在史上最低按揭贷款利率的诱惑下,加之远程办公一族越来越庞大,自新冠疫情爆发以来,美国迎来了一波购房热潮。购房者的激增也造成了住房市场库存——即待售住房数量的急剧下降。这种供不应求自然导致了房价的不断飙升。

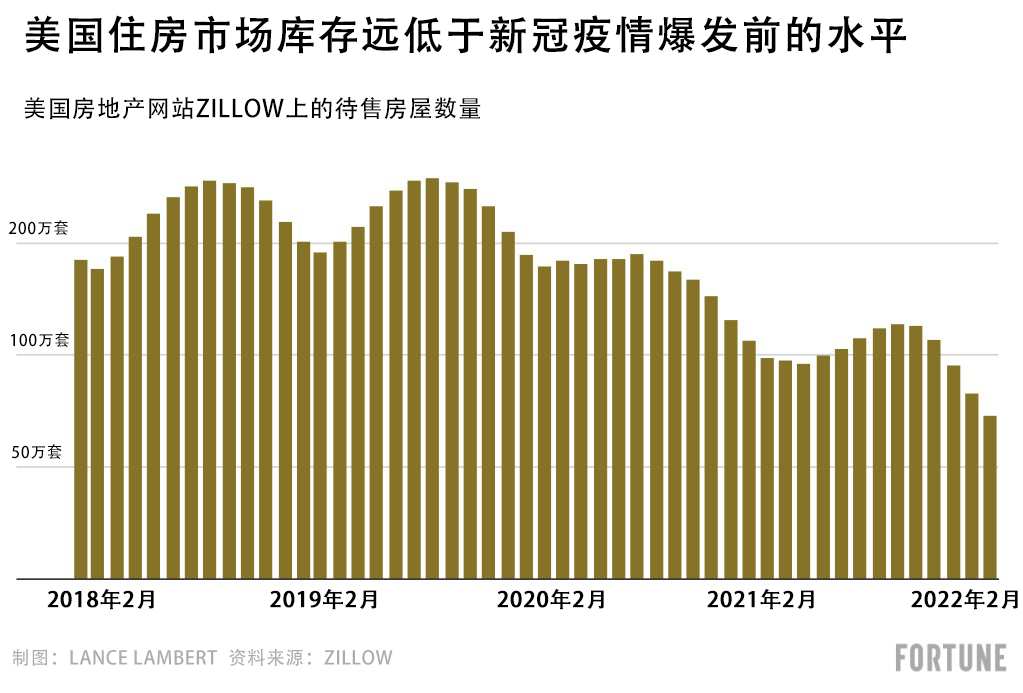

有人认为,一旦新冠疫情最严重的时期过去,住房市场库存不足的情况就会有所改善,理由是很多老年人在新冠疫情期间可能会放弃卖房或者搬家的打算,但一旦他们接种了新冠疫苗之后,他们就会按原计划卖房,从而增加市场上的二手房存量。还有很多房地产专家预测,随着2021年美国政府的疫情延期还贷政策到期,市场上有可能出现大量断供的法拍房。在一段时间之内,美国的住房库存确实有所增长。比如2021年4月,美国房地产网站Zillow上的住房库存一度降至96万套,而到了9月便回升至110万套。

但现在令购房者担忧的是,美国的住房库存水平再次出现了下跌。

3月11日,美国房地产网站Zillow报告称,美国2月的待售房屋数量已经降至72.9万套,较上年同期下降25%,较2020年2月下降了48%。这也标志着美国住房市场库存已经连跌了5个月。

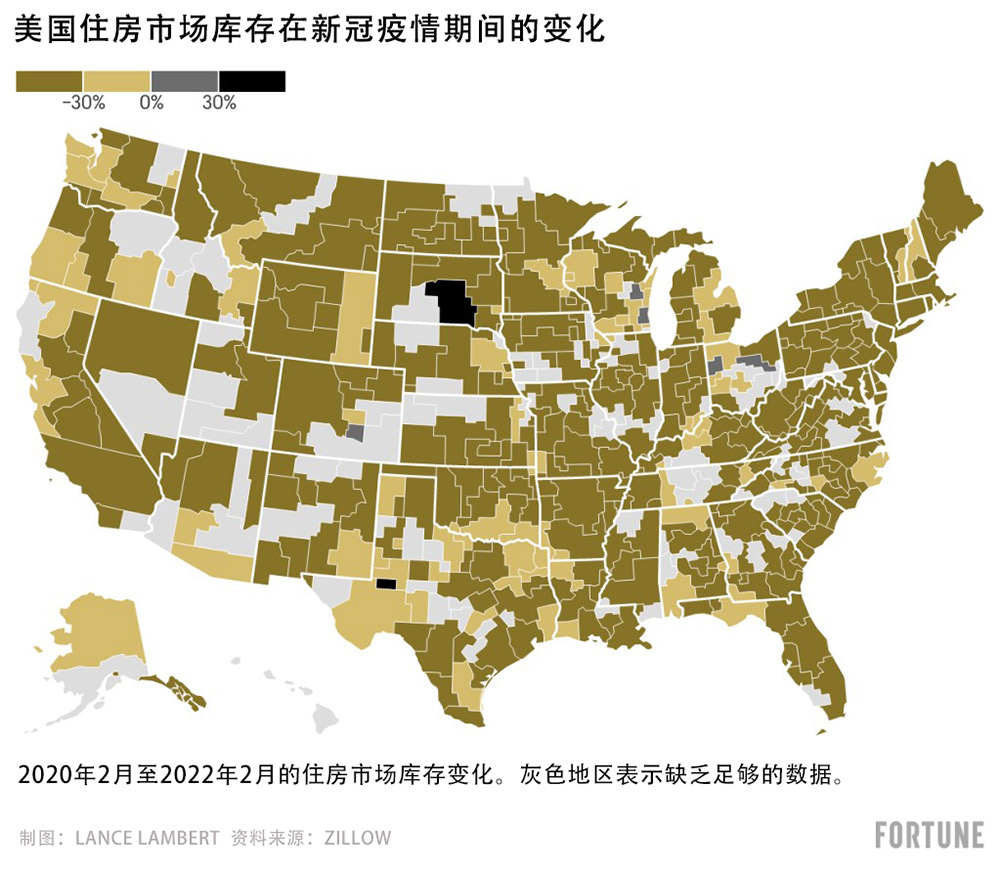

库存短缺问题并不仅仅发生在圣何塞和纽约等高房价城市。在Zillow网站调查的327个地区性房地产市场中,有四分之三的地区的住房库存都比新冠疫情前下降了至少30%。

“现在的房子都卖光了,人们的耐心也耗光了,这就是当前房地产市场的现状。”巴赫曼说。

还有一个问题也导致了住房库存的萎缩,那就是按揭贷款利率的飙升。2021年12月,美国的30年期固定抵押贷款利率平均为3.11%。截至今年3月11日,已经上升至3.85%。从理论上讲,随着时间的推移,更高的按揭利率会起到给房市降温的作用。但巴赫曼指出,抵押贷款利率的突然上升,短期内会令一部分买家产生更强的紧迫感,甚至加剧抢购现象,以免今后按揭利率升得更高。因此,这在短期内会进一步降低市场库存。(财富中文网)

译者:朴成奎

在史上最低按揭贷款利率的诱惑下,加之远程办公一族越来越庞大,自新冠疫情爆发以来,美国迎来了一波购房热潮。购房者的激增也造成了住房市场库存——即待售住房数量的急剧下降。这种供不应求自然导致了房价的不断飙升。

有人认为,一旦新冠疫情最严重的时期过去,住房市场库存不足的情况就会有所改善,理由是很多老年人在新冠疫情期间可能会放弃卖房或者搬家的打算,但一旦他们接种了新冠疫苗之后,他们就会按原计划卖房,从而增加市场上的二手房存量。还有很多房地产专家预测,随着2021年美国政府的疫情延期还贷政策到期,市场上有可能出现大量断供的法拍房。在一段时间之内,美国的住房库存确实有所增长。比如2021年4月,美国房地产网站Zillow上的住房库存一度降至96万套,而到了9月便回升至110万套。

但现在令购房者担忧的是,美国的住房库存水平再次出现了下跌。

3月11日,美国房地产网站Zillow报告称,美国2月的待售房屋数量已经降至72.9万套,较上年同期下降25%,较2020年2月下降了48%。这也标志着美国住房市场库存已经连跌了5个月。

约翰·伯恩斯房地产咨询公司(John Burns Real Estate Consulting)的研究副总裁德文·巴赫曼对《财富》杂志表示,只要住房库存水平仍然保持在近40年来的低点,美国的住房市场就很难恢复正常的增长水平。这一观点也在房地产经济学界中得到了广泛认同。很多经济学家指出,住房库存仍然是决定当前过热的住房市场最终将在何时降温的重要指标。

库存短缺问题并不仅仅发生在圣何塞和纽约等高房价城市。在Zillow网站调查的327个地区性房地产市场中,有四分之三的地区的住房库存都比新冠疫情前下降了至少30%。

“现在的房子都卖光了,人们的耐心也耗光了,这就是当前房地产市场的现状。”巴赫曼说。

为什么美国的住房库存问题会愈演愈烈?首先是需求并未减少。2019年至2023年这五年,将是美国“千禧一代”(也就是1989年到1993年出生的一代)整体步入30岁的重要窗口期,大量年轻人将成为首次购房者。而在供给端,在2008年的金融危机之后,各大房地产建筑商就削减了住房建设,因此哪怕没有新冠疫情影响,他们也根本没有为这波人口红利做好准备。此外还有全球供应链的问题,导致了从门窗到框架木材等各种原料全线短缺和延误,令房屋建筑商更加难以按时交房。

还有一个问题也导致了住房库存的萎缩,那就是按揭贷款利率的飙升。2021年12月,美国的30年期固定抵押贷款利率平均为3.11%。截至今年3月11日,已经上升至3.85%。从理论上讲,随着时间的推移,更高的按揭利率会起到给房市降温的作用。但巴赫曼指出,抵押贷款利率的突然上升,短期内会令一部分买家产生更强的紧迫感,甚至加剧抢购现象,以免今后按揭利率升得更高。因此,这在短期内会进一步降低市场库存。(财富中文网)

译者:朴成奎

Enticed by record-low mortgage rates and employers allowing them to work from anywhere, home shoppers rushed into the housing market during the pandemic. That influx of buyers caused inventory—the number of homes for sale—to plummet. Of course, less supply in the face of higher demand is the perfect recipe for spiking home prices.

It was believed this inventory crisis would improve once the worst of the pandemic was in the rearview mirror. The thinking was that many elderly Americans, who weren't keen on selling and moving during a pandemic, would finally list their homes for sale once they were vaccinated. In addition, many real estate experts predicted last year's winding down of mortgage forbearance, a program created to protect homeowners during the pandemic, would see more homes come on the market. For a while it did. In April 2021, housing inventory on Zillow bottomed out at 960,000 listings. By September, it had risen to 1.1 million.

The bad news for homebuyers? Inventory levels are once again falling.

On March 11, Zillow reported that U.S. inventory sank to 729,000 home listings in February. That's down 25% from February 2021, and a decrease of 48% since February 2020. It also marks the fifth consecutive month of declining inventory.

As long as inventory levels remain near four-decade lows, Devyn Bachman, vice president of research at John Burns Real Estate Consulting, tells Fortune it will be hard for the housing market to return to a normalized level of growth. That sentiment is shared widely among housing economists, who point to inventory as the key metric for determining when the unprecedented housing boom will finally cool down.

The inventory crunch isn't just happening in high-priced markets like San Jose and New York. Indeed, among the 327 regional housing markets measured by Zillow, three in four have inventory figures that are at least 30% below pre-pandemic levels.

"We're sold out of homes, and sold out of patience. That's where we are in today's housing market," Bachman says.

Why is the inventory situation getting worse? It starts with demand, which isn't letting up. We're still amid the five-year window (between 2019 and 2023) when every millennial born in the generation's five largest birth years (between 1989 and 1993) will hit the all-important first-time homebuying age of 30. Homebuilders, who cut back on building after the 2008 financial crisis, simply weren't ready for this demographic wave that was looming even before the pandemic struck. To make matters worse, homebuilders are now struggling to even fulfill contracts on time as the overwhelmed global supply chain continues to create delays and shortages for everything from garage doors and windows to framing lumber.

There's another reason inventory is shrinking again: Spiking mortgage rates. Back in December, the average 30-year fixed mortgage rate was at 3.11%. As of March 11, that rate has spiked to 3.85%. In theory, higher rates should cool the market over time. However, this sudden move up in mortgage rates, Bachman says, has corresponded in a short-term uptick in "buyer urgency." Home shoppers, she says, are rushing to buy now before rates go even higher. Of course, that's only taking more inventory off the market.