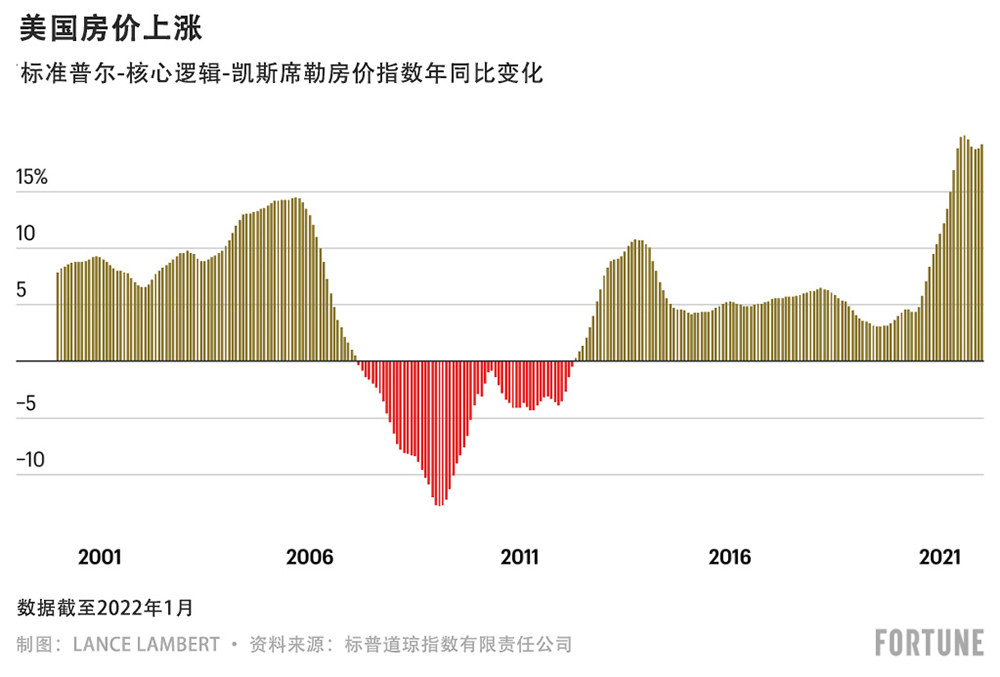

过去两年,美国房价上涨了32.6%,但房价飙涨所引发的财务困境,却因为疫情期间史上最低的抵押贷款利率,在某种程度上得到了缓解。虽然房价暴涨,许多购房人依旧可以承担月供。但这些好日子已经渐行渐远:随着抵押贷款利率恢复到疫情之前的水平,新购房人开始充分感受到高房价的影响。

早在去年12月,平均30年固定抵押贷款利率为3.11%。借款人以3.11%的利率贷款50万美元,月供含本金和利息共计2,137美元。目前平均抵押贷款利率为4.72%,同等金额的贷款月供金额为2,599美元。30年贷款总还款额额外增加了166,106美元。

抵押贷款利率的快速上涨,导致购房人面临自2007年以来最糟糕的局面。至少抵押贷款技术与数据提供商Black Knight的一个指标得出了这样的结论。

Black Knight向《财富》杂志提供的数据显示,按当前的抵押贷款利率计算,美国普通家庭抵押贷款购买一套平均价位的美国住宅,需要支出29%的月收入。Black Knight的抵押贷款月供-收入比自2007年以来从未达到过29%,在自2010年起的十年间平均水平为19.9%。这与2021年12月相比同样大幅提高,当时的月供-收入比为24%。

虽然住房负担能力(或者更准确地说,住房负担能力不足)开始表现出与2000年代中期的房地产市场类似的状况,但这并不意味着美国会重现2008年的房地产市场崩溃。

在上次房地产市场繁荣期间,房屋建筑商以难以持久的方式大量建造房屋。随着2006年左右房地产市场的增速开始放缓,很快就出现了供大于求,导致房价进一步下跌。而这一次,房屋建筑商的建造速度甚至没有跟上需求增长速度,也没有跟上人口结构的变化。业内人士对《财富》杂志表示,如果出现房价暴跌,现有库存不会从供应严重不足变成与2009年类似的供应过剩。

摩根士丹利(Morgan Stanley)研究人员在上周发布的一份报告中写道:“抵押贷款市场以固定利率为主,因此利率上涨不会增加现有房主的月供,但会对首次购房人产生严重影响。稳健的抵押贷款承销会限制止赎潮,避免强制出售,从而减少对房价的影响。”

有越来越多房地产经济学家支持通过上调抵押贷款利率给房地产市场降温。他们认为,房价上涨速度是不可持续的,如果房价上涨持续到2022年以后,可能导致房地产市场过热。他们宁愿房地产市场减速,维持可持续增长,也不愿意市场面临泡沫破裂的风险。达拉斯联邦储蓄银行(Federal Reserve Bank of Dallas)上个月发表了一篇标题为《实时市场监测发现美国房地产泡沫正在酝酿的迹象》的论文,显然引起了经济学家们的关注。

抵押贷款利率上涨能够给市场降温,这种观点有一定的道理。毕竟,这将是对市场需求侧的经济冲击:利率上浮不仅会将部分购房人挤出市场,还意味着部分借款人将失去贷款资格,因为借款人必须达到贷款机构严格的负债-收入比率。

摩根士丹利的研究人员称:“虽然房价上涨将会减速,但我们认为供应紧张依旧会支撑房价。事实上,利率上涨会减少供应,因为房主将锁定当前更低的利率(并且不太可能卖房)。(财富中文网)

译者:刘进龙

审校:汪皓

过去两年,美国房价上涨了32.6%,但房价飙涨所引发的财务困境,却因为疫情期间史上最低的抵押贷款利率,在某种程度上得到了缓解。虽然房价暴涨,许多购房人依旧可以承担月供。但这些好日子已经渐行渐远:随着抵押贷款利率恢复到疫情之前的水平,新购房人开始充分感受到高房价的影响。

早在去年12月,平均30年固定抵押贷款利率为3.11%。借款人以3.11%的利率贷款50万美元,月供含本金和利息共计2,137美元。目前平均抵押贷款利率为4.72%,同等金额的贷款月供金额为2,599美元。30年贷款总还款额额外增加了166,106美元。

抵押贷款利率的快速上涨,导致购房人面临自2007年以来最糟糕的局面。至少抵押贷款技术与数据提供商Black Knight的一个指标得出了这样的结论。

Black Knight向《财富》杂志提供的数据显示,按当前的抵押贷款利率计算,美国普通家庭抵押贷款购买一套平均价位的美国住宅,需要支出29%的月收入。Black Knight的抵押贷款月供-收入比自2007年以来从未达到过29%,在自2010年起的十年间平均水平为19.9%。这与2021年12月相比同样大幅提高,当时的月供-收入比为24%。

虽然住房负担能力(或者更准确地说,住房负担能力不足)开始表现出与2000年代中期的房地产市场类似的状况,但这并不意味着美国会重现2008年的房地产市场崩溃。

在上次房地产市场繁荣期间,房屋建筑商以难以持久的方式大量建造房屋。随着2006年左右房地产市场的增速开始放缓,很快就出现了供大于求,导致房价进一步下跌。而这一次,房屋建筑商的建造速度甚至没有跟上需求增长速度,也没有跟上人口结构的变化。业内人士对《财富》杂志表示,如果出现房价暴跌,现有库存不会从供应严重不足变成与2009年类似的供应过剩。

摩根士丹利(Morgan Stanley)研究人员在上周发布的一份报告中写道:“抵押贷款市场以固定利率为主,因此利率上涨不会增加现有房主的月供,但会对首次购房人产生严重影响。稳健的抵押贷款承销会限制止赎潮,避免强制出售,从而减少对房价的影响。”

有越来越多房地产经济学家支持通过上调抵押贷款利率给房地产市场降温。他们认为,房价上涨速度是不可持续的,如果房价上涨持续到2022年以后,可能导致房地产市场过热。他们宁愿房地产市场减速,维持可持续增长,也不愿意市场面临泡沫破裂的风险。达拉斯联邦储蓄银行(Federal Reserve Bank of Dallas)上个月发表了一篇标题为《实时市场监测发现美国房地产泡沫正在酝酿的迹象》的论文,显然引起了经济学家们的关注。

抵押贷款利率上涨能够给市场降温,这种观点有一定的道理。毕竟,这将是对市场需求侧的经济冲击:利率上浮不仅会将部分购房人挤出市场,还意味着部分借款人将失去贷款资格,因为借款人必须达到贷款机构严格的负债-收入比率。

摩根士丹利的研究人员称:“虽然房价上涨将会减速,但我们认为供应紧张依旧会支撑房价。事实上,利率上涨会减少供应,因为房主将锁定当前更低的利率(并且不太可能卖房)。(财富中文网)

译者:刘进龙

审校:汪皓

The financial sting of soaring home prices—up 32.6% over the past two years—was lessened, to a degree, by historically low mortgage rates during the pandemic. Even as prices soared, many buyers' monthly payments remained reasonable. Those days are behind us: Now that rates have returned to pre-pandemic levels, new homebuyers are starting to feel the full weight of record prices.

Back in December the average 30-year fixed mortgage rate sat at 3.11%. A borrower who took out a $500,000 mortgage at that 3.11% rate would've seen a monthly principal and interest payment of $2,137. Now that the average rate is up to 4.72%, a new loan at that size would equal a $2,599 monthly payment. Over the course of 30 years, that's an additional $166,106.

This swift jump in mortgage rates puts homebuyers in the worst position since 2007. At least that's according to one metric produced by Black Knight, a mortgage technology and data provider.

At current mortgage rate levels, the typical American household would have to spend 29% of their monthly income if they were to make a mortgage payment on the average priced U.S. home. That's according to data provided by Black Knight to Fortune. Black Knight's mortgage payment-to-income ratio—which averaged 19.9% during the 2010s decade—hasn't topped 29% since 2007. It also marks a massive jump from December, when the ratio was sitting at 24%.

While affordability (or better put, lack of affordability) levels are beginning to show glimpses of the mid-2000s housing market, it doesn't mean we should pencil in a 2008 housing crash.

During the last housing boom, homebuilders were churning out homes at an unsustainable level. Once the housing market began to slow down around 2006, the market quickly became oversaturated with supply—something that caused prices to sink further. This time around, homebuilders aren't even keeping up with demand and demographics. If a slump does come, industry insiders tell Fortune it is unlikely inventory would flip from severely undersupplied into a 2009-like housing glut.

"The mortgage market is mostly fixed-rate, so raising rates won't raise the monthly payment on current owners, but instead will disproportionately impact first-time homebuyers. Robust mortgage underwriting should keep foreclosures limited, preventing the forced selling that would weigh on home prices," wrote Morgan Stanley researchers in a report published last week.

There's a growing chorus of housing economists rooting for soaring mortgage rates to pull some steam out of the housing market. In their eyes, the rate of home appreciation is simply unsustainable, and if it continues beyond 2022, it risks the housing market getting overheated. They'd rather we slow to a sustainable level of growth rather than risk a bursting bubble. A paper published last month by the Federal Reserve Bank of Dallas titled "Real-time market monitoring finds signs of brewing U.S. housing bubble" certainly got their attention.

The idea that soaring mortgage rates would pull some steam out of the market makes sense. After all, it's an economic shock to the demand side of the market: Rising rates not only price some buyers out of the market, it also means some borrowers—who must meet lenders' strict debt-to-income ratios—will lose their loan eligibility.

"While home price appreciation should decelerate, we believe it will remain supported by tight supply. In fact, rising rates themselves will contribute to keeping supply subdued as homeowners will be locked in [and less likely to sell] at their current, lower rates," writes Morgan Stanley researchers.