Uber向来是一家非典型的公司。

Uber自打出生之日起就是一个搅局者,它将打破规则作为一种商业模式。面对各地的监管机构,Uber的态度向来是“抓住我算你有本事”。早在国内市场饱和之前,Uber就开始向全球进行扩张。它赔钱的速度跟融资的速度几乎一样快。在公司创业阶段,它就换了自己的CEO和管理团队的大部分成员,甚至连董事会也没有放过——而这一切都发生在Uber成为一家上市公司之前。

今年是Uber上市后的第一年,也是它创立的第11年,同时,今年Uber还首次登上了《财富》美国500强排行榜。不过年初以来,受全球新冠疫情影响,Uber的网约车客流量暴跌了80%,给公司营收造成了灾难性的打击。这种情况下,Uber明年很有可能会跌出这份榜单——当然,这种情况也绝对不会是孤例。

实际上,在疫情的冲击下,Uber已经经历了一场比2017年的换帅更惨烈的洗牌。(2017年,Uber的创始CEO特拉维斯·卡兰尼克被扫地出门。)今年年初,Uber就曾经表示,它有能力让公司的网约车业务盈利——换句话说,其他业务的盈利仍然没戏。它的Uber Eats外卖送餐业务虽然增长很快,却是一只吞金巨兽。Uber的其他试验性质的项目,比如科幻感很强的无人驾驶汽车和飞行出租车,也都是只出不进的项目,导致了公司几亿几亿地亏钱。而Uber在2018年收购的自行车和电动滑板车业务的情况也好不到哪里去。

然而一场疫情却改变了一切。突然之间,外卖送餐业务成了Uber短期内的救星。与此同时,Uber从“渣男”变“暖男”,干了一些放在以前简直难以想象的事,比如它贴心地呼吁乘客居家隔离,并且为司机们在经济和求职上提供了一些帮助。要知道,以前Uber与司机之间向来保持着一种相爱相杀的关系。而面对业务萎缩的现实,Uber也采取了大刀阔斧的改革,砍掉了一些早就应该砍掉的产品、地区和人员。

Uber仍然要面对很多令人头疼的挑战,尤其是至于它的核心业务何时能恢复,没有人可以说得准。但新冠肺炎疫情的意外爆发,却使Uber变得更加专注了,说不定反而有助于提高Uber的盈利能力。今年4月,Uber的CEO达拉·科斯罗萨西在旧金山家中的图书馆接受远程采访时表示:“我们必须重新审视我们的所有假设,3个月或者12个月以后的世界,跟昨天的世界肯定有很大的不同,而我们必须相应地做好准备。”

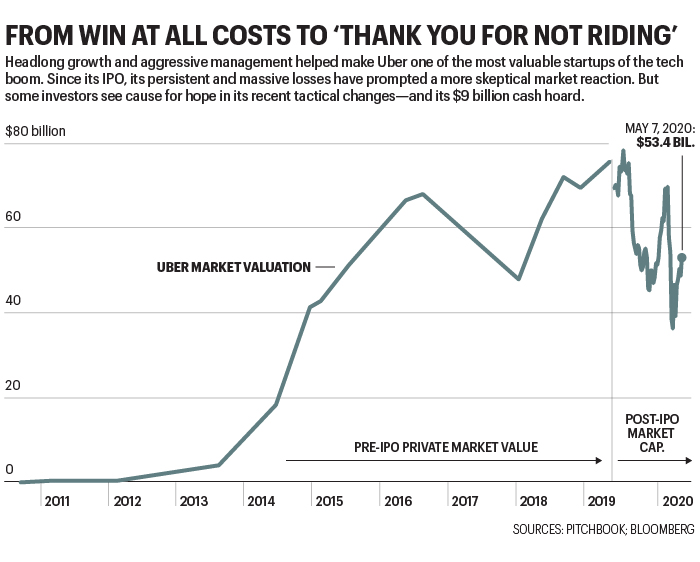

最近,Uber的世界远远不如一年以前那么美好。在过去的10年中,Uber在扩张道路上一路高歌猛进,在私人市场上创造了750亿美元的估值。去年春天,Uber已经做好了上市的准备。不过虽然Uber依然保持了高速增长(2019年的销售额上涨26%,达到141亿美元),但投资者却对Uber的盈利能力感到不满(去年的亏损达到85亿美元)。它的IPO也以失败告终,42美元的首次发行价并未达到预期,公司估值也降至700亿美元上下。而接下的几个月,Uber的股价又下跌了三分之一以上。不过它还是达到了一项重要的成就——拉到了80亿美元的融资。

到了今年2月底,Uber在看到疫情对公司在香港地区和台湾地区业绩的影响后,终于明白了这些现金是多么宝贵。公司在亚洲专门成立了一个应对新冠疫情的工作组,后来又将它升格为全球抗击疫情工作组。今年Uber原本打算3月3日在洛杉矶总部召开一场由全球150多名高管参加的管理层峰会。后来Uber多伦多地区的网约车业务负责人兼50多人的Uber抗疫工作组组长安德鲁·麦克唐纳表示,由于专家警告出差会增加传染风险,公司高层已经决定取消这次会议。麦克唐纳今年36岁,他原本是卡兰尼克时代的一员老将,在科斯罗萨西手下又得到了重用。他说:“除了避免增加传染风险,更重要的是,我们认为领导者必须在岗在位,做好应对危机的准备。”

对于一家多年以来早就习惯了说错话、办错事的公司来说,Uber这次难得地展现出了“泰山崩于前而面不改色”的气度。在这个非常时期,肯定没有人愿意跟陌生人待在同一辆车里,Uber也就识趣地暂停了UberPool拼车服务。同时,Uber还向确诊新冠肺炎的司机提供了短期经济援助,并且帮助一些司机转行做外卖送餐业务。另外,Uber还决定向独立餐馆免收送货费,并且发动它旗下的货运公司Uber Freight以成本价运送抗疫物资。另外,Uber还为医护人员提供了数百万次的免费乘车服务。

Uber甚至想出了各种办法呼吁用户不要叫车,这简直是与公司“为了胜利不择手段”的一贯作风背道而驰,更何况Uber去年四分之三的营收都是来自网约车业务。Uber先是通过自家的APP确保用户了解当地对疫情期间网约车出行的限制,然后它的营销团队还打出了一个公益性质的电视广告,并且聘请了知名广告公司Wieden+Kennedy进行制作。它的广告词里:“感谢您不打车。”科斯罗萨西说,他一开始对公益广告的这个点子并不感冒。“但当我听到它想传达的信息时,我就全心全意地支持了。”

这套“组合拳”的效果也是非常惊人的。科斯罗萨西上台以来,Uber可以说是不遗余力地试图给大众“洗脑”,希望让大家相信,Uber已经不是过去的那个Uber了。而这次Uber在全球防疫工作中的表现,则扎扎实实地重塑了它的品牌形象,效果要好于以往的任何招数。Lyft的前首席运营官、风投资本家乔恩·麦克尼尔表示:“我认为他们比Lyft清醒得更早,也做得更好。”

在疫情爆发前,Uber已经决定要把另一项业务打造成盈利业务。Uber早在四年前就推出了它的外卖送餐服务Uber Eats,到2019年,Uber Eats的营业额已经达到25亿美元,不过它的亏损额也达到了14亿美元,而且它的美国市场份额仍然落后于竞争对手DoorDash和Grubhub。今年3月初,随着美国老百姓开始避免乘坐网约车出行,科斯罗萨西也开始讨论靠Uber Eats来弥补收入损失的可能性。

在某种程度上,这种做法已经奏效了。今年4月,Uber Eats的全球销量猛增了89%(不包括Uber即将退出的印度市场)。虽然涨势喜人,但有些问题还是要说明一下。即便这个季度Uber Eats的业务额突飞猛进,但外卖送餐业务只占了Uber总销售额的23%,高于2019年全年的18%。而Uber在外卖订单中的“分成比例”大约是订单总价的11%左右,只相当于网约车业务的一半。

可以说,Uber已经把外卖送餐业务当成了“生命线”,同时它也在积极添加新的产品配送类别。近日有新闻报道称,Uber已经找到了作为上市公司的Grubhub谈收购的问题。与此同时,Uber也在积极添加其他服务。比如今年4月,该公司推出了针对零售企业的快递服务Uber Direct,和针对个人用户的快递服务Uber Connect。科斯罗萨西说:“我不认为我们会做那种送一个包裹需要三天的快递服务。不过如果你需要在30分钟到几个小时内收到某样东西,我们可以比其他任何人更好地提供这项服务。”

这几种服务很容易让人产生似曾相识的感觉,因为Uber之前也推出一个名叫Uberrush的类似服务,但由于未能取得成功,而在2018年将它砍掉了。皮埃尔-迪米特里·戈尔-科蒂是一名35岁的法国公民,他已经在Uber工作8年了,最近他被公司任命为Uber Eats和其他快递业务的负责人。他表示,以Uber的规模以及以往的经验教训,将有助于它这一次取得成功。他在阿姆斯特丹接受采访时说:“这两者之间有一些细微的区别,而且我们也从之前的错误中吸取了教训。”戈尔-科蒂还负责Uber的食杂快递业务,在这个领域里,Uber的竞争对手有沃尔玛、亚马逊和初创公司Instacart等。Uber现在正在收购Cornershop公司的多数股权,这家公司主要在智利、墨西哥和美国的两个地区提供食杂配送服务。

Uber在每一个细分快递市场都面临着激烈的竞争,而且和所有竞争对手一样,这几年来,Uber一直在想方设法激励商家和外卖小哥们跟它而不是跟它的竞争对手合作,在这个过程中,Uber也自然亏损了不少钱。不过这次疫情也给Uber和它的竞争对手们带来了一些好处。加拿大皇家银行的电子商务分析师马克·马哈尼指出,考虑到当前严峻的就业形势,加之全球餐饮行业都在苦苦挣扎,“他们不再需要补贴骑手和餐馆了。”

今年3月,投资者大幅压低了Uber的股价,使其一度跌至14美元以下,因为美国经济的停摆对Uber业务的影响是显而易见的。后来Uber的股价又强势回升到30美元以上,主要原因是,人们普遍认为,Uber已经通过IPO和其他融资活动搞到了不少现金,足以让它安然度过这场风暴。不过Uber的现金池也并非深不见底,到3月末的时候,Uber还有90亿美元现金,但较年初的110多亿美元,已经少了足足20亿美元。Uber已经发布了警报,在最糟糕的情况下,到今年年底,公司的现金可能就只剩下40亿美元了。

Uber并不指望它的网约车业务能很快恢复。我们可以拿中国的情况作为参考,中国目前的经济恢复速度远远超过了大多数国家,不过中国的网约车业务恢复得也并不理想。一些早期迹象表明,比起乘坐公共交通工具,中国的上班族更喜欢网约车,但是现在,比起网约车,他们更喜欢自己开车。在疫情爆发前,机场接送机服务大概为Uber贡献了15%的收入,而这部分业务将在一段时间内受到抑制。同样,消费者叫车去酒吧、餐厅的次数也会减少。而它的UberPool拼车服务,可能在疫情完全过去之前都不太可能恢复。

可以肯定的是,Uber必然会利用业务下滑之机来大幅降低成本。5月初,Uber砍掉了客服岗和招聘岗的3700个职位。它实际上还向初创公司Lime支付了一笔钱,好将它的自行车和电动滑板车业务转让给Lime,作为交换,Uber向Lime做了一笔8500万美元的投资。(有一个迹象能说明Uber的单车业务发展得有多差——Uber表示,这笔交易能让它的年亏损额下降1.64亿美元。)另外,Uber还将放弃8个UberEats的市场,因为在这些地方,Uber的订单份额几乎微不足道。

这些还只是开始。在5月7日的财报电话会议上,Uber向投资者承诺将削减10亿美元的成本,同时暗示公司将进一步裁员,而这一次,Uber就要向公司内部员工下手了。人们还普遍认为,Uber将削减甚至是完全砍掉它的无人驾驶业务Uber Freight和它的飞行出租车业务Elevate。Uber的CEO科斯罗萨西曾经是一名投资银行家,后来担任过在线旅游巨头Expedia公司的CEO,他并不讳言公司的减支计划。“我认为,你应该经常审视如何合理配置你的投资组合,而且我们就是这样做的,否则是很愚蠢的,尤其是在疫情带来的各种变化下。”Uber的财务总监尼尔森·柴也在电话会议上对投资者表示:“现实是世界已经变了,没有什么东西是不能改变的。”

除此之外,Uber面临的生存威胁中,也有一些与疫情无关。比如今年1月,美国加州颁布的《AB5法案》专门瞄准了Uber等公司的所谓“零工经济劳动者”。该法案的目的,是要迫使Uber将司机归类为企业的雇员,而不是企业的承包商。Uber声称它的司机并不具备雇员资格,并且与Lyft等几家公司共同筹集了1.1亿美元资金,打算在11月的大选期间进行政治游说,以让这家网约车公司获得豁免。今年5月,加州检方还对Uber和Lyft这两大网约车公司提起了诉讼,称他们剥夺了司机的带薪休假和失业保险等福利。无论是在法庭上败诉,还是政治游说失败,都会给Uber带来灾难性的打击。Uber尚未核算将司机归类为员工需要额外增加多少成本,不过据巴克莱的分析师罗斯·桑德勒估算,这种调整可能会导致Uber每年额外增加5亿美元的亏损。

科斯罗萨西在刚入主Uber时,曾经享受过一段“蜜月期”,他温文尔雅、和蔼可亲的个性,与卡兰尼克的咄咄逼人形成了鲜明对比。不过去年5月的IPO之后,由于投资者对Uber的亏损非常不满,科斯罗萨西从英雄变成了狗熊,高管团队里也有很多人离职,其中甚至包括他从Expedia公司挖来的首席运营官。很多Uber的观察人士都认为,科斯罗萨西是一个只会算小账的人,既不是运营型人才,也不是创新型人才。

这次危机也让人们从一个新的视角重新认识了他的这些品质,同时也给了他第二次证明自己的机会。他的大将之风激发了人们的信心,尤其是在貌似全世界都在分崩离析的时候。毕竟在这种时候,冷静灵活的手腕要比气势汹汹的咆哮管用。一位既认识卡兰尼克也认识科斯罗萨西的银行家说:“如果是卡兰尼克的话,他可能会从韩国征调检测试剂盒,然后开始谈论怎么把Lyft碾压在地上。”而此时此刻,科斯罗萨西并不需要把任何人踩在地上,他只需要让Uber继续上路。

关于Uber的一切

网约车巨头Uber有多条业务线,但并非所有业务都能坚持到疫情结束。

网约车

网约车业务是Uber的原创产品,以至于它在国际上几乎成了呼叫网约车的代名词。网约车业务也占了Uber收入的大头,2019年大约贡献了公司总销售额的76%。

送外卖

去年,Uber的外卖送餐业务Uber Eats大约贡献了18%的收入。目前Uber的外卖送餐业务仍未盈利,不过随着美国开放堂食的地方越来越少,老百姓的外卖需求也在日益走高。Uber看到了这个机会,它可以利用自己的配送网络,替零售企业和个人配送商品、包裹和食杂品。

送快递

Uber Freight是Uber的一个新业务,它的竞争对手是美国的各大物流业巨头,Uber赌的是它的算法优势能够战胜竞争对手的经验。

共享单车、滑板车

2018年,Uber收购了初创公司Jumpin,不过今年5月,它基本上已经将这项业务转让给了另一家初创公司Lime。Uber还向Lime投资了8500万美元。

无人驾驶汽车

Uber的高级技术部曾经豪言要建立一个无人驾驶网约车网络。不过这个部门已经烧掉了几亿美元现金,而且还面临着激烈的竞争。

飞行出租车

一个纯属意想天开的发明,这个名叫Uber Elevate的部门很可能活不到疫情结束。(财富中文网)

本文另一版本登载于《财富》杂志2020年6/7月刊,标题为《Uber转型生存之路》。

译者:隋远洙

Uber向来是一家非典型的公司。

Uber自打出生之日起就是一个搅局者,它将打破规则作为一种商业模式。面对各地的监管机构,Uber的态度向来是“抓住我算你有本事”。早在国内市场饱和之前,Uber就开始向全球进行扩张。它赔钱的速度跟融资的速度几乎一样快。在公司创业阶段,它就换了自己的CEO和管理团队的大部分成员,甚至连董事会也没有放过——而这一切都发生在Uber成为一家上市公司之前。

今年是Uber上市后的第一年,也是它创立的第11年,同时,今年Uber还首次登上了《财富》美国500强排行榜。不过年初以来,受全球新冠疫情影响,Uber的网约车客流量暴跌了80%,给公司营收造成了灾难性的打击。这种情况下,Uber明年很有可能会跌出这份榜单——当然,这种情况也绝对不会是孤例。

实际上,在疫情的冲击下,Uber已经经历了一场比2017年的换帅更惨烈的洗牌。(2017年,Uber的创始CEO特拉维斯·卡兰尼克被扫地出门。)今年年初,Uber就曾经表示,它有能力让公司的网约车业务盈利——换句话说,其他业务的盈利仍然没戏。它的Uber Eats外卖送餐业务虽然增长很快,却是一只吞金巨兽。Uber的其他试验性质的项目,比如科幻感很强的无人驾驶汽车和飞行出租车,也都是只出不进的项目,导致了公司几亿几亿地亏钱。而Uber在2018年收购的自行车和电动滑板车业务的情况也好不到哪里去。

然而一场疫情却改变了一切。突然之间,外卖送餐业务成了Uber短期内的救星。与此同时,Uber从“渣男”变“暖男”,干了一些放在以前简直难以想象的事,比如它贴心地呼吁乘客居家隔离,并且为司机们在经济和求职上提供了一些帮助。要知道,以前Uber与司机之间向来保持着一种相爱相杀的关系。而面对业务萎缩的现实,Uber也采取了大刀阔斧的改革,砍掉了一些早就应该砍掉的产品、地区和人员。

Uber仍然要面对很多令人头疼的挑战,尤其是至于它的核心业务何时能恢复,没有人可以说得准。但新冠肺炎疫情的意外爆发,却使Uber变得更加专注了,说不定反而有助于提高Uber的盈利能力。今年4月,Uber的CEO达拉·科斯罗萨西在旧金山家中的图书馆接受远程采访时表示:“我们必须重新审视我们的所有假设,3个月或者12个月以后的世界,跟昨天的世界肯定有很大的不同,而我们必须相应地做好准备。”

最近,Uber的世界远远不如一年以前那么美好。在过去的10年中,Uber在扩张道路上一路高歌猛进,在私人市场上创造了750亿美元的估值。去年春天,Uber已经做好了上市的准备。不过虽然Uber依然保持了高速增长(2019年的销售额上涨26%,达到141亿美元),但投资者却对Uber的盈利能力感到不满(去年的亏损达到85亿美元)。它的IPO也以失败告终,42美元的首次发行价并未达到预期,公司估值也降至700亿美元上下。而接下的几个月,Uber的股价又下跌了三分之一以上。不过它还是达到了一项重要的成就——拉到了80亿美元的融资。

到了今年2月底,Uber在看到疫情对公司在香港地区和台湾地区业绩的影响后,终于明白了这些现金是多么宝贵。公司在亚洲专门成立了一个应对新冠疫情的工作组,后来又将它升格为全球抗击疫情工作组。今年Uber原本打算3月3日在洛杉矶总部召开一场由全球150多名高管参加的管理层峰会。后来Uber多伦多地区的网约车业务负责人兼50多人的Uber抗疫工作组组长安德鲁·麦克唐纳表示,由于专家警告出差会增加传染风险,公司高层已经决定取消这次会议。麦克唐纳今年36岁,他原本是卡兰尼克时代的一员老将,在科斯罗萨西手下又得到了重用。他说:“除了避免增加传染风险,更重要的是,我们认为领导者必须在岗在位,做好应对危机的准备。”

对于一家多年以来早就习惯了说错话、办错事的公司来说,Uber这次难得地展现出了“泰山崩于前而面不改色”的气度。在这个非常时期,肯定没有人愿意跟陌生人待在同一辆车里,Uber也就识趣地暂停了UberPool拼车服务。同时,Uber还向确诊新冠肺炎的司机提供了短期经济援助,并且帮助一些司机转行做外卖送餐业务。另外,Uber还决定向独立餐馆免收送货费,并且发动它旗下的货运公司Uber Freight以成本价运送抗疫物资。另外,Uber还为医护人员提供了数百万次的免费乘车服务。

Uber甚至想出了各种办法呼吁用户不要叫车,这简直是与公司“为了胜利不择手段”的一贯作风背道而驰,更何况Uber去年四分之三的营收都是来自网约车业务。Uber先是通过自家的APP确保用户了解当地对疫情期间网约车出行的限制,然后它的营销团队还打出了一个公益性质的电视广告,并且聘请了知名广告公司Wieden+Kennedy进行制作。它的广告词里:“感谢您不打车。”科斯罗萨西说,他一开始对公益广告的这个点子并不感冒。“但当我听到它想传达的信息时,我就全心全意地支持了。”

这套“组合拳”的效果也是非常惊人的。科斯罗萨西上台以来,Uber可以说是不遗余力地试图给大众“洗脑”,希望让大家相信,Uber已经不是过去的那个Uber了。而这次Uber在全球防疫工作中的表现,则扎扎实实地重塑了它的品牌形象,效果要好于以往的任何招数。Lyft的前首席运营官、风投资本家乔恩·麦克尼尔表示:“我认为他们比Lyft清醒得更早,也做得更好。”

在疫情爆发前,Uber已经决定要把另一项业务打造成盈利业务。Uber早在四年前就推出了它的外卖送餐服务Uber Eats,到2019年,Uber Eats的营业额已经达到25亿美元,不过它的亏损额也达到了14亿美元,而且它的美国市场份额仍然落后于竞争对手DoorDash和Grubhub。今年3月初,随着美国老百姓开始避免乘坐网约车出行,科斯罗萨西也开始讨论靠Uber Eats来弥补收入损失的可能性。

在某种程度上,这种做法已经奏效了。今年4月,Uber Eats的全球销量猛增了89%(不包括Uber即将退出的印度市场)。虽然涨势喜人,但有些问题还是要说明一下。即便这个季度Uber Eats的业务额突飞猛进,但外卖送餐业务只占了Uber总销售额的23%,高于2019年全年的18%。而Uber在外卖订单中的“分成比例”大约是订单总价的11%左右,只相当于网约车业务的一半。

可以说,Uber已经把外卖送餐业务当成了“生命线”,同时它也在积极添加新的产品配送类别。近日有新闻报道称,Uber已经找到了作为上市公司的Grubhub谈收购的问题。与此同时,Uber也在积极添加其他服务。比如今年4月,该公司推出了针对零售企业的快递服务Uber Direct,和针对个人用户的快递服务Uber Connect。科斯罗萨西说:“我不认为我们会做那种送一个包裹需要三天的快递服务。不过如果你需要在30分钟到几个小时内收到某样东西,我们可以比其他任何人更好地提供这项服务。”

这几种服务很容易让人产生似曾相识的感觉,因为Uber之前也推出一个名叫Uberrush的类似服务,但由于未能取得成功,而在2018年将它砍掉了。皮埃尔-迪米特里·戈尔-科蒂是一名35岁的法国公民,他已经在Uber工作8年了,最近他被公司任命为Uber Eats和其他快递业务的负责人。他表示,以Uber的规模以及以往的经验教训,将有助于它这一次取得成功。他在阿姆斯特丹接受采访时说:“这两者之间有一些细微的区别,而且我们也从之前的错误中吸取了教训。”戈尔-科蒂还负责Uber的食杂快递业务,在这个领域里,Uber的竞争对手有沃尔玛、亚马逊和初创公司Instacart等。Uber现在正在收购Cornershop公司的多数股权,这家公司主要在智利、墨西哥和美国的两个地区提供食杂配送服务。

Uber在每一个细分快递市场都面临着激烈的竞争,而且和所有竞争对手一样,这几年来,Uber一直在想方设法激励商家和外卖小哥们跟它而不是跟它的竞争对手合作,在这个过程中,Uber也自然亏损了不少钱。不过这次疫情也给Uber和它的竞争对手们带来了一些好处。加拿大皇家银行的电子商务分析师马克·马哈尼指出,考虑到当前严峻的就业形势,加之全球餐饮行业都在苦苦挣扎,“他们不再需要补贴骑手和餐馆了。”

今年3月,投资者大幅压低了Uber的股价,使其一度跌至14美元以下,因为美国经济的停摆对Uber业务的影响是显而易见的。后来Uber的股价又强势回升到30美元以上,主要原因是,人们普遍认为,Uber已经通过IPO和其他融资活动搞到了不少现金,足以让它安然度过这场风暴。不过Uber的现金池也并非深不见底,到3月末的时候,Uber还有90亿美元现金,但较年初的110多亿美元,已经少了足足20亿美元。Uber已经发布了警报,在最糟糕的情况下,到今年年底,公司的现金可能就只剩下40亿美元了。

Uber并不指望它的网约车业务能很快恢复。我们可以拿中国的情况作为参考,中国目前的经济恢复速度远远超过了大多数国家,不过中国的网约车业务恢复得也并不理想。一些早期迹象表明,比起乘坐公共交通工具,中国的上班族更喜欢网约车,但是现在,比起网约车,他们更喜欢自己开车。在疫情爆发前,机场接送机服务大概为Uber贡献了15%的收入,而这部分业务将在一段时间内受到抑制。同样,消费者叫车去酒吧、餐厅的次数也会减少。而它的UberPool拼车服务,可能在疫情完全过去之前都不太可能恢复。

可以肯定的是,Uber必然会利用业务下滑之机来大幅降低成本。5月初,Uber砍掉了客服岗和招聘岗的3700个职位。它实际上还向初创公司Lime支付了一笔钱,好将它的自行车和电动滑板车业务转让给Lime,作为交换,Uber向Lime做了一笔8500万美元的投资。(有一个迹象能说明Uber的单车业务发展得有多差——Uber表示,这笔交易能让它的年亏损额下降1.64亿美元。)另外,Uber还将放弃8个UberEats的市场,因为在这些地方,Uber的订单份额几乎微不足道。

这些还只是开始。在5月7日的财报电话会议上,Uber向投资者承诺将削减10亿美元的成本,同时暗示公司将进一步裁员,而这一次,Uber就要向公司内部员工下手了。人们还普遍认为,Uber将削减甚至是完全砍掉它的无人驾驶业务Uber Freight和它的飞行出租车业务Elevate。Uber的CEO科斯罗萨西曾经是一名投资银行家,后来担任过在线旅游巨头Expedia公司的CEO,他并不讳言公司的减支计划。“我认为,你应该经常审视如何合理配置你的投资组合,而且我们就是这样做的,否则是很愚蠢的,尤其是在疫情带来的各种变化下。”Uber的财务总监尼尔森·柴也在电话会议上对投资者表示:“现实是世界已经变了,没有什么东西是不能改变的。”

除此之外,Uber面临的生存威胁中,也有一些与疫情无关。比如今年1月,美国加州颁布的《AB5法案》专门瞄准了Uber等公司的所谓“零工经济劳动者”。该法案的目的,是要迫使Uber将司机归类为企业的雇员,而不是企业的承包商。Uber声称它的司机并不具备雇员资格,并且与Lyft等几家公司共同筹集了1.1亿美元资金,打算在11月的大选期间进行政治游说,以让这家网约车公司获得豁免。今年5月,加州检方还对Uber和Lyft这两大网约车公司提起了诉讼,称他们剥夺了司机的带薪休假和失业保险等福利。无论是在法庭上败诉,还是政治游说失败,都会给Uber带来灾难性的打击。Uber尚未核算将司机归类为员工需要额外增加多少成本,不过据巴克莱的分析师罗斯·桑德勒估算,这种调整可能会导致Uber每年额外增加5亿美元的亏损。

科斯罗萨西在刚入主Uber时,曾经享受过一段“蜜月期”,他温文尔雅、和蔼可亲的个性,与卡兰尼克的咄咄逼人形成了鲜明对比。不过去年5月的IPO之后,由于投资者对Uber的亏损非常不满,科斯罗萨西从英雄变成了狗熊,高管团队里也有很多人离职,其中甚至包括他从Expedia公司挖来的首席运营官。很多Uber的观察人士都认为,科斯罗萨西是一个只会算小账的人,既不是运营型人才,也不是创新型人才。

这次危机也让人们从一个新的视角重新认识了他的这些品质,同时也给了他第二次证明自己的机会。他的大将之风激发了人们的信心,尤其是在貌似全世界都在分崩离析的时候。毕竟在这种时候,冷静灵活的手腕要比气势汹汹的咆哮管用。一位既认识卡兰尼克也认识科斯罗萨西的银行家说:“如果是卡兰尼克的话,他可能会从韩国征调检测试剂盒,然后开始谈论怎么把Lyft碾压在地上。”而此时此刻,科斯罗萨西并不需要把任何人踩在地上,他只需要让Uber继续上路。

关于Uber的一切

网约车巨头Uber有多条业务线,但并非所有业务都能坚持到疫情结束。

网约车

网约车业务是Uber的原创产品,以至于它在国际上几乎成了呼叫网约车的代名词。网约车业务也占了Uber收入的大头,2019年大约贡献了公司总销售额的76%。

送外卖

去年,Uber的外卖送餐业务Uber Eats大约贡献了18%的收入。目前Uber的外卖送餐业务仍未盈利,不过随着美国开放堂食的地方越来越少,老百姓的外卖需求也在日益走高。Uber看到了这个机会,它可以利用自己的配送网络,替零售企业和个人配送商品、包裹和食杂品。

送快递

Uber Freight是Uber的一个新业务,它的竞争对手是美国的各大物流业巨头,Uber赌的是它的算法优势能够战胜竞争对手的经验。

共享单车、滑板车

2018年,Uber收购了初创公司Jumpin,不过今年5月,它基本上已经将这项业务转让给了另一家初创公司Lime。Uber还向Lime投资了8500万美元。

无人驾驶汽车

Uber的高级技术部曾经豪言要建立一个无人驾驶网约车网络。不过这个部门已经烧掉了几亿美元现金,而且还面临着激烈的竞争。

飞行出租车

一个纯属意想天开的发明,这个名叫Uber Elevate的部门很可能活不到疫情结束。(财富中文网)

本文另一版本登载于《财富》杂志2020年6/7月刊,标题为《Uber转型生存之路》。

译者:隋远洙

Nothing has ever been typical about Uber.

A maverick at birth, Uber embraced rule-¬breaking as a business model, what with its catch-us-if-you-can flouting of local regulators. It expanded globally long before it saturated its home market. It lost money nearly as quickly as it raised it. The startup changed out its CEO and much of its management team, and then its board of directors—all before becoming a public company.

Now, in its first year of eligibility and only the 11th of its existence, Uber has joined the Fortune 500. Given the devastating effects on its revenue of a global pandemic that has pummeled its passenger-trip volumes by 80%, Uber might well fall off the list next year—which certainly wouldn’t be typical.

Indeed, as a result of the crisis, Uber has been forced to undergo a reset even more traumatic than the one that followed the ousting of its mercurial CEO, Travis Kalanick, in 2017. At the beginning of this year, the company had signaled it could make profits in its ride-hailing business—and just about nowhere else. Its fast-growing Uber Eats restaurant-meal delivery business was hemorrhaging money. Experiments from self-driving cars to flying taxis to a freight-¬forwarding service accounted for hundreds of millions of dollars of losses. A bike and scooter business it bought in 2018 was in no better shape.

The pandemic changed everything. Suddenly food delivery became Uber’s near-term savior. Uber made moves that would have been unthinkable in its bad-boy era, like cleverly and empathetically urging riders to stay home. It offered financial and job-hunting assistance to drivers, with whom it has long had a love-hate relationship. And faced with the reality of a shriveling business, Uber moved aggressively to prune products, locations, and people in ways that were long overdue.

A dizzying set of challenges remains, not least of which is the uncertainty around when its core business will recover. But there’s every chance the unwanted onset of COVID-19 could leave Uber more focused, and possibly more profitable, than it would have been without it. “We have to relook at all of our assumptions,” says Dara Khosrowshahi, Uber’s CEO, in a late-April Zoom interview from the library of his San Francisco home. “We’re making sure that we are prepared for the world as it’s going to be three months from now or 12 months from now, versus the world of yesterday.”

Uber's world wasn’t all that rosy as recently as a year ago. After tearing through the 2010s with breakneck expansion and achieving a private-market valuation that topped $75 billion, it prepared to go public last spring. Yet despite continued torrid topline growth—sales jumped 26% in 2019, to $14.1 billion—investors soured on the company’s unprofitability. (It lost $8.5 billion last year.) The IPO was a flop—shares debuted at a lower-than-expected $42, valuing Uber at around $70 billion, and fell by more than a third in the ensuing months. But it accomplished one critical achievement: Uber raised $8 billion.

By late February of this year, Uber began to understand how valuable that cash would be, having seen the effects of the pandemic on its revenue in Taiwan and Hong Kong. The company formed a working group in Asia to address the new coronavirus, then upgraded it to a global COVID-19 task force. On March 3, the 150 top leaders of the company from around the world were scheduled to meet in San Francisco, where Uber is based, for a management summit. Andrew Macdonald, who heads Uber’s rides business from Toronto as well as the 50-plus-person task force, says senior management canceled the gathering because health experts were warning against travel. “But more than that, we felt like leaders needed to be in place, getting ready to respond to the crisis,” says Macdonald, a 36-year-old Kalanick-era holdover whose star has risen under Khosrowshahi.

For a company that had made a habit over the years of doing and saying the wrong thing, Uber showed itself capable of grace under fire. It suspended its UberPool ride-sharing option, mindful that strangers wouldn’t want to be cooped up together in a back seat. It offered short-term financial help to drivers diagnosed with COVID-19, and helped drivers migrate to making food-delivery runs. It stopped charging independent restaurants delivery fees and mobilized Uber Freight, its freight-forwarding service, to move relief supplies, at cost. Uber also provided millions of free rides to health care workers.

Uber even devised various methods to urge customers not to request rides, an out-of-character gesture for a company once known for winning at all costs—and which relied on the passenger business for more than three-quarters of its 2019 revenue. First, it used its app to make sure riders understood local restrictions. Then its marketing group proposed a slick, PSA-style TV ad campaign and hired the prestigious agency Wieden+Kennedy to create it. Its tagline: “Thank you for not riding.” Khosrowshahi says he wasn’t initially sold on the idea, “but once I heard the messaging I was all in.”

The result of all this is a bit of a shocker: Uber’s response to a global health crisis may have done more so far to rehabilitate its image than any of its strenuous efforts during Khosrowshahi’s tenure to convince people Uber had changed. Says Jon McNeill, a former Lyft chief operating officer who is now a venture capitalist: “I think they out-‘woked’ Lyft.”

Before the crisis, Uber already had decided it had one other winning business in its portfolio. Begun four years ago, Uber Eats had grown to a $2.5 billion business by 2019. But it also lost $1.4 billion and trailed competitors DoorDash and Grubhub in U.S. market share. In early March, when riders had begun to stop hailing Ubers, Khosrowshahi started talking up the ability of Eats to counterbalance the lost revenues.

To a degree, that’s what happened. In April, Uber Eats saw global volume perk up by 89% (not including India, which Uber is exiting). That progress comes with caveats. Even in a quarter when its business was surging, food delivery made up only 23% of Uber’s overall sales, up from 18% for all of 2019. And the “take rate,” Uber’s share of the total check, is around 11% on food orders, roughly half its haul for a passenger trip.

Still, Uber is so enthusiastic about the Uber Eats lifeline that it is busily adding new delivery products. At press time, news accounts said that Uber had approached publicly traded Grubhub about an acquisition. In the meantime, it’s been adding other services. In April, the company announced Uber Direct, a delivery service for retailers, and Uber Connect, a courier service for individuals. “I don’t think we’re going to be delivering packages in three days,” says Khosrowshahi. “But if you need something within 30 minutes to a few hours, we think we can deliver that service better than anyone else can.”

Such offerings provoke a sense of déjà vu because Uber ran a similar (and unsuccessful) service called UberRush before killing it in 2018. Pierre-Dimitri Gore-Coty, a 35-year-old French citizen and an eight-year veteran of the company, recently was named to run Eats and the other delivery businesses. He says Uber’s scale, and its scars, will help it succeed this time. “There have been nuances, and we’ll learn from the mistakes,” he says in an interview from Amsterdam, where he is based. Gore-Coty also oversees Uber’s push into grocery delivery, where competitors include Walmart, Amazon, and startup Instacart. The company is buying a majority stake in Cornershop, which delivers groceries in Chile and Mexico as well as two U.S. locations.

Uber confronts fierce competition in each of its delivery markets and, like its competitors, it has for years incentivized drivers and restaurants to choose it over its rivals, losing money as a result. In that regard, a wrecked economy could benefit Uber and its foes alike. Given the dire employment situation and the shaky state of dining businesses worldwide, says Mark ¬Mahaney, an e-commerce analyst with RBC, “they will not need to subsidize drivers or restaurants anymore.”

Investors dramatically bid down Uber’s shares in March, driving the price below $14 as it became apparent what a U.S. lockdown would mean to its business. The stock rebounded above $30 primarily for one reason: It is widely perceived the company has enough cash from its IPO and other fundraising to ride out the storm. Still, the well isn’t bottomless. At the end of March, Uber had $9 billion in cash. But that was down from more than $11 billion at the beginning of 2020. The company has warned that in a worst-case scenario its cash could dwindle to $4 billion by year-end.

Uber doesn’t expect a quick return of its passenger business. Behavior in China, which is further along the economic recovery curve than most countries, suggests an uneven ride. Early indications there suggest that commuters prefer ride-hailing to mass transit, but they choose their own cars over ride-hailing. Airport runs, 15% of Uber’s pre-pandemic revenue, will be suppressed for some time, as will trips to bars and restaurants. UberPool, the cost-splitting service, isn’t likely to return until the pandemic passes completely.

The company is certain to use the business decline to dramatically lower its costs. In early May it cut 3,700 positions in customer support and recruiting. It also effectively paid the startup Lime to take Uber’s bikes and scooters business in exchange for Uber investing $85 million in Lime. (A sign of how badly the unit was foundering: Uber said the deal will lower its annual operating losses by $164 million.) Uber also will leave eight Eats markets where it reaps a negligible share of its bookings.

These cuts are just the beginning. Uber promised investors on a May 7 earnings call that it would eliminate $1 billion in costs. It has hinted there will be more layoffs, this time to corporate staff. It also is widely expected the company will trim or eliminate completely its self-driving car business, Uber Freight, and Elevate, the outfit trying to build a flying taxi. Khosrowshahi, a former investment banker and later a dealmaking CEO at online travel giant Expedia, is blunt about the cost-cutting. “I think you should constantly look at rationalizing your portfolio, and we are,” he says. “It would be foolish not to, especially with the kinds of changes that have happened with COVID.” As Nelson Chai, Uber’s chief financial officer, said on the call with investors, “The reality is the world has changed. There are no sacred cows.”

Uber also faces an existential threat that has nothing to do with COVID-19. The State of California enacted a law in January, AB 5, that specifically targeted “gig workers” at Uber and similar companies. The goal of the legislation was to compel Uber to classify drivers as employees rather than contractors. Uber contends its drivers don’t qualify as employees, and it joined with Lyft and others to raise $110 million to place an initiative on the November ballot that will exempt the companies. In May, California’s attorney general filed suit against Uber and Lyft, arguing that the companies are depriving drivers of benefits like paid sick leave and unemployment insurance. A loss in court or at the ballot box would be devastating for Uber. The company hasn’t quantified the cost of having to classify drivers as employees, but Barclays analyst Ross Sandler projects that the reclassification would add $500 million in operating losses annually.

Khosrowshahi enjoyed a honeymoon when he first arrived at Uber, so dramatic was the contrast between his suave and genial character and Kalanick’s in-your-face abrasiveness. But when investors soured on Uber’s losses after its IPO last May, he went from hero to goat. He suffered numerous departures from his senior management team, including the chief operating officer he brought over from Expedia. The rap among Uber watchers was that Khosrowshahi was merely a numbers guy: neither an operator nor an innovator.

The crisis has put his qualities in a new light—and given the CEO a second chance. His demeanor inspires confidence, especially when the world is falling apart. After all, a cool hand and a sharp pencil will be more useful these days than hard-charging bluster. “Travis would’ve been commandeering test kits from South Korea and talking about driving Lyft into the ground,” says a banker who knows both CEOs. At this point, Khosrowshahi doesn’t have to drive anyone else into the ground. He just needs to keep Uber on the road.

Uber everything

The ride-hailing giant has multiple business lines, but not all will outlast COVID-19.

Delivering people

The Rides business is the original product that made “Uber” a globally recognized verb. It’s the bulk of the company, accounting for 76% of 2019 sales.

Delivering things

Uber Eats made up 18% of revenues last year. The restaurant-food-delivery business is unprofitable, but in demand right now as dining-in options shrink. Uber sees an opportunity to use its delivery network to move merchandise from retailers, packages on behalf of individuals, and groceries.

Freight forwarding

The nascent Uber Freight competes against logistics stalwarts, a bet that Uber’s algorithms can outweigh the competition’s experience.

Bikes and scooters

Uber bought startup Jumpin 2018, but essentially gave the business to Lime, another startup, this May. Uber also invested $85 million in Lime.

Self-driving cars

Uber’s Advanced Technology Group once promised to anchor a driverless ride-hailing network. But the unit loses hundreds of millions and faces stiff competition.

Flying taxis

A flight of fancy, Uber Elevate isn’t likely to survive the pandemic.

A version of this article appears in the June/July 2020 issue of Fortune with the headline “Uber swerves to survive.”