SEC找上了马斯克,原因是他在推特上屏蔽了人

|

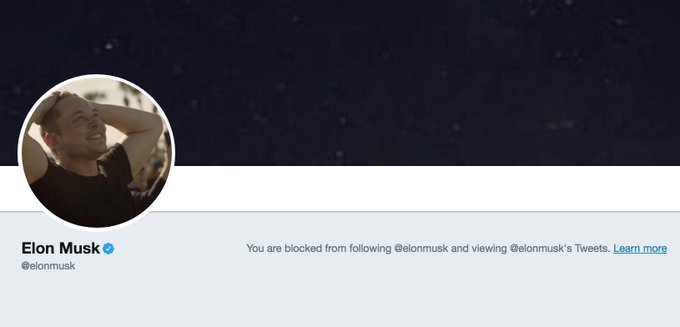

埃隆·马斯克上周二在推特上宣布他“正在考虑将特斯拉私有化”,这样做或许违法,但自有他自己的理由。 在推特上披露这种能左右市场的重大信息似乎显得有违常理。但2013年美国证券交易委员会(SEC)已将社交媒体定为有效披露方式。从那时起推特就一直是和投资者进行沟通的真正渠道,前提是公司要就这样的披露提醒投资者。 几个月后,也就是2013年11月,特斯拉就遵循这项要求,在业绩发布会上请投资者“关注埃隆·马斯克和特斯拉的推特账号”,以获取更多信息。 从那以后,马斯克养有了经常在推特上屏蔽别人的习惯。据一位参与制定社交媒体政策的前SEC官员透露,这样的习惯有可能给特斯拉的良好守法记录带来不利影响。 毕竟,SEC看待社交媒体公告的角度是公平披露,这项要求源于该机构的《公平披露规则》,即Regulation FD。该规则要求,公司的信息披露方式必须“设计合理,以便用非排他方式向广大公众发布信息。” SEC前办公室副主任迈克尔·利夫提克曾于2013年参与实施了对社交媒体的考察,如今他在律师事务所Quinn Emanuel Urquhart & Sullivan担任合伙人。利夫提克说:“关键在于一定要确保所有人都知道。但如果屏蔽了某些人,情况就会发生改变,因为如果不让想关注你的人看你的推特,那就会变成有选择的披露。这确实是个问题。” 《财富》杂志发现至少有三十多人表示马斯克在推特上屏蔽了他们,其中有投资者、新闻记者以及做空人士马克·斯皮格,这位对冲基金经理一直在公开批评特斯拉(我应该明白这种感觉:2016年年中前后,马斯克在推特上屏蔽了我。后来特斯拉和SolarCity公布了合并计划,我随即写了篇文章指出两家公司的董事会成员有非常大的重叠。很快我就发现自己被马斯克屏蔽了。他还在差不多同一时间屏蔽了我的几位同事,原因看来是在抗议卡罗尔·卢米斯在《财富》上发表的文章,内容涉及到特斯拉拖了太长时间才披露其自动驾驶汽车发生致命事故的消息——实际情况表明这对特斯拉的股价有重大影响)。 |

Elon Musk’s tweet Tuesday announcing that he was “considering taking Tesla private” may have been illegal—but not for the reasons many people think. Using Twitter to disclose such crucial market-moving information may seem unorthodox. But the platform has been a bonafide channel for investor communication since 2013, when the Securities and Exchange Commission blessed social media as a valid disclosure method—as long as companies gave investors a heads-up they would post it there. Tesla complied with this requirement a few months later, directing investors, in a November 2013 earnings press release, to “please follow Elon Musk’s and Tesla’s Twitter accounts” for additional information. Since then, though, Tesla’s CEO has developed a habit that could undermine the company’s good standing with the law, according to a former SEC regulator who helped establish the agency’s social media policy: Elon Musk routinely blocks people from following him on Twitter. After all, the SEC looks at social media announcements through the lens of fair disclosure requirements, as defined in a rule known as Regulation FD. Companies’ communication methods must be “reasonably designed to provide broad, non-exclusionary distribution of the information to the public,” according to the rules. “The point is to just make sure everyone knows,” says Michael Liftik, former deputy chief of staff of the SEC, who helped conduct the 2013 social media inquiry and is now a partner at the law firm Quinn Emanuel Urquhart & Sullivan. “But when you start blocking, that kind of does change the equation, because that kind of becomes a selective disclosure if you’re not letting anyone who wants to follow you, follow you. I do think that creates problems.” Fortune identified at least three dozen people who say Musk has blocked them on Twitter, including investors, journalists, and short-seller Mark Spiegel, a hedge fund manager who has been an outspoken critic of Tesla. (I should know what it feels like: Musk blocked me from following him on Twitter sometime in mid-2016, something I first noticed shortly after I wrote an article pointing out the significant overlap in the boards of Tesla and SolarCity as the companies announced their plan to merge. Musk also blocked several of my colleagues around the same time, in apparent protest of a Fortune article by Carol Loomis suggesting Tesla had waited too long to disclose a fatal crash of one of its cars running on autopilot—which turned out to be material to Tesla’s stock price.) |

|

哇,我才知道自己有幸被特斯拉CEO埃隆·马斯克亲自屏蔽了。真有意思,真的——2018年8月8日上午4:23 利夫提克说:“如果他屏蔽所有对特斯拉发表不利言论的人,比如,你说‘我不喜欢你们造的车’,结果就被屏蔽了,那么就可以说他存在一种屏蔽他人的行为模式,我觉得这确实会带来一个问题:即他是否已把这个开放渠道重新变为了选择性渠道。” 特斯拉和SEC均拒绝就此发表评论。 谁在什么时候了解到了什么? 问题在于是否有一部分投资者先于别人从特斯拉那里了解到了重大信息,从而能在被排除在消息圈之外的投资者采取行动前通过买卖特斯拉的股票牟利。就上周的特斯拉私有化消息而言,该公司股价最高涨幅曾达到7%(随后一度停牌)。做空者(获利方式为借入并卖出股票,然后以较低价格将其买回,再归还给股票出借人)因此受损。特斯拉股价快速上涨迫使一些做空者以高价买入该公司股票,这让后来才听到这个消息的人处于更不利的位置。 斯皮格就是其中之一,这位对冲基金经理告诉《财富》杂志,他“看到特斯拉股价飙升,然后听了新闻报道”才知道马斯克的私有化计划。“他已经屏蔽我好几年了。我不得不用浏览器和另一个用户名来关注他。” 和这个问题相呼应的是另一场全国性争论,那就是特朗普总统在推特上屏蔽他人是否合法。今年5月,一位联邦法官裁定特朗普此举违反美国宪法第一修正案,但司法部已就此项裁决提起上诉。 斯皮格还说:“就跟特朗普的案例一样,应该强制性‘禁言’[马斯克]而且不允许他‘屏蔽’别人。” 据报道,SEC正在调查特斯拉向投资者发布的公告,包括马斯克关于私有化的推特,只是还不清楚此项调查是否涉及这位CEO在推特上屏蔽别人的行为。但在判断是否违规时,选择性问题是SEC考虑的主要问题之一。 2013年,时任SEC执行部门代理主管的乔治·卡内洛斯在该机构颁布社交媒体指导意见时发表的声明中表示:“绝不能因为公司选择性地披露重要信息而使一部分股东先于其他股东采取行动。大多数社交媒体都是和投资者交流的最合适工具,但如果访问受到限制,或者如果投资者不知道社交媒体是他们获得最新消息的地方,那就得另当别论了。”(财富中文网) 译者:Charlie 审校:夏林 |

Wow, I didn't know I had the honor(?) of being personally blocked by $TSLA's Elon Musk. Fascinated by this, really. “If he blocks anyone who says anything negative about Tesla—you say ‘I don’t like your cars,’ you’re blocked—and he really has a pattern of blocking a lot of people, I do think that raises particular questions about whether he has turned that open channel back into a selective channel,” Liftik says. Tesla and the SEC each declined to comment. Who learns what, when? The problem lies in whether some investors learn material information from Tesla sooner than others, allowing them to make money by buying or selling the stock before investors who were out of the loop can take action. In the case of Musk’s taking-private tweet this week, Tesla stock instantly shot up as much as 7% (before trading was temporarily halted). That hurt short-sellers, who make money by borrowing stock, selling it, then buying it back at a cheaper price (to return it to the lender). The rapid surge in Tesla’s stock price forced some short-sellers to buy shares at elevated levels—putting those who heard the news later in an even worse position. Spiegel, for one, found out about Musk’s going-private plan when he saw “the jump in the stock and then the headlines,” the hedge fund manager tells Fortune. “He’s blocked me for years. I have to use a separate web browser and ID to follow him.” The debate echoes a similar controversy playing out on the national stage as to whether it is illegal for President Trump to block people on Twitter. A federal judge ruled in May that Trump’s actions violated the First Amendment, although the Department of Justice is appealing the decision. “As in the Trump ruling, [Musk] should be forced to ‘mute’ and not ‘block,'” Spiegel adds. The SEC is reportedly probing Tesla’s public statements to investors, including Musk’s tweet about going private, though it’s unclear if the CEO’s Twitter blocking practice is part of the review. But the issue of selectivity is a key consideration in how the SEC determines whether there has been a violation. “One set of shareholders should not be able to get a jump on other shareholders just because the company is selectively disclosing important information,” George Canellos, then acting director of the SEC’s division of enforcement, said in the 2013 statement announcing the agency’s social media guidance. “Most social media are perfectly suitable methods for communicating with investors, but not if the access is restricted or if investors don’t know that’s where they need to turn to get the latest news.” |