要让迈克尔·戴尔讲两句豪言壮语是很困难的事情,即便给他时间准备也于事无补。当被问及AI热潮会给这家以他名字命名的公司戴尔科技(Dell Technologies)带来多大的增长机遇时,这位创始人兼长期首席执行官并没有给出任何简洁有力的准确描述,而是陷入了沉思。

他在思考之后说:“感觉这次热潮的势头跟前几次一样大,而且可能会更大。”随后他补充说:“其实,可能要大得多。”他又停顿了一下,重新思考该如何措辞,然后给出了一个最为不确定的结论:“我也不确定。没有人能知道。”

我们坐在奥斯汀郊区戴尔科技总部的一间会议室里,这里3月份的气温已经升至31摄氏度。戴尔走了进来,身着深色宽松长裤和深蓝色粗棉布领扣衬衫(德州人称之为商务休闲,四季皆宜)。他刚刚完成了照片拍摄,能看出来谈不上享受,而是在应付。他并不是反对自己成为公司的品牌和形象代言人,毕竟很长一段时间以来都是如此,确切来说已经有40年了。他依然是戴尔科技最虔诚的信仰者,也是公司最大的股东,他和妻子苏珊名下持有公司53%的股份,价值790亿美元。然而,他在逢场作戏方面并没有什么天分,以前也是如此。事实上,他似乎在刻意避免给人留下这种印象,即便在其即将开展这一最伟大的壮举时亦是如此。

与其他科技公司首席执行官不一样的是,戴尔不会去讲一些豪言壮语,也不会惺惺作态。他没有从事什么副业,例如将自己送入外太空。尽管成年后其所有生活都处于公众视野当中,但他表现得十分慎重,颇有分析头脑,而且几乎是刻意表现得很平淡。因此,对于生成式AI会对其公司带来什么影响这个问题,他并没有给出一个明确的回答,这一点也就不足为奇了。

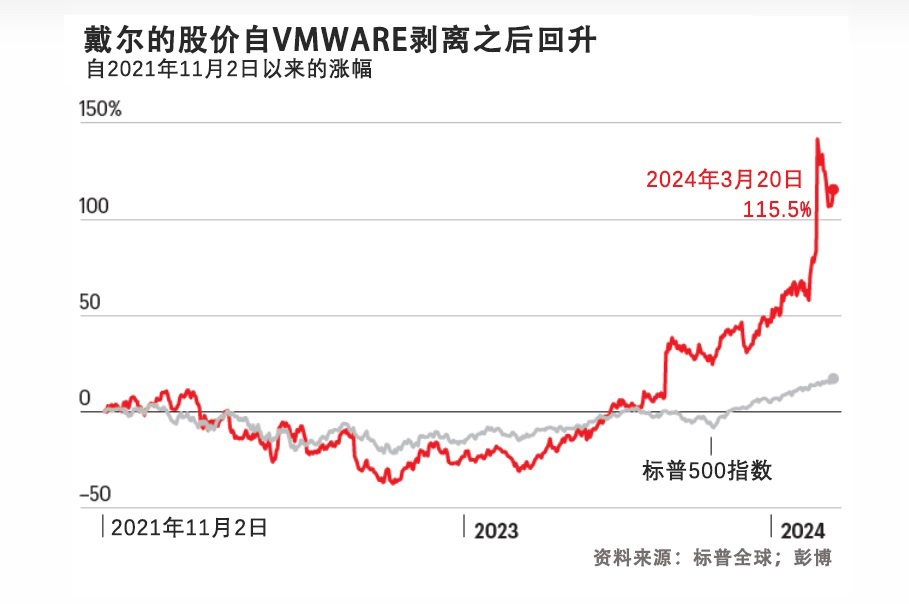

不过,尽管戴尔倾向于回避这个问题,市场却难掩其激动之心。就在我们进行采访数天之前,2024年3月1日,当戴尔科技公布了超出分析师预期的营收之后,其股价飙升了38%,突破了创纪录的131美元大关。这份财报让外界十分看好戴尔不断增长的终端科技产品组合的需求,也就是存储和管理生成式AI应用运行时所需海量数据组所使用的设备。针对AI优化后的服务器订单在上一季度增长了40%。首席运营官杰夫·克拉克在公司业绩发布会上曾表示:“我们刚开始接触摆在眼前的AI机遇。”

受此影响的不仅只有戴尔的公司。由于股价飙升,迈克尔·戴尔的个人净资产据称在3月初达到了1000亿美元,对于在30岁就成为亿万富翁的戴尔来说,这依然是一个显著的里程碑。

然而,戴尔对这一切都处之泰然。过去几十年中,面对一些大起大落,他始终保持着同样的波澜不惊。他曾经带领公司实现了多次重大转型。同时,他展现了一种不可思议的能力——读懂客户的需求,并在正确的时间做出合适的策略调整,无论是弱化PC转而投身服务器、感应器和存储,还是在巨额收购交易中不顾卡尔·伊坎的强烈反对而带领公司私有化时都是如此。

正是得益于这一私有化举措,戴尔科技才能去把握当前的AI浪潮。在私有化后的过去五年中,戴尔才真正开启了销售笔记本和台式电脑之外的多元化之路。戴尔远离了市场对季度业绩的痴迷,转而巩固和扩张了其公司,成为了一家为企业客户打造基础设施工具的巨头。在这一过程中,他策划了历史上最大的一次科技公司交易,以670亿美元收购数据存储提供商EMC。

如果戴尔并不是一个充满活力、轰动型的演讲者,这可能是因为他在过去40年中已经养成了倾听的习惯,并通过其分析技能和强烈的好奇心来发现其客户的需求,然后应对其所在领域的各种波折。他对我说:“我喜欢花时间去研究科技,也愿意与客户待在一起。”他补充说,至少就业务而言,“我真的没有什么别的爱好。”

戴尔科技依然在销售戴尔个人电脑;事实上,公司的大部分营收来自计算机业务。不过,如今的戴尔科技与5年前或10年前大不相同,与40年前相比更是如此。唯一不变的就是戴尔自己。企业软件制造商Salesforce联合创始人兼首席执行官马克·贝尼奥夫表示:“他可能是科技行业历史上任职时间最长的首席执行官。”贝尼奥夫在谈论戴尔时表示:“他比我小6个月,但我把他看作我的老哥。他在各个方面都是那么出色。”

如果不是其庞大的规模,人们很难记住戴尔的总部。在朗德罗克的戴尔公司总部坐在戴尔对面,“出色”并非是我想到的第一个词。不过,戴尔已经打造了一座为99%的世界500强公司提供科技构筑材料的帝国,并乐此不疲。这些公司在AI新时代将出现新的需求。如果戴尔能够精明行事,那么AI的未来可能会让这位首席执行官以及这家曾几何时毫无目标的计算机生产商,比以往任何时候都更讨市场喜欢,这一切都将确保他能够在未来继续掌控公司大权。

*****

在接受我们采访之后的上午,戴尔在其母校得克萨斯大学奥斯汀分校的一个医疗创新峰会上发表了演讲。(戴尔在这所大学读完了两个学期,然后便辍学开始全职销售个人电脑。)投资者吉姆·布雷耶在戴尔的建议下于2019年从硅谷搬到了奥斯汀,他在提到这位首席执行官时毫不吝惜赞美之词。他说:“迈克尔·戴尔是我合作过的最勇敢的企业家。”

戴尔的表现……还不错。(很明显,公开演讲并不是他的舒适区。)不过,他表现得很自信,也很坚决。59岁的戴尔依然保持着青春的气息,其卷发仅有淡淡的灰色。从观众的反应来看,很明显,戴尔在校园大受欢迎,即便他从未拿到毕业证。

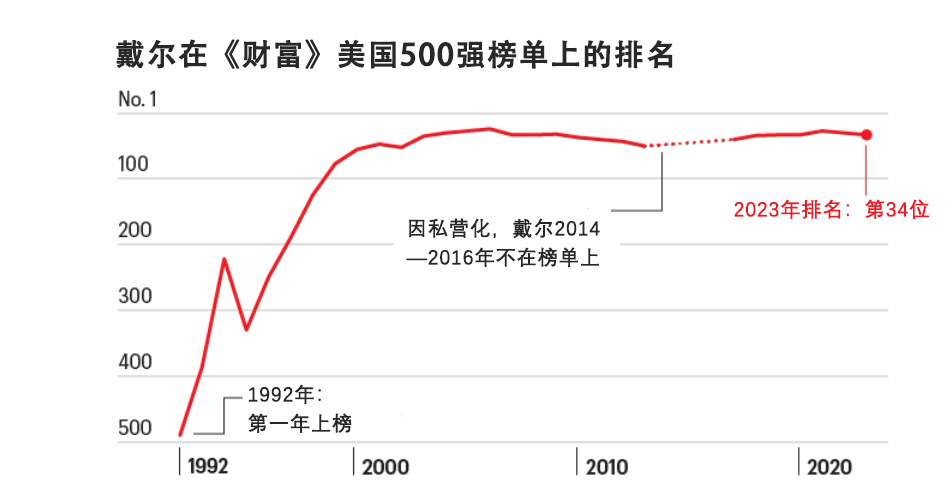

在有据可查的早些年间,这位古怪、冲动的创始人似乎从未出过错。1984年,作为医科大学预科生,他便开始在大学宿舍里捣弄起了电脑。在19岁那年,他离开了学校,并将所有精力放在自己的生意上。他面临着其他大得多的竞争对手,包括IBM和苹果,但戴尔开创了新的商业模式:他的电脑是可以定制的,而且直接面向消费者销售,砍掉了中间商。1988年,他带领戴尔计算机上市,筹集了3000万美元,并使用这笔资金在全球进行扩张。在27岁那年,他成为了《财富》美国500强企业中最年轻的首席执行官。只要个人电脑的需求在增长,公司的规模便一直在增长。

然而,个人电脑最终成为了公司的致命弱点。2001年,戴尔成为了全球领先的电脑制造商,超越了曾经叱咤风云的康柏。不过,其销量在不久后便开始下滑。亚洲制造商加入了战局,为美国消费者提供价格更低的产品。在21世纪00年代末,智能手机和平板蜂拥而至,进一步放缓了桌面和笔记本的需求。戴尔曾尝试进军移动领域,但其产品并不叫座。戴尔的“平板手机”定位于手机和笔记本之间的非必要尴尬地带,刚面世一年便停产了。

在此之前,戴尔耗费了数年的时间尝试业务的多元化。1995年,他携手PowerEdge进军服务器市场,该产品线目前依然存在,针对的是那些无法依靠现有设备管理海量数据的企业。2006年,公司成立了支持云计算的业务部门,包括支持“混合云”的工具,也就是能够与公共云(第三方托管数据)进行整合的私人云(按客户保存数据)。

然而,该业务的扩张速度还不够快,无法抵消电脑销量的下滑。戴尔的股价一落千丈。2013年,在个人电脑营收下滑两年多之后(而且在股价跌破11美元来到谷底之后),戴尔本人决定对其掌上明珠私有化,因为他认为让公司远离华尔街逐利的短视行为,是从长远角度出发对公司进行重新定位的最佳方式。

贝尼奥夫将这一交易称之为戴尔的“神奇壮举”。不过,该举措进展的并不顺利,而且十分难堪。戴尔回忆说:“我并不知道此事的难度有多大。在启动这一进程之后,[我觉得]‘是不是一两周就能完成?’没想到耗费了8个月的时间。”

戴尔并不是一个人在战斗。私募股权公司Silver Lake联合首席执行官埃贡·德班从一开始就成为了其战友。这两位向戴尔的股东提供了一个他们认为还不错的收购方案——用股权和债务资助的244亿美元交易,是科技行业历史上最大的一次杠杆收购。然而,公司劫掠者卡尔·伊坎进入了人们的视野,迅速购买了公司相当大一部分股权,并索要更高的价格。在众人了解这一信息之前,戴尔和德班已经与伊坎打响了战斗,因为伊坎给出了还价方案,涉及由他来收购公司,并让戴尔辞去首席执行官职务。

最终,伊坎做出让步,戴尔拿下了交易。戴尔和德班将其每股收购价格提升了10美分,并向一些股东发放了特别派息。2013年10月29日,戴尔电脑成为了一家私营公司,由迈克尔·戴尔和Silver Lake共同所有。

在这个漫长的斗争中,两位对手的个性可谓是展露无遗:伊坎通过财经频道和其他媒体来阐述其观点,戴尔则低调行事。然而在近些年,戴尔开始公开谈论这场冲突。他在2021年出版的自传《诚信为本,无谓输赢》(Play Nice But Win)讲述了其中一个场景:戴尔到伊坎家拜访,吃了顿普通的烘肉卷晚餐,试图达成共识,但以失败告终。尽管戴尔说他并不会记仇,但他称有必要“揭露”伊坎的手段。

十多年之后,很明显,他们并没有反目成仇。戴尔说:“伊坎的出现是收购过程中最难熬的部分。这是一个漫长、痛苦的时期,这一可怕的局面影响了所有人。”戴尔依然认为,伊坎从未真的打算收购其公司,只是希望从交易中赚更多的钱。在一次电话采访中,伊坎自己表示,他的举措迫使收购交易得到了“实质性改善”。伊坎说:“股东因为我而拿到了更多的钱。”

很明显,这两位人士都引用了二战时期领导人的话语来描述其冲突。“温斯顿丘吉尔说了句什么话来着?”戴尔反问我说,随即便援引了这位前英国首相的名言:“纵使前路铺满荆棘,也要继续走下去。”与此同时,伊坎则引用了富兰克林·罗斯福在1936年竞选时的讲话:“戴尔恨我,但我对此持欢迎态度。”

然而,双方的对决据称让戴尔成为了一个更好的领导者。这位首席执行官身边的人士表示,他对完成这一交易的决心和信念让公司度过了困难时期。德班说:“这场战斗让公司内部更加亲密无间。”德班依然是戴尔的密友,他的公司也是戴尔科技最大的股东之一。那个时期的雇员称,戴尔与员工之间的关系比以往任何时候都更加紧密,而且与基层的沟通也顺畅多了。

同样重要的是,戴尔向更广泛的商界证明,他是一位有分析头脑、果决的首席执行官。摩根大通(JPMorgan Chase)首席执行官杰米·戴蒙在评价戴尔私有化交易时指出:“戴尔冒了很大的风险,不采取这一举措的话事情会简单一些,但他不达目的不罢休。”在描述戴尔时,戴蒙提及了“OODA循环”,这是一个用来描述高效决策的军用术语,他称这种方式是科技公司首席执行官的执掌秘诀。(OODA是“观察、导向、决定、行动”四词的首字母缩写)。

这种冷静的头脑也注定戴尔的爱好少得可怜。贝尼奥夫对我说,他的这位朋友最近开始打猎,用的是弓和箭。(戴尔公司并未确认此事。)贝尼奥夫称,戴尔会捕猎鸟类,而这种神出鬼没的目标只有在猎手十分冷静、没有情绪波动而且异常专注时才能命中。

*****

戴尔科技首席运营官杰夫·克拉克是迈克尔·戴尔除创始人之外最亲近的人,他于1987年加入了团队。在通过视频会议与《财富》交谈时,穿着印有红白蓝“Texas”字样T恤的克拉克称,公司的私有化时期是其职业生涯中最快乐的时光。克拉克说:“真的是松了一口气。”

退出公开市场意味着戴尔可以大胆地冒险并投资研发,即便没有直接收益也无所谓。公司可以围绕向家得宝(Home Depot)和CVS Health等企业客户提供各类基础设施来进行重新定位。这些客户最大的需求越来越多地涉及其自身不断积累的海量数据。2016年,戴尔和德班在戴蒙的帮助下上演了另一场金融大戏,以670亿美元的价格收购EMC及其软件子公司VMware。戴尔称,这是一场梦寐以求的收购。

然而,该交易是一场巨额豪赌,让戴尔公司背上了沉重的债务负担,而且在随后引发了动荡。合并后的公司开始再次上市交易,其股票类别与其在VMware的所有权权益挂钩。两年后,公司回购了上述股票,并用新股票门类进行了置换。这一过程中,VMware投资者(包括戴尔的老朋友伊坎)提起诉讼,称这一复杂的交易低估了其股价,戴尔科技最终以10亿美元和解。然而,收购为戴尔的业务增添了更广泛的数据存储和管理资产组合,无疑让公司变得更加强大。

戴尔的公司从不“做市”,也就是创造此前不存在的需求。不过,戴尔并不用刻意为之。多年来一直关注戴尔及其竞争对手的分析师帕特里克·摩尔赫德称:“戴尔的强项在于了解应该在什么时候进入市场。他们就在客户身边,而且这些客户都是他们所熟知的客户。”帕特里克·摩尔赫德如今经营着市场研究公司Moor Insights & Strategy。

这种亲密关系从最初便深深扎根于戴尔,当时,迈克尔·戴尔自己每一次只为一名客户组装电脑。1988年,戴尔写下了公司的首个文化规范清单,首当其冲的便是“提供高品质产品和卓越客户服务”。他的盟友称,他在这一方面的关注度没有多少改变,而且他有一个中心任务,就是继续开展公司的转型。

在2018年12月28日,重新命名的戴尔科技破茧而出,以一种新股票类别在纽交所上市。更名后,这家公司摆脱了其作为滞后个人电脑制造商的形象,而是变成了企业基础设施巨人。事实证明,企业对基础设施的需求要比现在大得多,而且有可能需要更多的个人电脑,不过只是有可能。

*****

回到朗德罗克,戴尔正尝试解释什么是“AI个人电脑”,以及为什么所有人都想得到一台这样的电脑。“我列了一个清单”,他边说边站起来前往办公室拿起手机。这位首席执行官回来之后便开始逐一介绍各种功能。

他解释说,它拥有适时的基于人工智能的翻译,以及一个名为“圈中搜索”的功能,能够让电脑用户选出某个词或某句话,然后计算机就会提供与之相关的更多背景信息。它还有“生成式AI编辑”,可以协助任何类型的写作或内容创作。戴尔承认,以他的专长还不足以预见客户最终会用这些电脑来干什么。“但我认为,人们会找到有创意的用法,而且各大公司也希望自己能够提升其雇员的生产力。”

事实上,戴尔从其早期笔记本定制业务中吸取的经验依然适用于AI时代:关键是要足够的灵活,并借此来满足客户的需求。贝恩咨询公司(Bain & Co.)董事长奥里特·加迪耶什表示:“戴尔如今的竞争优势在于,公司可以按照你在AI领域的几乎所有需求,来提供定制式服务。它具有灵活性。”奥里特从事了数十年的咨询工作,而且是戴尔的追随者。

科技行业内外的企业客户已经在寻求终端机器——既能储存又能对生成式AI应用收到的数据进行分析。在这个大型平台创造者OpenAI和谷歌正在竞相竞争企业客户之时,戴尔科技并不用担心谁是最终赢家。其科技“堆栈”无需了解不同类型的生成式AI,就像其云产品始终兼容混合云、私人云和公共云策略一样。与云端化趋势一样,戴尔预计AI领域会出现一个普遍特征;所有公司,无论打造或部署了何种AI技术,都希望掌握数据存储硬件的控制权。

诚然,戴尔并不知道生成式AI会像现在这样呈现爆炸式发展;他将这一功劳归功于杰夫·克拉克,后者制定了公司大部分的AI路线图。然而,戴尔在很久前就曾琢磨过,全身心地投入数据基础设施是戴尔科技在未来立足的最佳出路。Sliver Lake的德班称,结果,“为了挖这座AI金矿,他不仅提供了镐和铲,还提供了食宿。”

戴尔科技公司的人工智能历程尚处于初期。即便增速很快,戴尔的AI服务器产品仅占其业务的一小部分。然而,大多数金融分析师似乎十分看好公司的未来。甚至有人希望这一AI浪潮将迅速推高人们对电脑的需求,具体来说应该是AI电脑。因为,对处理器有着更高性能需求的不仅仅只有数据中心(服务器和存储系统负责处理各大公司的信息),同时还有消费者和员工与之互动所需的桌面端和笔记本端。

今年2月,戴尔科技公司宣布推出其首个Latitude人工智能电脑生产线,它看起来就是一个普通电脑,但其中安装了一个名为神经处理器的小部件,它是承担生成式AI工作的关键。戴尔并非是看好这一领域的唯一企业,惠普和联想也发布了类似的产品。不过,我们并不清楚其需求何时才能起飞。彭博行业研究(Bloomberg Intelligence)分析师写道,“销量和发货量在2024年可能会让投资者感到失望,但有望在2025年带来更大的影响。”

即便是戴尔也承认,需求的增长需要一定的时间。尽管如此,戴尔表示:“如果你是某家公司的电脑维护负责人,你最不愿看到的就是,一部分电脑无法从事用户需要它们从事的工作。我确实认为会出现新一轮的需求。”

*****

得州大学创新大楼的最顶层依然是空的,这座新的大楼最初的用途是初创中心。然而,人们只要朝窗外看一看,灵感就会如潮水般涌来。人们在欣赏360度奥斯汀天际线景色的同时也会发现,几乎所有的方向都存在吊车和施工。

得州大学校长杰·哈特泽尔带我参观了这个地方,并指出了所有地标,包括那座以该校最出名的辍学生名字命名的大楼。迈克尔·戴尔并没有成为医生,但他的名字却列于其母校医学院、大学的教学医院以及儿科研究中心的发名册上。(还有奥斯汀的犹太社区中心。)

哈特泽尔表示:“当我们谈论一个大学应该培养什么样的人,以及人们为什么应该来此就读时,戴尔就是典范。”他称赞戴尔不仅是得州大学毕业生的一位首要雇主,同时还帮助大范围改善了奥斯汀的科技生态系统。多年来,从Meta到苹果这样的科技公司已经在奥斯汀设立了办事处。像Vista Equity Partners和太平洋投资管理公司(Pimco)以及吉姆·布雷耶这样的投资者也都在这里安营扎寨。得州大学最近迎来了首批就读全新人工智能硕士项目的学生。

戴尔是休斯敦人,他从未想过将总部搬离得州,即便有人建议他将总部迁至硅谷时亦是如此。奥斯汀市长科克·沃森在接受电话采访时对我说:“在他的帮助下,奥斯汀才有了如今的知名度。如果迈克尔·戴尔离开奥斯汀,那么整个城市将变得完全不同。”

戴尔在奥斯汀之外的城市亦留下了足迹。在任何时候,戴尔夫妇于1999年创建的迈克尔和苏珊·戴尔基金会(Michael & Susan Dell Foundation)在全球都拥有800个活跃项目。这些项目专注于教育、培训和健康创新,以帮助生活于贫困中的儿童。(戴尔夫妇最近又向基金会捐赠了36亿美元,使其总捐赠额达到了52亿美元。)戴尔称,他每年在基金会上的精力在逐渐增加,同时也会更多地过问家族理财室的工作,后者致力于投资房地产开发和酒店公司等。

这些工作在未来是否会交由其妻子打理?戴尔下个阶段的任务可能会十分漫长:即便在领导戴尔公司40年之后,戴尔依然很年轻,59岁。然而,一想到自己要承担当前工作(执掌这个以其名字命名的公司)之外的职责,他似乎会感到难受。当被问及是否会在未来20年继续执掌戴尔公司时,戴尔称还没有想过那么久远的事情,但也没有其他特别想做的事情。最后,他总算讲了一句类似于名言的话语:“我之前曾说过,即便不在了,我依然会心系戴尔。”

*****

漫长而又曲折的道路

迈克尔戴尔的公司于1984年设立,是一家致力于卖电脑的有限公司,仅此而已。几次重大转型帮助公司不断发展,并让戴尔不仅能够紧跟趋势,还成为了行业主导者。

1995

戴尔计算机发布了第一代PowerEdge企业服务器,这是该公司首次尝试向企业销售数据存储产品。当时,戴尔计算机已经是一家《财富》美国500强公司。

2006

戴尔进入了云时代,宣布设立新业务部门,向客户提供云产品和服务。很长一段时间以后,需求才逐渐显现。

2013

迈克尔·戴尔与私募股权公司Silver Lake埃贡·德班(见上图,左边是戴尔)实现了戴尔的私有化,以便重新让公司专注于企业数据基础设施需求。

2016

戴尔以670亿美元的价格收购EMC及其在VMware的股权,是当时最大的科技并购交易,也使得戴尔的数据存储和管理资产组合得到大幅扩张。

2023

戴尔科技发布了一系列针对生成式AI进行优化的基础设施产品,包括服务器和存储产品。

2024

今年2月,公司宣布推出其AI电脑,其中安装了用于处理AI工作的“神经处理器”。3月初,戴尔科技的股价创下历史新高。(财富中文网)

译者:冯丰

审校:夏林

要让迈克尔·戴尔讲两句豪言壮语是很困难的事情,即便给他时间准备也于事无补。当被问及AI热潮会给这家以他名字命名的公司戴尔科技(Dell Technologies)带来多大的增长机遇时,这位创始人兼长期首席执行官并没有给出任何简洁有力的准确描述,而是陷入了沉思。

他在思考之后说:“感觉这次热潮的势头跟前几次一样大,而且可能会更大。”随后他补充说:“其实,可能要大得多。”他又停顿了一下,重新思考该如何措辞,然后给出了一个最为不确定的结论:“我也不确定。没有人能知道。”

我们坐在奥斯汀郊区戴尔科技总部的一间会议室里,这里3月份的气温已经升至31摄氏度。戴尔走了进来,身着深色宽松长裤和深蓝色粗棉布领扣衬衫(德州人称之为商务休闲,四季皆宜)。他刚刚完成了照片拍摄,能看出来谈不上享受,而是在应付。他并不是反对自己成为公司的品牌和形象代言人,毕竟很长一段时间以来都是如此,确切来说已经有40年了。他依然是戴尔科技最虔诚的信仰者,也是公司最大的股东,他和妻子苏珊名下持有公司53%的股份,价值790亿美元。然而,他在逢场作戏方面并没有什么天分,以前也是如此。事实上,他似乎在刻意避免给人留下这种印象,即便在其即将开展这一最伟大的壮举时亦是如此。

与其他科技公司首席执行官不一样的是,戴尔不会去讲一些豪言壮语,也不会惺惺作态。他没有从事什么副业,例如将自己送入外太空。尽管成年后其所有生活都处于公众视野当中,但他表现得十分慎重,颇有分析头脑,而且几乎是刻意表现得很平淡。因此,对于生成式AI会对其公司带来什么影响这个问题,他并没有给出一个明确的回答,这一点也就不足为奇了。

不过,尽管戴尔倾向于回避这个问题,市场却难掩其激动之心。就在我们进行采访数天之前,2024年3月1日,当戴尔科技公布了超出分析师预期的营收之后,其股价飙升了38%,突破了创纪录的131美元大关。这份财报让外界十分看好戴尔不断增长的终端科技产品组合的需求,也就是存储和管理生成式AI应用运行时所需海量数据组所使用的设备。针对AI优化后的服务器订单在上一季度增长了40%。首席运营官杰夫·克拉克在公司业绩发布会上曾表示:“我们刚开始接触摆在眼前的AI机遇。”

受此影响的不仅只有戴尔的公司。由于股价飙升,迈克尔·戴尔的个人净资产据称在3月初达到了1000亿美元,对于在30岁就成为亿万富翁的戴尔来说,这依然是一个显著的里程碑。

然而,戴尔对这一切都处之泰然。过去几十年中,面对一些大起大落,他始终保持着同样的波澜不惊。他曾经带领公司实现了多次重大转型。同时,他展现了一种不可思议的能力——读懂客户的需求,并在正确的时间做出合适的策略调整,无论是弱化PC转而投身服务器、感应器和存储,还是在巨额收购交易中不顾卡尔·伊坎的强烈反对而带领公司私有化时都是如此。

正是得益于这一私有化举措,戴尔科技才能去把握当前的AI浪潮。在私有化后的过去五年中,戴尔才真正开启了销售笔记本和台式电脑之外的多元化之路。戴尔远离了市场对季度业绩的痴迷,转而巩固和扩张了其公司,成为了一家为企业客户打造基础设施工具的巨头。在这一过程中,他策划了历史上最大的一次科技公司交易,以670亿美元收购数据存储提供商EMC。

如果戴尔并不是一个充满活力、轰动型的演讲者,这可能是因为他在过去40年中已经养成了倾听的习惯,并通过其分析技能和强烈的好奇心来发现其客户的需求,然后应对其所在领域的各种波折。他对我说:“我喜欢花时间去研究科技,也愿意与客户待在一起。”他补充说,至少就业务而言,“我真的没有什么别的爱好。”

戴尔科技依然在销售戴尔个人电脑;事实上,公司的大部分营收来自计算机业务。不过,如今的戴尔科技与5年前或10年前大不相同,与40年前相比更是如此。唯一不变的就是戴尔自己。企业软件制造商Salesforce联合创始人兼首席执行官马克·贝尼奥夫表示:“他可能是科技行业历史上任职时间最长的首席执行官。”贝尼奥夫在谈论戴尔时表示:“他比我小6个月,但我把他看作我的老哥。他在各个方面都是那么出色。”

如果不是其庞大的规模,人们很难记住戴尔的总部。在朗德罗克的戴尔公司总部坐在戴尔对面,“出色”并非是我想到的第一个词。不过,戴尔已经打造了一座为99%的世界500强公司提供科技构筑材料的帝国,并乐此不疲。这些公司在AI新时代将出现新的需求。如果戴尔能够精明行事,那么AI的未来可能会让这位首席执行官以及这家曾几何时毫无目标的计算机生产商,比以往任何时候都更讨市场喜欢,这一切都将确保他能够在未来继续掌控公司大权。

*****

在接受我们采访之后的上午,戴尔在其母校得克萨斯大学奥斯汀分校的一个医疗创新峰会上发表了演讲。(戴尔在这所大学读完了两个学期,然后便辍学开始全职销售个人电脑。)投资者吉姆·布雷耶在戴尔的建议下于2019年从硅谷搬到了奥斯汀,他在提到这位首席执行官时毫不吝惜赞美之词。他说:“迈克尔·戴尔是我合作过的最勇敢的企业家。”

戴尔的表现……还不错。(很明显,公开演讲并不是他的舒适区。)不过,他表现得很自信,也很坚决。59岁的戴尔依然保持着青春的气息,其卷发仅有淡淡的灰色。从观众的反应来看,很明显,戴尔在校园大受欢迎,即便他从未拿到毕业证。

在有据可查的早些年间,这位古怪、冲动的创始人似乎从未出过错。1984年,作为医科大学预科生,他便开始在大学宿舍里捣弄起了电脑。在19岁那年,他离开了学校,并将所有精力放在自己的生意上。他面临着其他大得多的竞争对手,包括IBM和苹果,但戴尔开创了新的商业模式:他的电脑是可以定制的,而且直接面向消费者销售,砍掉了中间商。1988年,他带领戴尔计算机上市,筹集了3000万美元,并使用这笔资金在全球进行扩张。在27岁那年,他成为了《财富》美国500强企业中最年轻的首席执行官。只要个人电脑的需求在增长,公司的规模便一直在增长。

然而,个人电脑最终成为了公司的致命弱点。2001年,戴尔成为了全球领先的电脑制造商,超越了曾经叱咤风云的康柏。不过,其销量在不久后便开始下滑。亚洲制造商加入了战局,为美国消费者提供价格更低的产品。在21世纪00年代末,智能手机和平板蜂拥而至,进一步放缓了桌面和笔记本的需求。戴尔曾尝试进军移动领域,但其产品并不叫座。戴尔的“平板手机”定位于手机和笔记本之间的非必要尴尬地带,刚面世一年便停产了。

在此之前,戴尔耗费了数年的时间尝试业务的多元化。1995年,他携手PowerEdge进军服务器市场,该产品线目前依然存在,针对的是那些无法依靠现有设备管理海量数据的企业。2006年,公司成立了支持云计算的业务部门,包括支持“混合云”的工具,也就是能够与公共云(第三方托管数据)进行整合的私人云(按客户保存数据)。

然而,该业务的扩张速度还不够快,无法抵消电脑销量的下滑。戴尔的股价一落千丈。2013年,在个人电脑营收下滑两年多之后(而且在股价跌破11美元来到谷底之后),戴尔本人决定对其掌上明珠私有化,因为他认为让公司远离华尔街逐利的短视行为,是从长远角度出发对公司进行重新定位的最佳方式。

贝尼奥夫将这一交易称之为戴尔的“神奇壮举”。不过,该举措进展的并不顺利,而且十分难堪。戴尔回忆说:“我并不知道此事的难度有多大。在启动这一进程之后,[我觉得]‘是不是一两周就能完成?’没想到耗费了8个月的时间。”

戴尔并不是一个人在战斗。私募股权公司Silver Lake联合首席执行官埃贡·德班从一开始就成为了其战友。这两位向戴尔的股东提供了一个他们认为还不错的收购方案——用股权和债务资助的244亿美元交易,是科技行业历史上最大的一次杠杆收购。然而,公司劫掠者卡尔·伊坎进入了人们的视野,迅速购买了公司相当大一部分股权,并索要更高的价格。在众人了解这一信息之前,戴尔和德班已经与伊坎打响了战斗,因为伊坎给出了还价方案,涉及由他来收购公司,并让戴尔辞去首席执行官职务。

最终,伊坎做出让步,戴尔拿下了交易。戴尔和德班将其每股收购价格提升了10美分,并向一些股东发放了特别派息。2013年10月29日,戴尔电脑成为了一家私营公司,由迈克尔·戴尔和Silver Lake共同所有。

在这个漫长的斗争中,两位对手的个性可谓是展露无遗:伊坎通过财经频道和其他媒体来阐述其观点,戴尔则低调行事。然而在近些年,戴尔开始公开谈论这场冲突。他在2021年出版的自传《诚信为本,无谓输赢》(Play Nice But Win)讲述了其中一个场景:戴尔到伊坎家拜访,吃了顿普通的烘肉卷晚餐,试图达成共识,但以失败告终。尽管戴尔说他并不会记仇,但他称有必要“揭露”伊坎的手段。

十多年之后,很明显,他们并没有反目成仇。戴尔说:“伊坎的出现是收购过程中最难熬的部分。这是一个漫长、痛苦的时期,这一可怕的局面影响了所有人。”戴尔依然认为,伊坎从未真的打算收购其公司,只是希望从交易中赚更多的钱。在一次电话采访中,伊坎自己表示,他的举措迫使收购交易得到了“实质性改善”。伊坎说:“股东因为我而拿到了更多的钱。”

很明显,这两位人士都引用了二战时期领导人的话语来描述其冲突。“温斯顿丘吉尔说了句什么话来着?”戴尔反问我说,随即便援引了这位前英国首相的名言:“纵使前路铺满荆棘,也要继续走下去。”与此同时,伊坎则引用了富兰克林·罗斯福在1936年竞选时的讲话:“戴尔恨我,但我对此持欢迎态度。”

然而,双方的对决据称让戴尔成为了一个更好的领导者。这位首席执行官身边的人士表示,他对完成这一交易的决心和信念让公司度过了困难时期。德班说:“这场战斗让公司内部更加亲密无间。”德班依然是戴尔的密友,他的公司也是戴尔科技最大的股东之一。那个时期的雇员称,戴尔与员工之间的关系比以往任何时候都更加紧密,而且与基层的沟通也顺畅多了。

同样重要的是,戴尔向更广泛的商界证明,他是一位有分析头脑、果决的首席执行官。摩根大通(JPMorgan Chase)首席执行官杰米·戴蒙在评价戴尔私有化交易时指出:“戴尔冒了很大的风险,不采取这一举措的话事情会简单一些,但他不达目的不罢休。”在描述戴尔时,戴蒙提及了“OODA循环”,这是一个用来描述高效决策的军用术语,他称这种方式是科技公司首席执行官的执掌秘诀。(OODA是“观察、导向、决定、行动”四词的首字母缩写)。

这种冷静的头脑也注定戴尔的爱好少得可怜。贝尼奥夫对我说,他的这位朋友最近开始打猎,用的是弓和箭。(戴尔公司并未确认此事。)贝尼奥夫称,戴尔会捕猎鸟类,而这种神出鬼没的目标只有在猎手十分冷静、没有情绪波动而且异常专注时才能命中。

*****

戴尔科技首席运营官杰夫·克拉克是迈克尔·戴尔除创始人之外最亲近的人,他于1987年加入了团队。在通过视频会议与《财富》交谈时,穿着印有红白蓝“Texas”字样T恤的克拉克称,公司的私有化时期是其职业生涯中最快乐的时光。克拉克说:“真的是松了一口气。”

退出公开市场意味着戴尔可以大胆地冒险并投资研发,即便没有直接收益也无所谓。公司可以围绕向家得宝(Home Depot)和CVS Health等企业客户提供各类基础设施来进行重新定位。这些客户最大的需求越来越多地涉及其自身不断积累的海量数据。2016年,戴尔和德班在戴蒙的帮助下上演了另一场金融大戏,以670亿美元的价格收购EMC及其软件子公司VMware。戴尔称,这是一场梦寐以求的收购。

然而,该交易是一场巨额豪赌,让戴尔公司背上了沉重的债务负担,而且在随后引发了动荡。合并后的公司开始再次上市交易,其股票类别与其在VMware的所有权权益挂钩。两年后,公司回购了上述股票,并用新股票门类进行了置换。这一过程中,VMware投资者(包括戴尔的老朋友伊坎)提起诉讼,称这一复杂的交易低估了其股价,戴尔科技最终以10亿美元和解。然而,收购为戴尔的业务增添了更广泛的数据存储和管理资产组合,无疑让公司变得更加强大。

戴尔的公司从不“做市”,也就是创造此前不存在的需求。不过,戴尔并不用刻意为之。多年来一直关注戴尔及其竞争对手的分析师帕特里克·摩尔赫德称:“戴尔的强项在于了解应该在什么时候进入市场。他们就在客户身边,而且这些客户都是他们所熟知的客户。”帕特里克·摩尔赫德如今经营着市场研究公司Moor Insights & Strategy。

这种亲密关系从最初便深深扎根于戴尔,当时,迈克尔·戴尔自己每一次只为一名客户组装电脑。1988年,戴尔写下了公司的首个文化规范清单,首当其冲的便是“提供高品质产品和卓越客户服务”。他的盟友称,他在这一方面的关注度没有多少改变,而且他有一个中心任务,就是继续开展公司的转型。

在2018年12月28日,重新命名的戴尔科技破茧而出,以一种新股票类别在纽交所上市。更名后,这家公司摆脱了其作为滞后个人电脑制造商的形象,而是变成了企业基础设施巨人。事实证明,企业对基础设施的需求要比现在大得多,而且有可能需要更多的个人电脑,不过只是有可能。

*****

回到朗德罗克,戴尔正尝试解释什么是“AI个人电脑”,以及为什么所有人都想得到一台这样的电脑。“我列了一个清单”,他边说边站起来前往办公室拿起手机。这位首席执行官回来之后便开始逐一介绍各种功能。

他解释说,它拥有适时的基于人工智能的翻译,以及一个名为“圈中搜索”的功能,能够让电脑用户选出某个词或某句话,然后计算机就会提供与之相关的更多背景信息。它还有“生成式AI编辑”,可以协助任何类型的写作或内容创作。戴尔承认,以他的专长还不足以预见客户最终会用这些电脑来干什么。“但我认为,人们会找到有创意的用法,而且各大公司也希望自己能够提升其雇员的生产力。”

事实上,戴尔从其早期笔记本定制业务中吸取的经验依然适用于AI时代:关键是要足够的灵活,并借此来满足客户的需求。贝恩咨询公司(Bain & Co.)董事长奥里特·加迪耶什表示:“戴尔如今的竞争优势在于,公司可以按照你在AI领域的几乎所有需求,来提供定制式服务。它具有灵活性。”奥里特从事了数十年的咨询工作,而且是戴尔的追随者。

科技行业内外的企业客户已经在寻求终端机器——既能储存又能对生成式AI应用收到的数据进行分析。在这个大型平台创造者OpenAI和谷歌正在竞相竞争企业客户之时,戴尔科技并不用担心谁是最终赢家。其科技“堆栈”无需了解不同类型的生成式AI,就像其云产品始终兼容混合云、私人云和公共云策略一样。与云端化趋势一样,戴尔预计AI领域会出现一个普遍特征;所有公司,无论打造或部署了何种AI技术,都希望掌握数据存储硬件的控制权。

诚然,戴尔并不知道生成式AI会像现在这样呈现爆炸式发展;他将这一功劳归功于杰夫·克拉克,后者制定了公司大部分的AI路线图。然而,戴尔在很久前就曾琢磨过,全身心地投入数据基础设施是戴尔科技在未来立足的最佳出路。Sliver Lake的德班称,结果,“为了挖这座AI金矿,他不仅提供了镐和铲,还提供了食宿。”

戴尔科技公司的人工智能历程尚处于初期。即便增速很快,戴尔的AI服务器产品仅占其业务的一小部分。然而,大多数金融分析师似乎十分看好公司的未来。甚至有人希望这一AI浪潮将迅速推高人们对电脑的需求,具体来说应该是AI电脑。因为,对处理器有着更高性能需求的不仅仅只有数据中心(服务器和存储系统负责处理各大公司的信息),同时还有消费者和员工与之互动所需的桌面端和笔记本端。

今年2月,戴尔科技公司宣布推出其首个Latitude人工智能电脑生产线,它看起来就是一个普通电脑,但其中安装了一个名为神经处理器的小部件,它是承担生成式AI工作的关键。戴尔并非是看好这一领域的唯一企业,惠普和联想也发布了类似的产品。不过,我们并不清楚其需求何时才能起飞。彭博行业研究(Bloomberg Intelligence)分析师写道,“销量和发货量在2024年可能会让投资者感到失望,但有望在2025年带来更大的影响。”

即便是戴尔也承认,需求的增长需要一定的时间。尽管如此,戴尔表示:“如果你是某家公司的电脑维护负责人,你最不愿看到的就是,一部分电脑无法从事用户需要它们从事的工作。我确实认为会出现新一轮的需求。”

*****

得州大学创新大楼的最顶层依然是空的,这座新的大楼最初的用途是初创中心。然而,人们只要朝窗外看一看,灵感就会如潮水般涌来。人们在欣赏360度奥斯汀天际线景色的同时也会发现,几乎所有的方向都存在吊车和施工。

得州大学校长杰·哈特泽尔带我参观了这个地方,并指出了所有地标,包括那座以该校最出名的辍学生名字命名的大楼。迈克尔·戴尔并没有成为医生,但他的名字却列于其母校医学院、大学的教学医院以及儿科研究中心的发名册上。(还有奥斯汀的犹太社区中心。)

哈特泽尔表示:“当我们谈论一个大学应该培养什么样的人,以及人们为什么应该来此就读时,戴尔就是典范。”他称赞戴尔不仅是得州大学毕业生的一位首要雇主,同时还帮助大范围改善了奥斯汀的科技生态系统。多年来,从Meta到苹果这样的科技公司已经在奥斯汀设立了办事处。像Vista Equity Partners和太平洋投资管理公司(Pimco)以及吉姆·布雷耶这样的投资者也都在这里安营扎寨。得州大学最近迎来了首批就读全新人工智能硕士项目的学生。

戴尔是休斯敦人,他从未想过将总部搬离得州,即便有人建议他将总部迁至硅谷时亦是如此。奥斯汀市长科克·沃森在接受电话采访时对我说:“在他的帮助下,奥斯汀才有了如今的知名度。如果迈克尔·戴尔离开奥斯汀,那么整个城市将变得完全不同。”

戴尔在奥斯汀之外的城市亦留下了足迹。在任何时候,戴尔夫妇于1999年创建的迈克尔和苏珊·戴尔基金会(Michael & Susan Dell Foundation)在全球都拥有800个活跃项目。这些项目专注于教育、培训和健康创新,以帮助生活于贫困中的儿童。(戴尔夫妇最近又向基金会捐赠了36亿美元,使其总捐赠额达到了52亿美元。)戴尔称,他每年在基金会上的精力在逐渐增加,同时也会更多地过问家族理财室的工作,后者致力于投资房地产开发和酒店公司等。

这些工作在未来是否会交由其妻子打理?戴尔下个阶段的任务可能会十分漫长:即便在领导戴尔公司40年之后,戴尔依然很年轻,59岁。然而,一想到自己要承担当前工作(执掌这个以其名字命名的公司)之外的职责,他似乎会感到难受。当被问及是否会在未来20年继续执掌戴尔公司时,戴尔称还没有想过那么久远的事情,但也没有其他特别想做的事情。最后,他总算讲了一句类似于名言的话语:“我之前曾说过,即便不在了,我依然会心系戴尔。”

*****

漫长而又曲折的道路

迈克尔戴尔的公司于1984年设立,是一家致力于卖电脑的有限公司,仅此而已。几次重大转型帮助公司不断发展,并让戴尔不仅能够紧跟趋势,还成为了行业主导者。

1995

戴尔计算机发布了第一代PowerEdge企业服务器,这是该公司首次尝试向企业销售数据存储产品。当时,戴尔计算机已经是一家《财富》美国500强公司。

2006

戴尔进入了云时代,宣布设立新业务部门,向客户提供云产品和服务。很长一段时间以后,需求才逐渐显现。

2013

迈克尔·戴尔与私募股权公司Silver Lake埃贡·德班(见上图,左边是戴尔)实现了戴尔的私有化,以便重新让公司专注于企业数据基础设施需求。

2016

戴尔以670亿美元的价格收购EMC及其在VMware的股权,是当时最大的科技并购交易,也使得戴尔的数据存储和管理资产组合得到大幅扩张。

2023

戴尔科技发布了一系列针对生成式AI进行优化的基础设施产品,包括服务器和存储产品。

2024

今年2月,公司宣布推出其AI电脑,其中安装了用于处理AI工作的“神经处理器”。3月初,戴尔科技的股价创下历史新高。(财富中文网)

译者:冯丰

审校:夏林

It’s hard to get a splashy sound bite out of Michael Dell, even if you tee him up for one. When asked how big a growth opportunity the AI wave could be for his namesake company, Dell Technologies, the founder and longtime chief executive doesn’t offer up any pithy one-liners but instead ruminates in real time.

“It feels every bit as big as previous waves, but probably bigger,” he says, pondering the question, and then adds, “You know, maybe quite a bit bigger.” He takes another brief pause, reconsiders his own words, and delivers a most inconclusive conclusion: “I don’t know for sure. Nobody knows.”

We’re seated in a conference room at Dell Technologies’ headquarters just outside Austin, where the temperature has hit 88° F in early March. Dressed in dark slacks and a navy blue denim button-down (Texan for business casual, no matter the season), Dell has just emerged from a photo shoot that he tolerated but clearly didn’t relish. It’s not that he isn’t on board with being the name and face of his company. That’s been true for a while—40 years, to be exact. He remains Dell Technologies’ biggest believer—and biggest shareholder, with 53% of the $79 billion company’s stock under his or his wife Susan’s name. But he’s not a natural-born showman. Never was. In fact, he seems to go out of his way to not put on a performance—even as he’s embarking on what could be his greatest act yet.

Unlike some other tech CEOs, Dell doesn’t do bombastic declarations or colorful antics; he doesn’t have a side hustle that involves blasting himself into outer space. Despite having spent his entire adult life in the public eye, he is measured, analytical, and almost intentionally unexciting. So his reluctance to put a ceiling, or even a floor, on what generative AI could mean for his company is not surprising.

But while Dell may prefer to hedge, the market isn’t hiding its exuberance. Just a few days before our interview, on March 1, Dell Technologies’ share price leaped 38%, hitting an all-time high above $131 after the company reported earnings that beat analyst expectations. The announcement generated plenty of excitement about demand for Dell’s growing portfolio of back-end tech products, the kind required for storing and managing the massive datasets needed to run—you guessed it—generative AI applications. Orders for AI-optimized servers were up 40% in the most recent quarter. As chief operating officer Jeff Clarke said in the company’s earnings release, “We’ve just started to touch the AI opportunities ahead of us.”

It’s not just Dell’s company that’s been buoyed by the buzz. As a result of the massive rise in the stock, Michael Dell’s personal net worth reportedly hit the $100 billion mark in early March—a notable milestone even for a man who became a billionaire at the tender age of 30.

But none of this seems to rock Dell’s world. Over the decades, he’s maintained the same steady demeanor through exhilarating highs and harrowing lows. Along the way, he’s steered his company through multiple major pivots. And he’s showed an uncanny ability to read his customers’ needs and make the right strategic change at the right time, whether de-emphasizing PCs in favor of servers, sensors, and storage, or taking the company private—over the heated opposition of Carl Icahn—in a mammoth buyout.

That privatization maneuver is precisely what positioned the company to capitalize on the current AI boom. Over the five years that it was privately held, Dell was able to truly diversify from selling laptops and desktops. Away from the market’s obsession with quarterly earnings, Dell consolidated and expanded his company, creating a behemoth provider of infrastructure tools for corporate customers. Along the way, he engineered what was then the biggest tech deal in history, the $67 billion acquisition of data storage provider EMC.

If Dell isn’t a dynamic, headline-making speaker, it may be because he’s built this four-decade run on listening—deploying his analytical skills and deep curiosity to recognize what his customers need and to navigate his industry’s twists and turns. “I love spending time on the technology, and I love spending time with our customers,” he tells me. And at least where business is concerned, he adds, “I don’t really love anything else.”

Dell Technologies still sells Dell PCs; in fact, computers make up the majority of its revenue. But today it’s a company vastly different from what it was five or 10 years ago—let alone 40. The one constant? Dell himself. “This is probably the longest-sitting CEO in the tech industry,” says Marc Benioff, cofounder and CEO of enterprise-software maker Salesforce and a longtime friend. “He’s six months younger than I am, but I view him as an older brother,” Benioff says of Dell. “He’s a phenomenon in every possible way.”

Sitting across from Dell at his HQ in Round Rock, a corporate campus that’s forgettable except for its sheer size, “phenomenon” isn’t the first word that comes to mind. But Dell has built—and hung on to—an empire that now provides the technological building blocks for 99% of Fortune 500 companies, most of which will have new needs in this new era of AI. If he plays his cards right, the next chapter of the story could make both the CEO and his once-flailing PC maker more relevant than ever, all but ensuring he’ll stay at the helm for years to come.

*****

The morning after our interview, Dell is speaking on a panel at a health care innovation summit at the University of Texas at Austin, his alma mater. (Dell finished two semesters before dropping out to devote himself to selling PCs full-time.) Investor Jim Breyer, who relocated to Austin from Silicon Valley in 2019 at the Dells’ suggestion, introduces the CEO with glowing superlatives. “Michael Dell is the most courageous entrepreneur I’ve ever worked with,” he gushes.

Dell’s performance is … just fine. (It’s clear that public speaking is not his happy place.) Still, he comes across as confident and purposeful. At 59, Dell retains a youthful bearing, his curly hair only tinged by gray. And from the audience reaction, it’s clear Dell’s the big man on campus, even if he never graduated.

In his well-documented early days, the nerdy but gutsy founder could seemingly do no wrong. In 1984, as a premed freshman, he started tinkering with computers in his UT dorm room. By age 19, he had left school and turned all of his attention to his business. He faced other, much bigger competitors, including IBM and Apple. But Dell pioneered a new way of doing business: His computers were built to order, and he sold them directly to consumers, cutting out the middleman. In 1988 he took Dell Computer public, raising $30 million and using the capital to expand globally. At age 27, he became the youngest CEO on the Fortune 500. And the company just kept growing—as long as demand for PCs was on the rise.

But PCs would prove to be the company’s Achilles’ heel. In 2001, Dell became the world’s leading computer maker, surpassing the once-mighty Compaq. But sales soon began to decline. Asian manufacturers had entered the fray, offering cheaper products to American consumers. And by the late 2000s, smartphones and tablets had swarmed the market, slowing demand for desktops and laptops even more. The company tried to jump on the mobile bandwagon, but its efforts were ill-received: Dell’s “phablet,” a product that sat in the unnecessary purgatory between a phone and a tablet, was discontinued after just one year.

By then, Dell had been trying for years to diversify. In 1995 he entered the server market with the PowerEdge, a product line that still exists—designed for enterprises that were amassing far more data than they could manage with their existing equipment. In 2006, the company launched a business unit to support cloud computing, including tools to power “hybrid clouds”—private clouds (which keep data on a customer’s premises) that can integrate with public ones (where data is hosted by a third party).

But this expansion wasn’t happening fast enough to offset declines in PC sales, and investors hammered Dell’s shares. In 2013, after more than two years of falling PC revenue (and after the stock price bottomed at under $11), Dell decided to take his baby private—hypothesizing that shielding the company from Wall Street’s short-term focus on profitability was the best way to reset for the long term.

Benioff refers to the deal as Dell’s “magic trick.” But the maneuver was anything but slick and graceful. “I had no idea how difficult it was going to be,” Dell recalls. “When it started, [I thought], ‘Is this like a one-week thing or two-week thing?’ I didn’t know it was going to be an eight-month thing.”

Dell wasn’t in it alone. Egon Durban, co-CEO of private equity firm Silver Lake, was his partner from the get-go. The two presented Dell shareholders with what they thought was a good offer, a $24.4 billion deal financed by a mix of equity and debt—the largest leveraged buyout in tech-industry history. But then corporate raider Carl Icahn entered the picture, snapping up a sizable chunk of the company’s shares and agitating for a more generous offer. Before they knew it, Dell and Durban were going to war, fighting Icahn as he made a counteroffer that involved buying the company himself—and ousting Dell as CEO.

Eventually, Icahn got concessions, and Dell got his deal. Dell and Durban increased their offer by 10 cents a share and threw in a special dividend for some shareholders. And on Oct. 29, 2013, Dell Computer became a privately held company, owned by Michael Dell and Silver Lake.

During the lengthy feud, the antagonists stayed true to their personalities: Icahn took to CNBC and other outlets to spread his narrative, while Dell lay low. But in recent years, Dell has spoken openly about the clash. His 2021 memoir, Play Nice But Win, opens with a scene in which Dell goes to Icahn’s house for a dinner of mediocre meatloaf, in a (failed) attempt to find common ground. Though Dell says he doesn’t hold grudges, he also says he felt a need to “expose” Icahn’s tactics.

More than 10 years later, it’s clear there’s no love lost between them. “Icahn showing up was the hardest part,” Dell says. “It was a long, painful period where everyone was subjected to this horrible situation.” Dell maintains that Icahn never really planned to buy his company but simply wanted to squeeze more out of the deal. For his part, Icahn, in a phone interview, says that his actions forced a “meaningful improvement” of the buyout. “The shareholders got a lot more money because of me,” says Icahn.

Tellingly, both men quote World War II–era leaders to describe their conflict. “What’s that Winston Churchill quote?” Dell asks me rhetorically, invoking the former British prime minister: “If you’re going through hell, keep going.” Icahn, meanwhile, puts his own paraphrasing spin on a 1936 campaign speech by Franklin D. Roosevelt: “Dell hates me—and I welcome his hatred.”

Still, the trials arguably made Dell a better leader. Those close to the CEO say that his determination and belief in the deal carried the enterprise through a rough patch. “Relationships are forged on the battlefield,” says Durban, who remains close to Dell and whose firm is one of the company’s largest shareholders. Employees from that era say Dell became more connected than ever to his workforce, and even better about communication with the rank and file.

Just as important, Dell proved himself to a wider swath of the business world as an analytical, decisive chief executive. “He took a large risk, which is easier not to do,” Jamie Dimon, the CEO of JPMorgan Chase, says of Dell’s deal. “But he stuck to his guns.” Describing Dell, Dimon invokes the “OODA loop,” a military acronym for efficient decision-making that he says is a secret sauce for the tech CEO. (OODA stands for “observe, orient, decide, act.”)

That kind of coolheadedness also characterizes Dell’s very, very few hobbies. Benioff tells me that his friend recently took up hunting with a bow and arrow. (Dell’s company won’t confirm this.) Dell hunts for birds, Benioff says—the kind of elusive target you can hit only when you’re calm, unemotional, and utterly focused.

*****

Jeff Clarke, Dell Technologies’ COO, is the closest person Michael Dell has to a cofounder, having joined his team in 1987. Speaking to Fortune via videoconference, Clarke—dressed in a red, white, and blue T-shirt that simply says “TEXAS”—refers to the company’s private-company era as one of the most fun periods of his career. “It was liberating,” says Clarke.

Being out of the public market meant that Dell could make big bets and invest in R&D, even if the payoff wasn’t immediate. The company could rebuild itself around providing all things infrastructure for corporate customers like Home Depot and CVS Health, whose greatest needs increasingly revolved around the growing mountains of data they were accumulating. In 2016, Dell and Durban—with Dimon’s help—orchestrated another financial feat, the $67 billion purchase of EMC and its software subsidiary VMware. The acquisition was “something we had dreamed about doing,” Dell says.

Still, the deal was an expensive bet that saddled the business with a heavy debt load—and it created hassles down the road. The merged company started trading publicly again under a share class that tracked its ownership interest in VMware; two years later, it bought those shares back and replaced them with a new share class. Along the way, some VMware investors (including, briefly, Dell’s old buddy Icahn) sued, arguing that the complex deal undervalued their shares, and Dell Technologies eventually paid a $1 billion settlement. Still, the acquisition added an even broader data-storage and management portfolio to Dell’s arsenal, making the company indisputably stronger.

Dell’s company has never been a “market maker,” a company that creates demand for something that didn’t previously exist. But it hasn’t had to be. “What Dell’s been good at is knowing the right time to get into a market,” says Patrick Moorhead, an analyst who has covered Dell and its competitors for years and now runs Moor Insights & Strategy. “They’re so close to their customers that they just know.”

That closeness was embedded at Dell from the earliest days, when Michael Dell himself was building PCs for one customer at a time. In 1988 Dell wrote the company’s first Culture Code, with “Provide high-quality products and excellent customer service” at the top of the list. His focus hasn’t changed much, his allies say, and it’s been central to his ability to keep transforming the company.

On Dec. 28, 2018, the reorganized, renamed Dell Technologies emerged fully from its cocoon, trading on the NYSE under a new share class. In its metamorphosis, the company had all but shed its image as a lagging PC maker, refashioning itself as an enterprise infrastructure giant. And enterprises, it turned out, were about to need a whole lot more infrastructure—and maybe, just maybe, more PCs.

*****

Back in Round Rock, Dell is trying to explain what an “AI PC” is, and why anyone would want one. “I have a list,” he says as he gets up to grab his phone from his office. The CEO comes back and proceeds to rattle off a catalog of capabilities.

There’s real-time, AI-powered translation, he explains, and a feature called “circle to search,” which enables PC users to highlight a word or line, which the computer will then provide more context and information for. There’s also “generative AI editing,” which can assist with any kind of writing or content creation. What customers actually end up using these machines for, Dell admits, is beyond his expertise to foresee. “But I believe that people will figure out creative uses and that companies will want to have the capability to make their people more productive.”

In fact, Dell’s lessons from its earliest days of customizing laptops still apply in the AI era: The key is to be flexible enough to meet customers’ demands. “The competitive advantage for Dell today is that it offers services you can tailor to almost every need in AI,” says Orit Gadiesh, the chairman of Bain & Co. and a decades-long consultant and confidante of Dell’s. “It’s not a fixed thing.”

Corporate customers in and outside tech are already clamoring for back-end machines that can both house and make sense of the data that feeds into generative AI applications. At a time when huge platform creators like OpenAI and Google are competing for corporate clients, Dell Technologies doesn’t have to worry about who wins: Its tech “stack” is agnostic to different flavors of generative AI, just as its cloud offerings have always accommodated hybrid, private, and public cloud strategies. And just as with the move to the cloud, Dell is counting on one common denominator with AI: that all companies, regardless of which AI applications they build or deploy, will want control over the hardware where the relevant data is stored.

To be sure, Dell didn’t know that the generative AI explosion would happen when it did; he credits Jeff Clarke with devising much of the company’s AI road map. But he calculated long ago that going all in on data infrastructure was the best way to position his company for the future. As a result, “he’s not just providing the picks and shovels, but also housing and food and beverages for the AI gold mine,” says Silver Lake’s Durban.

It’s still early days for Dell Technologies’ AI story. Fast as it’s growing, Dell’s AI server products account for just a tiny fraction of its business. But most financial analysts seem bullish about what’s to come. There’s even hope that the AI craze will jump-start demand for PCs—AI PCs, to be precise. The thinking is that the need for increased processing power won’t just be on the data-center side (where servers and storage systems handle companies’ information), but also on the desktops and laptops that consumers and workers interact with.

In February, Dell Technologies announced its first line of Latitude AI PCs, which look like normal computers but include a tiny component called a neural processor, the key to enabling generative AI workloads. It’s not the only vendor with high hopes in the category—HP and Lenovo have announced similar products. And it’s not clear when demand will take off. Bloomberg Intelligence analysts wrote that “sales and units shipped may disappoint investors in calendar 2024, having a greater potential impact in 2025.”

Even Dell acknowledges that spurring demand could take a while. That said, “if you’re responsible for the PCs in a company, the last thing you want to do is have a bunch of PCs that don’t do the thing that the users want them to do,” says Dell. “I do think there’s going to be a refresh wave.”

*****

The top floor of the University of Texas’s Innovation Tower, a new high-rise that’s meant to be a startup hub, is still empty. But one only has to look out the windows for inspiration. The 360-degree views of the Austin skyline show a city dotted by cranes and construction in almost all directions.

Jay Hartzell, the university’s president, is showing me around, pointing out all of the landmarks—including the buildings adorned with the name of the institution’s most famous dropout. Michael Dell never did become a doctor, but his name is on his alma mater’s medical school, the university’s teaching hospital, and its pediatric research center. (Not to mention Austin’s Jewish Community Center.)

“When we talk about what we want to produce as a university, and why people should come here, he’s sort of Leading Exhibit A,” says Hartzell. He credits Dell not only with being a major employer of UT graduates but also with helping to spur the city’s broader tech ecosystem. Over the years, tech companies from Meta to Apple have set up shop in the Texas capital. Investors, too, from Vista Equity Partners to Pimco to Jim Breyer, have put down roots. UT recently welcomed its first cohort of students in a brand-new AI graduate degree program.

Dell, who is originally from Houston, never wanted to move his headquarters away from Texas, even when others told him he should relocate to Silicon Valley. “He helped put the place on the map,” Austin Mayor Kirk Watson tells me in a phone interview. “If you took Michael Dell out of the equation, it would be a strikingly different city.”

Dell has made his mark outside of Austin, too. The Michael & Susan Dell Foundation, which the couple founded in 1999, has 800 active projects around the world at any given time—focusing on education, training, and health innovation to help children living in poverty. (Dell and his wife recently contributed another $3.6 billion to the foundation, bringing its total endowment to $5.2 billion.) Dell says he spends a little more time each year on the foundation. He’s also gotten more hands-on with his family office, which invests in real estate development and hotel companies, among other sectors.

Could those jobs someday be his life’s work? Dell’s next chapter could be a long one: Even after 40 years leading Dell, he’s still so young, at 59. But the thought of playing any role other than his current one—at the center of the business that he’s synonymous with—seems to stump him. When asked if he could see himself running Dell Technologies in 20 years, Dell says he hasn’t thought that far ahead, but that there’s no other role he craves. Then, at long last, he provides something like a money quote: “I’ve said this before: I’ll still care about Dell when I’m gone.”

*****

The long and winding road

Michael Dell’s company began life in 1984 as PC’s Limited—selling computers, and that’s it. A few crucial pivots helped the company evolve and stay not just relevant but dominant.

1995

Dell Computer, by then a Fortune 500 company, releases the first-generation PowerEdge enterprise server—its first attempt to sell data storage to enterprises.

2006

Dell joins the cloud era, announcing a new business unit that provides cloud products and services to customers. Demand is relatively slow to catch on.

2013

Michael Dell and Egon Durban of PE firm Silver Lake (above, with Dell at left) take the company private in an effort to refocus the company on corporations’ data infrastructure needs.

2016

Dell acquires EMC and its stake in VMware for $67 billion, at the time the largest tech deal ever—making Dell’s data-storage and management portfolio far larger.

2023

Dell Technologies releases a series of infrastructure products, including servers and storage, that are optimized for generative-AI applications.

2024

In February, the company announces its AI PC, which includes a “neural processor” to handle AI workloads. In early March, Dell Technologies stock hits an all-time high.