2020年,沃尔玛(Walmart)大获成功,这主要源于该公司庞大的门店网络为其电商业务的蓬勃发展提供了强大的支撑,门店送货快,顾客从门店取货方便、快捷。

据eMarketer于3月29日发布的一项预测,尽管沃尔玛2020年在美国的电商业务取得了成功,销售额增长了79%,使其成为美国第二大电商,但沃尔玛仍然远远落后于其老对手亚马逊(Amazon),而且今年仍将如此。

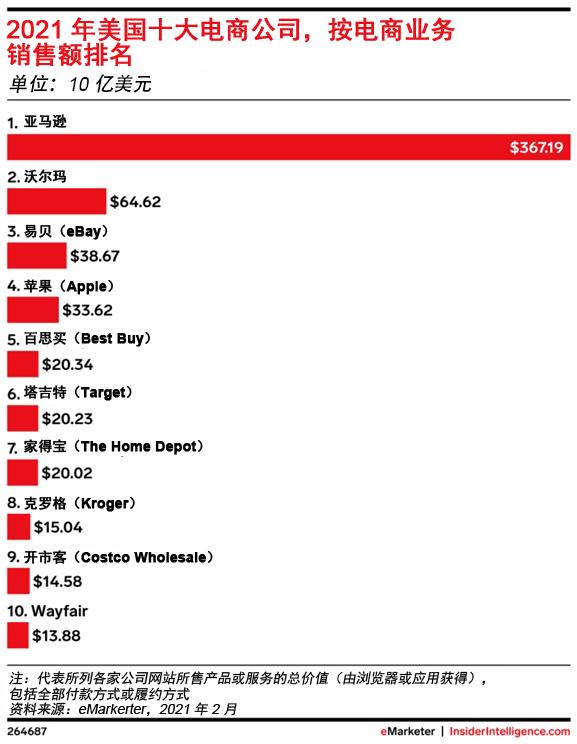

该研究公司预计,今年沃尔玛在美国的电商业务销售额将达到646亿美元,而亚马逊则是其六倍之多,达到3672亿美元。此外,eMarketer预计,尽管亚马逊已经拥有近40%的美国电商业务份额,但其将会赢得更多市场份额。

实际上,沃尔玛这些年也没有闲着,一直都在采取各种方式与亚马逊展开竞争。沃尔玛推出了一项杂货配送服务,沃尔玛在此电商领域明显比亚马逊有优势。此外,沃尔玛还推出了一项订阅服务Walmart+,对标亚马逊Prime服务。

“我们有绝对的市场先机,因为我们拥有庞大的门店网络。我们还拥有发展电商业务的一切条件。”沃尔玛的首席执行官董明伦(Doug McMillon)于今年2月向华尔街表示。

克罗格(Kroger)虽然规模庞大,但仍然未能进入美国十大电商之列,不过eMarketer预计这一情况今年会有所改变。2020年,克罗格在与科技公司Ocado的合作中获益匪浅,在Ocado的自动化和人工智能技术支撑下,其电商业务进行地非常顺利。

相比之下,一直位列前十的梅西百货(Macy's)去年跌出了榜单,而且不太可能重返榜单。梅西百货的电商业务实力一直十分强大,但此次疫情使其倒退了很远。

百思买(Best Buy)和家得宝(Home Depot)是此次疫情期间的两大零售赢家,预计其电商业务也将保持强劲增长。(财富中文网)

翻译:郝秀

审校:汪皓

2020年,沃尔玛(Walmart)大获成功,这主要源于该公司庞大的门店网络为其电商业务的蓬勃发展提供了强大的支撑,门店送货快,顾客从门店取货方便、快捷。

据eMarketer于3月29日发布的一项预测,尽管沃尔玛2020年在美国的电商业务取得了成功,销售额增长了79%,使其成为美国第二大电商,但沃尔玛仍然远远落后于其老对手亚马逊(Amazon),而且今年仍将如此。

该研究公司预计,今年沃尔玛在美国的电商业务销售额将达到646亿美元,而亚马逊则是其六倍之多,达到3672亿美元。此外,eMarketer预计,尽管亚马逊已经拥有近40%的美国电商业务份额,但其将会赢得更多市场份额。

实际上,沃尔玛这些年也没有闲着,一直都在采取各种方式与亚马逊展开竞争。沃尔玛推出了一项杂货配送服务,沃尔玛在此电商领域明显比亚马逊有优势。此外,沃尔玛还推出了一项订阅服务Walmart+,对标亚马逊Prime服务。

“我们有绝对的市场先机,因为我们拥有庞大的门店网络。我们还拥有发展电商业务的一切条件。”沃尔玛的首席执行官董明伦(Doug McMillon)于今年2月向华尔街表示。

尽管亚马逊日益占据主导地位,但在此次新冠疫情期间,一大批零售商飞速发展。例如,塔吉特(Target)去年的电商业务增长了一倍多,这得益于其广受欢迎的自有品牌和明显改善的杂货配送服务,对那些不愿意进店选购商品的人来说,配送服务是一个不错的选择。

克罗格(Kroger)虽然规模庞大,但仍然未能进入美国十大电商之列,不过eMarketer预计这一情况今年会有所改变。2020年,克罗格在与科技公司Ocado的合作中获益匪浅,在Ocado的自动化和人工智能技术支撑下,其电商业务进行地非常顺利。

相比之下,一直位列前十的梅西百货(Macy's)去年跌出了榜单,而且不太可能重返榜单。梅西百货的电商业务实力一直十分强大,但此次疫情使其倒退了很远。

百思买(Best Buy)和家得宝(Home Depot)是此次疫情期间的两大零售赢家,预计其电商业务也将保持强劲增长。(财富中文网)

翻译:郝秀

审校:汪皓

Walmart had a blockbuster 2020 in large part thanks to its booming e-commerce business buoyed by its large network of stores from where it could ship orders more quickly and from where customers could retrieve them faster.

Yet despite that success—Walmart's U.S. business saw e-commerce grow 79%, making it the No 2 online retailer in 2020—the big box store remains far behind its longtime rival, Amazon, and will continue to be so this year, according to a forecast released on March 29 by eMarketer.

The research firm expects Amazon to ring in sales of $367.2 billion this year, nearly six times more than the $64.6 billion it forecasts Walmart U.S. will rake in. What's more, eMarketer expects Amazon, which already generates almost 40% of all e-commerce stateside, to win more market share.

Walmart has hardly been idle in its battle with Amazon. It has launched an express delivery service for groceries, one area of e-commerce where it has a clear upper hand over Amazon, as well as Walmart+, a subscription service similar to Amazon Prime.

"We've got a unique opportunity because of our stores. We've got all of the things available to us related to eCommerce growth," Walmart CEO Doug McMillon told Wall Street in February.

Despite Amazon's growing dominance, a number of big box stores thriveD during the pandemic. Target, for one, saw e-commerce more than double last year, helped by its popular store brands and vastly improved grocery offering that curbside delivery for those wary of going into stores made easier to buy.

Kroger, despite its massive size, is still not a Top 10 U.S. e-retailer, but eMarketer thinks that changes this year. In 2020, Kroger benefited enormously from its partnership with tech firm Ocado, whose automation and artificial intelligence, make the grocer much better at filling online order.

In contrast, Macy's, long on the Top 10 list fell out of the list last year and isn't likely to return. The department store's e-commerce business is formidable but the pandemic set it back very far.

Best Buy and Home Depot, two of the pandemic's big retail winners, are also expected to have strong years online.