好消息是,全球汽车行业似乎已经度过了芯片短缺最严重的阶段。

福特(Ford)、梅赛德斯-奔驰(Mercedes-Benz)以及大众(Volkswagen)等汽车制造商均表示,近期因为马来西亚芯片封装厂出现新冠疫情导致停工而引发的供应中断或将在第四季度有所缓解。

坏消息是,新一轮关键原材料短缺危机或许已经在酝酿之中。

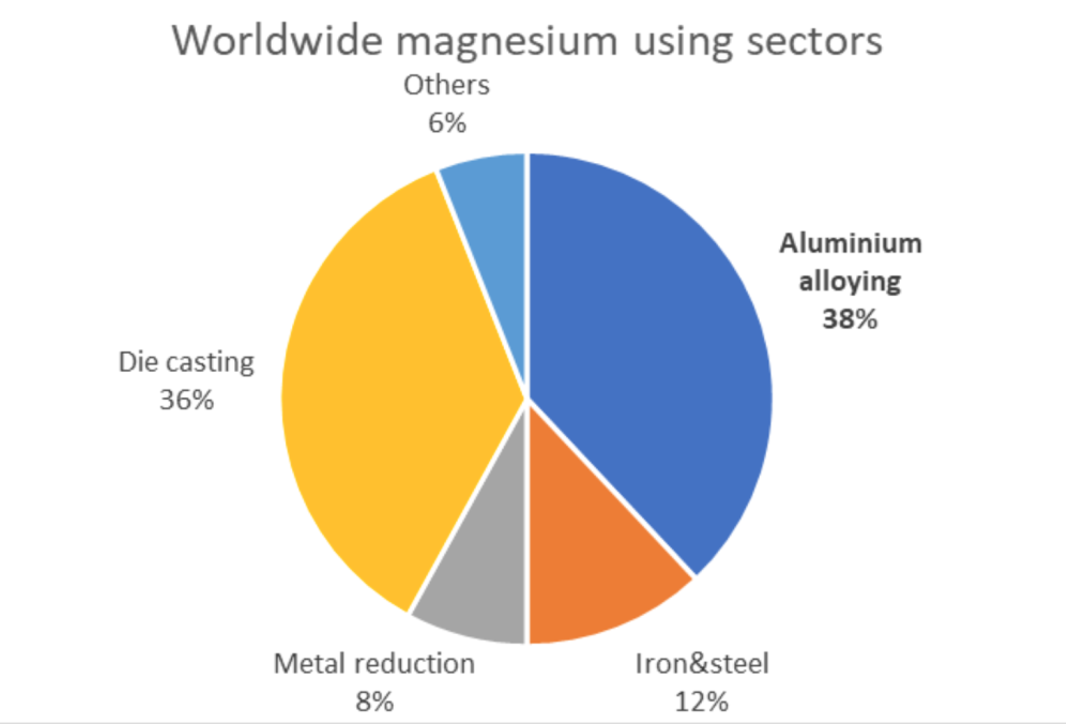

制造商正在密切关注中国的镁产量变化,由于电力短缺,中国各地轮流限电,导致能源密集型冶炼厂的供应受到影响。作为一种应用广泛的轻质材料,全球每年对镁的需求高达120万公吨,为减轻汽车零件(包括车身零件、引擎座、轮圈等)的重量,许多铝合金中都含有这种材料。

大众汽车集团(Volkswagen Group)的采购经理穆拉特·阿克塞尔在10月28日告诉分析师,为应对供应或将变得愈发紧张的情况,其团队已经采取相应对策。

他在一次电话会议上说:“按照目前的情况,镁、铝供应出现短缺在所难免,只是我们现在还无法预测相关短缺是否会比半导体的短缺问题更严重。”

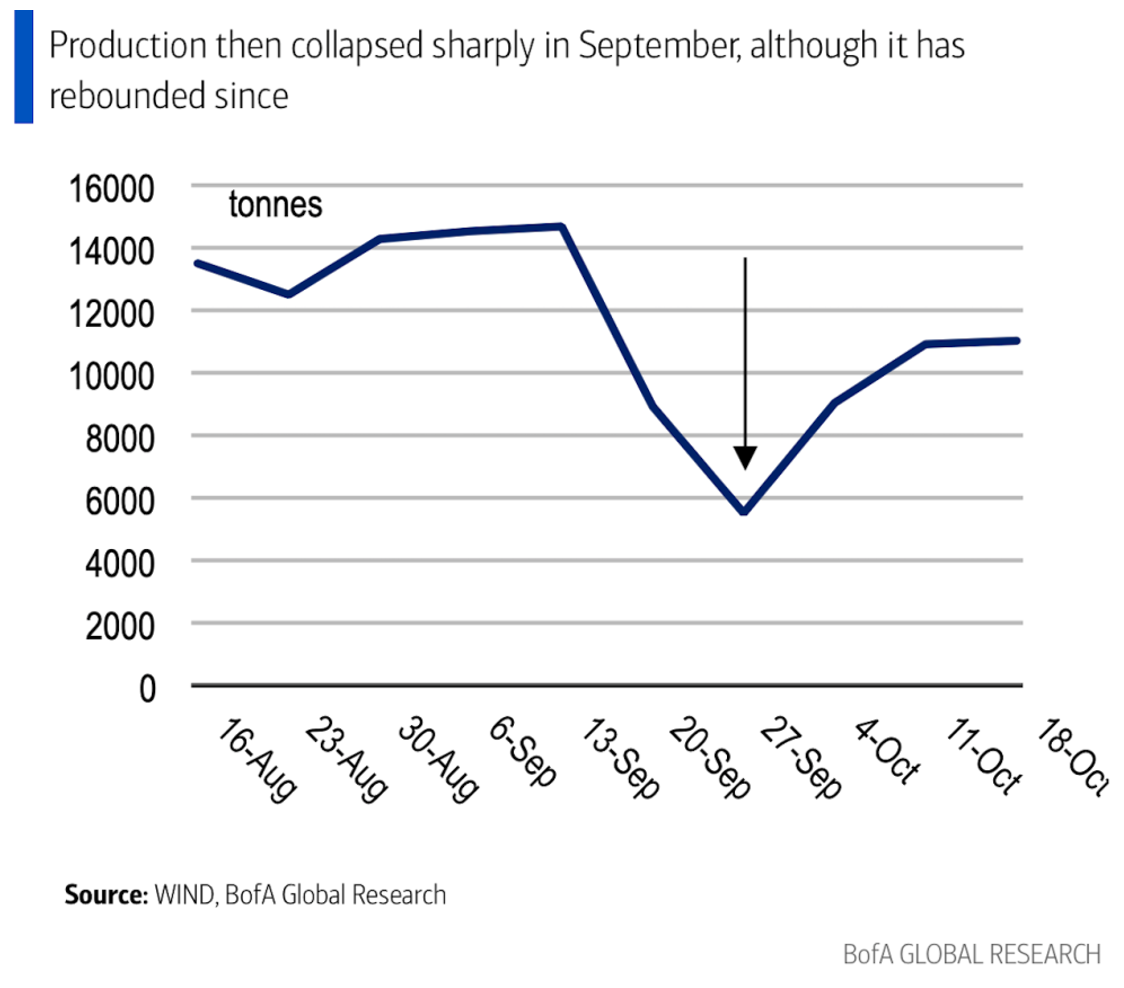

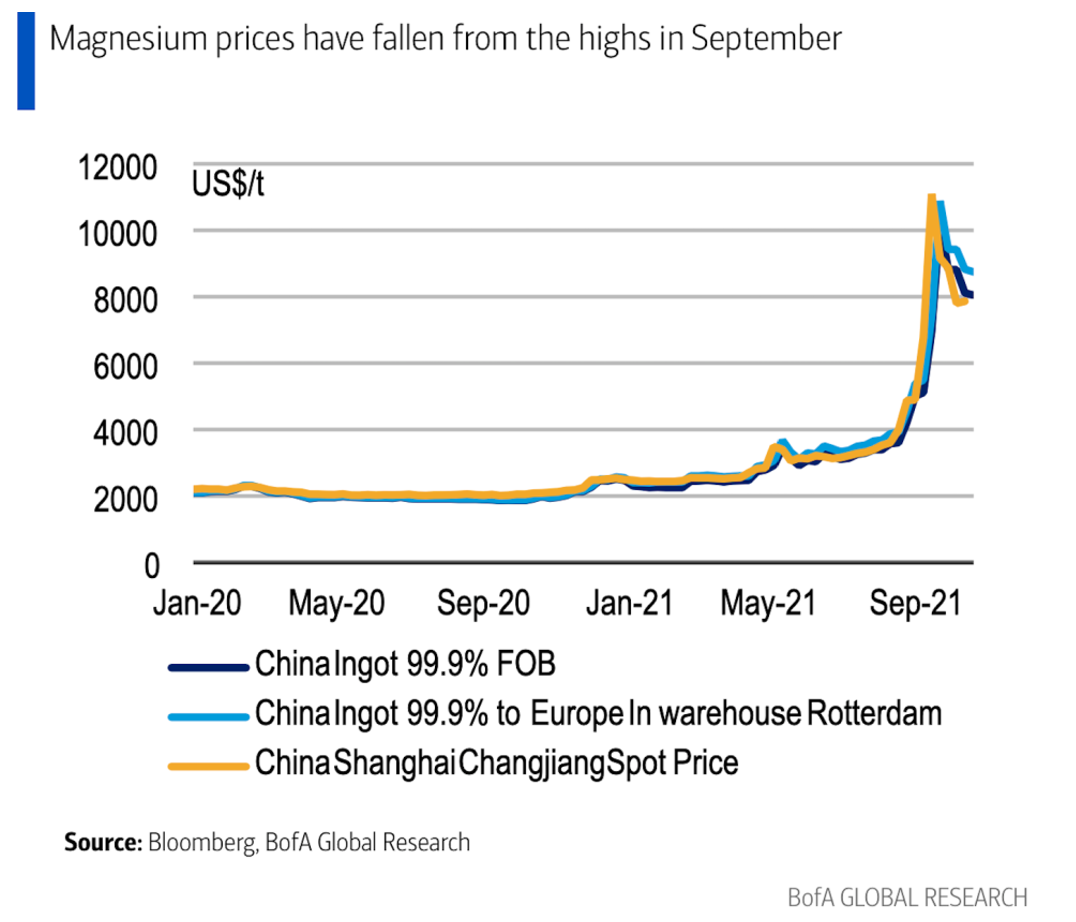

今年9月,镁产量大幅下降,美国银行(Bank of America)的分析师特别指出,在拥有丰富煤炭资源的中国内蒙古,冶炼厂也已经被迫停产。11月3日,剩余镁原料的进口价格在每吨1万到1.4万美元之间,而在今年早些时候,其进口价格仅为约2000美元。

根据这家投资银行的数据,欧洲95%的镁供应来自中国,受影响最为严重。据目前估计,欧洲的镁库存将于11月底耗尽。

他们写道:“如果铝企的镁原料耗尽,那么原料短缺问题就将迅速传导至下游企业,导致供应链问题进一步恶化。”

“空前规模的危机”

至少12家欧洲游说团体(包括代表汽车制造商和零部件供应商利益的团体)在一份声明中发出警告,表示或将出现“规模空前的国际供应危机”。

他们写道:“如果欧盟(European Union)不采取紧急行动,镁短缺问题就将危及欧洲各地的数千家企业、及其整个供应链和数百万就业岗位。”

虽然作为一个整体,制造业在大声疾呼,寻求援助,但个体企业却在努力避免发出如此绝望的声音。以宝马(BMW)为例(该公司在芯片危机中的表现优于大多数公司),其高管甚至在上周表示对镁、铝合金的供应完全不担心。

梅赛德斯-奔驰的首席财务官哈拉尔德·威廉在11月5日对记者表示,奔驰正在评估其供应链面临的风险,并将考虑是否转而采购镁含量较低或完全不含镁的材料。

他说:“据我了解,(镁产量下跌)是因为中国某些省份为满足碳排放要求而采取限电措施所致。有些人可能会觉得我这么说有些幼稚或者太过乐观,但在我们看来,镁、铝供应并不存在结构性问题(就像半导体芯片的情况一样),中国也并未打算停止向世界供应镁原料。”

据由标致雪铁龙集团(PSA Group)与菲亚特-克莱斯勒(Fiat Chrysler)合并成立的法美汽车制造商Stellantis预计,其镁铝库存不会很快耗尽。

该公司的首席财务官理查德·帕尔默于11月4日向分析师表示:“短期内我们不会出现任何问题。在我们的主要市场,铝材都以本地采购为主。遗憾的是,中国目前不是我们的主要市场。如果相关问题在中期开始(蔓延)到其他市场,那么我们可能也会遇到问题,不过至少就目前而言还不用太过担心。”

除了汽车制造业,另一需要大量轻质材料的重要行业——航空制造业也可能会受到原材料短缺的影响。

就目前而言,空中客车(Airbus)的首席执行官纪尧姆·傅里对分析师表示,他们的业务尚未受到任何重大干扰。

他说:“我知道我们的团队也在密切关注相关问题。”(财富中文网)

译者:梁宇

审校:夏林

好消息是,全球汽车行业似乎已经度过了芯片短缺最严重的阶段。

福特(Ford)、梅赛德斯-奔驰(Mercedes-Benz)以及大众(Volkswagen)等汽车制造商均表示,近期因为马来西亚芯片封装厂出现新冠疫情导致停工而引发的供应中断或将在第四季度有所缓解。

坏消息是,新一轮关键原材料短缺危机或许已经在酝酿之中。

制造商正在密切关注中国的镁产量变化,由于电力短缺,中国各地轮流限电,导致能源密集型冶炼厂的供应受到影响。作为一种应用广泛的轻质材料,全球每年对镁的需求高达120万公吨,为减轻汽车零件(包括车身零件、引擎座、轮圈等)的重量,许多铝合金中都含有这种材料。

大众汽车集团(Volkswagen Group)的采购经理穆拉特·阿克塞尔在10月28日告诉分析师,为应对供应或将变得愈发紧张的情况,其团队已经采取相应对策。

他在一次电话会议上说:“按照目前的情况,镁、铝供应出现短缺在所难免,只是我们现在还无法预测相关短缺是否会比半导体的短缺问题更严重。”

今年9月,镁产量大幅下降,美国银行(Bank of America)的分析师特别指出,在拥有丰富煤炭资源的中国内蒙古,冶炼厂也已经被迫停产。11月3日,剩余镁原料的进口价格在每吨1万到1.4万美元之间,而在今年早些时候,其进口价格仅为约2000美元。

根据这家投资银行的数据,欧洲95%的镁供应来自中国,受影响最为严重。据目前估计,欧洲的镁库存将于11月底耗尽。

他们写道:“如果铝企的镁原料耗尽,那么原料短缺问题就将迅速传导至下游企业,导致供应链问题进一步恶化。”

“空前规模的危机”

至少12家欧洲游说团体(包括代表汽车制造商和零部件供应商利益的团体)在一份声明中发出警告,表示或将出现“规模空前的国际供应危机”。

他们写道:“如果欧盟(European Union)不采取紧急行动,镁短缺问题就将危及欧洲各地的数千家企业、及其整个供应链和数百万就业岗位。”

虽然作为一个整体,制造业在大声疾呼,寻求援助,但个体企业却在努力避免发出如此绝望的声音。以宝马(BMW)为例(该公司在芯片危机中的表现优于大多数公司),其高管甚至在上周表示对镁、铝合金的供应完全不担心。

梅赛德斯-奔驰的首席财务官哈拉尔德·威廉在11月5日对记者表示,奔驰正在评估其供应链面临的风险,并将考虑是否转而采购镁含量较低或完全不含镁的材料。

他说:“据我了解,(镁产量下跌)是因为中国某些省份为满足碳排放要求而采取限电措施所致。有些人可能会觉得我这么说有些幼稚或者太过乐观,但在我们看来,镁、铝供应并不存在结构性问题(就像半导体芯片的情况一样),中国也并未打算停止向世界供应镁原料。”

据由标致雪铁龙集团(PSA Group)与菲亚特-克莱斯勒(Fiat Chrysler)合并成立的法美汽车制造商Stellantis预计,其镁铝库存不会很快耗尽。

该公司的首席财务官理查德·帕尔默于11月4日向分析师表示:“短期内我们不会出现任何问题。在我们的主要市场,铝材都以本地采购为主。遗憾的是,中国目前不是我们的主要市场。如果相关问题在中期开始(蔓延)到其他市场,那么我们可能也会遇到问题,不过至少就目前而言还不用太过担心。”

除了汽车制造业,另一需要大量轻质材料的重要行业——航空制造业也可能会受到原材料短缺的影响。

就目前而言,空中客车(Airbus)的首席执行官纪尧姆·傅里对分析师表示,他们的业务尚未受到任何重大干扰。

他说:“我知道我们的团队也在密切关注相关问题。”(财富中文网)

译者:梁宇

审校:夏林

The good news is the worst of the global chip shortage seems to be behind the auto industry.

Carmakers from Ford to Mercedes-Benz and Volkswagen have all indicated that the supply hiccups that were caused by recent COVID-related stoppages in Malaysian chip packaging plants appear to be easing in the fourth quarter.

The bad news is the next shortage of a key raw material could already be on its way.

Manufacturers are keeping a close eye on production levels of magnesium coming out of China, where a lack of power has led to rolling blackouts that hobble supply from energy-intensive smelters. Annual demand for the strong, lightweight material weighs in at 1.2 million metric tons, and it is found in many aluminum alloys to reduce the weight of car components ranging from body parts to engine blocks and wheel rims.

Volkswagen Group purchasing manager Murat Aksel told analysts on October 28 that his team was already taking countermeasures in the likely event that the supply becomes tighter.

“We cannot forecast right now if the shortage in magnesium and aluminum, which will happen definitely according to planning, will be bigger than the semiconductor shortage,” he said during a conference call.

Magnesium production dropped sharply in September, with analysts from Bank of America pointing in particular to smelters in coal-rich Inner Mongolia that were forced to shut down. November 3’s remaining magnesium imports are trading at prices of about $10,000 to $14,000 per metric ton, up from just around $2,000 earlier this year.

Europe, the most exposed region, with 95% of supply sourced from China, is currently expected to deplete its magnesium stocks by the end of November, according to the investment bank.

“If aluminum producers ran out of magnesium, this would quickly feed through downstream, further exacerbating supply-chain issues,” they wrote.

“Crisis of unprecedented magnitude”

No less than a dozen different European lobby groups, including those representing the interests of vehicle manufacturers and component suppliers, warned of an “international supply crisis of unprecedented magnitude” in a statement.

“Without urgent action by the European Union, this issue—if not resolved—threatens thousands of businesses across Europe, their entire supply chains, and the millions of jobs that rely on them,” they wrote.

Despite the manufacturing industry's impassioned plea for help, individual corporations have avoided sounding so desperate. Executives at BMW, which navigated the chip crisis better than most, even dismissed the concerns over magnesium and alloyed aluminum outright last week.

Mercedes-Benz finance chief Harald Wilhelm told reporters on November 5 the carmaker was evaluating the risk to its supply chain and examining whether to divert purchases to materials with reduced magnesium content or none at all.

"To my understanding this is due to power shutdowns in certain Chinese provinces that need to reach CO2 targets," he said. "I don't want to sound naive and overly optimistic, but in our view there's no structural problem (as is the case with semiconductor chips), nor do we see the threat that China no longer intends to supply the world with magnesium."

Stellantis, the Franco-American carmaker that emerged from PSA Group's acquisition of Fiat Chrysler, doesn’t expect its inventories of magnesium-alloyed aluminum will run out soon.

“In the short term we’re not seeing any issues. The sourcing of aluminum is relatively localized in our major markets,” finance chief Richard Palmer told analysts on November 4. “Unfortunately China is not a major market for us at this stage. If the issues there start to [spread to] other markets in the medium term, we’ll see. But we’re not seeing anything at the moment.”

Carmakers are not the only ones exposed. The shortage could also affect another key transport industry that requires lots of lightweight materials: aerospace manufacturing.

For now, Airbus CEO Guillaume Faury told analysts that there have not been any significant disruption to his operations.

“I know it’s on the radar of our teams,” he said.