福特汽车(Ford Motor Co.)向来自诩思路开阔。公司历史长达117年,长期以来把战略重点放在保持遍布全球主要市场的品牌地位,车型从超小型车覆盖到豪华SUV,不久的将来还将全面进军电动汽车。

但公司经营每况愈下,在2015年福特实现74亿美元利润后,去年勉强维持盈亏平衡,而当时新冠疫情还没有爆发,也尚未经受经济封锁对北美地区盈利造成的重创。今年第二季度,福特在北美亏损近10亿美元,不久之后公司免去了韩恺特(Jim Hackett)的首席执行官一职,并宣布新一轮收购计划。

新任首席执行官詹姆斯·法利之前担任首席运营官,面临的挑战巨大。但如果他愿意围绕产品和战略做一些艰难的选择,仍然有机会带领福特走向成功。

2021年以及2021年之后,福特会变成什么样?《财富》杂志采访了分析师和业内专家,还研究了福特的公开文件,为其复兴勾勒出似乎可信的蓝图。

法利确实面临难得的机遇窗口。在疫情冲击下,投资者对短期痛苦但最终可以赚钱、搁置失败计划且抛弃宏大目标的艰难决策的容忍度高得多。当前危机是福特不能浪费的机会。

北美市场放弃更多不赚钱的车型

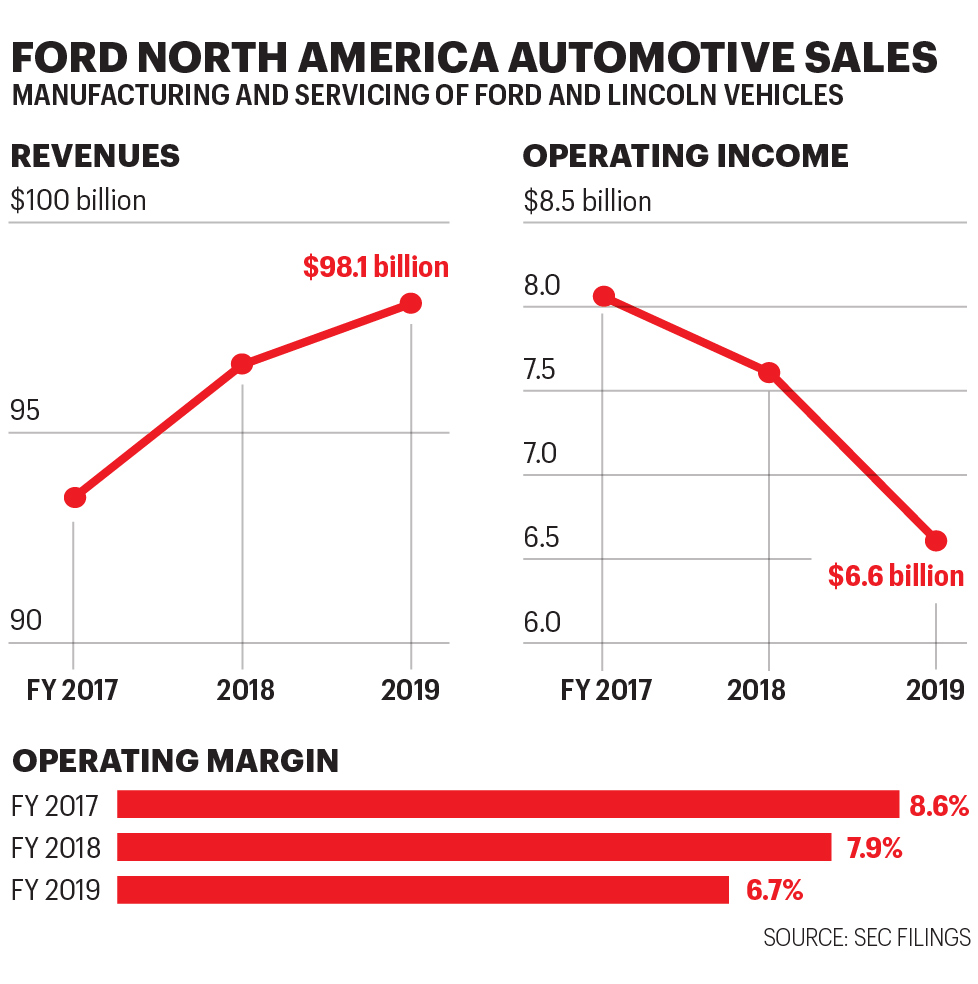

多年来,北美是福特唯一持续盈利的市场。“但利润率一直在下降,远远低于合理水平。”惠誉评级(Fitch Ratings)的分析师斯蒂芬·布朗表示。最大的问题是,从2016年到去年年底,成本基础猛增83亿美元,而同期销售额增幅为55亿美元。因此利润率从超过10%降至6.7%。2018年年中,福特宣布了110亿美元的全球重组计划,希望与供应商达成规模更大也更优惠的协议,增加机器人生产线推进自动化,调整劳动力规模,在北美地区逐步淘汰几乎所有传统乘用车。

不过,公司集中投资三块高利润业务将可以获得更大的成功,其中两块业务都增长迅速。

第一块,也是目前最大的一块是F系列皮卡。去年,福特令人震惊地卖出89.7万辆F系列卡车,其中F-150最畅销。炒得火热的F系列电动汽车最快明年面世,占福特在美国市场总销量40%的产品线成败在此一举。

第二块主要包括“商用车”或简称CV,Transit品牌继承了老款Econoline车型,客户包括从快递员到木匠等,也有箱型载客版本。华尔街的分析师称,这块业务F系列一样,利润率也达到两位数。

第三块是SUV,选择更加艰难。去年,福特锐际(Escape)和探险者(Explorer)等车型在美国销售了83.1万辆,但销量和市场份额正在下降,其中探险者的市场份额从2015年的12%下降到2019年的略低于10%。

不过,SUV在美国仍然有希望。SUV一般价格较高,利润也比较丰厚,即便增幅不明显,也可以基本保持。原因在于主打车型共享“车身框架”架构,与福特旗下大批量生产的卡车在同一平台上生产,从而降低了单位成本。新款Bronco SUV与福特的第二代皮卡品牌Ranger采用相同底盘和许多其他部件,且都在密歇根州韦恩市制造。尺寸最大的SUV“征服者”和高端林肯领航员(Lincoln Navigator)跟F-150卡车使用同款底盘。相比之下,EcoSport和锐际两款尺寸较小的车型采用了不同的系统,叫“单体式底盘”,经济效益方面差一点。“福特应该逐步淘汰EcoSport和锐际,这两款利润率都很低。”行业顾问乔恩·加布里埃森说。简单来说,如果福特能够剥离边缘SUV并降低成本,沿原有业务轨迹加速前进,仍然有机会蓬勃发展。

欧洲市场放弃轿车,主攻货车

福特最大的问题在海外。如果福特可以不计收益爽快地将海外业务出售给竞争对手,成功之路将容易得多也更直接。福特应该尽快撤出南美。目前其南美业务主要在巴西和阿根廷,然而数十年来一直未能填上成本。

欧洲市场上,2017年通用汽车(GM)就明智地将业务出售给标致(Peugeot)从而退出,福特还在承诺缩小利润低大排量乘用车生产线,大力投资发展明星车型、商用车和乘用车。但种种举措并不够。

福特应该全力掌控货车市场。目前福特在欧洲商用车市场份额领先,占15.1%。销量也不断增长,去年达到26.4万辆,业内专家称其Transit货车利润率为两位数。

福特要保持货车领域领先地位,实现大规模生产至关重要。与大众公司(Volkswagen)新成立合资企业应该大有帮助。大众已经承诺在欧洲采购商用货车,还有以福特为所有市场设计制造的Ranger为原型的皮卡。

不过在缩减乘用车阵容的过程中,福特不再能够享受工程和采购规模的优势,也无法保持成本的竞争力。福特要彻底退出该领域。

SUV的前景则更加黯淡。去年福特在英国和欧洲大陆销售了30万辆SUV,大部分为本地制造。与轿车领域不同,福特在美国设计制造大量同款SUV,其中一些型号与F-150共享平台,因此福特可以通过继续生产销售欧洲最受欢迎的车型来提升经济效益。

降低在中国市场的野心,尽量发挥优势

就在五年前,福特在中国市场的占有率近5%,107亿美元的销售额中有7.65亿美元税前利润来自中国。(早些时候的数据统计亚太地区,其中以中国为主。)然而随后出现惊人的断崖式下跌,到2019年已无收益,导致收入暴跌35%至70亿美元。随着福特推出锐际和新款林肯冒险家(Lincoln Corsair)SUV,2020年上半年财务状况有所改善。但福特在中国市场份额仍然仅为2.5%,面临的障碍也与欧洲市场类似,即严重依赖低利润乘用车,也很难提升销量,在轿车和SUV领域展开竞争。

尽管福特没有透露具体细分数据,但据《财富》杂志估计,第二季度福特在华销售的15.9万辆汽车中约一半是轿车,以中型福克斯(Focus)、紧凑型福睿斯(Escort)还有SUV为主。跟欧洲一样,中国正在迅速转向电动汽车。福特并没有畏缩,承诺未来三年内推出30款新车型,其中10款为全电动。但中国有400多家国内生产商在争夺电动汽车市场。目前,电动汽车的利润远远低于传统汽车,因为电池成本持续上升,而产量仍然太少。

这并不代表福特应该放弃中国。福特应该再次发挥自身优势。跟在欧洲一样,福特轻型商用车在中国很受欢迎。福特应该转型主推货车和小型皮卡。随着福特在美国和欧洲产量,包括新款电动汽车产量不断增长,有助于扩大规模在全世界最大的汽车市场中国获得成功。而且福特货车和皮卡业务利润丰厚,应该能够顺利推动向电动汽车的转型。

销售萎缩之际,成本控制要跟上

在新福特汽车调整规模并实现盈利后,可能只有目前业务的三分之二,意味着销量将从去年的1560亿美元缩水至1000亿美元左右。不过只有福特同步缩减管理费用才能实现。随着福特转向利润率更高的产品组合,不必与销售同步迅速降低成本以争取更高利润。但转变仍然会很残酷。整个工程和销售团队都要集体行动。

福特拥有一众核心的优秀产品,然而摊子铺太大导致优势不够明显。大胆实施瘦身计划意味着终结原有的全球帝国,但可以确保福特充分发挥长处。

新款Bronco是福特正确决策的案例

共享平台

Bronco的工程平台、底盘和部分零件都与福特新款Ranger皮卡共享,而Ranger一直很畅销。

适度怀旧

福特不怕回顾过去,福特GT和整个野马(Mustang)系列都是明证。但Bronco结合了怀旧与实用性,可以吸引年轻司机。

真实表现

Bronco在市场上的竞争对手是越野顶级品牌吉普牧马人(Jeep Wrangler),只有击败牧马人才能够在市场上取胜。从已经发布的技术规格来看,福特显然对这场大战非常重视。(财富中文网)

本文另一版本登载于《财富》杂志2020年10月刊。

译者:冯丰

审校:夏林

福特汽车(Ford Motor Co.)向来自诩思路开阔。公司历史长达117年,长期以来把战略重点放在保持遍布全球主要市场的品牌地位,车型从超小型车覆盖到豪华SUV,不久的将来还将全面进军电动汽车。

但公司经营每况愈下,在2015年福特实现74亿美元利润后,去年勉强维持盈亏平衡,而当时新冠疫情还没有爆发,也尚未经受经济封锁对北美地区盈利造成的重创。今年第二季度,福特在北美亏损近10亿美元,不久之后公司免去了韩恺特(Jim Hackett)的首席执行官一职,并宣布新一轮收购计划。

新任首席执行官詹姆斯·法利之前担任首席运营官,面临的挑战巨大。但如果他愿意围绕产品和战略做一些艰难的选择,仍然有机会带领福特走向成功。

2021年以及2021年之后,福特会变成什么样?《财富》杂志采访了分析师和业内专家,还研究了福特的公开文件,为其复兴勾勒出似乎可信的蓝图。

法利确实面临难得的机遇窗口。在疫情冲击下,投资者对短期痛苦但最终可以赚钱、搁置失败计划且抛弃宏大目标的艰难决策的容忍度高得多。当前危机是福特不能浪费的机会。

北美市场放弃更多不赚钱的车型

多年来,北美是福特唯一持续盈利的市场。“但利润率一直在下降,远远低于合理水平。”惠誉评级(Fitch Ratings)的分析师斯蒂芬·布朗表示。最大的问题是,从2016年到去年年底,成本基础猛增83亿美元,而同期销售额增幅为55亿美元。因此利润率从超过10%降至6.7%。2018年年中,福特宣布了110亿美元的全球重组计划,希望与供应商达成规模更大也更优惠的协议,增加机器人生产线推进自动化,调整劳动力规模,在北美地区逐步淘汰几乎所有传统乘用车。

不过,公司集中投资三块高利润业务将可以获得更大的成功,其中两块业务都增长迅速。

第一块,也是目前最大的一块是F系列皮卡。去年,福特令人震惊地卖出89.7万辆F系列卡车,其中F-150最畅销。炒得火热的F系列电动汽车最快明年面世,占福特在美国市场总销量40%的产品线成败在此一举。

第二块主要包括“商用车”或简称CV,Transit品牌继承了老款Econoline车型,客户包括从快递员到木匠等,也有箱型载客版本。华尔街的分析师称,这块业务F系列一样,利润率也达到两位数。

第三块是SUV,选择更加艰难。去年,福特锐际(Escape)和探险者(Explorer)等车型在美国销售了83.1万辆,但销量和市场份额正在下降,其中探险者的市场份额从2015年的12%下降到2019年的略低于10%。

不过,SUV在美国仍然有希望。SUV一般价格较高,利润也比较丰厚,即便增幅不明显,也可以基本保持。原因在于主打车型共享“车身框架”架构,与福特旗下大批量生产的卡车在同一平台上生产,从而降低了单位成本。新款Bronco SUV与福特的第二代皮卡品牌Ranger采用相同底盘和许多其他部件,且都在密歇根州韦恩市制造。尺寸最大的SUV“征服者”和高端林肯领航员(Lincoln Navigator)跟F-150卡车使用同款底盘。相比之下,EcoSport和锐际两款尺寸较小的车型采用了不同的系统,叫“单体式底盘”,经济效益方面差一点。“福特应该逐步淘汰EcoSport和锐际,这两款利润率都很低。”行业顾问乔恩·加布里埃森说。简单来说,如果福特能够剥离边缘SUV并降低成本,沿原有业务轨迹加速前进,仍然有机会蓬勃发展。

欧洲市场放弃轿车,主攻货车

福特最大的问题在海外。如果福特可以不计收益爽快地将海外业务出售给竞争对手,成功之路将容易得多也更直接。福特应该尽快撤出南美。目前其南美业务主要在巴西和阿根廷,然而数十年来一直未能填上成本。

欧洲市场上,2017年通用汽车(GM)就明智地将业务出售给标致(Peugeot)从而退出,福特还在承诺缩小利润低大排量乘用车生产线,大力投资发展明星车型、商用车和乘用车。但种种举措并不够。

福特应该全力掌控货车市场。目前福特在欧洲商用车市场份额领先,占15.1%。销量也不断增长,去年达到26.4万辆,业内专家称其Transit货车利润率为两位数。

福特要保持货车领域领先地位,实现大规模生产至关重要。与大众公司(Volkswagen)新成立合资企业应该大有帮助。大众已经承诺在欧洲采购商用货车,还有以福特为所有市场设计制造的Ranger为原型的皮卡。

不过在缩减乘用车阵容的过程中,福特不再能够享受工程和采购规模的优势,也无法保持成本的竞争力。福特要彻底退出该领域。

SUV的前景则更加黯淡。去年福特在英国和欧洲大陆销售了30万辆SUV,大部分为本地制造。与轿车领域不同,福特在美国设计制造大量同款SUV,其中一些型号与F-150共享平台,因此福特可以通过继续生产销售欧洲最受欢迎的车型来提升经济效益。

降低在中国市场的野心,尽量发挥优势

就在五年前,福特在中国市场的占有率近5%,107亿美元的销售额中有7.65亿美元税前利润来自中国。(早些时候的数据统计亚太地区,其中以中国为主。)然而随后出现惊人的断崖式下跌,到2019年已无收益,导致收入暴跌35%至70亿美元。随着福特推出锐际和新款林肯冒险家(Lincoln Corsair)SUV,2020年上半年财务状况有所改善。但福特在中国市场份额仍然仅为2.5%,面临的障碍也与欧洲市场类似,即严重依赖低利润乘用车,也很难提升销量,在轿车和SUV领域展开竞争。

尽管福特没有透露具体细分数据,但据《财富》杂志估计,第二季度福特在华销售的15.9万辆汽车中约一半是轿车,以中型福克斯(Focus)、紧凑型福睿斯(Escort)还有SUV为主。跟欧洲一样,中国正在迅速转向电动汽车。福特并没有畏缩,承诺未来三年内推出30款新车型,其中10款为全电动。但中国有400多家国内生产商在争夺电动汽车市场。目前,电动汽车的利润远远低于传统汽车,因为电池成本持续上升,而产量仍然太少。

这并不代表福特应该放弃中国。福特应该再次发挥自身优势。跟在欧洲一样,福特轻型商用车在中国很受欢迎。福特应该转型主推货车和小型皮卡。随着福特在美国和欧洲产量,包括新款电动汽车产量不断增长,有助于扩大规模在全世界最大的汽车市场中国获得成功。而且福特货车和皮卡业务利润丰厚,应该能够顺利推动向电动汽车的转型。

销售萎缩之际,成本控制要跟上

在新福特汽车调整规模并实现盈利后,可能只有目前业务的三分之二,意味着销量将从去年的1560亿美元缩水至1000亿美元左右。不过只有福特同步缩减管理费用才能实现。随着福特转向利润率更高的产品组合,不必与销售同步迅速降低成本以争取更高利润。但转变仍然会很残酷。整个工程和销售团队都要集体行动。

福特拥有一众核心的优秀产品,然而摊子铺太大导致优势不够明显。大胆实施瘦身计划意味着终结原有的全球帝国,但可以确保福特充分发挥长处。

新款Bronco是福特正确决策的案例

共享平台

Bronco的工程平台、底盘和部分零件都与福特新款Ranger皮卡共享,而Ranger一直很畅销。

适度怀旧

福特不怕回顾过去,福特GT和整个野马(Mustang)系列都是明证。但Bronco结合了怀旧与实用性,可以吸引年轻司机。

真实表现

Bronco在市场上的竞争对手是越野顶级品牌吉普牧马人(Jeep Wrangler),只有击败牧马人才能够在市场上取胜。从已经发布的技术规格来看,福特显然对这场大战非常重视。(财富中文网)

本文另一版本登载于《财富》杂志2020年10月刊。

译者:冯丰

审校:夏林

Ford Motor Co. prides itself on thinking big. The 117-year-old icon’s long-running strategy centers on preserving its status as a universal nameplate serving all the world’s major geographies and offering a wide array of vehicles from subcompacts to luxury SUVs, in a variety of flavors soon to widely encompass electric.

But it’s a company that’s sliding: After posting $7.4 billion in profit in 2015, Ford’s earnings barely broke even last year, and that was before COVID-19 and its subsequent lockdowns took a sledgehammer to its North American profitability. In the second quarter of this year the company lost nearly $1 billion in the region. Jim Hackett was ousted as CEO shortly after, and a new round of buyouts was announced.

New CEO James Farley, who was promoted from chief of operations, has a monumental challenge on his hands but also has everything he needs to make Ford a success, if he’s willing to make some hard choices around product and strategy.

So what should Ford look like in 2021 and beyond? Fortune spoke to analysts and industry experts and studied Ford’s public filings to assemble a plausible blueprint for its revival.

Farley has a rare opening to seize the moment. The pandemic’s onslaught makes investors a lot more tolerant of tough decisions that cause short-term pain but build on what makes money, shelves losers, and jettisons lofty ambitions. This is a crisis Ford can’t afford to waste.

Junk more unprofitable models in North America

For years, North America has been Ford’s only consistently profitable market. “But margins there have been falling, and are well below where they need to be,” says Stephen Brown, an analyst with Fitch Ratings. The big problem is a cost base that jumped $8.3 billion from 2016 to the end of last year, outpacing sales increases of just $5.5 billion; that combination shrank margins from over 10% to just 6.7%. In mid-2018, Ford announced an $11 billion worldwide restructuring plan aimed at securing bigger, better deals with suppliers, automating production by adding fleets of robots, rightsizing its workforce, and phasing out nearly all traditional passenger cars in North America.

But the company will see greater wins by winnowing the portfolio to three high-margin franchises, two of which are growing fast.

The first, and by far the biggest, is the F-series pickup. Last year, Ford sold an astounding 897,000 F-series trucks, led by the F-150, America’s bestselling vehicle. The much-hyped electric F-series, which could be unveiled as soon as next year, is going to be a make-or-break addition to a line that constitutes 40% of Ford’s total domestic sales.

The second category encompasses “commercial vehicles” or CVs, its Transit-brand vans used by businesses from couriers to carpenters, as well as boxy passenger versions that are the successors to the old Econoline models. Like the F-series, they boast double-digit margins according to Wall Street analysts.

The third category, SUVs, are a tougher call. Last year, Ford sold 831,000 in the category including the Escape and Explorer in the U.S., but its sales and market share are dropping, the latter falling from 12% in 2015 to just under 10% in 2019.

Still, SUVs are a promising business stateside. They’re generally high-priced, lucrative products, and even if they don’t grow much, can remain so. That’s because key models share the “body on frame” architecture and are produced on the same platforms as the trucks that Ford manufactures in gigantic volumes, lowering unit costs. The new Bronco SUV shares the same chassis, and many other parts, with Ford’s second pickup brand, the Ranger, and is being made alongside its cousin in Wayne, Mich. The Expedition, its largest SUV, and the high-end Lincoln Navigator use the same underpinnings as the F-150. By contrast, two of the smaller models, the EcoSport and Escape, employ a different system called “unibody,” and hence don’t offer the same economies. “Ford should phase out the EcoSport and Escape, which are low-margin anyway,” says Jon Gabrielsen, an industry consultant. Put simply, Ford can prosper if it speeds faster on the same route by shedding the marginal SUVs and hitting the brakes on costs.

In Europe, get out of sedans and go all-in with vans

Ford’s biggest problems lie overseas. If the automaker could simply sell its foreign operations to a rival at no gain, its road to success would be far shorter and straighter. Ford should leave South America as quickly as possible. Its operation there, serving mainly Brazil and Argentina, hasn’t earned its cost of capital in decades.

In Europe, where GM wisely withdrew via a sale to Peugeot in 2017, Ford is pledging to downsize its line of low-margin, high-volume passenger vehicles and invest heavily in growing its star performers, commercial and passenger vans. This doesn’t go far enough.

Ford should focus on dominating the van market. The company is the market-share leader in commercial vehicles in Europe at 15.1%. Sales are growing, hitting over 264,000 vehicles last year, and according to industry experts, its Transits are generating double-digit margins.

Achieving large-scale production is crucial to keeping its lead in vans. A new joint venture with Volkswagen should help a lot. VW has pledged to source commercial vans in Europe and a pickup based on the Ranger for all markets engineered and manufactured by Ford.

But in shrinking its passenger vehicle lineup, Ford will no longer benefit from scale in engineering and purchasing, and thus won’t be able to keep costs competitive. It needs to get out of this segment entirely.

The picture for SUVs is cloudier. Last year, Ford sold just under 300,000 SUVs in the U.K. and on the Continent, largely manufactured in the region. Unlike the situation in sedans, Ford is designing and making large volumes of the same SUVs in the U.S., some sharing platforms with its F-150s. So Ford would achieve economies by continuing to manufacture and sell the most popular models in Europe.

Scale back China ambitions and play to your strengths

Just five years ago, Ford was on a roll in China, holding an almost 5% market share and generating $765 million in pretax profits on $10.7 billion in sales. (Earlier figures are for the Asia-Pacific region, heavily dominated by China.) A stunning free fall ensued, erasing all earnings by 2019 and sending revenues plunging 35%, to $7.0 billion. Fortunes improved in the first half of 2020 with the introduction of new versions of the Ford Escape and Lincoln Corsair SUVs. But its market share is still just 2.5%, and it faces obstacles similar to those in Europe: A heavy dependence on low-margin passenger cars, and the challenge of achieving volumes big enough to compete on sedans and SUVs.

Though Ford doesn’t disclose the exact breakdown, Fortune estimates that of the 159,000 vehicles that Ford sold in China in Q2, roughly half were sedans, led by the midsize Focus and compact Escort, and SUVs. As in Europe, China is moving rapidly to EVs. Undaunted, Ford is pledging to introduce 30 new models over the next three years, 10 in all-electric versions. But China has over 400 domestic producers vying for that market. And EVs for now are far less profitable than conventional vehicles, because battery costs remain elevated, while volumes remain too low.

That doesn’t mean that Ford should abandon China. Rather, it should once again play to its strengths. Its light commercial vehicles are big hits in China, just as in Europe. Ford should transform itself into a specialty manufacturer concentrating on vans and small pickups. Its growing output in the U.S. and Europe, including in new EVs, will help provide the scale essential to winning in the world’s largest auto market. It’s also starting with fat margins in those vans and pickups, which should ease the transition to EVs.

As sales shrink, costs need to keep pace

A New Ford that’s resized and profitable might be two-thirds as big as the current model, meaning that sales would shrink from $156 billion last year to around $100 billion. But that template can work only if Ford crunches overhead. Since it would be shifting to a mix of much higher-margin products, the automaker wouldn’t need to lower costs quite as fast as sales to become far more profitable. But the transition would still be brutal. Entire engineering and sales teams behind axed models would have to go en masse.

Ford has a core of great products that are being diluted by trying to do too much in too many places. A daring plan for downsizing would mean the end of the global empire of old, but it could ensure that the blue oval survives on what Ford does best.

*****

The new Bronco is an example of everything Ford is doing right

Shared platform

The engineering platform, chassis, and several parts for the Bronco are shared with Ford’s new Ranger pickup truck, which has already proved to be a hit seller.

Bankable nostalgia

Ford isn’t afraid to look to the past and trade on nostalgia—take the Ford GT and its entire Mustang line for evidence.But with the Bronco that nostalgia is paired with a practicalvehicle, and one that will appeal to younger drivers.

Genuine performance

The Bronco is going right up against the proven off-roadcredentials of the Jeep Wrangler, and only by beating the Wrangler will it succeed in the market. The released specs show Ford is taking this fight very seriously.

A version of this article appears in the October 2020 issue of Fortune.