疫情期美国人有多爱吃比萨?看看这家公司的财报就知道了

每周一次不做饭点外卖时,布兰迪·约翰逊都守在窗边从红色窗帘缝隙朝外张望,等待最爱的外卖到来。看到送餐员转过拐角把车停到她家公寓前,她赶紧跑上楼看另一扇窗户,确保餐盒放在前门外。

跟疫情隔离期间很多美国人一样,约翰逊也订了很多比萨。

“对我来说,比萨非常完美,不太麻烦,非常方便,冷热都能吃,而且不用餐具。”约翰逊说。“非常时期,比萨是便利又管饱的一顿。”

头部比萨连锁店都因为约翰逊这样的顾客而获利颇丰。举例来说,棒约翰财报显示,今年二季度北美餐厅销售额同比增长28%,连续三个月实现两位数增长,3月至6月间聘请了2万名额外员工,计划再招1万名员工。截至8月初,在经历数年低迷之后,棒约翰的今年股价已经飙升约55%。

过去几年百胜集团旗下的必胜客一直面临销量下滑问题,今年5月初迎来八年来外卖和外带销售业绩最好的一周。对于旗下包括塔可钟和肯德基等品牌的百胜来说,当季全球总销售额下降15%之际,比萨外卖量上升确实是个亮点。

“二季度必胜客的非堂食业务增长了21%。过去几年该业务表现不佳,如今的增长表明有特定的行业因素推动比萨板块股价上涨。”瑞士信贷的分析师劳伦·西尔伯曼表示。

不过,因为美国人胃口大开获利最多的比萨外卖公司还要数达美乐。

达美乐是全球销量最大的比萨公司,在美国市场上占份额最高。据彭博行业研究,去年达美乐占据美国比萨总销量的19%,主要因为在外卖方面的主导地位。2019年达美乐占美国外卖销售额36%,而其他主要连锁店的总和为26%。(区域连锁店和独立餐厅占38%。)

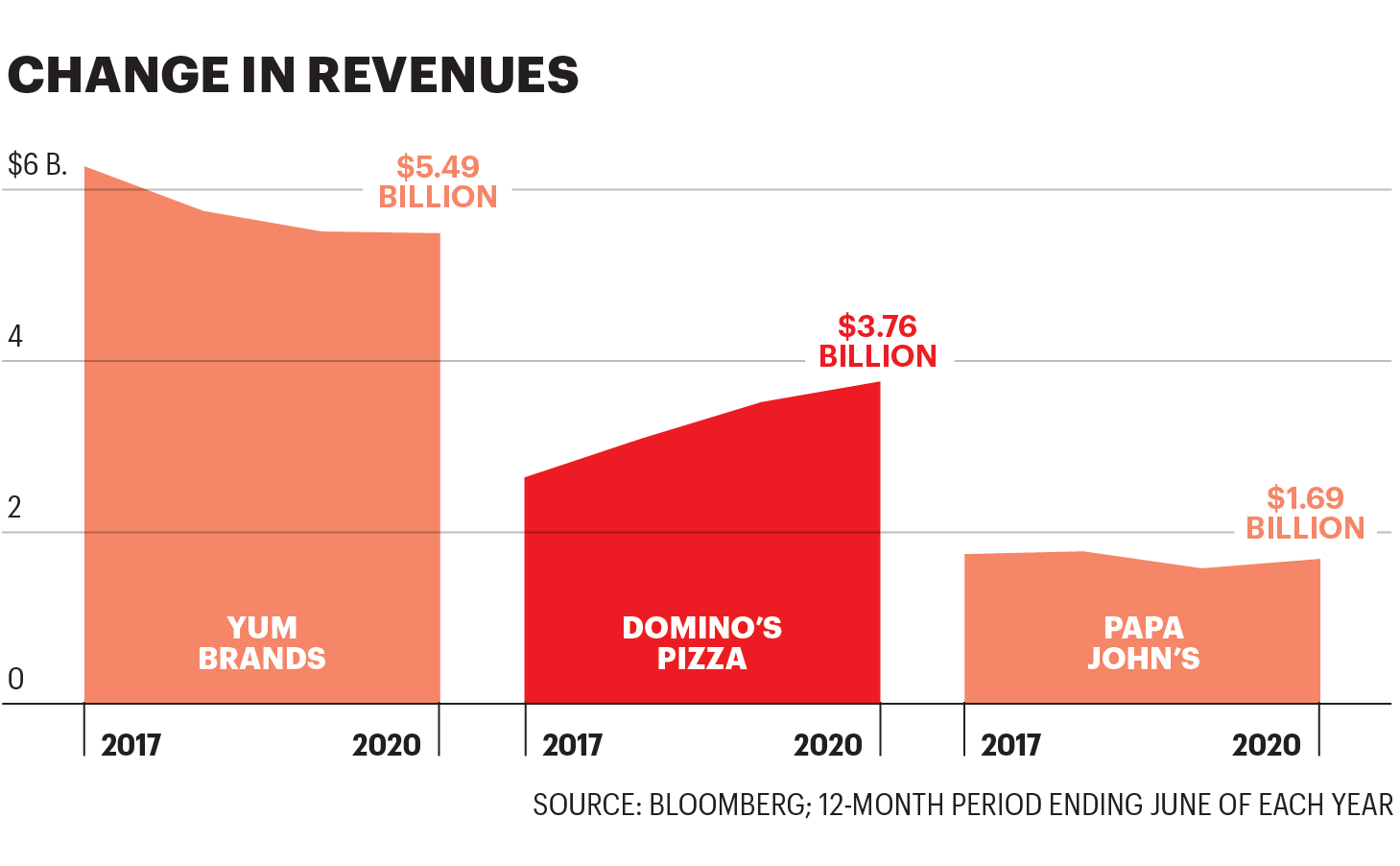

不同比萨店的收入变化。来源:彭博;截至每年6月底的12个月数据

与比萨行业同行一样,最近几个月达美乐销售额猛增。7月,达美乐财报显示,2020年二季度美国同店销售额增长了16%,每股收益从去年同期的2.19美元跃升至2.99美元。尽管国际市场增长放缓,但到2020年上半年达美乐净收入达2.4亿美元,同比增长了30%。

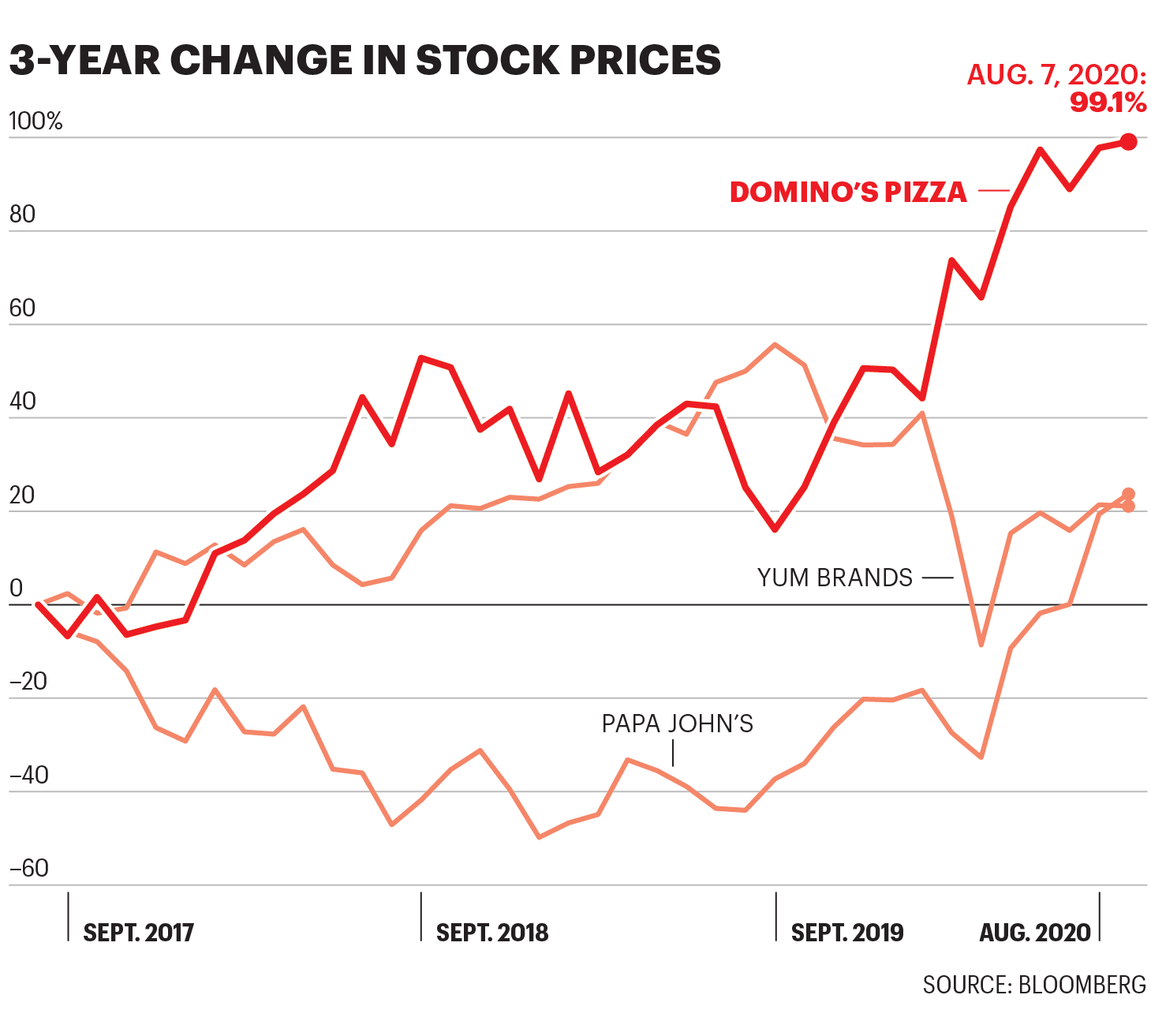

达美乐的股东获得了不错回报。截至8月第一周,2020年其股价上涨了24%。这还是多年回报强劲的基础上。过去三年里,达美乐股价上涨了99%,轻松超过了比萨同行。

分析人士表示,过去几年达美乐致力于创新,准确满足了消费者对意大利香肠和奶酪口味方便食品日益增长的需求。

“过去十年里达美乐的表现超过全行业,主要因为其执行力强大,从规模较小的竞争对手和必胜客手里抢夺了不少份额。”西尔伯曼说。“达美乐的数字和外卖基础设施在业界领先,我们认为这是公司最强大的资产。”

达美乐公司在提升送货能力和重塑公众形象方面的长期投资获得了巨大回报。2010年,达美乐公司的前首席执行官帕特里克·多伊尔从公司国内零售业务总裁升职时,公司股价为每股9美元左右,顾客抱怨说面饼尝起来像硬纸板。酱汁?跟番茄酱一样。于是达美乐努力提高声誉,还在多伊尔领导下改善配送流程。当2018年多伊尔卸职时,达美乐的股价已经涨到250美元以上,市值也增加了惊人的112亿美元。

“看看比萨行业三大巨头,都非常擅长配送,因为比萨外卖模式已经实践数十年。”巴鲁克学院Zicklin商学院的教授李珊(音译)表示。“但达美乐是唯一一家坚持自营配送的公司,并不与第三方(如Seamless或Uber Eats)合作。”

如今,达美乐的技术领先于其他公司。2018年,顾客不一定非要在特定地址就能取餐, 因为达美乐推出热点位置,从海滩到体育场停车场,人们可以在任何地方下单。总部位于安娜堡的达美乐同年还推出了晚餐铃声功能。如果下载了移动应用程序,顾客可以创建朋友和家人群组,订单配送时应用程序会自动“响铃”。

跟竞争对手相比,达美乐送货方式还有另一个根本性区别,由此实现利润最大化。虽然不少必胜客和棒约翰店同样自行配送,但也跟第三方配送服务合作以触达更多顾客。2019年,棒约翰与DoorDash合作,而必胜客则选择了Grubhub。本地比萨连锁店尤其依赖第三方,相比之下,达美乐完全依赖自营配送。

第三方送货服务是可以帮比萨店扩大配送范围,但要付出成本。例如,Uber Eats按照订单金额30%向餐厅收取配送费。因此,小作坊比萨店一方面可能获得更多订单,另一方面利润并不一定能同步增长。很多小餐厅面临维持营业和进店顾客减少的困境,只希望收支平衡。根据金融服务公司BTIG的数据,达美乐连锁店每笔在线订单要支付0.25美元配送成本,小餐厅向第三方配送服务支付的费用为每笔订单2美元或3美元。

佛罗里达州印第安港海滩的尼克森一家就点了不少比萨。两个月前26岁的卡罗琳搬回家跟父母一起住后,每周至少要点三次比萨,而且都是找距离3英里内的餐馆。

“我们压力都很大,所以容易想到点比萨。”卡罗琳·尼克森说。“正常情况下,我们不会点那么多比萨。我们会出门去餐馆吃饭,也会住在不同的地方。”

尼克森原本打算搬到费城找工作,发现机会渺茫之后,她决定搬回家。巴鲁克学院的李珊教授说,随着冠状病毒流行,不少千禧一代被迫回到家,很多家庭也不得不兼顾工作和育儿,于是开始选择更快速成本也更低的比萨。

“从预算方面来看,疫情爆发后很多消费者发现预算减少。”李珊说,她主要点加州比萨厨房(California Pizza Kitchen)的泰式比萨。“从某种意义上说,比萨是很多人以较低成本养家的最佳选择之一。”

随着需求激增,比萨连锁店也要想办法留住新顾客。今年2月,棒约翰推出了新款薄脆三明治Papadias。7月达美乐推出了采用新配方和调料的鸡翅。分析师西尔伯曼表示,比萨公司最赚钱的通常还是比萨。但是,巧妙增加菜单选项,尤其是多提供配菜可以提升平均支出,从而带来更多利润。

虽然专家并不确定疫情催生的比萨热潮能持续多久,但李珊说,很长一段时间内消费者行为都会因为担心疫情而转变。例如,Brick Meets Click和Mercatus的一项调查显示,过去20年网上购物增长都非常缓慢,然而过去几个月里突然出现猛增。李珊说,人们已经适应新的点餐方式,也会坚持使用Instacart等平台的新习惯。

“人们的生活习惯不会一夜之间返回疫情之前。”她说。“我认为消费者行为的转变以及疫情的影响将长期且深远。”

或许,还有比萨的助力。(财富中文网)

译者:Feb

每周一次不做饭点外卖时,布兰迪·约翰逊都守在窗边从红色窗帘缝隙朝外张望,等待最爱的外卖到来。看到送餐员转过拐角把车停到她家公寓前,她赶紧跑上楼看另一扇窗户,确保餐盒放在前门外。

跟疫情隔离期间很多美国人一样,约翰逊也订了很多比萨。

“对我来说,比萨非常完美,不太麻烦,非常方便,冷热都能吃,而且不用餐具。”约翰逊说。“非常时期,比萨是便利又管饱的一顿。”

头部比萨连锁店都因为约翰逊这样的顾客而获利颇丰。举例来说,棒约翰财报显示,今年二季度北美餐厅销售额同比增长28%,连续三个月实现两位数增长,3月至6月间聘请了2万名额外员工,计划再招1万名员工。截至8月初,在经历数年低迷之后,棒约翰的今年股价已经飙升约55%。

过去几年百胜集团旗下的必胜客一直面临销量下滑问题,今年5月初迎来八年来外卖和外带销售业绩最好的一周。对于旗下包括塔可钟和肯德基等品牌的百胜来说,当季全球总销售额下降15%之际,比萨外卖量上升确实是个亮点。

“二季度必胜客的非堂食业务增长了21%。过去几年该业务表现不佳,如今的增长表明有特定的行业因素推动比萨板块股价上涨。”瑞士信贷的分析师劳伦·西尔伯曼表示。

不过,因为美国人胃口大开获利最多的比萨外卖公司还要数达美乐。

达美乐是全球销量最大的比萨公司,在美国市场上占份额最高。据彭博行业研究,去年达美乐占据美国比萨总销量的19%,主要因为在外卖方面的主导地位。2019年达美乐占美国外卖销售额36%,而其他主要连锁店的总和为26%。(区域连锁店和独立餐厅占38%。)

与比萨行业同行一样,最近几个月达美乐销售额猛增。7月,达美乐财报显示,2020年二季度美国同店销售额增长了16%,每股收益从去年同期的2.19美元跃升至2.99美元。尽管国际市场增长放缓,但到2020年上半年达美乐净收入达2.4亿美元,同比增长了30%。

达美乐的股东获得了不错回报。截至8月第一周,2020年其股价上涨了24%。这还是多年回报强劲的基础上。过去三年里,达美乐股价上涨了99%,轻松超过了比萨同行。

分析人士表示,过去几年达美乐致力于创新,准确满足了消费者对意大利香肠和奶酪口味方便食品日益增长的需求。

“过去十年里达美乐的表现超过全行业,主要因为其执行力强大,从规模较小的竞争对手和必胜客手里抢夺了不少份额。”西尔伯曼说。“达美乐的数字和外卖基础设施在业界领先,我们认为这是公司最强大的资产。”

达美乐公司在提升送货能力和重塑公众形象方面的长期投资获得了巨大回报。2010年,达美乐公司的前首席执行官帕特里克·多伊尔从公司国内零售业务总裁升职时,公司股价为每股9美元左右,顾客抱怨说面饼尝起来像硬纸板。酱汁?跟番茄酱一样。于是达美乐努力提高声誉,还在多伊尔领导下改善配送流程。当2018年多伊尔卸职时,达美乐的股价已经涨到250美元以上,市值也增加了惊人的112亿美元。

“看看比萨行业三大巨头,都非常擅长配送,因为比萨外卖模式已经实践数十年。”巴鲁克学院Zicklin商学院的教授李珊(音译)表示。“但达美乐是唯一一家坚持自营配送的公司,并不与第三方(如Seamless或Uber Eats)合作。”

如今,达美乐的技术领先于其他公司。2018年,顾客不一定非要在特定地址就能取餐, 因为达美乐推出热点位置,从海滩到体育场停车场,人们可以在任何地方下单。总部位于安娜堡的达美乐同年还推出了晚餐铃声功能。如果下载了移动应用程序,顾客可以创建朋友和家人群组,订单配送时应用程序会自动“响铃”。

跟竞争对手相比,达美乐送货方式还有另一个根本性区别,由此实现利润最大化。虽然不少必胜客和棒约翰店同样自行配送,但也跟第三方配送服务合作以触达更多顾客。2019年,棒约翰与DoorDash合作,而必胜客则选择了Grubhub。本地比萨连锁店尤其依赖第三方,相比之下,达美乐完全依赖自营配送。

第三方送货服务是可以帮比萨店扩大配送范围,但要付出成本。例如,Uber Eats按照订单金额30%向餐厅收取配送费。因此,小作坊比萨店一方面可能获得更多订单,另一方面利润并不一定能同步增长。很多小餐厅面临维持营业和进店顾客减少的困境,只希望收支平衡。根据金融服务公司BTIG的数据,达美乐连锁店每笔在线订单要支付0.25美元配送成本,小餐厅向第三方配送服务支付的费用为每笔订单2美元或3美元。

佛罗里达州印第安港海滩的尼克森一家就点了不少比萨。两个月前26岁的卡罗琳搬回家跟父母一起住后,每周至少要点三次比萨,而且都是找距离3英里内的餐馆。

“我们压力都很大,所以容易想到点比萨。”卡罗琳·尼克森说。“正常情况下,我们不会点那么多比萨。我们会出门去餐馆吃饭,也会住在不同的地方。”

尼克森原本打算搬到费城找工作,发现机会渺茫之后,她决定搬回家。巴鲁克学院的李珊教授说,随着冠状病毒流行,不少千禧一代被迫回到家,很多家庭也不得不兼顾工作和育儿,于是开始选择更快速成本也更低的比萨。

“从预算方面来看,疫情爆发后很多消费者发现预算减少。”李珊说,她主要点加州比萨厨房(California Pizza Kitchen)的泰式比萨。“从某种意义上说,比萨是很多人以较低成本养家的最佳选择之一。”

随着需求激增,比萨连锁店也要想办法留住新顾客。今年2月,棒约翰推出了新款薄脆三明治Papadias。7月达美乐推出了采用新配方和调料的鸡翅。分析师西尔伯曼表示,比萨公司最赚钱的通常还是比萨。但是,巧妙增加菜单选项,尤其是多提供配菜可以提升平均支出,从而带来更多利润。

虽然专家并不确定疫情催生的比萨热潮能持续多久,但李珊说,很长一段时间内消费者行为都会因为担心疫情而转变。例如,Brick Meets Click和Mercatus的一项调查显示,过去20年网上购物增长都非常缓慢,然而过去几个月里突然出现猛增。李珊说,人们已经适应新的点餐方式,也会坚持使用Instacart等平台的新习惯。

“人们的生活习惯不会一夜之间返回疫情之前。”她说。“我认为消费者行为的转变以及疫情的影响将长期且深远。”

或许,还有比萨的助力。(财富中文网)

译者:Feb

Once a week Brandi Johnson finds herself peeping through her red curtains, on the lookout for her favorite delivery—the one that means she doesn’t have to cook dinner. When the driver pulls around the corner and stops in front of her apartment, she runs upstairs to look out another window, this time to make sure the box is placed outside her front door.

Like many Americans during quarantine, Johnson has been ordering a lot of pizza.

“Pizza is the perfect comfort food for me—not too messy, hard to mess up, good whether it’s hot or cold, and I don’t need silverware,” says Johnson. “It’s just a perfect guaranteed meal to have during such uncertain times.”

Top pizza chains have benefited from the cravings of customers like Johnson. Papa John’s, for instance, reported that sales at its North American restaurants saw a 28% increase in the second quarter compared with the year before, with three straight months of double-digit gains. To keep up with that skyrocketing demand, the company said that it had hired 20,000 additional employees between March and June—and plans on hiring 10,000 more. As of early August, shares of Papa John’s had spiked some 55% this year, after a couple of years of underperforming.

Yum Brands’ Pizza Hut, which has been battling falling sales over the past few years, had its best week for delivery and carry-out sales in eight years in early May. The uptick in pizza delivery was a bright spot for Yum Brands—whose portfolio includes Taco Bell and KFC—in a quarter in which overall sales fell 15% worldwide.

“Pizza Hut’s off-premise business was up 21% in 2Q, and for a business that has underperformed over the last few years, the performance suggests there is a material industry-specific component to the pizza category’s share gains,” says Credit Suisse analyst Lauren Silberman.

But no delivery operator has benefited more from America’s increased appetite than Domino’s Pizza.

The largest pizza company in the world by sales, Domino’s had the biggest slice of the U.S. market coming into the pandemic. According to Bloomberg Intelligence, last year Domino’s captured 19% of total pizza sales in the U.S. thanks to its dominance in delivery. The company gobbled up a whopping 36% of U.S. delivery sales in 2019 versus a combined total of 26% for other major chains. (Regional chains and independent restaurants garnered 38%.)

As with its pizza peers, the company’s sales have spiked in recent months. In July, Domino’s reported that its U.S. same-store sales increased by 16% in the second quarter of 2020 and earnings per share leapt to $2.99 from $2.19 in the same quarter last year. Domino’s generated $240 million in net income through the first half of 2020, a 30% increase over last year, despite slower growth in international markets.

Shareholders of Domino’s have been well rewarded. Through the first week of August, the pizza giant’s stock was up 24% in 2020. And that’s on top of years of strong returns. Over the past three years, Domino’s stock has risen 99%—easily outpacing its pizza peers.

Analysts say that Domino’s was uniquely positioned to meet consumers’ increased demand for pepperoni-and-cheese–topped comfort food thanks to its commitment to innovation over the past several years.

“Domino’s has outperformed the industry over the last decade given its strong execution, which has allowed it to gain share from smaller competitors and Pizza Hut,” Silberman says. “Domino’s has an industry-leading digital and delivery infrastructure, which we view as the most powerful asset it has.”

Domino’s long-term investment in advancing its delivery capabilities and rehabbing its public image has paid off in a big way. When former Domino’s CEO Patrick Doyle was promoted in 2010 from his role as president of the company’s domestic retail operations, the company’s stock was trading at about $9 a share, and customers complained that the crust tasted like cardboard. The sauce? Like ketchup. Domino’s went on a mission to improve its reputation and, under Doyle’s leadership, to perfect delivery. When Doyle stepped down in 2018, Domino’s price per share had risen to more than $250, and its market value had increased by an astonishing $11.2 billion.

“When you consider the three big players in pizza, they are already an expert in delivery because the pizza industry has been using this model for decades,” says Shan Li, a professor at the Zicklin School of Business at Baruch College. “But Domino’s is the only one to rely on their own capabilities to deliver food to customers instead of working with a third party [such as Seamless or Uber Eats].”

Today, Domino’s technology leads the pack. Customers don’t have to be at a specific address to get their favorite pie—Domino’s rolled out hotspot locations in 2018, which allows people to get their pizza anywhere, from the beach to a stadium parking lot. The Ann Arbor–based company also introduced the dinner bell function in 2018. Using the mobile app, customers can create groups of their friends and family and the app will automatically “ring the bell” when their order is out for delivery.

There is another fundamental difference in how Domino’s does delivery compared to its rivals—one that allows it to maximize profits. While many Pizza Hut and Papa John’s stores deliver their pizzas directly to customers, those chains have also paired up with third-party delivery services in order to reach more customers. In 2019, Papa John’s partnered with DoorDash, while Pizza Hut has a similar arrangement with Grubhub. Local pizza chains are especially reliant on third-party operators. By contrast, Domino’s relies solely on its own delivery infrastructure.

Third-party delivery services allow local pizza places to scale up their delivery volume, but it comes at a cost. Uber Eats, for example, charges restaurants a fee equal to 30% of the order to deliver to their customers. So although mom-and-pop pizzerias may be getting more orders, that doesn’t always lead to a profit increase; with the costs of staying open and few dine-in customers, many small businesses are just hoping to break even. According to financial services firm BTIG, while Domino’s franchisees pay $0.25 per online sale, small businesses are charged $2 or $3 for a similar transaction by third-party operators.

The Nickerson family in Indian Harbour Beach, Fla., has been doing its part to keep their local pizza places busy. Since Caroline, 26, moved back home with her parents two months ago, they’ve been ordering pizza at least three times a week, all from restaurants within a three-mile radius of their home.

“I think we’re all stressed, so it’s also the first thing we think of,” Caroline Nickerson says. “Under normal circumstances, we wouldn’t be ordering so much pizza. We’d go out to eat at different restaurants, and we’d be living in separate houses.”

Nickerson planned to move to Philadelphia for a job, but when the opportunity went remote, she decided to move home. As the coronavirus pandemic drives millennials back home and forces families to juggle work and childcare, many households are turning to pizza for a quick, low-cost option, says Li, the Baruch College professor.

“From the budget perspective, many consumers have found themselves with smaller budget constraints due to the pandemic,” says Li, whose go-to order is California Pizza Kitchen’s Thai pizza. “To some extent, pizza is just one of the best options for many of us to feed a family at a lower cost.”

Riding the spike in demand, pizza chains must now find a way to keep these new customers. Papa John’s answered with its new flatbread sandwich, the Papadias, in February. And Domino’s rolled out a new recipe and sauces for chicken wings in July. Typically the most profitable menu item for a pizza company is still pizza, analyst Silberman says. But smart menu additions and sides, in particular, can help increase the average check and lead to more profit.

While experts don’t know how long the pandemic pizza boom will last, Li says consumer behavior will be altered by pandemic concerns for a long time. For instance, online grocery shopping, which has grown very slowly over the past 20 years, suddenly experienced huge growth over the past few months, according to a survey conducted by Brick Meets Click and Mercatus. People have adjusted to the new ease of ordering, Li says, and will stick to their new habits of using platforms like Instacart.

“People will not go back to their pre-COVID lives overnight,” she says. “I think this shift in consumer behavior and the impact of the pandemic is going be long-lasting and profound.”

And, perhaps, pizza-fueled.