作为美国第三大银行的CEO,查尔斯·沙夫对富国银行的潜力是抱有很大期望的。

他对这家银行的优势如数家珍。首先,这是一家服务数百万小企业的商业银行;其次,它的消费信贷平台发放的抵押贷款,超过了全美各大银行;另外,它的财富管理部门帮助不计其数的客户扩大了财富。

“它的核心竞争力,以及我们为消费者和企业所做的一切,都是非同一般的。”

他停顿了几秒,实事求是地补充道:“但我们也犯了不少错误。”

这一天是十月中旬,再过一天,沙夫执掌富国银行就满一周年了。他坐在纽约长岛家中一间木质装修的书房里,通过视频会议软件Zoom接受了我们的采访。

由于疫情关系,这一年的大部分时间里,沙夫都是在这里发号施令,试图完成扭转富国银行颓势的任务。

富国银行在美国金融界是个庞然大物,涉及多个业务领域,拥有26万余名员工和大约7000万名客户。眼下正是富国银行近170年历史中最动荡的时期,因为最近它曾多次被人“抓包”滥用客户的信任。

直到现在,富国银行仍在为这些错误付出代价,不仅公司名声受到了损失,还要承担巨额罚款和严厉的政策制裁。其中最沉重的一击,是美联储给它戴上了一顶1.95万亿美元的“资金帽”,即该银行的资本不得超过上述上限。

受疫情影响,美国所有银行都在超低利率中瑟瑟发抖,其他银行还通过可以大量增加放贷和吸收资本储备来“过冬”,但美联储给富国银行的“紧箍咒”却直接断绝了它的这种可能性。

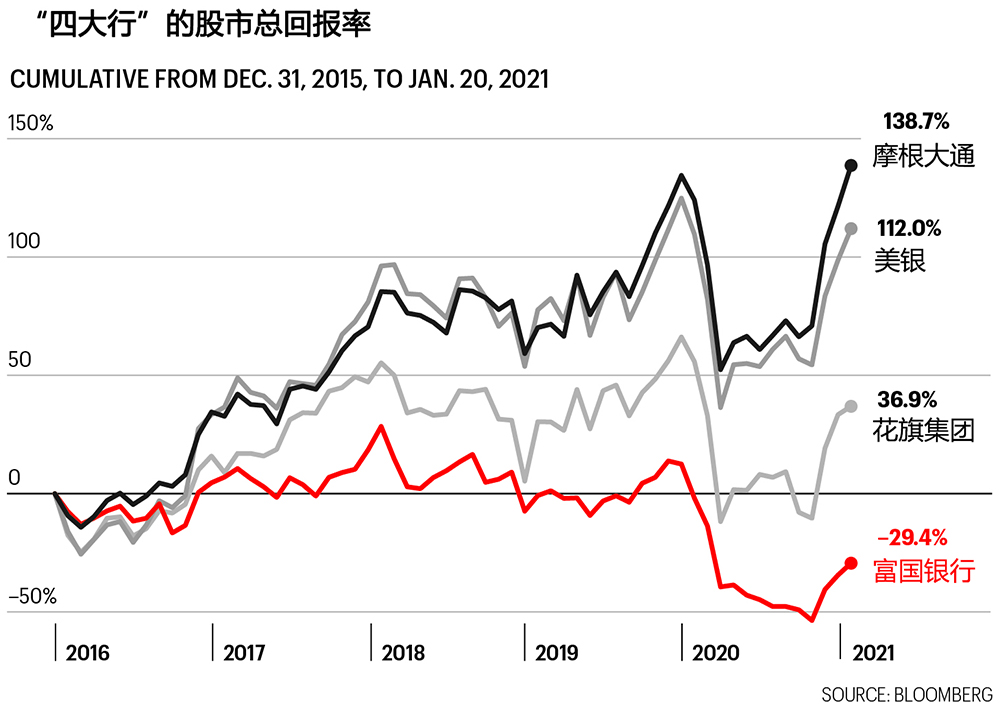

自2017年起,富国银行的收入一直在稳步下跌,在2020财年又下降了15%,只有723亿美元,利润也同步缩水了。而且自从爆出丑闻以来,它的股市表现一直不如其他大银行。去年更是暴跌44%。

加拿大皇家银行资本市场公司的美国银行业证券策略主管杰拉德•卡西迪指出:“这家公司已经千创百孔了,所有策略都必须拿到桌面上,好让它恢复到一个投资者可以接受的盈利水平。”

当现年55岁的沙夫接手时,这份工作直接将他推上了金融业的风口浪尖。

这已经是他第三次担任“财富500强”金融服务企业的CEO了,而且这份工作的报酬也是相当丰厚的。根据富国银行的股票激励政策,他每年有可能能赚到2300万美元。但富国银行的CEO,也是全美国最难干的CEO。富国银行是美国最大的借贷机构之一,它感冒了,美国的宏观经济都要打喷嚏。

沙夫一直以来的导师——摩根大通CEO杰米•戴蒙对《财富》表示,沙夫承担的任务“事关重大”,并表示“如果他们成功了,对全国乃至整个银行业都有好处。”

目前,沙夫正专心致志地在精简机构上下工夫——为了救命,只得先“缩水”、“瘦身”。

如果他成功了,他或许能将富国银行从监管的“紧箍咒”下解放出来,重现昔日荣光。如果他失败了,面对一众蓝筹股竞争对手的后来居上,富国银行可能将永远无法再现辉煌了。

在沙夫担任CEO大约15个月后,为了了解富国银行的改革情况,《财富》采访了沙夫和富国银行的高管,以及一些分析师、批评人士、行业竞争对手,还有沙夫以前的同事。

由于正逢多事之秋,富国又迎来了大规模的组织变革,加上一些重大失误,人们不禁怀疑,沙夫是否有能力推动一次彻底的企业文化变革。

巴克莱银行的高级证券研究分析师贾森•戈德堡表示: “让这么大的一艘船掉头需要很长时间,他正在学习。”

沙夫认为,富国银行还是有机会恢复原来的地位的。他表示:“我来的时候就很清楚,富国仍然有很好的发展机会,不过我们还有大量的工作要做。”

沙夫是在新泽西州的威斯菲德长大的,那里是纽约市的郊区。他父亲是一名股票经纪人,身边也都是金融专业人士。从13岁时开始,沙夫已经在曼哈顿的股票交易所里做一些后台工作了。

在约翰霍普金斯大学读本科时,他最初的目标是从事化学研究。不过读大二的时候,他突然顿悟了:“当时我在上物理化学课,我被关在一间实验室里,然后我对自己说:‘我不想一辈子待在一个连窗户都没有的地方。’”同时他意识到,在商业上,“你可以以一种完全不同的方式来创造事物。”

或许是命中注定,沙夫的一个亲戚恰好认识杰米•戴蒙的父亲,当时年轻的杰米·戴蒙还在巴尔的摩的商业信贷银行里当财务总监。1987年,戴蒙将刚毕业的沙夫招入公司,他俩的工作关系就此持续了20多年。而这家商业信贷银行就是花旗集团的前身。

在杰米·戴蒙和桑迪•威尔领导下,沙夫在商业信贷银行发展成为花旗集团的过程中发挥了一系列作用。2000年,戴蒙担任了美国第一银行的首席执行官,并任命沙夫为第一银行首席财务官。2004年,美国第一银行与摩根大通合并后,沙夫又接手了摩根大通规模庞大的零售银行业务。

戴蒙回忆道,沙夫能够“处理我甩给他的任何任务”。

他说:“他能把事情做好,而且他的商业嗅觉也很灵敏。”随着职务越来越高,沙发的领导才能也愈发出众。

他还发现,随着戴蒙领导的公司规模越来越大,戴蒙的工作风格也在发生变化。他说:“他总是挺身而出,而不是躲在别人后面。当某件事出错时,他总是亲自处理。”

2012年,沙夫被Visa聘为首席执行官,他的这些经验终于有了用武之地。

当时,Visa还处于从一家发卡银行协会所属的私人企业向一家上市公司的艰难转型中。到了Visa的旧金山总部后,沙夫发现,这竟然还是一家“与世隔绝”的企业,尚未“真正融入科技界”。

为了纠正这种情况,他与PayPal和Stripe等金融科技公司建立了合作关系,扩展了Visa在数字支付领域的存在。事实证明,他的这一招是很有远见的。

现任Visa总裁瑞安•麦金纳尼也是从摩根大通出来的,当年跟着沙夫一起去了Visa。他表示:“当时他做的很多基础性工作,特别是跟电商有关的部分,现在我们都看到了成果。”

为了离东海岸的家人近一些,2016年,沙夫离开了Visa。在他任内,Visa的股价上涨了一倍多。

在Visa的经历,以及随后在纽约梅隆银行担任CEO的经历,让他明白了一个CEO的职责有多庞杂。沙夫感言:“没有任何一个工作可以与之相比。整个企业的成败都系于你一人,要指望你来定调子、培养企业文化……有些人喜欢这项工作,也有些人不喜欢。”而沙夫属于第一类。

就在他离开Visa的时候,另一家总部位于旧金山的金融机构,却爆出了一桩大丑闻。

关于富国银行的虚假账户欺诈案,有很多细节都是有据可查的。

在极端扭曲的销售文化驱动下,富国银行员工未经客户同意,便为几百万个客户开立了账户,并向他们销售金融产品,这在当时已经成了整个公司的普遍现象。在房贷、车贷和财富管理业务上,也出现了类似的欺诈行为。

这种风气最终带来了毁灭性的结果。

从2016年到2018年,联邦监管机构连发五道命令,曝光了富国银行的管理乱象,同时对其施加了包括“资金帽”在内的制裁。

监管部门也没有放过富国银行高层的领导责任。2016年下台的前任CEO约翰·斯坦普被处以1750万美元罚款,并勒令其终身不得再从事银行业。他的继任者蒂姆·斯隆在2019年3月迫于政治压力辞职。

美国众议院金融服务委员会在去年一份报告中猛烈抨击了富国银行的董事会和管理层——丑闻都已经曝光好几年了,你们怎么还没有解决公司的问题?

在欺诈丑闻之前,富国银行算是少数几家名声还算不错,而且全须全尾地挺过了2008年金融危机的美国银行之一。一个个竞争对手都被金融危机打得灰头土脸,富国银行却变得更加强大,还在金融危机期间以150亿美元收购了美联银行。

但现在它已经成了银行业的众矢之的。

在富国银行奉献了15年的老将琼恩•威斯表示:“那时我们在忙增长,而其他银行都专注于如何更好地经营。在某种程度上,我们是自身成功的受害者,也许我们当时就应该多反省一下。”

2019年春天,富国银行董事会开始寻找一位能够真正发现问题并解决问题的CEO。在斯隆下台6个月后,沙夫得到了这份工作。

他上任不久即表示,解决当前面临的监管问题,“显然是首要任务”。

在新CEO的领导下,富国银行的运营委员会召开了第一次会议,头头脑脑们聚集在圣路易斯的一间没有窗户的会议室里,讨论如何扭转当前的不利局面。

威斯回忆道:“沙夫带来了一个便笺本,而不是那种四五十页图文并茂的PPT,本子上做了大概一页半的笔记,他一行一行地讲解了他做生意的重点,这是一次让人放下戒备、较为随意但又非常专注的讨论,没有任何废话。”

实事求是和“不搞形式主义”,是很多人对沙夫的印象。他的直率就像他的满头白发一样引人注目。但对一位需要经常传达坏消息并处理棘手事的CEO来说,坦率也是一笔重要的资产。

沙夫发现,富国银行最大的问题,是组织结构异常松散,缺乏明确的权责界限,否则像账户欺诈这样的现象是可以避免的。另外,富国银行还缺乏大多数银行已经建立的风险和合规保障机制。

玛丽•麦克已经在富国银行工作了26年,目前负责消费者和小企业银行业务。她表示:“当时,我们的内部组织结构确实较为封闭,各部门的业务较为独立。其实我们应该退一步审视一下,问问自己:‘那种情况,或者说那些弱点,是不是真的在整个公司都存在?’但我们在这方面做得并不好。”

沙夫开始了大刀阔斧的改革,首先从高层人事变动开始。

目前沙夫的高管团队一共有17人,其中9人都是新聘用的。去年以前,富国银行还没有首席运营官这个职位。沙夫设立了这个岗位,并且请来了他花旗集团和摩根大通的老同事斯科特•鲍威尔来担任首席运营官。在此之前,鲍威尔曾担任桑坦德银行美国业务的CEO,任内帮助桑坦德银行妥善应对了监管部门的制裁。

其他几位新人也多半是沙夫的老同事,CFO迈克•桑托马西莫原本是纽约梅隆银行的CFO;消费贷款部门和财富管理部门的负责人迈克•魏巴赫和巴里•索莫斯,也都是沙夫在摩根大通的老相熟。

2020年2月,沙夫公布了一项重组计划,将公司业务划分为五个不同的部门。另外,他还重组了富国银行的风险管理体系,这五个部门现在都有独立的风控官,通过这样的制度设计,来确保没有任何一个部门敢搞小动作。

这样一来,富国银行在制度设计上吸取了其他银行的最佳做法,使沙夫收获了不少分析师的赞扬。但后来发生的事表明,富国仍有大量工作要做。

去年2月,就在富国银行的重组计划公布的几天后,美国司法部宣布,富国银行将支付30亿美元罚款,以达成丑闻相关指控的刑事调解。当时人们普遍认为,这将是富国银行的最后一笔大额罚款,不过这也说明了丑闻对公司利润的影响有多深。

另一件事也能说明丑闻给公司成本带来了多大压力:2020年,富国银行在“专业服务/外部服务”上耗费了67亿美元,超过了年度总收入的9%。这笔费用的大头,无非是花在了官司善后的法务和咨询费上。

正所谓祸不单行,疫情一来,富国银行只得将日常应急工作放在长期改革前面。

沙夫连公司的人都没完全认熟,就只得坐困长岛一隅,开始居家办公。疫情期间,最重要的是让几千家分支机构继续开门营业。

即便是在封城期间,“每天也有100万左右的顾客进入我们的分支机构。”玛丽•麦克说。但要保证顾客的安全,并且让非分支机构的员工转入远程办公,这给公司的后勤工作提出了难题。

疫情期间,富国银行又爆出了一个小丑闻,说明富国银行的“整风之路”依然任重道远。

去年,美国政府出台了一些政策,以帮助那些因失去收入而无法偿还抵押贷款的人。但有1600多名借款人投诉称,富国银行在没有征得他们同意的情况下,给他们办理了暂缓还款,而这种行为很有可能损害借款人的信用评级,影响他们的再次贷款能力。

在谈到这次混乱时,沙夫表示,富国已经努力纠正了这个错误。“在非常艰难的时期里,我们在试图帮助客户的时候犯了错。每个金融机构都会犯错。”

富国银行还被卷进了人才多元化这种高度敏感的问题。

去年6月,他在一份备忘录里,对银行高层职位的人才储备深度提出了质疑。他在备忘录中写道:“不幸的现实是,有这种特殊经验的黑人人才非常有限,”这也是一年来,对他个人声誉威胁最严重的一件事了。

因为就在沙夫进行此番表述的几周前,美国发生了黑人男子乔治·弗洛伊德被“跪杀”事件,结构性的种族歧视成为全美上下高度关注的尖锐问题。沙夫的言论在此时显得异常刺耳,不仅令许多员工感到不满,也引发了外部人士的广泛批评。

他们强调,沙夫的很多左膀右臂都是他的老同事,而且是清一色的白人男性。虽然高管层里也有一名女性和两名黑人男性,但都处于边缘职位,而COO、CFO等关键岗位仍然是清一色的白人男性。

美国金融劳工组织改进银行委员会的尼克·韦纳认为:“我们看到的是,他用另一个孤立的团体,取代了一个孤立的团体。”

沙夫很快就为他的“黑人人才有限”言论道了歉,并表示,有关言论反映出“我自己无意识的偏见”。从那以后,富国银行建立了一个专门负责多元化、代表性和包容性的部门。

其负责人克莱贝尔·桑托斯是去年11月刚从第一资本银行跳槽来的,现在他也在高管委员会有了一席之地。几个月后,沙夫对这次“祸从口出”的事件开展了严肃的自我批评,并表示未来五年,要将公司高管队伍中的黑人比例增加一倍,而且公司计划将把部分高管的薪水与本部门员工队伍的多元化程度挂钩。

他似乎也敏锐地意识到,多年以来,他喜欢从外部请来神秘“强援”的做法,只会进一步固化晋升渠道的不公。他表示:“看看这家公司的内部代表性——而且大多数金融机构都是这个样子,你就会发现,我们非常有必要采取不同的做法。”

乍一看,1月15日对富国银行来说,只不过又是一个普通到沉闷的日子。

这一天,富国银行2020年四季度的财报,其营收低于分析师的预期,导致当天股价下跌了近8%。然而由此带来的沮丧情绪却掩盖了一个事实——富国银行已经披露了关于未来发展的大量细节——在精简机构的同时,它已经在一些强项领域上加倍下注了。

沙夫的团队总结了一年来的改革举措,并且公布了一些其他措施,比如公布了一系列资产出售计划,这些计划将把富国银行从“非核心”的业务中剥离出来。

首先是富国银行的100亿美元学生贷款项目和加拿大的设备融资业务。同时,富国银行还在考虑剥离其资产管理部门,该部门目前管理着逾6000亿美元的机构客户资产。

沙夫在财报电话会议上表示:“我们将要退出的都是非常好的业务。但问题是,它们是不是最适合放在富国银行内部?”

在沙夫看来,住房贷款业务是要保留的,这是富国银行的“生命线”,也是它主宰了几十年的大市场。此外还要保留消费银行、个人理财和投资银行业务——富国银行相信,投行业务可以成为它的一个增长点。

为了保持利润,富国银行还将继续“刀刃向内”。

目前,富国已经确定了80多亿美元的长期节支目标。裁员当然也是必不可少的:去年第四季度,富国银行裁掉了6400人,预计今年还会有更多裁员。富国银行还计划大幅削减办公用房开支,预计总办公面积将缩减20%。

同时,富国银行也在对分支网络进行“瘦身”。富国在2020年底拥有大约5000家分支机构,已经少于2009年的6600家,它还计划今年再关闭250家。

尽管改革计划雄心勃勃,但它对公司整体增长的提振依然有限——除非它能让监管机构满意,觉得它的改革已经全面完成了。富国银行及有关监管机构以“法律限制”为由,拒绝了就取消“奖金帽”的时间表一事发表评论。

沙夫对《财富》杂志表示:“我理解大家的想法,大家想听到的是,当我们最终跨过这些事情时,公司会变成什么样子。”但除非富国的风控机制让监管机构满意,否则要想真正“跨过”这些事,只怕还得再等等 。

大概20年前,也就是沙夫还在芝加哥担任第一银行CFO的时候,他学起了吉他。在疫情“封城”期间,他重新联系上了他的吉他老师,现在他每周都在通过Zoom上网课,练习蓝调和摇滚。

“这东西很有创意,”他兴奋地说:“你可以把它拿起来,并且用它创造一些东西,而且还和别人创造的东西不一样,这在我看来非同寻常。”

就像弹吉他一样,沙夫在富国银行也试图弹出一些新的、和谐的东西。但要将富国银行这把“吉他”的弦调好,他还需要更多的时间。

打小井,打深井

为了在当下的困境中生存下来,并且让股东满意,富国启动了“精兵简政”计划。

由于监管制裁限制了公司的增长能力,富国银行选择了剥离“非核心”部门,专注于最有前途的业务。CEO沙夫希望以下几个部门能在形势好转后再次蓬勃发展。

消费者和小企业银行借贷

2020年收入:340亿美元

负责人:玛丽·麦克、迈克尔·韦因巴赫

富国银行是美国最大的住房抵押贷款机构之一,该部门也是目前为止富国最大的业务板块。最近的低利率已经影响了该部门的收入。不过富国银行还有4000多亿美元的消费贷款规模,以及强劲的车贷和信用卡业务。这些业务有更高的利率,而且应该会随着经济复苏而复苏。

理财和投资管理

2020年收入:145亿美元

负责人:巴里·萨默斯

截止到2020年底,富国银行一共管理着2万亿美元资产——虽然它计划出售6000亿美元的机构资产管理业务,以便更好地专注于个人理财业务。

富国银行的财富管理团队历来不仅服务有钱人,也服务“大众富裕阶层”和中产阶级客户。沙夫很看好该部门与消费贷款部门的协同效应:“大量进入我们的分支机构的客户,都是有钱投资的。”他说。

企业和投资银行

2020年收入:138亿美元

负责人:琼恩·威斯

该部门包括1100亿美元的商业地产板块和大量的“C&I”贷款(即企业购置机械设备的贷款)。总体上看,富国银行的商业贷和消费贷差不多各占50%。虽然在企业和投资银行领域,富国银行的名声不算显赫,但根据Dealogic的数据,它仍然是美国的第九大投行。沙夫的团队认为,富国银行有望在这一领域赢得市场份额。

银行还能迎来好日子吗?

受疫情影响,银行业的复苏速度十分缓慢,而且前路依然坎坷曲折。

2020年,包括银行在内的金融机构的日子是很煎熬的,只不过这一点在一片大好的股市里没有反映出来。(去年美股大盘增长了16%,而标普500指数的金融板块却下跌了4%。)

受疫情影响,美国各大金融机构都忙着想方设法支持他们的商贷和消费贷客户,从而严重影响了他们从利差中获得的收益。

虽然目前情况貌似有所好转,但2021年的路,似乎也注定不会平坦。

复苏缓慢且不均衡

美国银行业的一些关键指标一直比较强劲,比如抵押贷款需求和存款的增长等。股票牛市也带动了交易收入,另外更多的经济刺激也有可能出台。但高失业率和小企业的经营困境,仍然注定了经济大环境在疫情缓解前不会根本好转。在短期内,大银行会更加强调盈利能力。而到目前为止,理财和投行业务相对来说对疫情还比较免疫。

利率触底

为了应对疫情对经济的影响,美联储将利率回归到了接近于零的水平,并暗示接下来几年都会如此。这就给银行向客户收取的利率设定了上限,并且导致了“净息收入”的降低,而这恰恰是决定银行收入的一个关键因素。(也就是银行贷款收息和存款利息之间的差额。) 预计短期内,银行将增加贷款规模,尤其是在抵押贷款领域,以弥补息差损失。

新政府的导向

银行领导们大概不会怀念特朗普政府的朝令夕改和不可预测性,但他们或许会怀念特朗普的一些政策。

拜登有可能会改变特朗普对华尔街的“去监管化”政策,并且取消对企业和高净值个人的一些减税。希望未来银行能与监管机构合作,为金融科技(比如加密货币和数字支付)和资本市场(比如直接上市和SPACs,即特殊目的收购)的新发展制定一些基本规则。(财富中文网)

本文原载于2021年二三月刊的《财富》杂志。

译者:朴成奎

富国银行CEO查尔斯·沙夫,照片拍摄于美国棕榈滩的富国银行办公室。面对联邦政府的处罚,富国银行可用的招数已经不多了。摄影:Erika Larsen

作为美国第三大银行的CEO,查尔斯·沙夫对富国银行的潜力是抱有很大期望的。

他对这家银行的优势如数家珍。首先,这是一家服务数百万小企业的商业银行;其次,它的消费信贷平台发放的抵押贷款,超过了全美各大银行;另外,它的财富管理部门帮助不计其数的客户扩大了财富。

“它的核心竞争力,以及我们为消费者和企业所做的一切,都是非同一般的。”

他停顿了几秒,实事求是地补充道:“但我们也犯了不少错误。”

这一天是十月中旬,再过一天,沙夫执掌富国银行就满一周年了。他坐在纽约长岛家中一间木质装修的书房里,通过视频会议软件Zoom接受了我们的采访。

由于疫情关系,这一年的大部分时间里,沙夫都是在这里发号施令,试图完成扭转富国银行颓势的任务。

富国银行在美国金融界是个庞然大物,涉及多个业务领域,拥有26万余名员工和大约7000万名客户。眼下正是富国银行近170年历史中最动荡的时期,因为最近它曾多次被人“抓包”滥用客户的信任。

直到现在,富国银行仍在为这些错误付出代价,不仅公司名声受到了损失,还要承担巨额罚款和严厉的政策制裁。其中最沉重的一击,是美联储给它戴上了一顶1.95万亿美元的“资金帽”,即该银行的资本不得超过上述上限。

受疫情影响,美国所有银行都在超低利率中瑟瑟发抖,其他银行还通过可以大量增加放贷和吸收资本储备来“过冬”,但美联储给富国银行的“紧箍咒”却直接断绝了它的这种可能性。

自2017年起,富国银行的收入一直在稳步下跌,在2020财年又下降了15%,只有723亿美元,利润也同步缩水了。而且自从爆出丑闻以来,它的股市表现一直不如其他大银行。去年更是暴跌44%。

加拿大皇家银行资本市场公司的美国银行业证券策略主管杰拉德•卡西迪指出:“这家公司已经千创百孔了,所有策略都必须拿到桌面上,好让它恢复到一个投资者可以接受的盈利水平。”

当现年55岁的沙夫接手时,这份工作直接将他推上了金融业的风口浪尖。

这已经是他第三次担任“财富500强”金融服务企业的CEO了,而且这份工作的报酬也是相当丰厚的。根据富国银行的股票激励政策,他每年有可能能赚到2300万美元。但富国银行的CEO,也是全美国最难干的CEO。富国银行是美国最大的借贷机构之一,它感冒了,美国的宏观经济都要打喷嚏。

沙夫一直以来的导师——摩根大通CEO杰米•戴蒙对《财富》表示,沙夫承担的任务“事关重大”,并表示“如果他们成功了,对全国乃至整个银行业都有好处。”

目前,沙夫正专心致志地在精简机构上下工夫——为了救命,只得先“缩水”、“瘦身”。

如果他成功了,他或许能将富国银行从监管的“紧箍咒”下解放出来,重现昔日荣光。如果他失败了,面对一众蓝筹股竞争对手的后来居上,富国银行可能将永远无法再现辉煌了。

在沙夫担任CEO大约15个月后,为了了解富国银行的改革情况,《财富》采访了沙夫和富国银行的高管,以及一些分析师、批评人士、行业竞争对手,还有沙夫以前的同事。

由于正逢多事之秋,富国又迎来了大规模的组织变革,加上一些重大失误,人们不禁怀疑,沙夫是否有能力推动一次彻底的企业文化变革。

巴克莱银行的高级证券研究分析师贾森•戈德堡表示: “让这么大的一艘船掉头需要很长时间,他正在学习。”

沙夫认为,富国银行还是有机会恢复原来的地位的。他表示:“我来的时候就很清楚,富国仍然有很好的发展机会,不过我们还有大量的工作要做。”

沙夫是在新泽西州的威斯菲德长大的,那里是纽约市的郊区。他父亲是一名股票经纪人,身边也都是金融专业人士。从13岁时开始,沙夫已经在曼哈顿的股票交易所里做一些后台工作了。

在约翰霍普金斯大学读本科时,他最初的目标是从事化学研究。不过读大二的时候,他突然顿悟了:“当时我在上物理化学课,我被关在一间实验室里,然后我对自己说:‘我不想一辈子待在一个连窗户都没有的地方。’”同时他意识到,在商业上,“你可以以一种完全不同的方式来创造事物。”

或许是命中注定,沙夫的一个亲戚恰好认识杰米•戴蒙的父亲,当时年轻的杰米·戴蒙还在巴尔的摩的商业信贷银行里当财务总监。1987年,戴蒙将刚毕业的沙夫招入公司,他俩的工作关系就此持续了20多年。而这家商业信贷银行就是花旗集团的前身。

在杰米·戴蒙和桑迪•威尔领导下,沙夫在商业信贷银行发展成为花旗集团的过程中发挥了一系列作用。2000年,戴蒙担任了美国第一银行的首席执行官,并任命沙夫为第一银行首席财务官。2004年,美国第一银行与摩根大通合并后,沙夫又接手了摩根大通规模庞大的零售银行业务。

戴蒙回忆道,沙夫能够“处理我甩给他的任何任务”。

他说:“他能把事情做好,而且他的商业嗅觉也很灵敏。”随着职务越来越高,沙发的领导才能也愈发出众。

他还发现,随着戴蒙领导的公司规模越来越大,戴蒙的工作风格也在发生变化。他说:“他总是挺身而出,而不是躲在别人后面。当某件事出错时,他总是亲自处理。”

2012年,沙夫被Visa聘为首席执行官,他的这些经验终于有了用武之地。

当时,Visa还处于从一家发卡银行协会所属的私人企业向一家上市公司的艰难转型中。到了Visa的旧金山总部后,沙夫发现,这竟然还是一家“与世隔绝”的企业,尚未“真正融入科技界”。

为了纠正这种情况,他与PayPal和Stripe等金融科技公司建立了合作关系,扩展了Visa在数字支付领域的存在。事实证明,他的这一招是很有远见的。

现任Visa总裁瑞安•麦金纳尼也是从摩根大通出来的,当年跟着沙夫一起去了Visa。他表示:“当时他做的很多基础性工作,特别是跟电商有关的部分,现在我们都看到了成果。”

为了离东海岸的家人近一些,2016年,沙夫离开了Visa。在他任内,Visa的股价上涨了一倍多。

在Visa的经历,以及随后在纽约梅隆银行担任CEO的经历,让他明白了一个CEO的职责有多庞杂。沙夫感言:“没有任何一个工作可以与之相比。整个企业的成败都系于你一人,要指望你来定调子、培养企业文化……有些人喜欢这项工作,也有些人不喜欢。”而沙夫属于第一类。

就在他离开Visa的时候,另一家总部位于旧金山的金融机构,却爆出了一桩大丑闻。

关于富国银行的虚假账户欺诈案,有很多细节都是有据可查的。

在极端扭曲的销售文化驱动下,富国银行员工未经客户同意,便为几百万个客户开立了账户,并向他们销售金融产品,这在当时已经成了整个公司的普遍现象。在房贷、车贷和财富管理业务上,也出现了类似的欺诈行为。

这种风气最终带来了毁灭性的结果。

从2016年到2018年,联邦监管机构连发五道命令,曝光了富国银行的管理乱象,同时对其施加了包括“资金帽”在内的制裁。

监管部门也没有放过富国银行高层的领导责任。2016年下台的前任CEO约翰·斯坦普被处以1750万美元罚款,并勒令其终身不得再从事银行业。他的继任者蒂姆·斯隆在2019年3月迫于政治压力辞职。

美国众议院金融服务委员会在去年一份报告中猛烈抨击了富国银行的董事会和管理层——丑闻都已经曝光好几年了,你们怎么还没有解决公司的问题?

在欺诈丑闻之前,富国银行算是少数几家名声还算不错,而且全须全尾地挺过了2008年金融危机的美国银行之一。一个个竞争对手都被金融危机打得灰头土脸,富国银行却变得更加强大,还在金融危机期间以150亿美元收购了美联银行。

但现在它已经成了银行业的众矢之的。

在富国银行奉献了15年的老将琼恩•威斯表示:“那时我们在忙增长,而其他银行都专注于如何更好地经营。在某种程度上,我们是自身成功的受害者,也许我们当时就应该多反省一下。”

2019年春天,富国银行董事会开始寻找一位能够真正发现问题并解决问题的CEO。在斯隆下台6个月后,沙夫得到了这份工作。

他上任不久即表示,解决当前面临的监管问题,“显然是首要任务”。

在新CEO的领导下,富国银行的运营委员会召开了第一次会议,头头脑脑们聚集在圣路易斯的一间没有窗户的会议室里,讨论如何扭转当前的不利局面。

威斯回忆道:“沙夫带来了一个便笺本,而不是那种四五十页图文并茂的PPT,本子上做了大概一页半的笔记,他一行一行地讲解了他做生意的重点,这是一次让人放下戒备、较为随意但又非常专注的讨论,没有任何废话。”

实事求是和“不搞形式主义”,是很多人对沙夫的印象。他的直率就像他的满头白发一样引人注目。但对一位需要经常传达坏消息并处理棘手事的CEO来说,坦率也是一笔重要的资产。

沙夫发现,富国银行最大的问题,是组织结构异常松散,缺乏明确的权责界限,否则像账户欺诈这样的现象是可以避免的。另外,富国银行还缺乏大多数银行已经建立的风险和合规保障机制。

玛丽•麦克已经在富国银行工作了26年,目前负责消费者和小企业银行业务。她表示:“当时,我们的内部组织结构确实较为封闭,各部门的业务较为独立。其实我们应该退一步审视一下,问问自己:‘那种情况,或者说那些弱点,是不是真的在整个公司都存在?’但我们在这方面做得并不好。”

沙夫开始了大刀阔斧的改革,首先从高层人事变动开始。

目前沙夫的高管团队一共有17人,其中9人都是新聘用的。去年以前,富国银行还没有首席运营官这个职位。沙夫设立了这个岗位,并且请来了他花旗集团和摩根大通的老同事斯科特•鲍威尔来担任首席运营官。在此之前,鲍威尔曾担任桑坦德银行美国业务的CEO,任内帮助桑坦德银行妥善应对了监管部门的制裁。

其他几位新人也多半是沙夫的老同事,CFO迈克•桑托马西莫原本是纽约梅隆银行的CFO;消费贷款部门和财富管理部门的负责人迈克•魏巴赫和巴里•索莫斯,也都是沙夫在摩根大通的老相熟。

2020年2月,沙夫公布了一项重组计划,将公司业务划分为五个不同的部门。另外,他还重组了富国银行的风险管理体系,这五个部门现在都有独立的风控官,通过这样的制度设计,来确保没有任何一个部门敢搞小动作。

这样一来,富国银行在制度设计上吸取了其他银行的最佳做法,使沙夫收获了不少分析师的赞扬。但后来发生的事表明,富国仍有大量工作要做。

去年2月,就在富国银行的重组计划公布的几天后,美国司法部宣布,富国银行将支付30亿美元罚款,以达成丑闻相关指控的刑事调解。当时人们普遍认为,这将是富国银行的最后一笔大额罚款,不过这也说明了丑闻对公司利润的影响有多深。

另一件事也能说明丑闻给公司成本带来了多大压力:2020年,富国银行在“专业服务/外部服务”上耗费了67亿美元,超过了年度总收入的9%。这笔费用的大头,无非是花在了官司善后的法务和咨询费上。

正所谓祸不单行,疫情一来,富国银行只得将日常应急工作放在长期改革前面。

沙夫连公司的人都没完全认熟,就只得坐困长岛一隅,开始居家办公。疫情期间,最重要的是让几千家分支机构继续开门营业。

即便是在封城期间,“每天也有100万左右的顾客进入我们的分支机构。”玛丽•麦克说。但要保证顾客的安全,并且让非分支机构的员工转入远程办公,这给公司的后勤工作提出了难题。

疫情期间,富国银行又爆出了一个小丑闻,说明富国银行的“整风之路”依然任重道远。

去年,美国政府出台了一些政策,以帮助那些因失去收入而无法偿还抵押贷款的人。但有1600多名借款人投诉称,富国银行在没有征得他们同意的情况下,给他们办理了暂缓还款,而这种行为很有可能损害借款人的信用评级,影响他们的再次贷款能力。

在谈到这次混乱时,沙夫表示,富国已经努力纠正了这个错误。“在非常艰难的时期里,我们在试图帮助客户的时候犯了错。每个金融机构都会犯错。”

富国银行还被卷进了人才多元化这种高度敏感的问题。

去年6月,他在一份备忘录里,对银行高层职位的人才储备深度提出了质疑。他在备忘录中写道:“不幸的现实是,有这种特殊经验的黑人人才非常有限,”这也是一年来,对他个人声誉威胁最严重的一件事了。

因为就在沙夫进行此番表述的几周前,美国发生了黑人男子乔治·弗洛伊德被“跪杀”事件,结构性的种族歧视成为全美上下高度关注的尖锐问题。沙夫的言论在此时显得异常刺耳,不仅令许多员工感到不满,也引发了外部人士的广泛批评。

他们强调,沙夫的很多左膀右臂都是他的老同事,而且是清一色的白人男性。虽然高管层里也有一名女性和两名黑人男性,但都处于边缘职位,而COO、CFO等关键岗位仍然是清一色的白人男性。

美国金融劳工组织改进银行委员会的尼克·韦纳认为:“我们看到的是,他用另一个孤立的团体,取代了一个孤立的团体。”

沙夫很快就为他的“黑人人才有限”言论道了歉,并表示,有关言论反映出“我自己无意识的偏见”。从那以后,富国银行建立了一个专门负责多元化、代表性和包容性的部门。

其负责人克莱贝尔·桑托斯是去年11月刚从第一资本银行跳槽来的,现在他也在高管委员会有了一席之地。几个月后,沙夫对这次“祸从口出”的事件开展了严肃的自我批评,并表示未来五年,要将公司高管队伍中的黑人比例增加一倍,而且公司计划将把部分高管的薪水与本部门员工队伍的多元化程度挂钩。

他似乎也敏锐地意识到,多年以来,他喜欢从外部请来神秘“强援”的做法,只会进一步固化晋升渠道的不公。他表示:“看看这家公司的内部代表性——而且大多数金融机构都是这个样子,你就会发现,我们非常有必要采取不同的做法。”

乍一看,1月15日对富国银行来说,只不过又是一个普通到沉闷的日子。

这一天,富国银行2020年四季度的财报,其营收低于分析师的预期,导致当天股价下跌了近8%。然而由此带来的沮丧情绪却掩盖了一个事实——富国银行已经披露了关于未来发展的大量细节——在精简机构的同时,它已经在一些强项领域上加倍下注了。

沙夫的团队总结了一年来的改革举措,并且公布了一些其他措施,比如公布了一系列资产出售计划,这些计划将把富国银行从“非核心”的业务中剥离出来。

首先是富国银行的100亿美元学生贷款项目和加拿大的设备融资业务。同时,富国银行还在考虑剥离其资产管理部门,该部门目前管理着逾6000亿美元的机构客户资产。

沙夫在财报电话会议上表示:“我们将要退出的都是非常好的业务。但问题是,它们是不是最适合放在富国银行内部?”

在沙夫看来,住房贷款业务是要保留的,这是富国银行的“生命线”,也是它主宰了几十年的大市场。此外还要保留消费银行、个人理财和投资银行业务——富国银行相信,投行业务可以成为它的一个增长点。

为了保持利润,富国银行还将继续“刀刃向内”。

目前,富国已经确定了80多亿美元的长期节支目标。裁员当然也是必不可少的:去年第四季度,富国银行裁掉了6400人,预计今年还会有更多裁员。富国银行还计划大幅削减办公用房开支,预计总办公面积将缩减20%。

同时,富国银行也在对分支网络进行“瘦身”。富国在2020年底拥有大约5000家分支机构,已经少于2009年的6600家,它还计划今年再关闭250家。

尽管改革计划雄心勃勃,但它对公司整体增长的提振依然有限——除非它能让监管机构满意,觉得它的改革已经全面完成了。富国银行及有关监管机构以“法律限制”为由,拒绝了就取消“奖金帽”的时间表一事发表评论。

沙夫对《财富》杂志表示:“我理解大家的想法,大家想听到的是,当我们最终跨过这些事情时,公司会变成什么样子。”但除非富国的风控机制让监管机构满意,否则要想真正“跨过”这些事,只怕还得再等等 。

大概20年前,也就是沙夫还在芝加哥担任第一银行CFO的时候,他学起了吉他。在疫情“封城”期间,他重新联系上了他的吉他老师,现在他每周都在通过Zoom上网课,练习蓝调和摇滚。

“这东西很有创意,”他兴奋地说:“你可以把它拿起来,并且用它创造一些东西,而且还和别人创造的东西不一样,这在我看来非同寻常。”

就像弹吉他一样,沙夫在富国银行也试图弹出一些新的、和谐的东西。但要将富国银行这把“吉他”的弦调好,他还需要更多的时间。

打小井,打深井

为了在当下的困境中生存下来,并且让股东满意,富国启动了“精兵简政”计划。

由于监管制裁限制了公司的增长能力,富国银行选择了剥离“非核心”部门,专注于最有前途的业务。CEO沙夫希望以下几个部门能在形势好转后再次蓬勃发展。

消费者和小企业银行借贷

2020年收入:340亿美元

负责人:玛丽·麦克、迈克尔·韦因巴赫

富国银行是美国最大的住房抵押贷款机构之一,该部门也是目前为止富国最大的业务板块。最近的低利率已经影响了该部门的收入。不过富国银行还有4000多亿美元的消费贷款规模,以及强劲的车贷和信用卡业务。这些业务有更高的利率,而且应该会随着经济复苏而复苏。

理财和投资管理

2020年收入:145亿美元

负责人:巴里·萨默斯

截止到2020年底,富国银行一共管理着2万亿美元资产——虽然它计划出售6000亿美元的机构资产管理业务,以便更好地专注于个人理财业务。

富国银行的财富管理团队历来不仅服务有钱人,也服务“大众富裕阶层”和中产阶级客户。沙夫很看好该部门与消费贷款部门的协同效应:“大量进入我们的分支机构的客户,都是有钱投资的。”他说。

企业和投资银行

2020年收入:138亿美元

负责人:琼恩·威斯

该部门包括1100亿美元的商业地产板块和大量的“C&I”贷款(即企业购置机械设备的贷款)。总体上看,富国银行的商业贷和消费贷差不多各占50%。虽然在企业和投资银行领域,富国银行的名声不算显赫,但根据Dealogic的数据,它仍然是美国的第九大投行。沙夫的团队认为,富国银行有望在这一领域赢得市场份额。

银行还能迎来好日子吗?

受疫情影响,银行业的复苏速度十分缓慢,而且前路依然坎坷曲折。

2020年,包括银行在内的金融机构的日子是很煎熬的,只不过这一点在一片大好的股市里没有反映出来。(去年美股大盘增长了16%,而标普500指数的金融板块却下跌了4%。)

受疫情影响,美国各大金融机构都忙着想方设法支持他们的商贷和消费贷客户,从而严重影响了他们从利差中获得的收益。

虽然目前情况貌似有所好转,但2021年的路,似乎也注定不会平坦。

复苏缓慢且不均衡

美国银行业的一些关键指标一直比较强劲,比如抵押贷款需求和存款的增长等。股票牛市也带动了交易收入,另外更多的经济刺激也有可能出台。但高失业率和小企业的经营困境,仍然注定了经济大环境在疫情缓解前不会根本好转。在短期内,大银行会更加强调盈利能力。而到目前为止,理财和投行业务相对来说对疫情还比较免疫。

利率触底

为了应对疫情对经济的影响,美联储将利率回归到了接近于零的水平,并暗示接下来几年都会如此。这就给银行向客户收取的利率设定了上限,并且导致了“净息收入”的降低,而这恰恰是决定银行收入的一个关键因素。(也就是银行贷款收息和存款利息之间的差额。) 预计短期内,银行将增加贷款规模,尤其是在抵押贷款领域,以弥补息差损失。

新政府的导向

银行领导们大概不会怀念特朗普政府的朝令夕改和不可预测性,但他们或许会怀念特朗普的一些政策。

拜登有可能会改变特朗普对华尔街的“去监管化”政策,并且取消对企业和高净值个人的一些减税。希望未来银行能与监管机构合作,为金融科技(比如加密货币和数字支付)和资本市场(比如直接上市和SPACs,即特殊目的收购)的新发展制定一些基本规则。(财富中文网)

本文原载于2021年二三月刊的《财富》杂志。

译者:朴成奎

Charlie Scharf, the CEO of America’s third-largest bank, is a man enamored with the potential of the company he leads. He sounds almost awestruck as he enumerates the forces at his disposal. There’s the commercial bank that serves millions of small businesses. There’s a consumer-lending platform that accounts for more mortgages than any other major bank. There’s a wealth management division that has helped countless customers expand their affluence. “The core franchise, and what we do for consumers and businesses, is extraordinary,” Scharf says.

He pauses before adding, matter-of-factly: “But we made a bunch of mistakes.”

It is mid-October, the day before Scharf’s first anniversary at the helm of Wells Fargo. The CEO is sitting in an elegant, wood-paneled study at his home on New York’s Long Island, speaking via a Zoom video link. For much of a pandemic-afflicted year, this house has been the hub from which Scharf has tackled one of the toughest turnaround assignments in business. Scharf oversees an enormous, multifaceted bank with more than 260,000 employees and some 70 million customers. It’s a company emerging from the most tumultuous period in its nearly 170-year history, one in which it got caught—on multiple occasions—flagrantly abusing the trust of those customers.

Wells Fargo continues to pay for those sins with a tarnished reputation and through the lingering impact of severe fines and sanctions. The most damaging of those is a Federal Reserve–imposed, $1.95 trillion cap on the bank’s assets. As the economy reels from the impact of the coronavirus, all banks are feeling the effects of ultralow interest rates that clobber their profit margins. But unlike its rivals, Wells can’t offset the impact by rapidly stepping up lending volume or attracting capital reserves—the asset cap prevents it. Wells Fargo’s revenue has steadily declined since 2017 and dropped another 15% in fiscal 2020, to $72.3 billion. Profits have shriveled, too, and its shares, which fell 44% last year, have consistently underperformed those of other big banks since the scandal erupted. “This company is a damaged company, and all strategies have to be put on the table to bring it back to a level of profitability that investors will find acceptable,” says Gerard Cassidy, head of U.S. bank equity strategy at RBC Capital Markets.

When he took the gig, Scharf, now 55, stepped into one of the most closely scrutinized positions in finance. It’s his third CEO stint at a Fortune 500 financial services company, and an extremely well-compensated one. He can earn up to $23 million annually, depending on stock incentives. It also ranks among the toughest chief executive jobs in America. Given Wells’ status as one of the biggest “Main Street” lenders, its overall health has implications for the broader economy too. Scharf’s longtime mentor, JPMorgan Chase CEO Jamie Dimon, tells Fortune that the task Scharf signed up for is a challenge “too big to walk away from,” adding, “It’s better for the country and for the banking industry that they succeed.”

For now, Scharf is concentrating on creating a leaner, more focused institution—shrinking the bank in order to save it. If he succeeds in shepherding Wells Fargo out of regulatory purgatory, he may restore the luster of one of the grand old names of American banking. Should he fail, Wells could be permanently relegated to afterthought status among its blue-chip rivals.

Fortune spoke with Scharf and top Wells Fargo executives—as well as analysts, critics, industry rivals, and former colleagues of Scharf’s—to capture the state of the turnaround, some 15 months into the CEO’s tenure. It has been an eventful time that has featured sweeping organizational changes—along with high-profile missteps that fueled skepticism about whether Scharf can institute meaningful cultural change. “It takes a long time to turn around such a big ship,” says Jason Goldberg, a senior equity research analyst at Barclays. “He’s learning that.”

Scharf, for his part, sees a chance to restore the bank to its rightful place. “I came in with a clear understanding that the core franchise continued to be this great opportunity,” he says, “but that there was a tremendous amount of work to do.”

*****

Scharf grew up in Westfield, N.J., a New York suburb crowded with financial professionals like his father, a stockbroker. By age 13, Charlie was working back-office jobs at Manhattan brokerages. As an undergrad at Johns Hopkins, he initially had designs on becoming a research chemist—until he had a sophomore-year epiphany. “I was in physical chemistry, locked in a lab, when I said to myself, ‘I really don’t want to spend my life in a place without windows,’ ” he recalls. In business, he realized, “you could create something in a very different way.”

As fate would have it, a relative of Scharf’s knew the father of a banker named Jamie Dimon, the young chief financial officer of Baltimore-based lender Commercial Credit. Dimon brought the recent grad on board in 1987—the start of a working relationship that would span more than 20 years. Scharf played a variety of roles under Dimon and Sandy Weill as they grew Commercial Credit into what eventually became Citigroup. When Dimon landed the top job at Bank One in 2000, he tapped Scharf as CFO. After Bank One merged with JPMorgan Chase in 2004, Scharf took the helm of Chase’s sprawling retail banking business.

Dimon recalls Scharf as able to “handle just about anything” Dimon threw at him: “He got stuff done; he had a good nose for cracking through the bull.” Scharf acquired the seasoning that came with ever-larger roles; he also saw Dimon’s job evolve as he led ever-larger companies. Of what he learned from Dimon as a leader, Scharf says, “He stands in front. He doesn’t hide behind people. He doesn’t look at others when something goes wrong.”

Scharf would put those lessons into practice in 2012, when Visa tapped him as CEO. Visa was still grappling with its 2008 transition from a private entity, owned by an association of card-issuing banks, to a publicly traded company. At Visa’s San Francisco headquarters, Scharf found what he describes as an “insular” business that “didn’t really engage with the technology community.” He aimed to rectify that, establishing relationships with fintechs like PayPal and Stripe that expanded Visa’s footprint in digital payments—a focus that proved prescient. Says current Visa president Ryan McInerney, a JPMorgan alum who followed Scharf to Visa: “A lot of the foundation he laid, especially as it relates to digital commerce, you’re seeing the results now.”

Scharf left Visa in 2016, seeking to be closer to his family on the East Coast—and leaving behind a company whose share price more than doubled during his tenure. His experience there, as well as a subsequent stint as CEO of custodian bank BNY Mellon, taught him how all-encompassing the chief’s role was. “There’s no job that’s comparable,” Scharf says. “The whole organization looks to you for the wins and the losses, for setting the tone and the culture … Some love it, and some don’t love it.” Scharf falls into the first category.

Around the time he was leaving Visa, another San Francisco–based company was reckoning with a scandal of tectonic proportions.

The details of Wells Fargo’s fake-accounts fraud debacle are well documented: Driven by a hyperaggressive sales culture, employees opened accounts for and sold financial products to millions of customers—without their approval. The problems were endemic across the company, with similar sharklike misconduct surfacing in Wells’ mortgage, auto lending, and wealth management businesses.

The fallout proved devastating. From 2016 through 2018, federal regulators hit Wells with five consent orders laying bare the institution’s mismanagement—along with sanctions that included the constraining asset cap. Regulators also held Wells’ leadership accountable: Former CEO John Stumpf, who stepped down after the scandal emerged in 2016, was eventually handed a $17.5 million fine and a lifetime ban from the banking industry. His successor, Tim Sloan, resigned under political pressure in March 2019. In a report last year, the House Financial Services Committee slammed Wells Fargo’s board and management for continually failing to address the company’s shortcomings, even years after the misdeeds came to light.

Wells Fargo had been one of the few American banks to emerge from the 2008 financial crisis with its reputation intact. As rivals stumbled, Wells grew stronger, as evidenced by its $15 billion mid-crisis acquisition of Wachovia. Now, it finds itself the bête noire of the banking sector. “We were growing while everyone else was focused on running themselves better,” says Jon Weiss, a 15-year Wells veteran who now leads the corporate and investment banking division. “We were to some degree victims of our own success, and maybe we could have used a bit more introspection.”

By spring 2019, Wells’ board was searching for a CEO who could lead the company in a long, hard look in the mirror. Six months after Sloan stepped down, Scharf got the job. Solving the bank’s regulatory issues, Scharf said shortly after his appointment, would be “clearly the first priority.”

*****

For the first meeting of Wells Fargo’s operating committee under the new CEO, its leaders gathered in a windowless conference room in St. Louis to address the daunting business of turning the bank around. “Charlie brought in a legal pad—not a PowerPoint presentation, not 40 pages of colored pictures the way that an investment bank would present—with a page and a half of notes, line by line, that he wanted to go through to explain the way he does business,” Weiss recalls. “It was a disarming, casual, but very focused discussion with no baloney.”

Matter-of-factness and a “no frills” demeanor are common threads in descriptions of Scharf; his directness can be as striking as his trademark shock of white hair. But plainspokenness can also be an asset for a chief executive with bad news to deliver and tough problems to solve.

The biggest problem Scharf identified at Wells Fargo was an exceptionally decentralized organization—one lacking the clear lines of accountability that might have prevented the fake-account fraud. The bank also lacked risk-and-compliance safeguards that most banks of comparable size already had. “We did have a relatively siloed organization, where you had intact businesses that were running a bit independently,” says Mary Mack, who has been with Wells for 26 years and now leads its consumer and small-business banking division. “I don’t think we did a very good job of stepping back and saying, ‘Could that condition or set of weaknesses actually exist across the entire company?’”

Scharf began a major overhaul, starting with turnover at the top. Nine of the 17 people now serving with Scharf on the bank’s senior leadership committee are new hires. Prior to last year, the role of chief operating officer didn’t exist at Wells Fargo. Scharf created it and recruited Scott Powell, a former colleague at Citi and JPMorgan, to fill it. Powell most recently served as CEO of Santander’s U.S. business, where he helped that bank cope with regulatory sanctions of its own. Several other new executives are also past colleagues of Scharf’s: CFO Mike Santomassimo had the same role at BNY Mellon; Mike Weinbach and Barry Sommers, who now head Wells’ consumer lending and wealth management divisions, respectively, are JPMorgan alumni.

In February 2020, Scharf unveiled a reorganization plan that redrew the company’s business lines across five distinct divisions. Just as important was a reconfiguration of Wells’ risk-management system: Each of the five divisions now has its own dedicated risk officer—a structure designed to ensure no unit of the bank is cutting corners.

Analysts hailed Scharf for bringing Wells Fargo in line with other banks’ best practices. But subsequent events offered persistent reminders of the work that remains to be done. Last February, just days after the reorganization’s unveiling, the Justice Department announced that Wells would pay $3 billion to settle criminal charges related to the accounts scandal. The consensus was that this would be Wells’ last major penalty, but it offered another stark example of the scandal’s erosion of the bank’s profits. Another sign of the lingering cost: In 2020, Wells Fargo spent $6.7 billion on “professional/outside services”—more than 9% of total revenue—the lion’s share of which reflects legal and consulting fees related to the post-scandal cleanup.

Meanwhile, the pandemic forced Wells Fargo to put daily emergencies ahead of long-term reforms. Scharf, still in the early days of meeting Wells’ workforce, found himself confined to his Long Island home office. Keeping the bank’s thousands of branches open was essential—even amid lockdowns, Wells had “1 million customers a day coming into our branches,” says Mack—but keeping them safe, and transitioning nonbranch employees to remote work, was a logistical obstacle course.

COVID-19 also triggered a mini-scandal that echoed the bank’s past misdeeds. After the government enacted mortgage relief measures to help people who couldn’t keep up with payments, no fewer than 1,600 borrowers complained that Wells Fargo had placed their loans in forbearance without their consent—an act that could actually harm the borrowers’ credit ratings and prevent them from refinancing. “We were erring on the side of trying to help customers in a very difficult time,” Scharf says of the snafu, which the bank scrambled to correct. “Every institution makes mistakes.”

The bank also entangled itself in difficult questions around diversity. No incident from his first year at Wells Fargo proved more threatening to Scharf’s reputation than comments he made in a June memo announcing new diversity initiatives, in which he cast doubt on the depth of talent available for top jobs at the bank. “The unfortunate reality is that there is a very limited pool of Black talent to recruit from with this specific experience,” he wrote.

With nationwide awareness of structural racism honed to a sharp edge by the killing of George Floyd just a few weeks earlier, the comments were particularly tone-deaf. They upset many employees and drew widespread condemnation from critics outside the bank. They also highlighted the whiteness and maleness of the ranks of former colleagues from which Scharf had recruited many of his lieutenants. While his nine hires on the leaders’ committee include a woman and two Black men, the highest-ranking ones, including the COO and CFO, are white men. “What we’ve seen is that he’s replaced one insular group with another,” says Nick Weiner of the financial industry labor group Committee for Better Banks.

Scharf quickly apologized for the “limited pool” comments, saying they reflected “my own unconscious bias.” Wells has since created a diversity, representation, and inclusion group: Its chief, Kleber Santos, who joined the company in November from Capital One, sits on the senior leadership committee. Months later, Scharf is solemn and cautious as he discusses the gaffe. He points to the company’s goal of doubling Black representation in its senior ranks over the next five years, as well as its plan (announced in his June memo) to tie some of executives’ compensation to the diversity of their business lines. He also seems acutely aware that the hire-who-you-know approach that he has relied on for years has also perpetuated inequities. “When you look at the representation inside this company—and this is true of most financial institutions—there’s a tremendous need to do things differently,” he says.

******

January 15 at first glance seemed like just another dreary day for Wells Fargo. Disclosing earnings for the fourth quarter of 2020, the bank reported revenues that missed analysts’ estimates, and shares fell nearly 8% on the day. The general gloom obscured the fact that Wells Fargo also revealed substantial details about its future—as a leaner institution doubling down on what it does well.

Recapping some moves and unveiling others, Scharf’s team listed a series of asset sales that would extract the bank from “noncore” businesses. On their way out are Wells Fargo’s $10 billion student loan portfolio and its Canadian equipment-financing business. The bank is also looking to off-load its asset management arm, which oversees more than $600 billion for institutional clients. “The businesses that we’re exiting are perfectly good businesses,” Scharf said on the earnings call. “The question is, are they best housed within Wells Fargo?”

In Scharf’s vision, that housing is reserved for bread-and-butter businesses that Wells has dominated for decades—including consumer banking and personal wealth management—as well as for investment banking, where the company believes it can rise in the ranks.

To sustain profits while it pivots, Wells Fargo will keep cutting. The company has identified more than $8 billion in long-term cost savings, of which job cuts are part and parcel: Wells reduced headcount by 6,400 in the fourth quarter, and more cuts are expected this year. The bank plans to dramatically reduce its real estate footprint, scaling down its office space by up to 20%. A downsizing of its branch network is well underway. Wells Fargo had about 5,000 branch locations at the end of 2020, down from 6,600 in 2009, and it plans to close 250 more this year.

Ambitious as it is, the plan will likely leave Wells Fargo running in place insofar as overall growth is concerned—until it can satisfy regulators that it has fully reformed. The bank and its regulators refuse to comment on a timeline for the removal of the asset cap, citing legal constraints. “I understand people’s desire to hear exactly what the company can look like when we get beyond these things,” Scharf tells Fortune. But until his risk-control regime impresses the authorities, “beyond” will have to wait.

Some 20 years ago, while living in Chicago as CFO at Bank One, Scharf began taking guitar lessons. During the pandemic lockdown, he reconnected with his old instructor, and Scharf now studies with him over Zoom once a week, playing blues and rock. “It’s creative,” he enthuses. “The idea that you can pick up [a guitar] and make something out of it, differently than someone else who you hand the same device to, to me is just an extraordinary thing.” Scharf is committed to coaxing something new and harmonious out of Wells Fargo. But it’s going to take quite a while longer to get the instrument back in tune.

*****

Digging smaller, deeper wells

To survive its current woes and keep shareholders happy, a big bank plans to downsize.

With regulatory sanctions limiting its ability to grow, Wells Fargo has been shedding “noncore” units to focus on its most promising businesses. Here are the units that CEO Charlie Scharf hopes will help the bank thrive again in better times.

Consumer and small-business banking and lending

2020 revenue: $34 billion

Heads: Mary Mack and Michael Weinbach

Wells Fargo has one of the largest home mortgage businesses in the U.S., and this division is Wells’ biggest business segment by far. Falling interest rates have hurt the division’s revenue as of late. But the bank’s $400-billion-plus consumer loan portfolio also includes strong auto-financing and credit card businesses that command higher interest rates and should perk up as the economy improves.

Wealth and investment management

2020 revenue: $14.5 billion

Head: Barry Sommers

Wells Fargo managed $2 trillion in total assets at the end of 2020—though it plans to sell its $600 billion institutional asset management business, the better to focus on individuals. Wells’ wealth management team has historically served “mass affluent” and middle-class customers as well as richer ones. Scharf sees the division synergizing with consumer lending: “Huge numbers of customers who come into our branches have money to invest,” he says.

Corporate and investment banking

2020 revenue: $13.8 billion

Head: Jon Weiss

This division includes a $110 billion commercial real estate portfolio and a big stake in “C&I” loans (financing for businesses buying equipment and machinery). Overall, the bank’s loans are split nearly 50/50 between commercial and consumer lending. While it’s not a household name in the field, Wells Fargo is still the ninth-biggest investment bank in the U.S., according to Dealogic, and Scharf’s team sees that as a business in which it could win market share.

*****

Will life get better for banks?

Banks have been slow to recover from the COVID recession—and the road ahead looks rocky.

Financial firms, banks included, had a rough 2020 that wasn’t reflected by the country’s soaring stock markets. (The S&P 500’s financials sector lost 4% in 2020, compared with a 16% gain for the broader market.) The coronavirus pandemic forced America’s largest financial institutions to retool on the fly, leaving them scrambling to support their commercial and consumer borrowers, and undermining the income they made from interest rate spreads. Though sentiment has improved, 2021 looks like it will be far from a stroll.

A slow, uneven recovery

Some key indicators for banks, including mortgage demand and deposit growth, have remained strong. A resurgent bull market has driven trading revenues, and more economic stimulus seems likely. But high unemployment and lingering woes for small businesses remain burdensome headwinds, with no clear end in sight until COVID-19 abates. In the short run, big banks will emphasize their profitable—and thus far, relatively pandemic-proof—wealth management and investment banking businesses.

Rock-bottom interest rates

The Fed returned rates to near zero to deal with economic fallout from the pandemic, and it has signaled that they could remain there for years to come. That puts a ceiling on the rates banks can charge customers and reduces “net interest income,” a key driver of revenues. (It’s the difference between what banks earn on loans and what they pay out on deposits.) In the near term, expect banks to step up loan volume to make up for what they’re losing in interest, especially in the mortgage space.

New management in Washington

Bank leaders won’t miss the volatility and unpredictability of the Trump administration, but they may find themselves feeling nostalgic for some of its policies. President Biden will likely seek a reversal of Trump’s pro–Wall Street deregulatory agenda, as well as the undoing of some tax cuts for corporations and high-net-worth individuals. Look for banks to team up with regulators to lay ground rules for new developments in fintech (like cryptocurrencies and digital payments) and capital markets (such as direct listings and SPACs).

This article appears in the February/March 2021 issue of Fortune with the headline “Busted stagecoach: Can Charlie Scharf—or anyone—fix Wells Fargo?”