在股市中寻找入手时机?别苦苦地等待经济衰退了

|

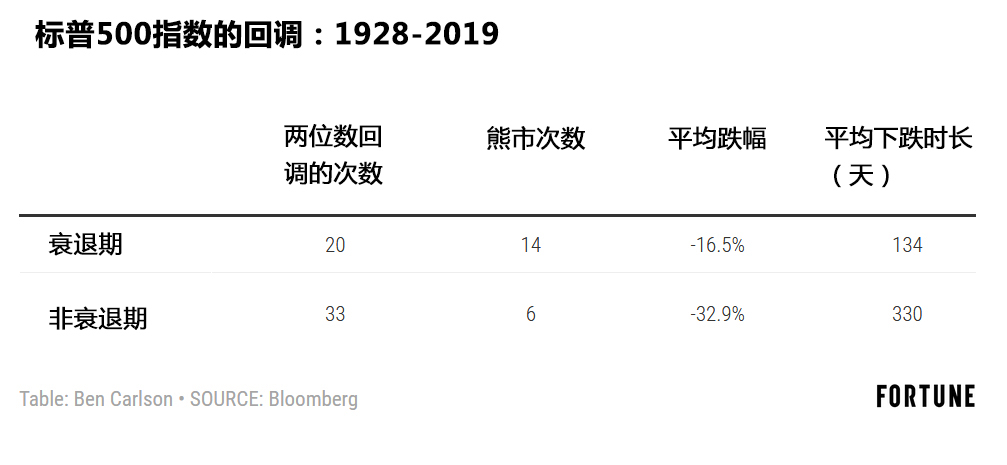

摩根士丹利(Morgan Stanley)的策略师迈克·威尔逊最近向美国全国广播公司财经频道(CNBC)表示,他在期待经济衰退让股市重新归零。威尔逊在《The Halftime Report》节目中说:“我在某种程度上期待经济衰退,因为衰退早晚会来,而衰退在某种程度上可以满足人们的期望。然后我们就会迎来周期性复苏。” 自2009年3月初金融危机触底以来,美国股市尽管出现了不少次回调,但一直持续上涨。据我计算,自2009年以来,标普500指数已经出现了6次两位数的回调,其中2018年第四季度的跌幅最大,达到19%。但V型复苏速度很快,目前还没有再次遭遇崩盘。随着市场持续推高,许多投资者都在观望,等待资本重新配置的机会。 许多投资者认同威尔逊的观点,即经济衰退是许多人一直等待的唯一买入机会。经济衰退是我们经济体系产生的自然结果,所以它们永远不会消失,但你不必为了找到更好的入市时机期待经济衰退。在经济衰退之外,投资者总有各种各样的原因产生过度反应,导致股票价格下降。 如果我们回顾一下1928年以来的标普500指数,会发现总共出现了53次两位数的回调。在过去的91年里,大约每一年半就有一次。在这53次两位数的下调中,有20次跌幅都超过20%,符合熊市的标准定义。也就是说,平均每四年半就会出现一次熊市。 但在这53次两位数的下调中,有33次发生在经济衰退之外。20次熊市中有6次出现在经济衰退之外。也就是说,60%的两位数下跌和30%的熊市都是在没有出现衰退的情况下发生的。 1987年的“黑色星期一”股市崩盘就是最极端的例子。1987年10月,股市单日跌幅超过20%,周跌幅超过30%,许多经济学家担心当时已经处于濒临大萧条的边缘。结果,这只不过是20世纪八九十年代股市长期上行轨迹上的一个小插曲。 之后的五年里,没有经济衰退,标普500指数上涨超过120%,年回报率达到惊人的17%。大多数人都忘记了,尽管那次股市暴跌史无前例,当年的标普500指数收盘仍然上涨了5%左右。 看看在经济衰退中和经济衰退外出现的股市下跌之间有区别也很有意义。 |

Morgan Stanley strategist Mike Wilson told CNBC recently that he’s rooting for a recession to get a reset in the stock market. Wilson told The Halftime Report, “I’m rooting for a recession in some ways because that’s what would get the flush in terms of expectations that still has to happen. And then we can have a cyclical recovery.” Although there have been a number of corrections along the way, the stock market has been in a relentless rise since the bottom of the Great Financial Crisis crash in early-March of 2009. By my count there have been six double-digit corrections in the S&P 500 since 2009, with the largest losses coming in the 4th quarter of 2018 at 19% and change. But the V-shaped recoveries have been swift and we haven’t gotten another crash. That’s left many investors waiting to redeploy capital they’ve been sitting on as the market continues to push ever higher. Many investors share Wilson’s belief that a recession is the only way to get that buying opportunity so many have been waiting for. Recessions are a natural outcome of our economic system so they’re never going away but you don’t have to root for an economic downturn to find better entry points in the stock market. Investors have always found other ways of overreacting outside of a recession to make stocks cheaper. If we look at the S&P 500 going back to 1928, there have been 53 double-digit corrections. That’s roughly one every year-and-a-half or so over the past 91 years. Of those 53 double-digit losses, 20 times stocks have fallen by the standard bear market definition of losses in excess of 20%. So bear markets have happened once every four-and-a-half years, on average. But 33 of those 53 double-digit drawdowns occurred outside of a recession. And 6 out of the 20 bear markets took place outside of an economic downturn. So more than 60% of all double-digit corrections and 30% of all bear markets took place without the onset of a recession. The 1987 Black Monday crash is the most extreme example. After the stock market fell more than 20% on a single day and more than 30% over the course of a week in October 1987, many economists were worried we were on the brink of a depression. It turned out to be nothing but a blip on the long-term upward trajectory of the stock market throughout the 1980s and 1990s. There was no recession and the S&P 500 would go on to gain more than 120% over the ensuing 5 years for an annual return of an astounding 17%. Most people fail to remember that although that crash was unprecedented, the S&P 500 still finished the year up around 5%. It’s also instructive to look at the differences in the drawdowns which take place in the context of a recession and outside of those periods. |

|

很明显,当经济陷入衰退时,股市会更加失控。股市下跌的规模更大,持续时间更长。仅以熊市为标准来进一步细分,也显示出类似的关系。经济衰退之外出现的熊市平均下跌30%,从峰顶到谷底持续的时间为273天。与经济衰退同时发生的熊市平均损失超过40%,持续时间近400天。 对投资者来说,问题在于无论是何种情形,我们事先都不知道股市开始回调时,外部经济会处于哪种情况。从后见之明来看,那些更大的衰退性崩溃往往看起来是绝佳的买入机会,但当你感觉身边的整个经济体系都在崩溃时,当时却未必会有这种感觉。 指望在经济衰退期抓住机会买入股票的另一个问题是,衰退中很多人失业或生意萧条。你需要的不仅是勇气,还有在情况最糟糕的时候可以投资的资本。 没有人知道下一次市场低迷将由什么引起,将于何时会发生。但可以肯定的是,无论经济衰退与否,股市都会在某个时候下跌。(财富中文网) 本文作者是注册金融分析师本·卡尔森(Ben Carlson),他是里萨兹财富管理公司(Ritholtz Wealth Management)机构资产管理部门的主任。 译者:Agatha |

It’s obvious things get more out of control in the stock market when a recession is involved. The stock market losses are larger in both magnitude and length. Breaking things down even further by only bear markets shows a similar relationship. The average bear market outside of a recession has been a loss of 30%, lasting 273 days from peak-to-trough. The average bear market that occurred in concert with a recession was a loss of more than 40%, lasting nearly 400 days. The problem for investors in either scenario is we don’t know in advance which one it’s going to be during the onset of a correction. Those larger recessionary crashes always look like wonderful buying opportunities with the benefit of hindsight but they rarely feel like it at the time when it feels like the entire economic system is crumbling around you. The other problem with banking on a recession for your buying opportunity is many people lose their jobs or see business slow when the economy takes a dive. You need not only intestinal fortitude but also capital available to invest when things are the worst. No one knows what will cause the next market downturn or when it will occur. But you can be sure, recession or not, stocks will fall at some point. Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. |