投资界传奇人物本杰明•格拉汉姆曾说过:“从短线来看,股市是一个投票机器,但从长线来看,股市是一个天平。”

这句话的基本道理是说,股市在短期内的效率可能会非常低下,但从长期来看大致还是会与基本面看齐。

说到股市,一个最重要的基本面就是收益。例如,在过去80年中,标普500每年的回报率约为11%。与此同时,企业收益每年的增幅高于6%。剩余的回报则来自于派息收益和倍数膨胀,因此,收益会在长期内为股市提供大量的回报。

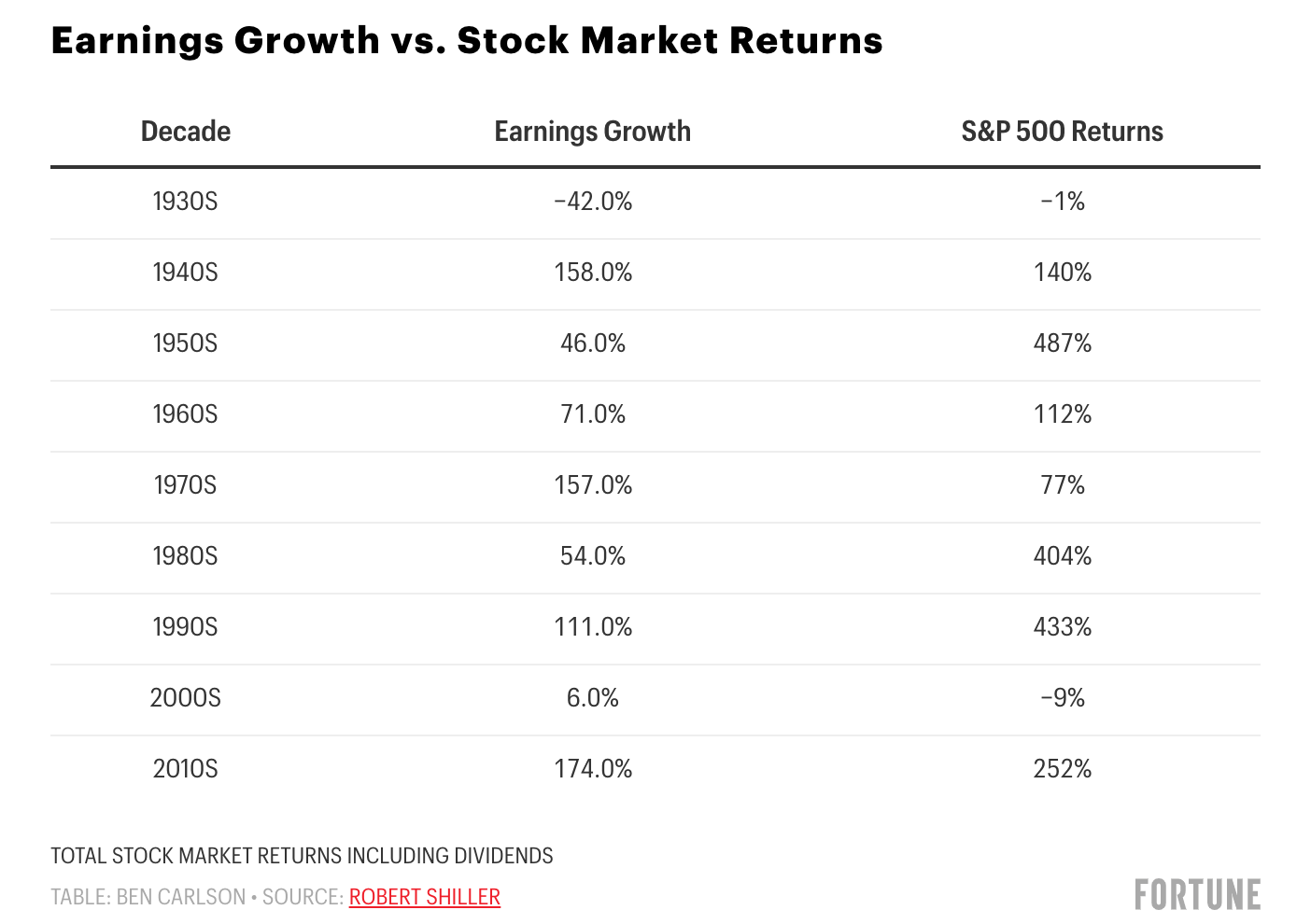

但这种关系通常是不稳定的,即便从长线来看亦是如此。下表显示了从上个世纪30年代开始每十年的收益增速和标普500总回报:

在某些时段,这种关系看起来十分稳健。上世纪30年代,收益大幅下滑,股市回报亦是不尽人意。21世纪00年代的那十年亦发生了同样的事情。上个世纪70年代,由于通胀居高不下,收益轻易地超过了股市。

在某些时期,收益增速和股市回报保持着一致的步调,例如上个世纪40年代,60年代和21世纪10年代。时间框架越短,这种关系就越不稳定。任何一年内的收益增长可能都无法明确地指明股市未来的走向。这一论断在当前的市场环境中可能尤为适用。

摩根大通最近发表的一份研究纪要称,“在2021年初,美国公司每股收益的预估值为175美元,如今已经达到了196美元,经营杠杆显示,这些股票的价格可能会进一步增长。”

相对于2020年底约94美元/股的收益,这个数字可谓实现了巨大的飞跃。诚然,这些收益因疫情影响而有所下滑,但196美元/股的水平依然比2019年年底,也就是经济在疫情冲击之前的水平高出40%。

如果收益大幅增长遇到了数十年来最快的经济增速,那么股市应该会获得更大的收益,不是吗?

然而并没有那么快。

受基本面影响的投资者将继续推高股价,但此举在股市中并不一定总能见效,以去年为例,2020年收益跌幅超过了30%,但标普500反而增长了18%。我们也可以看看2018年出现的相反局面,当年的收益增长了20%,但股市跌破了4%。2015年,收益跌幅超过了15%,而股市涨幅接近2%。这样的例子还有很多。

在1930年之后的91年中,美国股市收益同比增幅有60年都是正的。然而,在收益下滑的大多数时期,股市反而有所增长。在收益同比下滑的31年中,股市有24年都出现了正增长。

换句话说,在超过25%的年份中,企业收益出现了增长,但股市却出现了下滑。

很明显,股市应该是一个前瞻性的指示器,因此收益增长和股市回报之间不会始终同步的现象也是合乎情理的。

有一点很有意思,既然通胀如今已经是一个备受关注的话题,我们可以关注一下股票市场在高收益增长和高通胀同时出现时的表现。

从1971年到1974年,标普500收益增长了近75%,而股市总的来说实际上下滑了8%。1973年企业收益增长了27%,而标普500下滑了15%。1974年,收益再次增长了9%,而标普500的跌幅达到了近27%。通胀在上个世纪70年代要远高于当前的水平,但这一点也说明,有时候基本面也会与股市完全背道而驰。

企业可能会在2021年迎来收益的大幅增长,但我们很难保证股市亦会因此而一路高歌。(财富中文网)

本•卡尔森是Ritholtz Wealth Management机构资产管理业务总监。他可能持有本文中讨论的证券或资产。

译者:冯丰

审校:夏林

投资界传奇人物本杰明•格拉汉姆曾说过:“从短线来看,股市是一个投票机器,但从长线来看,股市是一个天平。”

这句话的基本道理是说,股市在短期内的效率可能会非常低下,但从长期来看大致还是会与基本面看齐。

说到股市,一个最重要的基本面就是收益。例如,在过去80年中,标普500每年的回报率约为11%。与此同时,企业收益每年的增幅高于6%。剩余的回报则来自于派息收益和倍数膨胀,因此,收益会在长期内为股市提供大量的回报。

但这种关系通常是不稳定的,即便从长线来看亦是如此。下表显示了从上个世纪30年代开始每十年的收益增速和标普500总回报:

在某些时段,这种关系看起来十分稳健。上世纪30年代,收益大幅下滑,股市回报亦是不尽人意。21世纪00年代的那十年亦发生了同样的事情。上个世纪70年代,由于通胀居高不下,收益轻易地超过了股市。

在某些时期,收益增速和股市回报保持着一致的步调,例如上个世纪40年代,60年代和21世纪10年代。时间框架越短,这种关系就越不稳定。任何一年内的收益增长可能都无法明确地指明股市未来的走向。这一论断在当前的市场环境中可能尤为适用。

摩根大通最近发表的一份研究纪要称,“在2021年初,美国公司每股收益的预估值为175美元,如今已经达到了196美元,经营杠杆显示,这些股票的价格可能会进一步增长。”

相对于2020年底约94美元/股的收益,这个数字可谓实现了巨大的飞跃。诚然,这些收益因疫情影响而有所下滑,但196美元/股的水平依然比2019年年底,也就是经济在疫情冲击之前的水平高出40%。

如果收益大幅增长遇到了数十年来最快的经济增速,那么股市应该会获得更大的收益,不是吗?

然而并没有那么快。

受基本面影响的投资者将继续推高股价,但此举在股市中并不一定总能见效,以去年为例,2020年收益跌幅超过了30%,但标普500反而增长了18%。我们也可以看看2018年出现的相反局面,当年的收益增长了20%,但股市跌破了4%。2015年,收益跌幅超过了15%,而股市涨幅接近2%。这样的例子还有很多。

在1930年之后的91年中,美国股市收益同比增幅有60年都是正的。然而,在收益下滑的大多数时期,股市反而有所增长。在收益同比下滑的31年中,股市有24年都出现了正增长。

换句话说,在超过25%的年份中,企业收益出现了增长,但股市却出现了下滑。

很明显,股市应该是一个前瞻性的指示器,因此收益增长和股市回报之间不会始终同步的现象也是合乎情理的。

有一点很有意思,既然通胀如今已经是一个备受关注的话题,我们可以关注一下股票市场在高收益增长和高通胀同时出现时的表现。

从1971年到1974年,标普500收益增长了近75%,而股市总的来说实际上下滑了8%。1973年企业收益增长了27%,而标普500下滑了15%。1974年,收益再次增长了9%,而标普500的跌幅达到了近27%。通胀在上个世纪70年代要远高于当前的水平,但这一点也说明,有时候基本面也会与股市完全背道而驰。

企业可能会在2021年迎来收益的大幅增长,但我们很难保证股市亦会因此而一路高歌。(财富中文网)

本•卡尔森是Ritholtz Wealth Management机构资产管理业务总监。他可能持有本文中讨论的证券或资产。

译者:冯丰

审校:夏林

Legendary investor Benjamin Graham once said, "In the short-run the stock market is a voting machine but in the long-run it is a weighing machine."

The basic idea here is the stock market can be wildly inefficient in the short-term but over the long-term it tends to follow fundamentals.

One of the most important fundamentals when it comes to the stock market is earnings. For instance, over the past 80 years the S&P 500 has returned roughly 11% per year. In that same time corporate earnings have grown at more than 6% per year. The remaining returns have come from the dividend yields and multiple expansion so earnings provide the bulk of returns for stocks in the long-term.

But this relationship is often inconsistent, even over decade-long periods. The following shows earnings growth and total S&P 500 returns by decade going back to the 1930s:

There are times where this relationship looks strong. The 1930s saw earnings get decimated and that was reflected in poor stock market returns. The same was true in the lost decade of the 2000s. In the 1970s, earnings handily outpaced the stock market because inflation was so high.

Then you have decades like the 1940s, 1960s and 2010s where earnings growth and stock market returns were in line with one another. This relationship breaks down even more the shorter your time frame. Earnings growth over any one year period may not tell you much about what's going to happen in the stock market. That could be true more than ever in the current market environment.

JP Morgan's recently put out a research note saying, "At the start of the year, 2021 US earnings expectations were $175 per share. They are now $196 per share and operating leverage suggests they may rise higher than that."

This is a big leap from year-end 2020 earnings of around $94 per share. Granted, those earnings were depressed from the pandemic but $196 a share would still be more than 40% where things finished in 2019 before COVID threw a wrench into the economy.

When you combine massive earnings growth with perhaps the fastest economic growth in decades, the stock market should be primed for further gains, right?

Not so fast.

It is possible investors will continue to bid up stocks with fundamentals but it doesn't always work so neatly in the markets. Look no further than last year to see this in action. Earnings fell more than 30% in 2020 yet the S&P 500 actually rose 18%. Or how about the opposite situation when earnings were up 20% in 2018 but the stock market fell more than 4% on the year. In 2015, earnings were down more than 15% yet stocks finished the year up nearly 2%. I could go on.

Going back to 1930, year-over-year earnings growth for the U.S. stock market has been positive in 60 out of 91 years. But the majority of the time when earnings were down, the stock market was actually up in that time. In 24 out of 31 years where earnings fell from one year to the next, the stock market was positive on the year.

Alternatively, more than 1 out of every 4 years which saw corporate earnings grow, the stock market finished the year with a loss.

Obviously, the stock market is meant to be a forward-looking indicator, so it would make sense earnings growth and stock market returns don't always move in lockstep with one another.

It's also interesting to note how the stock market has dealt with periods of high earnings growth in concert with high inflation in the past, since inflation is a topic on everyone's mind right now.

From 1971-1974, earnings for the S&P 500 grew nearly 75% yet in that time the stock market actually fell 8% in total. Earnings were up 27% in 1973 while the S&P 500 dropped 15%. In 1974, earnings were up an additional 9% while the S&P 500 cratered almost 27%. Inflation was much higher in the 1970s than it is today but this shows how it's possible for fundamentals to detach from the stock market in a big way at times.

Corporations could experience massive earnings growth in 2021 but there's no guarantee the stock market will match those gains.

Ben Carlson is the director of institutional asset management at Ritholtz Wealth Management. He may own securities or assets discussed in this piece.