美国房价增速高达收入增速四倍之多的情况终究无法持续,增速放缓在所难免。

不过虽然市场已经显露疲软迹象,但放眼美国各地,房价上涨、竞价买房的戏码依然接连上演。业内普遍认为,无论明年市场降温幅度如何,房价上涨趋势都会有所放缓,但拐点尚未到来。

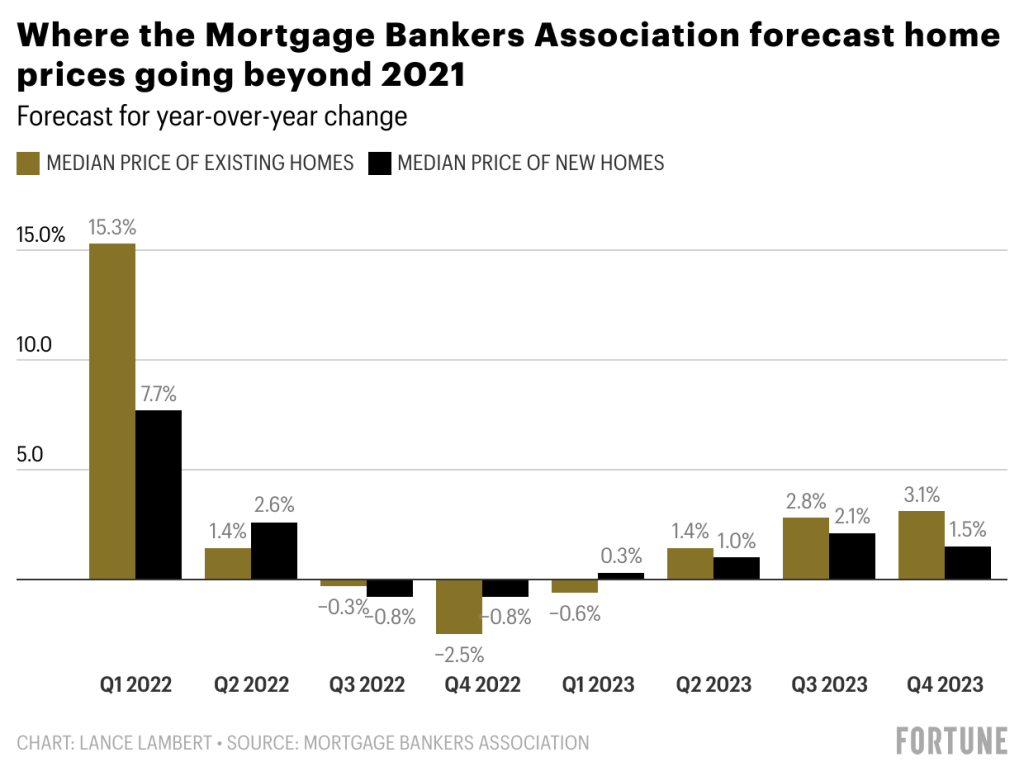

然而,总部位于美国华盛顿特区的行业协会——美国抵押贷款银行协会(Mortgage Bankers Association)并不认同这一观点。该协会于近期发布了自己的2022年预测报告,据其预计,2022年第一季度,现有住房的房价中位数将同比上涨15.3%至362,000美元,但随着时间继续推移,房价将开始下跌。该协会预计,到2022年年底,现有住房的房价中位数将降至352,000美元,也就是说,房价将同比下降2.5%。

为什么美国抵押贷款银行协会有这样的预测?其中很大一部分原因能够归结于通胀或者说较高通胀对市场的影响。

今年10月的消费者价格指数(CPI)最新数据表明,通胀依然居高不下,其延续时间可能长于经济学家的预期。在此背景之下,为控制通胀,美联储(Federal Reserve)将更有可能提高利率、进而提高抵押贷款的利率。此前,为缓解新冠疫情对经济的影响、保持低廉的资金成本,美联储一直将抵押贷款利率控制在接近历史低点的水平,而一旦抵押贷款利率开始走高,部分买家将完全丧失进入市场的机会,如此一来,房价必将承受下行压力。

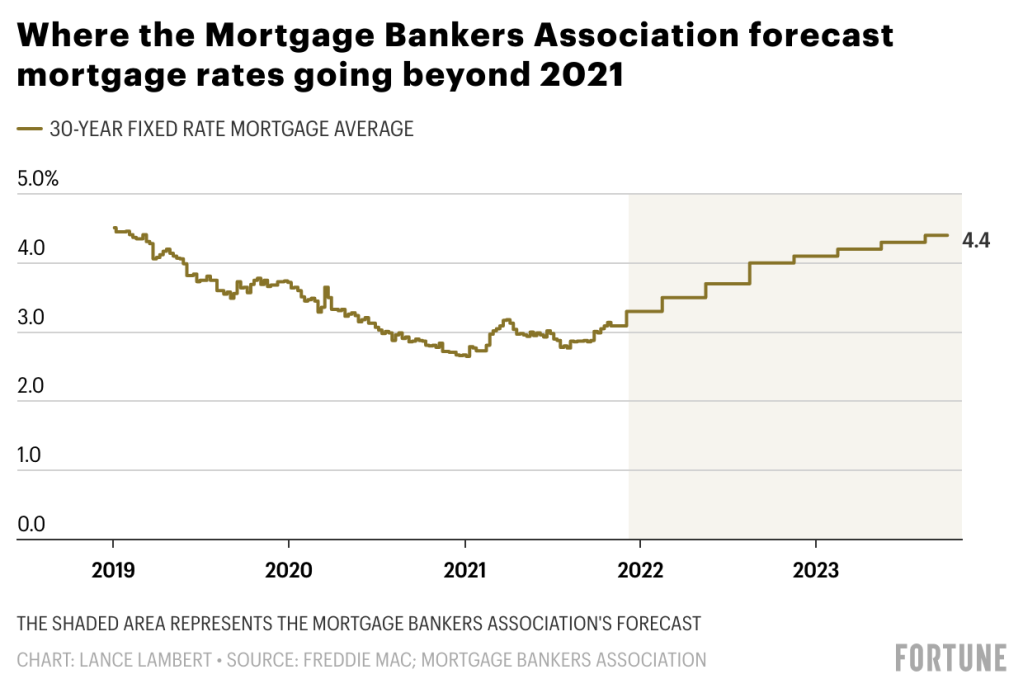

美国抵押贷款银行协会预测,到2022年第三季度,30年期固定抵押贷款平均利率将达到3.7%,到2022年年底则将进一步上涨到4%,较目前3.09%的利率大幅增加,也远高于房利美(Fannie Mae)预测的3.4%。

不过,美国抵押贷款银行协会的观点在业内仍然属于少数派。据Zillow Research预测,未来12个月,美国房价将上涨13.6%,而房利美和CoreLogic公司对美国房价涨幅的预计分别为7.9%和1.9%。

在经过前所未有的历史级别房价暴涨之后,为什么还有这么多人认为房价会继续攀升呢?业内人士在接受《财富》杂志采访时表示,在可以预见的未来,由于首次购房的千禧一代涌入市场,加上十年以来新建住房数量不足,房地产市场将继续面临供不应求的问题。(财富中文网)

译者:梁宇

审校:夏林

美国房价增速高达收入增速四倍之多的情况终究无法持续,增速放缓在所难免。

不过虽然市场已经显露疲软迹象,但放眼美国各地,房价上涨、竞价买房的戏码依然接连上演。业内普遍认为,无论明年市场降温幅度如何,房价上涨趋势都会有所放缓,但拐点尚未到来。

然而,总部位于美国华盛顿特区的行业协会——美国抵押贷款银行协会(Mortgage Bankers Association)并不认同这一观点。该协会于近期发布了自己的2022年预测报告,据其预计,2022年第一季度,现有住房的房价中位数将同比上涨15.3%至362,000美元,但随着时间继续推移,房价将开始下跌。该协会预计,到2022年年底,现有住房的房价中位数将降至352,000美元,也就是说,房价将同比下降2.5%。

为什么美国抵押贷款银行协会有这样的预测?其中很大一部分原因能够归结于通胀或者说较高通胀对市场的影响。

今年10月的消费者价格指数(CPI)最新数据表明,通胀依然居高不下,其延续时间可能长于经济学家的预期。在此背景之下,为控制通胀,美联储(Federal Reserve)将更有可能提高利率、进而提高抵押贷款的利率。此前,为缓解新冠疫情对经济的影响、保持低廉的资金成本,美联储一直将抵押贷款利率控制在接近历史低点的水平,而一旦抵押贷款利率开始走高,部分买家将完全丧失进入市场的机会,如此一来,房价必将承受下行压力。

美国抵押贷款银行协会预测,到2022年第三季度,30年期固定抵押贷款平均利率将达到3.7%,到2022年年底则将进一步上涨到4%,较目前3.09%的利率大幅增加,也远高于房利美(Fannie Mae)预测的3.4%。

不过,美国抵押贷款银行协会的观点在业内仍然属于少数派。据Zillow Research预测,未来12个月,美国房价将上涨13.6%,而房利美和CoreLogic公司对美国房价涨幅的预计分别为7.9%和1.9%。

在经过前所未有的历史级别房价暴涨之后,为什么还有这么多人认为房价会继续攀升呢?业内人士在接受《财富》杂志采访时表示,在可以预见的未来,由于首次购房的千禧一代涌入市场,加上十年以来新建住房数量不足,房地产市场将继续面临供不应求的问题。(财富中文网)

译者:梁宇

审校:夏林

It was inevitable that the housing market would slow down a bit. After all, home prices can’t continue to outpace income growth by a 4-to-1 ratio forever, right?

However, even as the market has seen some softening so far, price hikes and bidding wars are still ongoing across the U.S. And the industry consensus is that whatever cooling comes next year, it will slow—but not stop—the continuing rise in home prices.

However, that assessment isn’t shared by the Mortgage Bankers Association, an industry trade group based in Washington, D.C., which recently published its 2022 forecast. While the Mortgage Bankers Association foresees the median price of existing homes posting a 15.3% year-over-year gain to $362,000 in the first quarter of 2022, it sees prices beginning to fall as the year progresses. The group expects the median price of existing homes to end 2022 at $352,000. That would represent a 2.5% year-over-year drop in home prices.

What’s going on? A lot of it boils down to inflation—or what higher inflation means for the market.

The latest reading of the consumer price index in October made it clear that stubbornly high inflation could be around longer than economists were assuming. That has increased the odds that the Federal Reserve will raise interest rates, and thus mortgage rates, as a means of reining in inflation. A rise in mortgage rates—which have dropped to near record lows as the Fed kept money cheap to ease the economic effects of the pandemic—would lock some buyers out of the market altogether and put downward pressure on prices.

The Mortgage Bankers Association is forecasting that the average 30-year fixed mortgage rate will hit 3.7% by the third quarter of 2022, and 4% by the end of 2022. That would be a big increase from the current 3.09% rate, and is well above the 3.4% rate that Fannie Mae projects by the end of 2022.

That said, the Mortgage Bankers Association forecast is still something of an outlier. Zillow Research is predicting 13.6% growth in U.S. home prices over the coming 12 months. Meanwhile, Fannie Mae is predicting 7.9%, and CoreLogic has the number at 1.9%.

Why do so many outlooks still have prices climbing even after we’ve endured this historic stretch of unprecedented home price growth? Industry insiders tell Fortune that for the foreseeable future the housing market will see the supply side of the market simply outmatched by the demand side. The combination of a demographic wave of first-time millennial homebuyers and a decade of under-building is the culprit behind that mismatch.