房地产经济学家们宣称,目前发展繁荣的房地产业将面临与2008年类似的衰退,这番言论可能让你觉得胆战心惊。事实上,许多人持相反观点,理由是大批千禧一代首次购房人、工资上涨和有限供应,将继续推高房价。包括CoreLogic和房利美(Fannie Mae)在内发布公开预测的多家大型房地产公司都表示,明年房价将继续上涨。

尽管如此,美国火爆的房地产市场即将发展到自上一次出现房地产泡沫以来前所未见的水平。

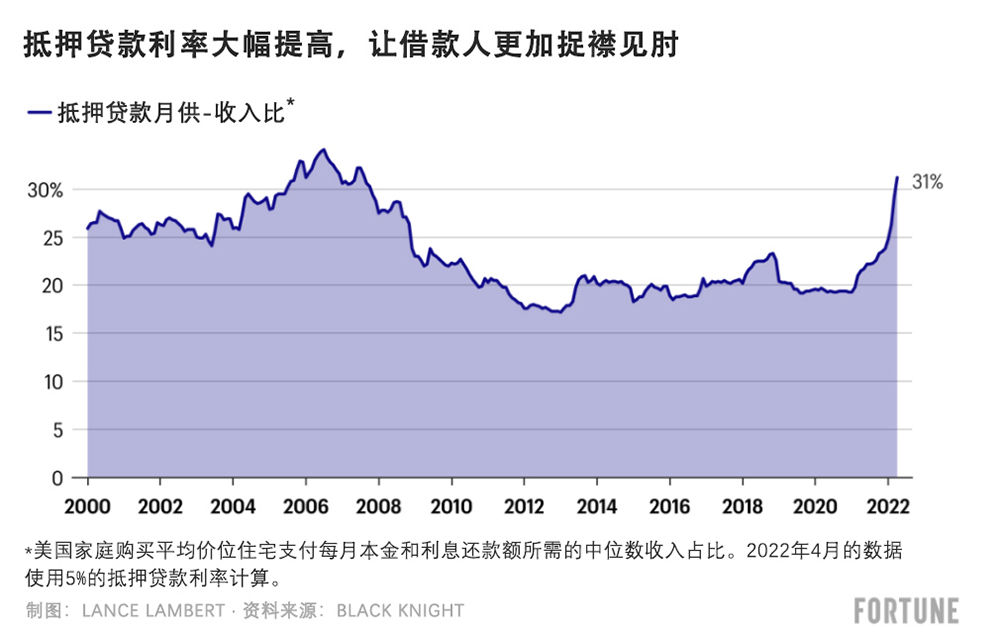

上周五,抵押抵款技术与数据提供商Black Knight向《财富》杂志展示的一项分析发现,普通美国家庭现在购买一般价位的美国住房,需要花费31%的月收入偿还抵押贷款。一周前这个比例只有29%,去年12月为24%。Black Knight’抵押贷款月供-收入比自2007年9月以来从未达到过31%,在2010年代期间平均水平为19.9%。

到底发生了什么?过去几周抵押贷款利率大幅上涨所带来的经济冲击,显著增加了新购房人的抵押贷款还款额。

早在12月,平均30年固定抵押贷款利率为3.11%。借款人按该利率抵押抵款500,000美元,月供为2,138美元。现在的平均利率为5%,申请同样一笔贷款的月供高达2,684美元。30年贷款的总还款额额外增加了196,700美元。

3月,达拉斯联邦储备银行(Federal Reserve Bank of Dallas)的一个研究员团队发表了一篇标题为《实时市场监测发现美国房地产泡沫正在酝酿的迹象》的论文,引起了房地产业的关注。研究人员发现,美国最近的房价上涨再次“脱离了”经济基本面。过去12个月,美国房价上涨了19.2%。

然而,达拉斯联储的研究人员认为2008年的危机不会重演。当然,许多新购房者在经济上变得捉襟见肘,这与上一次房地产泡沫时购房者的状况类似。但这只是新购房者。从整体上看,购房者的经济状况良好。

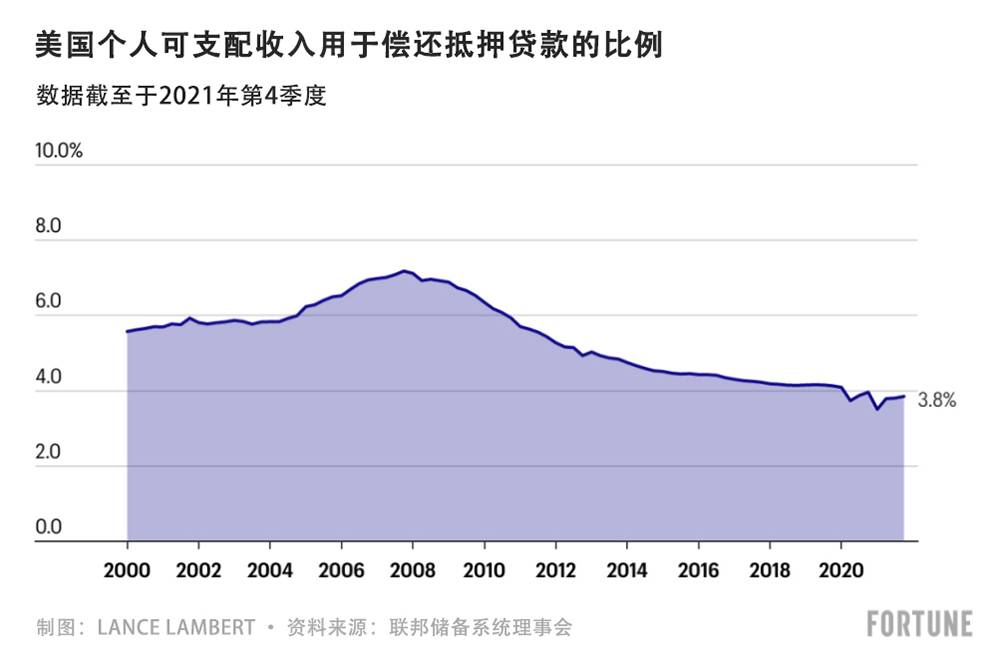

截至2021年第4季度,只有3.8%的美国个人可支配收入被用于偿还抵押贷款。在2000年代房地产泡沫最严重的时候,这个数字几乎翻了一番,达到7.2%。这一次,美国家庭的财务状况似乎更健康,而且更多购房者已经还清了贷款。此外,2010年的《多德-弗兰克法案》(Dodd-Frank Act)已经从市场中清理了之前那些违法贷款行为。简而言之:如果发生危机,理论上购房者更容易克服困难。

达拉斯联储的研究人员写道:“根据目前的证据,房价下跌的影响,无论从严重程度还是宏观经济重心来看,都不可能与2007-2009年的全球金融危机相提并论。除此之外,人们家庭财务状况似乎更好,而且过度借贷似乎并没有助长房地产市场的繁荣。”

抵押贷款利率上涨导致住房负担能力下降,这或许是好事。HousingWire首席分析师罗根·莫塔沙米这样认为。他表示,抵押贷款利率上涨可能给市场降温,有机会增加库存。库存增加会放慢房价上涨的速度,降低火爆的房地产市场达到过热甚至崩盘的可能性。

他对《财富》杂志表示:“抵押贷款利率上涨对于房地产市场而言是好消息,因为目前的房地产市场严重不健康,我们需要结束这种房屋库存量极低的状况。现在不是有太多贷款或不良信贷流入房地产市场。而是有太多人抢购过少的住房。我们迫切需要一个喘息的机会。”

Redfin认为,抵押贷款利率大幅上涨已经让房地产市场略有降温。该房屋中介平台发现房屋挂牌数量小幅增加,价格下降,而且预约看房的数量减少。然而,我们需要再等几周或者几个月,才能确定房地产市场确实正在降温。(财富中文网)

翻译:刘进龙

审校:汪皓

房地产经济学家们宣称,目前发展繁荣的房地产业将面临与2008年类似的衰退,这番言论可能让你觉得胆战心惊。事实上,许多人持相反观点,理由是大批千禧一代首次购房人、工资上涨和有限供应,将继续推高房价。包括CoreLogic和房利美(Fannie Mae)在内发布公开预测的多家大型房地产公司都表示,明年房价将继续上涨。

尽管如此,美国火爆的房地产市场即将发展到自上一次出现房地产泡沫以来前所未见的水平。

上周五,抵押抵款技术与数据提供商Black Knight向《财富》杂志展示的一项分析发现,普通美国家庭现在购买一般价位的美国住房,需要花费31%的月收入偿还抵押贷款。一周前这个比例只有29%,去年12月为24%。Black Knight’抵押贷款月供-收入比自2007年9月以来从未达到过31%,在2010年代期间平均水平为19.9%。

到底发生了什么?过去几周抵押贷款利率大幅上涨所带来的经济冲击,显著增加了新购房人的抵押贷款还款额。

早在12月,平均30年固定抵押贷款利率为3.11%。借款人按该利率抵押抵款500,000美元,月供为2,138美元。现在的平均利率为5%,申请同样一笔贷款的月供高达2,684美元。30年贷款的总还款额额外增加了196,700美元。

3月,达拉斯联邦储备银行(Federal Reserve Bank of Dallas)的一个研究员团队发表了一篇标题为《实时市场监测发现美国房地产泡沫正在酝酿的迹象》的论文,引起了房地产业的关注。研究人员发现,美国最近的房价上涨再次“脱离了”经济基本面。过去12个月,美国房价上涨了19.2%。

然而,达拉斯联储的研究人员认为2008年的危机不会重演。当然,许多新购房者在经济上变得捉襟见肘,这与上一次房地产泡沫时购房者的状况类似。但这只是新购房者。从整体上看,购房者的经济状况良好。

截至2021年第4季度,只有3.8%的美国个人可支配收入被用于偿还抵押贷款。在2000年代房地产泡沫最严重的时候,这个数字几乎翻了一番,达到7.2%。这一次,美国家庭的财务状况似乎更健康,而且更多购房者已经还清了贷款。此外,2010年的《多德-弗兰克法案》(Dodd-Frank Act)已经从市场中清理了之前那些违法贷款行为。简而言之:如果发生危机,理论上购房者更容易克服困难。

达拉斯联储的研究人员写道:“根据目前的证据,房价下跌的影响,无论从严重程度还是宏观经济重心来看,都不可能与2007-2009年的全球金融危机相提并论。除此之外,人们家庭财务状况似乎更好,而且过度借贷似乎并没有助长房地产市场的繁荣。”

抵押贷款利率上涨导致住房负担能力下降,这或许是好事。HousingWire首席分析师罗根·莫塔沙米这样认为。他表示,抵押贷款利率上涨可能给市场降温,有机会增加库存。库存增加会放慢房价上涨的速度,降低火爆的房地产市场达到过热甚至崩盘的可能性。

他对《财富》杂志表示:“抵押贷款利率上涨对于房地产市场而言是好消息,因为目前的房地产市场严重不健康,我们需要结束这种房屋库存量极低的状况。现在不是有太多贷款或不良信贷流入房地产市场。而是有太多人抢购过少的住房。我们迫切需要一个喘息的机会。”

Redfin认为,抵押贷款利率大幅上涨已经让房地产市场略有降温。该房屋中介平台发现房屋挂牌数量小幅增加,价格下降,而且预约看房的数量减少。然而,我们需要再等几周或者几个月,才能确定房地产市场确实正在降温。(财富中文网)

翻译:刘进龙

审校:汪皓

You’d be hard-pressed to find housing economists proclaiming that the ongoing housing boom is nearing a 2008-type bust. In fact, many say the opposite, based on the belief that the demographic wave of millennial first-time homebuyers, elevated wage growth, and limited supply will all continue pushing the market upwards. Every major real estate firm with a publicly available forecast, including CoreLogic and Fannie Mae, predicts that home prices will go even higher over the coming year.

That said, the red-hot U.S. housing market is beginning to hit levels not seen since our last housing bubble.

Black Knight, a mortgage technology and data provider, showed Fortune an analysis on Friday that finds the typical American household would now have to spend 31% of their monthly income to make a mortgage payment on the average-priced U.S. home. That’s up from 29% just one week earlier, and up from 24% in December. Black Knight’s mortgage-payment-to-income ratio—which averaged 19.9% during the 2010s decade—hasn’t topped 31% since September 2007.

What’s going on? The economic shock caused by soaring mortgage rates over the past few weeks has dramatically increased mortgage payments for new homebuyers.

Back in December, the average 30-year fixed mortgage rate stood at 3.11%. A borrower taking on a $500,000 mortgage at that rate would owe $2,138 per month. Now that the average rate is at 5%, that loan if issued today would cost $2,684 per month. Over the course of the 30-year loan, that’s an additional $196,700.

In March, a team of researchers at the Federal Reserve Bank of Dallas got the attention of the real estate industry after publishing a paper titled Real-time market monitoring finds signs of brewing U.S. housing bubble. They found that recent U.S. home-price growth—which is up 19.2% over the past 12 months—is once again becoming “unhinged” from economic fundamentals.

However, the Dallas Fed researchers don’t see this as a 2008 repeat. Sure, many new homebuyers are getting stretched financially in a way that resembles buyers during the last bubble. But that’s just new homebuyers. If you look broadly at homeowners, they’re doing quite well.

As of the fourth quarter of 2021, only 3.8% of U.S. disposable personal income was going toward mortgage debt payments. At the height of the 2000s housing bubble, that figure was nearly double at 7.2%. This time around, households’ balance sheets look healthier, and more homeowners have paid off their mortgage altogether. In addition, the shady lending practices of the aughts were regulated out of the market by the 2010 Dodd-Frank Act. Simply put: If a storm does come, homeowners, in theory, should be better positioned to ride it out.

“Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007–09 global financial crisis in terms of magnitude or macroeconomic gravity. Among other things, household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom,” write the Dallas Fed researchers.

It’s possible the affordability crunch created by soaring mortgage rates could be a good thing. That’s according to Logan Mohtashami, lead analyst at HousingWire. Spiking mortgage rates, he says, could take some steam out of the market and give inventory a chance to rise a bit. If that happens, it could slow down the rate of home price appreciation and reduce the likelihood of the red-hot housing market culminating in an overheated market—or even worse, a housing bust.

“Higher mortgage rates are the best thing for housing because we are in a savagely unhealthy housing market, and we need to get off these extreme low levels of inventory,” Mohtashami told Fortune. “It isn’t too much or bad credit chasing homes this time around. It’s too many people chasing too few homes. We desperately need a breather.”

According to Redfin, spiking mortgage rates are already softening the housing market a bit. The brokerage platform is seeing slightly more home listings with price cuts and fewer bookings for home showings. However, we’ll need to wait a few weeks—or months—before we can be sure that the housing market is actually softening.