从今年秋天六周的走势可以看出,特斯拉(Tesla)的股价已经严重脱离了公司基本面。

受第三季度亮眼财报影响,加上租车公司赫兹(Hertz)宣布计划购入10万辆特斯拉扩大其租赁车队的规模,从10月8日到11月4日,在19个交易日里,特斯拉股价大涨57%,最高达到1230美元。无论是亮眼的财报还是赫兹的购车计划,都是具有深远意义的商业里程碑,标志着特斯拉曾经显得激进的电动汽车业务已经在主流商业世界里越走越远。

但投资者的反应确实太过疯狂,对于任何股票而言,在不到一个月的时间里上涨57%都会令人瞠目结舌。而就特斯拉本次的上涨而言,在蜂拥而至的买家的助推下,特斯拉的市值更是(全部流通股的价值)暴涨了4480亿美元之巨,创下股票交易史上单个公司短期市值飙升纪录。那么这次市值上涨究竟有多惊人呢?仅仅特斯拉市值增加的部分就超过了标准普尔500指数(S&P 500)中前9大股票以外所有股票市值增加的总和,其中包括许多营收远超特斯拉的巨头企业,例如强生公司(Johnson & Johnson)和美国银行(Bank of America)。特斯拉也在投资者的支持之下首次进入“万亿美元”俱乐部,在微软(Microsoft)、苹果(Apple)、亚马逊(Amazon)和Alphabet身旁占据了一席之地。

而在市值创下历史纪录之后,特斯拉又一如既往地掀起了一番风浪,而这自然少不了马斯克“角落办公室”的功劳。首先,马斯克对赫兹宣布的交易发出了质疑,他在推特(Twitter)上回应称,特斯拉尚未与这家租车行业巨头签署合约。其次,马斯克又发起了一项莫名其妙的民意调查,在推特上询问粉丝自己是否应该抛售10%的股份,结果58%的人投了赞成票。其后,提交给美国证券交易委员会(SEC)的文件显示,马斯克已经开始出售特斯拉股票,规模达数十亿美元。总而言之,截至11月22日收盘,特斯拉的市值已经从顶峰下跌6%。但在投资者眼中,该公司的市值仍然高达1.16万亿美元,相较于股价“起飞”前仍然增加了近3750亿美元,而且特斯拉依然是“万亿美元俱乐部”的一员,与许多营收达其数倍之多的企业并驾齐驱。

特斯拉近期股价的大幅飙升让其怀疑者大跌眼镜,后者惊奇地发现,在他们眼中已然高到离谱的股价竟然还能够在如此短的时间里再涨50%多,实在不可思议。标准普尔500指数成份股的平均历史市盈率为24倍,而特斯拉目前的市盈率已经达到约365倍。“这可以说是‘害怕错过’的终极表现了。”贝内特·斯图尔特如是说。斯图尔特是一位专门研究分析公司资本回报率的顾问,他称:“这完全是企业冲劲、领导层魅力和超铁杆拥趸共同发力的结果。在此之前,这家伟大公司的股价已经严重偏离基本面。经过最近一轮飙升,这种情况更是愈演愈烈。”

特斯拉估值的一飞冲天也促使我们对当前这样一个“迷因股票、万物皆涨”的时代提出了本质性问题,即“1万亿美元估值到底意味着什么?”这种高昂的估值当然能够在一定程度上反映公司的受欢迎程度,也可以体现散户投资者的热情和信心。在马斯克的领导之下,特斯拉在电动汽车领域可谓遥遥领先。但是其能否创造足够的利润、销售额和市场份额来证明自己配得上美国第五大市值公司的名头?

我们都听过特斯拉粉丝为其设想的美好蓝图。其拥趸认为,在电动汽车彻底改变全球汽车制造业的历史性时刻,特斯拉将成为该行业当之无愧的王者。他们还认为,特斯拉绝不仅仅是“造车匠”,凭借其超级先进的软件和电池技术,特斯拉在能源储存和自动驾驶领域也拥有巨大的领先优势。未来,该公司也将在上述领域大展拳脚,通过出售产品、向竞争对手提供授权赚得盆满钵满。方舟投资公司(ARK Invest)的首席执行官凯西·伍德最近在Milken Institute全球峰会(Milken Institute Global Conference)上表示:“电动汽车正在从传统燃油车手中夺取大量的市场份额。股票最终对这一现实做出了反应。未来五年内,特斯拉的股价还将再翻两番(达到每股3000美元)。”

诚然,我们现在还无从得知特斯拉将会如何实现自己的雄心壮志、如何驾驭未来,但我们还是能够通过一些简单的方法算出特斯拉要想为股东带来高额回报或者跟上市场整体水平必须拿出怎样的业绩。而计算得出的结论则给我们泼了一盆冷水:要想配得上自己当前的股价,特斯拉必须拿出史诗级的、看似不切实际的业绩。

事实上,现在购买特斯拉的股票就等于在做一场终极的长期赌博,押注特斯拉将在电动汽车领域获得超乎想象的收益,而其竞争对手(等同于全球其他所有车企)则全部在市场竞争中败下阵来。简而言之,现在投资特斯拉等同于表示特斯拉将横扫电动汽车领域,其他公司则只能去争夺残羹剩饭。

为评估特斯拉需要做出怎样的业绩才可以匹配此轮暴涨,《财富》杂志使用了两种经过实战检验的精确评估工具:其一是投资研究公司New Constructs的创始人及首席执行官大卫·特雷纳开发的“预期投资”(expectations investments)分析工具;其二是机构股东服务公司(Institutional Shareholder Services,简称ISS)部署的“经济增加值”(economic value added,简称EVA),用于评估高管薪酬及其他公司业绩要素。

二者均涉及一种基本的收益衡量标准,即“税后净营业利润”(net operating profit after tax,简称NOPAT)。当前的市值能够扮演“路标”的角色。通过相关分析我们可以知道,某家公司如果想匹配以当前价格买入股票的风险,就必须达到多块的增长速度。如果以365倍的历史市盈率来看,买入特斯拉的股票就相当于你认为,凭借特斯拉的扩张速度,其股票的价值也能够实现相应增长。税后净营业利润可以帮助分析师制定具体的增长目标。特雷纳说:“只有当特斯拉的表现超过预期、且未来的税后净营业利润能够超过当前股价对应的巨大数值时,特斯拉的股票才值得买入。”

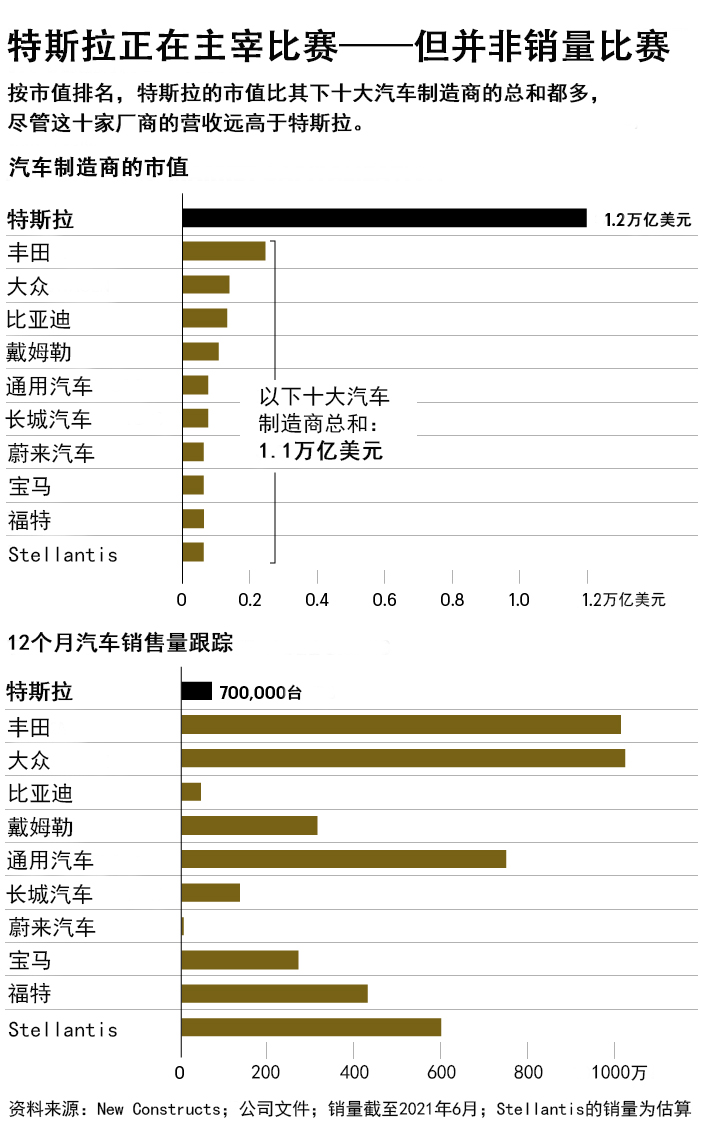

我们先从特雷纳的模型开始。在最近的一份报告中,特雷纳指出,特斯拉的市值已经超过了全球10大车企的市值总和,包括丰田(Toyota)、通用汽车(General Motors)、福特(Ford)和戴姆勒(Daimler),即梅赛德斯(Mercedes)的母公司。在过去的四个季度里,上述10大车企的汽车销售量达4500万辆,是特斯拉的50多倍。

据特雷纳计算,特斯拉目前的税后净营业利润为36亿美元。由此通过其数字分析可以得出,市场对特斯拉的未来业绩可谓“极为乐观”。他发现,(给特斯拉的估值相当于)市场预期特斯拉能够在2030年前实现17.2%的税后净营业利润率,相当于丰田的两倍,比特斯拉当前的数字还高10个百分点。

特雷纳以相关数据为基准,通过逆向推演得出,要想匹配其当前超过1.1万亿美元的估值,到2030年,特斯拉的营收就需要从过去四个季度的470亿美元暴涨至7830亿美元。这比丰田、通用汽车、福特、本田和Stellantis——克莱斯勒(Chrysler)、道奇(Dodge)和菲亚特(Fiat)的母公司——等公司目前的营收总额还多。更重要的是:这比目前地球上任何一家公司的收入都要多。

要想实现这一目标,特斯拉就需要像初创企业一样实现38%的年化增长率,而这种速度在大企业中几乎闻所未闻。税后净营业利润需要遵循相似的轨迹,也就是说,未来九年内每年需要达到1350亿美元,远超苹果公司(美国最赚钱的企业)当前的利润水平。

如此巨大的利润数字看起来令人生畏,而特斯拉还将面临更大的挑战:电动汽车产业的规模很可能不足以让特斯拉具备冲击传统行业巨头的实力。特雷纳引用了国际能源署(International Energy Agency)对“基本情况”的预测数据,即到2030年,电动汽车的销量将达到2580万辆。如果特斯拉汽车继续保持目前51000美元的平均售价,那么在这个十年结束时,特斯拉每年就要卖出1600万辆汽车才可以获得7830亿美元的收入。换句话说,“特斯拉需要在整个电动汽车市场占据60%的份额。”特雷纳表示。

特雷纳还警告称,如果我们把税后净营业利润率设定的更现实一些,比方说,8.5%(与通用汽车当前水平相当),那么特斯拉就需要在2030年售出3100万辆电动汽车才能够达到基准目标,相当于全行业总销量的118%,也就是说,特斯拉即便独霸全球电动汽车市场也无法实现目标。特雷纳总结说:“这种收入、盈利预期简直不可思议,根本不可能实现。”

机构股东服务公司的总经理安东尼·坎帕尼亚提出的假设与之不同,但却得出了相似的结论。据其估计,特斯拉目前的税后净营业利润为34亿美元,而后他又假设目标税后净营业利润率为8%。通过进行EVA分析,他认为,要想匹配特斯拉当前的股价,到2030年,特斯拉的销售额就必须达到1.2万亿美元,而税后净营业利润则需要达到930亿美元。而要达到这一目标,特斯拉的税后净营业利润的年增长率就必须达到19%。与之相比,同样经由EVA公式计算后,微软和亚马逊要想匹配投资者给出的估值,需要达到的年增长率分别为8%和9%,而对这两家公司而言,相关数字已然不低。坎帕尼亚说:“从估值来看,投资者对特斯拉的增长预期可谓非常之高。”

坎帕尼亚还提醒说,EVA算法假设特斯拉将使用自有现金流新建所有的超级工厂,不会通过借款或发行股票募集更多资本。但正如特雷纳所指出的那样,要想证明当前股价的合理性,特斯拉就需要在2030年生产15倍或20倍于当前销量的汽车,而如此规模的产能建设将侵蚀特斯拉的利润、拉低股价。因此,特斯拉很可能需要进行大幅融资。

人们对特斯拉将统治汽车行业的幻想不仅体现在特斯拉的股价上,还体现在投资者对其竞争对手的估值上。《财富》杂志根据过去四个季度的GAAP收益计算了美、欧、日、韩15家顶级传统车企的整体市盈率,结果仅为7.4,与特斯拉的历史市盈率相比简直微不足道。

从本质上讲,市场认为,即便已经在“电动汽车转型”上投入数十亿美元,特斯拉的竞争对手依然无法从电动汽车业务中赚到利润。斯图尔特认为:“在投资者眼中,电动汽车市场已经是一片红海。他们认为特斯拉将赢家通吃,其他公司只能成为特斯拉的模仿者和追随者,在商品终端展开争夺,而特斯拉则将成为行业内的顶级品牌和技术领袖。”

一言以蔽之,特斯拉的超万亿估值相当于投资者的一种预言,即电动汽车市场将成为特斯拉独享的财富宝库。但这种可能性有多大?特斯拉的所有主要竞争对手对于电动汽车领域都是雄心勃勃。特雷纳在他最近的文章中指出,大众、戴姆勒和Stellantis均已经做出承诺,到2030年,其生产的汽车中有50%将是电动汽车,而福特则为40%。总之,据特雷纳估计,特斯拉10家竞争对手的目标是到2030年每年生产1900万辆电动汽车。请注意,国际能源署对当年整个市场的销量预测是略低于2600万辆。传统汽车巨头每售出一辆电动汽车,都会进一步降低特斯拉卖出足够汽车证明当前超高估值合理的可能性。

最可能的结果是,在其他车企渡过“蹒跚学步”的阶段之后,特斯拉的股价将趋于平稳或一跌到底,虽然可能会对投资者造成打击,但即便该公司可以持续增长、创新,这种情况也极有可能发生。最终,基础数学的力量将会摧毁建立在信心、信念和美国梦想家魅力之上的沙堡。这些数字站不住脚。电动汽车行业必将迎来越发激烈的竞争,而特斯拉的股价又很容易发生变化。有些学费非交不可。(财富中文网)

本文另一版本登载于《财富》杂志2021年12月/2022年1月刊,标题为《特斯拉万亿赌局》(The trillion-dollar Tesla gamble)。

译者:梁宇

审校:夏林

从今年秋天六周的走势可以看出,特斯拉(Tesla)的股价已经严重脱离了公司基本面。

受第三季度亮眼财报影响,加上租车公司赫兹(Hertz)宣布计划购入10万辆特斯拉扩大其租赁车队的规模,从10月8日到11月4日,在19个交易日里,特斯拉股价大涨57%,最高达到1230美元。无论是亮眼的财报还是赫兹的购车计划,都是具有深远意义的商业里程碑,标志着特斯拉曾经显得激进的电动汽车业务已经在主流商业世界里越走越远。

但投资者的反应确实太过疯狂,对于任何股票而言,在不到一个月的时间里上涨57%都会令人瞠目结舌。而就特斯拉本次的上涨而言,在蜂拥而至的买家的助推下,特斯拉的市值更是(全部流通股的价值)暴涨了4480亿美元之巨,创下股票交易史上单个公司短期市值飙升纪录。那么这次市值上涨究竟有多惊人呢?仅仅特斯拉市值增加的部分就超过了标准普尔500指数(S&P 500)中前9大股票以外所有股票市值增加的总和,其中包括许多营收远超特斯拉的巨头企业,例如强生公司(Johnson & Johnson)和美国银行(Bank of America)。特斯拉也在投资者的支持之下首次进入“万亿美元”俱乐部,在微软(Microsoft)、苹果(Apple)、亚马逊(Amazon)和Alphabet身旁占据了一席之地。

而在市值创下历史纪录之后,特斯拉又一如既往地掀起了一番风浪,而这自然少不了马斯克“角落办公室”的功劳。首先,马斯克对赫兹宣布的交易发出了质疑,他在推特(Twitter)上回应称,特斯拉尚未与这家租车行业巨头签署合约。其次,马斯克又发起了一项莫名其妙的民意调查,在推特上询问粉丝自己是否应该抛售10%的股份,结果58%的人投了赞成票。其后,提交给美国证券交易委员会(SEC)的文件显示,马斯克已经开始出售特斯拉股票,规模达数十亿美元。总而言之,截至11月22日收盘,特斯拉的市值已经从顶峰下跌6%。但在投资者眼中,该公司的市值仍然高达1.16万亿美元,相较于股价“起飞”前仍然增加了近3750亿美元,而且特斯拉依然是“万亿美元俱乐部”的一员,与许多营收达其数倍之多的企业并驾齐驱。

特斯拉近期股价的大幅飙升让其怀疑者大跌眼镜,后者惊奇地发现,在他们眼中已然高到离谱的股价竟然还能够在如此短的时间里再涨50%多,实在不可思议。标准普尔500指数成份股的平均历史市盈率为24倍,而特斯拉目前的市盈率已经达到约365倍。“这可以说是‘害怕错过’的终极表现了。”贝内特·斯图尔特如是说。斯图尔特是一位专门研究分析公司资本回报率的顾问,他称:“这完全是企业冲劲、领导层魅力和超铁杆拥趸共同发力的结果。在此之前,这家伟大公司的股价已经严重偏离基本面。经过最近一轮飙升,这种情况更是愈演愈烈。”

特斯拉估值的一飞冲天也促使我们对当前这样一个“迷因股票、万物皆涨”的时代提出了本质性问题,即“1万亿美元估值到底意味着什么?”这种高昂的估值当然能够在一定程度上反映公司的受欢迎程度,也可以体现散户投资者的热情和信心。在马斯克的领导之下,特斯拉在电动汽车领域可谓遥遥领先。但是其能否创造足够的利润、销售额和市场份额来证明自己配得上美国第五大市值公司的名头?

我们都听过特斯拉粉丝为其设想的美好蓝图。其拥趸认为,在电动汽车彻底改变全球汽车制造业的历史性时刻,特斯拉将成为该行业当之无愧的王者。他们还认为,特斯拉绝不仅仅是“造车匠”,凭借其超级先进的软件和电池技术,特斯拉在能源储存和自动驾驶领域也拥有巨大的领先优势。未来,该公司也将在上述领域大展拳脚,通过出售产品、向竞争对手提供授权赚得盆满钵满。方舟投资公司(ARK Invest)的首席执行官凯西·伍德最近在Milken Institute全球峰会(Milken Institute Global Conference)上表示:“电动汽车正在从传统燃油车手中夺取大量的市场份额。股票最终对这一现实做出了反应。未来五年内,特斯拉的股价还将再翻两番(达到每股3000美元)。”

诚然,我们现在还无从得知特斯拉将会如何实现自己的雄心壮志、如何驾驭未来,但我们还是能够通过一些简单的方法算出特斯拉要想为股东带来高额回报或者跟上市场整体水平必须拿出怎样的业绩。而计算得出的结论则给我们泼了一盆冷水:要想配得上自己当前的股价,特斯拉必须拿出史诗级的、看似不切实际的业绩。

事实上,现在购买特斯拉的股票就等于在做一场终极的长期赌博,押注特斯拉将在电动汽车领域获得超乎想象的收益,而其竞争对手(等同于全球其他所有车企)则全部在市场竞争中败下阵来。简而言之,现在投资特斯拉等同于表示特斯拉将横扫电动汽车领域,其他公司则只能去争夺残羹剩饭。

为评估特斯拉需要做出怎样的业绩才可以匹配此轮暴涨,《财富》杂志使用了两种经过实战检验的精确评估工具:其一是投资研究公司New Constructs的创始人及首席执行官大卫·特雷纳开发的“预期投资”(expectations investments)分析工具;其二是机构股东服务公司(Institutional Shareholder Services,简称ISS)部署的“经济增加值”(economic value added,简称EVA),用于评估高管薪酬及其他公司业绩要素。

二者均涉及一种基本的收益衡量标准,即“税后净营业利润”(net operating profit after tax,简称NOPAT)。当前的市值能够扮演“路标”的角色。通过相关分析我们可以知道,某家公司如果想匹配以当前价格买入股票的风险,就必须达到多块的增长速度。如果以365倍的历史市盈率来看,买入特斯拉的股票就相当于你认为,凭借特斯拉的扩张速度,其股票的价值也能够实现相应增长。税后净营业利润可以帮助分析师制定具体的增长目标。特雷纳说:“只有当特斯拉的表现超过预期、且未来的税后净营业利润能够超过当前股价对应的巨大数值时,特斯拉的股票才值得买入。”

我们先从特雷纳的模型开始。在最近的一份报告中,特雷纳指出,特斯拉的市值已经超过了全球10大车企的市值总和,包括丰田(Toyota)、通用汽车(General Motors)、福特(Ford)和戴姆勒(Daimler),即梅赛德斯(Mercedes)的母公司。在过去的四个季度里,上述10大车企的汽车销售量达4500万辆,是特斯拉的50多倍。

据特雷纳计算,特斯拉目前的税后净营业利润为36亿美元。由此通过其数字分析可以得出,市场对特斯拉的未来业绩可谓“极为乐观”。他发现,(给特斯拉的估值相当于)市场预期特斯拉能够在2030年前实现17.2%的税后净营业利润率,相当于丰田的两倍,比特斯拉当前的数字还高10个百分点。

特雷纳以相关数据为基准,通过逆向推演得出,要想匹配其当前超过1.1万亿美元的估值,到2030年,特斯拉的营收就需要从过去四个季度的470亿美元暴涨至7830亿美元。这比丰田、通用汽车、福特、本田和Stellantis——克莱斯勒(Chrysler)、道奇(Dodge)和菲亚特(Fiat)的母公司——等公司目前的营收总额还多。更重要的是:这比目前地球上任何一家公司的收入都要多。

要想实现这一目标,特斯拉就需要像初创企业一样实现38%的年化增长率,而这种速度在大企业中几乎闻所未闻。税后净营业利润需要遵循相似的轨迹,也就是说,未来九年内每年需要达到1350亿美元,远超苹果公司(美国最赚钱的企业)当前的利润水平。

如此巨大的利润数字看起来令人生畏,而特斯拉还将面临更大的挑战:电动汽车产业的规模很可能不足以让特斯拉具备冲击传统行业巨头的实力。特雷纳引用了国际能源署(International Energy Agency)对“基本情况”的预测数据,即到2030年,电动汽车的销量将达到2580万辆。如果特斯拉汽车继续保持目前51000美元的平均售价,那么在这个十年结束时,特斯拉每年就要卖出1600万辆汽车才可以获得7830亿美元的收入。换句话说,“特斯拉需要在整个电动汽车市场占据60%的份额。”特雷纳表示。

特雷纳还警告称,如果我们把税后净营业利润率设定的更现实一些,比方说,8.5%(与通用汽车当前水平相当),那么特斯拉就需要在2030年售出3100万辆电动汽车才能够达到基准目标,相当于全行业总销量的118%,也就是说,特斯拉即便独霸全球电动汽车市场也无法实现目标。特雷纳总结说:“这种收入、盈利预期简直不可思议,根本不可能实现。”

机构股东服务公司的总经理安东尼·坎帕尼亚提出的假设与之不同,但却得出了相似的结论。据其估计,特斯拉目前的税后净营业利润为34亿美元,而后他又假设目标税后净营业利润率为8%。通过进行EVA分析,他认为,要想匹配特斯拉当前的股价,到2030年,特斯拉的销售额就必须达到1.2万亿美元,而税后净营业利润则需要达到930亿美元。而要达到这一目标,特斯拉的税后净营业利润的年增长率就必须达到19%。与之相比,同样经由EVA公式计算后,微软和亚马逊要想匹配投资者给出的估值,需要达到的年增长率分别为8%和9%,而对这两家公司而言,相关数字已然不低。坎帕尼亚说:“从估值来看,投资者对特斯拉的增长预期可谓非常之高。”

坎帕尼亚还提醒说,EVA算法假设特斯拉将使用自有现金流新建所有的超级工厂,不会通过借款或发行股票募集更多资本。但正如特雷纳所指出的那样,要想证明当前股价的合理性,特斯拉就需要在2030年生产15倍或20倍于当前销量的汽车,而如此规模的产能建设将侵蚀特斯拉的利润、拉低股价。因此,特斯拉很可能需要进行大幅融资。

人们对特斯拉将统治汽车行业的幻想不仅体现在特斯拉的股价上,还体现在投资者对其竞争对手的估值上。《财富》杂志根据过去四个季度的GAAP收益计算了美、欧、日、韩15家顶级传统车企的整体市盈率,结果仅为7.4,与特斯拉的历史市盈率相比简直微不足道。

从本质上讲,市场认为,即便已经在“电动汽车转型”上投入数十亿美元,特斯拉的竞争对手依然无法从电动汽车业务中赚到利润。斯图尔特认为:“在投资者眼中,电动汽车市场已经是一片红海。他们认为特斯拉将赢家通吃,其他公司只能成为特斯拉的模仿者和追随者,在商品终端展开争夺,而特斯拉则将成为行业内的顶级品牌和技术领袖。”

一言以蔽之,特斯拉的超万亿估值相当于投资者的一种预言,即电动汽车市场将成为特斯拉独享的财富宝库。但这种可能性有多大?特斯拉的所有主要竞争对手对于电动汽车领域都是雄心勃勃。特雷纳在他最近的文章中指出,大众、戴姆勒和Stellantis均已经做出承诺,到2030年,其生产的汽车中有50%将是电动汽车,而福特则为40%。总之,据特雷纳估计,特斯拉10家竞争对手的目标是到2030年每年生产1900万辆电动汽车。请注意,国际能源署对当年整个市场的销量预测是略低于2600万辆。传统汽车巨头每售出一辆电动汽车,都会进一步降低特斯拉卖出足够汽车证明当前超高估值合理的可能性。

最可能的结果是,在其他车企渡过“蹒跚学步”的阶段之后,特斯拉的股价将趋于平稳或一跌到底,虽然可能会对投资者造成打击,但即便该公司可以持续增长、创新,这种情况也极有可能发生。最终,基础数学的力量将会摧毁建立在信心、信念和美国梦想家魅力之上的沙堡。这些数字站不住脚。电动汽车行业必将迎来越发激烈的竞争,而特斯拉的股价又很容易发生变化。有些学费非交不可。(财富中文网)

本文另一版本登载于《财富》杂志2021年12月/2022年1月刊,标题为《特斯拉万亿赌局》(The trillion-dollar Tesla gamble)。

译者:梁宇

审校:夏林

Six weeks this autumn showed just how crazily detached Tesla the stock has become from Tesla the company.

During a stretch of 19 trading days from Oct. 8 to Nov. 4, Tesla shares soared 57%, to a peak of $1,230. The catalysts: a healthy, profitable third-quarter earnings report, followed by a Hertz news release unveiling its plans to buy 100,000 Teslas for its rental fleet. These were meaningful business milestones—signs that Tesla’s once-radical electric vehicles were moving deeper into the commercial mainstream.

But investors’ reaction was bonkers. A 57% increase in less than a month is a home run for any stock. But over the stretch in question, eager buyers swelled Tesla’s market capitalization—the value of all its shares outstanding—by $448 billion. That rampage marked the biggest short-term surge in a single company’s value across the history of equity exchanges. Just how big was it? During that moonshot, the amount of dollars investors added to Tesla’s valuation was greater than the total value of all but nine of the stocks in the S&P 500, including giants whose revenue dwarfs Tesla’s, like Johnson & Johnson and Bank of America. And for the first time, investors made Tesla a $1 trillion company, propelling the automaker into the exclusive U.S. club occupied by Microsoft, Apple, Amazon, and Alphabet.

As happens so often with Tesla, that summit was followed by a tumble, thanks to unsettling news from the corner office. First, CEO Elon Musk cast doubt on the Hertz deal, firing back in a tweet that he hadn’t even signed a contract with the rent-a-car giant. Second, Musk held a quirky poll asking his Twitter followers whether he should unload 10% of his shares. Fifty-eight percent voted “yes,” and subsequent SEC filings revealed that Musk had begun selling shares worth billions. All told, as of the close Nov. 22, Tesla’s market cap had retreated 6% from its summit. But in investors’ eyes, the company is still worth $1.16 trillion—almost $375 billion more than when the liftoff began—and it still sits comfortably in the 12-zeros club alongside companies with many times more revenue than Tesla commands.

The recent surge has astounded Tesla skeptics, who marvel that a company whose stock they already rated outrageously expensive could, in a flash, get half-again more wildly overpriced. The average stock in the S&P 500 trades at 24 times trailing earnings; Tesla now trades at around 365. “It’s the ultimate manifestation of FOMO,” says Bennett Stewart, a consultant who specializes in analytics that measure a company’s return on capital. “It’s all about momentum, glamour, the most loyal of loyal fan bases.” The recent surge, Stewart says, “made a great company’s stock that was already unhinged from fundamentals a lot more unhinged.”

Tesla’s leap into the valuation stratosphere raises the quintessential question of our meme-stock, everything-goes-up era: What does it really mean to be worth $1 trillion? Yes, it’s in part a sign of popularity, of retail investors’ passion and faith. And Musk’s company is far and away today’s leader in electric vehicles. But can it conceivably generate the margins, sales, and market share to justify its rank as America’s fifth-most-valuable enterprise?

We’ve all heard its fans’ bluebird view. Tesla will totally dominate the green-car market, the bulls avow, at a historic moment when that category is poised to revolutionize global auto manufacturing. They also believe that it’s far more than a metal-bending carmaker: Tesla enjoys a huge head start courtesy of its super-advanced software and battery technology, and it’ll be a future titan in energy storage and self-driving, selling its products and licensing its IT to rivals at fat margins. “Electric vehicles are taking massive share from traditional gas-powered vehicles,” ARK Invest CEO Cathie Wood said recently at the Milken Institute Global Conference. “The stock is finally responding to that reality. Tesla will be nearly quadrupling [to $3,000 a share] over five years.”

How Tesla will execute on its ambitions and navigate the future is unknowable, of course. But there are straightforward ways to calculate what it must do to continue to reward shareholders via superior returns, or simply track the overall market. And running those numbers leads to a sobering conclusion: Justifying Tesla’s current share price will require absolutely epic, seemingly unachievable results.

Indeed, to buy Tesla’s shares today is to make the ultimate long-shot bet. Investors are wagering that Tesla will mine incredible profits in electric cars while its competitors—in essence, every other automaker in the world—flop in pursuit of the prize. Put simply, investors are saying that Tesla will sweep the field and leave others to fight over the scraps.

*****

To assess what Tesla must do to justify the bull run in belief, Fortune relied on two precise, battle-tested tools. Those measures are “expectations investing,” analytics developed by David Trainer, founder and CEO of research firm New Constructs; and economic value added, or EVA, deployed by Institutional Shareholder Services (ISS), the proxy advisory firm, to evaluate executive pay packages and other elements of corporate performance.

Both favor a basic measure of profit called “NOPAT,” or net operating profit after tax. The current market cap sets the guideposts: Their analysis measures how fast a company must grow NOPAT to satisfy the risks of buying the stock at its current price. If you’re going to pay 365 times trailing earnings for Tesla, you’re assuming it’s going to keep expanding fast enough that the value of its shares grows accordingly. NOPAT helps analysts generate specific targets for that growth. “It’s only worth owning Tesla if it’s going to outperform,” says Trainer, “and that requires future NOPAT that’s materially higher than the huge numbers already implied by the stock price.”

We’ll start with Trainer’s model. In a recent report, Trainer notes that Tesla’s market cap now exceeds the total for the world’s 10 largest automakers by market capitalization, a group that includes Toyota, General Motors, Ford, and Daimler, home of Mercedes. Those top 10 sold 45 million cars in their past four quarters—more than 50 times as many as Tesla sold.

Trainer calculates Tesla’s current NOPAT at $3.6 billion. From there, his number crunching reveals an assumption that’s super-optimistic: He finds that the market expects Tesla to generate a NOPAT margin of 17.2% by the year 2030. That’s double the current margin he calculates for Toyota, and 10 percentage points better than Tesla’s current cushion.

Trainer plugs in those and other benchmarks, and reverse engineers the numbers that discount back to Tesla’s current $1.1 trillion–plus valuation today. His conclusion: To justify its current market cap, Tesla’s revenues would need to mushroom from $47 billion over the past four quarters, to $783 billion in 2030. That’s more than the combined current sales of Toyota, GM, Ford, Honda, and Stellantis (parent of Chrysler, Dodge, and Fiat). More to the point: That’s more revenue than any company on earth currently generates.

Getting there would require Tesla to achieve a yearly growth rate of 38%—startup-like growth almost never seen among bigger companies. NOPAT would need to follow a similar trajectory, reaching $135 billion annually in nine years. That’s far more profits than Apple, America’s most profitable company, gushes today.

*****

Those profit figures look intimidating, but Tesla would face an even bigger challenge: The EV industry most likely won’t be big enough for Tesla to hit them. Trainer cites the International Energy Agency (IEA) “base case” forecast, which predicts 25.8 million in EV unit sales in the year 2030. If Tesla’s vehicles keep fetching their current average of $51,000, it would have to sell 16 million vehicles a year to reap $783 billion in revenue at the decade’s close. In other words, “Tesla would need 60% of the entire EV market,” says Trainer.

Trainer also cautions that if we assume a more realistic NOPAT margin—comparable, for example, to GM’s current 8.5%—Tesla would need to sell 31 million electric vehicles in 2030 to hit its benchmark. That would be 118% of the estimated industry total, meaning Tesla would have to sell every EV in the world, and then some. “The expectations for revenues and profits are absurd,” Trainer concludes. “It won’t happen.”

At ISS, managing director Anthony Campagna makes different assumptions but reaches similar conclusions. He calculates Tesla’s current NOPAT at $3.4 billion and assumes a target NOPAT margin of 8%. In his EVA analysis, sales would have to advance to roughly $1.2 trillion by 2030 to justify Tesla’s current stock price, while NOPAT would ring the bell at $93 billion. Tesla would have to grow NOPAT by 19% annually for the next decade. By comparison, the EVA formula posits that investors are baking in annual gains of 8% for Microsoft and 9% for Amazon, steep numbers in their own right. “Tesla’s valuation is predicting incredibly, massively fast growth,” says Campagna.

Campagna also cautions that the EVA calculus assumes that Tesla will finance all of the gigantic building of new plants from its cash flows, and that it won’t raise more capital by borrowing money or issuing equity. But as Trainer points out, it’s likely to need lots of fresh financing. To justify its current stock price, Tesla is going to need to manufacture 15 or 20 times as many cars in 2030 as it currently sells, and building the capacity to do it will presumably eat into profits and share price alike.

The fantasy of total Tesla dominance isn’t reflected only in Tesla’s stock price: It shows up in the way investors are valuing its competitors. Fortune calculated the overall price/earnings ratio of the 15 largest U.S., European, Japanese, and Korean legacy automakers: It’s a puny 7.4, based on trailing four quarters of GAAP earnings. That’s a tiny fraction of Tesla’s P/E calculated on trailing earnings.

In essence, the market is saying that Tesla’s competitors won’t be able to make EVs profitable, even as they pour billions of dollars into the electric transition. “The market’s become highly segmented in the eyes of investors,” says Stewart. “They think it will be winner-take-all for Tesla, and the other companies will be me-toos and hangers-on. They’ll be battling over the commodity end of the market, while Tesla cleans up as the top brand and technology leader.”

The bottom line: Tesla’s trillion-plus valuation amounts to an augury by investors that EVs will turn out to be a bonanza for Tesla and Tesla alone. But how likely is that? All of Tesla’s big competitors harbor major ambitions in green autos. In his recent paper, Trainer notes that Volkswagen, Daimler, and Stellantis all pledge that 50% of their cars will be EVs by 2030, and Ford promises 40%. All told, Trainer estimates that 10 of Tesla’s competitors aim to produce 19 million EVs a year combined by 2030. Keep in mind that the IEA’s prediction of the entire market for that year is just under 26 million EVs. Every EV sold by the legacy auto giants makes it less likely that Tesla can sell enough cars to justify today’s Brobdingnagian valuation.

The most likely outcome is that as the other automakers get past the training wheels stage in EVs, Tesla’s stock price will level off or descend to earth—a comedown for investors, and one that’s highly possible even if the company keeps growing and innovating. Eventually, the force of basic math will crush the sandcastle built on faith, belief, and the charisma of American industry’s leading visionary. The numbers don’t add up. The irresistible force is an EV industry that’s poised to see ever-growing competition. The easily movable object is Tesla’s stock price. Something’s gotta give.

A version of this article appears in the December 2021/January 2022 issue of Fortune with the headline, “The trillion-dollar Tesla gamble.”