这家公司的成立,标志着比特币向主流货币迈出了重要一步

|

比特币可能马上就要突破限制,成为主流货币了。至少这是一家即将成立的新企业立下的目标,这家公司由华尔街上一家相当有份量的机构创立,还获得了美国多家领军企业的支持。 8月3日上午,拥有纽交所和其它全球交易市场的交易界巨头ICE交易所(ICE)宣布正在组建名为Bakkat的一家新公司。Bakkt预计于11月开业,将为比特币提供一个受到联邦政府管制的市场。ICE希望通过成立Bakkt,将比特币变成可以信赖并广泛使用的全球货币。 为实现这一目标,ICE和科技、咨询、零售业的巨头微软、波士顿咨询集团、星巴克以及堡垒投资集团(Fortress Investment Group)、 Eagle Seven和海纳国际集团( Susquehanna International Group)都达成了合作关系,但ICE未立刻披露各投资伙伴的总投资额。 作为游戏的主要参与者,世界各大金融机构却都对比特币敬而远之。为了让比特币成为健康安全的金融产品,成立Bakkt势在必行。Bakkt希望可以为基金经理扫清道理,让他们将比特币共有基金、养老金、ETF作为受到严格监管的主流投资产品推出市场。 再下一步可能是用比特币取代信用卡。 “Bakkt相当于一个可以拓展的入口,通过提升数字资产的效率、安全性和使用范围,让机构、商户、顾客利用Bakkt参与使用数字资产。”ICE主管数字资产的凯莉·吕弗勒在宣布成立该公司的新闻发布会上说,莱弗勒将出任Bakkt的CEO。“我们在携手打造一个开放平台,力图在全球市场和全球商务中释放数字货币的变革潜力。” 莱弗勒在《财富》杂志专访中说道,ICE在过去14个月里一直在秘密“建立基础设施”,目的是为Bakkt提供发展动力。公司的名字前两个星期才刚刚定下来。莱弗勒解释说,Bakkt是“资产支持债券(asset-backed securities)”里“backed”(意为支持)的同音词,意在获得客户高度信任的投资。 如果Bakkt的蓝图能够如期推进,将会出现大量新比特币基金,市场被压抑的对加密货币的需求将得到释放,比特币将成为一个简单安全的方案供日常投资者选择,尤其是将要拿到首笔401(k)基金的千禧一代。华尔街可以利用比特币的推广普及,将比特币作为股票债券的替代产品,实现巨额交易。机构的大量买入卖出反过来可以抚平比特币价格的疯狂波动,减少人们对于比特币投资的恐惧。 加密货币的波动既催生了个人投机分子,又吓跑了机构资金。2017年秋天,比特币的价格从6400美元涨到20000美元,一飞升天,之后又跌落至7700美元左右。 如果能打入401(k)和工人退休金账户(IRA)市场,Bakkt就打了大胜仗。但这家新公司的雄心抱负甚至不限于此,他们希望可以利用比特币颠覆优化现在的零售支付市场,推动消费者从刷信用卡转为扫描比特币app。市场前景十分广阔:全球消费者每年需要支付高达25万亿美元的信用卡手续费或在线购物手续费。 Bakkt的创始人告诉本刊,赢得机构投资者的战争是两步计划中的第一步。他们对第二步计划略有点含糊其辞。但星巴克和微软的参与释放了强烈的信号,说明Bakkt将力求实现消费者线上线下支付方式的变革。咖啡界巨擘星巴克在鼓励顾客使用手机而非信用卡支付的变革上处于行业领先地位。微软通过其Azure云业务,服务了大量零售商,为它们打理从开发票到电子商务等各种各样的后勤业务。 “星巴克作为旗舰零售商,将发挥重要作用,努力推出实用、可靠、合规的应用,推动消费者将其数字资产转化为美元并在星巴克消费。”星巴克主管合作与支付的副总玛丽亚·史密斯在发布会上说。 成立Bakkt是ICE创始人、主席兼CEO杰夫·斯普雷彻的想法,斯普雷彻是能够颠覆行业的佼佼者。近年来,他引领世界交易所从公开叫价的交易方式转变为电子化交易,在这个现代化的过程中,无人可以和他媲美。一路走来,他以据说1美元的价格购买了一家垂死挣扎的电子交易所,把它发展为价值440亿美元的全球交易和数据帝国。“25年来,他从默默无闻成长为世界上最强大的交易界创业家。”Tabb集团的首席咨询师拉里·塔博说:“他还没失败过。” |

Bitcoin could be on the verge of breaking through as a mainstream currency. At least that’s the goal of a startup that is soon to be launched by one of the most powerful players on Wall Street, with backing from some of America’s leading companies. On the morning of August 3rd, the Intercontinental Exchange—the trading colossus that owns the New York Stock Exchange and other global marketplaces—announced that it is forming a new company called Bakkt. The new venture, which is expected to launch in November, will offer a federally regulated market for Bitcoin. With the creation of Bakkt, ICE aims to transform Bitcoin into a trusted global currency with broad usage. To achieve that vision, ICE is partnering with heavyweights from the worlds of technology, consulting, and retail: Microsoft, Boston Consulting Group, and Starbucks. ICE did not immediately disclose the total investment of the investment partners, a group which also includes Fortress Investment Group, Eagle Seven, and Susquehanna International Group—or the ownership stakes. The founding imperative for Bakkt will be to make Bitcoin a sound and secure offering for key constituents that now mostly shun it—the world’s big financial institutions. The goal is to clear the way for major money managers to offer Bitcoin mutual funds, pension funds, and ETFs, as highly regulated, mainstream investments. The next step after that could be using Bitcoin to replace your credit card. “Bakkt is designed to serve as a scalable on-ramp for institutional, merchant, and consumer participation in digital assets by promoting greater efficiency, security, and utility,” said Kelly Loeffler, ICE’s head of digital assets, who will serve as CEO of Bakkt, in the press release announcing the launch. “We are collaborating to build an open platform that helps unlock the transformative potential of digital assets across global markets and commerce.” In an exclusive interview, Loeffler (pronounced “Leffler”) told Fortune that ICE and its partners have been “building the factory” that will power Bakkt in the strictest secrecy for the past 14 months. The name of the company was only decided in the past two weeks. Loeffler explains that “Bakkt” is a play on “backed,” as in “asset-backed securities,” and it’s meant to evoke a highly-trusted investment. If the Bakkt blueprint works as planned, a panoply of new Bitcoin funds would tap the pent-up demand for the cryptocurrency, making it a safe and easy choice for everyday investors—notably millennials getting their first 401(k)s. Wall Street could then tap Bitcoin’s popularity as an alternative to stocks and bonds to generate giant trading volumes. And that flood of institutional buying and selling, in turn, would take the terror out of Bitcoin by smoothing its wild swings in price. The volatility of the cryptocurrency has both attracted individual speculators and scared off institutional money. In the fall of 2017, the price of Bitcoin spiked from $6,400 to nearly $20,000; it has since fallen back to around $7,700. Cracking the 401(k) and IRA market for cryptocurrency would be a huge win for Bakkt. But the startup’s plans raise the prospect of an even more ambitious goal: Using Bitcoin to streamline and disrupt the world of retail payments by moving consumers from swiping credit cards to scanning their Bitcoin apps. The market opportunity is gigantic: Consumers worldwide are paying lofty credit card or online-shopping fees on $25 trillion a year in annual purchases. Bakkt’s founders tell Fortune that the institutional investor campaign is the first of two phases. They’re a little coy about the second phase. But the presence of Starbucks and Microsoft strongly suggests that Bakkt will strive to revolutionize the way consumers pay at the mall and online. The coffee giant is already a leading player in encouraging customers to pay with the their smartphones rather than their credit cards. And Microsoft, through its Azure cloud business, serves a huge base of retailers, handling back-office tasks from invoice processing to e-commerce. “As the flagship retailer, Starbucks will play a pivotal role in developing practical, trusted, and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks,” said Maria Smith, vice president, Partnerships and Payments for Starbucks, in the press release. Bakkt is the brainchild of Jeff Sprecher, the founder, chairman, and CEO of ICE, and a disrupter par excellence. Sprecher (pronounced “Sprecker”) stands alone as the leading force in modernizing the world’s exchanges in recent years from open-outcry pits into super-efficient electronic marketplaces. Along the way, Sprecher built a flailing electricity exchange that he reportedly purchased for $1 into a global trading and data empire now worth $44 billion. “In 25 years he’s gone from nothing to the most powerful exchange entrepreneur in the world,” says Larry Tabb, chief of consultancy the Tabb Group. “He hasn’t failed yet.” |

|

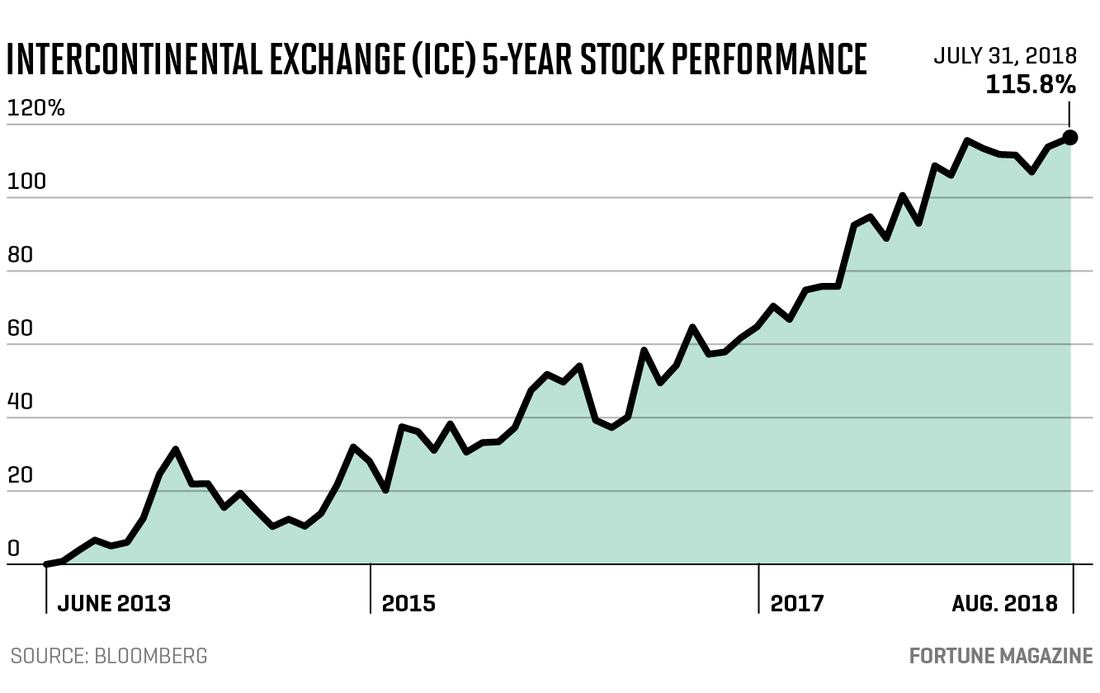

在金融交易所行业,ICE的收入在全球排在第二位,位居芝加哥商业交易所(CME)之后。ICE拥有12家交易所,由6家清算所提供服务。而且,斯普雷彻不仅实现了增长,还实现了赢利,可谓是公司股东的一大幸事。2006年上市后,ICE的年回报率为24.1%。公司去年净利率高达54%,在标普500指数的组成公司中排名第四位。 虽然股票债券交易市场业务极度分散,ICE仍然横跨各个领域,建立了交易帝国。纽交所是目前全世界最大的股票市场,每天交易量为15亿股,几乎占全球股票交易的四分之一。ICE还拥有中型企业股票交易的龙头平台美国证券交易所(NYSE American)和全球最大的ETF交易市场Arca。ICE于2007年收购美国期货交易所后,成为了糖、咖啡、棉花等“软性”农产品期货的全品类期货全球交易领头羊。ICE欧洲期货交易所是国际油价基准布伦特原油的主要全球市场。 现在这位具有远见卓识的帝国缔造者再次开启征程,力图让华尔街的资产经理和普通消费者爱上比特币。 斯普雷彻和他的投资伙伴们把这项独一无二的使命交给了一位新手CEO:凯莉·吕弗勒,她也是斯普雷彻在商业和生活中的灵魂伴侣。早在2002年ICE还没站稳脚跟的时候,凯莉作为公司高管就为斯普雷彻保驾护航。他们在2004年结婚。吕弗勒长期主管ICE的市场营销、投资关系和通讯业务。现在她要放弃在ICE的职务,掌管Bakkt。 过去两个月里,斯普雷彻和吕弗勒夫妇接受了本刊长达数小时的专访。他们着重强调了Bakkt如何能为比特币提供它们正需要的工具,使它们能得到人们的广泛接受。 最近一次和夫妻二人在纽交所豪华的交易室会面时,斯普雷彻特别强调吕弗勒参与了ICE的下步战略规划。“凯莉我们俩谋划了五年,才找到适合数字货币的战略。”斯普雷彻说。 乍一看这一对的搭配有点不寻常:吕弗勒47岁,穿上高跟鞋大概6英尺高,比他63岁的丈夫高出许多。但很快就能看出他们的相似处,他们都热衷于推动需要大量修正才能成功的宏大想法。“我是个工程师,喜欢修修补补。”斯普雷彻说,他周末会花时间修自己的老古董保时捷跑车。“比特币是个典型的坏模型,如果修好了,它可以改变世界。” 吕弗勒补充道:“杰夫我们俩会因为宏大的议题感到激动,而对于大多数人而言,这些问题可能无解。” 如果Bakkt成功,这将是一位(或一群)神秘的程序员在2009年化名中本聪发明了比特币之后动荡不安的币圈迎来的最大发展。 斯普雷彻想把加密货币带给大众的想法和比特币支持者们的通常想法背道而驰。纯粹主义者支持比特币的“分散化”结构,坚决反对把大交易所放在比特币投资或支付体系的中心。“在交易中间设置监护人进行规范交易违悖了比特币的基本理念。”风投公司Draper Associates的加密货币分析员阿布舍克· 普尼亚说。“比特币的设计理念是去中心化,没有中间人收取费用。在规范的交易所进行交易的方式可能会流行一阵子,但无法代表未来。比特币的未来是坚持个人对个人交易的原始理念。” 斯普雷彻和吕弗勒不同意这个观点,他们认为需要的恰恰是一个强大的中心基础架构,ICE及其合作伙伴将提供这个架构。难点在于让银行、资产经理、捐助机构热情接受比特币。“我们交易界对这个问题看法不同。”吕弗勒说。 ICE的主要客户是大机构,斯普雷彻和吕弗勒了解他们对于加密货币的看法。他们之所以认为比特币能够作为主流投资蓬勃发展,因为大基金经理意识到他们现在和将来的投资者中,有几千万人都想拥有比特币,前提是它们能被包装成共有基金或ETF。吕弗勒说:“这些机构觉得比特币就像金店银店一样,充满吸引力。” |

Today ICE is the world’s second largest owner of financial exchanges by revenue behind the CME, and one of the largest purveyors of market data. ICE’s 2017 revenues of $4.6 billion divide pretty evenly between those two main franchises. ICE owns twelve exchanges, served by six clearing houses. And to the delight of shareholders, Sprecher has delivered profitability as much as growth. Since going public in 2006, ICE has delivered annual total returns of 24.1%. The company’s towering 54% margin of net profits ranked fourth in the S&P 500 last year. Even in the heavily-fragmented galaxy of stock and bond trading, ICE has established a Brobdingnagian footprint. The NYSE is by far world’s largest stock market, trading 1.5 billion shares a day—or nearly one-in-four of all equity transactions. ICE also owns NYSE American, the leading platform for mid-cap companies, as well as Arca, the world’s largest marketplace for ETFs. ICE is the world leader in almost all categories of futures for “soft” agricultural commodities such as sugar, coffee, and cotton, chiefly through its 2007 acquisition of the New York Board of Trade. And ICE Futures Europe is the dominant global marketplace for the Brent crude, the global oil price benchmark. Now Sprecher, the visionary who assembled this empire, is crusading to make Wall Street asset managers and Main Street consumers love Bitcoin. Sprecher and his investment partners are putting this one-of-a-kind mission in the hands of a first-time CEO who’s Sprecher’s soulmate in both business and in life: Kelly Loeffler. The ICE executive has ridden shotgun alongside Sprecher since the company’s fledgling days in 2002. In 2004, they married. Loeffler long ran marketing, investor relations, and communications for ICE. Now she’s giving up her ICE roles to run Bakkt. Over the past two months, Sprecher and Loeffler sat for several hours of exclusive interviews with Fortune. Above all, they emphasized how Bakkt, in part by exploiting ICE’s trading infrastructure, could provide precisely the tools Bitcoin needs to achieve broad acceptance. At a recent meeting with the couple in the plush Bond Room at the NYSE, Sprecher stressed that Loeffler has been a collaborator in charting ICE’s next big move. “Kelly and I brainstormed for five years to find a strategy for digital currencies,” says Sprecher. At first glance, the pair present an unusual twosome: At over six-feet in her high heels, Loeffler, 47, stands much taller than her 63-year old husband. But their bond is quickly apparent—a passion for gig ideas that need lots of tinkering to succeed. “I’m an engineer who likes to fix things that are broken,” says Sprecher, who repairs his vintage Porsche racecars on weekends. “And Bitcoin was the epitome of a broken model that if fixed, could change the world.” Adds Loeffler, “Jeff and I get excited about big things that for most people, seem to have no answer.” If they succeed with Bakkt, it could be the biggest development in the churning, hazardous frontier of cryptocurrencies since a mysterious programmer (or programmers) under the pseudonym Satoshi Nakamoto unveiled Bitcoin in 2009. Sprecher’s plan for bringing crypto to the masses runs contrary to what Bitcoin supporters typically champion. The purists favor Bitcoin’s “distributed” architecture, and adamantly oppose putting a big exchange at the center of the both the Bitcoin investment and payments systems. “A regulated exchange with a custodian in the middle contradicts the basic idea of Bitcoin,” says Abhishek Punia, a crypto-currency analyst with venture capital firm Draper Associates. “Bitcoin was designed to be decentralized, without intermediaries taking fees. A regulated exchange may be popular for a short period of time, but it’s not the future. The future will be the original idea of a peer-to-peer network.” Sprecher and Loeffler disagree, arguing that a strong central infrastructure is precisely what’s needed, and that ICE and its partners are the ones to supply it. The challenge is getting the banks, asset managers, and endowments to embrace Bitcoin. “Being from the exchange world, we looked at the problem differently,” says Loeffler. The big institutions are ICE’s main customers, and Sprecher and Loeffler understood their thinking about crypto-currencies. They reckoned that Bitcoin could thrive as a mainstream investment because the big money managers recognize that ten of millions of their current and future investors want to own it––if it can be packaged as mutual funds and ETFs. “The institutions saw that Bitcoin had lots of appeal as a store of value like gold or silver,” says Loeffler. |

|

为了了解数字货币的运作,ICE2015年初在美国最大的数字货币市场Coinbase里购买了少量股权。“Coinbase的顾客数量是嘉信的两倍。”吕弗勒说。“大多数开了账户的用户都是千禧一代,做点加密货币的小投资。” 斯普雷彻补充道:“千禧一代不信任传统金融机构。为了赢得他们的信任,银行、经纪人、资产经理可以使用这代人能够信任的货币,比如说比特币。使用数字货币会让他们觉得兴奋。” 目前,富达投资、先锋集团等资产管理公司鲜少使用加密货币。斯普雷彻认为,原因在于“比特币没有良好的市场结构。”对于顾客而言,用美元兑比特币太贵了,其中一部分原因交易太分散、交易场所过多、每间机构的交易量过低。他指出,有200多家市场针对十几种主要数字货币进行交易,包括瑞波币(Ripple)、莱特币(Litecoin)等。“哪怕是比特币,不同市场的价格也不同。”斯普雷彻说,“如果用美元兑比特币,你最多需要支付6%的价差,这意味着比特币需要涨6%你才能回本。” 目前加密货币主要被部分愿意铤而走险的交易者和一些对冲基金用于投机,这些对冲基金持有全球总价值约3亿美元的数字货币总量的80%。(比特币是目前最大的加密货币,近期总价值约为1340亿美元。)由于投机行为大行其道,流动性又相对较差,比特币诞生后的十年里经历了四个熊市。“结果造成了信任危机。”吕弗勒说。 此外,比特币这种随心所欲的不羁气质和华尔街小心翼翼的后金融危机思维产生了冲突,华尔街想采用一切手段来保护投资者的利益。吕弗勒说:“大机构的人们认为加密货币不那么招人喜欢。” 更不用说华尔街上还有人认为加密货币是“小孩子”玩儿的,认为玩家的动机可以归纳为:“让银行见鬼去吧,咱们自己玩。” 但斯普雷彻和吕弗勒认为,碎片化的市场和不符合常规文化并非金融机构回避比特币的真正原因。他们相信有大批粉丝想要投资比特币或其它数字货币,但没有合适的产品。解决办法:建立新的生态系统,为比特币提供ICE交易所的股票、债券、商品期货等产品拥有的保护措施。这样能在少量的零售顾客和冒进的对冲基金外为更多投资者打开大门。 那么为什么先锋和Blackrocks不采用“做好服务,顾客自会前来”的策略?斯普雷彻和吕弗勒认为原因根深蒂固,但也可以修正。斯普雷彻说:“缺了两个要素:在官方交易所交易,在机构层面为数字货币提供安全储藏。” 斯普雷彻说,简单说,如果大基金经理无法在联邦监管的交易平台上购买代币或者无法将投资人的代币储存在能够确保其绝对安全的平台账户里,他们就不会成立数字货币基金。 如今,比特币、以太币等加密货币的代币在主要期货或债券交易平台上完全无法交易。官方期货交易平台受美国商品期货交易委员会(CFTC)监管,证券平台受美国证券交易委员会(SEC)监管。人们用美元或欧元交易数字货币的场所被称为“交易所”,但哪怕是其中像Coinbase和Gemini等规模最大的场所也只是在各州法律框架下获得执照的交易市场而已。 这些平台采用的监管机制分为三种:第一,Coinbase和许多其它交易市场在相应的州获得了“汇款机构”执照;第二,卡梅伦和泰勒·文克莱沃斯成立的Gemini在家乡纽约州获得了信托公司执照,它也因此可以在其它多个州运营;第三种是“互换交易执行基础设施(SEF)”,一会再细讲。 |

To study how digital currencies work, ICE in early 2015 took a minority stake in the largest U.S.-based marketplace for digital currencies, Coinbase. “Coinbase has twice as many customers as Charles Schwab,” says Loeffler. “Many of the people who have opened accounts on Coinbase are millennials who use it to make small investments in crypto-currencies.” Adds Sprecher: “Millennials don’t trust traditional financial institutions. To gain their trust, banks, brokerages, and asset managers can use a currency that millennials believe in, like Bitcoin. Using digital currencies brings a lot of sizzle.” So far, cryptocurrencies have gained little traction with asset managers like Fidelity and Vanguard. The reason, says Sprecher, is that “Bitcoin does not have a good market structure.” For consumers, it’s expensive to exchange dollars for Bitcoin, in part because trading is spread thinly across too many venues that individually do too little trading. He notes that more than 200 marketplaces trade over a dozen major digital currencies, from ether to Ripple to Litecoin. “Even for Bitcoin, different markets are posting lots of different prices,” says Sprecher. “And you can pay an up to 6% spread to exchange dollars for Bitcoin, meaning Bitcoin needs to rise by as much 6% before you break even.” Cryptocurrencies today serve primarily as a vehicle for speculation by daredevil traders, and by the hedge funds that own 80% of the roughly $300 billion in digital currencies worldwide. (Bitcoin is by far the biggest cryptocurrency for now, with a recent total value of around $134 billion.) The combination of rampant betting and relatively arid liquidity sent Bitcoin careening through four bear markets in the decade since its creation. “The result is a crisis of confidence,” says Loeffler. In addition, the freewheeling Bitcoin ethos clashes with the ultra-cautious, post-financial crisis mindset on Wall Street that emphasizes safeguarding the investor at all costs. “People at the big institutions have the view that cryptocurrencies can be unsavory actors procured by elicit means,” says Loeffler. Not to mention that some on Wall Street still view cryptocurrencies as being run by “kids” whose motivation can be summarized as, “Let’s screw the banks and do it all ourselves.” But Sprecher and Loeffler concluded that fragmented marketplaces and alien culture weren’t the real reasons the institutions avoided Bitcoin. In their view, a broad universe of fans wanted to invest in Bitcoin or other digital tokens, but couldn’t find the right products. The solution: A new ecosystem that provided Bitcoin the same protections afforded the stocks, bonds, and commodities futures traded on ICE’s exchanges. That would open an investor universe far beyond a relatively small group of retail customers and adventurous hedge funds. So why aren’t the Vanguards and Blackrocks taking a “serve them and they shall come” approach? For Sprecher and Loeffler, the reason is fundamental—and fixable. “Two things are missing,” says Sprecher. “Trading on an official exchange, and safe storage for digital currencies on an institutional scale.” Put simply, Sprecher says, the big money managers won’t create digital currency funds unless they can first buy the tokens on a federally regulated exchange, and, second, store the tokens for their investors in accounts rendered super-secure by the safeguards provided by those exchanges. Today, the tokens for cryptocurrencies such as Bitcoin and Ether aren’t traded at all on the major futures or securities exchanges. Official exchanges are overseen by the Commodities Futures Trading Commission (CFTC) for futures, and the Securities and Exchange Commission (SEC) for securities. The venues where folks exchange dollars or Euros for digital currencies—including the biggest ones such as Coinbase and Gemini—are often called “exchanges,” but they’re actually marketplaces that are licensed under state laws. These platforms fall under three main regulatory regimes: First, Coinbase and many other marketplaces are licensed in the individual states as “money transmitters.” Second, Gemini, the platform founded by Cameron and Tyler Winklevoss, is licensed in its home state of New York as trust company, and that designation is its passport to operate in a number of other states. The third category are markets called SEFs; more on them in a bit. |

|

这些交易平台不受两个联邦监管机构证SEC或CFTC监管的原因,与两个机构如何对加密货币进行分类有关。负责监管股票、债券和其他证券的SEC表示,比特币和以太币这两种最大的加密货币不是证券。SEC对其他加密货币持观望态度。目前,任何一家交易市场均未获得SEC的许可,均无法作为受监管的证券市场进行数字代币交易。 虽然比特币不被认定为证券,但被认为是商品。CFTC的职责是监管商品期货和这些期货的期权,涵盖范围极广,包括从原油到大豆到黄金等各种商品的合约。由于比特币的商品属性,比特币期货只能在受到CFTC监管的期货交易所交易,这些交易所被称为指定的合约市场。(与其他货币交易市场类似,在“现货”基础上简单地将美元或欧元兑换成比特币的场所不需要由 CFTC 监管。) 今天,芝加哥董事会期权交易所和芝加哥商业交易所都可以交易比特币期货合约。合约的结算并非真的使用比特币。交易双方根据比特币价格的变动以现金结算。所以实际上,人们只是用这种合约对加密货币的未来价格走势下注。 比特币被认定为商品,给ICE带来了大量机遇:它现在经营着全球最大的两家商品期货交易所——ICE美国期货交易所和ICE欧洲期货交易所。对于斯普雷彻和吕弗勒而言,这些交易所能够提供比特币交易需要的保护措施,从而实现像吕弗勒所说的 “让机构交易的引擎运转起来”。 重要的是要明白SEC或CFTC监管的大型交易所可以提供三种受到严格监督的服务: 交易、清算和安全储存(证券托管或期货仓库) 。交易所在交易中要确保基金经理点击的价格是他们为股票或期货合约支付的费用。交易所也针对清算和托管或交割仓储制定了严格的规则。这些规则必须通过SEC或CFTC的批准,并受其监管。 联邦监管的交易所要求清算服务能够有效消除买卖双方的信贷风险。清算所保证卖方能按照期货合约的规定交付糖、咖啡或黄金,买方能够全额付款。如果不能执行,则由交易所的会员贸易公司和交易所所有者(这个例子中为ICE)共同出资创办的清算所将兑付商品或现金。安全仓储分成两种情况: 股票和债券的托管以及期货的仓储。纽交所等受到SEC监管的交易所要求由共同基金或养老基金将股票或债券保存在道富银行、纽约梅隆银行等独立托管机构的超级安全账户里。 关于期货,ICE和其它受CFTC监管的交易所规定,在合同到期应当交付货物时,缔约一方要购买的咖啡、黄金或白银应储存在注册仓库或其他储存设施中。实际上,无论买方是像先锋这样的财务管理公司还是嘉吉这样的用户,都可以在仓库里实现金条或棉花的接取。如果无法实现交付或者卖方不付款,同样由清算所弥补损失。 Bakkt将为比特币交易提供首个一体化方案,方案中既包括一家受联邦政府监管的大型交易所,又包括该交易所监管的清算和存储机构。ICE拥有六家清算所,它们与美国ICE期货交易所和ICE旗下的其它交易所垂直整合。通过利用由CFTC监管的加密货币期货交易所,Bakkt能够提供按照基金经理的要求提供双重安全保障。第一层保障是通过ICE期货交易所的正规经纪人购买证券或商品(此处为购买数字代币)。 交易所规定储户需要提交护照及公司成立文件,同时说明购买资产的资金来源。他们还关注追踪非法活动的模式。比如,如果一个投资者在同一个柜台上屡次因为石油交易产生亏损,这些交易可能就含有风险,因为“输家”可能是通过从买主那里获取回扣进行洗钱。 只有由受监管交易所全面审查的经纪人和期货经纪商(FCMs)才允许作为ICE美国期货交易所的会员在所里进行交易。在SEC和CFTC监管的交易所,得到交易所许可的会员们可以与对方交易,他们代表的是基金经理,反过来也对基金经理进行充分审查。因此,如果可以向比特币的投资者提供同样的保护措施,他们就能放心确认他们要买的比特币不是通过黑入别人账户偷来的。 第二个关键点是为数字货币提供受到监管的存储设施。吕弗勒表示: “是否拥有一个合格的仓库是机构投资者选择进场或离场的重要原因。” Bakkt的做法是配备超级安全的相当于密码箱一样的仓库,类似于为投资者存放金条的地下室。期货交易所的仓库主要提供两项服务,一是确保资产不会被盗。在比特币的例子里,这意味着要通过多层级网络安全手段保护数字密码箱中的货币。二是交易所制订政策和程序,确保可以核实投资者的身份,保证他们储存在仓库里等待交付的黄金或石油不是非法所得。 Bakkt计划在得到委员会和其他监管机构批准后,制订完整方案,将受到CFTC监管的大型交易所、清算所和托管机构都纳入方案中。Bakkt将依托美国ICE期货交易所提供一个新的比特币交易平台。它还将提供全面的仓储服务,这是ICE目前没有开展的业务。吕弗勒说:“Bakkt的收入来源有两个,美国ICE期货交易所的交易费和购买比特币的用户将比特币存储在Bakkt所支付的仓储费。” Bakkt将提供迄今为止最大的比特币交易市场。但它不会是第一个或唯一一个 CFTC监管的比特币交易平台。多德-弗兰克法案创造了被称为掉期执行设施或SEFs的交易市场,此类市场由CFTC监管。(这是我们前面提到的第三类市场。)例如,LedgerX 拥有一个使用互换合同将法定货币与“Next Day Bitcoin”进行交易的SEF;它还提供了由 CFTC监管的托管服务。(Gemini和Coinbase也提供托管服务。)SEFs的规模远不及诸如美国ICE期货交易所等大型交易所,机构客户的基础也小得多,但它们是日后的潜在竞争对手。 如果Bakkt获得批准,它将按照如下模式交易比特币代币。它将使用所谓的 “一天期货”方式交易比特币,这类合约结算的时间和在当前现金市场上交易一样多,也就是一天。经纪人可以在交易日内任何时候代表基金经理客户点击标价价格。闭市时,ICE清算所已经安排好将买方的现金转入卖方的银行账户,同时比特币代币将被运往Bakkt数字仓库。 无论是管理比特币共同基金的机构还是用比特币进行跨境付款的公司,都可以将比特币委托给Bakkt。那这些客户如何使用他们的比特币支付?利用“私钥” 。私钥类似于数字签名,是由数字和字母随机生成的字符串。大多数比特币所有者将其密钥存储在个人电脑或服务器上,或者存放在不受管制的交易市场账户中。这些设备很容易受到黑客攻击,如果黑客窃取了密钥,被盗的比特币就归黑客了。Autonomous Research的数据表明,网络窃贼2011年来已经窃取了价值超过16亿美元的加密货币。 Bakkt计划通过把私钥“脱机”存储在受到严格保护的数字仓库中解决这个问题。基金经理或公司想从仓库中取出比特币时,Bakkt会确认客户身份并使用私钥释放比特币。仓库还将设置第二把钥匙“公钥”,用于打开收件人的账户接收比特币。双钥匙的安全机制类似于银行代表和客户同时使用钥匙才能打开保险柜。 全程在仓库里实施的交易怎么操作?Bakkt 将连接到美国ICE期货交易所,这样客户就可以无缝进行比特币与美元或欧元的交易。然后比特币就自然而然地从卖方在ICE仓库中的密码箱转移到买方的密码箱,好像一辆叉车把金条从一个储藏柜转移到另一个储藏柜。 为了使比特币成为主流,Bakkt必须克服加密货币的主要缺点:速度极慢。比特币运行在一个称为区块链的系统上,在一个由数以百万计的个人成员组成的网络上进行操作,人们在网络上竞相进行打包和交易验证。事实上,每当网络中有比特币所有者使用数字钱包购物时,这笔交易就会被 “广播” 到网络中的所有“节点”也就是计算机上。每一个节点争相证明交易的合法性,因为赢家将获得免费比特币作为奖励。问题在于无论你是花1.50美元买杯咖啡还是6万美元买辆SUV,所有的交易都必须一笔一笔地广播到所有节点。 因此现有系统每秒只能进行大约七笔交易。这个相较于斯普雷彻和吕弗勒设想中的机构规模,太慢了。 然而,Bakkt将转换比特币的体系结构以实现高速运行。想象一下有几十只共同基金、养老基金和捐赠基金在Bakkt仓库均持有比特币。如果资产经理A从资产经理B购买了2亿美元的比特币,那么比特币代币只需通过ICE交易所从B在Bakkt的账户移动到A在Bakkt的账户即可。储存在Bakkt的比特币总数没有改变。假设每天都有数以百万计的交易发生在Bakkt生态系统中,Bakkt只需简单记录比特币借方和贷方冲抵的分类账,不需要将每笔购买和销售广播到区块链中。只有进入或离开Bakkt仓库的交易才需要广播。 |

The reason why these trading platforms aren’t governed by either of the two federal watchdogs—the SEC or the CFTC—relates to how the two bodies classify cryptocurrencies. The SEC, which oversees stocks, bonds, and other securities, has said that the two biggest cryptocurrencies, Bitcoin and Ether, are not securities. The SEC is taking a wait-and-see approach to the others. So far, none of the current marketplaces have secured the SEC imprimatur as regulated securities exchanges for digital tokens. While Bitcoin isn’t considered a security, it is deemed to be a commodity. It’s the job of the CFTC to regulate commodity futures and options on those futures—a vast portfolio comprising contracts for everything from crude oil to soybeans to gold. As it is a commodity, Bitcoin futures could only trade on a CFTC-regulated futures exchange, called a Designated Contract Market. (Similar to other currency trading marketplaces, a venue that simply exchanges dollars or Euros for Bitcoin on a “spot” basis do not need to be regulated by the CFTC.) Today, the Chicago Board Options Exchange and Chicago Mercantile Exchange both trade futures contracts on Bitcoin. The contracts aren’t settled by delivering the actual coins. They’re settled in cash based on the movement of the price of Bitcoin. So in effect, they’re a vehicle for betting on the future price of the cryptocurrency. Bitcoin’s designation as a commodity opens a rich opportunity for ICE: It now operates the two of the largest commodities futures exchanges on the planet—ICE Futures U.S., and ICE Futures Europe. For Sprecher and Loeffler, these venues provide exactly the type of protections needed to, as Loeffler puts it, “get the institutional engine running.” It’s important to understand that the major exchanges regulated by the SEC or CFTC provide a broad package of three heavily-regulated services: trading, clearing, and either safe storage in the form of custody (for securities), or “warehouses” (for futures). On trades, the exchange ensures that the posted price the money manager clicks on is what they pay for a stock or futures contract. But the exchanges also set exacting rules for clearing and custody or warehousing. And those rules must be approved, and are overseen, by the SEC or CFTC The federally-regulated exchanges require clearing services that effectively remove credit risk for both the buyer and seller. The clearing house guarantees that the seller will deliver the sugar, coffee, or gold as agreed under a futures contract, and that the buyer will make the full payment. If either fails to perform, it’s the clearing house––which is jointly funded by the trading firms that are members of the exchange and its owner, in this case ICE––that makes good on the delivery or the cash. As for safe storage, it comes in two flavors: custody for stocks and bonds, and warehousing for futures. SEC-regulated exchanges like the NYSE require that a mutual fund or pension fund hold their stock or bond certificates in super-safe accounts at such independent custody houses as State Street or BNY Mellon. For futures, ICE and the other CFTC-regulated exchanges mandate that the coffee, gold, or silver that a party has agreed to purchase be stored in a licensed warehouse or other storage facility when the contract expires and the commodity is due for delivery. In effect, the buyer, whether a money manager like Vanguard or a user such as Cargill, can “pick up” the gold bars or bales of cotton at the warehouse. If the items aren’t there for pickup, or if the seller doesn’t pay, once again, it’s the clearing house that covers the losses. Bakkt would provide the first fully-integrated package combining a major federally-regulated exchange, as well as with the clearing and storage overseen by the exchange. ICE owns six clearing houses that are vertically-integrated with ICE Futures U.S. and its other exchanges. By utilizing a CFTC regulated futures exchange for cryptocurrencies, Bakkt would provide two main layers of security that money managers regard as absolutely essential. The first is purchasing a security or commodity—in this case a digital token—through a regulated broker-dealer that’s a member of the ICE futures exchange. The exchanges stipulate that depositors submit passports and articles of incorporation, and identify the source of funds used to purchase the assets. They also search for patterns of illegal activity. If one investor is, say, repeatedly losing money on oil trades to the same counter-party, those trades would raise a red flag, because the “loser” could be laundering money and getting kickbacks from the buyer. Only broker-dealers and futures commission merchants (FCMs) that are fully vetted by the regulated exchanges are allowed to trade on those venues as “members” of the ICE Futures U.S. On SEC and CFTC regulated exchanges, the exchange-approved members are trading with one another, on behalf of money managers that they, in turn, have fully vetted. Granted the same protections, investors could be absolutely sure they’re not buying Bitcoin from warlords who hacked a hedge fund to pilfer the tokens. The second essential is furnishing regulated storage for digital currencies. “A qualified warehouse is the difference between institutional investors’ getting in or staying out,” says Loeffler. Bakkt’s approach is furnishing what amounts to super-safe lockboxes resembling the vaults that hold gold bars for investors. The warehouses serving futures exchanges provide two main services. First, they ensure that assets can’t be stolen. In Bitcoin’s case, that would mean safeguarding the tokens in digital lock-boxes protected by multiple layers of cyber-security. Second, the policies and procedures followed by the exchanges verify the identities of the investors whose assets are held in the warehouses, guaranteeing that that the gold or oil stored for delivery wasn’t obtained illegally. Bakkt plans to offer a full package combining a major CFTC-regulated exchange with CFTC-regulated clearing and custody, pending the approval from the commission and other regulators. Bakkt will provide access to a new Bitcoin trading platform on the ICE Futures U.S. exchange. And it will also offer full warehousing services, a business that ICE doesn’t have. “Bakkt’s revenue will come from two sources,” says Loeffler, “the trading fees on the ICE Futures U.S. exchange, and warehouse fees paid by the customers that buy Bitcoin and store with Bakkt.” Bakkt will provide the biggest marketplace to date. But it won’t be the first or only CFTC-regulated platform trading Bitcoin tokens. The Dodd-Frank legislation created marketplaces called Swap Execution Facilities, or SEFs, that are overseen by the CFTC. (This is the third category of markets we mentioned earlier.) LedgerX, for example, owns a SEF that uses swap contracts to trade fiat currencies for Bitcoin called “Next Day Bitcoin”; it also provides custody services regulated by the CFTC. (Gemini and Coinbase also provide custody services.) The SEFs are far less established, and have far smaller base of institutional customers than the big exchanges such as ICE Futures U.S., but they are potential competitors in the years ahead. Here’s how Bakkt’s exchange for trading Bitcoin tokens, if approved, would operate. It would trade Bitcoin using what are known as “one-day futures,” contracts that would take the same amount of time to settle as trades in the current cash market, meaning in a single day. The broker-dealer would click on a posted price at anytime during the trading day on behalf of a money manager client. By the market close, the ICE clearing house would have arranged to route the cash from the buyer’s to the seller’s bank account, and the Bitcoin tokens would be en route the to the Bakkt digital warehouse. The clients entrusting their Bitcoin to Bakkt could be either institutions managing Bitcoin mutual funds, or companies making cross-border payments in Bitcoin. So how do those clients spend their Bitcoin? Control of “private keys” allow Bitcoin to be spent. Those keys are a randomly generated string of numbers and letters that resemble digital signatures. Most Bitcoin owners store their keys on PCs or servers, or in accounts at unregulated marketplaces. But private keys on those devices are vulnerable to hacking, and if the hacker steals the key, the hacker keeps the pilfered Bitcoin. Cyber-thieves have stolen more than $1.6 billion in cryptocurrencies by hacking investors’ accounts since 2011, according to Autonomous Research. Bakkt would solve that problem by storing the private keys “offline” in its heavily-guarded digital warehouse. When a fund manager or company wants take Bitcoin out of the warehouse, Bakkt would confirm the client’s identity and release the Bitcoin using the private key. The warehouse will also hold a second key, called the public key, that opens the recipient’s account to receive Bitcoin. The double-key security resembles how it takes a bank rep and the customer, both with their own keys, to open a safety deposit box. How about trades that occur all inside the warehouse? Bakkt would be connected to the ICE Futures U.S. exchange, so that customers could seamlessly trade Bitcoin for dollars or Euros. Then, the Bitcoin would simply shift from the seller’s lockbox in the ICE warehouse to the buyer’s lockbox, as if a forklift were transferring gold bars from one storage locker to another. To make Bitcoin mainstream, Bakkt must overcome the cryptocurrency’s chief drawback: its extremely slow speed. Bitcoin runs on a system known as blockchain, operated by a network of millions of individual members who compete to package and verify transactions. Essentially, every time a Bitcoin owner on the network buys anything using his or her digital wallet, the transaction is “broadcast” to all the “nodes,” or computers in the network. The nodes battle to prove the transactions are legitimate, and the winner is rewarded with free Bitcoin. The rub is that since all transactions—from purchasing a $1.50 cup of coffee to a $60,000 SUV—must be individually broadcast to all the nodes. As a result, the existing system can manage only around seven transactions per second. That’s much too slow to ever work on the institutional scale that Sprecher and Loeffler envision. Bakkt, however, would transform Bitcoin’s architecture to run at high speed. Imagine that dozens of mutual funds, pension funds, and endowments hold Bitcoin in the Bakkt warehouse. If Asset Manager A buys $200 million in Bitcoin from Asset Manager B, the Bitcoin tokens simply move from B’s account at Bakkt to A’s account at Bakkt, via a trade on the ICE exchange. The total number of Bitcoins held at Bakkt doesn’t change. Let’s assume that millions of those transactions happen every day, all inside the Bakkt ecosystem. Bakkt simply keeps a ledger of those offsetting Bitcoin debit and credits. The individual purchases and sales don’t need to be broadcast to the blockchain. What does need to be broadcast are any payments coming into or exiting Bakkt’s warehouse. |

|

因此,只要Bakkt能够占有市场的大部分份额,它需要向区块链报告的就只有一小部分交易,就能保证系统的高速运行。 吕弗勒解释说:“我们的系统将运行在区块链上方,除了区块链,我们还会保留自己的账目。”这种设计不是首创。它类似于一种被称为“闪电网络”的技术,这种技术已经在使用。在闪电网络中,同样的两个参与者,比如家电制造商和零部件供应商间发生了多起比特币交易。只要当事双方使用固定数量的比特币在二者之间购买、销售并存储,交易就不会被报告给区块链,只在同一生态系统中来回进行。 一旦华尔街的引擎转了起来,比特币就能获得流动性,成为真正的货币。斯普雷彻和吕弗勒预测,届时跨国公司将接受使用比特币进行国际支付。斯普雷彻说:“国际支付由银行控制,这个体系的收费非常昂贵。” 例如,美国汽车零部件制造商从日本购买零部件时,它需要支付高额费用,将美元兑换成日元。这笔交易至少需要中间经纪商促成,还涉及买方和卖方的银行。可能需要两天时间卖方才能收到日元,转账过程中美国制造商还要支付利息。相比之下,如果双方使用比特币付款,就可以绕过经纪商和银行,通过ICE交易所直接从买方在Bakkt的保险库进入到卖方在Bakkt的保险库,从而节约大笔开支。 “比特币将大大简化全球货币的流动,”斯普雷彻说。“它有可能成为首个世界货币。” 斯普雷彻已经一次又一次地展现了自己用技术改造全球工业的愿景。ICE涉足数据领域足以证明斯普雷彻的敏锐。在2015年年末以52亿美元收购 IDC之前, ICE在数据服务领域只是中等体量,而IDC是为机构投资者提供债券定价的龙头企业。 斯普雷彻的时机掌握得刚刚好:两年内,数据业务迅速增长,已经跻身ICE收入最高的业务行列。数据业务主要有两个渠道——交易定价和分析。ICE提供不同类型的交易定价服务并收取费用,既包括向经纪公司和电视网络提供 “证券买卖记录带(tape)”等常规产品,也包括向高频交易者提供交易兴旺市场的数据。ICE的大部分数据通过一个叫ICE全球网络的光纤和无线网格专有安全系统运行,该系统是纽交所在9/11 袭击后建立的超级安全型骨干网络。可以说,世界各地的主要基金经理都接入了该网络。 斯普雷彻做出了正确预测,基金经理需要越来越多的数据来创建目标明确的共同基金和ETF。ICE提供的是指标性数据,可以在决定应当追加还是出手股票用作参考,例如日本小市值指数基金。ICE不管理资金。但除了向基金经理出售数据外,它还购买了前美国银行的指数集,并授权给投资经理。ICE的美银美林基金现在拥有1万亿美元的资产。 斯普雷彻的目标是颠覆成本高昂的老式债券交易行业,目前行业里大多数业务仍然通过电话进行。斯普雷彻收购 IDC时,公司每天对固定收益产品进行一次定价。现在ICE每天联系不断地追溯270万债券和非流动性股票的实时报价。他希望通过让僵化的债券领域彻底电子化来实现行业现代化,这是其中一步。为了推进这个项目,ICE今年花了11亿美元收购了两个固定收益数字平台——行业领导者Virtu BondPoint和最大的市政债券电子交易网站TMC。 斯普雷彻既是工程师又是冒险家。他在威斯康星州的麦迪逊长大,父亲是一名兼职卖保险的财务规划师。他的妹妹吉尔·斯普雷彻说:“听妈妈说,他六岁的时候就把一个吐司机拆散又重新装回去。”吉尔和二妹凯伦制作独立电影,成绩斐然。“十六岁时,他在车库里重新组装了一台丰田,还用这台车换了一辆科迈罗。” 斯普雷彻其实渴望成为职业赛车手,他还上了威斯康星州著名的美国之路(Road America)驾校。“马里奥·安德雷蒂说,最好的司机不是最勇敢的,而是最聪明的。”斯普雷彻说。“他错了。我聪明但担心生命安全。面对紧张情况时,我的脚会离开油门去踩刹车。” 现在他更沉迷于车辆的本质和细节,而不是赛车冒险。他躺在修车躺板上,拿着扳手,修理他的宝贝保时捷的排气系统和摇杆面板。他收藏了十几台曾经在勒芒参加赛车比赛的保时捷,这些已经几十岁的老爷车是他的传家宝,他有时会借出去参加古董赛车。 20世纪90年代末,在斯普雷彻的加利福尼亚发电厂建成十几年后,他想在现货市场上出售过剩电力。那时几乎所有的电力交易都通过电话进行。斯普雷彻希望能让多家机构通过电子交易市场同时出价竞买他们公司的电力。他只能找到一个这样的交易市场,这是亚特兰大一家电力公司旗下的平台,虽然该平台已经签下了63家公用事业公司,但业务量极小,每月损失100万美元。1997年, 斯普雷彻用著名的1美元买下了这个平台。(也可能是1000美元; 他说他想不起来了。) 交易所刚起步的前三年,日子不好过。“我们在eBay上出售旧的路由设备来筹上几千美元。”ICE主管技术的副主席查克·怀斯说。 如果不是2001年的曼哈顿之行扭转了斯普雷彻的运势,他就要把房子抵给银行了。当时,安然正在开拓能源交易,但在每笔交易中它都是买方或卖方。只有斯普雷彻能提供一个大型交易市场让公共事业机构间可以直接进行交易。高盛和摩根士丹利在这次曼哈顿之行中告诉斯普雷彻,他们不想再让安然一家独大,因此借给他的交易所1500万美元, 拯救了这家企业和斯普雷彻危在旦夕的住房。之后,斯普雷彻用了一个让人震惊的策略,他把90%的股权基本上免费交给了13家银行、能源公司和公用事业单位,换取他们承诺在他的交易市场上进行保证数量的交易。2001年11月,安然倒闭了。第二个月,斯普雷彻的交易所的交易量飙升了180%。 与此同时,成长在伊利诺伊州农场上的凯莉·吕弗勒在芝加哥短暂地做了一段时间的零售分析师,为得州的一家私募基金进行交易。吕弗勒的新工作干了大概一年,她的老板、现任海军部长理查德·斯宾塞宣布他要跳槽去亚特兰大一家生意惨淡的电力交易所。吕弗勒研究了天然气市场,认为推广电子交易的时机已经成熟。所以她告诉斯宾塞想和他一起去。吕弗勒说:“我看到传统天然气交易像栋老房子一样着火了,我想冲进去灭火。”她在2002年加入ICE,当时它的员工还不到100人。 大约就在同期,斯普雷彻在伦敦买下了国际石油交易所,这同样是一间老式的公开喊价式交易市场,所里挤满了大声喊出指令的交易员。像往常一样,交易员不认可斯普雷彻想要电子化的举措,所以斯普雷彻让交易所下午关门,这样客户就别无选择,这半天只能在他们的终端上交易。因此所有的活动都挪到了晚上。到了 2005年,IPE,即今天的欧洲ICE期货交易所实现了完全电子化。两年后ICE 收购了正在苦苦挣扎的纽约贸易委员会,开始了另外一次痛苦但利润丰厚的变革,推动实现了电脑化。 2008年年末,斯普雷彻发现全球各大银行都没有出售价值万亿美元的信贷违约互换(CDS)的工具, CDS可以偿还他们在金融危机中遭受的部分衍生产品损失。斯普雷彻为CDS建立了一家特别清算所,到2010年拍卖了价值50万亿美元的CDS,帮助解决了金融体系的一大难题。 然后,在 2013年,斯普雷彻完成了他迄今最大也最出名的收购,他以97.5亿美元收购了纽约泛欧证交所。关于纽交所,我们一会再详谈。2015年ICE又收购了IDC,因此成为市场数据行业的主要参与者。ICE为什么一直在做这些大交易?斯普雷彻说: “我们就像一个不断增加热门节目的网络。” 斯普雷彻乐于告诉任何愿意听他说的人,他有办法解决他们的问题——而且不仅仅是生意上的问题。吉尔·斯普雷彻说:“他确实是一个无所不知的人。”吕弗勒回忆道,她在亚特兰大交响乐团董事会任职,一次和乐团指挥罗伯特·斯帕诺吃饭时,斯普雷彻开始教这位大师推广交响乐需要做什么。吕弗勒说,斯普雷彻一直在说:“你们需要走出大楼,走出壳子。你们需要在购物中心做快闪吸引年轻人!”“我觉得很尴尬,但杰夫就是这样的。”吕弗勒说,“没人能阻止他。” 两种明显的倾向决定了他的管理风格:凭着本能采用即兴的方式聘用关键人物,能够将创业精神和稳定的表现完美结合并因此吸引了大众股东。“我从来没有后悔凭本能雇用的任何人。”他说,“如果我是被他们的简历说服的,才可能会后悔。” 下面这个故事非常斯普雷彻。斯普雷彻说,多年前在亚特兰大公寓协会的一次乱糟糟的理事会上,与会人员因为一对夫妇爆发了一场争吵,因为他们的两条狗经常在电梯里大便,主人却不清理。 “然后有个家伙站起来,自愿要求做别人不想做的事。”斯普雷彻说,“他说:‘我来处理这个问题。’我对他的毫不犹豫印象深刻。”斯普雷彻当时正在找一个能够百求百应的经理来管理交易所的咨询台,那已经被客户投诉淹没了。所以他雇了那个解决狗狗便溺问题的人——马克·瓦瑟苏格,他现在是ICE的首席运营官。 斯普雷彻相信自己的直觉在6月提拔史黛西·坎宁安为纽交所总裁,这是纽交所226年历史中第一位女掌门。坎宁安的简历不是最华丽的。她在纽交所担任过八年专业经纪人,然后离职去攻读烹饪学位。在纳斯达克短暂任职后,又回到了纽交所,升任销售管理主管。后来斯普雷彻选了她来理顺一个历史遗留的小业务,这个业务是为上市公司提供公司治理建议。 “那块业务简直是场噩梦。”他说。“员工们总给举报人热线打电话,但又没什么要举报的。史黛西真的做到了,把它理顺了,我们因此能把它卖掉。”斯普雷彻一点也不怀疑坎宁安可以出色地经营公司最重要的业务。 |

Hence, so long as Bakkt controls a big share of the market, it would need to report only a tiny sliver of transactions to the blockchain, enabling its system to operate at warp speed. “Our system would operate on a layer above the blockchain, and we’d keep our own omnibus ledger apart from the blockchain,” explains Loeffler. The Bakkt design isn’t revolutionary. It closely resembles a technology called “the lightning network” that’s already in use. In the lightning network, the same two participants, say an appliance-maker and a parts supplier, engage in multiple Bitcoin transactions. As long as the parties are using a fixed number of Bitcoins to buy, sell from one another, and store for that purpose, the transactions aren’t reported to the blockchain, and zap back and forth within the same ecosystem. Once Wall Street gets the flywheel whirring, Bitcoin would gain the liquidity to become a bona fide currency. Sprecher and Loeffler predict that multinationals would then adopt Bitcoin for international payments. “The banks control international payments, and the system is very expensive,” notes Sprecher. When an U.S. auto parts manufacturer buys components from Japan, for example, it can pay stiff fees to convert dollars to yen. The purchase, at a minimum, involves a broker-dealer that makes the trade, and the purchaser’s and the seller’s banks. It might take two days before the seller can collect the yen, costing the U.S. producer interest while the funds are in transit. By contrast, if both parties use Bitcoin the payments could bypass the brokers and banks, flowing via the ICE exchange from the buyer’s to the seller’s vault held at Bakkt, and reaping big savings. ”Bitcoin would greatly simplify the movement of global money,” says Sprecher. “It has the potential to become the first worldwide currency.” Sprecher has demonstrated time and again the vision to transform global industries with technology. ICE’s foray into data, for example, is a testament to Sprecher’s agility. The company was a medium-sized player in data services until late 2015, when it purchased IDC, the leading provider of bond prices for institutional investors, for $5.2 billion. Sprecher’s timing was spot on: In two years, data has mushroomed into ICE’s biggest revenue category. The business splits into two main channels—exchange pricing, and analytics. For the former, ICE collects fees for dispensing different types of pricing from its exchanges, from such routine products as furnishing the “tape” to brokerage houses and TV networks to providing deep market data to high frequency traders. Most of ICE’s data runs through a secure, proprietary system of fiber and wireless grids called the ICE Global Network, built as a super-secure backbone by the NYSE following the 9/11 attacks. The IGN is connected to virtually every major money manager around the globe. Sprecher correctly predicted that money managers would need more and more data to create sharply-targeted mutual funds and ETFs. ICE supplies the data signaling when stocks should be added or dropped from, for example, a Japanese small cap value index fund. ICE doesn’t manage money. But besides selling data to fund managers, it purchased the former Bank of America family of indexes, and licenses them to investment managers. The ICE BofAML funds now boast $1 trillion in assets. Not surprisingly, Sprecher is aiming to disrupt the costly, old-fashioned bond trading universe, where most business is still conducted over the phone. When Sprecher bought IDC, the firm priced fixed income products once a day. Now, ICE sources real-time quotes on 2.7 million bonds and illiquid equities around the clock. That effort is part of his campaign to modernize bond trading by making the hidebound field fully electronic. To advance the project, ICE this year spent a total of $1.1 billion to purchase two digital fixed income platforms—Virtu BondPoint, a leader in corporates, and TMC, the largest electronic trading site for municipal bonds. Sprecher is a blend of an engineer and an adventurer. He grew up in Madison, Wisc., the son of a financial planner who sold insurance on the side. “Our mother says that when he was six years old, he took apart a toaster and put it back together,” says his sister Jill Sprecher, who with a second sister, Karen, forged a distinguished record making independent films. “Then at sixteen he rebuilt a Toyota in the garage and traded it for an ‘hugger orange’ Camaro.” Sprecher, in fact, longed to be a professional race car driver, attending the famous Road America driving school in Wisconsin. “Mario Andretti said the best drivers aren’t the bravest, but the smartest,” says Sprecher. “He was wrong. I was smart, but feared for my life. In tense situations, I took my foot off the gas, and hit the brake.” He now indulges more in the nitty-gritty than the romance racing by lying on a mechanic’s creeper, wrench in hand, to repair exhaust systems and rocker panels on his collection of a dozen decades-old Porsches that competed at Le Mans, heirlooms that he loans out for vintage rallies. Following a dozen years building power plants in California, Sprecher in the late 1990s sought a way to sell his surplus electricity on a spot market. In those days, almost all electricity trading happened over the phone. Sprecher wanted to get multiple utilities bidding for his power on an electronic marketplace. He could only find one, a platform owned by an Atlanta power company that had signed 63 utilities to its exchange, but was doing minimal business––and losing $1 million a month. In 1997, Sprecher bought it for that famous $1 sum. (Or it might have been $1,000; he says he can’t recall anymore.) The fledgling exchange stumbled for three years. “We were selling old routing equipment on eBay to raise a few thousand dollars,” says Chuck Vice, now ICE’s vice-chairman in charge of technology. Sprecher was about to lose his house to the bank when a trip to Manhattan in 2001 brought a reversal of fortune. At the time, Enron was pioneering energy trading, but it was the buyer or seller in every transaction. Only Sprecher was offering a major marketplace where utilities could trade directly with one another. On that trip to Manhattan, Goldman Sachs and Morgan Stanley told Sprecher they were wary of Enron’s dominance, and loaned $15 million to his exchange, saving the enterprise and Sprecher’s endangered residence. Then, in an astounding gambit, Sprecher handed 90% of his equity, basically for free, to thirteen banks, energy companies, and utilities, in exchange for their commitment to conduct a guaranteed volume of trades on his marketplace. In November of 2001, Enron collapsed. The next month, the volumes on Sprecher’s exchange soared 180%. Meanwhile, Kelly Loeffler––who grew up weeding soybean fields on her parents’ farm in Illinois––had traded a stint as a retail analyst in Chicago for a private equity position in Texas. Loeffler had spent about a year at the new job when her boss, the current Secretary of the Navy, Richard V. Spencer, announced that he was joining a struggling power exchange in Atlanta. Loeffler had studied the natural gas market, and was convinced the time was ripe for electronic trading. So she told Spencer she wanted to go with him. “I see a house that’s burning down like old fashioned trading in natural gas, and I want to run in and fix it,” says Loeffler. She joined ICE in 2002 when it still had fewer than 100 employees. Around that time, Sprecher bought the International Petroleum Exchange in London, once again, an antiquated open-outcry marketplace choked with floor traders shouting orders. As usual, the traders fought his campaign to go electronic, so Sprecher closed the exchange in the afternoons so that clients had no choice but to trade on their terminals half the day. All the action shifted to the evening hours, and by 2005, the IPE, now ICE Futures Europe, went fully electronic. Two years later, ICE bought the floundering New York Board of Trade, and engineered another painful but highly profitable transition to computerized trading. Late in 2008, Sprecher noted that the world’s big banks had no vehicle for selling the trillions of dollars in credit default swaps that would repay part of their losses on derivatives suffered in the financial crisis. Sprecher established a special clearing house for CDS that by 2010 auctioned off an astounding $50 trillion in CDS, helping to surmount a towering hazard to the financial system. Then, in 2013, Sprecher made his biggest and most prestigious acquisition to date by purchasing NYSE Euronext for $9.75 billion—more on the NYSE shortly––and in 2015, grabbed IDC in the deal that made ICE a major player in market data. Why does ICE keep making these big deals? “We’re like a network that keeps adding hit shows,” says Sprecher. Sprecher isn’t shy about telling anyone who’ll listen that he’s got the solution to their problem—and not just in business. “He’s a know-it-all who really knows it all,” says Jill Sprecher. Loeffler recalls that at a dinner with Robert Spano, conductor of the Atlanta Symphony, where Loeffler serves on the board, Sprecher began lecturing the maestro on what was really needed to promote the symphony. According to Loeffler, Sprecher kept saying, “You need to get out of the building, get out of this shell. You need to do pop-ups at the mall to appeal to young people!” “I was mortified, but that’s Jeff,” says Loeffler. “There was no stopping him.” Two distinct currents distinguish his management style: His instinctive, improvisational approach to hiring key people, and his ability marry entrepreneurship with a steady performance that appeals to public shareholders. “I’ve never regretted hiring anyone when I followed my instincts,” he says. “Only when I was swayed by their resume instead.” In one of his signature stories, Sprecher relates that at a raucous board meeting for his condo association in Atlanta years ago, an argument erupted about a couple whose two dogs were regularly pooping in the elevator, sans cleanup by their owners. “Then this guy gets up and volunteers for what nobody else wanted to do,” says Sprecher. “He says, ‘I’ll take care of the pooping dogs problem.’ I was really impressed that he jumped right in.” Sprecher was looking for a can-do manager to run the exchange’s help desk, which was overwhelmed by customer complaints. So he hired the guy who tackled the canine problem—Mark Wassersug, who is now ICE’s chief operating officer. Sprecher also trusted his gut in promoting Stacey Cunningham in June to be president of the NYSE—the first woman to head the exchange in its 226-year history. Cunningham didn’t have the fanciest of resumes. She’d served for eight years as a specialist broker at the Big Board, then left to pursue a culinary degree. After a stint at NASDAQ, she returned to the Big Board, rising to lead sales management. Sprecher then chose her to straighten out a small legacy NYSE business that provided listed companies advice on corporate governance. “It was a nightmare,” he says. “The employees were always calling the whistleblower hotline with nothing to complain about. Stacey really straightened it out, and we were able to sell it.” Sprecher had no doubt that Cunningham could perform brilliantly running his trophy business. |

|

斯普雷彻的第二大标志性才能是在投资颠覆性想法和保持收入持续增长之间巧妙保持平衡。ICE的首席独立董事、Verizon前高管弗雷德·萨乐诺对斯普雷彻能成功从培育初创公司的角色调整为大型上市企业的领导人赞叹不已。“大多数创业家都认识不到,重要的不仅仅是下一个想法。”他说,“如果让他们经营上市公司,他们会觉得因为刚刚进行了大额投资或收购导致利润下降了3到4个点是没有问题的。” 在萨乐诺看来,投资者固然注重远景,但他们也希望看到利润平稳上升。“杰夫明白,做了交易后要把不必要的费用从业务中剥离,通过节约花销为未来的项目筹集资金。他信仰的文化不是‘我们承诺在未来给你回报。’你现在就要做出业绩。杰夫明白这一点,但大多数创业者都不知道。” 斯普雷彻正是采用这一策略大幅削减了纽交所臃肿的花销,让纽交所重新焕发了活力,同时还能把节余用于重建这一世界上最伟大的品牌。2013年ICE 收购纽交所时,斯普雷彻通过将欧洲交易所作为泛欧交易所拆分,迅速筹集了约20亿美元。即便如此,纽交所仍然拥有3000多名员工和约1000名顾问。它有六个不同的技术平台来运营其三大交易所——纽交所、Arca和美国交易所。它持续在把顶尖的技术股和硅谷宠儿的股票拱手让给纳斯达克。它的传奇建筑、具有象征意义的标志性雕塑破败不堪。曾经十分华丽的巴洛克式董事会房间里,油漆已经剥落,他们没有把六楼七楼的豪华会议室开放给上市公司举办光鲜的活动,而是把这些空间都变成了一个个拥挤的小办公室。 许多华尔街传统主义者担心,斯普雷彻推行的全面电子化会磨灭纽交所的吸引力。但他反其道而行之,让这一地标重现昔日辉煌,甚至还增强了交易大厅的传奇色彩。他通过提升业务效率获得了重塑辉煌的经费。有一群聪明人在安静的21楼创造了一个名为Pillar的单一技术平台,取代了原来各种不同交易系统的混乱拼接,从而将员工数量降低到900人。 斯普雷彻不再追逐小规模IPO,专注于钓大鱼,因为新上市公司支付的费用是基于新股发行的数量。纽交所实现IPO38连胜,筹集了超过7亿美元。令人惊讶的是,作为电子交易的倡导者,斯普雷彻能够认识到,纽交所品牌的一个关键部分是那些专业交易者,他们给纽交所带来了丰富的色彩。 “电子交易有些过头了。”他说。“专业交易者能够用自己的资本,消除价格峰值和低谷的波动。” 很显然,穿蓝色工作服的人是象征美国资本市场的视觉符号。“有250个地方可以交易股票,”斯普雷彻说,“其中249家是雷同的。你想拥有哪一家?这就是为什么我们要把纽交所做成独一无二。” 为了恢复纽交所褪色的神秘感,斯普雷彻清理了迷宫似的办公室,把员工搬到楼上的格子间。斯普雷彻在六七层中间安装了一个大气的背光大理石楼梯。楼层经过翻新,有三个巨型招待厅和十五个稍小一些的会议室。斯普雷彻说:“我的想法是把纽约证交所变成《财富》美国500强企业的会所。”他做到了。举个例子,6月初的两天时间里就有十来家公司在纽约证交所举行了活动。 零售支付业似乎在斯普雷彻式的颠覆行为中逐渐成熟。如今,美国人每年要为购买商品和服务支付7万亿美元的信用卡、借记卡手续费和贝宝等数字门户网站交易费,约占国内生产总值的60%。接受这些卡片的商店和餐馆通常要向大约六个中间人支付2%到3%的费用,包括和商户签约的“商户承购者”、信用卡巨擘Visa和万事达卡以及发行卡片的银行等。 毫不夸张地说,转而使用比特币会大幅削减这些高昂的费用。消费者可以直接用手机或个人电脑上的比特币钱包购买杂货或洗涤剂,只需要在沃尔玛或星巴克的扫描仪上扫一扫即可,没有银行收取中间费用。如果比特币成为零售业的主要货币,信用卡可能会消失。 那么ICE和Bakkt会与ICE的主要客户大银行形成竞争关系吗?不一定。尽管收费很高, 银行很少能通过该业务盈利,因为这些费用要用于提供诸如欺诈监测、呼叫中心等服务,还要像常旅客计划或租车旅程累计折扣那样为客户提供折扣。银行赚大钱的地方是信用卡消费的利息。改变购买方式不会改变人们借钱的数额,只是改变了他们把钱放在哪的问题。 支付行业专家的数据表明,银行可能会和Bakkt合作,因为这一新系统有利于促进不同形式的借贷。例如,如果客户的比特币购买申请因余额太低遭到了拒绝,他可以立即去银行柜台借钱弥补差额。 在交易室进行采访时,可以看到墙上挂满了镶了相框的债券证书,记载着修建大铁路和基础设施时的融资历史,正是这些历史成就了美国。斯普雷彻拿纽交所和比特币做了个比较,一个是1972成立于梧桐树下的大名鼎鼎的交易所,一个是能改变消费者和公司购买方式的新技术。“比特币没办法凭借流氓式的想法存活,”他说。“为了发展进化,加密货币需要在已经建立的基础设施上运行。它们需要利用现有金融体系沉淀多年的信任和规则。它们需要拥有体现在纽交所身上的那种信任感。” 斯普雷彻修复了金融市场上最伟大的地标。我们很快就会看到,他能否给他认为能改变世界的数字货币也带来荣耀。(财富中文网) 译者:Agatha |

Sprecher’s second trademark talent is keeping an artful balance between investing in breakthrough ideas, and producing consistent growth in earnings. Fred Salerno, ICE’s lead independent director and a former top executive at Verizon, marvels at how Sprecher adjusted from nurturing a startup to guiding a huge public company. “Most entrepreneurs don’t recognize that it’s not just all about the next idea,” says Salerno. “Once they’re running a public company, they see no problem with taking margins down 3 or 4 points because they just made a big investment or acquisition.” In Salerno’s view, investors take a long-term outlook, but they also want to see a smooth ascent in profits. “Jeff understood that as soon as you do a deal, you need to mine unnecessary expenses out of the business, so you can generate the savings to fund future projects. His culture isn’t, ‘We’ll just promise something in the future.’ You need to deliver performance at the same time. Jeff understands that, and most entrepreneurs don’t.” Sprecher revitalized the Big Board by deploying just that strategy––radically paring bloated costs and channeling the savings into rebuilding one of the world’s great brands. When ICE bought the NYSE in 2013, Sprecher quickly raised roughly $2 billion by spinning off its European exchanges as Euronext. Even so, the NYSE still had over 3,000 employees and around 1,000 consultants. It was running six divergent tech platforms to operate its three major exchanges—NYSE, Arca, and American. It consistently lost trophy tech listings to the Nasdaq, then the darling of Silicon Valley. Its legendary building, the symbol of its iconic stature, was a wreck. The paint on its once grand, baroque Board Room was peeling, and the instead of opening what were once impressive meeting rooms on its sixth and seventh floors to its listed companies for fancy events, the NYSE had transformed those spaces into warrens of tiny offices. Many Wall Street traditionalists fretted that Sprecher would kill the Big Board’s allure by going all-electronic. But he did just the opposite, restoring the landmark at Wall and Broad Streets to its former splendor, and enhancing the legendary buzz on the trading floor. He found the money by radically improving the Big Board’s efficiency. A bunch of brainiacs sequestered on the 21st floor created a single tech platform called Pillar that replaced the crazy-quilt of trading systems, a coup that helped lower the headcount to 900. Sprecher stopped chasing small IPOs, and concentrated on the big fish, since newly-listed companies pay fees based on the number of shares outstanding. The NYSE established a streak of winning 38 straight IPOs that raised over $700 million. Surprising for an apostle of electronic trading, Sprecher recognized that a crucial part of the brand was the specialist traders who brought so much color to the Big Board’s floor. “Electronic trading went too far,” he remarks. “The specialists perform a service by smoothing out the spikes and valleys in prices by using their own capital.” But it’s also clear that the folks in the blue smocks are a visual symbol of the U.S. capital markets. “There are 250 places to trade equities,” says Sprecher. “Of those, 249 are the same. Which one would you want to own? That’s why we want the NYSE to be one of a kind.” To restore its fading mystique, Sprecher cleared out the maze of offices and moved the employees to cubicles on the upper floors. Sprecher installed a spectacular staircase composed of backlit marble slabs to join the sixth and seventh floors. Those refurbished floors now house three giant reception halls and fifteen smaller conference rooms. “The idea was to turn the NYSE into a clubhouse for the Fortune 500,” says Sprecher. It’s happened. On one two-day stretch in early June, for example, no fewer than 10 companies held events at the NYSE. Retail payments is an industry that appears ripe for Sprecher-style disruption. Today, Americans charge $7 trillion in goods and services every year—around 60% of GDP—on credit and debit cards, and through digital portals such as PayPal. The stores and restaurants that accept those cards typically pay 2% to 3% to around six intermediaries, including “merchant acquirers” who sign up the merchants, credit card giants such as Visa and MasterCard, and the banks that issue the cards. It’s hard to overstate how drastically a shift to Bitcoin could crunch those lofty fees. Consumers could pay for groceries or detergent directly from the Bitcoin wallets on their iPhones or PCs, right from a scanner at Walmart or Starbucks, with no banks taking fees in the middle. If Bitcoin became the chief currency for retail, it’s likely that credit cards would disappear. So would ICE and Bakkt be antagonizing ICE’s main customers, the major banks? Not necessarily. Despite the large fees, banks typically make little money processing purchases, since they mainly return those fees to provide services such as fraud monitoring, call centers, and providing rebates that go to such rewards as frequent flyer miles and rental car discounts. Where the banks make big money is on the interest charged on balances on credit cards. Changing the purchasing system wouldn’t alter the amounts that folks borrow, just where they hold those balances. According to payment industry experts, the banks might cooperate with Bakkt, because the new system could actually encourage different forms of borrowing. For example, a customer whose Bitcoin purchase is declined because of a low balance could get an immediate loan from his or her bank, right at the checkout counter, to cover the shortfall. At the interview in the Bond Room, featuring walls festooned with framed bond certificates chronicling the great railroad and infrastructure financings that built America, Sprecher drew a parallel between the exchange famously born in 1792 under the buttonwood tree and the technology that could transform the way consumers and companies buy just about everything. “Bitcoin can’t survive as a rogue idea,” he says. “To evolve, the cryptocurrencies need to run on established infrastructure. They need the trust and rules that have been built into our financial system for many years. They need the kind of trust that the Big Board represents.” Sprecher restored what may be the greatest icon in financial markets. We’ll soon see if he can bring respectability to the token that he thinks can change the world. |