近几个月,尽管公众对德尔塔变种毒株和缩减资产规模政策的担忧加剧,标准普尔500指数(S&P 500)却仍然在继续攀升。但有一项指标可能预示着,未来股市或将迎来疲软甚至熊市。

保证金借款是指投资者从经纪商借入用于购买证券的资金。根据美国金融业监管局(FINRA)的数据,保证金借款总量在6月创下8820亿美元的新高,此后出现下滑。7月是新冠肺炎疫情爆发以来保证金负债量首次下降,而此时的标准普尔500指数正创下历史新高。换句话说,与今夏初期相比,尽管股市仍然在走高,投资者上个月用于购买股票的借款却减少了。

这为什么是消极信号呢?嘉信理财(Charles Schwab)的交易和衍生品董事总经理兰迪•弗雷德里克解释说,保证金借款“总体上反映了人们对市场的信心”。“如果有人愿意借钱买股票,说明他们相信这些股票的收益能够超过自己为借款支付的利息。”

的确如此,正如美国银行(Bank of America)的技术研究策略师斯蒂芬•萨特迈尔在8月23日的报告中所写:“杠杆率上升往往和美国股市的上涨相呼应。我们不担心保证金借款量创下新高。”相反,“如果保证金借款量停止上涨,说明投资者已经开始去杠杆,我们才会感到担忧。”他指出,标准普尔500指数7月上涨了2.3%,但保证金借款量较上月高点下跌了4.3%。

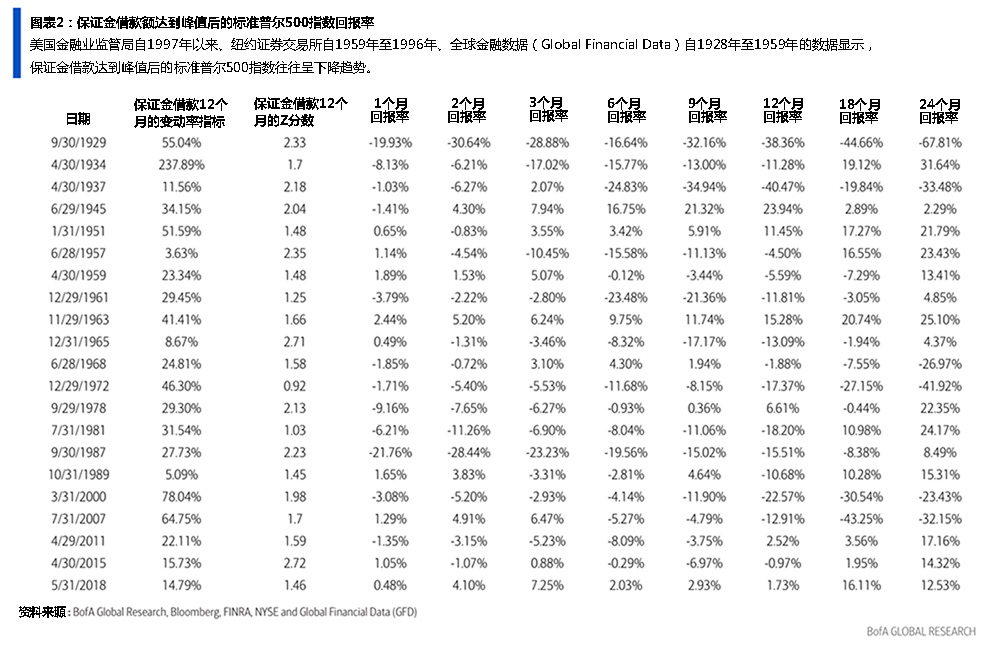

“尽管保证金借款的峰值并不总是与(标准普尔500指数)的高点同时出现,但出现峰值往往预示着股市将会疲软。”萨特迈尔表示。他在报告中指出,自1997年以来(基于美国金融业监管局的数据),有21次保证金借款在达到顶峰后变弱变差,随后标准普尔500指数也出现同样趋势(参见下面美国银行的图表)。

萨特迈尔说:“按照美国金融业监管局的数据,如果2021年6月是保证金负债量的又一个周期高点,那么在保证金见顶后的1个月到24个月里,(标准普尔500指数)存在回报变低、甚至在大多数情况下为负收益的风险。”他引用数据指出,“在保证金债务达到峰值一年后,(标准普尔500指数)下跌了71%,平均回报率为-7.8%(中位数为-10.7%)。”

弗雷德里克认为,7月保证金负债量的下降“不同寻常”,因为从历史上看,保证金负债量在市场上涨时上升,在股市下跌时下降。“自2020年3月以来,我们还没有真正看到市场出现大幅下滑,保证金负债量也没有大幅下降。”他向《财富》杂志表示,“所以7月的数据非常不寻常,因为市场基本上处于历史高点,而我们的保证金负债量却出现了相当大幅度的下降。这很奇怪。”

一方面,弗雷德里克在最近发布的推特(Twitter)中指出,保证金债务下降“降低了回调变成全面修正的可能”(事实上,最近我们看到,每当市场出现抛售时,就会有买家入场,市场因此不会进入全面修正),但“也意味着投资者趋于谨慎”。

保证金负债量往往与市场表现挂钩。但本月,尽管标准普尔500指数创下新高,但保证金负债量仍然出现了新冠肺炎疫情以来的首次下跌。这降低了回调变成全面修正的风险,但也意味着投资者变得更加谨慎。https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

——兰迪•弗雷德里克(@RandyAFrederick),2021年8月16日

肯定还有其他因素会影响投资者对股市的预判,影响标准普尔500指数的短期走势,比如季节性(8月和9月往往是股市淡季),即将到来的杰克逊霍尔全球央行年会、美联储会议(可能会透露关于缩减资产规模政策的信息),以及新冠病毒的持续传播。

弗雷德里克也提醒道,“一个月并不代表趋势”,如果8月的保证金负债量数据出现回升,7月就可能会被认为是一个无关紧要的“异常”。然而,如果8月的数据在股市保持强劲的情况下继续下滑,就可能有“更重要”的意义。(弗雷德里克说,总体而言,如果近期出现5%至7%的回调,他不会感到意外。)

不管怎样,继续关注下个月的数据才是上策。(财富中文网)

译者:Agatha

近几个月,尽管公众对德尔塔变种毒株和缩减资产规模政策的担忧加剧,标准普尔500指数(S&P 500)却仍然在继续攀升。但有一项指标可能预示着,未来股市或将迎来疲软甚至熊市。

保证金借款是指投资者从经纪商借入用于购买证券的资金。根据美国金融业监管局(FINRA)的数据,保证金借款总量在6月创下8820亿美元的新高,此后出现下滑。7月是新冠肺炎疫情爆发以来保证金负债量首次下降,而此时的标准普尔500指数正创下历史新高。换句话说,与今夏初期相比,尽管股市仍然在走高,投资者上个月用于购买股票的借款却减少了。

这为什么是消极信号呢?嘉信理财(Charles Schwab)的交易和衍生品董事总经理兰迪•弗雷德里克解释说,保证金借款“总体上反映了人们对市场的信心”。“如果有人愿意借钱买股票,说明他们相信这些股票的收益能够超过自己为借款支付的利息。”

的确如此,正如美国银行(Bank of America)的技术研究策略师斯蒂芬•萨特迈尔在8月23日的报告中所写:“杠杆率上升往往和美国股市的上涨相呼应。我们不担心保证金借款量创下新高。”相反,“如果保证金借款量停止上涨,说明投资者已经开始去杠杆,我们才会感到担忧。”他指出,标准普尔500指数7月上涨了2.3%,但保证金借款量较上月高点下跌了4.3%。

“尽管保证金借款的峰值并不总是与(标准普尔500指数)的高点同时出现,但出现峰值往往预示着股市将会疲软。”萨特迈尔表示。他在报告中指出,自1997年以来(基于美国金融业监管局的数据),有21次保证金借款在达到顶峰后变弱变差,随后标准普尔500指数也出现同样趋势(参见下面美国银行的图表)。

萨特迈尔说:“按照美国金融业监管局的数据,如果2021年6月是保证金负债量的又一个周期高点,那么在保证金见顶后的1个月到24个月里,(标准普尔500指数)存在回报变低、甚至在大多数情况下为负收益的风险。”他引用数据指出,“在保证金债务达到峰值一年后,(标准普尔500指数)下跌了71%,平均回报率为-7.8%(中位数为-10.7%)。”

弗雷德里克认为,7月保证金负债量的下降“不同寻常”,因为从历史上看,保证金负债量在市场上涨时上升,在股市下跌时下降。“自2020年3月以来,我们还没有真正看到市场出现大幅下滑,保证金负债量也没有大幅下降。”他向《财富》杂志表示,“所以7月的数据非常不寻常,因为市场基本上处于历史高点,而我们的保证金负债量却出现了相当大幅度的下降。这很奇怪。”

一方面,弗雷德里克在最近发布的推特(Twitter)中指出,保证金债务下降“降低了回调变成全面修正的可能”(事实上,最近我们看到,每当市场出现抛售时,就会有买家入场,市场因此不会进入全面修正),但“也意味着投资者趋于谨慎”。

保证金负债量往往与市场表现挂钩。但本月,尽管标准普尔500指数创下新高,但保证金负债量仍然出现了新冠肺炎疫情以来的首次下跌。这降低了回调变成全面修正的风险,但也意味着投资者变得更加谨慎。https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

——兰迪•弗雷德里克(@RandyAFrederick),2021年8月16日

肯定还有其他因素会影响投资者对股市的预判,影响标准普尔500指数的短期走势,比如季节性(8月和9月往往是股市淡季),即将到来的杰克逊霍尔全球央行年会、美联储会议(可能会透露关于缩减资产规模政策的信息),以及新冠病毒的持续传播。

弗雷德里克也提醒道,“一个月并不代表趋势”,如果8月的保证金负债量数据出现回升,7月就可能会被认为是一个无关紧要的“异常”。然而,如果8月的数据在股市保持强劲的情况下继续下滑,就可能有“更重要”的意义。(弗雷德里克说,总体而言,如果近期出现5%至7%的回调,他不会感到意外。)

不管怎样,继续关注下个月的数据才是上策。(财富中文网)

译者:Agatha

The S&P 500 has continued its upward climb in recent months, despite rising fears about the Delta variant and tapering. But one indicator may be warning of a weaker—or even bearish—period ahead for stocks.

Margin debt, which is the money investors borrow from brokers to buy securities, hit a record high in June, at $882 billion per FINRA, and has since slumped. July marked the first time margin debt declined since the pre-COVID days, and that decline comes at a time when the S&P 500 is hitting all-time highs of its own. In other words, investors were borrowing less money to buy stocks last month than they were earlier this summer, even as stocks ticked higher.

So why would that be a bad thing? Think of margin debt as "basically just a statement of confidence in the market," explains Randy Frederick, managing director of trading and derivatives at Charles Schwab. "If someone's willing to borrow money in order to buy stocks, they believe that the return they get on those stocks is going to exceed the interest rate they pay on that borrowing."

Indeed, as Stephen Suttmeier, technical research strategist at Bank of America, wrote in a August 23 note, "Rising leverage tends to confirm U.S. equity rallies. It is not new record highs for margin debt that we worry about." Instead, "we get concerned when margin debt stops rising to suggest that investors have begun to reduce leverage." He points out that the S&P 500 rose 2.3% in July, but margin debt dropped by 4.3% from its high the month prior.

"Although peaks in margin debt don't always coincide with highs for the [S&P 500], they tend to be bearish for equities," Suttmeier argues. In his note, he points to 21 times since 1997 (based on FINRA data) when margin debt peaked and weaker, and even poor, S&P 500 performance ensued (see Bank of America's chart below).

"If June 2021 proves to be another cycle high for FINRA margin debt, the risk is for weaker, and in most cases negative, [S&P 500] returns from one month through 24 months after a margin peak," Suttmeier says. To put numbers on that, he notes that one year after "a peak in margin debt shows the [S&P 500] down 71% of the time with an average return of -7.8% (-10.7% median)."

Frederick suggests the July drop in margin debt is "unusual," since historically margin debt goes up when the market is going up, and goes down when stocks sell off. "We haven't really seen a big downturn in the market, and we really haven't seen a big drop in margin debt since March 2020," he tells Fortune. "That's why the July data is very unusual, because the market is essentially sitting at an all-time high and we had a pretty sizable downtick in margin debt. That's really weird."

On one hand, Frederick noted in a recent tweet that declining margin debt "reduces the risk that a pullback becomes a full correction" (indeed, lately we've seen dip buyers jumping in whenever the market sells off, preventing it from going into a full correction), but that "it also implies investors are getting more cautious."

Margin debt is mostly tied to market performance. But this month it declined for the first time post-COVID, despite new $SPX highs. This reduces the risk that a pullback becomes a full correction, but it also implies investors are getting more cautious.https://t.co/wyfH3UcCAS pic.twitter.com/2i7wMaKrlQ

— Randy Frederick (@RandyAFrederick) August 16, 2021

Certainly there are other factors at play in terms of how investors are feeling about stocks and how the S&P 500 may perform in the short term, including seasonality (August and September tend to be weak months for stocks), the upcoming Jackson Hole summit, and Fed meetings (which could offer clues about tapering), and the continued path of the coronavirus.

Frederick cautions that "one month doesn't make a trend" and that if margin debt data for August comes in higher, July may be considered a somewhat insignificant "anomaly." If August data continues the slump while stocks remain resilient, however, that may be "more significant." (In general, Frederick says, he wouldn't be surprised by a 5% to 7% pullback in the near term.)

Either way, it might be a good idea to keep your eye on the next month's worth of data.