科技巨头往往在不起眼的地方慢慢地绽放光芒。谷歌在一个车库中悄然成长,Facebook起步于一间大学宿舍,亚马逊则是在一辆行驶在美国各地的汽车中成长起来的。风投家对这些科技初创公司的投资通常都显得微不足道,因为他们深知这些钱随时可能化为乌有。

然而,当其中两家巨头(Facebook和谷歌)斥资数十亿美元支持第三家巨头(亚马逊)的新兴竞争对手时,我们几乎可以宣告一个全新的科技巨头横空出世。Jio Platforms是一家成立仅四年的移动电话公司,由印度首富穆克什·安巴尼掌控。在短短的几个月内,它以令人惊叹的速度吸引到巨额投资。是的,就在世界其他地方疲于应对新冠疫情之际,Jio 突然有希望成为第一个在印度起步的全球科技巨头。

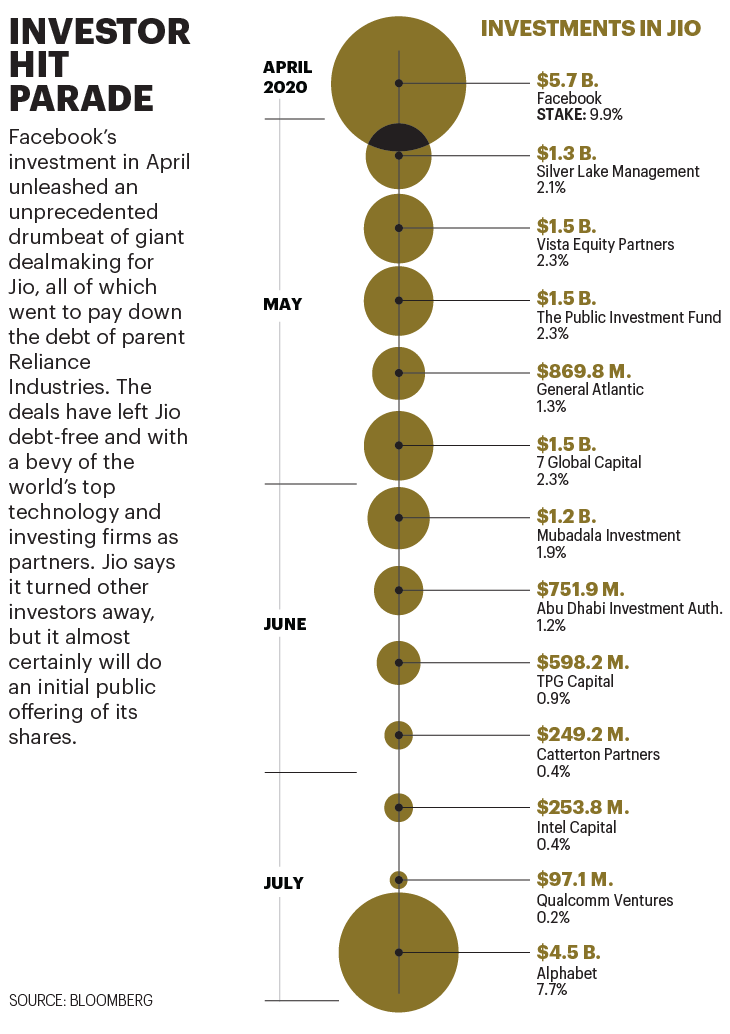

这场股权抢购战肇始于今年4月。彼时,Facebook与Jio达成协议,斥资57亿美元收购该公司9.9%的股份。随后,一批重量级投资者开始竞相抢购这家由安巴尼的家族企业、石化巨头信实工业控制的公司的股份。5月,美国私募股权巨头银湖资本、Vista Equity Partners、General Atlantic和KKR集团总计向Jio投资了近50亿美元。6月,在向美国芯片制造商英特尔和高通出售了部分股权之后,Jio与谷歌达成了一笔以45亿美元收购7.7%股份的协议。此外,作为Jio的资本靠山,信实工业还通过配股筹集了近70亿美元。

到7月中旬,Jio已经积聚了200多亿美元,使得信实工业和Jio实现零负债,并为这家移动分支的最终IPO铺平了道路。更重要的是,通过将Jio打造成为一家老牌能源公司的高增长分支,安巴尼巩固了自己作为全球顶级商业巨头的无上地位。原本就是亚洲首富的安巴尼,现在是地球上最富有的五个人之一。(他那栋坐落于孟买的27层豪宅拥有一个可容纳168辆轿车的车库,9部电梯,还有一个配备人造雪的房间——在这个酷热难耐的热带地区,如此别具心裁的奢华设施着实令人艳羡。)如果他对Jio抱有的厚望成为现实,Jio将跻身全球电子商务巨头之列,成为与中国的阿里巴巴和腾讯等量齐观的“超级APP”。

要想实现这一目标,Jio就必须携手它的众多非印度合作伙伴,与沃尔玛和亚马逊这两家在印度零售业投入巨资的美国巨头展开一场全面战争。这场战争的终极奖赏就是一个理应跻身国际商业第一梯队的超级市场——但直到现在,印度仍然让许多寻求在这个市场有所斩获的人深感失望。“印度不再是一个区域性参与者。”出生于印度的Jio Platforms总裁、前美国电信业高管马修·乌曼这样说道。在他看来,这就是投资者争相涌入的原因所在。尽管Jio资历尚浅,但这家科技新贵如今可以在一群急切的追求者中精心挑选符合其心意的投资者。乌曼透露说,Jio的首要标准是合作者必须把印度的利益放在心上。“我们拒绝的投资者之多可能会让你感到惊讶。”他说。

双胞胎的抱怨

如果不是安巴尼膝下一对十几岁的双胞胎不断抱怨——互联网太慢,无法充分运行其他孩子每天都上的那些网站(任何一位父母可能都听过类似的抱怨)——Jio的非凡筹款季可能永远不会发生。安巴尼从父亲那里继承了信实工业。在他的领导下,这家总部位于孟买的炼油和石化公司相继涉足超市、加油站和数以千计的便利店。信实工业也在海外选购资产,最近还收购了英国玩具零售商Hamleys。现年63岁的安巴尼早在2000年代就极其富有。但他的投资组合中缺少一个关键领域:电信。他的女儿伊莎和儿子阿卡什对此再清楚不过,因为他们受够了印度令人抓狂的2G网络,尽管他们是含着金汤匙出生的。“从小到大,他们经常向许多人——特别是向他们的父亲——表达无法使用移动数据的沮丧感。”Jio总裁乌曼说,“伊莎对她的老爸很有影响力,让他相信这是一个很大的机会。”

很少有人意识到这个机会到底有多大。被一对双胞胎说服后(也可能是架不住他们死缠硬磨),安巴尼在2010年收购了一家濒临倒闭的电话公司,由此获得印度部分无线频谱的使用权。那时候,数亿印度人还从未使用过手机,更不用说上网了。安巴尼投入了约350亿美元铺设光纤线路,并在广袤国土的每个角落架设了约20万个塔台,以提供现代4G网络服务。新公司的名字Jio朗朗上口,看起来有点像倒过来拼写的“石油”(oil)。这个非常贴切的笑话在公司内部广为流传。忆往昔,化石燃料让安巴尼发了财。现在,这位亿万富翁得出结论,他可以将巨额财富的增值前景寄托在数据身上。

Jio的发展轨迹令人瞠目结舌。当它在2016年9月推出时,在拥有超过13亿人口的印度,只有大约2,800万人拥有智能手机。在随后的18个月中,有1亿人成为Jio无线网络的签约用户。到今年7月底,其用户总数已经接近4亿人。这家新晋运营商的制胜诀窍是廉价数据。在Jio问世之前,移动数据的价格为每千兆字节4.5美元,对于这个人均年收入只有5,760美元的国家来说,如此高的价位显然难以承受。而Jio给出的价格仅为每千兆字节15美分,而且语音通话免费。这不可避免地引发了一场价格战,而沃达丰和巴蒂电信(Bharti Airtel)等老牌运营商注定是无法赢得这场比拼财力的战争的。

在提供免费通话和廉价数据服务两年后,Jio推出了一款售价20美元的安卓手机——Jio Phone不仅搭载YouTube等谷歌热门应用程序,还提供免费流量套餐。这款产品点燃了印度人的上网热情,他们消费的数据量几乎相当于所有美洲人之和。这不仅是印度人的福音,也是全球科技巨头的利好消息。Facebook旗下即时通信应用程序WhatsApp目前运行所有23种印度官方语言,拥有4亿用户,印度也由此成为这款应用程序的最大市场。在这个文盲现象非常普遍的国家,谷歌的YouTube成为许多人的默认搜索引擎。对于许多上网费用居高不下的新兴经济体来说,印度的案例充分表明,廉价数据能够对商业、教育和农村发展起到立竿见影的加速作用。“宽带连接呈现井喷式增长。”印度科技分析网站MediaNama的创始人兼总编辑尼希尔·帕瓦说,安巴尼是一位“有远大梦想的人”。

攀登移动高峰

在Jio横空出世之前,数亿印度人从未使用过互联网。廉价的手机流量套餐和快速的网络连接向这个国家展示了互联网的无穷魅力。

Jio营收在2020年为90亿美元;订户数量在2020年为3.875亿。数据来源:Jio Platforms

安巴尼的宏大梦想远非电信业所能满足。Jio迅速取代了它在手机领域的竞争对手,但它在移动支付和电子商务等互联网领域仍然缺乏存在感。“我们看到的只是一个庞大机遇的一小部分。”乌曼说。

要想抓住这些机会,Jio需要全球合作伙伴,这就形成了一个良性的投资循环。投资者获得了一家快速增长的公司的股份,而这家公司的核心业务带来了滚滚现金流。信实工业能够在既定的时间表之前清理资产负债表。Jio获得了全球最精明的科技盟友。银湖资本(Silver Lake)的联合首席执行官埃贡·德班引领这家科技投资公司斥巨资入股Jio。“安巴尼在Jio身上投下重注。”他说,“Jio是隐藏在众目睽睽之下的全球最大的私人科技公司。”

数字生活方式

开车离开庞大的孟买市区,穿过横跨阿拉伯海的大桥,来到新孟买这个安静的远郊地区,最终到达占地550英亩(约合2.22平方公里),绿树成荫的信实工业总部园区。围绕新旧办公楼群铺设的人行道错落有致,连接着网球场、足球场、一个板球场,以及篮球、排球、羽毛球场和一个提供完善服务的健身房等运动设施。Jio就坐落于这个犹如乡村田园的公司园区的中心地段。办公大楼的蓝色玻璃幕墙遮挡住了炙热的阳光,一道道柔和的阴影慵懒地洒在颇具格调的办公室内。

附近坐落着Jio体验中心。这栋建筑以柔和的粉色和紫色为主色调,它体现的是该公司对未来的愿景。在这幅愿景中,Jio并非一家移动电话运营商,而是一家“数字生活方式公司”。正如一位员工所言,这是一家嵌入印度人日常习惯的企业。跃入眼帘的产品包括Jio流媒体电视——用户可通过语音指令要求机顶盒播放宝莱坞热播剧,以及备受印度人追捧的板球比赛。“我们从一开始就把Jio定位为一个提供数字服务的平台。”乌曼说。他此前在美国移动运营商Sprint担任首席技术官,随后于2011年回国加入信实工业。“这绝不是事后的想法。”

也许不是。但直到今年早些时候,Jio仍然没有为其庞大的移动用户群提供一系列其他付费服务。在它构想的“数字生活方式”服务方面,Jio也远远落后于竞争对手。2012年,亚马逊开始在印度投入数十亿美元。2018年,就在Jio赠送手机的同时,沃尔玛强势入驻印度,以160亿美元的价格收购了本土在线购物公司Flipkart的控制权。

为了在加强产品竞争力的同时继续增长,Jio开始将目光投向国外,这样做的额外好处是有助于清理资产负债表。外部投资者一直渴望携手一位深谙印度营商之道的合作伙伴,共同开发这个潜力无限的市场。Facebook对Jio的投资是印度有史以来最大的一笔外国科技投资,也是Facebook自2014年斥资140亿美元收购WhatsApp以来最大的一笔投资。Jio的一大吸引力是它能够游刃有余地应对犹如迷宫般的印度监管法规,而这正是一直困扰亚马逊的地方。今年1月,就在亚马逊首席执行官杰夫·贝佐斯飞抵新德里,向这家电商巨头的印度分公司追加投资10亿美元的前一天,印度政府宣布该公司和沃尔玛控股的Flipkart正在接受反垄断调查。而深谙新德里权力运作的Jio几乎没有遇到过这种问题。“有证据表明,他们能够很好地执行既能解决规模问题又可以解决复杂性问题的举措,而这在任何国家都是很难做好的。”Facebook的印度业务主管阿吉特·莫汉感慨道。

安巴尼和扎克伯格几乎将他们的合作视为一种爱国行为,称这对保护数以百万计的小型社区商店(当地人称之为“柑仔店”)至关重要。数十年来,这些小杂货店一直是印度商业的支柱,但随着网络购物的兴起,它们的未来显得岌岌可危。安巴尼在他的豪宅发表YouTube讲话时指出,他和扎克伯格怀抱着“为所有印度人服务 ”的共同目标,WhatsApp已经与印度人建立了 “亲密关系”,而这种合作也跟印度总理纳伦德拉·莫迪设定的国家数字战略高度契合。

投资者接踵而至

Facebook在4月的投资引发了一场前所未有的Jio股份抢购潮。所有这些巨额投资都用于偿还母公司信实工业的债务。这些交易让Jio实现了零负债,并与一群世界顶级科技和投资公司成为合作伙伴。Jio透露称,它拒绝了很多投资者,但这家公司几乎肯定会进行首次公开募股。

根据该协议,Jio今年6月推出的电子商务网站JioMart将与WhatsApp链接,后者将首次包括一个在线支付选项。这个想法是,JioMart将帮助4,000万家社区商店完成订单支付,而这些遍布印度大街小巷的杂货店将通过结合它们的商品目录和配送服务,提供更加广泛的商品。亚马逊和沃尔玛正在对这些夫妻店构成致命威胁,这让Jio有机会扮演民族救世主的角色。“传统电子商务巨头正在淘汰这些杂货店。”乌曼说。在他看来,JioMart-WhatsApp的典型客户是他84岁的老母亲,她住在印度南部的喀拉拉邦。“我妈妈对在线购物懵懵懂懂。”他说,“但她认识街上那位为她配送大部分物品的人。”

Facebook也可以将它与Jio的合作作为其进军全球市场的原型模式。与之类似,谷歌首先在印度推出在线支付系统,然后将该应用程序扩展到美国和其他地区。谷歌表示,他们正在为Jio手机开发一款低成本的安卓操作系统。同样,这家科技巨头试图在印度测试这款原型系统,并计划将其推广到世界其他地区。在4月签署投资协议后,扎克伯格明确表示Facebook也有类似的设计。

Jio巨大的营收增长前景点燃了疯狂的交易热潮,投资者(几乎是清一色的美国人)竞相抢购该公司的股权。亚马逊的前高管迭戈·皮亚坎蒂尼表示:“这些公司逐渐意识到,印度是一个独特的市场。”皮亚坎蒂尼正是亚马逊此前斥资数十亿美元进军印度的操盘手,他目前担任KKR集团的顾问,但并未参与这家私募股权公司对Jio的投资。“投资者的态度是,‘宁可为错误的投资而后悔,也不要为错过一个巨大的机会而抱憾终生。’”他说。

事实上,与Facebook合作开展电商业务的潜力让Jio有机会成为搅局者。“信实工业或许能够像它此前改变印度电信业格局那样,颠覆印度的电子商务领域。”ASA Capital的印度消费业务分析师普拉纳夫·巴夫萨尔在接受印度记者采访时表示。西方投资者“正在为Jio有望改变印度零售景观的前景买单。”他说。

印度解决方案

事实证明,Jio非常善于构筑庞大的订户群,但这并不足以保证它也能够在提供新服务方面取得成功。例如,在新冠疫情肆虐的大背景下,Jio开始在5万个家庭测试其光纤服务。但在多条战线上,这家公司还需要努力追赶西方竞争对手。沃尔玛和亚马逊已经在印度拥有数百万客户。而作为Jio的新投资者,谷歌早在2017年9月就在印度推出在线支付系统。“在支付领域,谷歌支付对Facebook有着明显的领先优势。”MediaNama的总编辑帕瓦说,“我对他们的竞争力持怀疑态度。”

还有其他问题。这些问题有时会让扎克伯格质疑他的57亿美元投资是否明智。其中最重要的一点是在这个拥有多种语言和宗教的国家运营业务的极端复杂性。印度政府的监管法规严重偏向于本地企业。被问及西方科技投资者在印度面临哪些挑战时,皮亚坎蒂尼回答称,“我不知道你为这次采访安排了多少时间。”他举例说,印度28个邦执行不同的贸易法规,这使得在线商务变得错综复杂。“在印度,你做的是长线投资。这个长线意味着30年,而不是5年。”他说,“你需要大量资金和优秀人才。执行商业计划的难度之大远超你的想象。”

尽管如此,印度市场的未来仍然非常可期,而这也是信实工业关注的焦点所在。就像WhatsApp支付系统可能会迅速扩展到世界其他地区一样,Jio最终也可能以印度本土作为跳板,构筑起一个有可能复制到其他国家的服务平台。这将助推Jio和信实工业迅速跻身全球公司之列。乌曼表示,他相信就连美国和欧洲的部分地区也可能成为Jio的潜在市场。“我们不排除选择恰当的时机进军全球市场。”他说。市场观察人士预计Jio将在不远的将来进行IPO,但乌曼透露称,该公司“尚未正式商议”上市时间表。但他随即指出,“这种可能性是存在的。”

按照Jio的经典风格,这些计划可能会迅速展开,而且规模巨大,从而有望助力Jio成为下一个大型科技公司,同时让它成为第一个在印度起步的全球科技巨头。安巴尼在7月告诉股东,Jio计划明年在印度推出自己的5G技术,并将涉足大数据、机器学习、区块链和医疗保健等领域。他说,所有这些产品都会很容易出口到世界各地的市场。“每一个在印度获得验证的解决方案,都有可能成为全球性解决方案。”而安巴尼的美国投资者必然会追随他的前行脚步。

竞逐印度市场

西方投资者现在已经与Jio Platforms结为盟友,或与之对抗。三大科技和软件公司是这家公司的合作伙伴;美国两大零售商是它的劲敌。

今年4月,首席执行官马克·扎克伯格斥资57亿美元入股Jio Platforms,由此引发了西方公司对这家科技新贵的投资浪潮。Facebook旗下的即时通讯应用程序WhatsApp在印度很受欢迎,并且拥有比Jio用户收入更高的客户群体。

谷歌

7月,谷歌及其母公司Alphabet的首席执行官桑达尔·皮查伊通过视频现身信实工业年会,宣布对Jio投资45亿美元。谷歌一直密切关注尚未开发的印度市场,并将Jio视为规避印度错综复杂的政府监管风险的一条捷径。

微软

Jio与这家软件巨头的合作项目,正是微软首席执行官萨蒂亚·纳德拉任期内的最高成就——Azure云计算业务。两家公司成立了一家合资企业,在印度销售云服务。

亚马逊

亚马逊首席执行官杰夫·贝佐斯对印度市场抱有厚望,已经投资了数十亿美元。JioMart与WhatsApp的联姻对这家总部西雅图的电子商务巨头构成了威胁。

沃尔玛

沃尔玛的首席执行官董明伦在印度押下重注,收购了当地电子商务领军企业Flipkart的控股权。但这家零售巨头一直受制于严重偏向本土零售商的政府监管法规。(财富中文网)

本文另一版本刊载于《财富》杂志2020年8/9月刊,标题为《Jio能否成为下一个科技巨头?》

译者:任文科

科技巨头往往在不起眼的地方慢慢地绽放光芒。谷歌在一个车库中悄然成长,Facebook起步于一间大学宿舍,亚马逊则是在一辆行驶在美国各地的汽车中成长起来的。风投家对这些科技初创公司的投资通常都显得微不足道,因为他们深知这些钱随时可能化为乌有。

然而,当其中两家巨头(Facebook和谷歌)斥资数十亿美元支持第三家巨头(亚马逊)的新兴竞争对手时,我们几乎可以宣告一个全新的科技巨头横空出世。Jio Platforms是一家成立仅四年的移动电话公司,由印度首富穆克什·安巴尼掌控。在短短的几个月内,它以令人惊叹的速度吸引到巨额投资。是的,就在世界其他地方疲于应对新冠疫情之际,Jio 突然有希望成为第一个在印度起步的全球科技巨头。

这场股权抢购战肇始于今年4月。彼时,Facebook与Jio达成协议,斥资57亿美元收购该公司9.9%的股份。随后,一批重量级投资者开始竞相抢购这家由安巴尼的家族企业、石化巨头信实工业控制的公司的股份。5月,美国私募股权巨头银湖资本、Vista Equity Partners、General Atlantic和KKR集团总计向Jio投资了近50亿美元。6月,在向美国芯片制造商英特尔和高通出售了部分股权之后,Jio与谷歌达成了一笔以45亿美元收购7.7%股份的协议。此外,作为Jio的资本靠山,信实工业还通过配股筹集了近70亿美元。

到7月中旬,Jio已经积聚了200多亿美元,使得信实工业和Jio实现零负债,并为这家移动分支的最终IPO铺平了道路。更重要的是,通过将Jio打造成为一家老牌能源公司的高增长分支,安巴尼巩固了自己作为全球顶级商业巨头的无上地位。原本就是亚洲首富的安巴尼,现在是地球上最富有的五个人之一。(他那栋坐落于孟买的27层豪宅拥有一个可容纳168辆轿车的车库,9部电梯,还有一个配备人造雪的房间——在这个酷热难耐的热带地区,如此别具心裁的奢华设施着实令人艳羡。)如果他对Jio抱有的厚望成为现实,Jio将跻身全球电子商务巨头之列,成为与中国的阿里巴巴和腾讯等量齐观的“超级APP”。

要想实现这一目标,Jio就必须携手它的众多非印度合作伙伴,与沃尔玛和亚马逊这两家在印度零售业投入巨资的美国巨头展开一场全面战争。这场战争的终极奖赏就是一个理应跻身国际商业第一梯队的超级市场——但直到现在,印度仍然让许多寻求在这个市场有所斩获的人深感失望。“印度不再是一个区域性参与者。”出生于印度的Jio Platforms总裁、前美国电信业高管马修·乌曼这样说道。在他看来,这就是投资者争相涌入的原因所在。尽管Jio资历尚浅,但这家科技新贵如今可以在一群急切的追求者中精心挑选符合其心意的投资者。乌曼透露说,Jio的首要标准是合作者必须把印度的利益放在心上。“我们拒绝的投资者之多可能会让你感到惊讶。”他说。

双胞胎的抱怨

如果不是安巴尼膝下一对十几岁的双胞胎不断抱怨——互联网太慢,无法充分运行其他孩子每天都上的那些网站(任何一位父母可能都听过类似的抱怨)——Jio的非凡筹款季可能永远不会发生。安巴尼从父亲那里继承了信实工业。在他的领导下,这家总部位于孟买的炼油和石化公司相继涉足超市、加油站和数以千计的便利店。信实工业也在海外选购资产,最近还收购了英国玩具零售商Hamleys。现年63岁的安巴尼早在2000年代就极其富有。但他的投资组合中缺少一个关键领域:电信。他的女儿伊莎和儿子阿卡什对此再清楚不过,因为他们受够了印度令人抓狂的2G网络,尽管他们是含着金汤匙出生的。“从小到大,他们经常向许多人——特别是向他们的父亲——表达无法使用移动数据的沮丧感。”Jio总裁乌曼说,“伊莎对她的老爸很有影响力,让他相信这是一个很大的机会。”

很少有人意识到这个机会到底有多大。被一对双胞胎说服后(也可能是架不住他们死缠硬磨),安巴尼在2010年收购了一家濒临倒闭的电话公司,由此获得印度部分无线频谱的使用权。那时候,数亿印度人还从未使用过手机,更不用说上网了。安巴尼投入了约350亿美元铺设光纤线路,并在广袤国土的每个角落架设了约20万个塔台,以提供现代4G网络服务。新公司的名字Jio朗朗上口,看起来有点像倒过来拼写的“石油”(oil)。这个非常贴切的笑话在公司内部广为流传。忆往昔,化石燃料让安巴尼发了财。现在,这位亿万富翁得出结论,他可以将巨额财富的增值前景寄托在数据身上。

Jio的发展轨迹令人瞠目结舌。当它在2016年9月推出时,在拥有超过13亿人口的印度,只有大约2,800万人拥有智能手机。在随后的18个月中,有1亿人成为Jio无线网络的签约用户。到今年7月底,其用户总数已经接近4亿人。这家新晋运营商的制胜诀窍是廉价数据。在Jio问世之前,移动数据的价格为每千兆字节4.5美元,对于这个人均年收入只有5,760美元的国家来说,如此高的价位显然难以承受。而Jio给出的价格仅为每千兆字节15美分,而且语音通话免费。这不可避免地引发了一场价格战,而沃达丰和巴蒂电信(Bharti Airtel)等老牌运营商注定是无法赢得这场比拼财力的战争的。

在提供免费通话和廉价数据服务两年后,Jio推出了一款售价20美元的安卓手机——Jio Phone不仅搭载YouTube等谷歌热门应用程序,还提供免费流量套餐。这款产品点燃了印度人的上网热情,他们消费的数据量几乎相当于所有美洲人之和。这不仅是印度人的福音,也是全球科技巨头的利好消息。Facebook旗下即时通信应用程序WhatsApp目前运行所有23种印度官方语言,拥有4亿用户,印度也由此成为这款应用程序的最大市场。在这个文盲现象非常普遍的国家,谷歌的YouTube成为许多人的默认搜索引擎。对于许多上网费用居高不下的新兴经济体来说,印度的案例充分表明,廉价数据能够对商业、教育和农村发展起到立竿见影的加速作用。“宽带连接呈现井喷式增长。”印度科技分析网站MediaNama的创始人兼总编辑尼希尔·帕瓦说,安巴尼是一位“有远大梦想的人”。

攀登移动高峰

在Jio横空出世之前,数亿印度人从未使用过互联网。廉价的手机流量套餐和快速的网络连接向这个国家展示了互联网的无穷魅力。

Jio营收在2020年为90亿美元;订户数量在2020年为3.875亿。数据来源:Jio Platforms

安巴尼的宏大梦想远非电信业所能满足。Jio迅速取代了它在手机领域的竞争对手,但它在移动支付和电子商务等互联网领域仍然缺乏存在感。“我们看到的只是一个庞大机遇的一小部分。”乌曼说。

要想抓住这些机会,Jio需要全球合作伙伴,这就形成了一个良性的投资循环。投资者获得了一家快速增长的公司的股份,而这家公司的核心业务带来了滚滚现金流。信实工业能够在既定的时间表之前清理资产负债表。Jio获得了全球最精明的科技盟友。银湖资本(Silver Lake)的联合首席执行官埃贡·德班引领这家科技投资公司斥巨资入股Jio。“安巴尼在Jio身上投下重注。”他说,“Jio是隐藏在众目睽睽之下的全球最大的私人科技公司。”

数字生活方式

开车离开庞大的孟买市区,穿过横跨阿拉伯海的大桥,来到新孟买这个安静的远郊地区,最终到达占地550英亩(约合2.22平方公里),绿树成荫的信实工业总部园区。围绕新旧办公楼群铺设的人行道错落有致,连接着网球场、足球场、一个板球场,以及篮球、排球、羽毛球场和一个提供完善服务的健身房等运动设施。Jio就坐落于这个犹如乡村田园的公司园区的中心地段。办公大楼的蓝色玻璃幕墙遮挡住了炙热的阳光,一道道柔和的阴影慵懒地洒在颇具格调的办公室内。

附近坐落着Jio体验中心。这栋建筑以柔和的粉色和紫色为主色调,它体现的是该公司对未来的愿景。在这幅愿景中,Jio并非一家移动电话运营商,而是一家“数字生活方式公司”。正如一位员工所言,这是一家嵌入印度人日常习惯的企业。跃入眼帘的产品包括Jio流媒体电视——用户可通过语音指令要求机顶盒播放宝莱坞热播剧,以及备受印度人追捧的板球比赛。“我们从一开始就把Jio定位为一个提供数字服务的平台。”乌曼说。他此前在美国移动运营商Sprint担任首席技术官,随后于2011年回国加入信实工业。“这绝不是事后的想法。”

也许不是。但直到今年早些时候,Jio仍然没有为其庞大的移动用户群提供一系列其他付费服务。在它构想的“数字生活方式”服务方面,Jio也远远落后于竞争对手。2012年,亚马逊开始在印度投入数十亿美元。2018年,就在Jio赠送手机的同时,沃尔玛强势入驻印度,以160亿美元的价格收购了本土在线购物公司Flipkart的控制权。

为了在加强产品竞争力的同时继续增长,Jio开始将目光投向国外,这样做的额外好处是有助于清理资产负债表。外部投资者一直渴望携手一位深谙印度营商之道的合作伙伴,共同开发这个潜力无限的市场。Facebook对Jio的投资是印度有史以来最大的一笔外国科技投资,也是Facebook自2014年斥资140亿美元收购WhatsApp以来最大的一笔投资。Jio的一大吸引力是它能够游刃有余地应对犹如迷宫般的印度监管法规,而这正是一直困扰亚马逊的地方。今年1月,就在亚马逊首席执行官杰夫·贝佐斯飞抵新德里,向这家电商巨头的印度分公司追加投资10亿美元的前一天,印度政府宣布该公司和沃尔玛控股的Flipkart正在接受反垄断调查。而深谙新德里权力运作的Jio几乎没有遇到过这种问题。“有证据表明,他们能够很好地执行既能解决规模问题又可以解决复杂性问题的举措,而这在任何国家都是很难做好的。”Facebook的印度业务主管阿吉特·莫汉感慨道。

安巴尼和扎克伯格几乎将他们的合作视为一种爱国行为,称这对保护数以百万计的小型社区商店(当地人称之为“柑仔店”)至关重要。数十年来,这些小杂货店一直是印度商业的支柱,但随着网络购物的兴起,它们的未来显得岌岌可危。安巴尼在他的豪宅发表YouTube讲话时指出,他和扎克伯格怀抱着“为所有印度人服务 ”的共同目标,WhatsApp已经与印度人建立了 “亲密关系”,而这种合作也跟印度总理纳伦德拉·莫迪设定的国家数字战略高度契合。

投资者接踵而至

Facebook在4月的投资引发了一场前所未有的Jio股份抢购潮。所有这些巨额投资都用于偿还母公司信实工业的债务。这些交易让Jio实现了零负债,并与一群世界顶级科技和投资公司成为合作伙伴。Jio透露称,它拒绝了很多投资者,但这家公司几乎肯定会进行首次公开募股。

根据该协议,Jio今年6月推出的电子商务网站JioMart将与WhatsApp链接,后者将首次包括一个在线支付选项。这个想法是,JioMart将帮助4,000万家社区商店完成订单支付,而这些遍布印度大街小巷的杂货店将通过结合它们的商品目录和配送服务,提供更加广泛的商品。亚马逊和沃尔玛正在对这些夫妻店构成致命威胁,这让Jio有机会扮演民族救世主的角色。“传统电子商务巨头正在淘汰这些杂货店。”乌曼说。在他看来,JioMart-WhatsApp的典型客户是他84岁的老母亲,她住在印度南部的喀拉拉邦。“我妈妈对在线购物懵懵懂懂。”他说,“但她认识街上那位为她配送大部分物品的人。”

Facebook也可以将它与Jio的合作作为其进军全球市场的原型模式。与之类似,谷歌首先在印度推出在线支付系统,然后将该应用程序扩展到美国和其他地区。谷歌表示,他们正在为Jio手机开发一款低成本的安卓操作系统。同样,这家科技巨头试图在印度测试这款原型系统,并计划将其推广到世界其他地区。在4月签署投资协议后,扎克伯格明确表示Facebook也有类似的设计。

Jio巨大的营收增长前景点燃了疯狂的交易热潮,投资者(几乎是清一色的美国人)竞相抢购该公司的股权。亚马逊的前高管迭戈·皮亚坎蒂尼表示:“这些公司逐渐意识到,印度是一个独特的市场。”皮亚坎蒂尼正是亚马逊此前斥资数十亿美元进军印度的操盘手,他目前担任KKR集团的顾问,但并未参与这家私募股权公司对Jio的投资。“投资者的态度是,‘宁可为错误的投资而后悔,也不要为错过一个巨大的机会而抱憾终生。’”他说。

事实上,与Facebook合作开展电商业务的潜力让Jio有机会成为搅局者。“信实工业或许能够像它此前改变印度电信业格局那样,颠覆印度的电子商务领域。”ASA Capital的印度消费业务分析师普拉纳夫·巴夫萨尔在接受印度记者采访时表示。西方投资者“正在为Jio有望改变印度零售景观的前景买单。”他说。

印度解决方案

事实证明,Jio非常善于构筑庞大的订户群,但这并不足以保证它也能够在提供新服务方面取得成功。例如,在新冠疫情肆虐的大背景下,Jio开始在5万个家庭测试其光纤服务。但在多条战线上,这家公司还需要努力追赶西方竞争对手。沃尔玛和亚马逊已经在印度拥有数百万客户。而作为Jio的新投资者,谷歌早在2017年9月就在印度推出在线支付系统。“在支付领域,谷歌支付对Facebook有着明显的领先优势。”MediaNama的总编辑帕瓦说,“我对他们的竞争力持怀疑态度。”

还有其他问题。这些问题有时会让扎克伯格质疑他的57亿美元投资是否明智。其中最重要的一点是在这个拥有多种语言和宗教的国家运营业务的极端复杂性。印度政府的监管法规严重偏向于本地企业。被问及西方科技投资者在印度面临哪些挑战时,皮亚坎蒂尼回答称,“我不知道你为这次采访安排了多少时间。”他举例说,印度28个邦执行不同的贸易法规,这使得在线商务变得错综复杂。“在印度,你做的是长线投资。这个长线意味着30年,而不是5年。”他说,“你需要大量资金和优秀人才。执行商业计划的难度之大远超你的想象。”

尽管如此,印度市场的未来仍然非常可期,而这也是信实工业关注的焦点所在。就像WhatsApp支付系统可能会迅速扩展到世界其他地区一样,Jio最终也可能以印度本土作为跳板,构筑起一个有可能复制到其他国家的服务平台。这将助推Jio和信实工业迅速跻身全球公司之列。乌曼表示,他相信就连美国和欧洲的部分地区也可能成为Jio的潜在市场。“我们不排除选择恰当的时机进军全球市场。”他说。市场观察人士预计Jio将在不远的将来进行IPO,但乌曼透露称,该公司“尚未正式商议”上市时间表。但他随即指出,“这种可能性是存在的。”

按照Jio的经典风格,这些计划可能会迅速展开,而且规模巨大,从而有望助力Jio成为下一个大型科技公司,同时让它成为第一个在印度起步的全球科技巨头。安巴尼在7月告诉股东,Jio计划明年在印度推出自己的5G技术,并将涉足大数据、机器学习、区块链和医疗保健等领域。他说,所有这些产品都会很容易出口到世界各地的市场。“每一个在印度获得验证的解决方案,都有可能成为全球性解决方案。”而安巴尼的美国投资者必然会追随他的前行脚步。

竞逐印度市场

西方投资者现在已经与Jio Platforms结为盟友,或与之对抗。三大科技和软件公司是这家公司的合作伙伴;美国两大零售商是它的劲敌。

今年4月,首席执行官马克·扎克伯格斥资57亿美元入股Jio Platforms,由此引发了西方公司对这家科技新贵的投资浪潮。Facebook旗下的即时通讯应用程序WhatsApp在印度很受欢迎,并且拥有比Jio用户收入更高的客户群体。

谷歌

7月,谷歌及其母公司Alphabet的首席执行官桑达尔·皮查伊通过视频现身信实工业年会,宣布对Jio投资45亿美元。谷歌一直密切关注尚未开发的印度市场,并将Jio视为规避印度错综复杂的政府监管风险的一条捷径。

微软

Jio与这家软件巨头的合作项目,正是微软首席执行官萨蒂亚·纳德拉任期内的最高成就——Azure云计算业务。两家公司成立了一家合资企业,在印度销售云服务。

亚马逊

亚马逊首席执行官杰夫·贝佐斯对印度市场抱有厚望,已经投资了数十亿美元。JioMart与WhatsApp的联姻对这家总部西雅图的电子商务巨头构成了威胁。

沃尔玛

沃尔玛的首席执行官董明伦在印度押下重注,收购了当地电子商务领军企业Flipkart的控股权。但这家零售巨头一直受制于严重偏向本土零售商的政府监管法规。(财富中文网)

本文另一版本刊载于《财富》杂志2020年8/9月刊,标题为《Jio能否成为下一个科技巨头?》

译者:任文科

MAMMOTH TECHNOLOGY COMPANIES tend to blossom slowly. Google grew quietly out of a garage, Facebook from a dorm room, Amazon in a car rolling across the country. The investments in such upstarts amount to grubstakes, relatively paltry sums from risk-seeking investors who know it could all come to naught.

Yet when two of these giants (Facebook and Google) plunk down billions of dollars to back an emerging competitor to the third (Amazon), a new tech colossus can be crowned nearly instantaneously. That company, Jio Platforms, is a four-year-old mobile phone company controlled by India’s richest man, Mukesh Ambani. It has attracted so much capital so quickly that while the rest of the world is focused on a global pandemic, Jio suddenly has staked its claim to becoming the first global tech giant to get its start in India.

The scramble began when Facebook inked a $5.7 billion deal with Jio in April for a 9.9% stake in the company. That ignited a cascade of investors grabbing a slice of Jio, which is controlled by Ambani’s family business, the petrochemical conglomerate Reliance Industries. In May, U.S. private equity heavyweights Silver Lake, Vista Equity Partners, General Atlantic, and KKR together plowed nearly $5 billion into Jio. In June, Jio collected more than $4 billion from other U.S. tech investors and sovereign wealth funds in Saudi Arabia and the United Arab Emirates. And in July, after selling slices of Jio to U.S. chipmakers Intel and Qualcomm, Jio sealed a $4.5 billion deal with Google for 7.7% of the company. For good measure, Reliance, which funded Jio from its own balance sheet, raised nearly $7 billion more in a rights offering.

By mid-July, Jio had amassed more than $20 billion, leaving Reliance and Jio net debt-free and positioning the mobile offshoot for an eventual IPO. What’s more, by spinning up Jio as a high-growth offshoot of an old-line energy company, Ambani has solidified his place as one of the world’s top business titans. Already Asia’s richest man—his 27-story Mumbai mansion has a 168-car garage; nine elevators; and a room with artificial snow, a handy feature in the tropical heat—Ambani now is one of the five richest people on the planet. If his ambitions for Jio succeed, it will join the ranks of global e-commerce “superapps” of the magnitude of China’s Alibaba and Tencent.

To do that, Jio and its many new non-Indian partners will wage an all-out battle with two American behemoths that have invested heavily in Indian retail: Walmart and Amazon. The prize is nothing short of a market that, by all rights, should be among the top tier in international commerce—but which until now has frustrated many of those who have tried to capitalize on it. “India is no longer a regional player,” says Mathew Oommen, the Indian-born president of Jio Platforms and a former U.S. telecom executive. That is why, he says, investors rushed in. Despite its youth, Jio is now in a position to pick and choose among its eager suitors. Oommen says Jio’s top criterion has been partners who appear to have India’s interests at heart. “You would be surprised, the number of investors we have turned down,” he says.

****

JIO’S EXTRAORDINARY season of fundraising might never have happened had it not been for a persistent complaint by Ambani’s teenage twins that will sound familiar to any parent: The Internet was too slow to adequately run the sites other kids were consuming every day. Ambani had inherited Reliance from his father, and he expanded the Mumbai-based oil-refining and petrochemical outfit into supermarkets, gas stations, and thousands of convenience stores. Reliance has shopped for assets abroad as well, more recently buying the British toy retailer Hamleys. Already immensely rich by the 2000s, Ambani, now 63, lacked one crucial segment in his portfolio: telecommunications. That was all too clear to his daughter, Isha, and son Akash as they struggled (albeit in the lap of luxury) with India’s creaky 2G networks. “Growing up, they expressed to many people, and to their dad, their frustration not being able to use mobile data,” says Oommen, the Jio president. “Isha had a large influence on her dad, persuading him that this was a big opportunity.”

Few realized just how big. Won over (or worn down) by his children, Ambani purchased a failing phone company in 2010, giving him licenses over some of India’s wireless spectrum. At the time, hundreds of millions of Indians had never used a mobile phone, let alone logged on to the Internet. Ambani plowed about $35 billion into laying fiber lines and erecting about 200,000 towers for a modern 4G network in every corner of the vast country. The new company’s catchy name, Jio, looks a bit like “oil” spelled backward. It was a fitting inside joke. Fossil fuels had made Ambani rich. Now, he concluded, he could future-proof his wealth by pegging it to data.

Jio’s trajectory has been jaw-dropping. When it launched in September 2016, only about 28 million Indians owned smartphones, out of a population of more than 1.3 billion. Within 18 months Jio had signed 100 million people to its network, and by the end of July had nearly 400 million subscribers. The newcomer’s trick was cheap data. Before Jio, mobile data cost $4.50 per gigabyte, painful in a country with per capita annual income at the time of $5,760. Jio offered a gigabyte for just 15¢ and made voice calls free. This unleashed a price war that entrenched operators like Vodafone and Bharti Airtel were destined to lose.

Two years after offering free calls and inexpensive data, Jio unveiled a $20 Android handset called the Jio Phone, loading it up with Google-owned apps like YouTube, included free with mobile plans. With that one product, Indians began to consume as much data as all of the Americas combined. It was a boon not only for Indians but for global tech giants too. Facebook’s WhatsApp now operates in all 23 official Indian languages and has 400 million users, making India WhatsApp’s biggest market. And in a country with widespread illiteracy, Google’s YouTube acts as the default search engine for many. To other emerging countries with high-priced Internet, India now offers a prime example of the accelerator effect cheap data can have on businesses, education, and rural development. “Broadband connections have skyrocketed,” says Nikhil Pahwa, founder and editor of the Indian tech analysis site MediaNama. Ambani, he says, is “someone who dreams big.”

Ambani’s dreams are far bigger even than telecommunications. Jio has rapidly displaced its cell phone competition, but it still has little presence in huge swaths of the Internet, including mobile payments and e-commerce. Says Oommen: “What we’re seeing is only a small piece of the larger, bigger opportunity.”

To grab those opportunities, Jio needed global partners, which created a virtuous investment circle. The investors got a stake in a fast-growing company that generated cash on its core business. Reliance was able to wipe clean its balance sheet ahead of its stated timetable. And Jio gains the globe’s savviest tech players as allies. “Ambani made a huge bet on Jio,” says Egon Durban, co-CEO of technology investment firm Silver Lake, who led the firm’s Jio investment. Jio, he says, “is the world’s greatest private tech company hidden in plain sight.”

****

DRIVING AWAY from the sprawling megalopolis of Mumbai, across the bridge spanning the Arabian Sea, you reach the quieter exurb of Navi Mumbai and eventually arrive at the leafy, cordoned-off, 550-acre campus that is headquarters to Reliance Industries. Set around the complex of office buildings, both old and new, are neat footpaths connecting tennis courts, soccer fields, and a cricket pitch, as well as basketball, volleyball, and badminton courts and a full-service gym. At the center of this idyll sits Jio, whose building has blue-tinted glass walls shielding the interior from the blistering sun, with soothing shadows across its sleek offices.

Nearby sits the Jio Experience center, a building spotlighted in soft pinks and purples that represents the company’s vision for its future. It imagines Jio not as a mobile phone carrier but a “digital lifestyle company,” as a staff member puts it, a business embedded in Indians’ daily habits. The whizbang toys on display include Jio TVs streaming, among other offerings, Bollywood hits and cricket matches—addictive Indian pastimes—via voice commands into a set-top box. “Our story has been about digital services as a platform from the beginning,” says Oommen, who was chief technology officer of U.S. mobile operator Sprint before returning home to join Reliance in 2011. “It has never been an afterthought.”

Perhaps not. But by earlier this year, Jio was still not offering its gargantuan number of mobile users an array of other paying services. And it trailed badly behind competitors in the “digital lifestyle” offerings it had envisioned. Amazon began spending billions in India in 2012. And even as Jio was giving away its handsets, Walmart muscled into India in 2018, buying control of the homegrown online-shopping company Flipkart for $16 billion.

To continue growing while beefing up its offerings, Jio began to look outward, which had the added benefit of cleaning up its balance sheet. The outsiders were eager for a way into the Indian market with a partner who knew how to operate there. Facebook’s investment in Jio was India’s single biggest foreign tech investment ever and Facebook’s biggest investment since buying WhatsApp in 2014 for $14 billion. One big draw was Jio’s ability to maneuver through India’s labyrinth of government regulations—something that has entangled Amazon. In January, one day before Bezos flew to New Delhi to invest $1 billion more into Amazon India, the government announced the company was under investigation, along with Walmart-controlled Flipkart, for anti-trust violations. Jio, adept at working the halls of power in New Delhi, has faced few such problems. “They’ve shown evidence they can execute well on initiatives that solve for both scale and complexity, which is hard to do well in any country,” says Ajit Mohan, Facebook’s top executive in India.

Ambani and Zuckerberg cast their partnership almost as a patriotic act, saying it would be crucial to protecting the millions of small mom-and-shop shops, called “kirana stores,” that for decades have been the backbone of Indian commerce, and whose future has looked increasingly precarious as online shopping takes off. In a YouTube address from his mansion, Ambani said he and Zuckerberg shared the goal of “serving all Indians,” saying that WhatsApp had built an “intimate relationship with Indians,” and whose partnership aligned with Prime Minister Narendra Modi’s digital strategy for the country.

Under the deal, Jio’s e-commerce site, JioMart, which launched in June, will be linked to WhatsApp, which will include an online payment option for the first time. The idea is that the payments will be for orders from 40 million or so kirana stores, which would deliver a far wider range of goods by combining their catalogs and delivery. Amazon and Walmart constitute a mortal threat to these family-owned shops, putting Jio in the role of a nationalist savior. “The big traditional e-commerce players are eradicating them,” Oommen says. He sees the quintessential JioMart-WhatsApp customer as his mother, 84, who lives in India’s southern state of Kerala. “My mom is not the most proficient with online things,” he says. “But she knows the guy down the street who delivers most of her items.”

Facebook will also be able to use its Jio deal as a prototype for its global market. In the same way, Google first rolled out its online payment system in India, before expanding the app into the U.S. and elsewhere. Google says it is now working on a low-cost Android operating system for Jio phones, which positions it yet again to test prototypes in India for use elsewhere in the world. In statements after his April deal, Zuckerberg made it clear Facebook has similar designs.

It is Jio’s prospect for huge revenue growth that has ignited the frenzied dealmaking, as investors, almost all American, raced to buy slivers of the company while they could. “Companies are coming to the realization that India is a unique market,” says Diego Piacentini, a former Amazon executive who oversaw the company’s multibillion-dollar move into India. Piacentini now is an adviser to KKR, though he wasn’t involved with the private equity firm’s Jio investment. For investors, he says, “the approach is, ‘better be sorry I made the wrong investment, than I missed a huge opportunity.’”

In fact, the potential to launch its e-commerce business with Facebook was, for Jio, a game changer. “Reliance may be able to disrupt India’s e-commerce space the way it did within the telecom sector,” Pranav Bhavsar, India consumer analyst for ASA Capital, told an Indian journalist. Western investors, he says, are “buying into the promise of changing India’s retail landscape.”

****

WHILE JIO has proved adept at building a subscriber base, its success in offering new services is not entirely assured. Under the pandemic, Jio began testing its fiber services in 50,000 homes, for example. But on several fronts, the company is racing to catch up with the Western competition. Walmart and Amazon already each have many millions of customers in India. And Google, Jio’s newest investor, launched its online payment system in India in September 2017. “Google Pay has a significant head start over Facebook in terms of online payments,” MediaNama’s Pahwa says. “I doubt they will be able to compete.”

There are other issues, too, which could lead Zuckerberg to question his $5.7 billion investment at times. Not the least of those issues is the sheer complexity of operating in a country with multiple languages and religions, whose government regulations still heavily favor local businesses. When I ask Piacentini, the former Amazon executive, what challenges Western tech investors face in the country, he replies, “How many hours do you have?” He cites as one example trade regulations among India’s 28 states, which make online commerce convoluted. “In India you make investments for the long term. That means 30 years, not five years,” he says. “You need a lot of capital and great people. Execution is incredibly hard.”

For all that, there could be huge prospects ahead, which Reliance is already eyeing. Just as the WhatsApp payments system is likely to expand quickly to Facebook’s markets in the rest of the world, so too might Jio ultimately use its home country as a place to build a platform of services that it could then replicate in other countries. That would catapult Jio, and by extension, Reliance, into the ranks of global companies. Jio president Oommen says he believes even parts of the U.S. and Europe might be potential markets for Jio. “We will not rule out going global at the right time,” he says. Market watchers expect a Jio IPO in the not so distant future, although Oommen says the company has “not officially deliberated a timeline” for going public. But he says, “It is a possibility.”

In classic Jio style, those plans could unfold quickly and on a huge scale—potentially making Jio the world’s next big tech giant, and India’s first. In July, Ambani told shareholders Jio is set to roll out its own 5G technology next year in India, and also expand into big data, machine learning, blockchain, and health care platforms. All of them, he says, would be readily exportable to markets across the world. “Each of these solutions, once proven in India, has the potential to be a global solution,” Ambani said. His U.S. investors will be along for the ride.

****

VYING FOR THE INDIAN MARKET

Western players have now lined up either with or against Jio Platforms. The three big tech and software companies are partners; America’s two biggest retailers are foes.

CEO Mark Zuckerberg led the Western parade of investments in Jio Platforms with a $5.7 billion stake in April. Facebook’s WhatsApp is huge in India and has a higher-income clientele than Jio’s users.

Sundar Pichai, CEO of Google and its parent company, Alphabet, appeared by video at the Reliance annual meeting in July to unveil a $4.5 billion investment in Jio. Google has focused intently on India for its untapped market and sees Jio as a way to navigate treacherous governmental waters.

MICROSOFT

Jio has partnered with the software giant through the project that is CEO Satya Nadella’s crowning achievement, Microsoft’s cloud-computing Azure business. The two companies have formed a joint venture to sell cloud services in India.

AMAZON

Jeff Bezos, the boss of Amazon, has invested billions to make India a winning market for the Seattle-based e-commerce giant. JioMart and its tie-up with WhatsApp constitute a threat to Amazon.

WALMART

CEO Doug McMillon bet big on India, buying a controlling stake in e-commerce champion Flipkart. Walmart has been stymied by regulations that favor local retailers.

A version of this article appears in the August/September 2020 issue of Fortune with the headline “Can Jio be the next tech giant?”