如果要从零开始设计一家可以将全球性危机转化为机遇的公司,最终的设计结果可能会与亚马逊有着很高的相似度。作为一台令人敬畏的运营机器,整个商界对亚马逊可谓是又爱又恨。这家销售额达2800亿美元的科技巨头在遇到挑战时,能够像最敏捷的初创企业一样迅速拿出应对方案。亚马逊今年在新冠疫情中的表现便是例证。公司创始人兼首席执行官杰夫•贝佐斯在4月底将这段时间描述为“我们所面临的最困难的时期”。

亚马逊的领导团队一开始就意识到,疫情可能会成为史上最具破坏力的灾难。每周会在其火箭公司Blue Origin工作一天的贝佐斯很快将更多精力投入到了亚马逊的运营中。他每天都会与其“S”(高管缩写)团队(公司的最高层领导)会面,其中很多人都在公司工作了十几年或更长的时间。几乎在一夜之间,亚马逊进一步扩大了其规模已然异常庞大的在线零售业务,以满足第一季度订单的激增,因为盘坐在家中的客户转向网络来获取其必要物资。为了提升响应速度,公司踏上了额外审核和招聘17.5万名员工的征程。

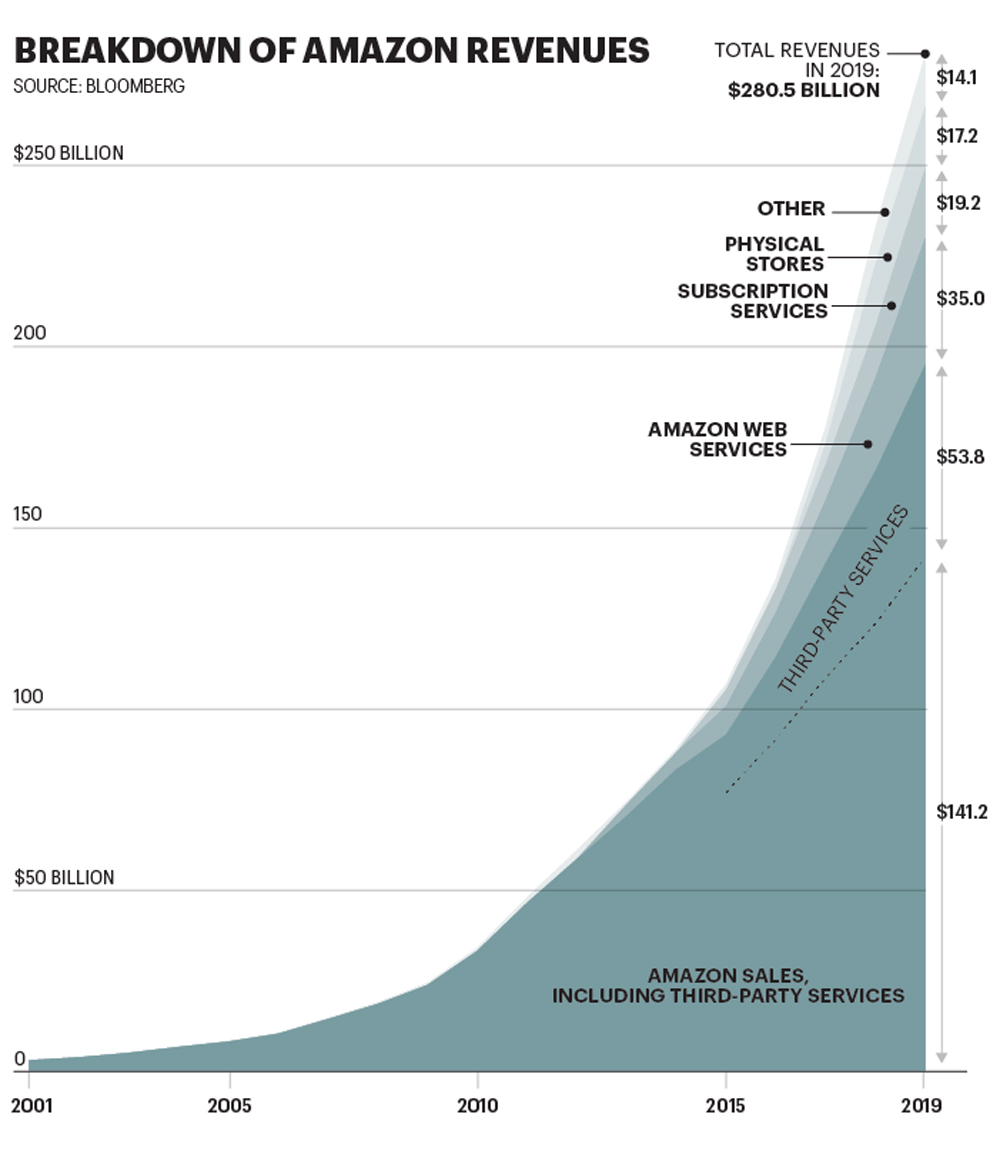

这场迅速的动员活动得到了回报。截至3月底的三个月,亚马逊创造了754亿美元的营收,同比增长26%。亚马逊云服务AWS的单季销售额首次突破了100亿美元的大关,因为包括Netflix在内的流媒体娱乐巨头、视频会议大拿Zoom,以及职场协作工具Slack的使用频率出现了激增。从今年年初到5月初,亚马逊的股价增长了25%。世界首富贝佐斯的净财富值飙升至1440亿美元,在短短数个月内大涨290亿美元。

然而,惊艳的业绩通常都伴随着争议,这对于亚马逊来说并不是什么新鲜事。公司不得不采取措施来应对数以万计开始在其网站上哄抬物价的影子卖家。随后,在5月1日,一些亚马逊员工参与了波及全美的“托病旷工”抗议活动,他们称亚马逊在其工作场所并没有采取足够的安全防范措施。亚马逊今春开除了少数公开批评公司安全措施的员工。(每一次,亚马逊都称开除员工是因为其违反了公司的政策,而不是对其公开言论报复。)在宣布其第一季度业绩之后,亚马逊称公司第二季度在新冠疫情相关费用方面的支出将达到约40亿美元或更多,用于一线工人的加薪、保护装备以及雇员检测等,足以抵消其第二季度预期的经营利润。对亚马逊来说,为了让公司的注意力回归执行,这个代价并不算大。

亚马逊在快速配送领域的声誉在危机期间也略微受到了影响。在疫情之前,公司的大多数Prime会员客户都能够享受到隔日送达和百货同日送达服务。自疫情爆发之后,像家用必需品和医疗物资需要耗费多达4天的时间,而非必需物品则需要更长的时间。亚马逊相对来说是百货领域(公司于2017年收购了全食超市)的新手,但却被潮水般的食品订单压得喘不过气来。在很多城市,亚马逊都没有能力提供足够的配送槽来满足需求。

尽管存在上述问题,但华尔街一致认为亚马逊将从新冠疫情危机中脱颖而出,变得比以往任何时候都更大更强,而且消费者甚至会更加依赖其产品和服务的广度。加拿大皇家银行资本市场(RBC Capital Markets)的科技行业资深分析师马克•马哈尼说:“没有一家公司能够像亚马逊那样处理如此之大的需求增幅。当疫情真正结束时,实体零售竞争将被削弱,而亚马逊将成为赢家。”

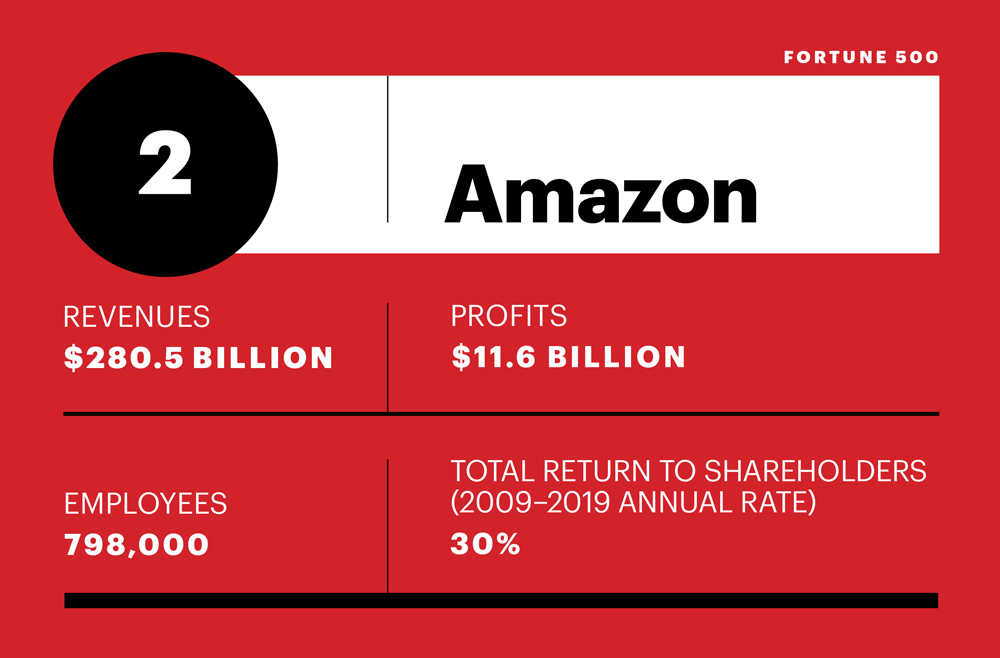

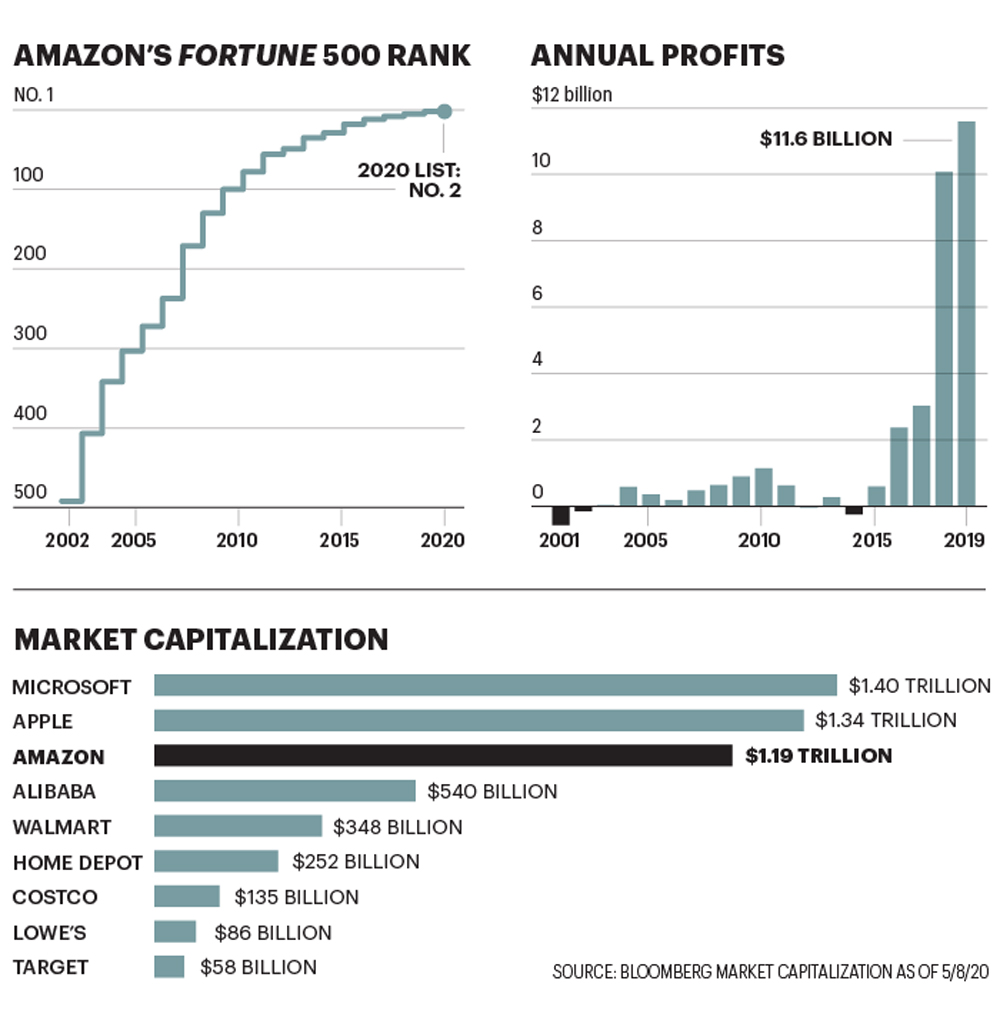

与以往一样,贝佐斯看重的是长远发展,而正是因为这个策略帮助公司获得了非凡的业绩。今年,亚马逊在《财富》美国500强榜单上的排名升至第二位,是其有史以来最高的排名。自公司于2002年首次入榜以来,其市值增幅超过了22000%,在5月初曾抵达1.2万亿美元附近,公司的销售额实现了28%的年平均增速。如果想要了解亚马逊随着时间的推移到底会变得多强大,那么关键就在于弄清楚这一惊艳增长轨迹背后的策略。

自贝佐斯于1994年创建亚马逊之日起,人们基本上认为它是一家碰巧涉足零售业务的数据驱动型公司。在此前的25年中,贝佐斯打造了可能是全世界迄今为止所见证过的最复杂和最成功的数据驱动型公司。驱动亚马逊在线零售业务的算法能够逐秒扫描购买模式,并在其巨大的仓库中调整库存内容、储存地点,以及货物配送的最快方式。

在疫情发生很久之前,亚马逊曾使用其数字能力,不断地将自身融入大众生活。其中约1.5亿(这个数字在过去不到两年的时间中增长了5000万)Prime会员会从这位电商巨头那里订购服装、必需品和电子产品,观看Prime Video原创电影和TV电视节目,并倾听亚马逊流媒体频道的音乐。即便那些很少通过亚马逊网站购物的消费者,也会在其数字生活中使用诸如Netflix这样的服务,而它们都依托于亚马逊无所不在的AWS服务器。

如今,疫情已经加速了这些趋势的发展,其速度之快已经超乎所有人的想象,而且美国人对亚马逊日渐增强的依赖性有可能会持续。有人甚至认为,有鉴于亚马逊在为受困当地和州政府提供物资方面所发挥的重要作用,它已经成为了一家企业红十字会。研究与投资公司Loup Ventures的合作伙伴基尼•蒙斯特在最近的采访中向《财富》杂志透露:“如果没有亚马逊,美国的局势将更加窘迫。它已经成为了国家资产。”

对于亚马逊来说,前方还有更多的扩张机会。尽管亚马逊占据着美国电商市场38%的市场份额,但仅占美国新冠疫情前总零售额的约5%,其中有90%的零售依然发生在实体店。不过,在科学家研制出有效的疫苗之前(而且就算一切顺利也至少还得等数个月的时间),很多购物者不愿返回商场和百货店。这意味着更多的人将继续从亚马逊购物。即便在病毒得到控制之后,我们不难想象,亚马逊的百货业务将继续蓬勃发展。加拿大皇家银行预计,由于在一定程度上受线上业务的推动,2023年百货行业的总营收将达到880亿美元,接近2020年水平的两倍。

亚马逊还看到,自己可以利用疫情拓展至新领域。其魔法般的语音精灵Alexa如今可以回答数万个与新冠疫情相关的问题,例如“Alexa,如果我觉得自己感染了病毒,我该怎么做?”或“Alexa,给我一些有关家里清扫和消毒的建议。”亚马逊甚至还申请了一项技术专利,让Alexa识别打喷嚏的声音。亚马逊进军在线诊断还需要多长的时间?(公司已经向其西雅图雇员提供Amazon Care远程健康服务。)

与此同时,贝佐斯已经匆忙地闯入了无人驾驶电动汽车竞赛。他投资了数十亿美元用于打造未来的自动驾驶汽车送货技术、在邻里之间穿梭的小机器人,以及嗡嗡飞向目的地的无人机。这些配送技术有一个共同之处——都对新冠病毒免疫。(然而却有被电脑病毒感染的可能。)

亚马逊何以能够如此迅速地适应疫情?公司最强的一大实力就是,它自身的构架就像是由不同独立国家组成的联邦,每一个国家都有其领导者和市民。在公司的西雅图总部,亚马逊没有将所有业务部门负责人圈在一个办公楼中,而是将这些高管散布于整个城市,各自负责自己的业务。例如,贝佐斯是整个联邦的领导者,重要决策都由他说了算。然而,与当前其他企业的常态相比,贝佐斯的副官们在迅速行动、决策、投资以及开发新创新方面有着更大的自主权。

从外界来看,这种结构似乎只会导致灾难:独立运营的各个封地散布在西雅图不同地区的多个大楼。然而,这种模式十分奏效,原因只有一个。贝佐斯一直在不断地向企业灌输着用于指导决策的三大基本原则:顾客至上、极致创新,以及着眼于长远的管理。几乎所有配得上手握股权的首席执行官都声称自己会遵守部分或大部分上述原则,以至于这些原则都成为了有关领导力的陈词滥调。然而,大多数领导者都未能做到言行一致或贯彻始终。不过在贝佐斯的领导下,亚马逊做到了。

贝佐斯的秘诀在于他所称的“惯性轮”,它是一个推动其三大根本价值观的概念引擎。从本质上,“惯性轮”这个理念的普及归功于管理大拿吉姆•柯林斯,它形容的是良性循环。亚马逊团队并没有专注于竞争,而是将所有的精力用于提升其客户的舒适度。其中一个方式就是降低成本。通过此举,亚马逊提升了到访其网站的客户数量,并借此吸引了更多独立卖家的入住,后者希望接触亚马逊平台不断增长的客流量。这一切又为亚马逊带来了更多的营收,继而实现了有助于进一步降低价格的规模经济效益。价格的降低又会带来更多的客户,从而让这个惯性轮一直处于转动状态。

正是这个所有亚马逊经理都铭记于心的惯性轮理念,才使得这家巨型企业能够像独立国家组成的联邦一样运转。雇员无需琢磨自己该做什么,其每天的工作便是更努力地推动惯性轮的转动。

为了继续营造亚马逊的发展态势,贝佐斯认为其公司必须继续通过创新来更新其惯性轮的每一个部件。这意味着亚马逊团队必须发挥其想象力。他们必须经常问自己该如何做才能取悦客户,并吸引更多的第三方卖家。贝佐斯在去年说:“我们十分渴望去先行先试,去创造。这一点非常契合顾客至上的理念,因为客户永远都不会满意,不过有时候他们自己都没有察觉到这一点,即便在他们感到很开心时亦是如此。客户始终希望寻找更好的方式,但他们也不知道是什么样的一种方式。我曾警告员工,践行顾客至上理念并不是仅仅在于倾听客户的心声,同时还包括设身处地地进行创造。”

每一个新的创新,包括Prime会员的隔日达配送、免费视频和音频流、Kindle、Fire TV、Echo智能音箱和Alexa,都旨在吸引新客户,并让老客户感到欣喜。

说到以长远为导向,贝佐斯始终认为,打造和维持这个惯性轮是一项长期、艰巨的任务。所有的亚马逊重大创新——从Kindle到AWS再到Echo,都需要耗费数年的时间。即便当亚马逊失败时,例如姗姗来迟、毫无新意的Fire Phone,公司依然在继续创新。贝佐斯深深感到,失败是不可避免的,但即便是多次失败,从长远来看也可能有成功的那一天。例如,通过吸取Fire Phone失利的部分教训,Echo诞生了。

抗议亚马逊:位于加州霍桑的亚马逊雇员于2020年5月1日加入了一场全国性的“托病罢工”抗议活动,呼吁员工工会化,以及亚马逊加大对员工保护的投入力度。图片来源:Valerie Macon—AFP¬/Getty Images

亚马逊对效率和市场占有率的不懈追求引发了业界的一些控诉,这些控诉称亚马逊有时候越过了反竞争红线。在4月底,《华尔街日报》发布了一篇调查报告,称亚马逊使用平台上卖家的内部信息来开发竞争产品,然后以低于销售商的价格出售。有鉴于此,国会曾要求贝佐斯对众议院司法委员会进行解释。亚马逊称,公司将配合委员会的工作,但公司并未明确表明贝佐斯是否会去解释。作为对《华尔街日报》这篇文章的回应,亚马逊称,使用定价数据来打压销售商的行为违反了公司的政策,亚马逊已对此发起内部调查。

在过去10年中,贝佐斯已将惯性轮理念推向了新的高度。亚马逊如今正在以前所未有的速度将大数据、人工智能和机器学习等技术运用至运营当中,从而让惯性轮自身能够更快地转动。正是得益于这一能力,亚马逊才能够迅速地对疫情做出响应。在贝佐斯2016年致股东的信中,他解释了这类模型的力量:“机器学习能够让我们的算法进行需求预测、产品搜索排名、交易推荐、广告放置、欺诈检测和翻译等等。”

不妨将这个新表述看作是一个人工智能惯性轮。贝佐斯聘请的数万名工程师、数据科学家和编程人员已经让这个人工智能惯性轮成为了一台学习机器,一台有其自身智慧的神奇网络装备,它可以汇总亚马逊从客户那里搜集来的所有数据,然后事无巨细地加以分析。这台机器能够自己做决定,例如购买什么物品、卖多少钱,以及应该在全球哪个仓库存放。亚马逊的全球客户部门首席执行官杰夫•威尔克解释说:“在过去,我们使用数据帮助做决策,然而,最终的决策依然得靠人类。我们当前对机器学习的研究就是挑出一些重复率最高的智能流程,并取消其对人力决策的需求。我们能够完成这个闭环,这样就无需人类参与决策。我们可以对购买数百万件产品实现自动下单。”

令其竞争对手感到更可怕的是,所有因为疫情而引发的活动可能会大大提升亚马逊算法的智能水平。与那些为了生存而削减预算的企业相比,亚马逊生来便已做好了化危机为机遇的准备。几乎可以肯定的是,亚马逊必然将在疫情后脱颖而出,为客户提供更好的服务和更低的价格,而且这个惯性轮将继续转动。(财富中文网)

本文另一版本登载于《财富》杂志2020年6/7月刊,标题为《亚马逊:为疫情而生的商业巨头》。

译者:Biz

如果要从零开始设计一家可以将全球性危机转化为机遇的公司,最终的设计结果可能会与亚马逊有着很高的相似度。作为一台令人敬畏的运营机器,整个商界对亚马逊可谓是又爱又恨。这家销售额达2800亿美元的科技巨头在遇到挑战时,能够像最敏捷的初创企业一样迅速拿出应对方案。亚马逊今年在新冠疫情中的表现便是例证。公司创始人兼首席执行官杰夫•贝佐斯在4月底将这段时间描述为“我们所面临的最困难的时期”。

亚马逊的领导团队一开始就意识到,疫情可能会成为史上最具破坏力的灾难。每周会在其火箭公司Blue Origin工作一天的贝佐斯很快将更多精力投入到了亚马逊的运营中。他每天都会与其“S”(高管缩写)团队(公司的最高层领导)会面,其中很多人都在公司工作了十几年或更长的时间。几乎在一夜之间,亚马逊进一步扩大了其规模已然异常庞大的在线零售业务,以满足第一季度订单的激增,因为盘坐在家中的客户转向网络来获取其必要物资。为了提升响应速度,公司踏上了额外审核和招聘17.5万名员工的征程。

走近贝佐斯:这是对《贝佐斯经济学:亚马逊如何改变我们的生活以及全球最好的公司从中学到了什么?》(Bezonomics: How Amazon Is Changing Our Lives and What the World’s Best Companies Are Learning From It)一书的节选改编。(Scribner出版公司,2020年5月12日)。如需了解更多信息,请访问Bezonomics.com。

这场迅速的动员活动得到了回报。截至3月底的三个月,亚马逊创造了754亿美元的营收,同比增长26%。亚马逊云服务AWS的单季销售额首次突破了100亿美元的大关,因为包括Netflix在内的流媒体娱乐巨头、视频会议大拿Zoom,以及职场协作工具Slack的使用频率出现了激增。从今年年初到5月初,亚马逊的股价增长了25%。世界首富贝佐斯的净财富值飙升至1440亿美元,在短短数个月内大涨290亿美元。

然而,惊艳的业绩通常都伴随着争议,这对于亚马逊来说并不是什么新鲜事。公司不得不采取措施来应对数以万计开始在其网站上哄抬物价的影子卖家。随后,在5月1日,一些亚马逊员工参与了波及全美的“托病旷工”抗议活动,他们称亚马逊在其工作场所并没有采取足够的安全防范措施。亚马逊今春开除了少数公开批评公司安全措施的员工。(每一次,亚马逊都称开除员工是因为其违反了公司的政策,而不是对其公开言论报复。)在宣布其第一季度业绩之后,亚马逊称公司第二季度在新冠疫情相关费用方面的支出将达到约40亿美元或更多,用于一线工人的加薪、保护装备以及雇员检测等,足以抵消其第二季度预期的经营利润。对亚马逊来说,为了让公司的注意力回归执行,这个代价并不算大。

亚马逊在快速配送领域的声誉在危机期间也略微受到了影响。在疫情之前,公司的大多数Prime会员客户都能够享受到隔日送达和百货同日送达服务。自疫情爆发之后,像家用必需品和医疗物资需要耗费多达4天的时间,而非必需物品则需要更长的时间。亚马逊相对来说是百货领域(公司于2017年收购了全食超市)的新手,但却被潮水般的食品订单压得喘不过气来。在很多城市,亚马逊都没有能力提供足够的配送槽来满足需求。

尽管存在上述问题,但华尔街一致认为亚马逊将从新冠疫情危机中脱颖而出,变得比以往任何时候都更大更强,而且消费者甚至会更加依赖其产品和服务的广度。加拿大皇家银行资本市场(RBC Capital Markets)的科技行业资深分析师马克•马哈尼说:“没有一家公司能够像亚马逊那样处理如此之大的需求增幅。当疫情真正结束时,实体零售竞争将被削弱,而亚马逊将成为赢家。”

与以往一样,贝佐斯看重的是长远发展,而正是因为这个策略帮助公司获得了非凡的业绩。今年,亚马逊在《财富》美国500强榜单上的排名升至第二位,是其有史以来最高的排名。自公司于2002年首次入榜以来,其市值增幅超过了22000%,在5月初曾抵达1.2万亿美元附近,公司的销售额实现了28%的年平均增速。如果想要了解亚马逊随着时间的推移到底会变得多强大,那么关键就在于弄清楚这一惊艳增长轨迹背后的策略。

自贝佐斯于1994年创建亚马逊之日起,人们基本上认为它是一家碰巧涉足零售业务的数据驱动型公司。在此前的25年中,贝佐斯打造了可能是全世界迄今为止所见证过的最复杂和最成功的数据驱动型公司。驱动亚马逊在线零售业务的算法能够逐秒扫描购买模式,并在其巨大的仓库中调整库存内容、储存地点,以及货物配送的最快方式。

在疫情发生很久之前,亚马逊曾使用其数字能力,不断地将自身融入大众生活。其中约1.5亿(这个数字在过去不到两年的时间中增长了5000万)Prime会员会从这位电商巨头那里订购服装、必需品和电子产品,观看Prime Video原创电影和TV电视节目,并倾听亚马逊流媒体频道的音乐。即便那些很少通过亚马逊网站购物的消费者,也会在其数字生活中使用诸如Netflix这样的服务,而它们都依托于亚马逊无所不在的AWS服务器。

如今,疫情已经加速了这些趋势的发展,其速度之快已经超乎所有人的想象,而且美国人对亚马逊日渐增强的依赖性有可能会持续。有人甚至认为,有鉴于亚马逊在为受困当地和州政府提供物资方面所发挥的重要作用,它已经成为了一家企业红十字会。研究与投资公司Loup Ventures的合作伙伴基尼•蒙斯特在最近的采访中向《财富》杂志透露:“如果没有亚马逊,美国的局势将更加窘迫。它已经成为了国家资产。”

对于亚马逊来说,前方还有更多的扩张机会。尽管亚马逊占据着美国电商市场38%的市场份额,但仅占美国新冠疫情前总零售额的约5%,其中有90%的零售依然发生在实体店。不过,在科学家研制出有效的疫苗之前(而且就算一切顺利也至少还得等数个月的时间),很多购物者不愿返回商场和百货店。这意味着更多的人将继续从亚马逊购物。即便在病毒得到控制之后,我们不难想象,亚马逊的百货业务将继续蓬勃发展。加拿大皇家银行预计,由于在一定程度上受线上业务的推动,2023年百货行业的总营收将达到880亿美元,接近2020年水平的两倍。

亚马逊还看到,自己可以利用疫情拓展至新领域。其魔法般的语音精灵Alexa如今可以回答数万个与新冠疫情相关的问题,例如“Alexa,如果我觉得自己感染了病毒,我该怎么做?”或“Alexa,给我一些有关家里清扫和消毒的建议。”亚马逊甚至还申请了一项技术专利,让Alexa识别打喷嚏的声音。亚马逊进军在线诊断还需要多长的时间?(公司已经向其西雅图雇员提供Amazon Care远程健康服务。)

与此同时,贝佐斯已经匆忙地闯入了无人驾驶电动汽车竞赛。他投资了数十亿美元用于打造未来的自动驾驶汽车送货技术、在邻里之间穿梭的小机器人,以及嗡嗡飞向目的地的无人机。这些配送技术有一个共同之处——都对新冠病毒免疫。(然而却有被电脑病毒感染的可能。)

亚马逊何以能够如此迅速地适应疫情?公司最强的一大实力就是,它自身的构架就像是由不同独立国家组成的联邦,每一个国家都有其领导者和市民。在公司的西雅图总部,亚马逊没有将所有业务部门负责人圈在一个办公楼中,而是将这些高管散布于整个城市,各自负责自己的业务。例如,贝佐斯是整个联邦的领导者,重要决策都由他说了算。然而,与当前其他企业的常态相比,贝佐斯的副官们在迅速行动、决策、投资以及开发新创新方面有着更大的自主权。

从外界来看,这种结构似乎只会导致灾难:独立运营的各个封地散布在西雅图不同地区的多个大楼。然而,这种模式十分奏效,原因只有一个。贝佐斯一直在不断地向企业灌输着用于指导决策的三大基本原则:顾客至上、极致创新,以及着眼于长远的管理。几乎所有配得上手握股权的首席执行官都声称自己会遵守部分或大部分上述原则,以至于这些原则都成为了有关领导力的陈词滥调。然而,大多数领导者都未能做到言行一致或贯彻始终。不过在贝佐斯的领导下,亚马逊做到了。

贝佐斯的秘诀在于他所称的“惯性轮”,它是一个推动其三大根本价值观的概念引擎。从本质上,“惯性轮”这个理念的普及归功于管理大拿吉姆•柯林斯,它形容的是良性循环。亚马逊团队并没有专注于竞争,而是将所有的精力用于提升其客户的舒适度。其中一个方式就是降低成本。通过此举,亚马逊提升了到访其网站的客户数量,并借此吸引了更多独立卖家的入住,后者希望接触亚马逊平台不断增长的客流量。这一切又为亚马逊带来了更多的营收,继而实现了有助于进一步降低价格的规模经济效益。价格的降低又会带来更多的客户,从而让这个惯性轮一直处于转动状态。

正是这个所有亚马逊经理都铭记于心的惯性轮理念,才使得这家巨型企业能够像独立国家组成的联邦一样运转。雇员无需琢磨自己该做什么,其每天的工作便是更努力地推动惯性轮的转动。

为了继续营造亚马逊的发展态势,贝佐斯认为其公司必须继续通过创新来更新其惯性轮的每一个部件。这意味着亚马逊团队必须发挥其想象力。他们必须经常问自己该如何做才能取悦客户,并吸引更多的第三方卖家。贝佐斯在去年说:“我们十分渴望去先行先试,去创造。这一点非常契合顾客至上的理念,因为客户永远都不会满意,不过有时候他们自己都没有察觉到这一点,即便在他们感到很开心时亦是如此。客户始终希望寻找更好的方式,但他们也不知道是什么样的一种方式。我曾警告员工,践行顾客至上理念并不是仅仅在于倾听客户的心声,同时还包括设身处地地进行创造。”

每一个新的创新,包括Prime会员的隔日达配送、免费视频和音频流、Kindle、Fire TV、Echo智能音箱和Alexa,都旨在吸引新客户,并让老客户感到欣喜。

说到以长远为导向,贝佐斯始终认为,打造和维持这个惯性轮是一项长期、艰巨的任务。所有的亚马逊重大创新——从Kindle到AWS再到Echo,都需要耗费数年的时间。即便当亚马逊失败时,例如姗姗来迟、毫无新意的Fire Phone,公司依然在继续创新。贝佐斯深深感到,失败是不可避免的,但即便是多次失败,从长远来看也可能有成功的那一天。例如,通过吸取Fire Phone失利的部分教训,Echo诞生了。

亚马逊对效率和市场占有率的不懈追求引发了业界的一些控诉,这些控诉称亚马逊有时候越过了反竞争红线。在4月底,《华尔街日报》发布了一篇调查报告,称亚马逊使用平台上卖家的内部信息来开发竞争产品,然后以低于销售商的价格出售。有鉴于此,国会曾要求贝佐斯对众议院司法委员会进行解释。亚马逊称,公司将配合委员会的工作,但公司并未明确表明贝佐斯是否会去解释。作为对《华尔街日报》这篇文章的回应,亚马逊称,使用定价数据来打压销售商的行为违反了公司的政策,亚马逊已对此发起内部调查。

在过去10年中,贝佐斯已将惯性轮理念推向了新的高度。亚马逊如今正在以前所未有的速度将大数据、人工智能和机器学习等技术运用至运营当中,从而让惯性轮自身能够更快地转动。正是得益于这一能力,亚马逊才能够迅速地对疫情做出响应。在贝佐斯2016年致股东的信中,他解释了这类模型的力量:“机器学习能够让我们的算法进行需求预测、产品搜索排名、交易推荐、广告放置、欺诈检测和翻译等等。”

不妨将这个新表述看作是一个人工智能惯性轮。贝佐斯聘请的数万名工程师、数据科学家和编程人员已经让这个人工智能惯性轮成为了一台学习机器,一台有其自身智慧的神奇网络装备,它可以汇总亚马逊从客户那里搜集来的所有数据,然后事无巨细地加以分析。这台机器能够自己做决定,例如购买什么物品、卖多少钱,以及应该在全球哪个仓库存放。亚马逊的全球客户部门首席执行官杰夫•威尔克解释说:“在过去,我们使用数据帮助做决策,然而,最终的决策依然得靠人类。我们当前对机器学习的研究就是挑出一些重复率最高的智能流程,并取消其对人力决策的需求。我们能够完成这个闭环,这样就无需人类参与决策。我们可以对购买数百万件产品实现自动下单。”

令其竞争对手感到更可怕的是,所有因为疫情而引发的活动可能会大大提升亚马逊算法的智能水平。与那些为了生存而削减预算的企业相比,亚马逊生来便已做好了化危机为机遇的准备。几乎可以肯定的是,亚马逊必然将在疫情后脱颖而出,为客户提供更好的服务和更低的价格,而且这个惯性轮将继续转动。(财富中文网)

本文另一版本登载于《财富》杂志2020年6/7月刊,标题为《亚马逊:为疫情而生的商业巨头》。

译者:Biz

If you were designing a company from scratch that could capitalize on a global crisis, it would probably look a lot like Amazon. A fearsome operating machine that inspires equal measures of dread and admiration throughout the business world, the $280-billion-in-sales tech behemoth can react with the speed of the nimblest startup when challenged. Look no further than the company’s response this year to the coronavirus, which founder and CEO Jeff Bezos described to shareholders in late April as “the hardest time we’ve ever faced.”

Amazon’s leadership team recognized early on that the pandemic could be a historically disruptive event. And Bezos, who’d been spending one day a week at his rocket company, Blue Origin, quickly became more involved in Amazon’s operations, meeting daily with his “S” (for senior) team—a group of top executives, many of whom have been with the company for a decade or more. Almost overnight, Amazon ramped up its already massive online retail business to meet a huge surge in orders in the first quarter, as customers hunkered down at home and turned to the web for essential supplies. To bolster its response, the company embarked on an effort to vet and hire 175,000 additional employees.

The rapid mobilization paid off. For the three months ended in March, Amazon brought in $75.4 billion in revenue—a 26% gain over 2019. Sales at Amazon Web Services, the company’s cloud-computing business, crossed $10 billion in a quarter for the first time, as customers like streaming entertainment giant Netflix, videoconference sensation Zoom, and workplace-collaboration tool Slack experienced huge spikes in usage. Through early May, Amazon’s stock was up 25% for the year. And the net worth of Bezos, already the world’s wealthiest person, had surged to $144 billion—a leap of $29 billion in a matter of months.

As is often with case with Amazon, the extraordinary results didn’t come without controversy. The company had to respond to the thousands of shadowy sellers who began price-gouging on its site. Then, on May 1, some Amazon workers participated in a nationwide “sickout” to protest what they described as inadequate safety precautions by the company in its facilities. Amazon terminated a handful of employees this spring who were outspoken in their criticism of the company’s safety practices. (In each case the company said the firings were because of violations of company policies, not in retaliation for speaking out.) In announcing its first-quarter results, Amazon said that in the second quarter it would spend some $4 billion or more on COVID-related expenses, including increased salaries for frontline workers, protective gear, and employee testing—enough to cancel out all of its expected operating profits for the period. For Amazon, it’s a small price to pay in order to get the focus back on execution.

Amazon’s reputation for speedy delivery has suffered a little during the crisis as well. Before the pandemic, the norm for most of the company’s Prime customers was one-day delivery and same-day for groceries. Since the pandemic hit, essential items like household staples and medical supplies have taken as many as four days, and nonessential items even longer. Amazon, which is relatively new to the grocery game—it bought Whole Foods in 2017—has been deluged with food orders, and in many cities the company simply hasn’t been able to offer enough delivery slots to fulfill demand.

Despite those stumbles, the consensus on Wall Street is that Amazon will emerge from the coronavirus crisis bigger and stronger than ever—and with consumers even more reliant on its breadth of products and services. “No company can handle the kind of surge in demand that Amazon can,” says Mark Mahaney, the veteran tech industry analyst at RBC Capital Markets. “When the pandemic is really over, the physical retail competition will be weakened—and Amazon comes out of this a winner.”

As always, Bezos is playing the long game. And it’s a strategy that has produced spectacular results. This year Amazon jumped three spots on the Fortune 500 list to No. 2—its highest ranking ever. Since the company first made the list in 2002 at No. 492, its market value has risen more than 22,000%—it was hovering at around $1.2 trillion in early May—and the company’s sales have grown an average of 28% annually. Studying the formula behind that stunning growth trajectory is key to understanding just how much more powerful Amazon may become over time.

****

Since the day Bezos founded Amazon in 1994, it has essentially been a data-driven company that just happened to do retailing. Over that quarter-century span, Bezos built perhaps the most sophisticated and successful data-powered corporation the world has ever seen. Amazon’s online retail business is powered by algorithms that scan buying patterns second by second and adjust what the company stocks in its vast warehouses, where to stock it, and the fastest way to deliver it.

Well before the pandemic, Amazon was using its digital might to increasingly insinuate itself into our lives. Some 150 million Prime members—a number that grew by 50 million in less than two years—order clothing, staples, and electronics from the e-commerce giant, watch original Prime Video movies and TV shows, and listen to music on Amazon’s streaming media channels. Even consumers who don’t actively use Amazon’s website to shop spend much of their digital lives using services like Netflix that run on Amazon’s ubiquitous AWS servers.

Now the pandemic has accelerated these trends more than anyone could have imagined—and America’s increased reliance on Amazon’s services is likely to stick. Some have even argued that Amazon is becoming a kind of corporate Red Cross, given its essential role in providing supplies for strapped local and state governments. Gene Munster, a partner at the research and investment firm Loup Ventures, told Fortune in a recent interview: “The U.S. would be in a tighter spot if it were not for Amazon. It is a national asset.”

More opportunities for expansion lie ahead. While Amazon dominates the U.S. e-commerce market with a 38% share, it accounts for only about 5% of total retail in the U.S. Pre-COVID-19, some 90% of all retail still occurred in brick-and-mortar stores. But until scientists discover an effective vaccine—and under the best-case scenario, that’s at least months away—many shoppers will be reluctant to return to malls and department stores. That means more will keep reaching for Amazon’s buy button. Even after the virus is contained, it’s easy to imagine that Amazon’s grocery business will continue to thrive. RBC predicts the segment, driven in part by online sales, will reach $88 billion in gross revenues by 2023—nearly double the 2020 level.

Amazon also sees an opportunity to use the virus to expand into new areas. Alexa, its magical voice genie, can now answer tens of thousands of COVID-19 questions such as, “Alexa, what do I do if I think I have the virus?” Or, “Alexa, give me tips for cleaning and disinfecting my home.” The company has even patented a technology that will enable Alexa to recognize the sound of a cough. How long before Amazon enters telemedicine? (It’s already offering its Amazon Care telehealth service to its Seattle employees.)

At the same time, Bezos has jumped headlong into the autonomous electric-vehicle race. He has invested billions to build a future in which packages will be delivered by self-driving vans, small bots rolling through neighborhoods, and drones buzzing to their destinations. One thing all those delivery options have in common? They’re impervious to the coronavirus. (Though potentially vulnerable to a computer virus.)

****

How did Amazon adapt so quickly to the pandemic? One of the company’s great strengths is that it’s run like a federation of independent nations, each with its own leader and citizens. In Seattle, where the company is headquartered, there’s no central corporate suite for the heads of all the business units. The execs are spread throughout the city, running their own operations. Bezos, of course, is the leader of the federation, and his word on important decisions is final. But his lieutenants have more latitude to move quickly, make decisions and investments, and pursue new innovations than is typical in today’s corporations.

From the outside, this structure seems like a recipe for disaster: fiefdoms operating in separate buildings scattered throughout downtown Seattle. But it works. And for one reason only. Bezos has inculcated his business with three bedrock principles that guide all decision-making: customer obsession, extreme innovation, and long-term management. Just about any CEO worth his or her stock options claims to follow some or most of these principles—so much so that they’ve become leadership clichés. Most, however, fail to execute them consistently and over long periods. Under Bezos, Amazon does.

Bezos’s secret is what he calls his flywheel, a conceptual engine that drives his three deeply seated values. At heart, the flywheel—a concept popularized by management guru Jim Collins—is a metaphor for a virtuous cycle. Rather than focusing on the competition, Amazonians spend their every working moment trying to make their customers’ lives better. One way is to lower costs. By doing that, Amazon increases the number of customers who visit Amazon.com. That attracts more independent sellers who want to reach the growing traffic on Amazon’s platform, which leads to more revenue for Amazon. That in turn leads to economies of scale, which help further lower prices for customers. The lower prices pull in still more customers. And the flywheel keeps turning and turning and turning.

It is this flywheel concept, which every Amazon manager knows by heart, that enables the giant corporation to operate as a federation of independent nations. Employees don’t have to wonder what their role is. Their job is to push the flywheel a little harder every day.

To keep building Amazon’s momentum, Bezos understood that his company had to continually renew each element of the flywheel by innovating. This meant Amazonians had to think imaginatively. They had to ask constantly what they could do to please customers and to attract more third-party sellers. “We are eager to pioneer and invent,” Bezos said last year. “This marries well with customer obsession, because customers are always dissatisfied even if they don’t know it, even when they think they’re happy. They always want a better way, and they don’t know what that will be. I warn people that customer obsession is not just listening to customers, it’s also inventing on their behalf.”

Every new innovation—Prime membership with one-day free shipping, free video and audio streaming, the Kindle, Fire TV, the Echo smart speaker, and Alexa—is designed to attract new customers and keep current ones happy.

As for being long-term oriented, Bezos has always known that building and maintaining a flywheel is a long, hard slog. All of Amazon’s major innovations—from the Kindle to AWS to the Echo—were many years in the making. Even when Amazon failed, as in the case of its late-to-market and mediocre Fire Phone, it kept innovating. Bezos felt deeply that failures were inevitable but even flops might pay off in the long run. Some of the learning from the failed Fire Phone, for instance, ended up in the Echo.

The relentlessness of Amazon’s push for efficiency and dominance has drawn accusations that the company has at times crossed anticompetitive lines. In late April, the Wall Street Journal published an investigative report alleging that Amazon had used inside information about sellers on its platform to develop competing products and then undercut the vendors on price. That prompted Congress to request that Bezos testify before the House Judiciary Committee. Amazon has said it is cooperating with the committee, but it is not clear whether Bezos will agree to testify. In response to the Journal article, Amazon said that using pricing data to undercut vendors would violate its policies and that it has launched an internal investigation.

****

Over the past decade, Bezos has taken the flywheel concept to an even higher level. Amazon is now applying big data, A.I., and machine learning to the operation at an unprecedented rate—to make it spin even faster on its own. This capacity is what helped Amazon respond so swiftly to the pandemic. In his 2016 shareholder letter, Bezos explained the power of such models: “Machine learning drives our algorithms for demand forecasting, product search ranking, deals recommendations, merchandising placements, fraud detection, translations, and much more.”

Think of this new iteration as the A.I. flywheel. The tens of thousands of engineers, data scientists, and programmers whom Bezos has hired have made the A.I. flywheel a learning machine, a cyber contraption with its own intelligence that takes all the data that Amazon collects on its customers and then analyzes it in minute detail. The machine makes decisions about what items to purchase, how much to charge for them, and where in the world to stock them. As Jeff Wilke, CEO of Amazon’s worldwide consumer division, explains: “In the old days we used data to help make decisions, but humans still made the ultimate decisions. Part of what we’re doing now with machine learning is taking some of the most repetitive intellectual processes and eliminating the requirement for human decision-making. We are able to close the loop so humans no longer have to decide. We place buy orders for millions of items automatically.”

Even scarier for its competitors is how much smarter Amazon’s algorithms may get from all the pandemic-fueled activity. Unlike businesses that are cutting budgets to stay afloat, Amazon is built to optimize in a crisis. It will almost certainly emerge on the other side delivering better service, at lower prices, to its customers. And the flywheel will keep on turning.

A version of this article appears in the June/July 2020 issue of Fortune with the headline “Amazon Was Built for the Pandemic.”