性的方式,前提是投资者对市场涨跌的判断准确。”

保尔表示,随着波动率指数交易的增长,该指数将不再像以前一样,充分代表市场的“恐慌”或“贪婪”。但他认为,该指数依旧是“个人和机构管理投资组合风险的一个主要工具”,其作为衡量投资者情绪的指标,重要性不容忽视。

他说:“波动率指数已经变成了抵消波动性的黄金标准。因此,它是一种非常高效的机制,尽管它所采用的看跌/看涨比率与市场上涨或下跌的关联度较为宽松。”(财富中文网)

译者:刘进龙

审校:汪皓

The Dow Jones Industrial Average sank over 600 points on August 22 as fears of aggressive interest rate hikes by the Federal Reserve crept back into investors’ minds, putting an end to this summer’s stock market rally.

At the same time, the Chicago Board Options Exchange’s Volatility Index (VIX), also known as Wall Street’s “fear gauge,” jumped nearly 17% to start the week.

The VIX was created after the Black Monday crash of 1987 as a way to measure the expected volatility of the U.S. stock market. It’s derived from real-time prices of S&P 500 call and put options, and has become widely used on Wall Street since the 2008 financial crisis.

Options, also known as derivatives, give investors the right—but not the obligation—to buy or sell an underlying asset at a specific price on or before a specified date.

The VIX has been given the moniker the “fear gauge,” because of its role in measuring volatility, or how fast prices change, which is seen as a way to gauge the sentiment of investors and traders.

It works something like this: When investors and traders become worried about the future of the stock market, they’re more likely to use options to help protect their portfolios. This, in turn, causes a rise in the VIX that helps other investors recognize that their peers are sensing danger.

Experts told Fortune that there were several key factors that helped push the VIX higher on August 22.

First, August 22 was the first trading day since the assassination of Daria Dugina, the daughter of the Russian nationalist philosopher and President Vladimir Putin’s “spiritual guide” Alexander Dugin. Traders are expecting Putin to respond to the assassination with further cuts to Europe’s natural gas supplies, and are betting that it will only help to extend the Russia-Ukraine war.

“The Russia-Ukraine war looks increasingly unlikely to wind down before it causes winter energy shortages and a severe downturn in Europe,” Bill Adams, Comerica Bank’s chief economist, told Fortune.

On top of that, August 22 was the first trading day since Russia’s state-owned energy giant Gazprom announced another unscheduled maintenance period for the Nord Stream 1 pipeline that carries natural gas from Russia to Germany via the Baltic Sea.

With natural gas prices at record highs, critics say Russia has used the pipeline as a way to punish European nations for their sanctions and “blackmail” countries into using Russian rubles to purchase natural gas supplies.

Natural gas prices in the U.S. and Europe spiked on August 22 as a result of Nord Stream 1 pipeline maintenance and Dugina’s assassination, with Dutch TTF gas futures, a European benchmark for natural gas, rising 19% to reach $291.90 per megawatt hour.

But the surge in the VIX is about more than just the increasing chance of a European energy shortage. Investors are worried that central banks will be forced to continue raising interest rates in the U.S. and Europe even as economic growth stalls due to persistent inflation, thereby increasing the odds of a more severe recession in the West.

“Expectations of an ongoing surge in inflation in Europe along with the sentiment that central banks will pursue aggressive tightening is making investors extremely anxious,” said Greg Daco, EY-Parthenon’s chief economist, adding that he believes the markets will remain in “a highly volatile environment for the foreseeable future.”

Beyond recession fears and Europe’s energy crisis, another potential reason for the VIX’s rise could be that traders are attempting to make a profit off market swings amid the recent onslaught of mixed economic news.

Trading on the VIX has become a cottage industry in recent years due to the rise of exchange-traded funds (ETFs) and derivatives tied to the index. George Ball, the chairman of Sanders Morris Harris, a Houston-based investment firm, noted that the VIX is “an efficient, low-cost, liquid way for investors to profit from market swings, up or down—assuming the investor is right about the direction.”

Because of the growth of VIX trading, Ball said that the VIX isn’t as good a representation of the market’s “fear” or “greed” as it used to be. Still, he noted that the index is still “primarily a tool to manage portfolio risk, both for individuals and institutions” and shouldn’t be discounted as a measure of investor sentiment altogether.

“It has become the gold standard for offsetting volatility,” he said. “As a result, it is quite efficient as a mechanism for doing that, even though the put/call ratio that it employs is only loosely linked to the market heading up or down.”