尽管受中国股市拖累,《财富》2018年选股表面尚好

|

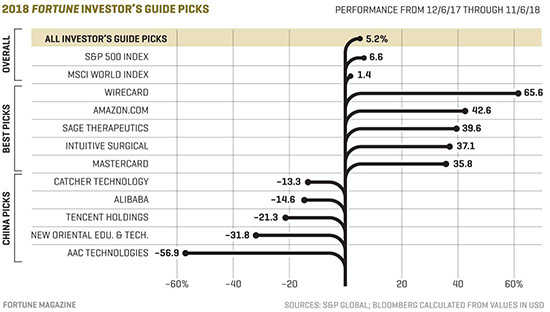

一年前,《财富》杂志投资团队选出了一个“全科技股投资组合”。我们的主题是无论属于哪个行业,已经证明最善于利用科技的公司将为投资者带来最好的业绩。 这一投资组合在市场上表现如何呢?到目前为止情况良好——在过去12个月市场出现异常波动的情况下,我们的全球投资组合(31只股票中有8只不是美股)实现的回报率为5.2%,轻松击败MSCI世界指数,只比标普500指数6.6%的回报率低一点儿。如果剔除其中的5只中国股票,其回报率将高达11.5%,当然我们不会这样做。以下我们将对这个组合的表现进行总结。 |

A year ago, the Fortune investment team picked an “All-Tech Portfolio.” Our thesis was that the companies that proved best at leveraging technology—no matter their industry—would deliver the best results for ¬investors. How did that thesis play out in the markets? So far, so good: During an unusually volatile 12 months, our global portfolio (eight of 31 stocks were non-U.S.) returned 5.2%. That handily beat the MSCI World stock index, and fell just shy of the S&P 500’s 6.6% return. And if you exclude our five Chinese stocks—which, of course, we won’t—we delivered a hefty 11.5% return. Here’s a roundup of what did and didn’t work. |

|

金融科技股呈上升趋势:我们的投资组合中表现最好的是金融股,信用卡巨头万事达和德国支付处理公司Wirecard这一年的表现都很强劲。二者在打造电子商务工具和升级数字金融基础设施方面都是领跑者,投资者也注意到了这一点。 医疗股回归:外界预计Sage Therapeutics的产后抑郁症治疗药物将获得美国食品和药物管理局的批准,推动该公司的股价上升。同时,Intuitive Surgical继续借助机器人在市场上高歌猛进。该公司的达芬奇外科手术机器人有助于缩短术后康复时间并降低成本,受到医院方面热捧。 科技股暴跌:我们没有预见到Facebook会陷入数据隐私漩涡,我们将其纳入投资组合以来,Facebook的股价已下跌15%(但现在我们认为又可以买进它了)。中美贸易战可能怎样干扰科技供应链的担忧影响到了整个芯片制造业,包括我们推荐的两只股票——应用材料和德国公司英飞凌。 说说中国:今年,贸易战担忧加上GDP增速放缓拉低了大多数中国股票(见上图),我们挑选的5只中国股票都至少下跌了13%,其中表现最惨淡的是手机触觉反馈器件制造商瑞声科技。(财富中文网) 本文的另一版本刊登在2018年12月1日出版的《财富》杂志,是报道《2019投资者指南》的一部分。 译者:Charlie 审校:夏林 |

Fintech on the Rise: Our best-performing picks were financial stocks, where credit card giant Mastercard and German payment processor Wirecard had monster years. Both are leaders in building e-commerce tools and upgrading digital financial infrastructures, and investors took notice. Healthy Returns: Anticipation of FDA approval of its postpartum depression drug lifted the shares of Sage Therapeutics. Meanwhile, Intuitive Surgical continued to ride robots to big market gains. Its da Vinci Surgical System can help reduce postoperative recovery times and slash costs, making it catnip for hospital customers. Turmoil in Tech: We didn’t foresee the data-privacy face-plant at Facebook, whose shares are down 15% since we picked them (but which we now see as a buy again). Fears about how a U.S.-China trade war might disrupt the tech supply chain hurt chipmakers in general, including two that we recommended, Applied Materials and Germany’s Infineon. Speaking of China: Those trade fears, along with a slowdown in GDP growth, dragged down most Chinese stocks this year (see the chart in this story), and each of our five China picks lost at least 13%. The hardest-hit: AAC Technologies, which makes “haptics” that create clicking and vibrating sensations in mobile phones. A version of this article appears in the December 1, 2018 issue of Fortune, as part of the “2019 Investor’s Guide.” |