美国的住宅房地产市场无疑正处于火爆状态。根据最新报道,凯斯-席勒指数同比增长了11%,而这仅仅只统计到了今年1月。我认为,在接下来的几个月里,这项数值还会变得更高。

关于住房短缺和荒谬的全现金交易,我们都有所耳闻。对众多预测专家来说,种种迹象均显示,一场新的房地产泡沫似乎近在咫尺。

但我不这么认为。原因如下:

有信誉的借贷人

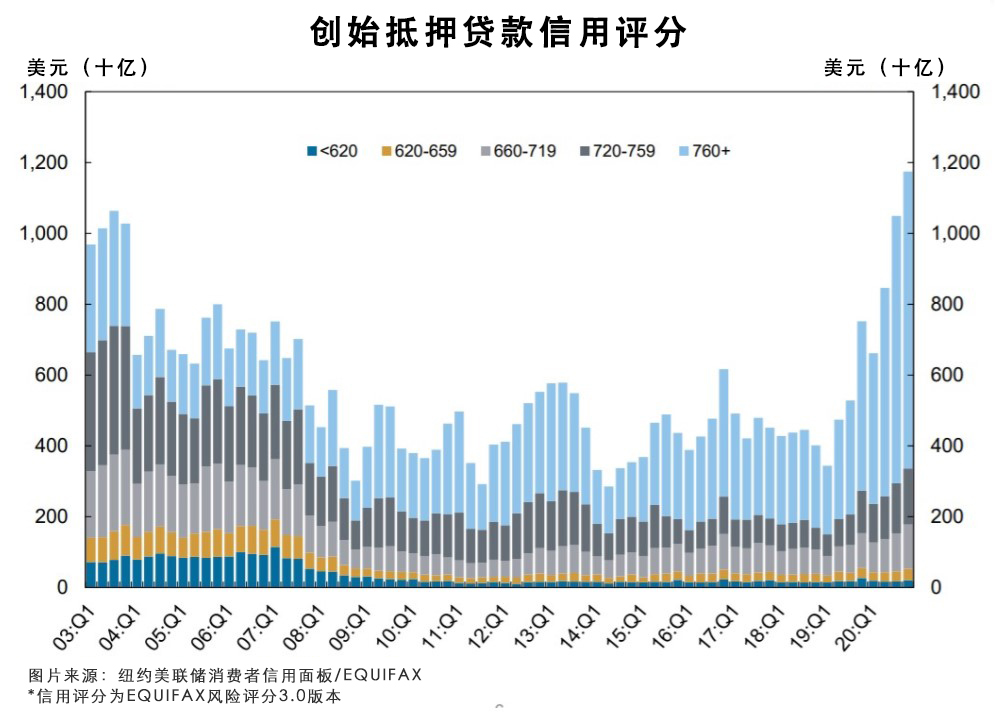

没错,房价正在快速上涨,但目前的状况与发生次贷危机时完全不同。看看抵押贷款机构的信用评分吧:

贷款大多都发放给了那些信用评分高、首付金额大的人,这与次贷房地产繁荣时的情况刚好相反。据《华尔街日报》报道,获取抵押贷款的可能性已接近2014年以来的最低点。也就是说,银行会收紧贷款;出于对疫情影响财务状况的担忧,居民们也会更加谨慎。不管怎样,如果最终选择贷款的人数变多,就可能会导致房地产市场的又一次膨胀。

住房供应量

自上世纪90年代末以来,市场上的现房供应量一直处于历史最低水平:

然而,这并不一定是贪婪的购房大军导致的结果。没错,因为疫情的爆发,以及居家办公几率的提升,选择搬迁的群体有所扩大。

市场上的住房数量也有所减少,因为当一种通过空气传播的病毒在全球范围内蔓延时,许多房主都不再敢让陌生人到自家的房子里走动。

上一次房地产繁荣和萧条的后遗症导致房屋建筑商减少了建房数量。自2006年达到顶峰以来,建筑许可和房屋开工量分别下降了26%和37%。

而自房地产泡沫破裂以来,建筑许可和房屋开工量分别下降了30%和43%。从某些层面来说,我并不会怪罪这些房屋建筑商,但他们不愿多建的迹象表明,如今的状况并不像2000年代中期那样严重泡沫化。

相对良好的资产负债表

与次贷危机时有所不同的另一点在于,美国消费者的财务状况。

因为利率下降、上次经济危机后的恐慌以及经济刺激支出的健康增长,与以往任何一次摆脱经济衰退时相比,美国消费者如今的状况都还算不错。

房主把房产留在手里,其资产净值也大有增长。截至2007年底,全美房产总净值超过了10万亿美元,但抵押贷款债务超过了9万亿美元;而如今,房产总净值超过了21万亿美元,抵押贷款债务仅为10万亿美元。

上一次深陷房地产泡沫时,信用评分很差的人背负了太多的债务,根本无力偿还。这次的状况则完全不同。

看看其他地方是否也存在泡沫

相比于美国,另外一些国家更像是出现了房地产泡沫。

本世纪,加拿大和英国的房价轻而易举地超过了美国。自2000年以来,英国房屋价格指数已上涨了200%以上。本世纪,加拿大的房价攀升了260%以上。而针对美国的凯斯-席勒房屋价格指数仅上涨了139%。

可能你会说,美国的房地产市场正处于泡沫之中,其他地区的房地产则处于巨大的泡沫之中。不过,如果你说的是多伦多和温哥华,还更有可能拿到我的赞同票。

房价上升得很合理

如今,千禧一代是美国人口占比最多的群体。其中,年龄最大的千禧一代今年就要满40岁了。相比于父母那一辈,我们这群人买房的时间要晚得多,因为上大学的人更多,受金融危机影响的程度更深,也可能是,我们只是不想这么快就长大。

和前几代人一样,千禧一代也在慢慢长大。虽然在金融危机发生之后,似乎有些不太可能,但我们还是决定要安定下来,买套房子。

在新冠疫情、远程办公、利率降低等因素的综合作用下,越来越多的人都选择了买房。

单纯的价格上涨并不会自动导致某个市场泡沫化。有些时候,价格上涨也是有充分理由的。你可能会不喜欢这些原因,但这和投机狂热完全是两码事。

这些因素会催生房地产泡沫吗?

当然会,永远不要低估美国人追求极端的欲望。

但目前还没有走到那一步。(财富中文网)

本·卡尔森Ritholtz Wealth Management的机构资产管理总监。他可能就拥有本文所讨论的证券或资产。

译者:殷圆圆

美国的住宅房地产市场无疑正处于火爆状态。根据最新报道,凯斯-席勒指数同比增长了11%,而这仅仅只统计到了今年1月。我认为,在接下来的几个月里,这项数值还会变得更高。

关于住房短缺和荒谬的全现金交易,我们都有所耳闻。对众多预测专家来说,种种迹象均显示,一场新的房地产泡沫似乎近在咫尺。

但我不这么认为。原因如下:

有信誉的借贷人

没错,房价正在快速上涨,但目前的状况与发生次贷危机时完全不同。看看抵押贷款机构的信用评分吧:

贷款大多都发放给了那些信用评分高、首付金额大的人,这与次贷房地产繁荣时的情况刚好相反。据《华尔街日报》报道,获取抵押贷款的可能性已接近2014年以来的最低点。也就是说,银行会收紧贷款;出于对疫情影响财务状况的担忧,居民们也会更加谨慎。不管怎样,如果最终选择贷款的人数变多,就可能会导致房地产市场的又一次膨胀。

住房供应量

自上世纪90年代末以来,市场上的现房供应量一直处于历史最低水平:

然而,这并不一定是贪婪的购房大军导致的结果。没错,因为疫情的爆发,以及居家办公几率的提升,选择搬迁的群体有所扩大。

市场上的住房数量也有所减少,因为当一种通过空气传播的病毒在全球范围内蔓延时,许多房主都不再敢让陌生人到自家的房子里走动。

上一次房地产繁荣和萧条的后遗症导致房屋建筑商减少了建房数量。自2006年达到顶峰以来,建筑许可和房屋开工量分别下降了26%和37%。

而自房地产泡沫破裂以来,建筑许可和房屋开工量分别下降了30%和43%。从某些层面来说,我并不会怪罪这些房屋建筑商,但他们不愿多建的迹象表明,如今的状况并不像2000年代中期那样严重泡沫化。

相对良好的资产负债表

与次贷危机时有所不同的另一点在于,美国消费者的财务状况。

因为利率下降、上次经济危机后的恐慌以及经济刺激支出的健康增长,与以往任何一次摆脱经济衰退时相比,美国消费者如今的状况都还算不错。

房主把房产留在手里,其资产净值也大有增长。截至2007年底,全美房产总净值超过了10万亿美元,但抵押贷款债务超过了9万亿美元;而如今,房产总净值超过了21万亿美元,抵押贷款债务仅为10万亿美元。

上一次深陷房地产泡沫时,信用评分很差的人背负了太多的债务,根本无力偿还。这次的状况则完全不同。

看看其他地方是否也存在泡沫

相比于美国,另外一些国家更像是出现了房地产泡沫。

本世纪,加拿大和英国的房价轻而易举地超过了美国。自2000年以来,英国房屋价格指数已上涨了200%以上。本世纪,加拿大的房价攀升了260%以上。而针对美国的凯斯-席勒房屋价格指数仅上涨了139%。

可能你会说,美国的房地产市场正处于泡沫之中,其他地区的房地产则处于巨大的泡沫之中。不过,如果你说的是多伦多和温哥华,还更有可能拿到我的赞同票。

房价上升得很合理

如今,千禧一代是美国人口占比最多的群体。其中,年龄最大的千禧一代今年就要满40岁了。相比于父母那一辈,我们这群人买房的时间要晚得多,因为上大学的人更多,受金融危机影响的程度更深,也可能是,我们只是不想这么快就长大。

和前几代人一样,千禧一代也在慢慢长大。虽然在金融危机发生之后,似乎有些不太可能,但我们还是决定要安定下来,买套房子。

在新冠疫情、远程办公、利率降低等因素的综合作用下,越来越多的人都选择了买房。

单纯的价格上涨并不会自动导致某个市场泡沫化。有些时候,价格上涨也是有充分理由的。你可能会不喜欢这些原因,但这和投机狂热完全是两码事。

这些因素会催生房地产泡沫吗?

当然会,永远不要低估美国人追求极端的欲望。

但目前还没有走到那一步。(财富中文网)

本·卡尔森Ritholtz Wealth Management的机构资产管理总监。他可能就拥有本文所讨论的证券或资产。

译者:殷圆圆

There's no question residential real estate in the United States is on fire. The latest Case-Shiller Index data showed an 11% year-over-year increase. And this data is only through January. I would expect the numbers will be even higher in subsequent months.

We've all heard anecdotes of housing shortages and ridiculous all-cash offers. The logical conclusion for many prognosticators is to call this yet another housing bubble.

I don't think this is the case. Here are some reasons why:

Credit-worthy borrowers

Yes, housing prices are rising at a rapid clip but this is nothing like the subprime crisis. Just look at the credit scores for mortgage originations:

Loans are mostly being made to those with high credit scores and sizable down payments, the exact opposite of the subprime housing boom. According to the Wall Street Journal, mortgage credit availability is near its lowest point since 2014. This means the banks pulling back on lending or households pulling back because they have been worried about the effects of the pandemic on their finances. Either way, if more people eventually begin to take out loans this could actually lead to another leg higher in the housing market.

Housing supply

The supply of existing home sales on the market is as low as its ever been on record going back to the late-1990s:

Yet the reason for this isn’t necessarily a bunch of ravenous home-buyers. Yes, there has been an increase in people moving because of the pandemic and the work from home opportunities it has created.

There are also fewer homes on the market because so many homeowners felt uncomfortable having strangers walk through their house while an airborne virus is spreading around the globe.

And the hangover caused by the last housing boom and bust caused homebuilders to pull back on the number of homes they built. The number of building permits and housing starts are down 26% and 37%, respectively, since peaking in 2006.

Building permits and housing starts are off 30% and 43%, respectively since the housing bubble burst. In some ways I don’t blame these homebuilders but their reluctance to build is one of the signs things aren’t nearly as frothy as they were in the mid-2000s.

Better balance sheets

Another reason this is nothing like the subprime crisis is the state of the U.S. consumer’s finances.

A combination of falling rates, some trepidation following the last crash and a healthy dose of stimulus payments mean the U.S. consumer is in better shape than they’ve ever been coming out of a recession:

Homeowners themselves also have way more equity in their home. By the end of 2007 there was more than $10 trillion in home equity but more than $9 trillion in mortgage debt. Now there is more than $21 trillion in home equity and $10 trillion in mortgage debt.

During the last bubble people with terrible credit scores took on too much debt that they couldn’t possibly hope to repay. That’s not the case this time.

Look elsewhere for a bubble

If you want to call a housing bubble somewhere, there are much better options in other countries.

Prices in Canada and the UK have handily outpaced the United States this century. Since 2000, the UK House Price Index is up more than 200%. Housing prices in Canada are up over 260% this century. The Case-Shiller National Home Price Index for the United States is up 139%.

I suppose you could make the claim that U.S. housing prices are in a bubble while prices elsewhere are in a mega-bubble but you would have more sympathy from me as a bubble-caller if you’re talking about Toronto and Vancouver.

Prices are rising for the right reason

Millennials are now the biggest demographic in this country. The oldest millennial is turning 40 this year. My generation put off buying a house much longer than our parent’s generation because more of us went to college or the financial crisis or we just didn’t want to grow up as fast.

Like all previous generations, millennials got older. They decided to settle down and buy a home even though it seemed like that would never happen following the Great Financial Crisis.

And a combination of the pandemic, remote work and low interest rates have all pushed even more people to start buying houses.

Just because prices are rising does not automatically make something a bubble. Sometimes prices rise for good reasons. You may not like those reasons but that’s not the same thing as a speculative mania.

Could this turn into a bubble?

Sure, never underestimate the American desire to take things to excess.

But it’s not one right now.

Ben Carlson is the director of institutional asset management at Ritholtz Wealth Management. He may own securities or assets discussed in this piece.