最新数据显示,过去12个月美国的通胀率达到5.3%,创下13年以来的最高水平。事实上,自2011年以来,美国的通胀率从未超过3%。

今年第二季度,美国的国内生产总值(GDP)年化增长率为6.5%。目前,美联储(Federal Reserve)预测美国2021年全年经济增长7%,将创下自20世纪80年代中期以来的最高经济增长率。

诚然,由于新冠疫情导致经济放缓,这些数据的基数较低。我们应该期待经济数据中的异常值先降后升。然而,综合政府不断支出、房价上涨、薪资上涨、物资短缺、零售消费热和通胀率上升等诸多因素,你可能认为现在是利率上涨的绝佳环境。

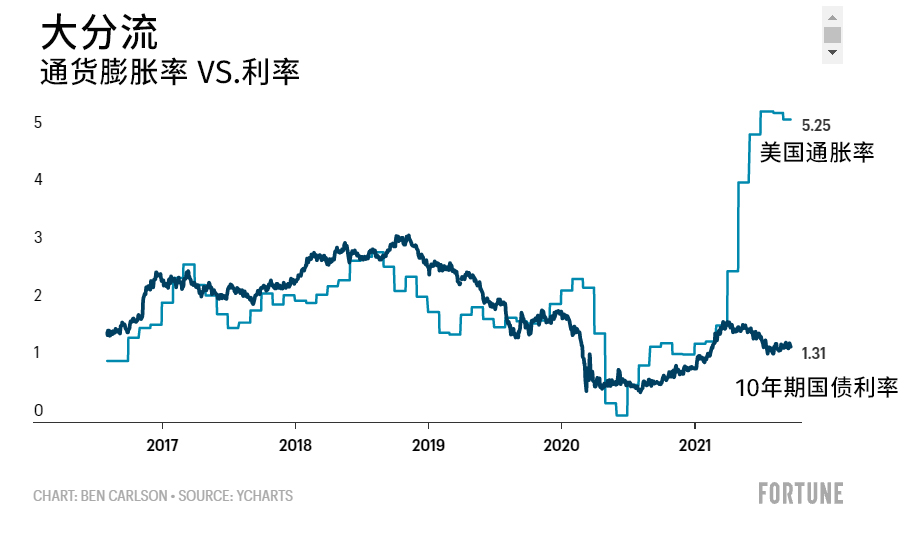

利率的确曾经小幅上涨,但仅维持了一段时间。目前,利率再次下跌,这一走势与最新通胀数据出现明显背离:

8月,美国10年期国债收益率一度跌至1.13%。

出现这种情况的原因是什么?面对不断上升的通货膨胀和经济增长率,为什么债券投资者仍然欣然接受低得可怜的债券收益率?正如大多数市场波动一样,从来没有一个决定性因素。利率的变动是由多个因素导致的。

人口结构

如今,婴儿潮一代掌控着美国的大部分金融资产,他们的财富总量接近70万亿美元。据估计,从现在到2030年每天将有1万名婴儿潮一代退休。

当你接近或达到退休年龄时,你就没有足够多的时间或人力资本等待熊市结束。而退休也就意味着你的投资组合从积累期转向退出模式。因此,大多数投资者会通过减少股票投资、增加债券投资,降低至少一部分投资组合的风险。

这就解释了为什么在过去十年尽管收益率始终保持在较低水平,却仍然有数万亿美元持续流入固定收益基金。如果债券需求持续走高,人口结构的影响甚至会超过宏观经济因素。

美联储

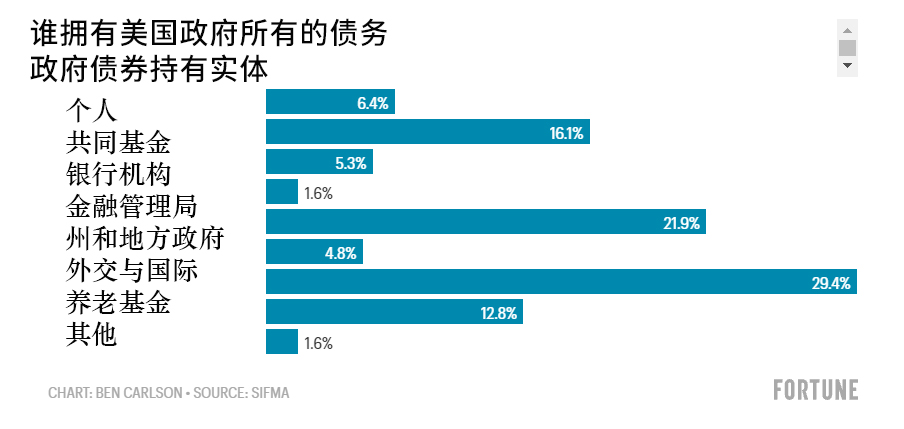

不光投资者有债券需求。近年来,美联储作为政府债券的购买者,发挥着更加举足轻重的作用。2020年,美联储和美国政府购买了近60%的美国政府债券。

此番购买行为很大一部分原因是由于新冠疫情,但是美联储和美国政府现在持有超过四分之一的美国政府债务:

如果将美国的养老金机构、保险公司、散户和基金等所有投资者加起来,他们仍然是政府债券的最大持有者,占比超过40%。这很好地提醒了我们,一方的负债就是另一方的资产。

未来几年,有一件很有趣的事情是美联储能否大规模退出债务市场。美国已经负债累累,因此我们很难看到政府官员允许利率大幅上升,除非利率费用变得过于沉重。

为了控制借贷成本,美联储很可能被迫继续扮演政府债务持有人的重要角色。

无风险利率重新定价

利率之所以没有像很多人预期的那样上涨,可能还有其他大环境方面的原因(除投资者需求和中央银行外)。

美国拥有全球最大、最成熟和最多元的经济和金融市场,还有世界储备货币——美元。

经济历史学家理查德·西拉曾经写道:“任何一个工业国家的自由市场长期利率,通过恰当汇总记录,可以提供体现一个国家经济和政治健康状况的动态图。”

人类历史上许多伟大的文明中都出现了这种“动态图”。它表明当经济不稳定时,利率更高,随着国家趋向成熟,利率则会下降。随着国家变得更加富有,借贷成本通常会逐渐降低。

投资者可能无法在无风险政府债券中获取高回报率。由于经济更加成熟、技术创新、财富水平提高、投资者准入门槛降低以及中央银行加强对金融市场的干预,美国政府债券5%收益率的时代可能一去不复返了。

既然投资者持有的资产必定会带来回报,为什么还要以高利率作为补偿?

金融市场瞬息万变,如果认为随着形势继续好转这些因素将能够永远抵消宏观经济的影响,这种想法就太天真了。今年的市场行情或许证明了一点,那就是利率的走势很难预测。

但是对投资者而言,现在或许应该做好准备,迎接一个利率长期处于较低水平的世界。(财富中文网)

作者的个人投资组合或里萨兹财富管理公司(Ritholtz Wealth Management)管理的投资组合可能目前持有、曾经持有或未来可能持有文中提及的证券。

翻译:郝秀

审校:汪皓

最新数据显示,过去12个月美国的通胀率达到5.3%,创下13年以来的最高水平。事实上,自2011年以来,美国的通胀率从未超过3%。

今年第二季度,美国的国内生产总值(GDP)年化增长率为6.5%。目前,美联储(Federal Reserve)预测美国2021年全年经济增长7%,将创下自20世纪80年代中期以来的最高经济增长率。

诚然,由于新冠疫情导致经济放缓,这些数据的基数较低。我们应该期待经济数据中的异常值先降后升。然而,综合政府不断支出、房价上涨、薪资上涨、物资短缺、零售消费热和通胀率上升等诸多因素,你可能认为现在是利率上涨的绝佳环境。

利率的确曾经小幅上涨,但仅维持了一段时间。目前,利率再次下跌,这一走势与最新通胀数据出现明显背离:

8月,美国10年期国债收益率一度跌至1.13%。

出现这种情况的原因是什么?面对不断上升的通货膨胀和经济增长率,为什么债券投资者仍然欣然接受低得可怜的债券收益率?正如大多数市场波动一样,从来没有一个决定性因素。利率的变动是由多个因素导致的。

人口结构

如今,婴儿潮一代掌控着美国的大部分金融资产,他们的财富总量接近70万亿美元。据估计,从现在到2030年每天将有1万名婴儿潮一代退休。

当你接近或达到退休年龄时,你就没有足够多的时间或人力资本等待熊市结束。而退休也就意味着你的投资组合从积累期转向退出模式。因此,大多数投资者会通过减少股票投资、增加债券投资,降低至少一部分投资组合的风险。

这就解释了为什么在过去十年尽管收益率始终保持在较低水平,却仍然有数万亿美元持续流入固定收益基金。如果债券需求持续走高,人口结构的影响甚至会超过宏观经济因素。

美联储

不光投资者有债券需求。近年来,美联储作为政府债券的购买者,发挥着更加举足轻重的作用。2020年,美联储和美国政府购买了近60%的美国政府债券。

此番购买行为很大一部分原因是由于新冠疫情,但是美联储和美国政府现在持有超过四分之一的美国政府债务:

如果将美国的养老金机构、保险公司、散户和基金等所有投资者加起来,他们仍然是政府债券的最大持有者,占比超过40%。这很好地提醒了我们,一方的负债就是另一方的资产。

未来几年,有一件很有趣的事情是美联储能否大规模退出债务市场。美国已经负债累累,因此我们很难看到政府官员允许利率大幅上升,除非利率费用变得过于沉重。

为了控制借贷成本,美联储很可能被迫继续扮演政府债务持有人的重要角色。

无风险利率重新定价

利率之所以没有像很多人预期的那样上涨,可能还有其他大环境方面的原因(除投资者需求和中央银行外)。

美国拥有全球最大、最成熟和最多元的经济和金融市场,还有世界储备货币——美元。

经济历史学家理查德·西拉曾经写道:“任何一个工业国家的自由市场长期利率,通过恰当汇总记录,可以提供体现一个国家经济和政治健康状况的动态图。”

人类历史上许多伟大的文明中都出现了这种“动态图”。它表明当经济不稳定时,利率更高,随着国家趋向成熟,利率则会下降。随着国家变得更加富有,借贷成本通常会逐渐降低。

投资者可能无法在无风险政府债券中获取高回报率。由于经济更加成熟、技术创新、财富水平提高、投资者准入门槛降低以及中央银行加强对金融市场的干预,美国政府债券5%收益率的时代可能一去不复返了。

既然投资者持有的资产必定会带来回报,为什么还要以高利率作为补偿?

金融市场瞬息万变,如果认为随着形势继续好转这些因素将能够永远抵消宏观经济的影响,这种想法就太天真了。今年的市场行情或许证明了一点,那就是利率的走势很难预测。

但是对投资者而言,现在或许应该做好准备,迎接一个利率长期处于较低水平的世界。(财富中文网)

作者的个人投资组合或里萨兹财富管理公司(Ritholtz Wealth Management)管理的投资组合可能目前持有、曾经持有或未来可能持有文中提及的证券。

翻译:郝秀

审校:汪皓

The latest reading on inflation in the United States checked in at 5.3% over the past 12 months, its highest level in 13 years. In fact, inflation hasn't been more than 3% since 2011.

GDP growth in the second quarter came in at an annualized rate of 6.5%. The Federal Reserve is now projecting 7% economic growth for the whole of 2021, the highest economic growth since the mid-1980s.

Granted, these numbers are coming off a low base from the pandemic slowdown. We should expect outliers in economic data to the upside following outliers to the downside. But with all of the government spending, rising home prices, rising wages, supply shortages, retail spending boom and higher inflation, you would assume this is the perfect environment for interest rates to rise.

And rates did rise a bit, but only for a time. They are now once again falling and show a clear divergence from the latest inflation numbers:

In August the 10 year Treasury yield briefly hit 1.13%.

So what gives? Why are bond investors still accepting paltry bond yields in the face of rising inflation and economic growth? As with most market moves, there is never one overarching reason. There is a lot that goes into the movement of interest rates.

Demographics

Baby boomers control the bulk of financial assets in this country, with close to $70 trillion in wealth. It's estimated ten thousand boomers will be retiring every single day through the end of the decade.

When you are approaching or in retirement age, you don't have as much time or human capital to wait out bear markets. And retirement means your portfolio goes from the accumulation phase to withdrawal mode. For most investors, this means de-risking at least a portion of their portfolio by decreasing their allocation to stocks and increasing their allocation to bonds.

This is why trillions of dollars have continued to flow into fixed-income funds over the past decade despite generationally low yields. If the demand for bonds remains high, that can trump macroeconomic factors.

The Federal Reserve

Demand for bonds extends beyond the investor class as well. The Federal Reserve has taken a much bigger role as a buyer of government bonds in recent years. In 2020, the Fed and the government accounted for nearly 60% of U.S. government bond purchases.

Much of this buying was due to the pandemic but you can see the Fed and government now owns more than one-quarter of U.S. government debt:

When you add up all of the U.S. investors between pensions, insurance companies, individuals and funds that remains the largest holders of government bonds at more than 40%. This is a good reminder that every liability for one party is an asset for another.

What will be interesting in the years ahead is seeing if the Fed will be able to pull out of the debt markets in a big way. With so much debt in this country, it's hard to see government officials allowing interest rates to go much higher before the interest expense becomes too burdensome.

It's possible the central bank will be forced to continue playing a large role as a holder of government debt to keep borrowing costs under control.

A repricing of risk-free rates

There could be other big picture reasons (beyond investor demand and central banks) why interest rates aren't rising as many expected.

The United States has the largest, most mature, most diverse economy and financial markets on the planet by a wide margin. We also have the world's reserve currency.

Economic historian Richard Sylla once wrote, "the free market long-term rates of interest for any industrial nation, properly charted, provide a sort of fever chart of the economic and political health of that nation."

This "fever chart" shows up in many of history's great civilizations. It shows interest rates are higher when economies are unstable and fall over time as countries mature. As countries become wealthier, their borrowing costs typically fall over time.

It's also possible investors aren't supposed to earn high rates of return on risk-free government bonds. It's possible the days of 5% government bond yields in the United States are behind us from a combination of a more mature economy, technological innovation, higher levels of wealth, lower barriers to entry to investors and the increased intervention from central banks in the financial markets.

Why should investors be compensated with a high rate of interest for holding an asset that is guaranteed to pay you back?

Nothing lasts always and forever in the financial markets so it would be naive to assume these forces will be able to counteract the macroeconomy forever if things continue to improve. If this year proves anything it's that the path of interest rates is extremely difficult to predict.

But it might be time for investors to prepare for a world in which interest rates stay relatively low for a very long time.

Certain of the securities mentioned in the article may be currently held, have been held, or may be held in the future in the personal portfolio or a portfolio managed by Ritholtz Wealth Management