比特币价格下跌,Coinbase系统宕机

|

数字货币市场陷入一片混乱。上周五上午,比特币价格跌破12,000美元,比其最近的高点下跌了约40%,而其他加密货币的价格也出现了相同幅度甚至更大幅度的下跌。 与此同时,大规模抛售似乎导致备受欢迎的数字货币交易平台在周五出现短暂宕机。客户在美国东部时间上午9:30左右访问该交易平台时,看到一条信息称该网站处于离线状态,只能提供“快照”视图: |

The digital currency markets are in turmoil. On Friday morning the price of bitcoindropped below $12,000, which is around 40% off its recent high, while other crypto-currencies are falling as much or further. Meanwhile, the mass sell-off appears to have forced the popular digital currency exchange, Coinbase, to go down for short stretches on Friday. Customers who visited the exchange around 9:30 a.m. ET saw a message the site is currently offline, and that only a “snapshot” view was available: |

|

而试图登陆的用户则收到了下列信息: |

Meanwhile, those who tried to log-in received the following message: |

|

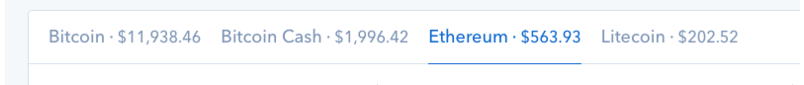

到美国东部时间上午10点,Coinbase的网站才重新上线。该公司尚未就宕机的原因发布声明,但有熟悉Coinbase的人士告诉《财富》杂志,宕机的原因是庞大的网络流量和交易量,与恶意行为无关。 美国东部时间上午11点之后不久,Coinbase宣布已经暂停了部分交易: 该公司在现状更新网页中表示:“由于昨天的高网络流量,买卖功能可能临时下线。我们正在努力恢复全部功能。” 熟悉Coinbase的人士还否认了Reddit和社交媒体上流传的有关该公司面临流动性紧缩的传闻。这些传闻似乎并没有可信的依据,可能与做空比特币的卖家和试图打击加密货币市场的其他人有关。正如彭博社的报道所说: 伦敦黄金交易商Sharps Pixley的首席执行官罗斯·诺曼表示:“嗜血的鲨鱼已经开始集结,而期货市场为他们提供了一个打击比特币市场的平台。”Sharps Pixley提供黄金兑换比特币的服务。他表示:“比特币价格主要的推动力一直来自于零售投资者,但未来将会有一些激进的基金,会寻找合适的机会来打击比特币市场。” 另外,到Coinbase的网站恢复时,其提供的四种加密货币的价格均进一步下跌: |

By 10 a.m. ET the Coinbase site was back online. The company has yet to issue a statement explaining the outage, though a person familiar with Coinbase told Fortuneit was the result of large traffic and trading volume, and not malicious activity. Shortly after 11am ET, Coinbase said it has suspended some trading: “Due to today’s high traffic, buys and sells may be temporarily offline. We’re working on restoring full availability as soon as possible,” the company said on its status updatepage. The person familiar with Coinbase also disavowed rumors, circulating on corners of Reddit and social media, that the company faced a liquidity crunch. The rumors, which do not appear to have been based on any credible information, may be tied to short shellers and others trying to hammer the crypto markets. As Bloomberg reports: “The sharks are beginning to circle here, and the futures markets may give them a venue to strike,” Ross Norman, chief executive officer of London-based bullion dealer Sharps Pixley, which offers gold in exchange for bitcoin. “Bitcoin’s been heavily driven by retail investors, but there’ll be some aggressive funds looking for the right opportunity to hammer this thing lower.” Meanwhile, by the time Coinbase’s site recovered, prices had fallen further across all four crypto-currencies it offers: |

|

虽然本周数字资产价格的下跌幅度巨大(部分原因是比特币内部人士之间的混战),但这并非是前所未有的。众所周知,数字货币市场波动性大,过去曾经历过多次大规模崩盘,但最后全都实现了反弹。 甚至最近呼吁人们“负责任投资”的Coinbase CEO布莱恩·阿姆斯特朗也表示,加密货币市场过度膨胀: 他在最近召开的全体大会之后告诉《财富》杂志:“我们可能处在泡沫之中。”所有加密货币的总市场估值远高于5,000亿美元,但这些货币投入实际应用的机会很少,因此阿姆斯特朗担心“我们并没有获得这五千亿美元的真正价值。”但按照他的经验,每次比特币价格暴涨时,即便经过了下跌,比特币的估值都稳定保持在了一个更高的水平之上。 暴跌不久,比特币价格再次开始强力反弹。(财富中文网) 译者:刘进龙/汪皓 |

While this week’s collapse of digital asset prices—tied in part to infighting among Bitcoin insiders—has been dramatic, it’s hardly unprecedented. The market is notoriously volatile and has experienced major crashes in the past, only to recover. Even Coinbase CEO Brian Armstrong, who recently urged people to “invest responsibly,” has said the market is overly-inflated: “We probably are in a bubble,” Brian Armstrong confide[d] to Fortune following a recent all-hands meeting. With the total market valuation of all cryptocurrencies well above $500 billion, and few opportunities to put these coins to real use, Armstrong worries that “we haven’t really earned the value of that half trillion.” Nonetheless, in his experience, each time Bitcoin’s price has surged, the valuation has leveled off at a higher plateau—even after crashes. By mid-morning, bitcoin prices had begun to tick upwards again with bitcoin back near the $13,000 mark. |