近十年股市大盘点:是什么导致如今的境况?

|

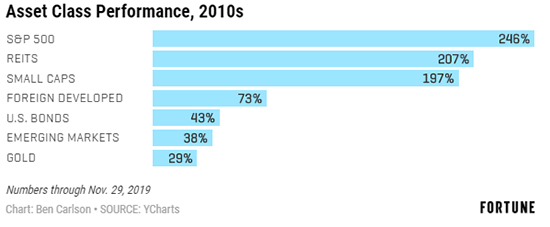

如果说21世纪的头10年对于市场和经济并不友好,那算是把话往轻里说了。那10年简直就是一场经济崩溃。我们经历了两次衰退,包括自20世纪30年代大萧条以来最严重的一次经济危机,而两次股市的崩溃中,每次股市市值都被腰斩。 这些大溃败定义了这寥落的10年,对于标普500来说这是失去的10年,美国最大型的一批股票从2000年到2009年整体下跌约10%。尽管在2009年底,股市从当年3月的低点强势反弹,但当时很多人预测,未来数年意味着更多的股市崩溃、波动性和经济的衰退。 所以,很自然的,接下去的10年会反其道而行之。事实上,自2010年始的10年,是自1850年(能获得有效数据的最早可追溯时间)以来第一次美国没有经历任何一次经济衰退的10年期。股市虽然也经历小幅波动的阵痛,但每一次市场矫正都变成了买入的机会,仅在这10年中,我们就看到标普500出现了200次的历史新高。 这10年即将落幕,我们将迎来2020年开启的新10年,一起来回顾这过去的10年中,市场都发生了些什么,才让我们到了如今的境况。 难以击败的标普500 从绝对和相对的意义上来说,21世纪的头10年是标普500史上最差的10年之一,而此后的10年又是史上最好的10年之一。从总收益看,标普打败了所有的主要资产类别: |

To call the first decade of the 21st unkind to markets and the economy would be a massive understatement. It was a debacle. We lived through two recessions, including the worst economic crisis since the Great Depression, and two enormous stock market crashes which saw stocks drop by half each time. Those brutal crashes bookended the decade of the aughts, and that led to a lost decade in the S&P 500, which saw the largest stocks in the U.S. as a whole fall nearly 10% in total from 2000 to 2009. Although the stock market had rallied mightily off the March, 2009 lows by the end of that year, many were predicting more of the same dose of pain in terms of crashes, volatility, and economic calamities in the years ahead. So, naturally, the ensuing decade did the complete opposite. In fact, the 2010s was the first decade since 1850 (which is about as far back as we have good data) that the U.S. didn’t experience a single recession. The stock market had minor bouts of volatility but every correction turned out to be a buying opportunity as we’ve now seen well over 200 new all-time highs on the S&P 500 this decade alone. As the 2010s wind down, and we get ready to usher in the 2020s, here’s a look back at what happened in the markets over the past decade that got us to this point. S&P 500: tough to beat The S&P 500 followed one of its worst decades on record in the 2000s with one of its best in the 2010s on both an absolute and relative basis. The S&P crushed all of the main asset classes as you can see from the total returns: |

数据截至2019年11月29日 表格:本·卡尔森 来源:YCharts

|

这10年中有9年标普指数上涨,只有2019年下跌,跌幅仅为4.2%。上涨的9年中有7年,收益是两位数涨幅,而其中有不连续的3年,股市上涨20%或更多。 |

The S&P was up nine out of 10 years with the only down year in 2019, a loss of just 4.2%. Seven out of those nine years showed double-digit gains while stocks were up 20% or more three different years. |

标普500收益 21世纪第二个10年

2019年收益数据截至2019年11月29日 表格:本·卡尔森 来源:YCharts

|

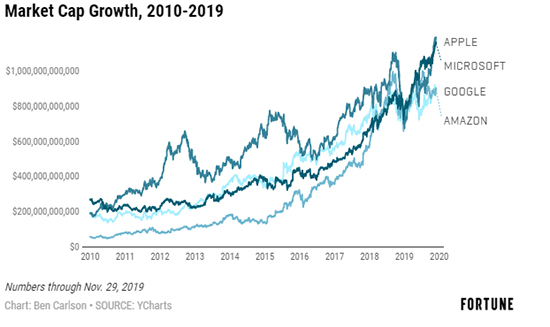

股市10年9涨的情况,在历史上只有20世纪的80和90年代出现过,那两个十年的年度收益更高一些。标普指数在20世纪的80和90年代分别涨了17.3%和18%,而2010年开始的这10年,投资者的年度收益率是13.1%。 除了20世纪90年代,2010开始的这10年,还是史上仅有的没有出现一次熊市的10年(熊市的定义是股市下跌20%或更多)。标普500在2011年曾下跌19.4%,在2018年末曾下跌19.8%,但在这10年中,美国大型资本股票从未触及那个神奇的20%熊市门槛。 科技股主导 大型资本的美国股票难以被击败,而其中一小撮股票表现得更佳。从成长性和股市表现来说,这10年中科技股的业绩可谓现象级。截至2019年11月底,纳斯达克100在这10年中涨幅接近400%,比标普500在这10年的涨幅还要多150%有余。 这一涨幅主要来自一小撮业已成为当下全球最大的公司。这10年的初期,苹果、亚马逊、微软和谷歌的市值加在一起是7160亿美元,而当前这一数字已经超过4.1万亿美元。 |

The only other time stocks were up nine out of 10 times in a decade came during the 1980s and 1990s, although those decades saw higher annual returns. The S&P was up 17.3% and 18.0% annually in the 1980s and 1990s, respectively. The 2010s have given investors total annual returns of 13.1%. The 2010s do, however, have the distinction of being the only other decade on record besides the 1990s without a single bear market on record (as defined by a loss of 20% or more). The S&P 500 was down 19.4% in 2011 and 19.8% in late-2018, but U.S. large-cap stocks never hit that magical 20% bear market threshold this decade. Tech dominance While large-cap U.S. stocks were tough to beat, there was a subset of stocks within that universe that did even better. Technology stocks had a phenomenal decade in terms of both growth and stock performance. Through the end of November 2019, the Nasdaq 100 was up nearly 400% over the course of the decade. That’s more than 150% better than the S&P 500 during that time. Much of that growth came from a small handful of what are now some of the largest companies in the world. The combined market cap of Apple, Amazon, Microsoft and Google was $716 billion heading into this decade. That number currently stands at more than $4.1 trillion. |

市值增幅,2010-2019

数据截至2019年11月29日 表格:本·卡尔森 来源:YCharts

|

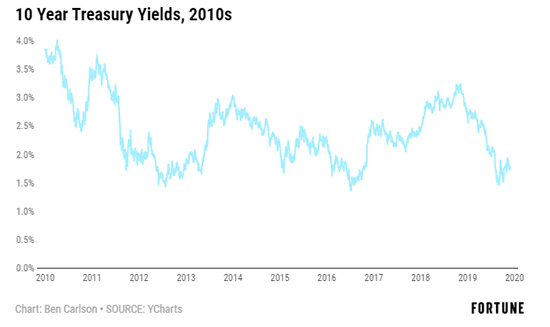

这些数据还不包括Facebook股价的巨幅增长。Facebook在2012年上市,同一年马克·扎克伯格的Facebook以10亿美元收购了Instagram, 这肯定是这10年中最优质的一次收购。据预测仅2019年,Instagram的营收将接近140亿美元。Facebook目前的市值是5750亿美元,而在上市时其市值为800亿美元。这五家公司的权重几乎占了整个标普500指数的17%。 短短数十年间,这些科技公司从衣衫褴褛的初创企业,一跃而成世界级的巨头大鳄。 商品交易 21世纪的头10年,对于商品贸易是一段黄金时期,尤其是这10年的前半期,因为中国对基础设施建设进行了巨额的投入。但当下的10年路径却不相同。综合了一篮子不同商品的彭博商品指数,在这10年中下跌了约45%。美国西得克萨斯中质原油下跌幅度超过27%。唯一的亮点是黄金,在这10年中涨了30%,但主要涨幅来自2010和2011年。实际上目前金价比2011年8月的顶峰时期相比,要低25%。 人人皆知商品贸易就是如此,不同时期总会涨涨跌跌。而2000年开始的10年是涨的时期,而2010年开始的10年则是跌。 利率 过去的10年中,经济学家和预言家们几乎每年都预测说利率要涨,可实际上更多的情形是利率下跌。在这10年的大部分时候,利率都定在一个范围内,看看下表10年期美国国债收益率的表格就知。 |

And these numbers don’t include the massive growth in Facebook shares; it went public in 2012. In what was surely one of the best acquisitions of the decade, Mark Zuckerberg and company bought Instagram for $1 billion that same year. It’s estimated Instagram will do close to $14 billion in revenue alone in 2019. Facebook is now a $575 billion market cap, rising from roughly $80 billion when the company went public. These 5 companies now make up just shy of 17% of the entire S&P 500 index. The tech industry has quickly gone from scrappy upstarts to world-beaters in just a few short decades. Commodities The 2000s were a wonderful decade for commodities, especially in the earlier part of the decade because of massive infrastructure spending by China. The current decade did not follow the same path. The Bloomberg Commodity Index, a basket of different commodities, was down nearly 45% this decade. The price of WTI Crude oil fell more than 27%. The lone bright spot was gold, which was up close to 30% in the 2010s but most of that price increase came in 2010 and 2011. Gold prices are actually still 25% below their peak from August, 2011. Commodities are known for being a sector filled with varying periods of booms and busts. The 2000s were a boom. The 2010s were a bust. Interest Rates It seems like every year throughout the past decade economists and market prognosticators predicted rising rates, but the actual pattern was more down than anything else. In fact, rates have actually been range-bound for most of the decade as you can see from the chart of the benchmark 10 year U.S. treasury yield: |

10年期美国国债收益率,21世纪第二个10年

表格:本·卡尔森 来源:YCharts

|

10年期国债收益率,以略低于4%开局,在2016年7月触及历史低点1.37%。不过收益率在10年的大部分时间中,都固定在1.5%到3.5%之间。自20世纪80年代初,利率就开始下跌,看起来已经跌无可跌了,所以看好利率持续走高也不奇怪,但利率并不配合,目前还在2%以下。 美联储 金融危机的发生,人们多少会责怪于美联储,但最近10年的经济好转也要归功于它。量化宽松政策和数年接近0%的名义利率,让很多人预测,央行这种非正统的做法,会导致恶性通货膨胀、经济二次衰退和股市的萧条。可事实上,我们看到了自二战以来的失业率最大幅度的减少,从顶峰时的10%跌到如今3.5%的低点。 加上在这10年中有三位不同的主席(本·伯南克、珍妮特·耶伦和现在的杰罗姆·鲍威尔),美联储的表现更加夺人眼球。很多人认为,美联储的利率从2008年的0%维持到2015年的12月,等了太长时间才开始提高利率。此后美联储开始一系列的动作大幅提升利率,直到去年底的2%略多。在2019年我们见证了美联储三次削减利率,听起来很多,但从1960年开始,平均每10年中就会出现23次利率削减。 美联储不是完美的,它也不是无所不能的。但美联储引领了经济的恢复,还是值得称道的,它的表现比在面对金融危机时好得多了。 没有人知道,未来的10年将会给投资者带来什么,但有一点是确定无疑的,未来的10年跟过去的10年肯定大不相同。 (财富中文网) 本文作者是注册金融分析师本·卡尔森,他是里萨兹财富管理公司(Ritholtz Wealth Management)机构资产管理部门的主任。 译者:宣峰 |

The 10-year yield began the decade just shy of 4%, and touched an all-time low of 1.37% in July, 2016. But rates essentially remained in a tight range between 1.5% and 3.5% for the majority of the decade. Rates have been falling since the early-1980s and seemingly don’t have much further to fall, so it’s no surprise we see a consistent stream of higher rate calls. But rates have not cooperated, and still sit below 2%. The Federal Reserve After getting taken to task for more or less missing the financial crisis, you have to hand it to the Fed for their role in getting the economy on better footing this decade. Quantitative easing and near-0% nominal rates for a number of years led many to predict hyperinflation, a double-dip recession and more pain in the stock market from these unorthodox central bank actions. Instead, we’ve had the biggest decline in the unemployment rate since World War II, falling from a peak of 10% to the recent low of 3.5%. This is even more impressive based on the fact that we’ve had three different Fed Chairs this decade (Ben Bernanke, Janet Yellen and now Jerome Powell). Many say the Fed waited far too long to raise rates after the Fed Funds Rate was effectively 0% from December 2008 through December 2015. That’s when the Fed embarked on a series of hikes that brought rates up well over 2% by the end of last year. Alas, we’ve now had three rate cuts in 2019 alone, which sounds like a lot until you consider the average decade since 1960 has experienced 23 rate cuts. The Fed is not perfect. Nor are the central bankers omnipotent. But you have to give them credit for navigating the recovery much better than they navigated the onset of the financial crisis. No one knows what the next decade has in store for investors but one thing’s for sure: the next 10 years will look nothing like the last 10 years. Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. |