编者语:

本文的主人公乔安妮·克里沃塞拉为人低调,要被公关团队说服才愿意坐下来接受采访。

作为蔻驰母公司Tapestry的首席执行官,今年8月,她以85亿美元(约合614亿人民币)收购竞争对手Capri Holdings。Capri拥有迈克高仕(Michael Kors)、范思哲(Versace)和Jimmy Choo等品牌。

但克里沃塞拉特在2020年10月正式接手Tapestry时,面临的是一家深陷混乱的公司:掌门人被接连罢免、疫情对奢侈品行业造成冲击、员工之间越发疏离。而华尔街对于这场并购并不买账。克里沃塞拉特如何应对这些难题,并促成了几十年来美国奢侈品行业规模最大的一笔交易?她在和《财富》杂志的专访中,给出了答案。

一项发表在《领导力季刊》的研究显示,危机是影响女性获取晋升机会的重要情境和关键要素,在经济衰退或者业绩下滑的危机情境下,女性担任领导职务的可能性相对提升。这些女性,在危机当中接过重担,在风暴中保持冷静,一步步扭转颓势、稳舵前行。

在明日发布的2023年《财富》中国最具影响力的商界女性榜单中,我们也将看到女性力量的加速崛起。今年开始,更多的中国女性领导者在各行各业担任更重要的职务。她们用智慧和韧性,带领我们突破困境,重回复苏之路。

詹妮弗·洛佩兹来了,利尔·纳斯·X也在,中国电视明星吴谨言和韩国说唱歌手李泳知也出席了。曼哈顿第 42 街的交通陷入停顿。甚至连反皮草走秀的抗议者也蜂拥而入。

9 月,蔻驰(Coach)纽约时装周活动在纽约公共图书馆主楼举行,这个夜晚众星云集,气氛相当火爆。然而明显少了一位贵宾,就是蔻驰母公司时尚集团 Tapestry 首席执行官乔安妮·克里沃塞拉特。

这是克里沃塞拉特公司旗下最大品牌举办的最引人注目的活动(去年,蔻驰在Tapestry的 67亿美元收入中约占50亿美元),她缺席并不是因为不感兴趣。但在这个耀眼华丽的行业,克里沃塞拉特一直避开聚光灯。

这位首席执行官表示,更希望把出风头的机会让给蔻驰团队的创意人员。“我不是重点,希望支持创意团队,”克里沃塞拉特在纽约哈德逊庭院的办公室接受《财富》杂志采访时说。“时装秀有很多工作要做,创意才是品牌背后的引擎,”当时她和已成年的女儿在皇后区美网公开赛贵宾席上看了场网球比赛。

克里沃塞拉特深耕零售和服装行业多年,却绝不是谦逊的“壁花”。她更相信首席执行官的角色是幕后玩家,负责指引方向提升凝聚力,制定能团结公司的战略。在像Tapestry之类旗下掌控多个品牌的公司里,首席执行官的角色格外重要。她承认,经常要被Tapestry公关团队说服才愿意坐下来接受采访。

确实,对于Tapestry的领导者来说,媒体关注是一把双刃剑。2017年,蔻驰收购了配饰制造商Kate Spade,这是该公司有史以来最大的一笔收购。收购之后宣布成立资产组合公司并更名为Tapestry(Tapestry还拥有鞋类品牌Stuart Weitzman)。整合Kate Spade过程中的问题导致2019年Tapestry一位首席执行官离职;不到一年后,因之后一位首席执行官个人行为引发争议,董事会将其免职。

2020年10月,克里沃塞拉特在担任临时首席执行官三个月后正式接任。经历接连罢免掌门之后,她接手的公司深陷混乱:不仅首席执行官更迭,疫情也造成奢侈品消费减少,员工之间也越发疏离。上任伊始,她就是稳定耐心的领导者,主要任务是在Tapestry建立更具凝聚力的文化,一方面结合部分规模优势,如运营效率和更多职业机会,同时充分尊重各品牌的个性和经营方式。与同时代其他零售业首席执行官一样,她也一直改革Tapestry的技术基础设施——多数分析师都认为比较成功。

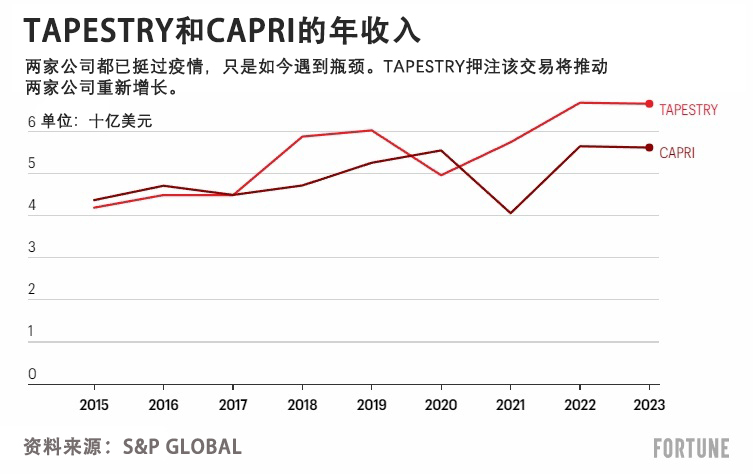

克里沃塞拉特使尽浑身解数,才帮Tapestry以85亿美元(约合614亿人民币)成功拿下竞争对手Capri Holdings。Capri旗下的迈克高仕(Michael Kors)、范思哲(Versace)和Jimmy Choo等品牌在奢侈品领域与蔻驰和Kate Spade存在竞争。该交易将使Tapestry年收入翻一番,达到约120亿美元,而且真正成为拥有六个独立品牌的资产组合公司。(这是2005年百货商店Federated收购竞争对手May Department Stores以来美国零售领域最大一笔并购交易。)

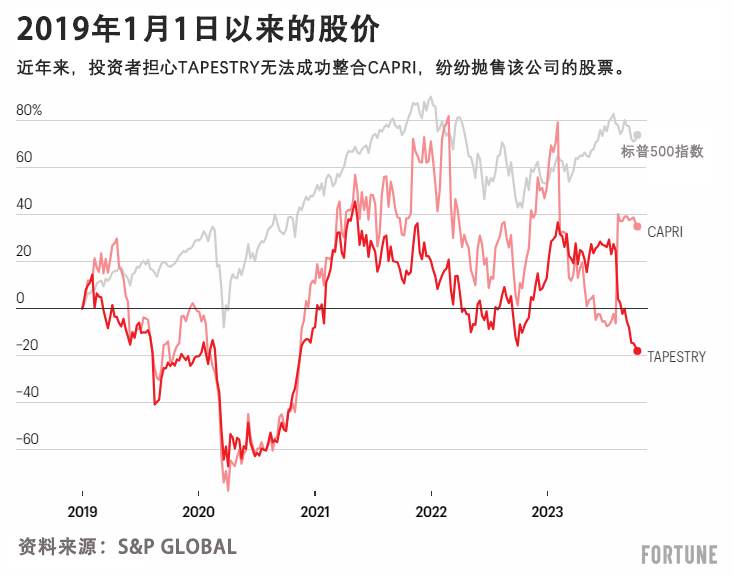

8月Tapestry宣布了与Capri的交易,称尽管两家公司旗下品牌有相似之处却能形成互补。然而华尔街并不买账:多位分析师认为该交易存在风险,宣布之后Tapestry的股价下跌了30%。

部分怀疑源于所谓的“转型疲劳”。挣扎数年后,2010年代后半期Tapestry努力改善蔻驰经营,因为前几年该品牌过度扩张并出现贬值;之后公司对Kate Spade开展类似的改善经营,但进度拖拖拉拉。如今,投资者担心Tapestry又要经历一遍Capri对迈克高仕漫长的业务整顿,迈克高仕跟蔻驰一样都是母公司旗下最大的品牌。迈克高仕以旅行风和闪耀光环闻名,高级成品系列是最大业务,不过多年来过度曝光严重损害了声誉,市场渗透过高导致品牌遍布各折扣店和奥特莱斯店。

美国富国银行(Wells Fargo)分析师艾克·博鲁乔在一份研究报告中指出,零售业并购失败案例众多,并表示迈克高仕地位不稳“提升了执行风险”。花旗银行(Citi)的保罗·勒朱兹则更为直率:“TPR在收购和整合方面记录不佳,”他在一份研究报告中写道,不过承认克里沃塞拉特和团队比前任高管层成功,而且Tapestry收购Capri价格相对合理。

此外,这笔交易还将导致Tapestry内部复杂局面大为恶化。“要消化的东西很多,”GlobalData董事总经理尼尔·桑德斯说。“Tapestry收购的公司需要大量整合工作,而且基本上需要大转型。”这对克里沃塞拉特来说是艰巨的考验,不过她已经证明自己身处行业风暴中保持冷静的能力。

危机时刻保持冷静

克里沃塞拉特几乎从未想过要进入时尚界当掌门人。她是康涅狄格州人,从小在格罗顿长大,距离长岛湾的罗德岛边境不远,专业则是会计师。1985年大学毕业后,她曾想就读法学院但因费用太高放弃,她决定去零售业工作,当时以为只是短暂过渡,之后按计划会读MBA学位并“找一份真正的工作”。但她从学校毕业去五月百货公司之后,参加了该公司的管理培训生计划;后来又去了沃尔玛和科尔士百货公司。

从防盗措施到规划和分配,多年从业经历让克里沃塞拉特接触到零售业各方各面。再加上会计专业背景,2014年到2019年间在Abercrombie & Fitch工作期间顺理成章成为首席财务官,之后加入Tapestry担任首席财务官。

克里沃塞拉特表示,事后看来,她走向首席财务官的路径不太寻常。通常情况下,希望从事财务总监的人会先在普华永道(PwC)等“四大”公司或证券交易委员会担任会计师。不过克里沃塞拉特承认,即便担任其他职务,她也保持着财务总监的纪律和成本控制。“可以不当首席财务官,但骨子里仍然是首席财务官,”她开玩笑说。

除了首席财务官之外,她对多岗位的熟稔可能是胜任首席执行官的关键。最重要的是,她曾是Abercrombie首席执行官弗兰·霍洛维茨最得力臂膀,共同设计并执行时间长但最终大获成功的转型。在此期间,克里沃塞拉特还曾担任首席运营官。2010年代初,在麦克·杰弗里斯领导下Abercrombie销售额大幅下降,公司文化也很糟糕,2014年这位首席执行官被罢免。克里沃塞拉特接任首席财务官“三把火”之一就是卖掉Abercrombie的私人飞机,也是该公司浪费的象征:除了昂贵,媒体还曾报道称杰弗里斯的无理规定,如要求飞机乘务员年轻、肌肉发达和裸上身,经常成头条新闻。

Abercrombie首席执行官空缺两年多,期间霍洛维茨和克里沃塞拉特组成的“董事长办公室”联合负责工作,董事会遴选委员会则在寻找能拯救公司的人。克里沃塞拉特表示当时感觉自己不适合当首席执行官,因为她总感觉能当首席执行官的人个性要非常强。她想起当时Abercrombie董事长,也曾担任西尔斯首席执行官的阿瑟·马丁内斯曾问她为何没参与竞争。“我说,‘我不确定能当首席执行官,’她回忆称。马丁内斯告诉她,这世上‘首席执行官’并非只有一种,但她还是没迈出那一步。

她表示,她内心开始重新思考自己曾经的观点:CEO是否一定要超凡脱俗或者至少非常高调。2020年,当Tapestry任命她为临时CEO时,她感觉自己早已做好了担任这个职务的准备。

她在危机当中接过重担。不到一年前,吉德·泽特林取代维克多·刘易斯担任CEO;刘易斯失去工作的部分原因是,收购Kate Spade的交易严重拖累了公司业绩。泽特林自2006年起担任蔻驰(Coach)董事,他后来黯然离职的原因是因为以往的不当行为被指控;特别是一名女性指控他在2007年冒充摄影师,诱骗她与其发展成恋爱关系。这让新人CEO克雷沃瑟拉特必须面对三个方面的问题:安抚因管理层变动而不安的团队;应对疫情,在疫情期间,消费者不再需要Tapestry的手提袋和鞋子;以及让Kate Spade品牌恢复正常运营。

现在,克雷沃瑟拉特承认,Tapestry在2017年收购Kate Spade之后犯下了战略性错误。Tapestry强迫该品牌放弃了以鲜活大胆的色调呈现出来的相对快乐的气质,转而采用了更沉闷、更成熟的配色,此举抹杀了Kate Spade从无数手提包品牌中脱颖而出的特色。她说道:“对于Kate品牌,我们背离了它的核心品牌基因,实际上是我们放弃了我们的顾客。”

在克雷沃瑟拉特的领导下,Tapestry让Kate品牌恢复了以往的风格。该品牌的业务从疫情中强势反弹(虽然去年销售额下滑2%,这也提醒了我们,一旦消费者停止购买,Kate Spade等奢侈品牌可能受到多大的冲击)。这种做法代表了克雷沃瑟拉特广泛支持Tapestry旗下品牌的自主权:这位首席执行官和其他高管可以随时了解创意团队的动向,但他们不会进行干预,除非他们的创意严重偏离了品牌的定位。克雷沃瑟拉特表示:“虽然我不会对创意发表意见,但我会支持创意团队。而且我希望确保创意团队开发创意的过程,能够帮助发展我们的品牌。”

克雷沃瑟拉特表示,在遭到疫情和CEO危机的双重打击之前,Tapestry正准备启动一个变革项目,将由她和泽特林负责。新冠疫情导致公司旗下的大批门店连续数周停业,这反过来增加了变革的必要性:疫情凸显出技术和电子商务现代化的必要性,以及采用更少自上而下的公司文化对于培养一线员工灵活性的重要性。事实证明,参与主持Abercrombie扭亏为盈的经历令她受益匪浅。她在谈到Tapestry发生的严重危机时表示:“坦白说,这可能会创造一个经典的组织变革案例。”

奢侈品牌规模化经营的机会

虽然克雷沃瑟拉特为人低调,但她很快将成为美国奢侈品行业规模最大的一笔交易的操盘手。Capri公司2022年营收57亿美元,几乎与Tapestry相当。许多华尔街的分析师对这笔交易感到震惊,尤其是Tapestry为了完成这笔交易拟采用的80亿美元过桥融资负债。

Tapestry收购Kate Spade之后遭遇了长达数年的困境,这令一些投资者依旧心有余悸,而且考虑到Tapestry为当前这笔交易背负的债务负担,它能否像投资者们期待的那样快速有效地解决迈克高仕(Michael Kors)品牌的问题,也遭到了投资者的质疑。迈克高仕贡献了Capri公司69%的营收。迈克高仕品牌在2022年的38.8亿美元营收,依旧远低于2016年45亿美元的最高水平。而且,Tapestry与Capri的北美业务增长放缓无助于解决问题。

克雷沃瑟拉特依旧表示,华尔街对这笔交易的反应令她困惑。她说道:“这笔收购交易非常合情合理,我很惊讶竟然有那么多人对此感到意外。”

她认为两家公司相辅相成,优势互补。例如,Capri的欧洲业务更成熟。范思哲(Versace)和Jimmy Choo在高端奢侈品市场的影响力超过Tapestry的品牌;而迈克高仕高端品牌的消费群体,比蔻驰的消费者更年轻、更多元化。而Tapestry的亚洲业务规模更大,而且它拥有强大的皮革制品业务,尤其是手提袋业务。

Tapestry还拥有Capri欠缺的核心技术优势。Tapestry投资了一个名为“Toro”的系统基础设施,可帮助其所有品牌更好地管理库存。Toro还可以生成对消费者行为的深度洞察,从而帮助公司更好地开展营销,并指导新产品开发。反过来,Toro可以帮助Tapestry实现一直以来的一个目标,即减少对面临各种问题的百货商店的依赖,提高通过自营门店和网站销售产品的比例。目前,电子商务业务的营收为20亿美元,约占Tapestry总收入的三分之一。克雷沃瑟拉特表示,Tapestry还创建了更高效的成本结构,她表示,交易完成后,该结构可以为合并后的公司每年节约2亿美元。

开展这笔交易的另外一个重要理由是,所有公司都在进行合并。高端品牌作为大公司的一部分,通常比独立的公司更能蓬勃发展,因为大公司拥有更多资源,而且能够影响供应商。过去二十年间,欧洲奢侈品业巨头LVMH、开云集团(Kering)和历峰集团(Richemont)的增长就是很好的证明。

Kate Spade虽然存在许多问题,但它展现了这种理念的优势。在被Tapestry收购后,这个品牌能以比以前更优惠的价格获得皮革原料。哥伦比亚商学教授、曾任职于LVMH营销部门的西尔维娅·贝莱扎表示:“当你为多个品牌采购时,能够获得更大的议价能力,这是这些大型奢侈品集团可以拥有的另外一个巨大优势。”正如蔻驰品牌CEO托德·卡恩所说:“我们希望无论为门店采购厕纸,还是谈判皮革供应时,能拥有一家规模达到120亿美元的企业的议价能力。”(Tapestry的高管坚称,该笔交易的目的并非为了打造北美版的LVMH。一方面,LVMH旗下拥有更大数量级的产品组合,在时装、首饰、化妆品和酒精饮料等领域拥有约75个品牌,营收高达900亿美元)。

Tapestry的管理层还承诺,不会不惜一切代价追求增长。在2010年代,过度扩张对蔻驰造成了负面影响:该品牌推出了太多款式的手提包,其产品上出现了太多蔻驰的“C”字标识,结果引起了消费者对这个标识的反感,而且它过于依赖折扣店。2014年,蔻驰一次性关闭了25%的门店,减少了折扣店业务,最终将杂乱无章的产品砍掉了一半。

在同一时期,蔻驰聘请了备受赞誉的设计师斯图尔特·维沃斯,后来他将蔻驰转变成了一家以羊毛大衣、皮裤和配饰而闻名的时装公司,而且成为时尚界举足轻重的力量,足以吸引珍妮弗·洛佩兹等名人参加蔻驰的服装秀。蔻驰和Tapestry的元老卡恩表示:“我们不再低估我们的产品,而且我们开始在时尚界树立更高的可信度。”

Tapestry后来不得不对Kate Spade采取类似的措施。现在,它在迈克高仕面临类似的挑战。该品牌的产品出现在尼曼集团(Neiman Marcus)和诺德斯特龙(Nordstrom)等高端零售商以及T.J. Maxx等无数折扣店的柜台。

有分析师批评,收购迈克高仕将会变成一个大麻烦,但Tapestry的高管反驳了这种观点。其财务负责人斯科特·罗伊表示,他和克雷沃瑟拉特进行的尽职调查,包括深入评估Capri每一个品牌在消费者当中的信誉。罗伊表示:“我们希望确保我们不会收购存在重大健康问题的品牌。”

Tapestry在研究潜在收购对象时,会坚持两条红线,其中之一是品牌价值;另外一条红线是潜在收购对象是否会损害Tapestry的投资级债务评级。罗伊表示:“迈克高仕确实有许多负债。对于这笔交易,我们要承认现实。但它也有大量现金流。”罗伊在担任Tapestry首席财务官之前,曾任职于品牌组合公司威富集团(VF),该公司旗下有乐斯菲斯(The North Face)和Vans等品牌。

尽管华尔街对这笔交易和融资状况有所疑虑,投资者却对Tapestry的高管团队充满信心。特尔西咨询集团(Telsey Advisory Group)在一份报告中写道“我们认为TPR的管理层非常适合未来的战略和财务工作。”

克雷沃瑟拉特对企业文化的敏锐感知,将是这笔巨额交易成功的关键之一。作为CEO,克雷沃瑟拉特既要创造一个团结公司和员工的氛围,又要允许各个品牌保持其内在的独特性,这些品牌不久前还是独立的公司,都有各自的理念和经营方式。她必须在这两者之间取得平衡。GlobalData的桑德斯表示:“文化方面将非常重要,因为我认为这笔交易的关键是整合所有这些品牌。”

对于克雷沃瑟拉特而言,品牌整合的一个重要组成部分是承诺提供更广阔的机会,培养更多人才:在Tapestry这样的品牌组合公司,人们可以在不同品牌之间调动,获得蓬勃发展的职业生涯。她还强调公司要建立包容、多元的员工队伍。而且Tapestry高度关注可持续性,规模化经营同样有助于实现这个优先目标,因为各品牌可以共用影响公司碳足迹的许多职能部门,例如采购和租约谈判等。

“我们是建设者”

六年前,蔻驰更名为Tapestry时,最初并没有受到高管或华尔街的欢迎。但克雷沃瑟拉特认为这个名称非常适合公司和她的职务。她说道,她的工作“就是要将美好的事物编织在一起,创作更动人的故事,这就是公司名称Tapestry所代表的织锦的意义。”

这或许是为什么克雷沃瑟拉特不认为自己是交易撮合者,尽管她促成了数十年来美国时尚界规模最大的并购交易。她说道:“这笔交易对于我们公司而言是正确的选择。当我听到‘交易撮合者’这个词时,我会想到:‘你的工作就是买这个,卖那个。’但我们是建设者,我宁愿被称为品牌建设者和人才建设者,而不是交易撮合者。”(财富中文网)

翻译:夏林、刘进龙、汪皓

编者语:

本文的主人公乔安妮·克里沃塞拉为人低调,要被公关团队说服才愿意坐下来接受采访。

作为蔻驰母公司Tapestry的首席执行官,今年8月,她以85亿美元(约合614亿人民币)收购竞争对手Capri Holdings。Capri拥有迈克高仕(Michael Kors)、范思哲(Versace)和Jimmy Choo等品牌。

但克里沃塞拉特在2020年10月正式接手Tapestry时,面临的是一家深陷混乱的公司:掌门人被接连罢免、疫情对奢侈品行业造成冲击、员工之间越发疏离。而华尔街对于这场并购并不买账。克里沃塞拉特如何应对这些难题,并促成了几十年来美国奢侈品行业规模最大的一笔交易?她在和《财富》杂志的专访中,给出了答案。

一项发表在《领导力季刊》的研究显示,危机是影响女性获取晋升机会的重要情境和关键要素,在经济衰退或者业绩下滑的危机情境下,女性担任领导职务的可能性相对提升。这些女性,在危机当中接过重担,在风暴中保持冷静,一步步扭转颓势、稳舵前行。

在明日发布的2023年《财富》中国最具影响力的商界女性榜单中,我们也将看到女性力量的加速崛起。今年开始,更多的中国女性领导者在各行各业担任更重要的职务。她们用智慧和韧性,带领我们突破困境,重回复苏之路。

乔安妮·克里沃塞拉特在纽约市Tapestry全球总部的大厅。这位首席执行官对《财富》杂志说:“我们正努力打造未来,比起交易高手,我更喜欢当品牌建设者和人才建设者。”

詹妮弗·洛佩兹来了,利尔·纳斯·X也在,中国电视明星吴谨言和韩国说唱歌手李泳知也出席了。曼哈顿第 42 街的交通陷入停顿。甚至连反皮草走秀的抗议者也蜂拥而入。

9 月,蔻驰(Coach)纽约时装周活动在纽约公共图书馆主楼举行,这个夜晚众星云集,气氛相当火爆。然而明显少了一位贵宾,就是蔻驰母公司时尚集团 Tapestry 首席执行官乔安妮·克里沃塞拉特。

这是克里沃塞拉特公司旗下最大品牌举办的最引人注目的活动(去年,蔻驰在Tapestry的 67亿美元收入中约占50亿美元),她缺席并不是因为不感兴趣。但在这个耀眼华丽的行业,克里沃塞拉特一直避开聚光灯。

这位首席执行官表示,更希望把出风头的机会让给蔻驰团队的创意人员。“我不是重点,希望支持创意团队,”克里沃塞拉特在纽约哈德逊庭院的办公室接受《财富》杂志采访时说。“时装秀有很多工作要做,创意才是品牌背后的引擎,”当时她和已成年的女儿在皇后区美网公开赛贵宾席上看了场网球比赛。

克里沃塞拉特深耕零售和服装行业多年,却绝不是谦逊的“壁花”。她更相信首席执行官的角色是幕后玩家,负责指引方向提升凝聚力,制定能团结公司的战略。在像Tapestry之类旗下掌控多个品牌的公司里,首席执行官的角色格外重要。她承认,经常要被Tapestry公关团队说服才愿意坐下来接受采访。

确实,对于Tapestry的领导者来说,媒体关注是一把双刃剑。2017年,蔻驰收购了配饰制造商Kate Spade,这是该公司有史以来最大的一笔收购。收购之后宣布成立资产组合公司并更名为Tapestry(Tapestry还拥有鞋类品牌Stuart Weitzman)。整合Kate Spade过程中的问题导致2019年Tapestry一位首席执行官离职;不到一年后,因之后一位首席执行官个人行为引发争议,董事会将其免职。

2020年10月,克里沃塞拉特在担任临时首席执行官三个月后正式接任。经历接连罢免掌门之后,她接手的公司深陷混乱:不仅首席执行官更迭,疫情也造成奢侈品消费减少,员工之间也越发疏离。上任伊始,她就是稳定耐心的领导者,主要任务是在Tapestry建立更具凝聚力的文化,一方面结合部分规模优势,如运营效率和更多职业机会,同时充分尊重各品牌的个性和经营方式。与同时代其他零售业首席执行官一样,她也一直改革Tapestry的技术基础设施——多数分析师都认为比较成功。

克里沃塞拉特使尽浑身解数,才帮Tapestry以85亿美元(约合614亿人民币)成功拿下竞争对手Capri Holdings。Capri旗下的迈克高仕(Michael Kors)、范思哲(Versace)和Jimmy Choo等品牌在奢侈品领域与蔻驰和Kate Spade存在竞争。该交易将使Tapestry年收入翻一番,达到约120亿美元,而且真正成为拥有六个独立品牌的资产组合公司。(这是2005年百货商店Federated收购竞争对手May Department Stores以来美国零售领域最大一笔并购交易。)

8月Tapestry宣布了与Capri的交易,称尽管两家公司旗下品牌有相似之处却能形成互补。然而华尔街并不买账:多位分析师认为该交易存在风险,宣布之后Tapestry的股价下跌了30%。

部分怀疑源于所谓的“转型疲劳”。挣扎数年后,2010年代后半期Tapestry努力改善蔻驰经营,因为前几年该品牌过度扩张并出现贬值;之后公司对Kate Spade开展类似的改善经营,但进度拖拖拉拉。如今,投资者担心Tapestry又要经历一遍Capri对迈克高仕漫长的业务整顿,迈克高仕跟蔻驰一样都是母公司旗下最大的品牌。迈克高仕以旅行风和闪耀光环闻名,高级成品系列是最大业务,不过多年来过度曝光严重损害了声誉,市场渗透过高导致品牌遍布各折扣店和奥特莱斯店。

美国富国银行(Wells Fargo)分析师艾克·博鲁乔在一份研究报告中指出,零售业并购失败案例众多,并表示迈克高仕地位不稳“提升了执行风险”。花旗银行(Citi)的保罗·勒朱兹则更为直率:“TPR在收购和整合方面记录不佳,”他在一份研究报告中写道,不过承认克里沃塞拉特和团队比前任高管层成功,而且Tapestry收购Capri价格相对合理。

此外,这笔交易还将导致Tapestry内部复杂局面大为恶化。“要消化的东西很多,”GlobalData董事总经理尼尔·桑德斯说。“Tapestry收购的公司需要大量整合工作,而且基本上需要大转型。”这对克里沃塞拉特来说是艰巨的考验,不过她已经证明自己身处行业风暴中保持冷静的能力。

危机时刻保持冷静

克里沃塞拉特几乎从未想过要进入时尚界当掌门人。她是康涅狄格州人,从小在格罗顿长大,距离长岛湾的罗德岛边境不远,专业则是会计师。1985年大学毕业后,她曾想就读法学院但因费用太高放弃,她决定去零售业工作,当时以为只是短暂过渡,之后按计划会读MBA学位并“找一份真正的工作”。但她从学校毕业去五月百货公司之后,参加了该公司的管理培训生计划;后来又去了沃尔玛和科尔士百货公司。

从防盗措施到规划和分配,多年从业经历让克里沃塞拉特接触到零售业各方各面。再加上会计专业背景,2014年到2019年间在Abercrombie & Fitch工作期间顺理成章成为首席财务官,之后加入Tapestry担任首席财务官。

克里沃塞拉特表示,事后看来,她走向首席财务官的路径不太寻常。通常情况下,希望从事财务总监的人会先在普华永道(PwC)等“四大”公司或证券交易委员会担任会计师。不过克里沃塞拉特承认,即便担任其他职务,她也保持着财务总监的纪律和成本控制。“可以不当首席财务官,但骨子里仍然是首席财务官,”她开玩笑说。

除了首席财务官之外,她对多岗位的熟稔可能是胜任首席执行官的关键。最重要的是,她曾是Abercrombie首席执行官弗兰·霍洛维茨最得力臂膀,共同设计并执行时间长但最终大获成功的转型。在此期间,克里沃塞拉特还曾担任首席运营官。2010年代初,在麦克·杰弗里斯领导下Abercrombie销售额大幅下降,公司文化也很糟糕,2014年这位首席执行官被罢免。克里沃塞拉特接任首席财务官“三把火”之一就是卖掉Abercrombie的私人飞机,也是该公司浪费的象征:除了昂贵,媒体还曾报道称杰弗里斯的无理规定,如要求飞机乘务员年轻、肌肉发达和裸上身,经常成头条新闻。

Abercrombie首席执行官空缺两年多,期间霍洛维茨和克里沃塞拉特组成的“董事长办公室”联合负责工作,董事会遴选委员会则在寻找能拯救公司的人。克里沃塞拉特表示当时感觉自己不适合当首席执行官,因为她总感觉能当首席执行官的人个性要非常强。她想起当时Abercrombie董事长,也曾担任西尔斯首席执行官的阿瑟·马丁内斯曾问她为何没参与竞争。“我说,‘我不确定能当首席执行官,’她回忆称。马丁内斯告诉她,这世上‘首席执行官’并非只有一种,但她还是没迈出那一步。

她表示,她内心开始重新思考自己曾经的观点:CEO是否一定要超凡脱俗或者至少非常高调。2020年,当Tapestry任命她为临时CEO时,她感觉自己早已做好了担任这个职务的准备。

她在危机当中接过重担。不到一年前,吉德·泽特林取代维克多·刘易斯担任CEO;刘易斯失去工作的部分原因是,收购Kate Spade的交易严重拖累了公司业绩。泽特林自2006年起担任蔻驰(Coach)董事,他后来黯然离职的原因是因为以往的不当行为被指控;特别是一名女性指控他在2007年冒充摄影师,诱骗她与其发展成恋爱关系。这让新人CEO克雷沃瑟拉特必须面对三个方面的问题:安抚因管理层变动而不安的团队;应对疫情,在疫情期间,消费者不再需要Tapestry的手提袋和鞋子;以及让Kate Spade品牌恢复正常运营。

现在,克雷沃瑟拉特承认,Tapestry在2017年收购Kate Spade之后犯下了战略性错误。Tapestry强迫该品牌放弃了以鲜活大胆的色调呈现出来的相对快乐的气质,转而采用了更沉闷、更成熟的配色,此举抹杀了Kate Spade从无数手提包品牌中脱颖而出的特色。她说道:“对于Kate品牌,我们背离了它的核心品牌基因,实际上是我们放弃了我们的顾客。”

在克雷沃瑟拉特的领导下,Tapestry让Kate品牌恢复了以往的风格。该品牌的业务从疫情中强势反弹(虽然去年销售额下滑2%,这也提醒了我们,一旦消费者停止购买,Kate Spade等奢侈品牌可能受到多大的冲击)。这种做法代表了克雷沃瑟拉特广泛支持Tapestry旗下品牌的自主权:这位首席执行官和其他高管可以随时了解创意团队的动向,但他们不会进行干预,除非他们的创意严重偏离了品牌的定位。克雷沃瑟拉特表示:“虽然我不会对创意发表意见,但我会支持创意团队。而且我希望确保创意团队开发创意的过程,能够帮助发展我们的品牌。”

克雷沃瑟拉特表示,在遭到疫情和CEO危机的双重打击之前,Tapestry正准备启动一个变革项目,将由她和泽特林负责。新冠疫情导致公司旗下的大批门店连续数周停业,这反过来增加了变革的必要性:疫情凸显出技术和电子商务现代化的必要性,以及采用更少自上而下的公司文化对于培养一线员工灵活性的重要性。事实证明,参与主持Abercrombie扭亏为盈的经历令她受益匪浅。她在谈到Tapestry发生的严重危机时表示:“坦白说,这可能会创造一个经典的组织变革案例。”

奢侈品牌规模化经营的机会

虽然克雷沃瑟拉特为人低调,但她很快将成为美国奢侈品行业规模最大的一笔交易的操盘手。Capri公司2022年营收57亿美元,几乎与Tapestry相当。许多华尔街的分析师对这笔交易感到震惊,尤其是Tapestry为了完成这笔交易拟采用的80亿美元过桥融资负债。

Tapestry收购Kate Spade之后遭遇了长达数年的困境,这令一些投资者依旧心有余悸,而且考虑到Tapestry为当前这笔交易背负的债务负担,它能否像投资者们期待的那样快速有效地解决迈克高仕(Michael Kors)品牌的问题,也遭到了投资者的质疑。迈克高仕贡献了Capri公司69%的营收。迈克高仕品牌在2022年的38.8亿美元营收,依旧远低于2016年45亿美元的最高水平。而且,Tapestry与Capri的北美业务增长放缓无助于解决问题。

克雷沃瑟拉特依旧表示,华尔街对这笔交易的反应令她困惑。她说道:“这笔收购交易非常合情合理,我很惊讶竟然有那么多人对此感到意外。”

她认为两家公司相辅相成,优势互补。例如,Capri的欧洲业务更成熟。范思哲(Versace)和Jimmy Choo在高端奢侈品市场的影响力超过Tapestry的品牌;而迈克高仕高端品牌的消费群体,比蔻驰的消费者更年轻、更多元化。而Tapestry的亚洲业务规模更大,而且它拥有强大的皮革制品业务,尤其是手提袋业务。

Tapestry还拥有Capri欠缺的核心技术优势。Tapestry投资了一个名为“Toro”的系统基础设施,可帮助其所有品牌更好地管理库存。Toro还可以生成对消费者行为的深度洞察,从而帮助公司更好地开展营销,并指导新产品开发。反过来,Toro可以帮助Tapestry实现一直以来的一个目标,即减少对面临各种问题的百货商店的依赖,提高通过自营门店和网站销售产品的比例。目前,电子商务业务的营收为20亿美元,约占Tapestry总收入的三分之一。克雷沃瑟拉特表示,Tapestry还创建了更高效的成本结构,她表示,交易完成后,该结构可以为合并后的公司每年节约2亿美元。

开展这笔交易的另外一个重要理由是,所有公司都在进行合并。高端品牌作为大公司的一部分,通常比独立的公司更能蓬勃发展,因为大公司拥有更多资源,而且能够影响供应商。过去二十年间,欧洲奢侈品业巨头LVMH、开云集团(Kering)和历峰集团(Richemont)的增长就是很好的证明。

Kate Spade虽然存在许多问题,但它展现了这种理念的优势。在被Tapestry收购后,这个品牌能以比以前更优惠的价格获得皮革原料。哥伦比亚商学教授、曾任职于LVMH营销部门的西尔维娅·贝莱扎表示:“当你为多个品牌采购时,能够获得更大的议价能力,这是这些大型奢侈品集团可以拥有的另外一个巨大优势。”正如蔻驰品牌CEO托德·卡恩所说:“我们希望无论为门店采购厕纸,还是谈判皮革供应时,能拥有一家规模达到120亿美元的企业的议价能力。”(Tapestry的高管坚称,该笔交易的目的并非为了打造北美版的LVMH。一方面,LVMH旗下拥有更大数量级的产品组合,在时装、首饰、化妆品和酒精饮料等领域拥有约75个品牌,营收高达900亿美元)。

Tapestry的管理层还承诺,不会不惜一切代价追求增长。在2010年代,过度扩张对蔻驰造成了负面影响:该品牌推出了太多款式的手提包,其产品上出现了太多蔻驰的“C”字标识,结果引起了消费者对这个标识的反感,而且它过于依赖折扣店。2014年,蔻驰一次性关闭了25%的门店,减少了折扣店业务,最终将杂乱无章的产品砍掉了一半。

在同一时期,蔻驰聘请了备受赞誉的设计师斯图尔特·维沃斯,后来他将蔻驰转变成了一家以羊毛大衣、皮裤和配饰而闻名的时装公司,而且成为时尚界举足轻重的力量,足以吸引珍妮弗·洛佩兹等名人参加蔻驰的服装秀。蔻驰和Tapestry的元老卡恩表示:“我们不再低估我们的产品,而且我们开始在时尚界树立更高的可信度。”

Tapestry后来不得不对Kate Spade采取类似的措施。现在,它在迈克高仕面临类似的挑战。该品牌的产品出现在尼曼集团(Neiman Marcus)和诺德斯特龙(Nordstrom)等高端零售商以及T.J. Maxx等无数折扣店的柜台。

有分析师批评,收购迈克高仕将会变成一个大麻烦,但Tapestry的高管反驳了这种观点。其财务负责人斯科特·罗伊表示,他和克雷沃瑟拉特进行的尽职调查,包括深入评估Capri每一个品牌在消费者当中的信誉。罗伊表示:“我们希望确保我们不会收购存在重大健康问题的品牌。”

Tapestry在研究潜在收购对象时,会坚持两条红线,其中之一是品牌价值;另外一条红线是潜在收购对象是否会损害Tapestry的投资级债务评级。罗伊表示:“迈克高仕确实有许多负债。对于这笔交易,我们要承认现实。但它也有大量现金流。”罗伊在担任Tapestry首席财务官之前,曾任职于品牌组合公司威富集团(VF),该公司旗下有乐斯菲斯(The North Face)和Vans等品牌。

尽管华尔街对这笔交易和融资状况有所疑虑,投资者却对Tapestry的高管团队充满信心。特尔西咨询集团(Telsey Advisory Group)在一份报告中写道“我们认为TPR的管理层非常适合未来的战略和财务工作。”

克雷沃瑟拉特对企业文化的敏锐感知,将是这笔巨额交易成功的关键之一。作为CEO,克雷沃瑟拉特既要创造一个团结公司和员工的氛围,又要允许各个品牌保持其内在的独特性,这些品牌不久前还是独立的公司,都有各自的理念和经营方式。她必须在这两者之间取得平衡。GlobalData的桑德斯表示:“文化方面将非常重要,因为我认为这笔交易的关键是整合所有这些品牌。”

对于克雷沃瑟拉特而言,品牌整合的一个重要组成部分是承诺提供更广阔的机会,培养更多人才:在Tapestry这样的品牌组合公司,人们可以在不同品牌之间调动,获得蓬勃发展的职业生涯。她还强调公司要建立包容、多元的员工队伍。而且Tapestry高度关注可持续性,规模化经营同样有助于实现这个优先目标,因为各品牌可以共用影响公司碳足迹的许多职能部门,例如采购和租约谈判等。

“我们是建设者”

六年前,蔻驰更名为Tapestry时,最初并没有受到高管或华尔街的欢迎。但克雷沃瑟拉特认为这个名称非常适合公司和她的职务。她说道,她的工作“就是要将美好的事物编织在一起,创作更动人的故事,这就是公司名称Tapestry所代表的织锦的意义。”

这或许是为什么克雷沃瑟拉特不认为自己是交易撮合者,尽管她促成了数十年来美国时尚界规模最大的并购交易。她说道:“这笔交易对于我们公司而言是正确的选择。当我听到‘交易撮合者’这个词时,我会想到:‘你的工作就是买这个,卖那个。’但我们是建设者,我宁愿被称为品牌建设者和人才建设者,而不是交易撮合者。”(财富中文网)

翻译:夏林、刘进龙、汪皓

Coach’s New York Fashion Week event, which commandeered the main branch of the New York Public Library for a glamorous night in September, was clearly a hot ticket. But one VIP was conspicuously absent: Joanne Crevoiserat, the CEO of Coach’s parent company, the fashion conglomerate Tapestry.

It’s not that Crevoiserat wasn’t interested in the splashiest show by the biggest brand in her company’s portfolio. (Coach accounted for about $5 billion of Tapestry’s $6.7 billion in revenue last year.) But in an industry known for flamboyant, publicity-seeking leaders, Crevoiserat has always eschewed the limelight, preferring a low-key, get-it-done management style.

The CEO says she preferred to have her ticket go to a creator in the Coach ranks. “It isn’t my thing, and I want to support our creative teams,” Crevoiserat tells Fortune during an interview at her office in New York’s Hudson Yards. “There’s a lot of work that goes into the runway shows, and creativity is the engine that drives the brands.” She and her adult daughter caught a tennis match instead, from nosebleed seats at the U.S. Open in Queens.

Crevoiserat, a retail and apparel industry lifer, is hardly a self-effacing wallflower. Rather, she sees the role of a CEO as that of a behind-the-scenes player who provides direction and cohesion and comes up with the strategy around which the company will coalesce. That’s an especially important role at a portfolio company like Tapestry that is steering multiple brands. She admits she has often had to be persuaded by Tapestry’s communications team to do sit-down interviews like ours.

To be sure, publicity has been a double-edged sword for Tapestry’s leaders of late. The company formerly known as Coach renamed itself in 2017 after Coach bought the accessories maker Kate Spade, its biggest-ever acquisition at that point, and announced plans to become a portfolio company. (Tapestry also owns the shoe brand Stuart Weitzman.) Problems with integrating Kate Spade cost one Tapestry CEO his job in 2019; less than a year later, the board pushed out the next CEO amid a controversy over his personal behavior.

Crevoiserat, who became CEO in October 2020 after three months as interim chief, inherited a company in turmoil after those very public ousters: Overlaid on the CEO turnover was the pandemic, which hurt luxury spending and isolated workers from each other. Since then, she’s been a stable, patient presence, and a leader whose primary mission has been instilling a more cohesive culture at Tapestry–one that combines some of the advantages of scale, like operating efficiencies and a wider range of career opportunities, with a respect for individual brands’ personalities and ways of operating. Like just about every other retail CEO of her generation, she’s also been overhauling Tapestry’s tech infrastructure–successfully, most analysts agree.

Crevoiserat will need every skill in her toolkit to help her successfully pull off Tapestry’s recently announced $8.5 billion purchase of its arch-rival, Capri Holdings. Capri is home to Michael Kors, Versace and Jimmy Choo—all names that rival Coach and Kate Spade in the luxury category. The deal will double Tapestry by annual revenue to about $12 billion and make it a true portfolio company with six separate brands. (It’s the largest U.S. retail M&A deal since department store operator Federated bought rival May Department Stores in 2005.)

Tapestry announced the Capri deal in August, making the case that the two companies, despite some similarities among their brands, are complementary. But Wall Street isn’t buying it: Many analysts see the deal as risky, and Tapestry’s shares are down 30% since the announcement.

Part of the skepticism stems from what one might call turnaround fatigue. Tapestry spent the second half of the 2010s rehabilitating Coach after a few very painful years during which the brand became overextended and cheapened; it then pulled off a similar fixer-upper job for Kate Spade that dragged on. Now investors worry that Tapestry could again be facing a long slog in continuing Capri’s overhaul of Michael Kors—which, like Coach, is by far the biggest brand in its parent’s stable. Michael Kors is famed for the jet-set, blingy aura that made its ready-to-wear lines big business, but its cachet has been severely damaged by years of overexposure, the kind of market saturation that leads to too much presence at discount stores and outlet malls.

In a research note, Wells Fargo analyst Ike Boruchow pointed to the ample M&A failures in retail, and said of the Capri deal that Michael Kors’s shaky status “adds real execution risk.” Paul Lejuez at Citi was more blunt: “TPR has not had a great track record of making and integrating acquisitions,” he wrote in a research note, though he did acknowledge Crevoiserat and her team had had more success than previous c-suites had, and that Tapestry was paying a reasonable price for Capri.

In addition, the deal will also dramatically increase Tapestry’s complexity. “It’s a lot to digest,” says Neil Saunders, a managing director at GlobalData. “Tapestry is buying a company that is in need of a lot of work and that it basically has to turn around.” That makes it a formidable test for Crevoiserat—an executive who has already shown that she can project calm amid the industry’s storms.

Cool in times of crisis

For much of her life, becoming a CEO in the fashion world was nowhere on Crevoiserat’s radar screen. The Connecticut native, who grew up in Groton, not far from the Rhode Island border on Long Island Sound, is an accountant by training. She was tempted by law school when she finished college in 1985, but daunted by the cost, she decided to go work in retail, thinking it would be a brief interlude after which she’d get her MBA and “get a real job.” But her just-out-of-school gig at May Department Stores led her to undergo that company’s management trainee program; later, she worked at Walmart and Kohl’s.

Those experiences exposed Crevoiserat to many facets of retailing, from anti-theft measures to planning and allocation. Combined with her accounting training, it foretold her future as CFO at Abercrombie & Fitch, where she worked from 2014 to 2019 before joining Tapestry as CFO.

In hindsight, Crevoiserat says, her path to CFO roles was unconventional. Typically, someone eyeing a finance chief role will start with a stint as an accountant at a “Big Four” firm like PwC, or at the Securities and Exchange Commission. Still, Crevoiserat allows that even in other roles she has kept the discipline and focus on cost-control typical of finance chiefs. “You can take the girl out of the CFO role but you can’t take the CFO out of the girl,” she jokes.

Her versatility in roles other than CFO may be the key to her success as CEO. Crucially, she was the top lieutenant to Abercrombie CEO Fran Horowitz in co-designing and executing the company’s long but ultimately wildly successful turnaround–during which Crevoiserat also held the role of chief operating officer. Abercrombie in the early 2010s had seen sales plummet and, in Mike Jeffries, had a CEO who had created a toxic culture at the retailer prior to his ouster in 2014. One of Crevoiserat’s earliest moves as CFO was to get rid of Abercrombie’s private jet, which had become a symbol of excess: On top of being expensive, it made headlines when media reports said that Jeffries had implemented imperious rules such as demanding that the jet’s flight attendants be young, buffed, and shirtless.

Abercrombie’s CEO office sat unoccupied for more than two years, with an “Office of the Chairman” that included Horowitz and Crevoiserat to do the job while the board’s search committee looked for someone to save the deeply damaged corporation. Yet Crevoiserat says didn’t feel she was the right person for the CEO position at the time, since she believed CEOs by definition had big personalities. She recalls being asked by Abercrombie’s then-chairman Arthur Martinez, a former Sears CEO, why she hadn’t tossed her hat in the ring. “I said, ‘I’m not sure I’m the CEO type,” she recalls. After Martinez told her that there was no single “CEO type,” she still didn’t apply.

But in the back of her mind, she says, she started to rethink her view that CEOs had to be larger than life, or at least very much out there. By the time the Tapestry board tapped her to be interim CEO in 2020, she felt more than ready for the role.

Her arrival came at a time of crisis. CEO Jide Zeitlin had replaced Victor Luis less than a year earlier; Luis lost his job in part because of how big a drag on the company the Kate Spade acquisition was turning out to be. Zeitlin, who had been a Coach director since 2006, was then ousted because of allegations of past inappropriate behavior; in particular, one woman accused him of posing as a photographer under an alias in 2007 to lure her into a romantic relationship. That left Crevoiserat, a rookie CEO, to deal with a troika of problems: reassuring a workforce rattled by the management turnover; navigating a pandemic during which consumers did not need Tapestry’s handbags and shoes; and bringing the Kate Spade brand back to health.

Crevoiserat now recognizes that Tapestry made strategic mistakes with Kate Spade after buying it in 2017. Tapestry pushed the brand to trade its relatively joyful ethos, anchored in novelty and crazy colors, for a more muted, sophisticated color palette—a move that effaced what made Kate Spade stand out among countless handbag brands. “At Kate, we walked away from some of that core DNA and we effectively fired our customer,” she says.

Under Crevoiserat’s leadership, Tapestry has gone back to letting Kate be Kate. The business bounced back strongly from the pandemic (although sales fell 2% last year, in a reminder of how exposed to consumer pullbacks “aspirational” luxury brands like Kate Spade can be). That approach represents Crevoiserat’s broader support of autonomy among Tapestry’s brands: The chief exec and her fellow c-suite officers keep apprised of what the creative teams are up to, but won’t intervene unless they see something wildly off brand. “While I don't weigh in on the creativity, I'm there for those teams,” Crevoiserat says, “and I want to make sure that we're allowing them to drive the creative process in a way that helps move the brands forward.”

Crevoiserat says that just before the one-two punch of the pandemic and the CEO crisis, Tapestry was about to launch a transformation program that she and Zeitlin were to lead. COVID shut down a huge chunk of its store fleet for weeks, which in turn fueled the need for that transformation: The pandemic underscored how necessary modernizing its tech and e-commerce was, along with the importance of adopting a less top-down culture to foster agility on the front lines. And her time co-piloting the Abercrombie turnaround would prove to be very handy to her: “Frankly, it could create a case for change in the organization that was compelling,” the CEO says of the perfect storm of crises at Tapestry.

A chance to do luxury at scale

For all of Crevoiserat’s low-key style, she will soon be the author of one of biggest luxury sector deals ever in the U.S. Capri, with 2022 revenue of $5.7 billion, is almost as large as Tapestry. Many on Wall Street were stunned by the deal, not least by the $8 billion in bridge-financing debt Tapestry will take on to finalize it.

There is also some PTSD in the investor community after Tapestry’s years-long Kate Spade struggles—and related questions about whether Tapestry will be able to fix Michael Kors, which generates 69% of revenue at Capri, as fast and effectively as investors would like given the debt burden. The $3.88 billion the Kors brand pulled in in 2022 is still well below its $4.5 billion high water mark in 2016. And it isn’t helping that business is slowing in North America for both Tapestry and Capri.

Still, Crevoiserat professes to be baffled by Wall Street’s reaction to the deal. “This acquisition was so completely obvious that it surprised me how many people were surprised,” she says.

She posits that the companies are complimentary. Capri, for example, is better established in Europe. In Versace and Jimmy Choo, it has a bigger presence in the world of high luxury than Tapestry’s brands; and in Kors it has a jet set brand popular with shoppers younger and more diverse than Coach’s. In return, Tapestry’s Asia business is much bigger, and it is a powerhouse in leather goods, notably handbags.

Tapestry also has a tech backbone that Capri lacks. It has invested in an infrastructure of systems, which the company calls "Toro," that helps all its brands manage inventory better. Toro also fuels better marketing and guides new product development, by generating deep insights into consumers’ behavior. Toro, in turn, serves a long-standing effort by Tapestry to become much less dependent on department stores with all their problems, and to sell a greater percentage of its products via its own stores and websites. E-commerce is now a $2 billion business for Tapestry, accounting for almost a third of revenues. Crevoiserat says the company has also created a more efficient cost structure at Tapestry that she says will save the combined company $200 million a year when the deal closes.

Another big rationale for the deal is that, well, everyone else is consolidating. As evidenced by the growth in the last twenty years of European luxury giants LVMH, Kering, and Richemont, upscale brands often thrive as part of a larger company with bigger resources, and clout with suppliers, than as stand-alone companies.

For all its problems, Kate Spade illustrates the potential of that idea. After the Tapestry acquisition, the brand was able to get better prices for leather than it was on its own. “When you are buying for several brands, you get better negotiating power and that’s another big advantage that these luxury conglomerates can have,” says Columbia Business School professor Silvia Bellezza, who once worked at LVMH in marketing. As Coach brand CEO Todd Kahn puts it: “We want to have the power of a $12 billion enterprise when we’re procuring everything from toilet paper for our stores to negotiating leather supplies.” (Tapestry execs insist that the idea of the deal is not to create a North American counterpart to LVMH. LVMH’s portfolio, for one thing, is an order of magnitude bigger, with about 75 brands in fashion, jewelry, beauty products and alcohol, and $90 billion in revenue.)

Tapestry’s management is also committed to avoiding any growth-at-all-costs mindset. Overextension hurt Coach in the 2010s: There were too many models of handbags, too many “C” Coach logos slapped on its products at a time of a backlash against logos among consumers, and too much reliance on outlet stores. Coach closed 25% of its stores in one fell swoop in 2014, dialed back its discount outlet business, and eventually ended up removing half the products in its cluttered assortment.

Over the same span, Coach hired Stuart Vevers, the lauded designer who has since then turned Coach into a fashion house known for shearling coats and leather pants as well as accessories, and enough of a serious fashion force to attract the likes of Jenny from the Block to Coach’s shows. “We stopped undervaluing our product and we started to create more fashion credibility,” says Kahn, a longtime Coach and Tapestry veteran.

Tapestry later had to do similar work on Kate Spade. Now it faces similar challenges at MIchael Kors, which is present at high-retailers like Neiman Marcus and Nordstrom, but also at T.J. Maxx and countless other outlet stores.

Tapestry executives dismiss the criticism from some analysts that Michael Kors will turn out to be a troublesome acquisition. Tapestry’s finance chief, Scott Roe, says that the due diligence he and Crevoiserat conducted included in-depth assessments of each Capri brand’s reputation with consumers. “We wanted to make sure we weren’t buying brands that had health issues we thought were significant,” says Roe. Brand equity was one of two red lines for Tapestry in looking at the potential acquisition; the other was whether it would jeopardize Tapestry’s investment grade debt rating. “There’s a lot of debt. Let’s acknowledge the reality about this transaction. But it’s also a lot of cash flow,” says Roe, who came to be CFO from VF, the brand portfolio company that owns The North Face and Vans, among others.

Whatever misgivings Wall Street has about the deal and the financing, investors do have faith in Tapestry’s c-suite. Telsey Advisory Group wrote in a note that “we view TPR management as well suited for the strategic and financial work ahead.”

Crevoiserat’s fine-tuned sense of corporate culture will be one key to making this mega-deal work. The CEO will have to find the balance of fostering an atmosphere that unifies the company and its employees, while allowing the brands—all stand-alone companies not long ago, with their own ethoses and ways of doing things—to keep their internal identities. “The cultural side is going to be very important because I think the key to a lot of this is actually integrating all these brands,” says GlobalData’s Saunders.

A big part of that integration, for Crevoiserat, means cultivating talent with a promise of wider opportunity: At a portfolio company like Tapestry, people can have a thriving career that can move across different brands. She emphasizes having an inclusive and diverse workforce, as well. And Tapestry is very focused on sustainability—another priority that benefits from scale, given that many functions that affect the company’s carbon footprint, like procurement and lease negotiation, will be shared across brands.

'We're building here'

The name Tapestry itself was not beloved at first by executives or Wall Street when it was introduced six years ago to replace Coach. But Crevoiserat has come to think it applies well both to the company and to her own role. Her job, she says, “is about weaving together beautiful things and making a more beautiful story, and that’s what a tapestry is.”

Perhaps that’s why Crevoiserat doesn’t see herself as a dealmaker, despite being the CEO who pushed for the largest U.S. fashion deal in decades. “It’s the right thing for our business,” she says. “When I hear the term ‘dealmaker,’ I think, ‘Your job is to buy this one, sell that one.’ We’re building here, and I’d rather be a brand-builder and a talent-builder than a dealmaker.”