去年,正是在这一周,美国股市似乎得到了首个暗示:新冠疫情可能会带来重大影响。

当时股市并未出现自由落体式下跌,但各种麻烦却在去年的这一周接踵而至。LPL Financial的首席市场策略师莱恩•德特里克写道:“市场上有一句老话:‘股市上涨像爬楼梯,下跌像坐电梯。’它成为了接下来几周中股市的真实写照。”

在1月底之前,尽管有少数头条在报道中国的新冠疫情,但市场观察家依然认为新冠病毒不会对股市造成多大的影响。直到2月19日,一则新闻才真正引起了市场的关注:“中国将尽一切努力来缓冲新冠疫情的影响,而且会视情况采取刺激举措。”

两天后,也就是2月21日,展望突然发生了巨大变化。有报道称,日本、韩国和澳大利亚出现了大量的新冠病例。当天,高盛(Goldman Sachs)的皮特•奥本海默在一则纪要中向投资者发出警告,股市进行修正的“可能性更大了”。

到了第二周的周一,意大利的病例出现激增,美国则在缓慢上升,股市终于开始认真对待这件事情。《财富》杂志的高级编辑伯纳德•华纳写道:“所有的指标显示,就算这不是自新冠疫情最初于1月中旬爆发以来最差的交易时期,也算是最差之一了。与此挂钩的道琼斯指数和标普500指数(S&P 500)在开盘后便下跌了约2%。”

很快,股市的自由落体开始了。德特里克在其报告中写道,到当月月底,“标普500指数迎来了历史上最快的熊市(收盘时较此前的历史新高下滑了20%),而且仅用16天便完成了这一壮举。”

尽管当时在任的唐纳德•特朗普总统依然称新冠病毒对大多数美国人来说属于低风险事件,但市场已经处于高度警惕状态。2月28日,华纳称:“美元下跌,原油下跌,大宗商品再次暴跌。即便是黄金也出现了抛售现象。很明显,牛市正在消退。”

这还只是个开始。在市场暴跌期间,全球的经济学家担心情况会变得一发不可收拾,有一些人甚至预测会出现另一场经济大萧条。

Commonwealth Financial Network的资产组合负责人皮特•艾瑟拉说:“经济学家预测,全球会出现贸易暂停,大规模的封锁,而且认为这将是一个持续数月、数个季度,甚至可能是数年的梦魇。”

一年后,超过50万美国人死于新冠病毒,这个数字已经高于亚特兰大的人口数量。此外,美国暴力案件数量呈上升趋势,因为持续的阿片类药物危机而导致的过量服药案例出现了激增,创纪录的美国民众因为2020年失业率的飙升而失去了医疗保险。

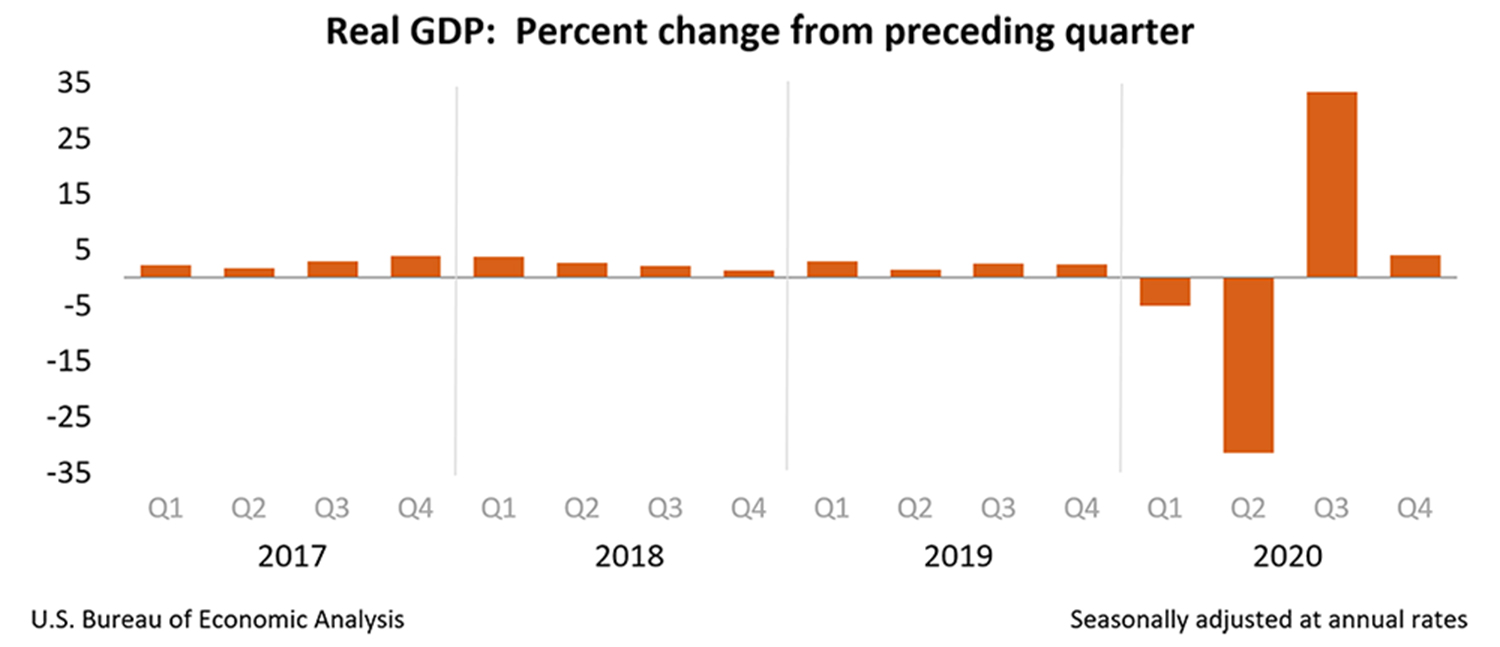

然而事实证明,有关经济最为悲观的预测并未实现。在经历了纷乱的上半年之后,美国实际GDP在2020年第三季度增长了33.4%。美国经济分析局(U.S. Bureau of Economic Analysis)的数字显示,这一增长延续到了第四季度,当时美国的实际GDP再次增长了4%。

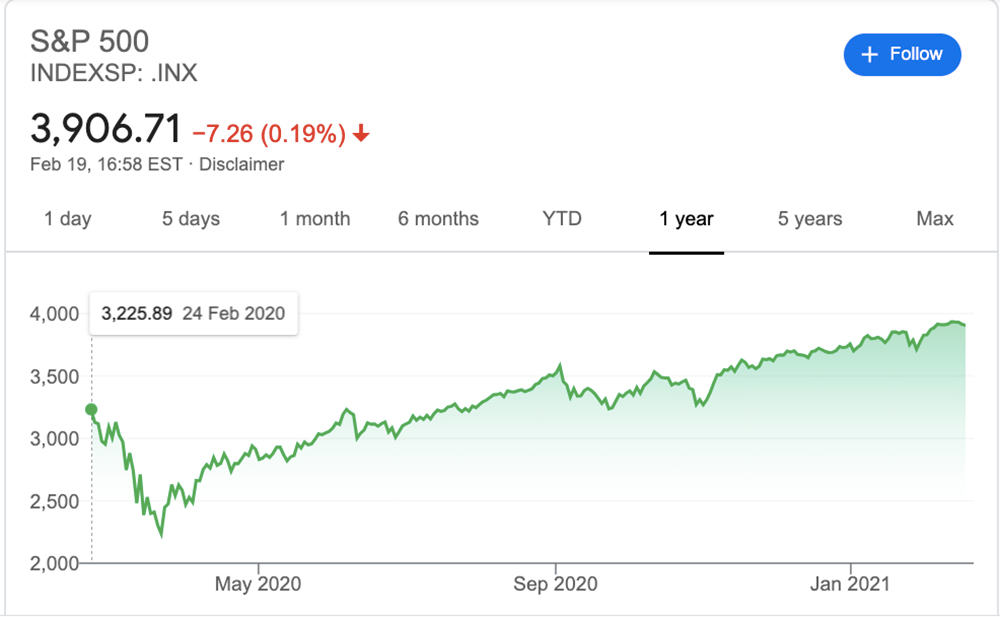

到了8月18日,标普500指数再创历史新高,而且自此之后一路高歌。

德特里克在报告中写道:“股市有着十分奇怪的机制。”

LPL Financial称,对日常生活回归常态化的预期已经开始决定股市的定价,不过,生活何时完全回归正常依然是个未知数。

德特里克写道:“相对于新冠疫情初期,全球经济环境一直在不断改善。尽管依然存在诸多弱点,但市场更担心的是经济今后的走向,而不是其当前的状况。”(财富中文网)

译者:冯丰

审校:夏林

去年,正是在这一周,美国股市似乎得到了首个暗示:新冠疫情可能会带来重大影响。

当时股市并未出现自由落体式下跌,但各种麻烦却在去年的这一周接踵而至。LPL Financial的首席市场策略师莱恩•德特里克写道:“市场上有一句老话:‘股市上涨像爬楼梯,下跌像坐电梯。’它成为了接下来几周中股市的真实写照。”

在1月底之前,尽管有少数头条在报道中国的新冠疫情,但市场观察家依然认为新冠病毒不会对股市造成多大的影响。直到2月19日,一则新闻才真正引起了市场的关注:“中国将尽一切努力来缓冲新冠疫情的影响,而且会视情况采取刺激举措。”

两天后,也就是2月21日,展望突然发生了巨大变化。有报道称,日本、韩国和澳大利亚出现了大量的新冠病例。当天,高盛(Goldman Sachs)的皮特•奥本海默在一则纪要中向投资者发出警告,股市进行修正的“可能性更大了”。

到了第二周的周一,意大利的病例出现激增,美国则在缓慢上升,股市终于开始认真对待这件事情。《财富》杂志的高级编辑伯纳德•华纳写道:“所有的指标显示,就算这不是自新冠疫情最初于1月中旬爆发以来最差的交易时期,也算是最差之一了。与此挂钩的道琼斯指数和标普500指数(S&P 500)在开盘后便下跌了约2%。”

很快,股市的自由落体开始了。德特里克在其报告中写道,到当月月底,“标普500指数迎来了历史上最快的熊市(收盘时较此前的历史新高下滑了20%),而且仅用16天便完成了这一壮举。”

尽管当时在任的唐纳德•特朗普总统依然称新冠病毒对大多数美国人来说属于低风险事件,但市场已经处于高度警惕状态。2月28日,华纳称:“美元下跌,原油下跌,大宗商品再次暴跌。即便是黄金也出现了抛售现象。很明显,牛市正在消退。”

这还只是个开始。在市场暴跌期间,全球的经济学家担心情况会变得一发不可收拾,有一些人甚至预测会出现另一场经济大萧条。

Commonwealth Financial Network的资产组合负责人皮特•艾瑟拉说:“经济学家预测,全球会出现贸易暂停,大规模的封锁,而且认为这将是一个持续数月、数个季度,甚至可能是数年的梦魇。”

一年后,超过50万美国人死于新冠病毒,这个数字已经高于亚特兰大的人口数量。此外,美国暴力案件数量呈上升趋势,因为持续的阿片类药物危机而导致的过量服药案例出现了激增,创纪录的美国民众因为2020年失业率的飙升而失去了医疗保险。

然而事实证明,有关经济最为悲观的预测并未实现。在经历了纷乱的上半年之后,美国实际GDP在2020年第三季度增长了33.4%。美国经济分析局(U.S. Bureau of Economic Analysis)的数字显示,这一增长延续到了第四季度,当时美国的实际GDP再次增长了4%。

到了8月18日,标普500指数再创历史新高,而且自此之后一路高歌。

德特里克在报告中写道:“股市有着十分奇怪的机制。”

标普500指数

LPL Financial称,对日常生活回归常态化的预期已经开始决定股市的定价,不过,生活何时完全回归正常依然是个未知数。

德特里克写道:“相对于新冠疫情初期,全球经济环境一直在不断改善。尽管依然存在诸多弱点,但市场更担心的是经济今后的走向,而不是其当前的状况。”(财富中文网)

译者:冯丰

审校:夏林

It was this week one year ago that the stock market seemed to get the first hint that COVID could be a thing.

It wasn’t a straight drop down, but this week one year ago marked the start of trouble. “The old market adage ‘Stairs up, elevator down’ certainly rang true over the coming weeks,” wrote Ryan Detrick, chief market strategist for LPL Financial, in a new report.

By the end of January, market-watchers were still guessing that the coronavirus would have little impact on the stock market despite a smattering of headlines about the virus spreading rampantly throughout China. As late as Feb. 19, markets were “climbing on the news that Beijing [would] likely do whatever it takes—injecting stimulus where needed—to cushion the coronavirus blow.”

Two days later, on Feb. 21, the outlook was suddenly far different. Coronavirus cases were reported in large numbers in Japan, South Korea, and Australia, signaling the end of any hope of containing the virus in China. That day, Goldman Sachs’s Peter Oppenheimer warned investors in a note that a stock market correction was “looking more probable.”

By the following Monday, cases were surging in Italy, slowly rising in the United States, and the market was finally beginning to take serious notice. As Fortune senior editor Bernhard Warner wrote in his daily Bull Sheet newsletter on Feb. 24: “All indicators are pointing to one of the worst—if not the worst—trading sessions since the coronavirus outbreak first emerged in mid-January, with the Dow and S&P 500 pegged to open down about 2%.”

Soon, the market was in free fall. By the end of the month, “the S&P 500 recorded the fastest bear market (closing 20% below a previous all-time high) in history, accomplishing that feat in a mere 16 days,” Detrick wrote in his report.

And while then-President Donald Trump was still describing the coronavirus as a low-risk affair for most Americans, markets were already on high alert. On Feb. 28, Warner’s Bull Sheet reported that “the dollar is down, crude is down, and commodities are slumping again. Even gold is selling off. The bulls clearly are in retreat.”

That was just the beginning. Amid the market plunge, economists around the world feared the worst, some even going so far as to predict another Great Depression.

“Economists were forecasting a global halt to trade, massive worldwide lockdowns, and were suggesting that it was going to be a multi-month, multi-quarter, and potentially even a multiyear nightmare scenario,” said Peter Essele, head of portfolio management for Commonwealth Financial Network.

A year later, more than 500,000 Americans have lost their lives to COVID-19, a number higher than the population of Atlanta. In addition, domestic violence numbers have risen, overdose numbers stemming from the ongoing opioid crisis are surging, and a record number of Americans were left without health insurance as unemployment soared in 2020.

But it turns out that the most dire predictions about the economy did not come to pass. After a tumultuous first half of the year, U.S. real GDP increased 33.4% in the third quarter of 2020. Those gains continued into the fourth quarter, when real GDP again rose by 4%, according to the U.S. Bureau of Economic Analysis.

And by Aug. 18, the S&P 500 set new all-time highs and hasn’t looked back since.

“The stock market is a peculiar mechanism,” Detrick wrote in the report.

The stock market has already priced in the normalization of daily life, even if the timeline for a complete return remains uncertain, according to LPL Financial.

“Economic conditions around the world have been improving relative to how they were at the beginning of the pandemic,” Detrick wrote. “While pockets of weakness remain, the market is more concerned with where the economic conditions will be, not where they are currently.”