近期,美国小企业信心指数高企,达到新冠疫情爆发以来的顶点。然而,很多小企业经营者正苦于通货膨胀带来的不良影响。

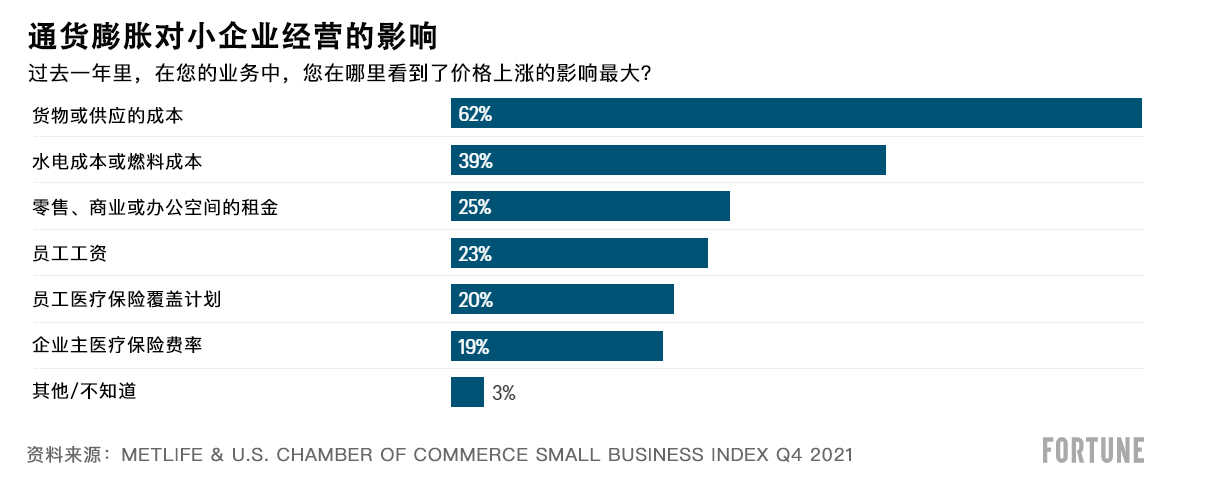

2021年12月14日发布的小企业指数(Small Business Index)报告显示,超过七成的小企业主表示,过去12个月内商品和服务成本上升,对经营产生了重大影响。这项报告每季度做一次调查分析,本次调查的时间为2021年10月13日至10月27日,收集了全美范围内750名小企业经营者的意见。

美国商会(U.S. Chamber of Commerce)的首席政策官尼尔·布拉德利说:“近期,通货膨胀确已经成为小企业所面临的主要问题。”营收当然永远是小企业主们的头等关切,但他们对通胀的担忧甚至已经超过了新冠疫情,布拉德利指出。

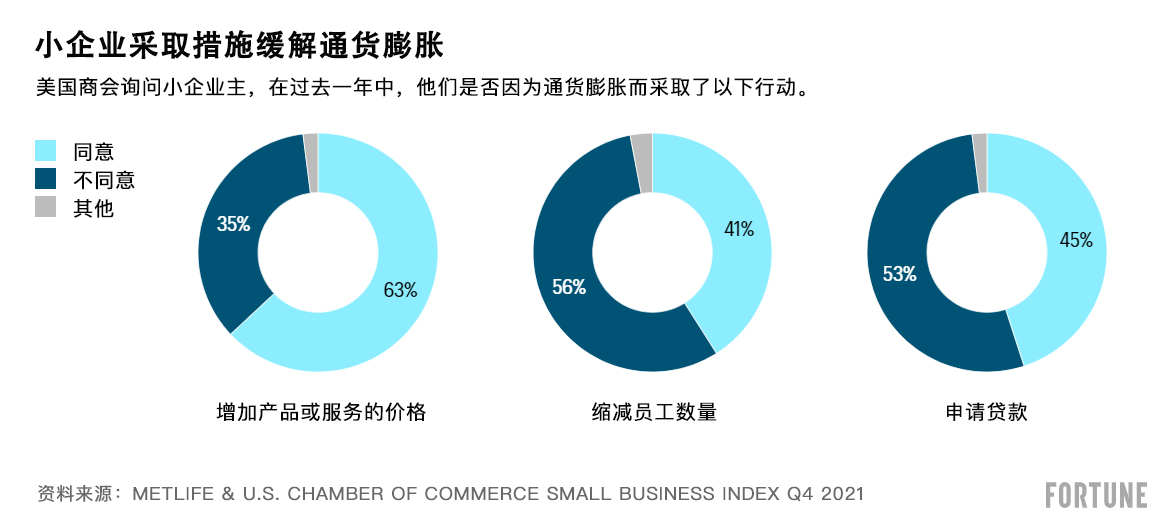

为了对抗通货膨胀,不至于亏本经营,63%的小企业提高了产品价格,约40%的小企业表示它们已经做出裁员的举措。但是,居然有高达45%的受访企业表示,为应对通货膨胀,它们在2021年申请了贷款。这一比例明显高于全美独立企业联盟(National Federation of Independent Business)的调查结果。该联盟于2021年10月进行了一项相关调查,虽然提出的问题不同,但只发现23%的小企业主会定期申请贷款。

布拉德利称:“如果这些小企业主不进货,不保障库存,那么就将无货可卖。为了不出现这种情况,他们只能寄希望于提高售价。”2020年,小企业平均贷款7.1万美元,美国商会的调查没有提及2021年的贷款规模。根据美国小企业管理局(Small Business Administration)的数据,2021年发放的薪酬保护项目贷款平均为4.6万美元。

布拉德利对《财富》杂志表示,45%的小企业主申请贷款,表明目前他们确实担心,通胀压力会丝毫不减地长期持续下去。受劳动力严重短缺和供应链危机的双重影响,美国的通胀压力可能会陷入恶性循环。

布拉德利说:“小企业主们招聘难,留人难,为此很是忧心。这种担忧让他们不得不提高员工的工资,进一步加重了企业的负担。因为运营成本提高了,所以产品也不得不随之涨价。”

布拉德利表示,许多小企业可能仍然处于复苏阶段,但新的问题已经产生。他指出:“小企业主们现在面临的困境与之前不同。新冠疫情爆发初期,他们受困于封城、对疫情的恐惧以及疫情导致的经济衰退。而现在,他们面临的困难主要是通胀、劳动力严重短缺和供应链中断。”(财富中文网)

译者:Transn

近期,美国小企业信心指数高企,达到新冠疫情爆发以来的顶点。然而,很多小企业经营者正苦于通货膨胀带来的不良影响。

2021年12月14日发布的小企业指数(Small Business Index)报告显示,超过七成的小企业主表示,过去12个月内商品和服务成本上升,对经营产生了重大影响。这项报告每季度做一次调查分析,本次调查的时间为2021年10月13日至10月27日,收集了全美范围内750名小企业经营者的意见。

美国商会(U.S. Chamber of Commerce)的首席政策官尼尔·布拉德利说:“近期,通货膨胀确已经成为小企业所面临的主要问题。”营收当然永远是小企业主们的头等关切,但他们对通胀的担忧甚至已经超过了新冠疫情,布拉德利指出。

为了对抗通货膨胀,不至于亏本经营,63%的小企业提高了产品价格,约40%的小企业表示它们已经做出裁员的举措。但是,居然有高达45%的受访企业表示,为应对通货膨胀,它们在2021年申请了贷款。这一比例明显高于全美独立企业联盟(National Federation of Independent Business)的调查结果。该联盟于2021年10月进行了一项相关调查,虽然提出的问题不同,但只发现23%的小企业主会定期申请贷款。

布拉德利表示,虽然申请贷款可能有点夸张,但最终还是取决于企业及其发展需求。许多小企业主都尽可能避免负债,但有一些不得不借贷,比如零售商,因为它们得保证进货。

布拉德利称:“如果这些小企业主不进货,不保障库存,那么就将无货可卖。为了不出现这种情况,他们只能寄希望于提高售价。”2020年,小企业平均贷款7.1万美元,美国商会的调查没有提及2021年的贷款规模。根据美国小企业管理局(Small Business Administration)的数据,2021年发放的薪酬保护项目贷款平均为4.6万美元。

布拉德利对《财富》杂志表示,45%的小企业主申请贷款,表明目前他们确实担心,通胀压力会丝毫不减地长期持续下去。受劳动力严重短缺和供应链危机的双重影响,美国的通胀压力可能会陷入恶性循环。

布拉德利说:“小企业主们招聘难,留人难,为此很是忧心。这种担忧让他们不得不提高员工的工资,进一步加重了企业的负担。因为运营成本提高了,所以产品也不得不随之涨价。”

总体而言,员工人数在5至499人之间的大中型企业,可能稍微比个体经营者以及少于5名员工的小企业,更易感觉受价格上涨的影响。

布拉德利表示,许多小企业可能仍然处于复苏阶段,但新的问题已经产生。他指出:“小企业主们现在面临的困境与之前不同。新冠疫情爆发初期,他们受困于封城、对疫情的恐惧以及疫情导致的经济衰退。而现在,他们面临的困难主要是通胀、劳动力严重短缺和供应链中断。”(财富中文网)

译者:Transn

Optimism among small-business owners is the highest it’s been since the start of the pandemic, but many are now struggling with the effects of inflation.

More than seven out of 10 small-business owners say the rising costs of goods and services significantly impacted their operations within the past 12 months, according to the latest Small Business Index report released on December 14, 2021. The quarterly analysis, conducted between Oct. 13 to Oct. 27, surveyed 750 small-business operators across the country.

“Inflation has really become the new dominant issue for small businesses,” says Neil Bradley, chief policy officer for the U.S. Chamber of Commerce. Revenue, of course, is always top-of-mind, Bradley says, but inflation has eclipsed even COVID concerns.

To combat the effects of inflation on their bottom lines, 63% of small businesses increased their prices, and about 40% say they have decreased staff. But a surprising 45% of small businesses say they have dealt with inflation by taking out a loan over the past year. That’s a significantly higher percentage than was found in a similar survey released by the National Federation of Independent Business in October, which asked a different question and found that 23% of owners reported borrowing on a regular basis.

While taking out loans may seem dramatic, Bradley says it depends on the business and its needs. Many small-business owners try to avoid taking on debt as much as possible, but retailers, for example, need to be able to purchase goods.

“If they’re not acquiring the inventory, then they don’t have anything to sell,” he says. “It’s an expectation that they will be able to raise prices sufficiently to cover that.” The Chamber’s survey did not ask about the size of the loans 2021, but 2020 the average small-business loan was $71,000. The average Paycheck Protection Program loan issued in 2021 was $46,000, according to the Small Business Administration.

A loan rate of 45% shows a real concern among many small businesses right now that the ongoing inflationary pressures won’t abate, Bradley tells Fortune. Because of the confluence of the worker shortage crisis and the supply chain crisis, the U.S. may have some inflationary pressures that become self-reinforcing.

“The level of concern among small-business owners about ability to retain employees and to find applicants for the open jobs that they have fuels some of the wage pressures that we’re already seeing—which then have to be offset by higher prices to offset the higher operating costs,” Bradley says.

Overall, larger and midsize businesses—those with between five and 499 employees—are slightly more likely than solo operators and small businesses with fewer than five employees to say they have been impacted by rising prices.

These new challenges come at a time when many small businesses are probably still in the recovery phase, Bradley says. “Small-business owners are now dealing with different headwinds,” he notes. “For the first part of the pandemic, it really was shutdowns, fear of COVID, and the economic disruption that the pandemic induced. Now the headwinds that they are facing are inflation, a worker shortage crisis, and supply chain disruptions.”