持乐观态度的经济预测者认为,在最理想的情况下,2020年美国第二季度GDP将出现8%的负增长,而其他人则给出了高达15%的负增长预测。一些有根据的推测认为,如果我们回过头来看,第一季度也将出现负增长。结合这一推测,美国很有可能已经进入了衰退期。

雷蒙德詹姆斯金融公司首席经济学家斯考特·布朗说:“郑重警告,我们真的不知道接下来会发生什么,因此我认为人们预测10%-15%的负增长是合理的。”

牛津经济研究院美国分部首席美国经济学家格里高利·达科表示:“这可能是历史上出现的单季度GDP最大跌幅。”他预计GDP的负增长率为12%。

让我们先抛开这些专家意见和深奥的计算,小心地走出家门,看一看周边的那些商业。关闭的店面,无所事事的员工,就连厕纸这类基本生活用品都已断货,这就是经济萧条的写照。

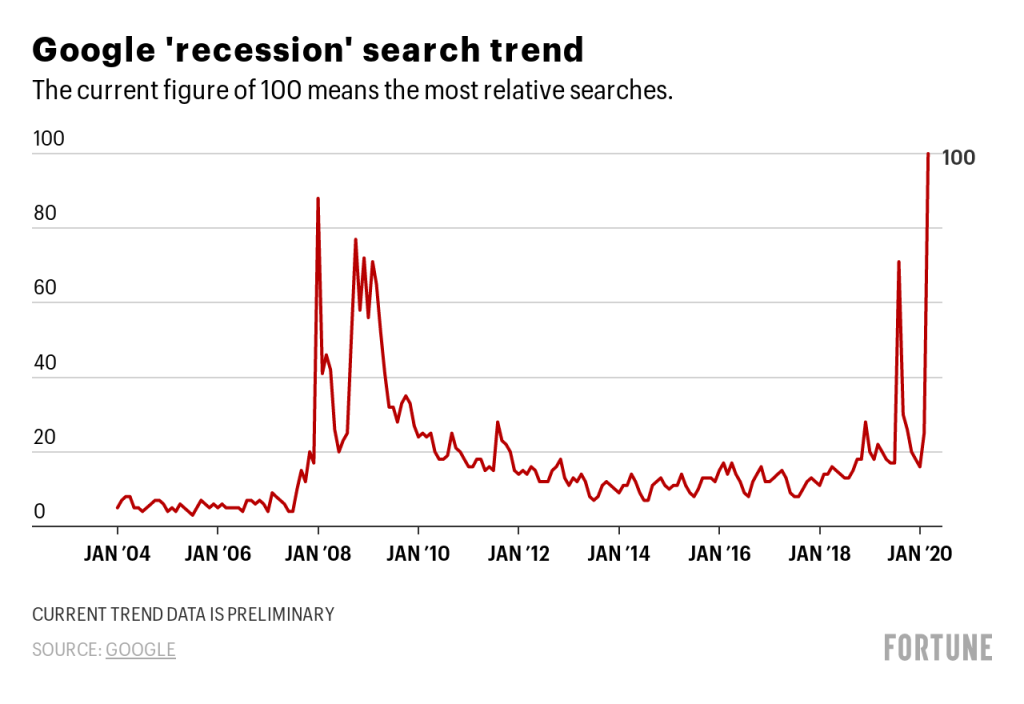

人们有理由感到担心。下表是从2004年到现在谷歌有关“衰退”一词的搜索趋势数据月走势图:

一些传统经济指标,例如国债收益,则反映了这种悲观情绪。10年期债券收益率(被视为投资者对更长时期经济的乐观程度指标)在3月18日收报1.18%。这个数据并不好,但也要强于本月早些时候的0.54%,然而前者源自于美联储庞大的流动性干预。

3月的官方就业数据要到4月3日才能发布,但调查工作已于上周结束。如今,单日出现的变化可能是巨大的。美国劳工部当前的周失业率报告显示,申请失业金的人数为28.1万,较上周的21.1万有所上升。Berenberg Capital Markets称,就一周的变化而言,这是一个“可观的增幅”,而且是2017年以来最大单周增幅。

即便是这个数据也已经过时:因为它没有纳入之前新闻报道的影响:通用、福特和菲亚特克莱斯勒将暂停美国、加拿大和墨西哥工厂的所有生产活动。这一切都意味着就业情况将受到巨大的持续冲击。

衡量即将到来的下滑

确实,获得当前确切的经济数据十分困难。很多当前的数据都来自于之前的阶段,那时,地方、州和国家政府还没有采取更为严厉的举措来预防病毒传播。

TS Lombard首席美国经济学家史蒂夫·布里茨称,通常,模型会整合当前的数据趋势,然后预测今后可能的走向。他预测经济的负增长上限是8.4%。布里茨说:“这是一个迥异的怪兽,因为经济活动的强制性萎缩源于社会疏隔。”

尽管大多数娱乐和服务类活动因社会疏隔而被大幅削减,但这里也存在抵消因素,例如医疗开支的增加,政府刺激计划以及供应链的不畅和美中贸易战的遗留影响所导致的进口额下滑(在理论层面上推高了GDP)。

此外,负面事件均存在涓滴效应。失业人群在经济中的开销会降低。公司会取消扩张,甚至是缩减运营,这一点会导致裁员或工作时长的减少,并形成恶性循环。

有关第二个季度过后的预测已经出炉,有的专家认为经济会在第三季度开始反弹,然后年底出现质的飞跃。其他人则认为第三季度损失会更加惨重,而且表示经济的恢复很大程度上取决于联邦政府举措的成效。

不管最终结果如何,今后的旅程必然充满了坎坷。(财富中文网)

译者:Feb

持乐观态度的经济预测者认为,在最理想的情况下,2020年美国第二季度GDP将出现8%的负增长,而其他人则给出了高达15%的负增长预测。一些有根据的推测认为,如果我们回过头来看,第一季度也将出现负增长。结合这一推测,美国很有可能已经进入了衰退期。

雷蒙德詹姆斯金融公司首席经济学家斯考特·布朗说:“郑重警告,我们真的不知道接下来会发生什么,因此我认为人们预测10%-15%的负增长是合理的。”

牛津经济研究院美国分部首席美国经济学家格里高利·达科表示:“这可能是历史上出现的单季度GDP最大跌幅。”他预计GDP的负增长率为12%。

让我们先抛开这些专家意见和深奥的计算,小心地走出家门,看一看周边的那些商业。关闭的店面,无所事事的员工,就连厕纸这类基本生活用品都已断货,这就是经济萧条的写照。

人们有理由感到担心。

一些传统经济指标,例如国债收益,则反映了这种悲观情绪。10年期债券收益率(被视为投资者对更长时期经济的乐观程度指标)在3月18日收报1.18%。这个数据并不好,但也要强于本月早些时候的0.54%,然而前者源自于美联储庞大的流动性干预。

3月的官方就业数据要到4月3日才能发布,但调查工作已于上周结束。如今,单日出现的变化可能是巨大的。美国劳工部当前的周失业率报告显示,申请失业金的人数为28.1万,较上周的21.1万有所上升。Berenberg Capital Markets称,就一周的变化而言,这是一个“可观的增幅”,而且是2017年以来最大单周增幅。

即便是这个数据也已经过时:因为它没有纳入之前新闻报道的影响:通用、福特和菲亚特克莱斯勒将暂停美国、加拿大和墨西哥工厂的所有生产活动。这一切都意味着就业情况将受到巨大的持续冲击。

衡量即将到来的下滑

确实,获得当前确切的经济数据十分困难。很多当前的数据都来自于之前的阶段,那时,地方、州和国家政府还没有采取更为严厉的举措来预防病毒传播。

TS Lombard首席美国经济学家史蒂夫·布里茨称,通常,模型会整合当前的数据趋势,然后预测今后可能的走向。他预测经济的负增长上限是8.4%。布里茨说:“这是一个迥异的怪兽,因为经济活动的强制性萎缩源于社会疏隔。”

尽管大多数娱乐和服务类活动因社会疏隔而被大幅削减,但这里也存在抵消因素,例如医疗开支的增加,政府刺激计划以及供应链的不畅和美中贸易战的遗留影响所导致的进口额下滑(在理论层面上推高了GDP)。

此外,负面事件均存在涓滴效应。失业人群在经济中的开销会降低。公司会取消扩张,甚至是缩减运营,这一点会导致裁员或工作时长的减少,并形成恶性循环。

有关第二个季度过后的预测已经出炉,有的专家认为经济会在第三季度开始反弹,然后年底出现质的飞跃。其他人则认为第三季度损失会更加惨重,而且表示经济的恢复很大程度上取决于联邦政府举措的成效。

不管最终结果如何,今后的旅程必然充满了坎坷。(财富中文网)

译者:Feb

The optimistic view from economic forecasters is that the annual GDP growth rate in the second quarter of 2020 will, at best, be -8%. Others predict as bad as -15%. Combined with educated guesses that the first quarter will also see negative growth in retrospect, there's a good chance the country is already in a recession.

"With the big caveat that we really don't know, I think it's reasonable to look for something like 10% to 15% down," said Scott Brown, chief economist at Raymond James.

"It may be the largest contraction of GDP on record in a specific quarter," said Gregory Daco, chief U.S. economist at Oxford Economics USA. He expects a 12% contraction.

Forget the expertise and abstruse calculations for a moment. Take a cautious step outside the front door and look at any nearby businesses. Shuttered storefronts, idled workers, the inability to get basic products like toilet paper—all tell the same tale of bad economic times.

People are rightly worried. In the chart below, Google search trend data on the word "recession" yields the following monthly graph from 2004 to the present.

Some traditional economic measures, like Treasury yields, are mirroring that pessimism. The 10-year bond yield—considered an indicator of investor optimism for the longer term, closed Wednesday at 1.18%. Not great, although better than the low of 0.54% earlier this month—but only after massive liquidity intervention by the Federal Reserve.

Official job numbers for March won't be out until April 3. Even then, the survey work was done last week. These days, the difference a single day brings can be immense. Today's weekly unemployment report from the Department of Labor showed claims of 281,000, up from last week's 211,000. That's a "sizeable increase" over one week and the largest since 2017, according to Berenberg Capital Markets.

And even that data is already outdated: it doesn't include yesterday's news that GM, Ford, and Fiat Chrysler would stop all production in the U.S., Canada, and Mexico for the time being. It all indicates a sizeable and growing hit to the workforce.

Measuring the coming drop

Indeed, getting hard economic data at the moment is difficult. Much of the current data was taken before the more draconian steps that local, state, and national governments have been taking to stop virus transmission.

Normally, models incorporate current data trends and then project forward what path they might take, according to Steven Blitz, chief U.S. economist for TS Lombard. His projection is on the low end at -8.4%. "This is a very different animal because you have an imposed contraction in economic activity because of social distancing," Blitz said.

While most categories of leisure and service activities are being slashed due to social distancing, there are also offsetting factors, such as increased healthcare spending, government stimulus plans, and reduced imports (which technically increase GDP) that are a result of stymied supply chains and lingering effects of the U.S.-China trade war.

Plus, the negative events all have trickle down effects. People out of work have less to spend in the economy. Companies put off expansions, or even contract operations, which leads to layoffs or reduced hours, which feed into a vicious circle.

Past the second quarter, the estimates spread out, with some experts looking for a rebound beginning in Q3 and really taking off by year's end. Others look for more losses in the third quarter and say a recovery depends largely on how effectively the federal government moves.

Whatever the final result, the journey is certain to be a bumpy one.